- Home

- »

- Network Security

- »

-

Phishing Protection Market Size, Share, Industry Report 2033GVR Report cover

![Phishing Protection Market Size, Share & Trends Report]()

Phishing Protection Market (2025 - 2033) Size, Share & Trends Analysis Report By Offering (Solutions, Services), By Deployment Mode (On-Premises, Cloud-Based), By Sub-Type, By Organization Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-666-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Phishing Protection Market Summary

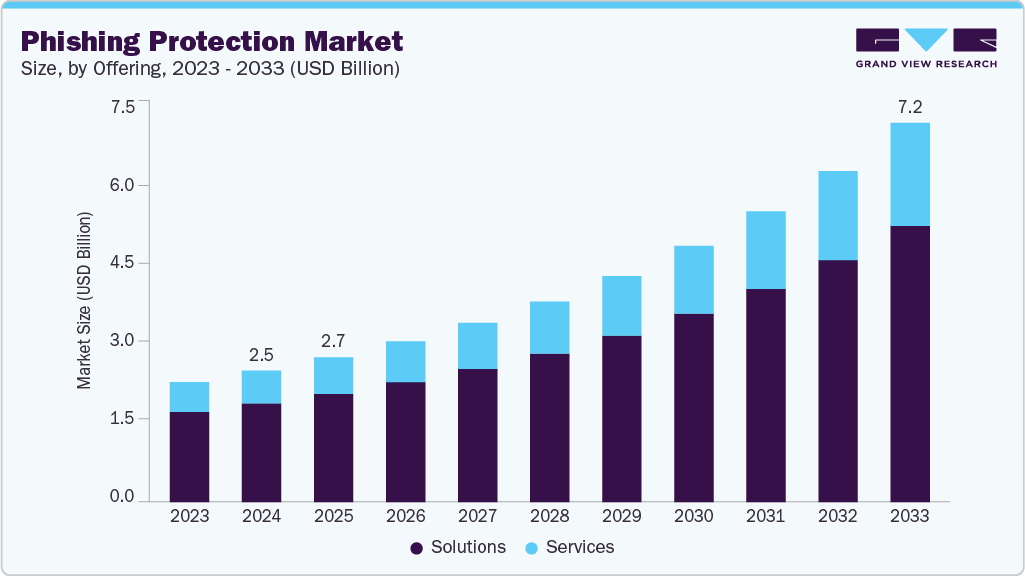

The global phishing protection market size was estimated at USD 2.48 billion in 2024 and is projected to reach USD 7.16 billion by 2033, growing at a CAGR of 12.8% from 2025 to 2033. A key trend shaping the global phishing protection industry is the integration of AI-powered threat detection with cloud-based email and communication platforms.

Key Market Trends & Insights

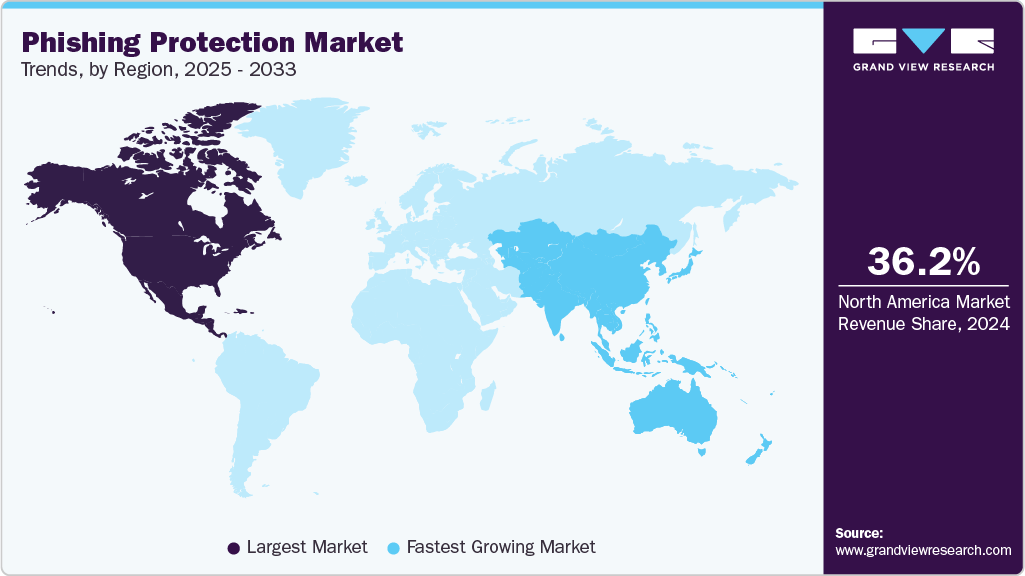

- North America held a 36.2% revenue share of the global phishing protection market in 2024.

- In the U.S., the market growth is driven by a combination of evolving threat sophistication and regulatory enforcement, prompting widespread adoption of advanced email security solutions across both private and public sectors.

- By organization size, the large enterprises segment held the largest revenue share of 71.9% in 2024.

- By sub-type, the email-based phishing segment held the largest revenue share in 2024.

- By offering, the solutions segment accounted for the largest revenue share of over 74.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.48 Billion

- 2033 Projected Market Size: USD 7.16 Billion

- CAGR (2025-2033): 12.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Enterprises are adopting advanced analytics, behavioral analysis, and real-time URL scanning to detect phishing attacks across both email and non-email vectors. As phishing attacks become more sophisticated, including tactics like business email compromise (BEC) and social engineering, organizations are shifting from static, rules-based defenses to adaptive AI-powered platforms that continuously learn and respond to evolving threat patterns. For instance, companies are deploying phishing protection solutions with contextual email analysis and automated remediation workflows that allow security teams to quarantine threats and reduce response time.

Additionally, the growing emphasis on proactive defense against phishing attacks is compelling organizations to shift from reactive to predictive security strategies. National cybersecurity authorities are urging enterprises to adopt adaptive technologies that can detect threats based on behavior and context, rather than relying solely on static filters. For instance, in October 2023, the U.S. National Security Agency (NSA) warned that modern phishing attacks use convincing fake websites, impersonated identities, and multi-channel deception, recommending measures such as zero-trust access, domain monitoring, and user training to stay ahead of sophisticated threat actors. Consequently, with phishing tactics rapidly evolving, real-time threat detection, AI-driven pattern analysis, and integrated response solutions are becoming essential elements of modern enterprise security strategies.

Offering Insights

The solutions segment accounted for the largest revenue share of over 74.9% in 2024, driven by the rising need for real-time, cross-platform phishing protection that addresses both traditional and emerging threat vectors. As phishing campaigns are targeting non-corporate users, including content creators, freelancers, and influencers, security vendors are expanding their offerings beyond conventional enterprise boundaries. Unlike services that rely heavily on user intervention, phishing protection solutions integrate automated detection, behavioral analytics, and multi-layered filtering to provide instant threat mitigation across email, social media, and cloud platforms.

For instance, in September 2024, Bitdefender launched the industry’s first complete security solution tailored for YouTube content creators and influencers, combining phishing protection, credential theft prevention, and account takeover defense into a unified platform. This development reflects a shift wherein solution providers are strategically evolving their technologies to address the unique security requirements of digital professionals. Consequently, the increasing demand for proactive, adaptable, and scalable security tools that safeguard both organizational infrastructure and individual digital identities is contributing significantly in driving the growth of the solutions segment.

The services segment is expected to register the fastest CAGR during the forecast period, driven by the rising demand for continuous threat management and scalable security support. As phishing attacks are expected to become more frequent, organizations are relying on professional and managed services to handle real-time monitoring, incident response, and user awareness training. These services not only bridge internal skill gaps but also ensure faster detection and remediation of phishing threats across diverse digital channels.

Additionally, compliance with evolving cybersecurity regulations is encouraging businesses to engage service providers for policy enforcement and employee risk assessments. For instance, Barracuda Networks expanded its managed phishing defense services with the launch of “Barracuda Managed XDR for Email Threats,” which provides 24/7 monitoring, AI-driven threat detection, and personalized user training modules. The service enables organizations to reduce the burden of threat response while improving resilience through ongoing education. This trend reflects a shift in the market toward service-based security models that offer real-time intelligence and strategic support, thereby driving the services segment growth in the phishing protection market.

Deployment Mode Insights

The on-premises segment accounted for the largest revenue share of the phishing protection industry in 2024, driven by sectors with stringent data control, customization, and compliance demands. Industries such as banking, defense, and healthcare prefer on-premises phishing protection to gain insights into sensitive data, integrate deeply with legacy systems, and meet data sovereignty regulations. These deployments also benefit from long-term contracts, infrastructure ownership, and internal governance, reinforcing their preference in high-security environments. For instance, VISUA introduced its “Deploy‑Anywhere” on-premises phishing detection suite, specifically designed for organizations that require local processing of sensitive data. The solution integrates seamlessly with existing infrastructure without transmitting data to external servers, offering zero-latency response and compliance with strict privacy regulations. Consequently, the increasing demand for private, highly controlled security implementations that deliver robust protection is driving the growth of the on-premises segment.

The cloud-based segment is expected to register the fastest CAGR over the forecast period, driven by increasing reliance on cloud applications, hybrid work setups, and the need for scalable, low-maintenance phishing defenses. Cloud-based phishing protection offers real-time threat intelligence, automated updates, and centralized management that appeal to both large enterprises and SMEs aiming to protect distributed users across diverse digital environments. Additionally, the growing complexity of phishing tactics targeting cloud-hosted collaboration and communication platforms is pushing organizations to adopt solutions that can adapt and respond instantly.

For instance, in July 2024, Fortra announced enhancements to its integrated cloud-based email security solution-Cloud Email Protection, introducing features like QR code threat detection, optical character recognition (OCR), and active content inspection to combat advanced threats such as business email compromise (BEC) and impersonation attacks. Subsequently, these innovations drive cloud-native platforms' growth, enabling continuous evolution in threat defense, thereby driving the market growth.

Sub-Type Insights

The email-based phishing segment accounted for the largest revenue share of the phishing protection market in 2024, primarily due to email's continued role as the most frequently exploited and accessible attack vector for cybercriminals across the globe. With the proliferation of business email compromise (BEC), credential harvesting, and malicious link and attachment campaigns, organizations are investing in email security technologies such as secure gateways, real-time scanning, domain spoofing protection, and AI-powered anomaly detection. Moreover, as email serves as the initial access point for larger attacks like ransomware or data breaches, fortifying email defenses remains a top priority for enterprise security strategies.

For instance, in March 2023, ReliaQuest enhanced its GreyMatter platform with the launch of GreyMatter Phishing Analyzer, a new capability designed to automate abuse-mailbox processing. The tool analyzes reported suspicious emails, initiates remediation actions such as removing malicious messages, and notifies both users and security teams of outcomes. This helps security operations centers (SOCs) save thousands of analyst hours while improving response times and reducing alert fatigue, hence contributing significantly to bolstering the growth of the global email-based phishing segment.

The non-email-based phishing segment is predicted to register the fastest CAGR over the forecast period, driven by the rapid proliferation of alternative attack channels such as SMS‑based smishing, voice‑based vishing, social messaging apps, and collaboration platforms. Cyber-attackers exploit these communication methods to bypass traditional email defenses, leveraging tactics like AI‑generated voice cloning and QR code scams to deceive targets. As reliance on mobile and virtual communication channels is growing, the need for comprehensive defense strategies has intensified, compelling organizations to prioritize investments in mobile threat detection, behavioral analytics, and cross-platform monitoring solutions. For instance, in February 2024, Enea revealed that mobile fraud incidents, including smishing and vishing, had surged dramatically since the release of ChatGPT, with enterprises reporting losses in 61% of cases and 76% acknowledging inadequate protection against these threats. In conclusion, the aforementioned factors are contributing significantly in driving the growth of the global non-email-based phishing segment.

Organization Size Insights

The large enterprises segment accounted for the largest share of 71.9% in 2024, driven by their expansive digital infrastructures, elevated risk exposure, and regulatory compliance demands. Large organizations manage vast volumes of data, operate across multiple geographies, and utilize diverse communication platforms, becoming prime targets for phishing attacks such as business email compromise (BEC), credential theft, and advanced social engineering schemes. As a result, these enterprises allocate substantial budgets to deploy enterprise-grade phishing protection solutions such as secure email gateways, real-time threat intelligence, AI-enhanced anomaly detection, and integrated incident-response platforms.

For instance, in April 2025, Menlo Security announced enhancements to its Secure Enterprise Browser, introducing a Secure Application Access dashboard and advanced browsing forensics capabilities designed specifically for large organizations. These enhancements enable security operations centers to gain extraordinary visibility into user behavior across browsers, detect AI-driven phishing threats in real time, and accelerate incident response. Consequently, the aforementioned factors are contributing significantly in driving the growth of large enterprises segment.

The Small and Medium-sized Enterprises (SMEs) segment is expected to register the fastest growth during the forecast period, driven by the rising intensity of phishing attacks targeting smaller organizations with limited cybersecurity resources. SMEs are recognized as vulnerable targets due to underdeveloped security practices and minimal staff training, underscoring the need for affordable, automated, and scalable phishing defense solutions. The growing accessibility of phishing-as-a-service and AI-augmented attack tools has further compelled SMEs to seek layered protection, including email filtering, web security, user awareness training, and managed response.

For instance, in April 2023, Guardz introduced an AI-powered Multilayered Phishing Protection solution aimed specifically at SMEs and managed service providers (MSPs), integrating capabilities such as continuous email scanning, AI-based threat detection and quarantine, real-time web monitoring, and adaptive awareness training. This platform automates threat remediation, removing risky emails across an organization, alerting administrators instantly, and delivering customized phishing simulations to employees, helping SMEs strengthen their cybersecurity posture efficiently and cost‑effectively.

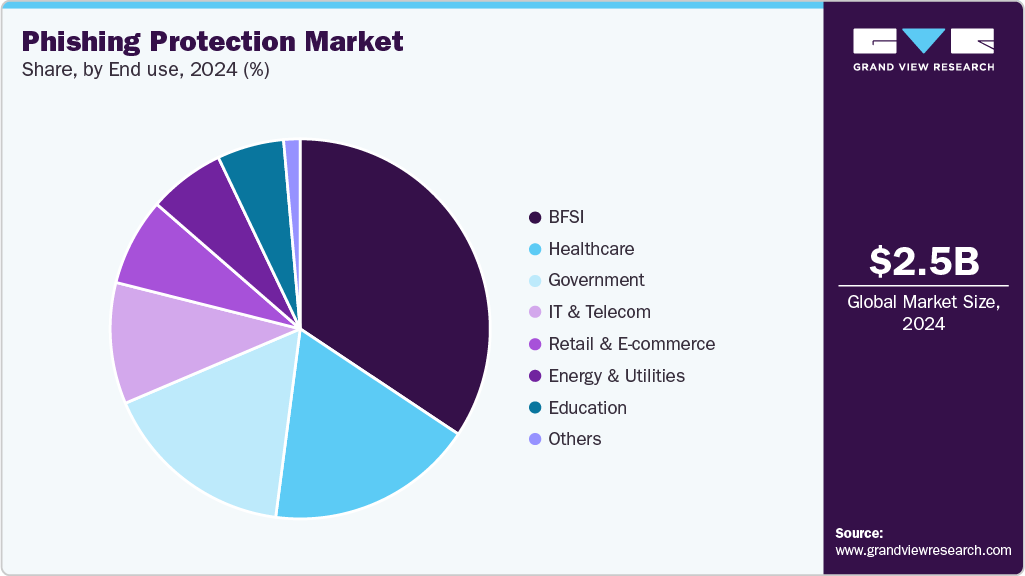

End Use Insights

The BFSI segment accounted for the largest revenue share of the phishing protection industry in 2024, driven by the sector's extensive exposure to sensitive financial assets and transactional systems, which are a prime target for phishing campaigns such as credential theft, account takeover, and business email compromise (BEC). Additionally, regulatory standards such as PCI DSS and GLBA have compelled BFSI firms to invest heavily in phishing defenses, including secure email gateways, AI-powered fraud analytics, domain monitoring, and rigorous user awareness training.

Moreover, the shift to digital banking services, mobile payment systems, and remote onboarding processes has significantly expanded the attack surface, positioning phishing protection as an essential strategic investment. For instance, in May 2025, ThreatMark launched ScamFlag, a generative-AI-fueled scam detection platform tailored for digital banks and their customers. Integrated directly within banking applications, ScamFlag provides real-time analysis across multiple channels, including emails, messaging platforms, and payment portals, with a reported 99% accuracy. Consequently, the factors above are contributing notably in driving the growth of the BFSI segment.

The retail & e-commerce segment is expected to register the fastest CAGR during the forecast period, driven by the expanding digital presence, high transaction volumes, and direct consumer interactions. Cybercriminals exploit peak shopping seasons, promotional messaging, and false brand impersonations to harvest customer credentials, payment information, and loyalty data. Ecommerce platforms are responding by deploying advanced phishing defenses such as AI-driven brand spoofing detection, real-time website monitoring, and behavioral analytics to preserve customer trust and transaction security.

Additionally, the proliferation of third-party sellers and digital marketplaces has broadened potential entry points, compelling retailers to adopt proactive, multi-layered mitigation strategies. For instance, in August 2023, ecommerce risk prevention specialist ClearSale launched its new Brand Protection platform, integrating AI-powered detection and reporting of impersonation attacks across social media profiles, fake websites, apps, and digital ads. The solution enables retailers to detect phishing scams early, safeguard brand reputation, and reduce customer fraud through automated takedowns and continuous monitoring.

Regional Insights

North America accounted for the largest market share of 36.2% in 2024, owing to the heightened frequency of business email compromise (BEC) attacks targeting enterprises, government agencies, and educational institutions. Also, the enforcement of stringent cybersecurity frameworks like the U.S. Cybersecurity Executive Order, along with active regulatory oversight from bodies such as CISA and NIST, is driving the adoption of advanced phishing protection platforms. Additionally, the surge in phishing threats exploiting cloud-based collaboration tools like Microsoft 365 and Google Workspace has accelerated the deployment of API-integrated, cloud-native email security solutions. Moreover, North American enterprises are also placing greater emphasis on employee awareness programs, phishing simulations, and automated abuse-mailbox analysis to mitigate internal risks and improve response times.

U.S. Phishing Protection Market Trends

The phishing protection industry in the U.S. is shaped by a combination of evolving threat sophistication and regulatory enforcement, prompting widespread adoption of advanced email security solutions across both private and public sectors. U.S. organizations are targeted by phishing-as-a-service (PhaaS) operations like Tycoon 2FA, which exploit multi-factor authentication fatigue and use QR codes, deepfakes, and SMS-based lures to bypass traditional defenses. In response, U.S. enterprises are integrating AI-powered phishing detection, domain spoofing prevention, and automated remediation tools with cloud platforms such as Microsoft 365 and Google Workspace. Additionally, federal directives from CISA and NIST have also accelerated the implementation of zero-trust email protection, incident response automation, and phishing simulation training across critical infrastructure sectors. Furthermore, financial services, healthcare providers, and educational institutions are prioritizing API-based security orchestration and SOC integrations to mitigate high-frequency phishing attempts targeting customer portals and employee credentials.

Europe Phishing Protection Market Trends

The phishing protection industry in Europe is anticipated to register considerable growth from 2025 to 2033. Cybercriminals across Europe are leveraging AI-generated phishing campaigns that utilize generative models to craft highly sophisticated and personalized messages. Additionally, regional providers and enterprises are responding by embedding robust AI-driven detection systems and behavioral analytics into their defenses. Threat intelligence firms, like Cyberint, have also upgraded their tools to combat dynamic phishing sites and fake domains, reporting an 87% increase in detection rates following their July 2024 enhancements. Furthermore, the EU continues to reinforce its cyber stance through coordinated initiatives such as the European Cybersecurity Month, while enforcing regulations like NIS2, GDPR, and the forthcoming AI Act to fortify digital resilience and specifically drive adoption of phishing countermeasures.

The UK phishing protection market is evolving in response to a surge in sophisticated threats and proactive government policy. Cybercriminals are deploying advanced phishing tactics such as callback phishing, AI-generated voice and SMS attacks, and SIM-swapping schemes, threats that bypass traditional email-centric defences and exploit human vulnerabilities. Furthermore, national initiatives are shifting towards passkey authentication, mandated for government services and supported by the NCSC, are reshaping the authentication landscape to reduce phishing reliance on SMS and passwords.

The phishing protection market in Germany is gaining growth as cybercriminals in Germany are deploying AI-powered polymorphic phishing campaigns that use generative techniques to craft novel, evasive attack variants, accounting for AI-generated phishing in over 82% of recent malicious emails, thus bypassing signature-based filters and traditional secure email gateways. Additionally, the country recorded approximately 37.5 million blocked phishing attempts in 2024, highlighting a distinct reliance on email deception and QR-code scams targeting both consumers and businesses.

Asia Pacific Phishing Protection Market Trends

Asia Pacific is expected to register the fastest CAGR of 13.2% from 2025 to 2033, propelled by increasing phishing threats targeting its rapidly digitizing economies and expansive e-commerce markets. Also, a significant year-over-year increase in phishing incidents across Australia, Japan, and Singapore underlines heightened vulnerability, particularly during peak online shopping seasons. In response, organizations throughout Asia Pacific are integrating AI-enhanced security measures, such as behavioral analytics, self-learning threat-detection, and cross-platform monitoring to combat AI-driven spear-phishing and deepfake scams. Moreover, major cybersecurity firms are expanding their regional presence in Singapore to offer proximity support, real-time fraud detection, and localization of threat intelligence.

Japan’s phishing protection market is witnessing expansion, driven by government policy and growing investment in preemptive cybersecurity measures. The increasing use of phishing kits, such as those targeting mobile users via encrypted, rotating domains, has prompted Japanese organizations to adopt advanced early-warning systems and infrastructure-focused threat intelligence tools. This shift is further reinforced by legislative action supporting cybersecurity resilience. For instance, in May 2025, Japan enacted the Active Cyberdefence Law, empowering authorities to proactively identify and neutralize foreign cyber threats before they infiltrate domestic networks. These developments underscore Japan’s growing emphasis on intelligence-led, rapid-response phishing protection aligned with national security objectives and cross-border threat mitigation.

The phishing protection market in China is evolving in response to rapid digitization, cross-border cyber threats, and government-led cybersecurity enhancement initiatives. Cybercriminals have escalated attack campaigns by leveraging advanced technologies, including AI and IoT-based vectors, and deploying phishing kits, prompting organizations and state institutions to elevate their defenses with infrastructure upgrades and threat intelligence platforms. Additionally, the Ministry of Public Security’s National Anti-Fraud Center, an app pre-installed on millions of devices, continues to serve as a frontline tool for detecting and reporting phishing via SMS, calls, and apps, underscoring China’s nationwide commitment to public cyber protection.

Key Phishing Protection Company Insights

Key players operating in the phishing protection industry are Abnormal Security, Barracuda Networks, Cofense, and Proofpoint. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2025, Malwarebytes launched Scam Guard, an AI-powered, mobile-first digital safety companion designed to combat today's most prevalent phishing threats and scams across texts, calls, emails, images, and QR codes. The tool integrates seamlessly with Malwarebytes Mobile Security on iOS and Android, offering real-time, personalized scam detection and guidance without requiring a separate app.

-

In September 2023, Proofpoint launched a suite of industry-first AI and ML-powered innovations designed to disrupt the entire phishing attack chain, from pre-delivery detection of social-engineered emails to post-compromise identity threat defense and data loss prevention.

-

In January 2023, Abnormal.ai expanded its partnership with Microsoft to enhance phishing protection for Microsoft Office 365 users by integrating its cloud-native email security solution, which supplements Microsoft's native defenses with precise behavioral analysis. This collaboration, recognized by Microsoft through awards and partner status upgrades, aims to provide scalable, effective protection against email threats like business email compromise (BEC) and phishing attacks.

Key Phishing Protection Companies:

The following are the leading companies in the phishing protection market. These companies collectively hold the largest market share and dictate industry trends.

- Abnormal Security

- Barracuda Networks

- Cofense

- Proofpoint

- Microsoft Corporation

- Mimecast

- Trend Micro

- Cisco Systems

- Symantec (Broadcom)

- FireEye

- GreatHorn

- IRONSCALES

- OpenText

- Paubox

- ZeroFox

Phishing Protection Market Report Scope

Report Attribute

Details

Market size in 2025

USD 2.74 billion

Revenue forecast in 2033

USD 7.16 billion

Growth rate

CAGR of 12.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report organization size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offering, deployment mode, sub-type, organization size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Abnormal Security; Barracuda Networks; Cofense; Proofpoint; Microsoft; Mimecast; Trend Micro; Cisco Systems; Symantec (Broadcom); FireEye; GreatHorn; IRONSCALES; OpenText; Paubox; ZeroFox

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Phishing Protection Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global phishing protection market report based on offering, deployment mode, sub-type, organization size, end use, and region:

-

Offering Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Services

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud-Based

-

-

Sub-Type Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Email-based Phishing

-

Non-Email-based Phishing

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small & Medium-sized Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Government

-

Healthcare

-

Retail & E-commerce

-

IT & Telecom

-

Energy & Utilities

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global phishing market size was estimated at USD 2.48 billion in 2024 and is expected to reach USD 2.73 billion in 2025.

b. The global phishing market is expected to grow at a compound annual growth rate of 12.8% from 2025 to 2033 to reach USD 7.16 billion by 2033.

b. The solution segment dominated the phishing market with a market share of 74.70% in 2024. The growth is driven by the rising need for real-time, cross-platform phishing protection that addresses both traditional and emerging threat vectors.

b. Some key players operating in the market include Abnormal Security, Barracuda Networks, Cofense, Proofpoint, Microsoft, Mimecast, Trend Micro, Cisco Systems, Symantec (Broadcom), FireEye, GreatHorn, IRONSCALES, OpenText, Paubox, ZeroFox and Others.

b. Factors such as the the integration of AI-powered threat detection with cloud-based email and communication platforms plays a key role in accelerating the phishing market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.