- Home

- »

- Renewable Chemicals

- »

-

Plastic To Fuel Market Size, Share & Growth Report, 2030GVR Report cover

![Plastic To Fuel Market Size, Share & Trends Report]()

Plastic To Fuel Market Size, Share & Trends Analysis Report By Technology Type (Pyrolysis, Gasification), By Source, By Plastic Type, By End Fuel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-487-1

- Number of Pages: 111

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Specialty & Chemicals

Plastic To Fuel Market Size & Trends

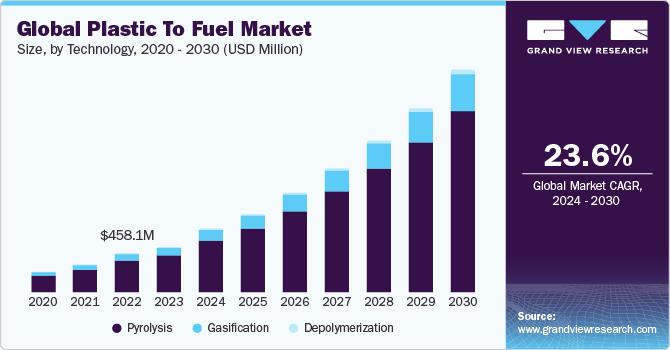

The global plastic to fuel market size was estimated at USD 531.0 million in 2023 and is expected to grow at a CAGR of 23.6% from 2024 to 2030. Growing demand for the generation of energy from waste has triggered the growth of this market. Increasing household and industrial waste has caused governments in different regions to generate energy from plastic. A favorable regulatory scenario combined with government support in the form of tax benefits and financial incentives is likely to have a positive impact on the market growth in the coming years. However, the increasing environmental concerns about the use of non-renewable energy sources may hinder growth to some extent.

Over 70% to 80% of the plastic waste in the U.S. is disposed of in landfills. The country's recycling rate is very low compared to other countries, such as Germany, France, the UK, China, and Italy. However, the rising adoption of recycled material in numerous industries is likely to drive the demand for recycling plastic waste. Hence, it is expected to increase plastic to fuel projects by market players across the globe. The U.S. was one of the largest exporters of plastic waste to China until introducing the National Sword policy in China to ban the import of plastic waste.

As a result of this ban, the country is facing a plastic waste recycling crisis. To overcome this crisis, the U.S. Plastics Industry Association drafted the RECOVER Act. USD 500 million will be allocated to states and municipalities as a federal grant to boost the investments for the improvement of the recycling programs and infrastructure including increasing material collection and upgrading the plants that process recyclables.

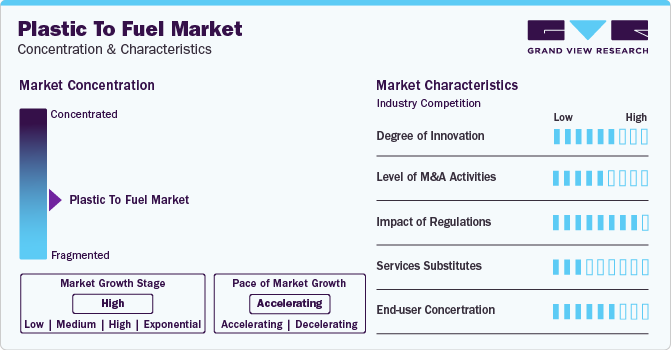

Market Concentration & Characteristics

The market is fragmented, with the top five companies holding a market share of less than 20%. Thus, increasing plastics manufacturing with growing concerns pertaining to plastic pollution and mismanaged plastic waste is expected to offer new avenues for the plastic to fuel industry players, thereby driving the overall market growth.

On account of the recycling crisis in the U.S. on account of China’s ban on importing plastic waste from the U.S., the U.S. Plastics Industry Association drafted the RECOVER Act. This, in turn, is likely to increase the demand for recycling infrastructure, thereby benefitting the overall plastic-to-fuel market over the forecast period.

Technology Insights

Based on technology, the market is further segmented into depolymerization, pyrolysis, and gasification. The pyrolysis segment held the largest share of over 80.84% in 2023. Plastic to fuel pyrolysis is commercialized in municipal solid waste, charcoal, and biomass Sources. The pyrolysis technology for mixed plastics has been developed over the past two decades but is currently becoming a commercial reality as several commercial plastic-to-fuel plants are currently operational and many more units are scheduled to be commissioned on a commercial scale over the next few years.

For instance, Needa Green Energy Limited (NGEL) operates the world’s first plastic-to-fuel plant in India located in Guntur, Andhra Pradesh, which utilizes petrol to manufacture reusable fuels including diesel and petrol. Plastics that are compatible with pyrolysis include polybutylene (PB), polyethylene (PE), polystyrene (PS), and PMMA (poly-methyl methacrylate) - acrylic glass. Due to these plastic types, which can be utilized as a feedstock for plastic-to-fuel conversion, the demand for pyrolysis technology is expected to grow at a significant pace during the forecast period.

Plastic Type Insights

In 2023, the polyethylene segment accounted for the largest market share of over 32.47%. Polyethylene is used as a packaging material in consumer goods, food & beverages, and industrial packaging applications. The demand for polyethylene is expected to be driven by its increasing use in packaging applications. In addition, its use for the production of other advanced polymers, such as high-density polyethylene (HDPE), polyethylene terephthalate (PET), and extended polyethylene (EPE), which are used in high-performance applications, is expected to rise significantly.

The PET segment emerged as the second-largest segment with a share of 21.50% in 2023. The rising demand for face shields, which are made of a material called PETG, to overcome the critical shortage of face masks required by healthcare professionals coupled with an increasing need for hand sanitizers for personal hygiene is expected to have a positive impact on the product demand in the coming years.

Source Insights

Based on source, the market is further segmented into commercial & industrial waste and municipal solid waste (MSW). The commercial & industrial waste segment accounted for the largest share of over 61.53% in 2023. The growing hospitality industry coupled with high demand for plastics from the medical industry is expected to increase the generation of plastic waste in the U.S. Before the start of the pandemic, governments across the globe were making some progress on shifting from single-use plastic products to paper bags or reusable cloth bags and banning plastic bags.

A large portion of plastic is used in the packaging, building & construction, textiles, consumer goods, transportation, electrical/electronic, and machinery manufacturing industries. Increasing demand for consumer electronics, such as mobile phones and portable electronics (which are typically made of 40% plastic), washing machines, PCs/laptops, and dishwashers, is expected to increase the plastic waste generation from these industrial sources over the forecast period.

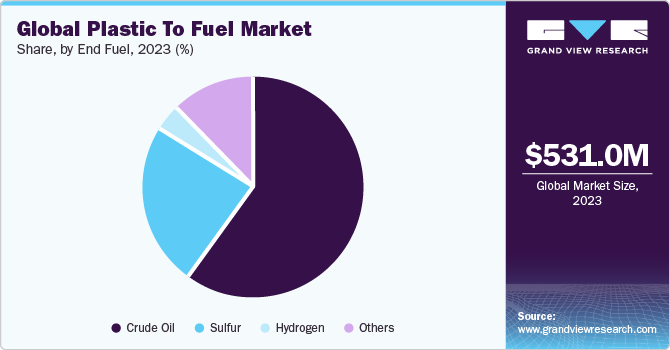

End Fuel Insights

Based on end fuel, the market is segmented into sulfur, hydrogen, crude oil, and others. The crude oil segment accounted for the largest share of 60.31% in 2023 owing to the robust utilization of crude oil in boilers, automobiles, ships, trucks, tractors, construction machinery, and power generators. The rising utilization of crude oil as a fuel in major countries, such as the U.S., China, Germany, and India, due to the flourishing automotive industries in these countries is expected to foster market growth over forecast period.

Sulfur accounted for the second-largest share in 2023. According to a study published by Argonne National Laboratory, low-sulfur diesel fuel produced by pyrolysis of waste plastics is up to 14% less greenhouse gas (GHG)-intensive as compared to its production from crude oil. The U.S.-based Plastic2Oil Inc. specializes in converting plastic into ultra-low sulfur diesel, which contains 15ppm or lower sulfur content. Such fuel type helps in curbing carbon emissions, helping secure funding for technological advancement and pilot studies. These factors are anticipated to drive the production of sulfur from plastic in the coming years.

Regional Insights

The North America plastic to fuel market accounted for the second-largest share in 2023. Rising industrial and domestic plastic waste in North America has stimulated the governments to adopt strict regulations against solid waste landfilling across different parts of the region. Increased municipal solid waste and strict legislation by the regional governments have prompted energy generation from the region's waste.

U.S. Plastic To Fuel Market Trends

The plastic to fuel market in the U.S. was the largest exporter of plastic waste to China until the introduction of the National Sword Policy China to ban the import of plastic waste. Due to the ban, the country is facing a plastic waste recycling crisis. To overcome this, the U.S. Plastics Industry Association drafted the RECOVER Act. The rising adoption of recycled material in numerous industries is likely to drive the demand for recycling plastic waste. Hence, it is projected to have a positive impact on the U.S. market.

Asia Pacific Plastic To Fuel Market Trends

The Asia Pacific plastic to fuel market dominated the global industry in 2023 and accounted for the largest revenue share of over 49.10%. The major demand for plastic to fuel is expected from Singapore, Indonesia, Vietnam, China, Japan, and India. Rapid urbanization and industrialization in this region are expected to foster market growth over the coming years. Favorable government policies and regulations to promote the development of renewable energy technologies are projected to propel market growth further.

The plastic to fuel market in China accounted for the largest share of 40.74% of the APAC regional market in 2023. Plastic to fuel technology in China has been influenced by significant environmental initiatives, particularly the ban on plastic waste imports in 2017. This ban, which targeted most plastic waste imports, led to a decline in global plastic waste trade flow and prompted changes in waste treatment methods. The ban resulted in short-term improvements in environmental impact indicators but also contributed to global warming. The transition towards domestic waste management and recycling is crucial for long-term environmental sustainability, with potential eco-cost savings of billions of euros. China’s proactive measures to reduce single-use plastics and enhance recycling practices are driving the demand for innovative solutions like plastic-to-fuel technology, aligning with global efforts to address plastic pollution and promote a circular economy.

The India plastic to fuel market is expected to grow at a significant CAGR of 27.7% from 2024 to 2030. Rising environmental concerns related to agro-industrial and manure waste management are contributing to the increased demand for and growing interest in using renewable sources of energy. The Indian government is establishing new policies to support the development of anaerobic digestion and renewable energy sources while creating more opportunities for anaerobic digestion, thus helping the local market to expand.

Europe Plastic To Fuel Market Trends

The plastic to fuel market in Europe is projected to grow at a lucrative pace from 2024 to 2030. Initiatives, such as the Zero-Waste Strategy and Environment Action Programme, are expected to drive the market demand over the forecast period.

The Germany plastic to fuel market accounted for the largest share of 22.00% in Europe market in 2023. Stringent restrictions on landfills and efforts by the government to reduce plastic waste are projected to have a positive impact on the local market. Companies in Germany, such as Remondis Se & Co. K, Greenfuels AG, FE, Klean Industries, Bayer, and BASF, are working together to convert mixed plastics into high-grade fuel oil.

The plastic to fuel marketin France is expected to grow at a CAGR of 30.9% from 2024 to 2030.The government of France has strengthened the role of Regional and Communal Action Plans (Plan Régional de Prévention et de Gestion des Déchets (PRPGD)) implementing legislation, including waste reduction and management. In addition, the government has introduced stringent restrictions on landfills, which is expected to benefit the market growth over the forecast period.

Central & South America Plastic To Fuel Market Trends

The Central & South America plastic to fuel market is estimated to have a significant growth on account of various factors, such as increasing population, rapid urbanization, economic growth, and unsustainable consumption & production patterns, that contribute to the rise in waste generation. However, countries including Brazil, Argentina, Chile, and Venezuela are showing improvement in the collection of generated waste. Furthermore, rising awareness of waste recycling is expected to have a positive impact on the market growth over the forecast period.

The plastic to fuel market in Brazil accounted for the largest share of 64.42% of the CSA market in 2023 due to a rise in waste generation, which, in turn, increases the need for proper plastics waste recycling/plastics to fuel processing. The implementation of a new National Policy and increasing public-private partnerships in waste management are projected to benefit the market in the country over the forecast period.

Middle East & Africa Plastic To Fuel Trends

The Middle East & Africa plastics to fuel market is expected to ascend in the coming years. The growth is attributed to the increasing awareness regarding the sustainable advantages and benefits of recycled plastic waste used to convert it into a high-grade fuel. However, the lack of money and inadequate infrastructure to introduce effective collection and recycling in most African countries have resulted in illegal landfill sites, thereby hampering market growth.

The plastic to fuel market in Saudi Arabia accounted for the largest share of 20.58% of the MEA market in 2023 owing to the rapid industrialization and increased population, which resulted in augmented levels of waste and pollution.

Key Plastic To Fuel Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In July 2023, GAIL announced a partnership with Lanza Tech to explore bio-recycling carbon waste into fuels and chemicals. The partnership will foster GAIL’s net zero 2040 goals, which will support wide decarbonization applications in various regions globally

-

In June 2023, Lummus Technology announced a partnership with the MOL group for advanced waste plastic recycling. The partnership with focus on the deployment and integration of chemical recycling in MOL’s facilities located in Slovakia and Hungary

Key Plastic To Fuel Companies:

The following are the leading companies in the plastic to fuel market. These companies collectively hold the largest market share and dictate industry trends.

- Plastic2oil

- Alterra Energy

- Neste

- Agilyx Inc.

- BRADAM Group, LLC

- Brightmark LLC

- Klean Industries

- Beston (Henan) Machinery Co. Ltd.

- Plastic Energy

- Agilyx Inc.

Plastic To Fuel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 754.01 million

Revenue forecast in 2030

USD 2,693.58 million

Growth rate

CAGR of 23.6% from 2024 to 2030

Base year for estimation

2023 Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative Units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, plastic type, source, end fuel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands; China; India; Japan; South Korea; Indonesia; Australia ;South Korea; Vietnam; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Plastic2oil; Alterra Energy; Neste; Nexus Circular; BRADAM Group, LLC; Brightmark LLC; Klean Industries; Beston (Henan) Machinery Co. Ltd.; Plastic Energy; Agilyx Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic To Fuel Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic to fuel market report based on technology, plastic type, source, end fuel, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Pyrolysis

-

Depolymerization

-

Gasification

-

-

Plastic Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyethylene

-

Polyethylene Terephthalate

-

Polypropylene

-

Polyvinyl Chloride

-

Polystyrene

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Municipal Solid Waste (MSW)

-

Commercial & Industrial Waste

-

-

End Fuel Outlook (Revenue, USD Million, 2018 - 2030)

-

Sulfur

-

Hydrogen

-

Crude Oil

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

Singapore

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plastic to fuel market size was estimated at USD 531.0 million in 2023 and is expected to reach USD 754.0 million in 2024.

b. The global plastic to fuel market is expected to witness a compound annual growth rate of 23.6% from 2024 to 2030 to reach USD 2,693.6 million by 2030

b. Pyrolysis accounted for a revenue share of 80.84% in the global market in 2023. Numerous fuel types can be generated through this technology such as biofuel, solid residue, and synthetic gas which is anticipated to drive this segment.

b. Some key players operating in the plastic to fuel market include Vadaxx Energy, Plastic2Oil, RES Polyflow, Green Envirotec Holdings LLC, Agilyx Corporation, JBI Inc., Envion, Shangqiu Sihai Machinery Equipment Manufacturing Co., Ltd., Beston (Henan) Machinery Co., Ltd., Zhangzhou Qiyu Renewable Energy Technology Co., Ltd.

b. Key factors driving the plastic to fuel market growth include growing need for alternate sources of energy pertaining to the excess dependence on natural resources

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."