- Home

- »

- Advanced Interior Materials

- »

-

Pipe Insulation Market Size And Share, Industry Report, 2030GVR Report cover

![Pipe Insulation Market Size, Share & Trends Report]()

Pipe Insulation Market (2023 - 2030) Size, Share & Trends Analysis Report By Material (Cellular Glass, Elastomeric Foam), By Application (Industrial, Building & Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-654-7

- Number of Report Pages: 143

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pipe Insulation Market Summary

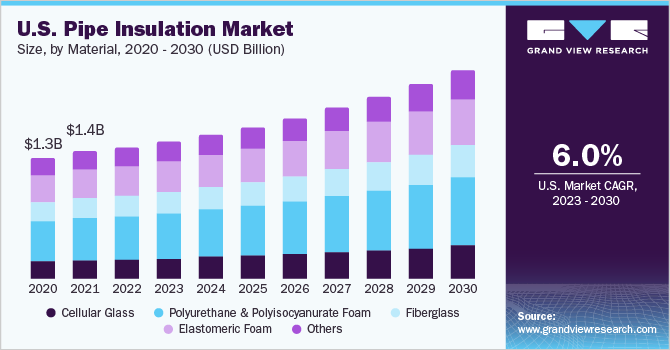

The global pipe insulation market size was estimated at USD 8.87 billion in 2022 and is projected to reach USD 13.57 billion by 2030, growing at a CAGR of 5.5% from 2023 to 2030. Rising awareness pertaining to energy conservation among consumers is expected to drive the market over the forecast period.

Key Market Trends & Insights

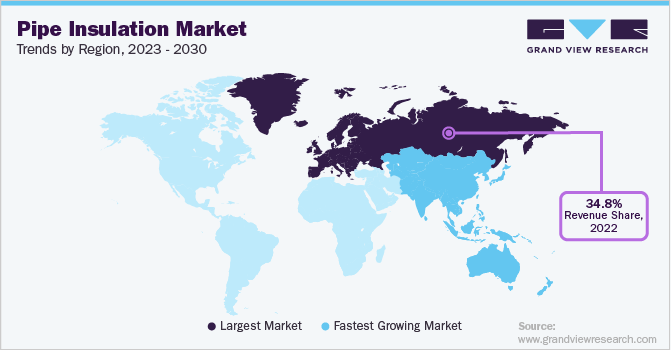

- The Europe dominated the market and accounted for 34.8% of the total revenue share in 2022.

- The Asia Pacific is expected to witness the fastest growth rate over the forecast period owing to the growing investments in the chemical processing industry.

- Based on material, the polyurethane & polyisocyanurate foam led the market and accounted for a 22.7% share of the revenue in 2022.

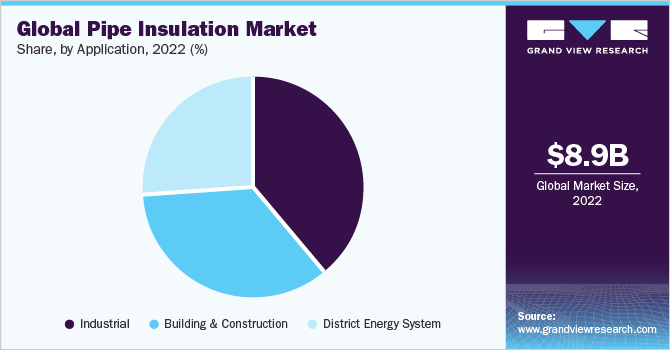

- The industrial application segment led the market and accounted for about 39.1% share of the revenue in 2022.

Market Size & Forecast

- 2022 Market Size: USD 8.87 Billion

- 2030 Projected Market USD 13.57 Billion

- CAGR (2023-2030): 5.5%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

The market witnessed a severe downfall in investments in the industrial sector owing to the pandemic, thereby impacting overall growth. In addition, a dramatic fall in crude oil prices led to a drop in fiscal resources for oil-producing countries, which affected the product demand from the oil & gas sector. The market in Asia Pacific is expected to witness exponential growth over the forecast period on account of the rising number of industries in economies, such as China and India.

Rapid urbanization coupled with the rising demand for residential and commercial construction is anticipated to further fuel the market growth. Increasing adoption of district heating systems, driven by rising electricity tariffs, rising environmental awareness, and technological advances is expected to propel market growth in the U.S. In addition, rising investments in the expansion of gas liquefaction terminals are expected to drive the demand for pipe insulations over the forecast period.The presence of a large number of manufacturers and service providers, coupled with the easy availability of raw materials and easy installation processes, has resulted in intense market competition.

The price structure for pipe insulation varies with respect to production processes and raw materials used. The growing demand for pharmaceutical and cosmetic products is driving the expenditure on capacity additions by major pharmaceutical companies. Process pipes form an integral component in these production facilities and are expected to generate significant demand for pipe insulation over the forecast period. Corrosion under insulation has been one of the major challenges faced by the industry. It is a localized form of external corrosion that occurs on carbon, low alloy steel, and stainless-steel pipes operating at temperatures above 80° Celsius.

If not detected and prevented in time, CUI may cause the pipe to leak and lead to piping failure. The manufacturers are largely dependent on reliable suppliers with high goodwill on account of past product procurement, making it moderately difficult for new entrants to penetrate the market. In addition, the industryhasa presence of several well-established players with a strong financial base. This is anticipated to limit the entry of new players. Moreover, high initial investments required to set up the business are expected to further restrict new entrants.

Material Insights

Polyurethane & polyisocyanurate foam led the market and accounted for a 22.7% share of the revenue in 2022. The product is typically used in pipe insulation applications as it can restrict the absorption of air, water, and gas. The material is commonly used in applications below 50°F as it offers excellent dimensional stability over a wide temperature range. Cellular glass is used in various applications, such as in heat transfer fluid systems, chemical processing systems, ductwork & commercial pipework, storage tanks, and in many other application areas. The material exhibits consistent insulating efficiency, low vapor permeability, fire protection, and high compressive strength.

Fiberglass is widely used in insulation systems due to its lower cost and easy installation. The material is used in the automotive and construction industries in providing insulation solutions. The material is widely used to insulate copper, iron, and PVC pipes in industrial, commercial, and institutional buildings.The demand for elastomeric foam insulation is expected to grow owing to its properties, such as moisture retention and strong water vapor permeability. The demand for elastomeric foam has witnessed an upward trend over the past few years due to rising environmental concerns and strict government regulations regarding reducing carbon emissions since the material does not contain any formaldehyde or fibers and has low VOC emission levels.

Application Insights

The industrial application segment led the market and accounted for about 39.1% share of the revenue in 2022. Escalating demand for piping systems in various industries, such as petrochemical, oil & gas, power generation, chemical, and wastewater treatment, is estimated to augment segment growth. The product is used in oil pipelines to provide enhanced safety, particularly in onshore pipelines.The increasing population, coupled with rapid urbanization, is likely to propel the product demand in building & construction applications. The growth of the construction sector and stricter energy-efficiency norms are projected to positively influence the demand further. In addition, the emerging trend of sustainable buildings is one of the primary factors driving the growth of pipe insulation in buildings.

District energy systems have been adopted across the globe as an effective solution to connect thermal storage, renewables, power grids, waste heat, and heat pumps, thus ensuring sustainable heating and cooling. The systems use pre-insulated pipes for the distribution of produced streams and supply steam or hot water for cooling building spaces.Insulated piping systems are the major components of district energy systems. Insulated pipes used in these systems are made from eco-friendly materials. With the rapid growth of district energy systems, the demand for pipe insulation is also expected to grow over the forecast period.

Regional Insights

Europe dominated the market and accounted for 34.8% of the total revenue share in 2022. This can be attributed to the rapidly increasing number of construction and infrastructural activities coupled with the rising installation of district energy systems in economies, such as Germany, the U.K., and Spain.Growing domestic consumption of food & beverages and pharmaceutical products is driving investments in the respective manufacturing sectors, thereby propelling the demand for process pipes and pipe insulation materials in North America. In addition, rising product demand for residential applications due to climatic conditions is anticipated to benefit the industry growth.

Asia Pacific is expected to witness the fastest growth rate over the forecast period owing to the growing investments in the chemical processing industry. In addition, rising demand from the oil & gas sector, coupled with theirincreasing LNG regasification capacities to meet future demand, is expected to propel the market growth.Though the chemical industry holds an important position in the manufacturing sector of Brazil, the prevailing stagnant economic conditions have negatively impacted the overall investments in the manufacturing sector, thereby affecting the demand for pipe insulation. In addition, the global pandemic delayed the economic recovery and affected the investment scenario.

Key Companies & Market Share Insights

The industry is highly fragmented owing to the presence of various players. Keycompanies are highly focused on providing eco-friendly and diversified product portfolios to their customers. The companies also emphasize the adoption of raw materials to maintain a steady supply coupled with the cost-effectiveness of the overall pipe insulation system.Small companies often rely on channel intermediates, such as brokers and suppliers, to perform many of the marketing functions due to a lack of resources. Established players have their distribution and sales channel through which they supply products to end-users.Some of the prominent players in the global pipe insulation market include:

-

Armacell

-

Lydall, Inc.

-

Kingspan Group

-

Owens Corning

-

Huntsman International LLC

-

Saint-Gobain Group

-

Rockwool Insulation A/S

-

Johns Manville

-

Knauf Insulation

-

BASF SE

-

Covestro AG

-

Wincell Insulation Co., Ltd.

-

NMC International SA

-

Gilsulate International, Inc.

-

Sekisui Foam Australia

-

Omkar Puf Insulation Pvt. Ltd.

Pipe Insulation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.29 billion

Revenue forecast in 2030

USD 13.57 billion

Growth rate

CAGR of 5.5% from 2022 to 2030

Base year for estimation

2022

Historical data

2018 - 2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Brazil; Argentina

Key companies profiled

Armacell; Lydall, Inc.; Kingspan Group; Owens Corning; Huntsman International LLC; Saint-Gobain Group; Rockwool Insulation A/S; Johns Manville; Knauf Insulation; BASF SE; Covestro AG, Wincell Insulation Co., Ltd.; NMC International SA; Gilsulate International, Inc.; Sekisui Foam Australia; Omkar Puf Insulation Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

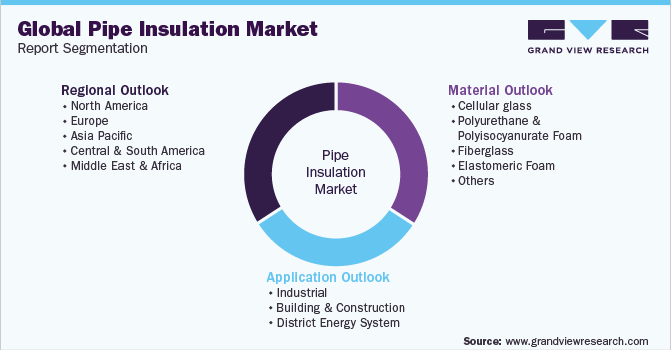

Global Pipe Insulation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global pipe insulation market report on the basis of material, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Cellular glass

-

Polyurethane & Polyisocyanurate Foam

-

Fiberglass

-

Elastomeric Foam

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Building & Construction

-

District Energy System

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global pipe insulation market size was estimated at USD 8.87 billion in 2022 and is expected to reach USD 9.29 billion in 2023.

b. The global pipe insulation market is expected to grow at a compound annual growth rate a CAGR of 5.5% from 2023 to 2030 to reach USD 13.57 billion by 2030.

b. Europe dominated the pipe insulation market with a share of 34.84% in 2022. This is attributable to the rapidly increasing number of construction and infrastructural activities coupled with the rising installation of district energy systems in economies such as Germany, UK, Spain, and others.

b. Some key players operating in the pipe insulation market include Armacell International Holding GmbH, Lydall Inc., Rockwool, Kingspan, Owens Corning, Saint-Gobain, Huntsman, Johns Manville, Knauf Insulation, BASF, Covestro, Itw Insulation Systems, Wincell, NMC SA, Gilsulate International, Inc., Sekisui Foam Australia, and others.

b. Key factors that are driving the market growth include rising product demand across applications including building and construction, industrial, and district energy systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.