- Home

- »

- Pharmaceuticals

- »

-

Plant-based API Market Size & Share, Industry Report, 2033GVR Report cover

![Plant-based API Market Size, Share & Trends Report]()

Plant-based API Market (2025 - 2033) Size, Share & Trends Analysis Report By Molecule Type (Alkaloids, Anthocyanin, Flavonoids, Phenolic Acids, Terpenoids, Lignin and Stilbenes), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-082-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plant-based API Market Summary

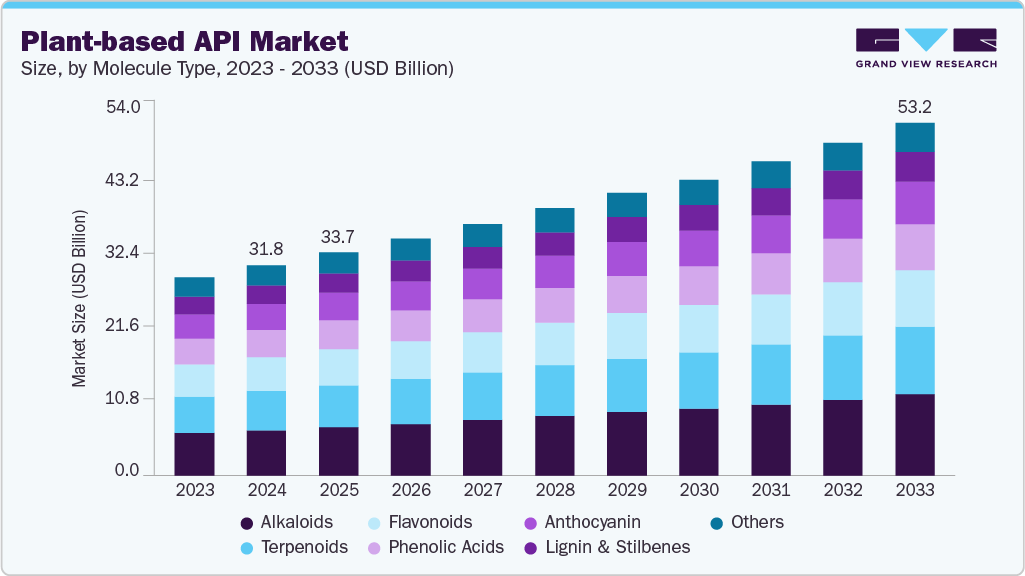

The global plant-based API market size was estimated at USD 31.78 billion in 2024 and is projected to reach USD 53.21 billion by 2033, growing at a CAGR of 5.9% from 2025 to 2033. The market is progressing steadily as pharmaceutical companies shift toward natural-origin ingredients supported by strong therapeutic relevance.

Key Market Trends & Insights

- The North America plant-based API market held the largest global revenue share of 34.06% in 2024.

- The plant-based API industry in the U.S. is expected to grow significantly from 2025 to 2033.

- By molecule type, the alkaloids segment held the highest market share of 21.62% in 2024.

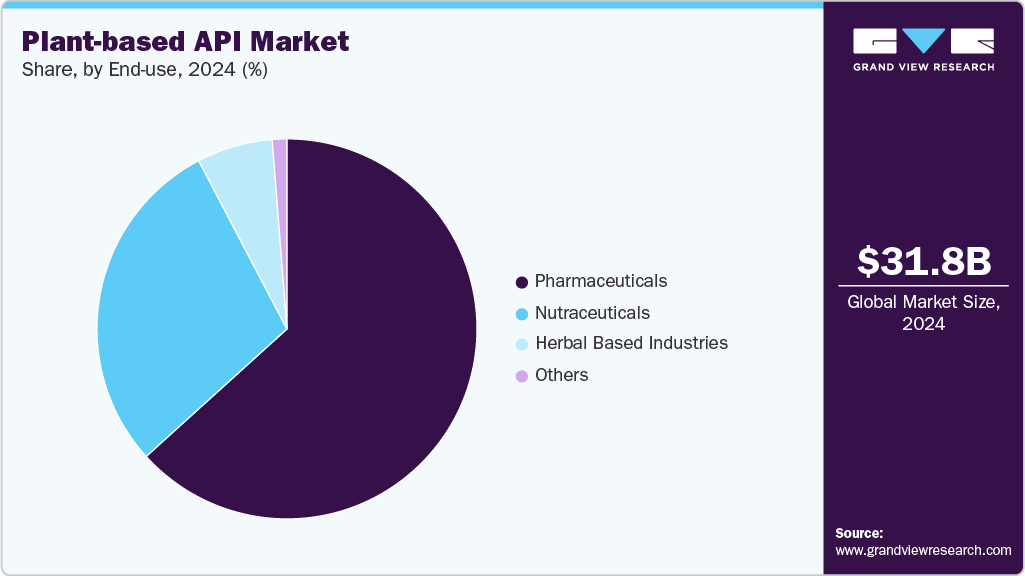

- By end use, the pharmaceuticals segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 31.78 Billion

- 2033 Projected Market Size: USD 53.21 Billion

- CAGR (2025-2033): 5.9%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Demand is increasing as patients and clinicians show greater confidence in botanical actives that deliver cleaner impurity profiles and favorable safety outcomes. For instance, in September 2025, Current Issues in Molecular Biology published a review describing how metabolic engineering raised terpenoid production, including paclitaxel, by 25‑fold and enhanced artemisinin yield by 38% in engineered systems. Multi-omics approaches, including genomics, transcriptomics, and metabolomics, revealed key biosynthetic genes and regulatory networks. Meanwhile, CRISPR tools, enzyme engineering, and subcellular targeting addressed the low natural yields, which often fall below 0.05% dry weight.

The review highlighted challenges such as metabolic flux balancing, cytotoxicity, and scale-up costs, proposing a roadmap to translate lab-scale terpenoid production into industrial manufacturing. This growing interest is encouraging manufacturers to upgrade extraction and purification systems that ensure uniform potency and regulatory compliance across production batches. Drug developers are strengthening pipelines that feature phyto-derived compounds for chronic and lifestyle-driven conditions, which helps establish consistent market momentum. The industry is further supported by scalable cultivation networks that secure dependable raw material availability, allowing producers to maintain continuous output and deliver a stable supply across global markets.

Innovation across research programs is advancing rapidly as scientists explore plant species with bioactive molecules that demonstrate strong pharmacological promise. Clinical research is expanding in anti-inflammatory, antimicrobial, cardiovascular, and metabolic categories, where botanical APIs offer compelling efficacy signals. For instance, in March 2025, Natural Products and Bioprospecting published a review documenting that from 2019 to April 2024, a total of 217 new terpenoids were isolated from the genus Aspergillus, including 81 sesquiterpenoids, 60 meroterpenoids, and 44 sesterterpenoids, while only four triterpenoids were reported. Aspergillus terreus and Aspergillus sydowii each accounted for 8.62% of isolates, with Aspergillus versicolor contributing 6.90%, highlighting fungi as an under-exploited source of terpenoids with antimicrobial potential. Companies are refining extraction protocols, analytical tools, and quality systems to meet API-grade standards that align with stringent regulatory expectations. Long-term partnerships are emerging as drug developers collaborate with botanical suppliers to ensure consistency, traceability, and standardized production. This growing emphasis on clean, traceable, and scientifically validated inputs is guiding the industry toward broader acceptance of plant-origin APIs across regulated and emerging healthcare markets.

Market growth is strengthening as life sciences companies incorporate plant-based APIs into advanced formulations designed for therapeutic care and preventive health needs. High consistency in purity, stability, and performance supports deeper adoption among formulation teams seeking dependable natural-origin inputs. Controlled cultivation systems, integrated traceability frameworks, and refined supply chain processes are helping manufacturers address variability concerns and deliver high-grade botanical materials. Scalable processing technologies are enabling suppliers to meet the rising demand from the pharmaceutical, nutraceutical, and wellness sectors, which prioritize natural ingredients. Increasing engagement from researchers, innovators, and product developers is shaping a strong pipeline of clinically supported plant-derived APIs that align with evolving healthcare priorities.

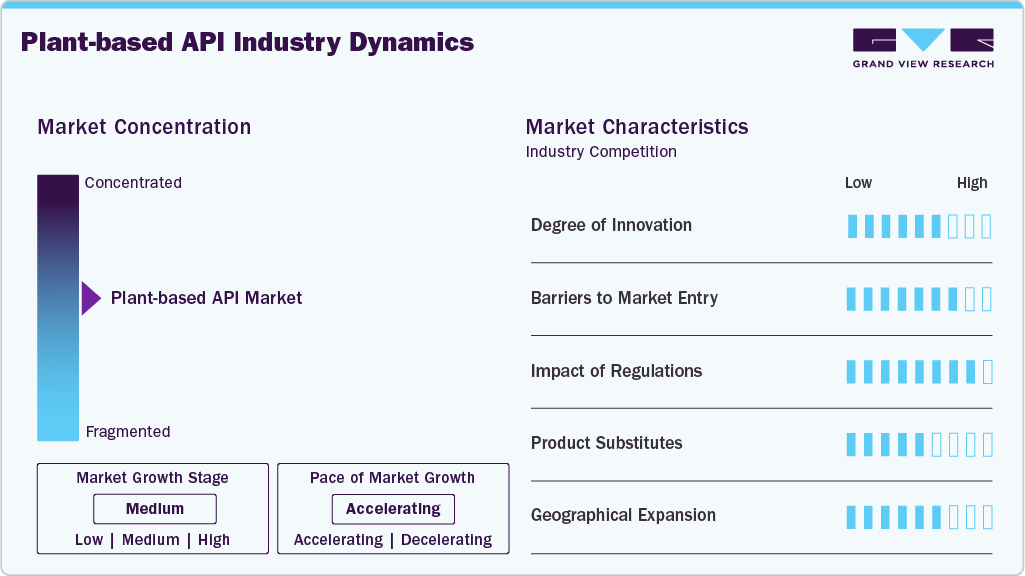

Market Concentration & Characteristics

Innovation in the plant-based API market is driven by advances in extraction science, analytical chemistry, and controlled cultivation systems. Companies are investing in standardized processes that deliver consistent purity and potency across batches. Research teams are identifying new plant species with bioactive compounds that support emerging therapeutic categories. Modern chromatography and purification tools are enabling manufacturers to meet stringent pharmaceutical standards. Collaboration between biotech firms and botanical researchers is accelerating the commercial development of new products. The market demonstrates steady innovation as clinical validation continues to expand.

Entry barriers in the plant-based API industry remain significant due to the high capital investment required for extraction, purification, and quality control infrastructure. New entrants must secure reliable plant sources with strict traceability requirements. Compliance with pharmaceutical-grade standards demands advanced analytical capabilities and experienced technical personnel. Establishing global distribution networks requires a strong understanding of regulatory requirements and a stable supply chain system. Competition from established botanical and pharmaceutical manufacturers heightens market pressure. These conditions create a controlled environment that favors experienced players.

Regulations shape the plant-based API market through strict purity, safety, and traceability expectations. Manufacturers must follow GMP guidelines to qualify their products for pharmaceutical applications. Regulatory agencies monitor source material, extraction methods, and contaminant limits to maintain patient safety. Documentation, audit readiness, and batch-level quality evidence are essential for market access. Certification requirements influence product development timelines and overall cost structures. These conditions ensure consistent standards across global markets.

Product substitutes include synthetic APIs, semi-synthetic derivatives, and fermentation-derived actives, which provide consistent performance and a stable supply. Some therapeutic areas rely on established synthetic molecules with strong clinical histories. Substitutes may offer lower cost and easier regulatory pathways in certain applications. The presence of well-validated alternatives creates competitive pressure for botanical APIs. Companies respond by improving standardization and clinical validation for plant-derived options. Strength of substitutes varies by therapeutic class and formulation needs.

Geographical expansion is influenced by growing demand for natural-origin APIs across North America, Europe, and parts of Asia. Companies are establishing cultivation and extraction centers in regions with favorable climates and strong botanical biodiversity. Expansion efforts focus on proximity to pharmaceutical clusters that require a stable raw material supply. Regional partnerships support regulatory navigation and distribution efficiency. Emerging markets show rising interest in botanical therapeutics and preventive care solutions. These trends support long-term global footprint growth for plant-based API manufacturers.

Molecule Type Insights

The alkaloids segment dominated the plant-based API market, with the largest revenue share of 21.62% in 2024, driven by the strong therapeutic relevance of these compounds across pain management, oncology, cardiovascular health, and neurological care. These compounds offer well-established pharmacological actions and decades of clinical use, while manufacturers favor them for high potency, stable extraction profiles, and clear regulatory pathways. For instance, according to an article published by University College London (UCL) reported that alkaloid-containing species showed an average increase of 8.66 in GBIF occurrence records between 2014 and 2020, with about 20% of plant species containing modest alkaloid amounts; among 36 isoquinoline alkaloids tested, 30 inhibited CYP3A4 moderately (IC₅₀ < 10 µM) and 15 potently (IC₅₀ < 1 µM), highlighting their pharmacological strength and low-dose efficacy. Rising demand and controlled cultivation programs ensure reliable large-scale production, positioning alkaloids as the leading molecule type.

The terpenoids segment is projected to grow at a CAGR of 6.3% over the forecast period, driven by increasing interest in anti-inflammatory, antimicrobial, antioxidant, and metabolic applications. These compounds attract significant R&D activity as researchers explore their diverse therapeutic roles. For instance, in November 2023, an article published by MDPI 2023 stated that over 80,000 terpenoid compounds have been identified in medicinal plants, with more than 195 medicinal plant genomes assembled to enable the discovery of terpenoid biosynthesis pathways. The study highlighted that in Artemisia annua, overexpression of the genes AaCYP71AV1 and AaCPR increased artemisinin content 2.4‑fold compared to wild-type; artemisinin content in A. annua also rose by 27.16% under cold stress, and terpenoid levels in Ginkgo biloba increased by 14.5% under chilling conditions, illustrating how technological advances and controlled cultivation improve yield and quality. Extraction technologies that enhance purity and yield are increasing the commercial viability of pharmaceutical applications. At the same time, product developers favor terpenoids due to their broad biochemical properties and strong compatibility with modern formulation systems. Growing adoption in respiratory, dermatology, and metabolic health products is strengthening demand. These conditions support a sustained high-growth outlook for the terpenoids segment.

End Use Insights

The pharmaceuticals segment led the plant-based API industry, with the largest revenue share of 63.29% in 2024, driven by consistent integration of plant-origin APIs into treatments for chronic disorders. Drug manufacturers prioritize plant-based compounds that have robust safety data and a long-standing clinical history. Advanced extraction and analytical systems help producers deliver pharmaceutical-grade purity for regulated markets. Formulators value plant-derived APIs for their potential to support targeted therapies with stable performance. The growing interest in natural-origin ingredients is driving adoption across multiple therapeutic categories. These combined advantages secure the dominant position of pharmaceuticals in the market.

The nutraceuticals segment is projected to grow at the fastest CAGR of 6.1% over the forecast period, driven by consumer shift toward preventive health solutions supported by natural-origin compounds. Plant-based APIs offer functional benefits that align with the growing interest in wellness-focused products, particularly in areas such as immunity, metabolic balance, and cognitive support. Companies are expanding the development of standardized botanical extracts that ensure consistent dosing and strong safety profiles. Advanced delivery formats are helping brands introduce products with improved absorption and enhanced convenience. Clean-label positioning strengthens demand for plant-derived ingredients within global nutraceutical portfolios. These combined factors shape a strong expansion trajectory for the nutraceuticals segment across the forecast period.

Regional Insights

North America held the largest share of the plant-based API market in 2024, accounting for 34.06% of global revenue, due to strong demand from established pharmaceutical and nutraceutical manufacturers. Large clinical research networks and active CDMOs accelerate translation of botanical leads to regulated APIs. High healthcare expenditure supports the adoption of standardized plant-derived compounds for chronic and specialty therapies. Well-developed supply chains and contract manufacturing capabilities enable the rapid scaling up of commercial volumes. The presence of major ingredient suppliers and ingredient quality certifications strengthens buyer confidence. Robust private and corporate investment in botanical R&D underpins the region’s dominant market position.

U.S. Plant-based API Market Trends

The U.S. plant-based API industry shows concentrated demand driven by advanced formulation needs in specialty therapeutics and high-value nutraceuticals. Strong biopharma clusters support partnerships that shorten development timelines for plant-derived APIs. Large-scale CDMO capacity enables commercial launches with pharmaceutical-grade quality control. High consumer acceptance of natural-origin products boosts the entry of plant-derived actives into mainstream OTC and prescription segments. Extensive clinical trial activity provides evidence that supports the uptake of the product across various therapeutic classes. Sophisticated distribution networks ensure rapid national availability for commercial products.

Europe Plant-based API Market Trends

A strong pharmaceutical manufacturing tradition and high demand for traceable botanical ingredients support the growth of the plant-based API industry. Companies in the region emphasize analytical rigor and botanical characterization to meet stringent quality expectations. Collaboration between botanical suppliers and universities fuels applied research into therapeutic phytochemicals. Market adoption is driven by established nutraceutical brands that integrate clinically validated plant-based API’s. Well-developed logistics across the region enable efficient sourcing from Mediterranean and Eastern European cultivation zones. Premium positioning for clean-label, well-characterized APIs supports steady revenue expansion.

The UK plant-based API market benefits from a concentrated cluster of contract developers and analytical specialists focused on botanical characterization. Strong ties between academic pharmacognosy groups and industry accelerate the translation of plant leads into APIs. The life sciences service sector provides robust testing, stability studies, and regulatory support for botanical APIs. Demand is amplified by growing private investment in preventive health and wellness products that use plant-based API’s. London's role as a commercial and distribution hub supports the export of UK-made botanical ingredients. Skilled talent pools and quality laboratories enhance the region’s capability to serve high-value formulations.

The strength of the plant-based API market in Germany is rooted in advanced processing technologies and high standards for pharmaceutical manufacturing. Local chemical and biotech firms utilize precision extraction and purification methods tailored to produce API-grade outputs. Manufacturers prioritize traceability and impurity control to serve demanding formulation partners. A strong engineering capacity supports the development of continuous processing and scale-up solutions for botanical APIs. Industrial clusters offer integrated services, spanning from cultivation to final API testing. This combination helps German suppliers compete on technical capability and product reliability.

The France plant-based API Market is expected to grow. France leverages its long history in botanical sciences and specialty ingredients to support plant-based API activity. Established botanical extractors and fragrance/ingredient houses provide extraction know-how adaptable to pharmaceutical standards. Collaborative research centers enable targeted exploration of regionally abundant medicinal plants. Demand from cosmetics, nutraceuticals, and pharma converges to create cross-sector opportunities for plant-derived actives. Robust export networks facilitate the movement of high-value botanical APIs to broader European markets. Emphasis on product provenance and quality enhances premium market positioning for French suppliers.

Asia Pacific Plant-based API Market Trends

The Asia Pacific plant-based API industry shows considerate growth due to manufacturing capacity and sourcing advantages scale up rapidly. Strong agricultural bases and lower production costs allow suppliers to offer competitive pricing for standardized botanical extracts. Increasingly capable CDMOs and analytical labs in the region are raising API quality to meet regulated market requirements. Expanding domestic demand for preventive health solutions fuels local nutraceutical and pharma development using plant-derived actives. Strategic investments in processing technologies are improving yield, purity, and traceability across supply chains. These factors collectively drive faster growth momentum in the region.

Japan’s plant-based API market emphasizes high analytical standards and demonstrated clinical utility for plant-derived APIs. Strong pharmaceutical and nutraceutical manufacturers integrate botanical actives into premium formulations for aging and metabolic health. Advanced analytical labs and stability testing facilities support rigorous quality assurance for API-grade materials. Domestic consumers favor evidence-backed natural products, which supports the commercialization of standardized extracts. Distribution channels into hospital and retail pharmacies enable a broad product reach. Technology partnerships with botanical researchers accelerate targeted development for local therapeutic needs.

The plant-based API market in China is expected to grow over the forecast period. China combines large cultivation capacity with growing capabilities in downstream processing and API manufacturing. Local suppliers can rapidly scale extraction and purification operations to meet rising domestic and export demand. Increasing investment by industry players enhances analytical and regulatory readiness for supplying the global pharmaceutical market. A strong interest in integrating traditional botanical knowledge with modern pharmacology supports the discovery of novel actives. Supply chain integration from farm to API reduces variability and improves traceability for exported materials. Competitive cost structures and expanding quality infrastructure position China as a major supplier in the plant-based API value chain.

Latin America Plant-based API Market Trends

Latin America offers rich botanical biodiversity and emerging processing capacity that support niche sourcing of specialty plant actives. Regional suppliers are developing standardized cultivation and harvesting practices to improve consistency and comply with international buyer expectations. The growth of the nutraceutical and functional food sectors within the region creates local demand for botanical APIs. Export opportunities arise from unique regional plants with therapeutic potential not widely available elsewhere. Investment in drying, extraction, and quality control infrastructure is increasing to support higher-value shipments. Strategic partnerships with international ingredient buyers accelerate the integration into global supply chains.

The Brazil plant-based API market is expected to grow. Brazil’s botanical strengths stem from exceptional plant biodiversity and established extract industries that serve global nutraceutical markets. Local companies are advancing standardized extraction and supply-chain traceability to meet international API specifications. Investments in sustainable sourcing programs and scalable processing enable the conversion of regional plant resources into exportable, API-grade materials. Brazil’s role as a specialty ingredient supplier complements broader global portfolios seeking novel plant actives. Collaborative research with international partners supports clinical validation of region-specific botanicals.

Middle East & Africa Plant-based API Market Trends

The MEA plant-based API industry is expected to register a significant CAGR of 6.5% over the forecast period, due to driven by import demand for standardized plant-derived ingredients and rising local interest in wellness products. Limited local processing capacity encourages partnerships with international extractors to secure API supplies. Arid and semi-arid cultivation zones support the cultivation of specific medicinal plants and the production of essential oils, which supply regional markets. Growing private sector investment in pharmaceutical manufacturing is creating new demand pockets for botanical inputs. Improved logistics infrastructure is facilitating faster import and distribution of high-value plant actives. Niche opportunities exist for regionally relevant botanicals used in traditional medicine and wellness formulations.

Saudi Arabia’s plant-based API market development is influenced by investments in healthcare diversification and growing interest in high-quality import sourcing. Local pharmaceutical and nutraceutical players seek reliable botanical APIs to expand product portfolios for domestic and regional markets. Strategic partnerships with international suppliers provide technical transfer and supply continuity. Rising consumer demand for premium wellness products supports the commercial uptake of standardized plant extracts. Infrastructure improvements in logistics and warehousing enable faster distribution across the Gulf Cooperation Council. Focused procurement from reputable botanical API manufacturers strengthens supply security for high-value applications.

Key Plant-based API Company Insights

Roquette Frères and BASF SE contribute significantly to the plant-based API market through advanced extraction technologies and strong manufacturing capabilities. Cargill and Evonik Industries AG strengthen market reach with scalable production and diversified ingredient portfolios. Arboris, Centroflora, and Brains Bioceutical support growth with specialized botanical APIs and high-purity formulations. Kothari Phytochemicals, Indo Phytochem Pharmaceuticals, and HimPharm.com enhance global availability through efficient sourcing and broad herbal processing capacities. Competition continues to intensify as companies expand applications across pharmaceutical, nutraceutical, and wellness categories.

Key Plant-based API Companies:

The following are the leading companies in the plant-based API market. These companies collectively hold the largest market share and dictate industry trends.

- Roquette Frères

- Arboris

- Centroflora

- BASF SE

- Kothari Phytochemicals & Industries Ltd.

- Evonik Industries AG

- Brains (Brains Bioceutical)

- Indo Phytochem Pharmaceuticals.

- HimPharm.com.

- Cargill, Incorporated

Recent Developments

-

In November 2025, BASF expanded production capacity for Alkyl Polyglucosides (APGs) at its Bangpakong site in Thailand, complementing existing facilities in Düsseldorf, Cincinnati, and Jinshan. The company reported USD 70.7 billion in sales in 2024. APGs, derived from 100% natural, renewable feedstocks, support personal care, home care, industrial cleaning, and agricultural applications. This expansion enhances regional supply, flexibility, and BASF’s commitment to sustainable, high-performance surfactant solutions.

-

In October 2025, Roquette launched KLEPTOSE Crysmeb methyl‑beta‑cyclodextrin, a novel excipient for oral and parenteral delivery. Most methyl groups are substituted at the C2 position, enhancing aqueous solubility and enabling inclusion complexes with poorly soluble APIs, including BCS Class II and IV compounds. The product meets ISO 9001 and GMP standards and aligns with ICH guidelines, with US Drug Master File Type IV availability. Roquette highlighted its integrated supply chain and formulation expertise as key enablers for accelerating early-stage drug development.

-

In September 2025, Evonik Industries AG added BoruCare® Capsin, a plant-based ruminant product, to its portfolio. Containing at least 0.5% capsaicinoids with polyphenols and flavonoids, it is encapsulated in a fatty matrix to remove pungency.

Plant-based API Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33.70 billion

Revenue forecast in 2033

USD 53.21 billion

Growth rate

CAGR of 5.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Molecule type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Roquette Frères; Arboris; Centroflora; BASF SE; Kothari Phytochemicals & Industries Ltd.; Evonik Industries AG; Brains (Brains Bioceutical); Indo Phytochem Pharmaceuticals; HimPharm.com; Cargill, Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant-based API Market Report Segmentation

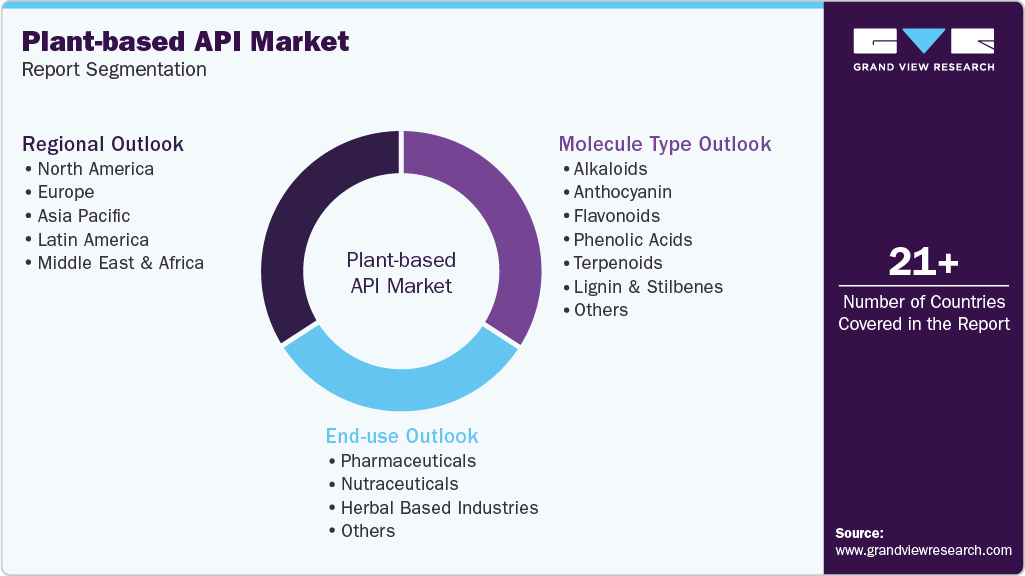

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global plant-based API market report based on molecule type, end use, and region:

-

Molecule Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Alkaloids

-

Anthocyanin

-

Flavonoids

-

Phenolic Acids

-

Terpenoids

-

Lignin and Stilbenes

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceuticals

-

Nutraceuticals

-

Herbal Based Industries

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global plant-based API market size was estimated at USD 31.78 billion in 2024 and is expected to reach USD 33.70 billion in 2025.

b. The global plant-based API market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2033 to reach USD 53.21 billion by 2033.

b. Alkaloids dominated the plant-based API market with a share of 21.62% in 2024. This is attributable as they have anesthetic, cardioprotective, and anti-inflammatory properties

b. Some key players operating in the plant-based API market include Roquette Frères; Arboris; Centroflora; BASF SE; Kothari Phytochemicals & Industries Ltd.; Evonik Industries AG; Brains (Brains Bioceutical); Indo Phytochem Pharmaceuticals; HimPharm.com; Cargill, Incorporated

b. Key factors that are driving the market growth include rising awareness and interest for plant-based medicines, increasing prevalence of chronic diseases, and growing advancements in genomics and biotechnology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.