- Home

- »

- Food Additives & Nutricosmetics

- »

-

Phycocyanin Market Size, Share And Trends Report, 2030GVR Report cover

![Phycocyanin Market Size, Share & Trends Report]()

Phycocyanin Market (2024 - 2030) Size, Share & Trends Analysis Report By Nature (Organic, Conventional), By Form (Powder, Liquid), By Grade (E18, E25, E30), By End-use (Food & Beverages), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-248-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Phycocyanin Market Summary

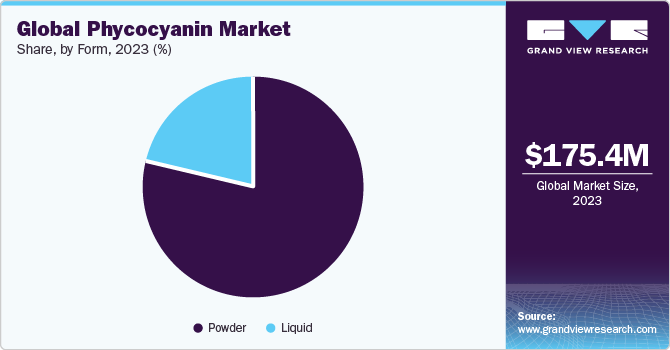

The global phycocyanin market size was estimated at USD 175.4 million in 2023 and is projected to reach USD 276.4 million by 2030, growing at a CAGR of 6.9% from 2024 to 2030. Growing consumer inclination towards clean-label and natural ingredients, coupled with rising demand for natural blue colorants is anticipated to drive market growth.

Key Market Trends & Insights

- The North America phycocyanin market led the global industry with a revenue share of 34.85% in 2023.

- The phycocyanin market in the U.S. is estimated to gror at a Significant CAGR over the forecast period.

- Based on nature, the conventional nature segment dominated the market with a revenue share of more than 90% in 2023.

- Based on grade, the phycocyanin E18 segment dominated the market with a revenue share of 56.9% in 2023.

- Based on end use, the food & beverages segment dominated the market with a revenue share of 89.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 175.4 Million

- 2030 Projected Market Size: USD 276.4 Million

- CAGR (2024-2030): 6.9%

- North America: Largest market in 2023

In addition, a rise in demand for functional food & beverage products, especially in developed economies of Europe and North America, is projected to trigger product demand. Phycocyanin is a fluorescent, water-soluble, blue pigment protein, which belongs to the phycobiliproteins family. These are obtained by the extraction process from the Arthrospira platensis and are the photosynthetic accessory pigments in certain red algae and cyanobacteria.

Growing product adoption for the manufacturing of dietary supplements, nutraceuticals, therapeutic products, and food color processing, is anticipated to boost its demand. The consumption of synthetic colors is showing major side effects including allergies, cancer, and hyperactivity in children. Consumer awareness concerning health hazards related to synthetic colors and utilization of the spirulina as a high-nutritional food source is estimated to contribute to market growth.

Market Concentration & Characteristics

The market is moderately consolidated in nature, with the presence of key players, occupying more than 60% of the share. Key industry participants are focusing on developmental strategies, mergers & acquisitions, and collaborations to expand regionally and gain a higher market share. For instance, in December 2021, Givaudan completed the acquisition of the Color House company “DDW” to establish global leadership in the natural colors market.

Similarly, in July 2020, GEP (Global EcoPower), a French renewable energy firm, acquired marketing assets and spirulina production from Tam, a Brittany-based spirulina manufacturer. GEP, with this acquisition, expanded its spirulina and phycocyanin production capacity, which strengthened its stance at a global platform.

Phycocyanin is among the natural blue colorants that are approved by the regulatory bodies in Asia Pacific, Europe, and North America. Spirulina extract is exempted from certification and has been approved as a color additive by the U.S. FDA Code of Federal Regulations. The product is manufactured by using the filtered aqueous extraction of the spirulina platensis dried biomass.

Nature Insights

The conventional nature segment dominated the market with a revenue share of more than 90% in 2023. The production of conventional phycocyanin is a cost-effective technique, thus leading to more preference for conventional production methods. Conventional phycocyanin is used as a functional ingredient and natural colorant in several nutraceutical products, such as health drinks, supplements, and functional food products. The product is witnessing high inclusion in skincare formulations, natural cosmetics, and haircare formulations, owing to its antioxidant and anti-inflammatory properties. In addition, a higher preference for organic food products and growth in the vegan population globally are anticipated to contribute to the demand for organic phycocyanin.

Grade Insights

The phycocyanin E18 segment dominated the market with a revenue share of 56.9% in 2023. Key factors responsible for this growth are rising interest in clean-label eatables, inclusion as a substitute for synthetically produced colors incorporated in final food products, and stringent policies against synthetic colors.

E18 grade is primarily known as the food coloring agent. Consumers are becoming aware of the health risks related to the consumption of synthetic colors, thus leading to product demand. For instance, high tartrazine consumption, which is associated with cancer and other skin issues, such as allergic reactions and asthma episodes, shall restrain the demand for synthetic colors in the longer run.

End-use Insights

The food & beverages segment dominated the market with a revenue share of 89.2% in 2023. The growth is attributed to rising consumer inclination towards ready-to-drink beverages, and convenience food. In addition, the ban on synthetic colors used in food & beverage products in developed economies is contributing to product demand. For instance, Allura red AC, a synthetic color, is banned in Belgium, Denmark, Switzerland, and France.

Form Insights

The powder form segment dominated the market with a revenue share of 78.92% in 2023. The high share is attributed to advantageous characteristics and benefits of powder form, like higher flexibility, easy solubility, and digestibility. Technical advances in processing and extraction, including innovations such as freeze drying and spray drying, have enhanced the production quality and efficiency of phycocyanin powder.

The liquid segment is anticipated to grow at a notable CAGR from 2024 to 2030 due to growing demand for liquid phycocyanin for a broad range of applications in personal care & cosmetics and dietary supplements. In addition, a surge in demand for products with minimal use of artificial additives and transparent labeling is gaining traction, thus triggering segment growth.

Regional Insights

The North America phycocyanin market led the global industry and accounted for a revenue share of 34.85% in 2023 owing to its growing product usage in key industries, such as pharmaceuticals, personal care, and food & beverages. In addition, the rise in illnesses exposed by the consumption of artificial colors has prompted consumers to choose natural colors, which is projected to trigger product demand.

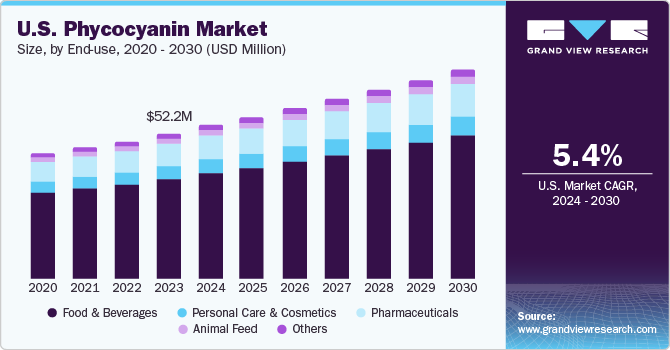

U.S. Phycocyanin Market Trends

The phycocyanin market in the U.S. is estimated to be driven by the presence of strong food & beverage and healthcare sectors in the country. Rising investments in drug development in the country and awareness related to the utilization of products as anti-cancer ingredients are expected to positively impact market growth. In addition, a rising preference for functional beverages, primarily due to changing lifestyles, is expected to propel product demand in the U.S. market.

Europe Phycocyanin Market Trends

The Europe phycocyanin market growth is highly attributed to a rise in the vegetarian and vegan population, coupled with the supportive regulatory environment promoting the product usage across industries like personal care and food & beverages. In addition, research institutions and major companies in the region are vigorously investing in research & development activities to discover new production methods and untapped applications for phycocyanin, thus contributing to industry growth.

The phycocyanin market in the UK is reliant on the larger food & beverage industry. The technological leadership in the country in key food color applications has helped the UK be one of the dominating countries in Europe.

Asia Pacific Phycocyanin Market Trends

The Asia Pacific phycocyanin market growth can be attributed to the presence of key players, such as Fuqing King Dnarmsa Spirulina Co., Ltd. and Dongtai City Spirulina Bio-Engineering Co., Ltd. The involvement of domestic and regional players, coupled with rising demand for processed food items in emerging economies of Indonesia, China, Thailand, and India, is predicted to boost growth.

The phycocyanin market in Japan will witness significant growth in the future. Since 2017, the trading of synthetic food color-infused products has been banned in Japan, leading to the growing consumption of blue phycocyanin in the country. In addition, spirulina as a dietary supplement is widely consumed by more than 40% of the Japanese population, thus contributing to market growth.

MEA Phycocyanin Market Trends

The MEA phycocyanin marketdemand is driven primarily by the food & beverage and animal feed sectors. Religious sentiments associated with the consumption of pigskin products in Arabic countries, including the UAE, Saudi Arabia, and Qatar, are expected to limit the demand for porcine-sourced products and pork farming. In addition, the demand for phycocyanin in the healthcare industry is expected to register growth due to an increase in the use of medical procedures for liver protection and inhibiting hepatic lipid peroxidation.

Central & South America Phycocyanin Market Trends

The phycocyanin market in Central & South America is projected to experience a steady but gradual growth rate. This growth is driven by health and wellness trends, with consumers showing interest in cruelty-free alternatives made from plants. The emphasis on natural beauty products and the improvement of consumer health are driving the market growth in Brazil.

Key Phycocyanin Company Insights

The market is moderately consolidated with a few players dominating the global share. A surge in future investment startup plans by key players, such as Gavan Ltd. and Synergia Biotech, is anticipated to pave the way for new entrants and move towards fragmentation in the next decade. Chr. Hansen Holding A/S and DIC Corp. are some of the leading market participants in the phycocyanin market.

-

Chr. Hansen Holding A/S—The company mainly operates in three segments namely research, process, and applied solutions. It offers C-Phycocyanin from Spirulina sp. in two iterations, namely 1MG and 5MG for usage in food & beverage and cosmetics products

-

DIC Corporation—The company mainly deals in organic pigments as synthetic resins, offering its products to the automotive, food & housing as well as electronics industries. Currently, it operates in more than 60 countries around the globe

Japan Algae Co. Ltd., Bluetec Naturals Co., Ltd, and AlgoSource are some of the emerging market participants in the phycocyanin market.

-

Japan Algae Co. Ltd.—The company offers organic germanium, natural pigment, and kumejima Enzyme apart from spirulina. The company offers 5% phycocyanin mixed with normal cultured spirulina 95% to enhance its characteristics

-

Bluetec Naturals Co., Ltd.—The company is a manufacturer of spirulina extract products, blue spirulina apart from phycocyanin. The company offers blue spirulina extracts, spirulina powder, tablets, and chlorella powder & tablets to a wide range of multinational organizations in candy, coatings, ice cream, beverages, and other applications

-

AlgoSource—It is a French firm that deals in bioactive molecules and natural marine resources. It cultivates its own biomass and works in the extraction and packaging of products. It offers Spirulysat, a food supplement made from different concentrations of phycocyanin products, packaged in 2ml, 5ml, 10ml and 15ml

Key Phycocyanin Companies:

The following are the leading companies in the phycocyanin market. These companies collectively hold the largest market share and dictate industry trends.

- Givaudan Sense Colour

- Cyanotech Corporation

- AlgoSource

- Bluetec Naturals Co., Ltd.

- DIC Corporation

- Phyco-Biotech

- Japan Algae Co. Ltd.

- Arthrise Nutritionals LLC

- PARRY Nutraceuticals

Recent Developments

-

In October 2023, SpirulinaNord, a Latvia-based firm announced that it had secured a sum of USD 600 thousand to implement its novel technology cultivating algae spriulina for creating recipes of food products. The photobioreactors would be based indoors to prevent water, air, and insect pollution, thereby ensuring the quality of the product and increasing the nutritional quality of spirulina

-

In July 2022, DIC Corp. and Innoqua Inc. announced their collaboration towards research regarding the effects of natural blue phycocyanin on marine ecosystems. The research would use phycocyanin cultivated spirulina by DIC to study its effects via raising corals, facilitating the recreation of the marine environment

-

In November 2022, GNT Group announced that it had secured approval from the U.S. Food & Drug Administration for the use of its spirulina extract in beverages. The approval would allow the company to achieve a vibrant blue shade in its beverages products while maintaining a clean label

Phycocyanin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 185.2 million

Revenue forecast in 2030

USD 276.4 million

Growth rate

CAGR of 6.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume in kilotons, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, form, grade, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Givaudan Sense Colour; Cyanotech Corp.; AlgoSource; Bluetec Naturals Co., Ltd.; DIC Corp.; Phyco-Biotech; Japan Algae Co. Ltd.; Arthrise Nutritionals LLC; PARRY Nutraceuticals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Phycocyanin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the phycocyanin market report based on nature, form, grade, end-use, and region:

-

Nature Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Phycocyanin E18

-

Phycocyanin E25

-

Phycocyanin E30

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Animal Feed

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global phycocyanin market size was estimated at USD 175.4 million in 2023 and is expected to reach USD 185.2 million in 2024.

b. The global phycocyanin market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 276.4 million by 2030.

b. North America dominated the phycocyanin market with a share of 34.85% in 2023. This is attributable to its expanding use in key industries such as pharmaceuticals, personal care, and food & beverages.

b. Some key players operating in the phycocyanin market include Givaudan Sense Colour; Cyanotech Corporation; AlgoSource; Bluetec Naturals Co., Ltd; DIC Corporation; Phyco-Biotech; Japan Algae Co. Ltd.; Arthrise Nutritionals LLC; and PARRY Nutraceuticals.

b. Key factors that are driving the market growth include growing consumers inclination towards clean-label and natural ingredients.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.