- Home

- »

- Automotive & Transportation

- »

-

Pickup Trucks Market Size & Share, Industry Report, 2030GVR Report cover

![Pickup Trucks Market Size, Share & Trends Report]()

Pickup Trucks Market (2025 - 2030) Size, Share & Trends Analysis Report By Fuel (Diesel, Petrol, Electric), By Vehicle (Light-duty, Heavy-duty), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68039-939-5

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pickup Trucks Market Summary

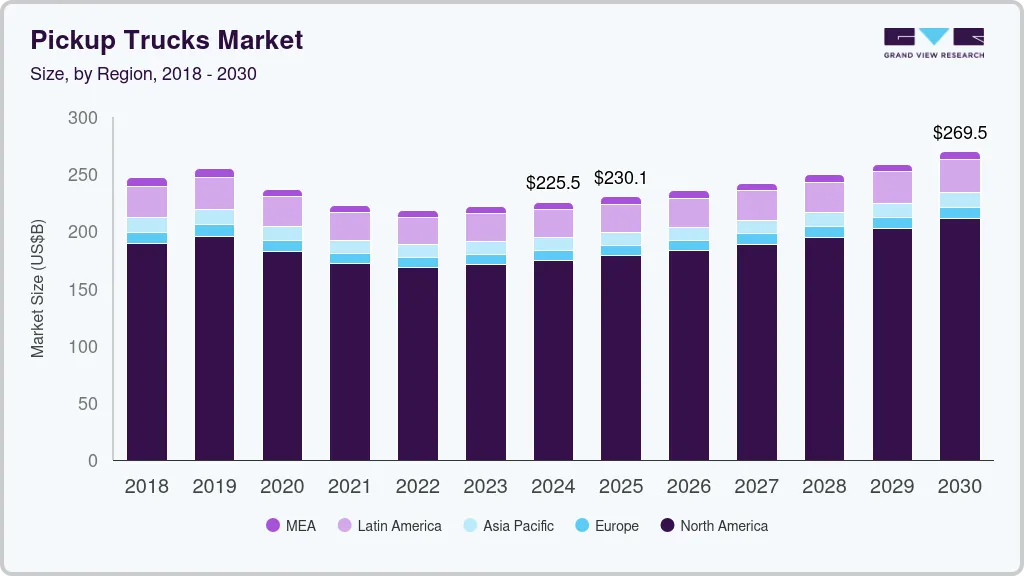

The global pickup trucks market size was estimated at USD 225.48 billion in 2024 and is projected to reach USD 269.52 billion by 2030, growing at a CAGR of 3.2% from 2025 to 2030. The growth of this market is primarily driven by factors such as the availability of products equipped with advanced technology features and an increase in disposable income levels.

Key Market Trends & Insights

- North America pickup trucks industry dominated globally with a revenue share of 77.5% in 2024.

- The pickup trucks industry in the U.S. accounted for the largest revenue share of the regional market in 2024.

- Based on fuel, the diesel segment dominated the global market and held a revenue share of 95.6% in 2024.

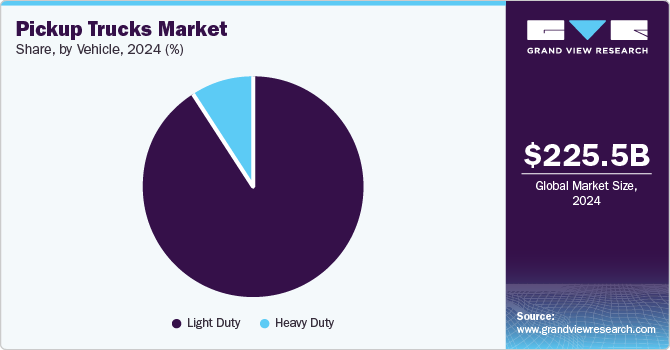

- Based on vehicle, light-duty pickup trucks segment accounted for the largest global market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 225.48 Billion

- 2030 Projected Market Size: USD 269.52 Billion

- CAGR (2025-2030): 3.2%

- North America: Largest market in 2024

In addition, versatility and improved utility offered by pickup trucks are expected to add significant growth opportunities to this market. The ability of light-duty vehicles such as pickup trucks to handle a wide range of tasks, the large cargo space offered by pickup trucks, and the popularity of products in numerous regional markets, including the U.S., have a major influence on the growth of this market. Pickup trucks provide well-equipped options for hauling, towing, and off-road travel and exceptional strength and utility. The growing utilization of these trucks for commercial purposes, especially in sectors such as construction, logistics, e-commerce, and food processing, is expected to drive demand for this market over the forecast period.Higher costs and initial investment requirements associated with incorporating full-size pickup vehicles in fleets stimulate businesses, especially small and medium-scale enterprises, and individual contractors, to use affordable pickup trucks. The multi-utility abilities offered by products and customer-friendly pricing add lucrative opportunities to this market. In addition, newly designed features and capabilities driven by technological advancements are anticipated to draw more attention to pickup trucks in the next few years.

Changing automotive industry dynamics, growing inclination among manufacturers to add electric vehicles to portfolios, and ongoing research & development efforts focused on the delivery of products that enable reduced carbon footprint also significantly influence this market's advancement. For instance, in August 2024, The Ford Motor Company, one of the key market participants in the automotive industry, announced its plans to launch newly designed electric commercial vehicles, including pickup trucks. The production of these vehicles is set to begin in 2026.

Innovation-based product development and new product launches by key market participants and manufacturers are expected to fuel growth. For instance, in November 2024, RIDDARA, which specializes in developing products with lower carbon footprints and improved environmental protection, launched RIDDARA RD6, a complete electric-powered pickup truck equipped with M.A.P (Multiplex Attached Platform). The products offer new designs, SUV-level comfort, and improved energy efficiency. RIDDARA is investing significant resources in R&D to integrate electric technology and innovations in intelligent driving in the pickup truck portfolio.

Fuel Insights

Based on fuel, the diesel segment dominated the global market and held a revenue share of 95.6% in 2024. The segment's largest market share is attributed to the majority of pickup truck models available being diesel engine-based. Key players, such as GM, Toyota, FCA, and Nissan, offer a wide portfolio of pickup trucks with most diesel engines. In addition, due to the higher torque and higher calorific value provided by diesel, consumers prefer diesel engine-based pickup trucks over other fuels, which also supports segment growth. Innovations and technological advancements by industry stakeholders also contribute to the growth of this segment. For instance, in January 2025, Cummins Inc., alongside its partners at Ram, brand by Stellantis, launched its new diesel pickup engine system, the 2025 6.7-liter turbo for Ram Heavy Duty. This system is set to be part of the recently introduced Ram 3500 and 2500 heavy-duty pickups.

The electrical segment is expected to grow at the fastest CAGR during the forecast period. A diesel engine has many perks regarding pickup truck efficiency; however, it also leads to higher emissions of GHG & CO2 and increased air pollution. Due to the increasing global warming, automakers are obliged to and keen on developing and manufacturing clean and green fuel-based vehicles. Changing government regulations, encouraging the adoption of EVs over diesel engine-driven commercial vehicles, and increasing the inclination among manufacturers to launch advanced product ranges are expected to add more growth opportunities to this segment. For instance, in May 2024, BYD Company Ltd., one of the major automotive manufacturers from China, launched BYD SHARK, an energy-intelligent pickup vehicle, in Mexico. The key product features include a DMO super hybrid off-road platform, an EHS electric hybrid system, a maximum power capacity of 430 horsepower, and more.

Vehicle Insights

Light-duty pickup trucks accounted for the largest global market revenue share in 2024. The higher market revenue share of the segment is attributed to the diverse range of products offered by multiple manufacturers. In addition, higher consumer preference and the rising popularity of light-duty pickup trucks due to their appearance and compact space & size will boost the segment growth. Leading models with higher unit sales in the market are light-duty trucks, including Ford F-150, Ram 1500, Toyota Hilux, Ford Ranger, Chevrolet Silverado, and many more. The higher popularity of these models worldwide contributed to the dominance of the light-duty vehicle segment.

The heavy-duty vehicle segment is anticipated to witness the fastest CAGR over the forecast period. The increasing interest of consumers in newly launched models and increasing product launches by key manufacturers are credited to the segment’s growth. For instance, in January 2025, Ram, one of Stellantis, launched 2025 Ram heavy-duty trucks equipped with 6.7-liter high-capacity turbo diesel engines by Cummins.

Regional Insights

North America pickup trucks industry dominated globally with a revenue share of 77.5% in 2024. The growth of this market is mainly driven by the growing utilization for commercial use in multiple sectors such as logistics, construction, and others, the availability of advanced products in the region, and presence of numerous manufacturers. The focus of key market participants on North America’s regional market owing to a large number of existing users of pickup trucks and increasing demand for newly developed pickup trucks equipped with cutting-edge technology are also adding noteworthy growth opportunities to this market.

U.S. Pickup Trucks Market Trends

The pickup trucks industry in the U.S. accounted for the largest revenue share of the regional market in 2024. This market is primarily driven by the growth in demand from commercial buyers such as businesses active in application industries such as construction, logistics and transportation, enabling services, and others. These vehicles are increasingly used by small and medium-scale companies and individual contractors/vendors owing to the multi-utility benefits offered by the products. Growth in disposable income, numerous manufacturers in the domestic market, and the launch of new products equipped with EV technology are expected to add growth to this market over the forecast period.

Europe Pickup Trucks Market Trends

Europe pickup trucks industry was identified as one of the key markets globally in 2024. This is attributed to rising demand for vehicles that offer rugged strength and versatility, increasing demand from commercial users, and the presence of key manufacturers such as Volkswagen, Ford, Renault, Iveco, and others. Increasing awareness regarding environmental footprint is expected to drive growth for electric pickup trucks in the regional market.

The Germany pickup truck market is expected to experience significant growth over the next few years owing to the country's strong manufacturing sector and increasing utilization by individual contractors, vendors, services providers, and small and medium-scale businesses active in sectors such as food delivery, logistics, transportation, construction, and others. New product launches by major market players in Germany are anticipated to add novel growth opportunities to this market.

The pickup trucks industry in the UK accounted for the largest revenue share of the regional market. This market is mainly driven by the growing demand for multi-functional vehicles with strong structures, improved cargo transport and hauling capabilities, advanced technologies, and more. Government regulations regarding emission control and increasing inclination towards using vehicles with reduced carbon footprint are expected to develop growth for electric pickups in this market over the forecast period.

Asia Pacific Pickup Trucks Market Trends

Asia Pacific pickup trucks industry is estimated to experience a notable CAGR from 2025 to 2030. This is attributed to factors such as increasing infrastructure developments and enhancements initiated in the region, leading to strong growth for the construction industry and the rising availability of pickup trucks offered by global manufacturers operating in the area. The presence of key manufacturers such as BYD, Isuzu, Mahindra & Mahindra Ltd, GWM, and others also facilitates the growth of this regional industry.

China pickup trucks market dominated the regional market owing to the strong presence of manufacturers focusing on developing and manufacturing electric pickup trucks and significant growth in technology advancements associated with the automotive industry. China contributes a major share of the global trade in electric vehicles. Ongoing research & development activities in the domestic automotive market, a large number of parts and components manufacturers operating in the country, and rising exports from China across multiple regions are expected to drive the growth of this market over the coming years.

India's pickup trucks market is anticipated to experience moderate growth from 2025 to 2030. This market is mainly driven by the noteworthy demand from commercial buyers, especially in sectors such as transportation and logistics, construction, food processing, distribution, and supply chain management. Vehicles and models launched by domestic manufacturers, aligned with requirements associated with local terrains and working environments, are expected to drive growth for the pickup truck industry in the country.

Key Pickup Trucks Company Insights

Some of the key companies in the pickup trucks industry include Stellantis N.V.; Ford Motor Company; Toyota Motor Corporation; Nissan Motor Co. Ltd.; and Volkswagen Group. These companies are undergoing various strategic initiatives, such as new product launches, partnerships and collaborations, and business expansions, to gain a competitive edge in the market.

-

Stellantis N.V., a company operating 14 automotive brands, offers a diverse range of products with cutting-edge technologies and innovation. Through its Dare Forward 2030 strategic plan, it focuses on developing and delivering products featuring electric capacities and novel technologies to facilitate its journey towards its plans to accomplish carbon net zero by 2038.

-

Ford Motor Company, one of the manufacturers of advanced automotive products and vehicles in line with the changing demands of users, such as electric vehicles, offers a large portfolio of pickups. This includes multiple product series such as Maverick, Super Duty, Ranger, F-150, and others. The company has been focusing on delivering electric-powered pickups to address the changing demands of modern markets and commitment to environmental protection.

Key Pickup Trucks Companies:

The following are the leading companies in the pickup trucks market. These companies collectively hold the largest market share and dictate industry trends.

- Stellantis N.V.

- Ford Motor Company

- Toyota Motor Corp.

- Nissan Motor Co. Ltd.

- Volkswagen Group

- Tata Motors Ltd.

- Ashok Leyland Ltd.

- General Motors Company

- Hyundai Motor Company

- Suzuki Motor Corp.

- Kia Corporation

- Mahindra & Mahindra Ltd

Recent Developments

-

In December 2024, Ram Trucks, a brand by Stellantis, launched a new Ram 1500 in Europe. This pickup has a 3-liter Hurricane High Output (H/O) Straight-Six Turbo (SST) engine and additional features such as a Uconnect system, adaptive cruise control, and advanced technologies such as forward collision, emergency braking, etc.

-

In October 2024, Kia Corporation, one of the key automotive manufacturers with a global presence, launched its first pickup truck offering, the Kia Tasman. The new product development addresses lifestyle truck demand and changing consumer preferences.

-

In July 2024, NYE Toyota announced that Toyota plans to launch an all-electric, newly designed pickup truck by 2025. It aims to deliver an electric version of its well-applauded Hilux model.

Pickup Trucks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 230.06 billion

Revenue forecast in 2030

USD 269.52 billion

Growth rate

CAGR of 3.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Fuel, vehicle, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Stellantis N.V.; Ford Motor Company; Toyota Motor Corp.; Nissan Motor Co. Ltd.; Volkswagen Group; Tata Motors Ltd.; Ashok Leyland Ltd.; General Motors Company; Hyundai Motor Company; Suzuki Motor Corp.; Kia Corporation; Mahindra & Mahindra Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pickup Trucks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pickup trucks market report based on fuel, vehicle, and region:

-

Fuel Outlook (Revenue, USD Million, 2018 - 2030)

-

Diesel

-

Petrol

-

Electric

-

Other

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Light duty

-

Heavy duty

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pickup trucks market size was estimated at USD 225.48 billion in 2024 and is expected to reach USD 230.06 billion in 2025.

b. The global pickup trucks market is expected to grow at a compound annual growth rate of 3.2% from 2025 to 2030 to reach USD 269.52 billion by 2030.

b. North America dominated the pickup trucks market with a share of 77.5% in 2024. The growth of this market is mainly driven by the growing utilization for commercial use in multiple sectors such as logistics, construction, and others, the availability of advanced products in the region, and the presence of numerous manufacturers.

b. Some key players operating in the pickup trucks market include Stellantis N.V.; Ford Motor Company; Toyota Motor Corp.; Nissan Motor Co. Ltd.; Volkswagen Group; Tata Motors Ltd.; Ashok Leyland Ltd.; General Motors Company; Hyundai Motor Company; Suzuki Motor Corp.; Kia Corporation; and Mahindra & Mahindra Ltd.

b. Key factors that are driving the pickup trucks market growth include the growing utilization of these trucks for commercial purposes, especially in sectors such as construction, logistics, e-commerce, food processing, etc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.