- Home

- »

- Medical Devices

- »

-

Physiological Saline Market Size, Industry Report, 2033GVR Report cover

![Physiological Saline Market Size, Share & Trends Report]()

Physiological Saline Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Intravenous (IV) Saline Solutions, Nasal Irrigation Solutions), By Container, By Volume, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-751-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Physiological Saline Market Summary

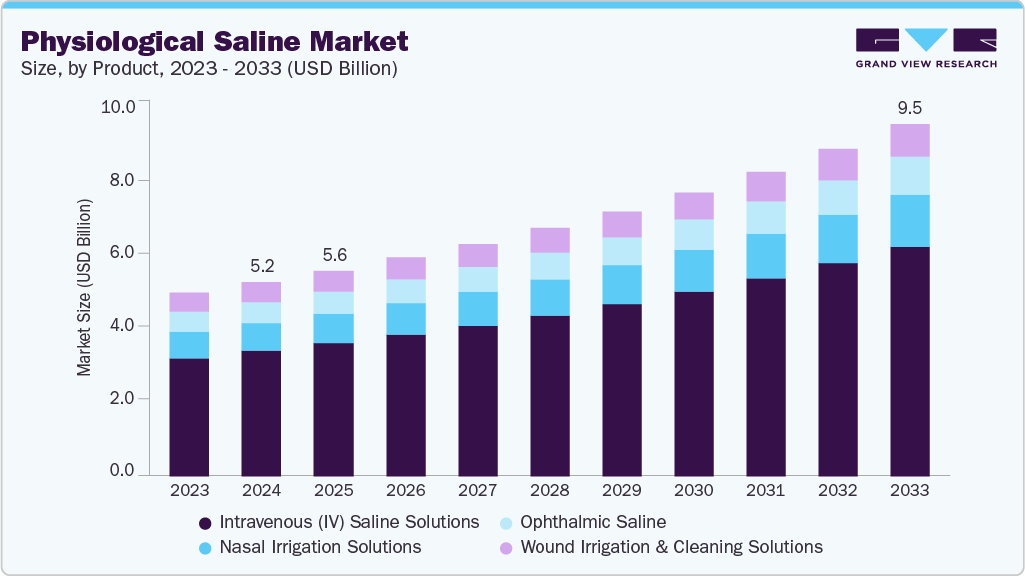

The global physiological saline market size was estimated at USD 5.24 billion in 2024 and is projected to reach USD 9.54 billion by 2033, growing at a CAGR of 6.97% from 2025 to 2033. The growth of the industry is attributed to the rising number of surgical procedures, prevalence of chronic diseases such as kidney disorders requiring dialysis, and the extensive use of saline in IV infusions for hydration and drug delivery.

Key Market Trends & Insights

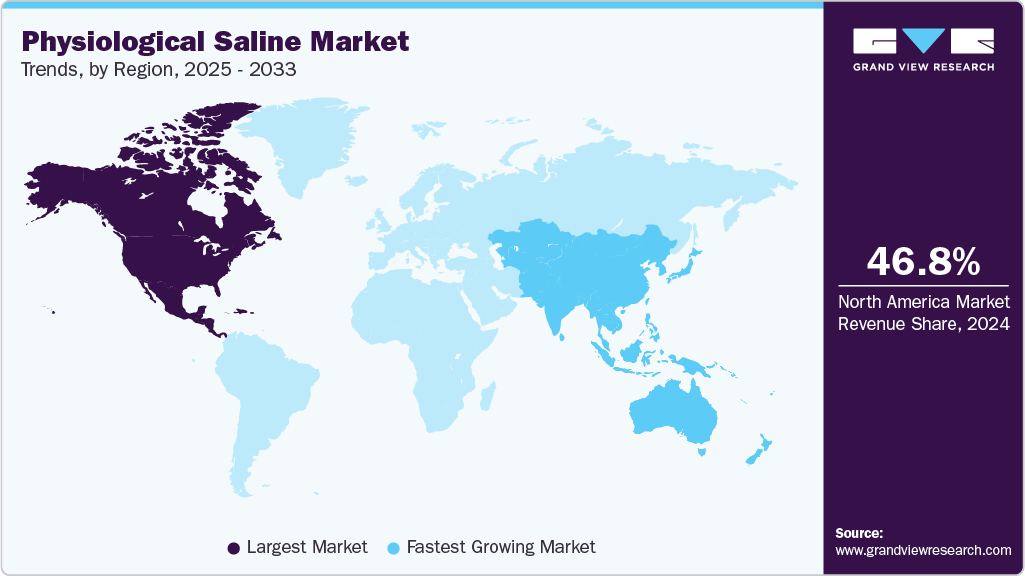

- North America dominated the physiological saline market with the largest revenue share of 46.79% in 2024.

- The physiological saline market in the U.S. accounted for the largest market revenue share of 82.64% in North America in 2024.

- Based on product, the intravenous (IV) saline solutions segment led the market with the largest revenue share of 64.54% in 2024.

- In terms of container, the flexible container segment led the market with the largest revenue share of 64.27% in 2024.

- On the basis of volume, the 1000 ML segment led the market with the largest revenue share of 41.54% in 2024.

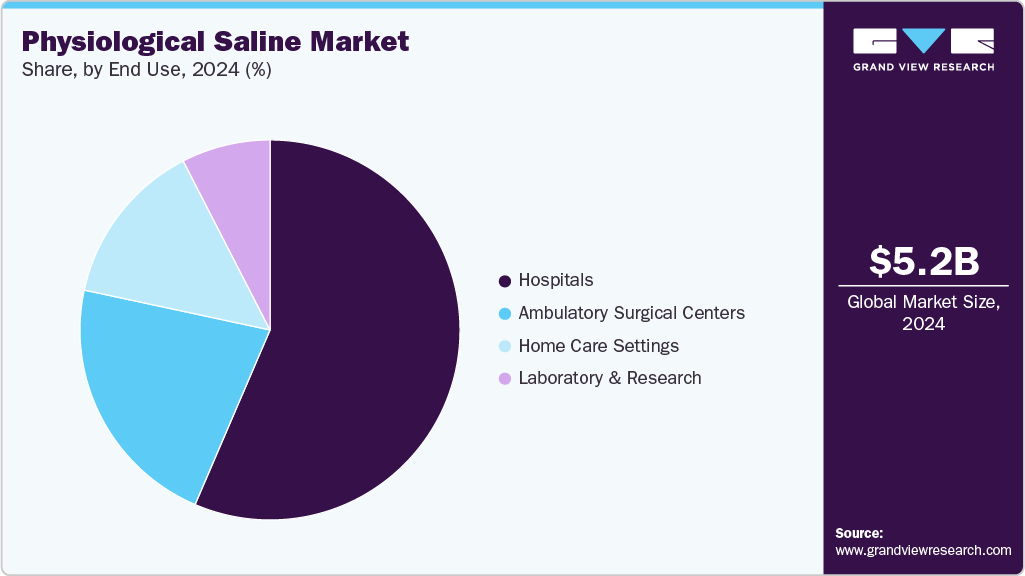

Market Size & Forecast

- 2024 Market Size: USD 5.24 Billion

- 2033 Projected Market Size: USD 9.54 Billion

- CAGR (2025-2033): 6.97%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing applications in wound irrigation, ophthalmic procedures, and nasal care further expand demand. In addition, the shift toward home-based healthcare, an aging global population with higher hospitalization needs, and continuous product innovations in packaging formats such as flexible containers and small-volume vials are fueling market growth.Rising inpatient admissions and the increasing reliance on IV therapy are major factors driving the physiological saline industry. Saline is the most commonly used IV fluid for hydration, electrolyte balance, and as a carrier for medications in hospitalized patients. With the growing incidence of chronic illnesses, infectious diseases, and emergency admissions, hospitals are witnessing higher demand for large-volume saline solutions in flexible containers and bottles. The expansion of critical care units, coupled with a preference for IV therapy in both acute and long-term treatment settings, directly fuels the steady growth of the market.

High and rising surgical volumes are a major driver of the physiological saline industry, as sterile 0.9% saline is a critical requirement in nearly all procedures for wound irrigation, tissue cleaning, fluid replacement, and IV infusion. The increasing global burden of chronic diseases, trauma cases, and elective surgeries is fueling the demand for saline solutions across hospitals and surgical centers, supported by their use in general, orthopedic, cardiovascular, and ophthalmic surgeries. According to the 2024 Procedural Statistics Release, approximately 1,585,878 cosmetic surgeries were performed in 2024, representing a 1% increase compared to 2023, while reconstructive procedures rose by 2% during the same period, underscoring steady growth in surgical interventions. Similarly, data from the Aesthetic Society highlighted that cosmetic surgical procedures grew 2.9% from 2022 to 2023, reflecting the continuous expansion of surgical volumes and reinforcing the rising demand for physiological saline.

Table 1 Top 10 countries ranked by total number of aesthetic surgical procedures

RANK

Country

Total Surgical Procedures

Percentage Of Total Surgical Procedures

1

U.S.

1,791,102

11.3%

2

Brazil

2,185,038

13.8%

3

Mexico

932,539

5.9%

4

Germany

463,026

2.9%

5

Argentina

475,887

3.0%

6

Turkiye

553,122

3.5%

7

India

531,792

3.4%

8

France

323,600

2.0%

9

Italy

262,254

1.7%

10

Spain

259,473

1.6%

Source: International Society of Aesthetic Plastic Surgery, GVR Analysis

The rising prevalence of chronic wounds, particularly diabetic foot ulcers and pressure ulcers, is a significant driver of the market for physiological saline, as these conditions require frequent wound cleaning and irrigation with sterile saline to prevent infection and promote healing. In March 2025, MDPI noted diabetic foot as one of the most serious complications of diabetes, affecting around 18.6 million people globally each year and accounting for nearly 80% of diabetes-related lower limb amputations. It is estimated that up to 25% of individuals with diabetes are at risk of developing diabetic foot, with 19%-34% likely to experience ulcers during their lifetime. Supporting this, a JAMA study in November 2023 reported that one in three diabetic patients (33.33%) develops foot ulcers, impacting 1.6 million individuals annually in the U.S., while Trios Health (October 2023) noted that around 2 million Americans develop diabetic foot ulcers each year. Such wounds' high incidence and recurrence drive consistent demand for physiological saline solutions as an essential component of wound management.

The expansion of home and outpatient care is driving the market for physiological saline by increasing demand for convenient, smaller-volume packaging formats such as vials, prefilled syringes, and flexible containers. With the growing shift toward cost-effective and patient-centered healthcare, more treatments such as IV infusions, wound irrigation, nasal care, and ophthalmic procedures are being managed outside traditional hospital settings. This trend is particularly supported by the rising elderly population, chronic disease management needs, and advancements in portable infusion systems. As a result, the accessibility and ease of use of saline solutions in home and outpatient environments are fueling steady market growth.

The FDA’s approval of Baxter’s Sabinanigo, Spain, facility as a manufacturing site for 0.9% Sodium Chloride Injection, USP, is a key development for the U.S. physiological saline market. This move enhances supply security and addresses the ongoing shortages of saline solutions impacting healthcare providers. By adding new production capacity and ensuring availability in multiple volumes (250 mL, 500 mL, and 1000 mL), the approval strengthens the resilience of the saline supply chain and supports uninterrupted clinical use across hospitals and surgical centers, thereby driving market growth.

"The approval of an additional manufacturing site for Sodium Chloride Injection in the U.S. gives us greater flexibility to respond to market demand fluctuations and will help as we continue to meet patient and healthcare provider need for this critical product," said Brik Eyre, president of Baxter's Hospital Products business. "FDA was quick to recognize the benefit of addressing industry demand for sterile IV solutions in collaboration with companies like Baxter. This approval illustrates the strength of Baxter's global manufacturing network, as well as our commitment to meeting important healthcare needs."

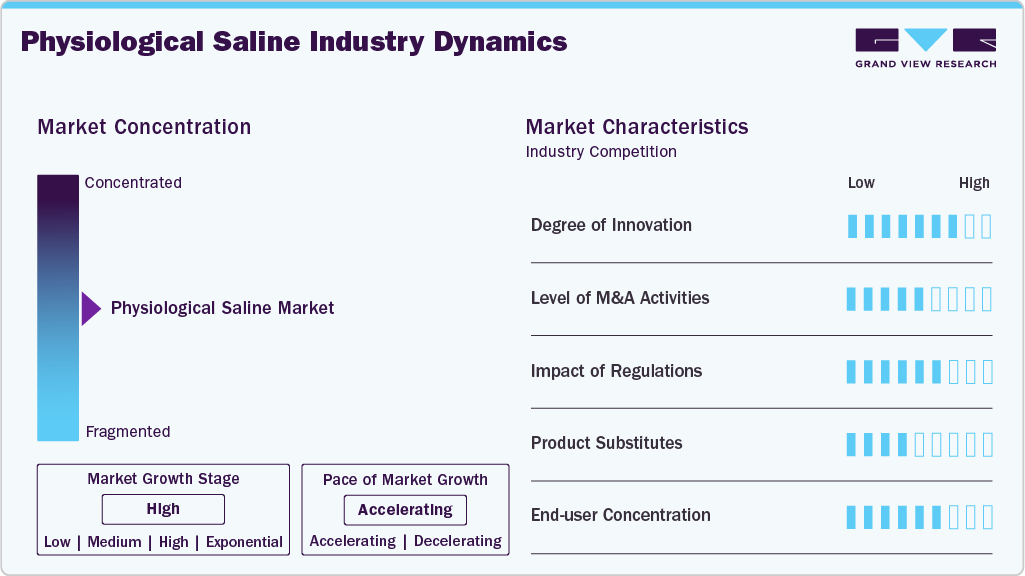

Market Concentration & Characteristics

The degree of innovation in the physiological saline industry is relatively moderate compared to other healthcare segments, as saline is a standardized, essential solution with limited scope for reformulation. However, innovation is evident in packaging, delivery formats, and usability enhancements. Developments such as flexible IV bags, prefilled vials, single-dose nasal sprays, and portable irrigation kits are designed to improve convenience, safety, and reduce contamination risks. In addition, advancements in manufacturing technologies focus on ensuring sterility, extended shelf life, and cost efficiency. While the core composition of saline remains unchanged, these incremental innovations in delivery systems and packaging continue to drive differentiation and competitiveness within the market.

The impact of regulations on the market is significant, as saline is classified as a medical product and must meet strict safety, sterility, and quality standards set by regulatory authorities such as the FDA (U.S.), EMA (Europe), and CDSCO (India). Regulations govern every stage, from raw material sourcing and manufacturing processes to packaging and labeling, ensuring patient safety and preventing contamination risks. Compliance with Good Manufacturing Practices (GMP) and pharmacopeia standards (USP, EP, JP) is mandatory, creating high entry barriers for new players and ensuring consistent product reliability. Furthermore, regulatory oversight on pricing, approval for new packaging formats, and product recalls in case of quality lapses directly affect market dynamics, making adherence to regulations both a challenge and a driver of trust in the physiological saline industry.

The level of M&A activities in the industry is moderate, primarily driven by larger healthcare and pharmaceutical companies seeking to expand their portfolios in essential medical consumables. Since saline is a high-volume, low-margin product, mergers and acquisitions often focus on strengthening manufacturing capacities, expanding geographic reach, and securing distribution networks rather than innovation-led deals. Consolidation among regional players is common to achieve economies of scale, reduce production costs, and ensure uninterrupted supply in hospital and outpatient settings. While not as frequent as in high-tech medical device markets, M&A in the saline segment plays a crucial role in addressing global shortages, stabilizing supply chains, and enabling companies to maintain a competitive edge in both mature and emerging markets. For instance, in November 2024, ICU Medical, Inc., a leader in developing, manufacturing, and marketing innovative medical devices, and Otsuka Pharmaceutical Factory, Inc. (OPF), the IV solutions manufacturing arm of Otsuka Holdings Co., Ltd., have announced the formation of a joint venture aimed at strengthening supply chain resilience and driving innovation within the North American IV solutions market.

The end use concentration is high, as hospitals and clinics account for the majority of demand due to the essential use of saline in IV infusions, surgeries, wound irrigation, and emergency care. Ambulatory surgical centers (ASCs) and dialysis centers also represent significant users, while home care settings are emerging as a fast-growing segment with the increasing adoption of self-administered IV therapies, nasal irrigation, and wound care. This concentration around large institutional buyers such as hospitals creates strong bargaining power, pushing manufacturers to maintain competitive pricing, reliable supply, and compliance with strict quality standards. As a result, end use concentration directly influences market dynamics, favoring players with strong hospital partnerships and wide distribution networks.

Product Insights

On the basis of product, the intravenous (IV) saline solutions segment held the largest share in 2024 as it is indispensable across various medical procedures, from fluid replacement and electrolyte balance to medication dilution and blood transfusions. Nearly every inpatient treatment involves IV saline, making it the largest and most consistent demand segment among hospitals, surgical centers, and emergency care units. Their critical role in managing dehydration, trauma, sepsis, and chronic conditions like kidney disease further strengthens their dominance. Moreover, the rising number of surgeries, hospital admissions, and critical care cases globally ensures sustained and growing demand, firmly positioning IV saline solutions as the leading segment in the market.

Nasal irrigation solutions segment is expected to witness the fastest CAGR over the forecast period. This growth is driven by their expanding use in respiratory health management and self-care. The rising prevalence of allergies, sinusitis, and upper respiratory tract infections has increased consumer adoption of saline sprays and rinses as a safe, drug-free solution for nasal cleansing. The growth is further fueled by the surge in demand for home-based and preventive care, especially post-pandemic, as individuals seek to maintain respiratory hygiene and reduce infection risks.

Container Insights

On the basis of container, the flexible containers segment held the largest share in 2024 and is expected to witness the fastest growth over the forecast period. Flexible containers offer superior convenience, safety, and cost efficiency compared to traditional packaging formats. Widely used in hospitals and clinical settings, flexible IV bags minimize contamination risks, reduce breakage during handling and transportation, and allow easy storage due to their lightweight and space-saving design. They are also compatible with various infusion systems, making them the preferred choice for intravenous therapies and surgical procedures. Growing adoption in both developed and emerging markets and continuous innovation, such as multi-chamber bags and eco-friendly materials, further enhance their demand. As healthcare facilities increasingly shift toward efficient and safer saline delivery systems, flexible containers are set to remain the dominant format while registering the fastest growth over the forecast period.

Volume Insights

On the basis of volume, the 1000 ML segment held the largest share in 2024. 1000 ml is the most commonly used volume in hospitals and surgical settings, where large quantities of saline are required for intravenous infusions, fluid replacement, and wound irrigation during procedures. Its capacity makes it ideal for continuous administration in critical care, trauma management, dialysis, and long-duration surgeries, reducing the need for frequent replacements compared to smaller volumes. Furthermore, 1000 ml packs are widely preferred in bulk hospital procurement due to cost efficiency and standardized usage protocols. This consistent and indispensable demand across multiple therapeutic areas and clinical environments firmly positions the 1000 ml segment as the leading volume category in the market.

The 250 ml segment is expected to witness the fastest CAGR over the forecast period. This volume is ideal for a wide range of applications, including intravenous (IV) infusions, wound care, and ophthalmic treatments, making it a preferred choice in hospital and outpatient settings. The increasing prevalence of chronic diseases, surgical procedures, and trauma cases has led to a higher demand for saline solutions in emergency departments and surgical centers. Besides, the growing adoption of home healthcare services and ambulatory surgical centers has further fueled the demand for 250 mL saline solutions, as they offer a convenient and efficient option for patient care outside traditional hospital settings.

End Use Insights

On the basis of end use, the hospitals and clinics segment held the largest share in 2024. Hospitals and clinics are the primary centers for inpatient and outpatient treatments, surgeries, and emergency care, which heavily rely on saline solutions. Sterile 0.9% saline is indispensable for intravenous (IV) infusions, wound irrigation, catheter flushing, and surgical procedures, making it a critical consumable in these settings. The high patient inflow, increasing surgical volumes, and the rising burden of chronic conditions requiring long-term IV therapy have further fueled the demand. Moreover, hospitals maintain large-scale inventories of saline solutions in multiple volumes and packaging formats to ensure an uninterrupted supply for routine and critical care. This consistent and large-volume usage directly positions hospitals and clinics as the leading end use segment, significantly driving overall market growth.

The ambulatory surgical centers segment is expected to witness the fastest CAGR over the forecast period. This growth is driven by the rapid shift toward outpatient and same-day surgical procedures. ASCs are increasingly preferred due to their cost-effectiveness, shorter recovery times, and reduced risk of hospital-acquired infections compared to inpatient settings. Since most surgeries and diagnostic procedures in ASCs require saline for wound irrigation, IV fluid replacement, and cleaning of surgical instruments, their rising adoption directly boosts demand. Furthermore, the growing number of minimally invasive procedures, supported by favorable reimbursement policies and patient preference for accessible care, accelerates the expansion of ASCs. As a result, these facilities are emerging as a key growth engine for the market for physiological saline over the forecast period.

Regional Insights

The North America physiological saline industry dominated with the largest revenue share of 46.79% in 2024. The growth is driven by the high demand for saline solutions in surgeries, critical care, and chronic disease management. Rising surgical volumes, combined with the shift toward outpatient and ambulatory care, are increasing the need for sterile saline in flexible packaging and portable formats. Technological advancements, particularly the adoption of flexible containers and single-dose vials, are enhancing safety, ease of use, and infection control in clinical settings. Besides, the expanding role of home healthcare, particularly for hydration therapy, nasal irrigation, and wound care, is broadening the market beyond hospitals. Strong regulatory oversight by the FDA and Health Canada ensures high safety and quality standards, pushing manufacturers to focus on compliance and innovation.

U.S. Physiological Saline Market Trends

The U.S. physiological saline industry is primarily driven by the rising surgical procedures, the expanding use of IV therapies, and the increasing prevalence of chronic diseases requiring regular fluid management. Packaging innovations, such as flexible containers and single-dose vials, are gaining traction due to their convenience, safety, and reduced risk of contamination. Moreover, the rise of ambulatory surgical centers and outpatient facilities is reshaping consumption patterns, as these settings increasingly rely on saline for minimally invasive procedures. Regulatory standards and ongoing investments in saline production capacity ensure supply stability, making the U.S. a key market driving innovation and consumption in the global physiological saline industry.

Europe Physiological Saline Market Trends

The Europe physiological saline industry is witnessing steady growth, fueled by rising surgical volumes, an aging population, and the increasing prevalence of chronic conditions such as diabetes and cardiovascular disorders. A strong emphasis on infection prevention and wound management further boosts the demand for saline in hospitals and clinics. Furthermore, nasal irrigation solutions are gaining popularity in countries such as Germany, France, and the UK, supported by growing awareness of respiratory health and sinus care. The market is also being shaped by Europe’s strong regulatory framework and a shift toward modern packaging formats, such as flexible containers and vials, which enhance patient safety and convenience.

The physiological saline industry in the UK is largely driven by the UK's rising number of surgeries, an aging population, and growing adoption of IV therapies in hospitals and home care. The market is expanding rapidly, with demand also supported by advanced wound care efforts and infection management for chronic conditions like diabetic foot ulcers. In essence, NHS initiatives for efficient patient care and increasing home-based treatments are encouraging the use of flexible saline packaging, while a trend toward self-care, including nasal irrigation and minor wound cleaning, continues to boost steady market growth.

Asia Pacific Physiological Saline Market Trends

The Asia Pacific physiological saline industry is expected to depict the fastest CAGR of 8.54% from 2025 to 2033. The growth outlook is largely attributed to the rising burden of chronic diseases, increasing surgical volumes, and expanding access to healthcare in emerging economies. Growing investments in hospital infrastructure, along with the rapid adoption of IV therapy in both inpatient and outpatient care, are fueling demand for saline solutions across diverse formats. In addition, the region’s large population base and rising health awareness are driving the use of saline for wound irrigation, ophthalmic care, and nasal applications. The increasing penetration of home healthcare and cost-effective manufacturing in countries like India and China is further shaping the market’s upward trajectory.

The physiological saline industry in China is driven by the country’s ongoing healthcare modernization, a higher prevalence of chronic diseases, and growing demand for surgical and therapeutic treatments in both hospitals and clinics; this momentum is supported by the government’s initiative to strengthen primary care and domestic manufacturing, ensuring widespread, affordable access to saline solutions for IV therapy and wound care, while the rise of home healthcare and a larger elderly population continues to drive steady, long-term growth.

Latin America Physiological Saline Market Trends

The Latin America physiological saline industry is showing steady growth, driven by improving access to healthcare, rising surgical volumes, and a growing focus on emergency and critical care services. Saline is widely used in IV therapy, dialysis, wound irrigation, and general surgical procedures, making it a staple in hospitals and outpatient settings across the region. Expanding public health initiatives, coupled with the rising prevalence of chronic diseases such as diabetes and kidney disorders, are further driving demand. Further, the increasing adoption of home healthcare solutions is boosting the use of small-volume saline packaging, creating new growth opportunities in the market.

Middle East Africa Physiological Saline Market Trends

The Middle East & Africa physiological saline industry is experiencing moderate growth, driven by rising investments in healthcare infrastructure, increasing surgical volumes, and expanding access to essential medical supplies. The region’s high prevalence of chronic diseases, trauma cases, and maternal healthcare needs contributes to consistent demand for saline in IV therapy, wound irrigation, and emergency care. Furthermore, government-led initiatives to strengthen hospital networks and improve access to affordable treatments are supporting market expansion. The growing focus on home care and outpatient services is also boosting demand for varied saline packaging formats, making it a critical component of the region’s healthcare landscape.

Key Physiological Saline Company Insights

The market for physiological saline is extremely fragmented, with both major and local market competitors. Due to the fact that the current market players are stepping up their efforts to grab the majority in the global landscape, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many industry participants are engaging in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, in an effort to gain a competitive edge over rivals. Thus, with various strategies adopted by the industry players, the market is predicted to grow during the forecast period.

Key Physiological Saline Companies:

The following are the leading companies in the physiological saline market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun Medical Inc.

- Baxter

- Fresenius SE & Co. KGaA

- Pfizer Inc.

- ICU Medical, Inc.

- Medline Industries, LP.

- AirLife

- Amsino International, Inc.

- AdvaCare Pharma

- Advin Health Care

- WAMIN (Suppliers, Exporters, and Manufacturers China Medicine)

Recent Developments

-

In November 2024, ICU Medical, Inc., a leader in developing, manufacturing, and marketing innovative medical devices, and Otsuka Pharmaceutical Factory, Inc. (OPF), the IV solutions manufacturing arm of Otsuka Holdings Co., Ltd., have announced the formation of a joint venture aimed at strengthening supply chain resilience and driving innovation within the North American IV solutions market.

Physiological Saline Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.56 billion

Revenue forecast in 2033

USD 9.54 billion

Growth rate

CAGR of 6.97% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, container, volume, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE.

Key companies profiled

B. Braun Medical Inc.; Baxter; Fresenius SE & Co. KGaA; Pfizer Inc.; ICU Medical, Inc.; Medline Industries, LP.; AirLife; Amsino International, Inc.; AdvaCare Pharma; Advin Health Care; WAMIN (Suppliers, Exporters, & Manufacturers China Medicine)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Physiological Saline Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global physiological saline market report on the basis of product, container, volume, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Intravenous (IV) Saline Solutions

-

Nasal Irrigation Solutions

-

Ophthalmic Saline

-

Wound Irrigation and Cleaning Solutions

-

-

Container Outlook (Revenue, USD Million, 2021 - 2033)

-

Flexible Container

-

Plastic Bottles

-

Vial

-

-

Volume Outlook (Revenue, USD Million, 2021 - 2033)

-

1000 ML

-

500 ML

-

250 ML

-

Less Than 250

-

More Than 1000 ml

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers (ASCs)

-

Home Care Settings

-

Laboratory & Research

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global physiological saline market size was estimated at USD 5.24 billion in 2024 and is expected to reach USD 5.56 billion in 2025.

b. The global physiological saline market is expected to grow at a compound annual growth rate of 6.97% from 2025 to 2033 to reach USD 9.54 billion by 2033.

b. North America dominated the physiological saline market with a share of 46.79% in 2024. The growth is driven by the high demand for saline solutions in surgeries, critical care, and chronic disease management. Rising surgical volumes, combined with the shift toward outpatient and ambulatory care, are increasing the need for sterile saline in flexible packaging and portable formats.

b. Some key players operating in the physiological saline market include B. Braun Medical Inc.; Baxter; Fresenius SE & Co. KGaA; Pfizer Inc.; ICU Medical, Inc.; Medline Industries, LP.; AirLife; Amsino International, Inc.; AdvaCare Pharma; Advin Health Care; WAMIN (Suppliers, Exporters, and Manufacturers China Medicine)

b. Key factors that are driving the market growth include the rising number of surgical procedures, growing prevalence of chronic diseases such as kidney disorders requiring dialysis, and the extensive use of saline in IV infusions for hydration and drug delivery. Increasing applications in wound irrigation, ophthalmic procedures, and nasal care further expand demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.