- Home

- »

- Biotechnology

- »

-

Plasmid DNA Manufacturing Market Size, Share Report, 2033GVR Report cover

![Plasmid DNA Manufacturing Market Size, Share & Trends Report]()

Plasmid DNA Manufacturing Market (2026 - 2033) Size, Share & Trends Analysis Report By Disease (Cancer, Infectious Diseases), By Grade (R&D, GMP), By Application, By Development Phase, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-977-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plasmid DNA Manufacturing Market Summary

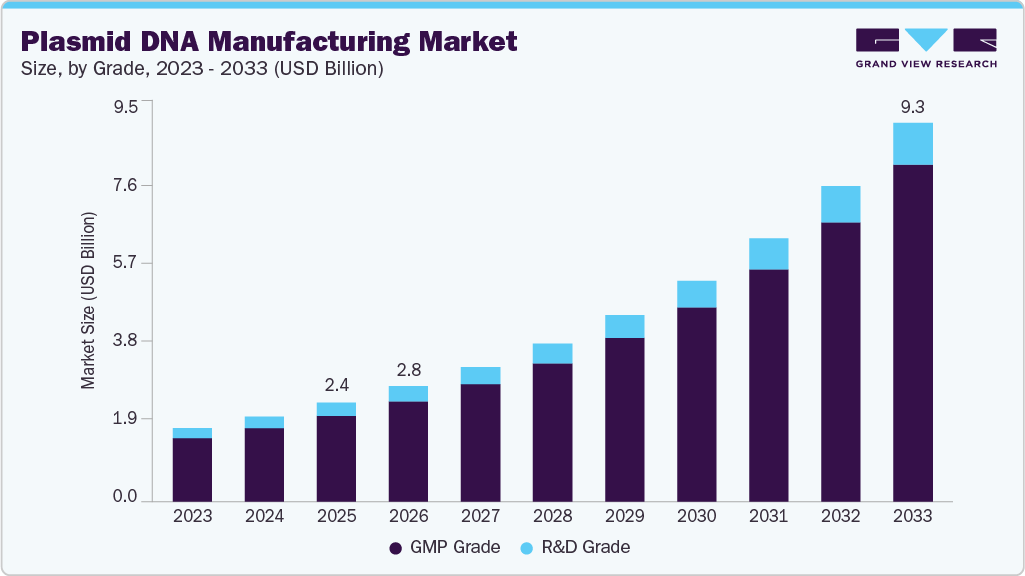

The global plasmid DNA manufacturing market size was valued at USD 2.43 billion in 2025 and is projected to reach USD 9.29 billion by 2033, growing at a CAGR of 18.52% from 2026 to 2033. Growth is driven by rising demand for plasmid DNA in gene and cell therapies, mRNA vaccines, and outsourcing to specialized manufacturers.

Key Market Trends & Insights

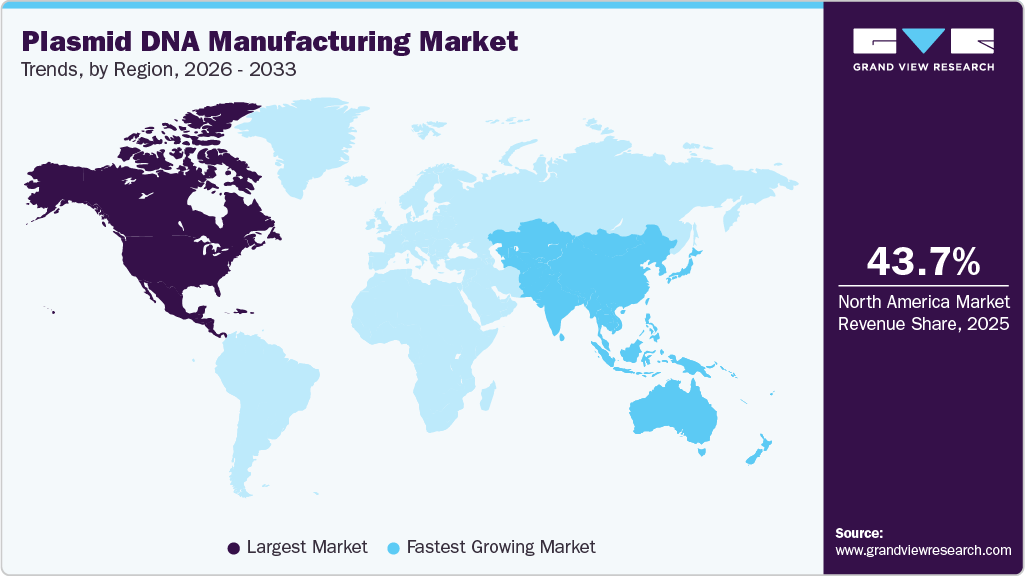

- North America plasmid DNA manufacturing industry held the largest global market share of 43.70% in 2025.

- The plasmid DNA manufacturing industry in the U.S. is expected to grow over the forecast period due to the expanding aging population.

- Based on grade, the GMP-grade segment dominated the market with a share of 86.58% in 2025.

- Based on development phase, the clinical therapeutics segment dominated the market in 2025.

- Based on application, the cell & gene therapy segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.43 Billion

- 2033 Projected Market Size: USD 9.29 Billion

- CAGR (2026-2033): 18.52%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Robust pipeline for gene therapiesThe strong gene therapy pipeline drives the plasmid DNA market, as plasmid DNA is a key material for making viral vectors. As more gene therapy candidates enter the clinical trial phase for rare diseases, cancer, and heart diseases, the need for top-notch plasmid DNA is increasing, which in turn is leading producers to increase their output and to implement new technologies

Gene Therapy Pipeline of Sarepta Therapeutics

Program Name

Indication / Target

SRP-9003

LGMD2E/R4 β-sarcoglycan

SRP-9004

LGMD2D/R3 α-sarcoglycan

SRP-6004

LGMD2B/R2 Dysferlin

Other Targets1

Multiple

Source: Sarepta Therapeutics, Inc Corporate Presentation., Secondary research. Grandview research.inc

The emphasis on individualized treatments is increasing the need for personalized plasmid DNA. Businesses are putting money into research to keep a steady flow of production for both clinical and commercial use, which in turn is pushing the envelope in the areas of production, purification, and GMP-compliant manufacturing and increasing the demand for viral vectors and plasmid DNA manufacturing market.

Increasing demand for plasmid DNA in various medical therapies

Rising demand for plasmid DNA in medical therapies is driving the market. Plasmid DNA is essential for mRNA vaccines, gene therapies, and cell therapies, prompting manufacturers to expand production and adopt advanced technologies.

The growing prevalence of chronic diseases, genetic disorders, and cancer is boosting plasmid DNA adoption. Companies are investing in scalable, GMP-compliant manufacturing and optimized processes to meet clinical and commercial needs, supporting market growth.

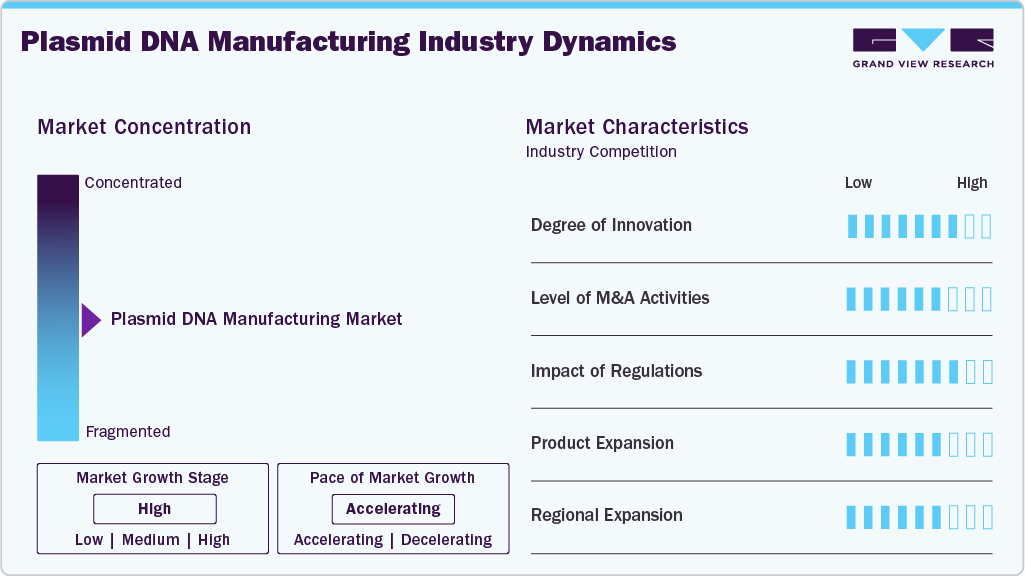

Market Concentration & Characteristics

The plasmid DNA manufacturing industry is propelled by a significant amount of innovation, with firms working on cutting-edge technologies for production, improved purification techniques, and GMP-compliant processes that can be scaled up. The process of continuous innovation results in increased yield, quality, and efficiency, which are in line with the rising demand for gene therapies, mRNA vaccines, and cell-based therapies.

The plasmid DNA manufacturing industry is witnessing increased M&A activity as companies aim to expand capacity, access advanced technologies, and strengthen their presence in the growing gene and cell therapy sector. Strategic acquisitions and partnerships are accelerating market consolidation and driving competitive growth.

Regulations significantly impact on the plasmid DNA manufacturing industry, as strict GMP guidelines and quality standards govern production for clinical and commercial use. Compliance with regulatory requirements ensures product safety and efficacy but also increases operational costs and drives investment in advanced manufacturing and quality-control technologies.

The expansion of products is the main reason behind the growth of the plasmid DNA manufacturing industry, as new variants of plasmid, mass production, and tailor-made formulations are the answers to the increasing needs of gene treatments, mRNA vaccines, and cell-based therapies.

Regional expansion is fueling growth in the plasmid DNA manufacturing industry, as companies establish new facilities and partnerships in emerging markets to meet rising demand for gene and cell therapies. Expanding geographically allows manufacturers to improve supply chain efficiency, access new customer bases, and strengthen their global market presence.

Grade Insights

GMP-grade plasmid DNA manufacturing dominated the market in 2025 and is projected to grow at the fastest CAGR during the forecast period. This segment’s growth is driven by the increasing demand for high-quality, regulatory-compliant plasmid DNA in gene therapies, mRNA vaccines, and cell-based therapies, where safety and consistency are critical.

The R&D grade segment of the plasmid DNA manufacturing market is expected to grow significantly during the forecast period, driven by rising preclinical research in gene therapy, vaccines, and molecular biology.

Development Phase Insights

The clinical therapeutics segment held the largest share, 54.28%, in 2025, driven by the growing use of plasmid DNA in genetic vaccines and gene therapies. Its application in cardiovascular disorders, such as angiogenic gene therapy for peripheral artery disease, is further boosting segment growth.

The pre-clinical therapeutics segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising clinical trial volumes, increasing prevalence of chronic diseases, and advances in gene therapy. Increasing investments in R&D and the adoption of advanced plasmid DNA manufacturing technologies are also supporting the segment’s rapid expansion.

Application Insights

The cell & gene therapy segment held the largest share, 53.88% in 2025, driven by the widespread use of gene therapy for inherited and genetic diseases and by ongoing technological advancements that enhance treatment safety and reliability.

The DNA vaccines segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising chronic disease prevalence and increased R&D from the COVID-19 pandemic. For example, Takara Bio and AGC Biologics developed a plasmid DNA-based COVID-19 vaccine, boosting demand for plasmid DNA manufacturing.

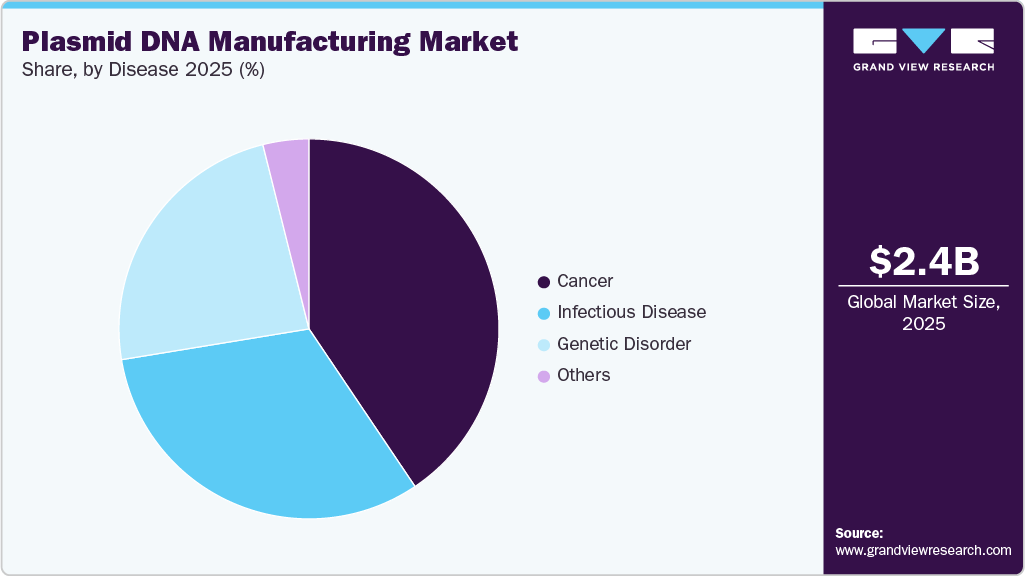

Disease Insights

The cancer segment held the largest share of 40.57% in 2025 and is expected to grow fastest from 2026 to 2033, driven by rising plasmid DNA use in cancer therapies and increasing demand from vaccine production, and advancing technologies.

The genetic disorder segment is expected to register a significant CAGR over the forecast period, driven by the rising prevalence of inherited diseases, increasing adoption of gene and cell-based therapies, and growing investment in advanced genetic research and personalized medicine.

Regional Insights

The North America plasmid DNA manufacturing market held the largest revenue share of 43.70% of the global market in 2025. Some of the major factors that have contributed to the large share of this region are the strong presence of R&D centers, advanced gene and cell therapy initiatives, and supportive regulatory frameworks.

U.S. Plasmid DNA Manufacturing Market Trends

The U.S. plasmid DNA manufacturing market is expected to grow steadily, driven by increasing demand for gene and cell therapies, expansion of GMP-compliant production facilities, and ongoing technological advancements in plasmid DNA production.

Europe Plasmid DNA Manufacturing Market Trends

The Europe plasmid DNA manufacturing industry is witnessing growth due to rising investments in gene and cell therapy R&D, increasing adoption of advanced manufacturing technologies, and supportive regulatory initiatives for biopharmaceutical production.

The UK plasmid DNA manufacturing market held a significant share in 2025, supported by strong biopharmaceutical research infrastructure, presence of key CDMOs, and increasing investments in gene and cell therapy development.

The Germany plasmid DNA manufacturing market is thriving due to increasing clinical trials for gene and cell therapies, growing demand for GMP-grade plasmid DNA, and investments in scalable and automated manufacturing technologies.

Asia Pacific Plasmid DNA Manufacturing Market Trends

The Asia Pacific plasmid DNA manufacturing industry is expected to register the fastest CAGR of 19.74% throughout the forecast period. Key factors such as the presence of untapped opportunities, economic development, improving healthcare infrastructure, and favorable initiatives by the government and manufacturers in the biotechnology sector are some factors accounting for this rapid growth.

The China plasmid DNA manufacturing industry is growing rapidly, driven by the surge in domestic vaccine production, expanding clinical trials for gene therapies, and the emergence of local CDMOs offering large-scale GMP plasmid DNA services.

The Japan plasmid DNA manufacturing market is growing steadily, as it has one of the most developed pharmaceutical and biotechnology sectors in the region. Moreover, the high prevalence of chronic diseases and rare genetic disorders has led to an increase in R&D activities for the development of novel therapies and vaccines, creating a high demand for plasmid DNA manufacturing solutions for research purposes.

Middle East & Africa Plasmid DNA Manufacturing Market Trends

The MEA plasmid DNA manufacturing market is expected to grow over the forecast period, owing to the increase in cancer cases and the prevailing medical shortages. The need for potent cancer treatments is boosting the application of plasmid DNA and viral vectors and thus propelling the progress of cell-based cancer therapies throughout the area.

The Kuwait plasmid DNA manufacturing market is highly competitive due to the presence of established and mid-tier companies. Several growth strategies employed by these companies, such as strategic partnerships and collaborations with biotechnology and pharmaceutical companies, are fueling market expansion.

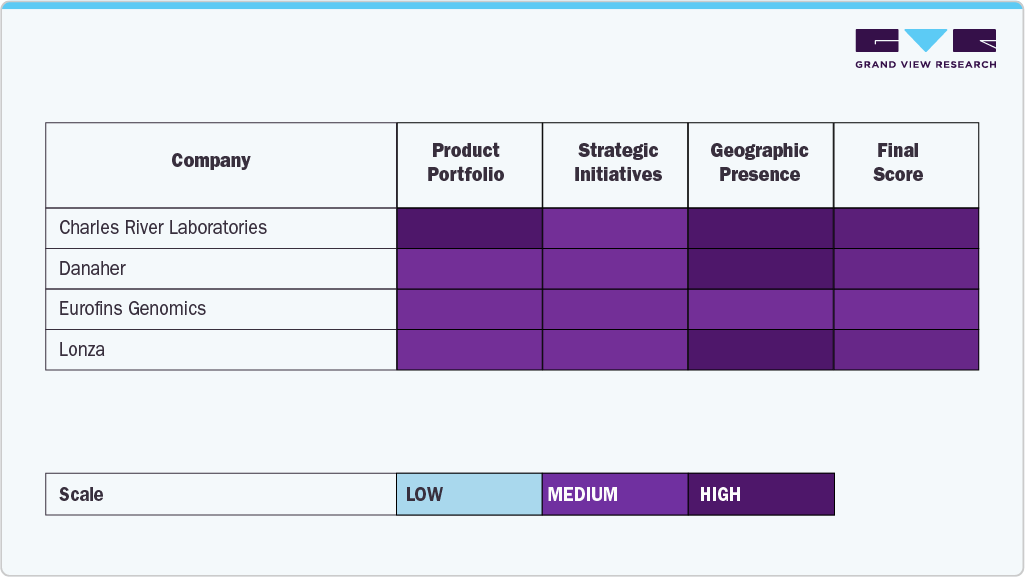

Key Plasmid DNA Manufacturing Company Insights

Leading companies operating in the plasmid DNA manufacturing market include Charles River Laboratories, Danaher Corporation, Lonza Group, Eurofins Genomics, and Luminous BioSciences, LLC, reflecting a competitive landscape with an established contract service portfolio in the plasmid DNA contract manufacturing market and specialized biotechnology firms offering plasmid design, synthesis, and large‑scale production solutions.

These companies focus on enhancing production efficiency, ensuring quality compliance, and supporting R&D and clinical applications, leveraging advanced technologies and global manufacturing networks to meet the growing demand for plasmid DNA in gene therapy, vaccines, and molecular biology research.

Key Plasmid DNA Manufacturing Companies:

The following key companies have been profiled for this study on the plasmid DNA manufacturing market

- Charles River Laboratories

- VGXI, Inc.

- Danaher (Aldevron)

- Kaneka Corp.

- Cell and Gene Therapy Catapult

- Eurofins Genomics

- Lonza

- Luminous BioSciences, LLC

- Akron Biotech

- Catalent, Inc.

Recent Developments

-

In January 2026, Bionova Scientific formed a manufacturing alliance with Syenex to expand global plasmid DNA access, leveraging IS-free cell lines for stable, reproducible vectors supporting gene and cell therapy applications.

-

In August 2025, Bionova Scientific (USA), a subsidiary of Japan’s Asahi Kasei, opened a 10,000 sq. ft. plasmid DNA facility in The Woodlands, Texas, providing research-grade and upcoming cGMP pDNA production to support cell and gene therapy development and commercial-scale manufacturing.

-

In April 2025, ProBio launched GMP plasmid DNA manufacturing services at its Hopewell, New Jersey facility, providing integrated production with in-house analytics, method development, and project management for U.S. and European markets.

Plasmid DNA Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.83 billion

Revenue forecast in 2033

USD 9.29 billion

Growth rate

CAGR of 18.52% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, development phase, application, disease, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Charles River Laboratories; VGXI, Inc.; Danaher (Aldevron); Kaneka Corp.; Catalent, Inc.; Cell and Gene Therapy Catapult; Eurofins Genomics; Lonza; Luminous BioSciences, LLC; Akron Biotech.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Plasmid DNA Manufacturing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the plasmid DNA manufacturing market on the basis of grade, development phase, application, disease, and region.

-

Grade Outlook (Revenue, USD Million, 2021 - 2033)

-

R&D Grade

-

Viral Vector Development

-

AAV

-

Lentivirus

-

Adenovirus

-

Retrovirus

-

Others

-

-

mRNA Development

-

Antibody Development

-

DNA Vaccine Development

-

Others

-

-

GMP Grade

-

-

Development Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-Clinical Therapeutics

-

Clinical Therapeutics

-

Marketed Therapeutics

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

DNA Vaccines

-

Cell & Gene Therapy

-

Immunotherapy

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2021 - 2033)

-

Infectious Disease

-

Cancer

-

Genetic Disorder

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the plasmid DNA manufacturing market include Charles River Laboratories, VGXI, Inc., Aldevron, KANEKA CORPORATION, Nature Technology, Cell and Gene Therapy Catapult, Eurofins Genomics, Lonza, and others.

b. Key factors that are driving the market growth include increasing awareness about cell and gene therapy. Moreover, increasing demand for plasmid DNA is also estimated to accelerate market growth.

b. The global plasmid DNA manufacturing market size was estimated at USD 2.43 billion in 2025 and is expected to reach USD 2.83 billion in 2026.

b. The global plasmid DNA manufacturing market is expected to grow at a compound annual growth rate of 18.52% from 2026 to 2033 to reach USD 9.29 billion by 2033.

b. North America dominated the plasmid DNA manufacturing market with a share of 43.70% in 2025. This is attributable to technological advancements, and the presence of a substantial number of centers and institutes that are engaged in the R&D of advanced therapies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.