- Home

- »

- Automotive & Transportation

- »

-

Planting Equipment Market Size, Share, Industry Report 2030GVR Report cover

![Planting Equipment Market Size, Share & Trends Report]()

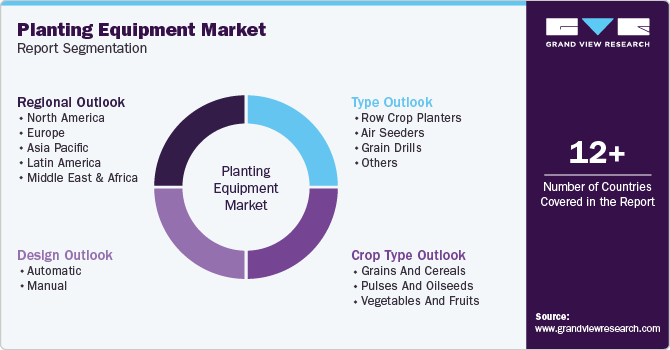

Planting Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Row Crop Planters, Air Seeders, Grain Drills), By Design (Automatic, Manual), By Crop Type (Grains & Cereals, Pulses & Oilseeds, Vegetables & Fruits), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-573-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Planting Equipment Market Summary

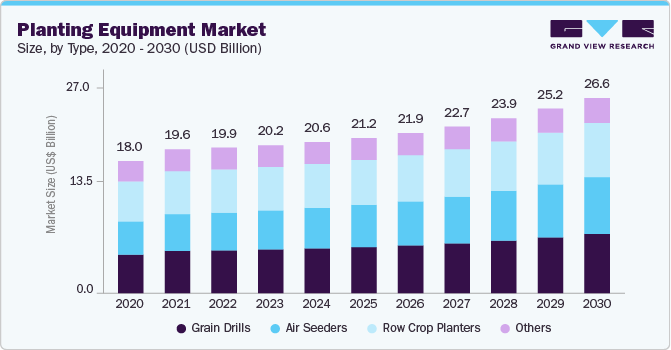

The global planting equipment market size was estimated at USD 20.65 billion in 2024 and is projected to reach USD 26.65 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. The growing trend of farm mechanization, particularly in emerging economies, is driving the growth of the industry.

Key Market Trends & Insights

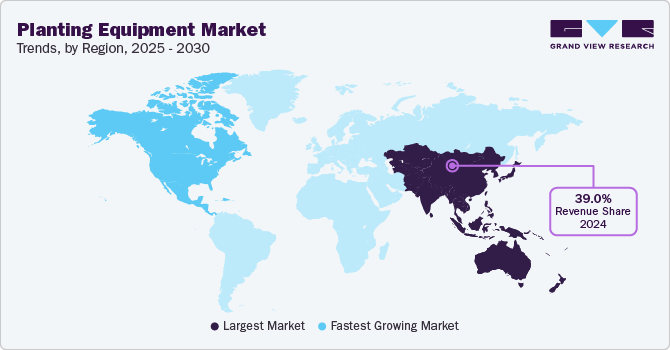

- The planting equipment industry in Asia Pacific held the major share of over 39.0% in 2024.

- North America planting equipment market is expected to grow at a CAGR of 5.2% from 2025 to 2030.

- Based on type, the grain drills segment accounted for the largest revenue share of over 29.0% in 2024.

- Based on design, the automatic segment dominated the market and accounted for the largest revenue share of over 64.0% in 2024.

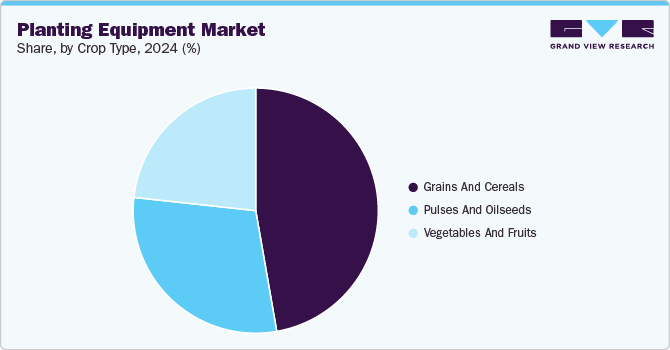

- Based on crop type, the grains and cereals segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20.65 Billion

- 2030 Projected Market Size: USD 26.65 Billion

- CAGR (2025-2030): 4.7%

- Asia Pacific: Largest market in 2024

Countries in Asia, Latin America, and Africa are increasingly adopting modern agricultural machinery to overcome labor shortages, reduce manual errors, and improve farm productivity. Mechanization not only accelerates the planting process but also ensures better seed placement, which leads to improved germination rates and crop uniformity.

Governments in several developing countries are supporting this trend by type subsidies and incentives for the purchase of agricultural machinery, including planting equipment. These efforts are facilitating the modernization of agriculture and fueling the demand for advanced planting solutions.

The rising adoption of precision agriculture technologies, which aim to optimize input use and increase operational efficiency, is driving the adoption of planting equipment. Precision planting equipment, integrated with GPS, IoT, and sensor technologies, allows farmers to plant seeds with high accuracy, minimizing seed wastage and ensuring optimal spacing. These technologies also enable real-time monitoring and data-driven decision-making, which further enhances planting outcomes. With the increasing availability of affordable smart equipment and digital tools, farmers are increasingly turning to precision planting solutions to improve their profit margins and environmental sustainability.

The need for higher agricultural productivity due to shrinking arable land is also contributing to the growth of the planting equipment market. As urbanization and industrial expansion continue to reduce the availability of agricultural land, farmers are under pressure to maximize output from limited areas. Efficient planting equipment helps in achieving this by ensuring timely sowing, uniform seed distribution, and minimal soil disturbance. This, in turn, leads to better crop stands and higher productivity per hectare. The ability of modern planting equipment to work efficiently across various soil designs and terrains also adds to its appeal, making it a preferred choice among large-scale and commercial farmers.

Moreover, the increasing focus on sustainable farming practices is encouraging the use of equipment that promotes soil health and resource efficiency. Many modern planting machines are designed to support conservation agriculture techniques, such as minimum tillage and cover cropping. By reducing soil disturbance and promoting better water retention, these machines align with sustainable farming goals while maintaining productivity. As sustainability becomes a major priority in agriculture, equipment manufacturers are innovating to offer eco-friendly planting solutions, further driving market growth.

Type Insights

The grain drills segment accounted for the largest revenue share of over 29.0% in 2024. The growing emphasis on conservation agriculture is a significant driver for the grain drills segment's growth. Many grain drills are compatible with no-till or reduced-till farming systems, which help preserve soil structure, reduce erosion, and improve moisture retention. These practices are being increasingly adopted in regions experiencing soil degradation or water scarcity. By minimizing soil disturbance, grain drills support sustainable land management and long-term soil fertility, aligning with global efforts to promote climate-resilient agriculture. As environmental sustainability becomes a top priority for farmers, agribusinesses, and policymakers, the demand for conservation-friendly planting equipment like grain drills is on the rise.

The air seeders segment is anticipated to grow at the fastest CAGR during the forecast period. The rising demand for productivity-enhancing equipment is driving segment growth. Air seeders enable high-speed planting with precision, which is especially valuable during short sowing windows. This ensures timely planting, which is critical for optimizing yields and aligning crop cycles with climatic conditions. Their ability to uniformly distribute seeds and fertilizers reduces wastage and enhances input efficiency, thereby lowering operating costs. In farming environments where time is of the essence due to unpredictable weather or seasonal constraints, air seeders provide a reliable and scalable solution, driving their adoption in both developed and developing agricultural economies.

Design Insights

The automatic segment dominated the market and accounted for the largest revenue share of over 64.0% in 2024. The rising demand for high-efficiency equipment among commercial and large-scale farmers is fueling the growth of the automatic planting segment. These farmers often manage thousands of acres and require machinery that can cover large areas quickly and with precision. Automatic planters reduce downtime, optimize seed and fertilizer use, and minimize errors that can occur with manual or semi-automatic equipment. In highly competitive markets where profit margins are tight, the investment in automatic equipment offers long-term savings and productivity gains, making it a strategic priority for large agricultural enterprises.

The manual segment is anticipated to expand at a CAGR of 4.1% during the forecast period. The focus on sustainable and organic farming practices is also contributing to the demand for manual planting equipment. In organic farms and community-supported agriculture (CSA) initiatives, where minimal soil disturbance and close plant monitoring are crucial, manual tools are often favored for their precision and simplicity. These tools allow for the gentle handling of soil and seedlings, aligning with eco-friendly agricultural methods. As consumer demand for sustainably grown produce increases, more small-scale organic growers are opting for manual equipment to maintain control over every aspect of planting.

Crop Type Insights

The grains and cereals segment accounted for the largest revenue share in 2024. The expansion of commercial and mechanized farming in developing economies is driving market growth. Countries like India, Brazil, and parts of Sub-Saharan Africa are witnessing growing mechanization in grain production, supported by government subsidies, favorable policies, and technological transfer. Planting equipment enables these regions to modernize traditional practices and increase yields to meet both domestic consumption and export demands. As access to credit and training improves, small and mid-sized farmers are increasingly adopting mechanized planting solutions tailored to grains and cereals, further fueling market growth.

The pulses and oilseeds segment is anticipated to register the highest CAGR of 5.0% during the forecast period. The rising global consumption of plant-based proteins is driving segment growth. Pulses, as a primary protein source in many vegetarian diets, are in higher demand due to health trends and the growing popularity of plant-based food products. This trend is particularly strong in regions like Asia-Pacific, North America, and Europe. To meet this demand, farmers are turning to precision planting equipment that ensures uniform seed distribution, reduces seed loss, and enhances productivity. By minimizing labor and maximizing planting efficiency, these machines help increase production to keep up with expanding markets.

Regional Insights

North America planting equipment market is expected to grow at a CAGR of 5.2% from 2025 to 2030. Advancements in planting equipment technology are playing a crucial role in the growth of the market. Manufacturers are constantly innovating to improve planting equipment, incorporating features such as automated depth control, variable rate planting, and intelligent seed placement. These advancements help farmers optimize their planting practices, reduce seed waste, and improve crop establishment. Moreover, new planting equipment is being designed to be more fuel-efficient, durable, and easier to maintain, which reduces operational costs for farmers. As technology continues to advance, North American farmers are increasingly investing in equipment that can provide higher performance and better results, driving the growth of the planting equipment market.

U.S. Planting Equipment Market Trends

The planting equipment market in the U.S. is projected to grow during the forecast period. The integration of alternative energy solutions is emerging as a driver for the planting equipment market. Many modern farming operations are looking to reduce their reliance on fossil fuels and reduce their environmental footprint. As a result, some planting equipment manufacturers are incorporating alternative energy solutions, such as electric-powered planters or those that run on renewable energy sources like solar power. This shift aligns with the broader push for sustainability in agriculture as farmers look to reduce greenhouse gas emissions and lower operating costs. The demand for energy-efficient, low-emission planting equipment is expected to increase as renewable energy solutions become more mainstream in agriculture.

Asia Pacific Planting Equipment Market Trends

The planting equipment industry in Asia Pacific held the major share of over 39.0% in 2024. The growing adoption of precision agriculture in the region is driving the planting equipment. Precision farming is increasingly gaining traction in countries with large-scale agricultural industries, such as India, China, and Australia. Technologies like GPS, automated guidance systems, and sensors are being integrated into planting equipment to optimize seed placement, soil preparation, and input management. This leads to improved yield potential, efficient resource use, and reduced environmental impact, aligning with the region’s push toward sustainable agricultural practices. As more farmers embrace these technologies, there is a growing demand for planting equipment capable of supporting precision agriculture, thus expanding the market in the Asia Pacific.

India planting equipment market is projected to grow during the forecast period. Crop diversification and increased demand for high-value crops are contributing to the expansion of the planting equipment market in India. Traditionally, India’s agriculture has been centered around staples like rice, wheat, and maize. However, with changing dietary preferences and the growing demand for pulses, oilseeds, fruits, and vegetables, farmers are diversifying their crop selection. This shift necessitates planting equipment that can handle a variety of crops with different planting requirements. Planters and seed drills with adjustable settings for various crop designs are becoming increasingly popular, allowing farmers to manage crop rotations and optimize their land use efficiently.

Europe Planting Equipment Market Trends

The planting equipment market in Europe is expected to grow at a CAGR of 4.1% during the forecast period. Farm consolidation and large-scale farming operations in Europe are also driving the market for planting equipment. As small-scale farms become less economically viable, many farmers are opting for larger operations to increase productivity and reduce per-unit costs. With larger fields and higher output requirements, there is a growing need for equipment that can handle larger areas in shorter time frames. The adoption of advanced planting equipment like high-capacity air seeders, precision drills, and multi-row planters is necessary to meet these demands. These machines are designed for high efficiency, ensuring faster planting and better uniformity across extensive land areas, which is essential for large-scale farming operations.

The UK planting equipment industry is expected to grow during the forecast period. The shift toward organic and regenerative farming in the UK is influencing the planting equipment market. As consumer demand for organic and sustainably grown food increases, many UK farmers are adopting organic farming practices, which require specialized planting techniques to ensure soil health and reduce the use of synthetic inputs. Organic farming often involves minimal soil disturbance and careful seed placement to optimize plant growth. This has led to a rise in demand for precision planting equipment that can meet these specific needs, such as no-till drills and equipment that can be planted into cover crops. The growth of organic and regenerative farming practices is thus driving the need for specialized planting equipment designed to maintain soil integrity and improve crop health over time.

Key Planting Equipment Company Insights

Key players operating in the planting equipment market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Planting Equipment Companies:

The following are the leading companies in the planting equipment market. These companies collectively hold the largest market share and dictate industry trends.

- AGCO Corporation

- Bucher Industries AG

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Deere & Company

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Buhler Industries Inc.

- Kinze Manufacturing

- Bourgault Industries Ltd.

Recent Developments

-

In April 2025, CNH Industrial N.V. and MASCHIO GASPARDO signed a licensing contract for the distribution of New Holland-branded mowers, mower conditioners, tedders, and rotary rakes across Europe, including parts and service support. This partnership will involve both companies collaboratively defining future products based on customer needs, with MASCHIO GASPARDO taking the lead in engineering development. The strengthened cooperation highlights the shared commitment of both companies to innovation, quality, and delivering customer-focused solutions in the crop preparation sector.

-

In June 2024, New Holland, a brand under CNH Industrial N.V., partnered with Bluewhite, an autonomous technology company specializing in AI-driven solutions for farming. The collaboration, announced today, will focus on distribution, manufacturing, and integrating Bluewhite’s autonomous technology into New Holland tractors across North America. This partnership enables New Holland tractors to function autonomously in orchards and other specialty crop operations.

-

In February 2024, Linamar Corporation acquired Bourgault Industries Ltd., including its core seeder operations based in St. Brieux, Saskatchewan. The acquisition also encompasses the Highline Manufacturing division and the roto-molding company Free Form Plastics. Bourgault will be incorporated into Linamar's newly formed Agriculture division alongside MacDon, a leader in harvesting equipment, and Salford, known for its tillage and crop nutrition equipment, all within the broader Industrial Segment.

Planting Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.18 billion

Revenue forecast in 2030

USD 26.65 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, design, crop type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

AGCO Corporation; Bucher Industries AG; CLAAS KGaA mbH; CNH Industrial N.V.; Deere & Company; Kinze Manufacturing; Kubota Corporation; Bourgault Industries Ltd.; Mahindra & Mahindra Ltd.; Buhler Industries Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Planting Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global planting equipment market report based on type, design, crop type, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Row Crop Planters

-

Air Seeders

-

Grain Drills

-

Others

-

-

Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Manual

-

-

Crop Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Grains and Cereals

-

Pulses and Oilseeds

-

Vegetables and Fruits

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global planting equipment market size was estimated at USD 20.65 billion in 2024 and is expected to reach USD 21.18 million in 2025.

b. The global planting equipment market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2030 to reach USD 26.65 billion by 2030.

b. Asia Pacific held the major share of 39.2% of the planting equipment industry in 2024. The growing adoption of precision agriculture in the region is driving the planting equipment adoption.

b. Some key players operating in the market include AGCO Corporation, Bucher Industries AG, CLAAS KGaA mbH, CNH Industrial N.V., Deere & Company, Kinze Manufacturing, Kubota Corporation, Bourgault Industries Ltd., Mahindra & Mahindra Ltd., Buhler Industries Inc.

b. The growing trend of farm mechanization, particularly in emerging economies is driving the planting equipment market growth and The rising adoption of precision agriculture technologies, which aim to optimize input use and increase operational efficiency, is driving the adoption of planting equipment

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.