- Home

- »

- Advanced Interior Materials

- »

-

Plastic Welding Equipment Market Size & Share Report, 2033GVR Report cover

![Plastic Welding Equipment Market Size, Share & Trends Report]()

Plastic Welding Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Ultrasonic Welding, Vibration Welding), By Type (Automatic, Semi-automatic), By Application (Packaging, Electronics & Electrical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-637-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Welding Equipment Market Summary

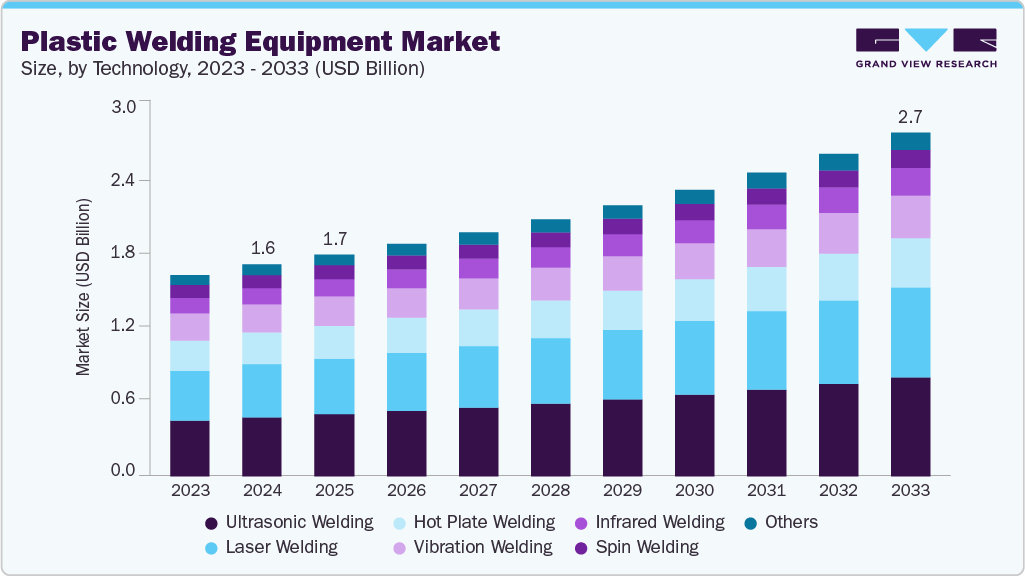

The global plastic welding equipment market size was valued at USD 1,652.5 million in 2024 and is projected to reach USD 2,675.4 million by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The global plastic welding equipment market is witnessing growth due to rising demand for lightweight and durable plastic products in industries such as automotive, packaging, and electronics.

Key Market Trends & Insights

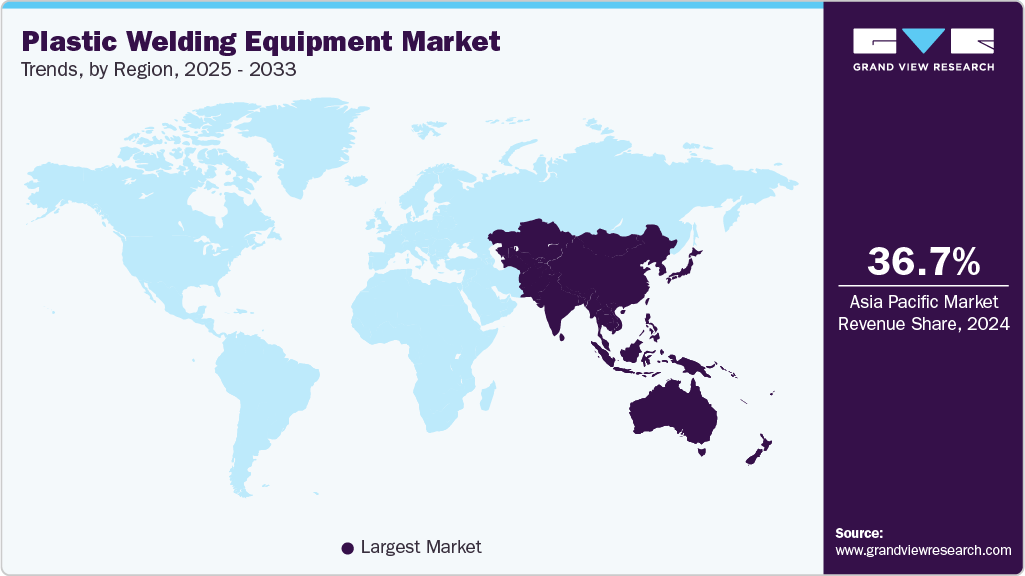

- Asia Pacific dominated the plastic welding equipment market with the largest revenue share of 36.7% in 2024.

- The plastic welding equipment market in the U.S. is expected to grow at a substantial CAGR of 4.5% from 2025 to 2033.

- By technology, the laser welding segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

- By type, the automatic plastic welding equipment segment is expected to grow at a considerable CAGR of 6.0% from 2025 to 2033 in terms of revenue.

- By application, the electronics & electrical segment is expected to grow at a considerable CAGR of 6.3% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1,652.5 Million

- 2033 Projected Market Size: USD 2,675.4 Million

- CAGR (2025-2033): 5.6%

- Asia Pacific: Largest market in 2024

The push for fuel efficiency and emission reduction has led to increased plastic usage in vehicle manufacturing. Technological advancements in plastic welding machines, including automation and integration with smart control systems, are enhancing productivity and precision. Increased emphasis on sustainable production and recycling processes also drives the market, as plastic welding helps in efficient material reuse. Moreover, the medical sector’s expansion is boosting demand for precision welding of plastic medical devices. These factors contribute to the sustained growth of the plastic welding equipment market.

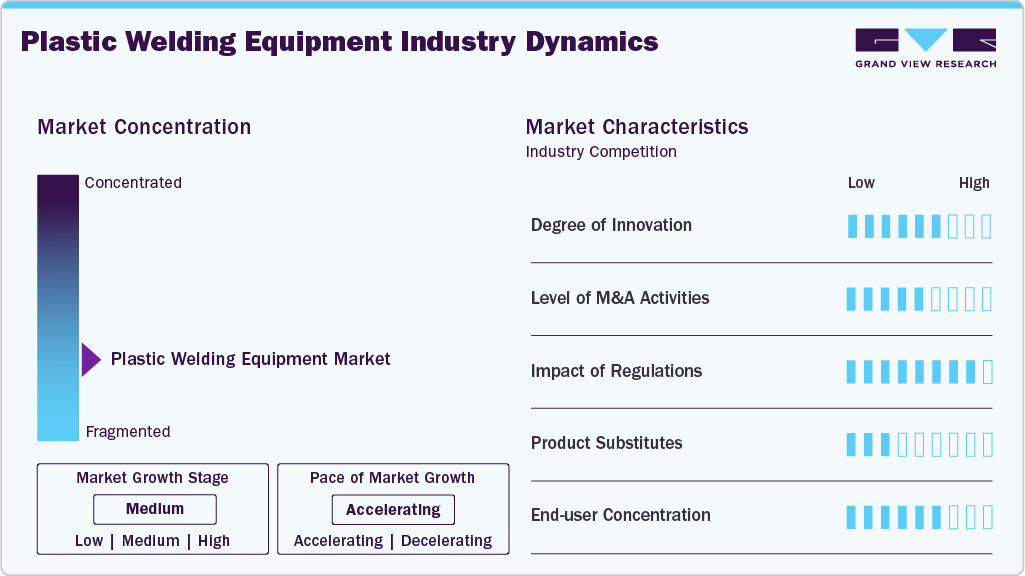

Market Concentration & Characteristics

The market is fragmented. It comprises a mix of global players and numerous regional manufacturers, each offering specialized equipment tailored to different welding techniques such as ultrasonic, hot plate, and laser welding. While a few large companies hold notable market shares, no single player dominates globally, leading to high competition and frequent technological innovations across the industry.

The industry shows a moderate to high degree of innovation, driven by the need for faster, more precise, and energy-efficient welding processes. Companies are increasingly investing in automation, robotics, and digital control systems to enhance performance. Advancements in laser and ultrasonic welding technologies are particularly prominent. These innovations help meet the growing demand in sectors like automotive, electronics, and healthcare.

The level of mergers and acquisitions (M&A) in the industry is moderate, often aimed at expanding geographic presence or integrating advanced technologies. Larger companies tend to acquire smaller, specialized firms to strengthen their product portfolio. M&A activity is also driven by efforts to gain a competitive edge in specific application areas. This contributes to some consolidation but does not eliminate fragmentation.

Regulations play a critical role in shaping the plastic welding equipment industry, particularly in the areas of safety, environmental compliance, and energy efficiency. Adherence to international standards such as CE (Conformité Européenne), ISO (International Organization for Standardization), and RoHS (Restriction of Hazardous Substances) is essential for ensuring product acceptance across global markets.

Drivers, Opportunities & Restraints

The key drivers of the plastic welding equipment market include rising demand for lightweight and durable plastic components across the automotive, electronics, and packaging sectors. Increased focus on fuel efficiency and cost-effective manufacturing further boosts adoption. Technological advancements in welding methods enhance productivity and precision. The growing need for sustainable solutions also fuels demand for efficient plastic joining techniques.

Opportunities in the market stem from the growing use of plastic welding in the healthcare and renewable energy sectors. Expansion in emerging economies presents untapped potential for market players. Integration of Industry 4.0 and automation technologies opens new avenues for innovation. Customization and servicing of equipment also offer profitable business models.

Restraints include the high initial cost of advanced plastic welding equipment, which may deter small and medium-sized enterprises. A lack of skilled labor for operating sophisticated machines can limit adoption. Stringent regulations regarding plastic use and recycling pose compliance challenges. Additionally, fluctuating raw material prices may affect profitability and production planning.

Technology Insights

The ultrasonic welding segment accounted for a share of 27.9% in 2024, due to its high-speed operation and clean, precise joining capabilities. It is widely used in industries like automotive, electronics, and medical devices, where accuracy and efficiency are crucial. Its non-invasive, energy-efficient nature also supports sustainability goals. The technology's proven performance and low operational cost further drive its widespread adoption.

Laser welding is the fastest growing segment, fueled by increasing demand for micro-welding and aesthetically clean joints in electronics and medical sectors. It enables non-contact, highly accurate welding of complex plastic components, supporting miniaturization trends. The integration of laser systems with automation and Industry 4.0 tools enhances productivity. As product designs become more intricate, laser welding’s precision is becoming increasingly vital.

Type Insights

Automatic segment accounted for a share of 47.8% in 2024. Automatic plastic welding machines dominate the market due to their high efficiency, precision, and suitability for mass production. Industries like automotive and electronics favor fully automated systems to reduce human error and enhance consistency. Integration with robotics and Industry 4.0 technologies further boosts their adoption. Their ability to deliver faster output with minimal downtime supports large-scale manufacturing needs.

Semi-automatic machines are growing significantly, especially among small and medium-sized enterprises seeking cost-effective solutions. These systems offer flexibility for low-to-medium production volumes and are easier to operate and maintain. Growth in emerging economies is also contributing to their rising demand. As manufacturers seek a balance between automation and affordability, semi-automatic systems are gaining traction.

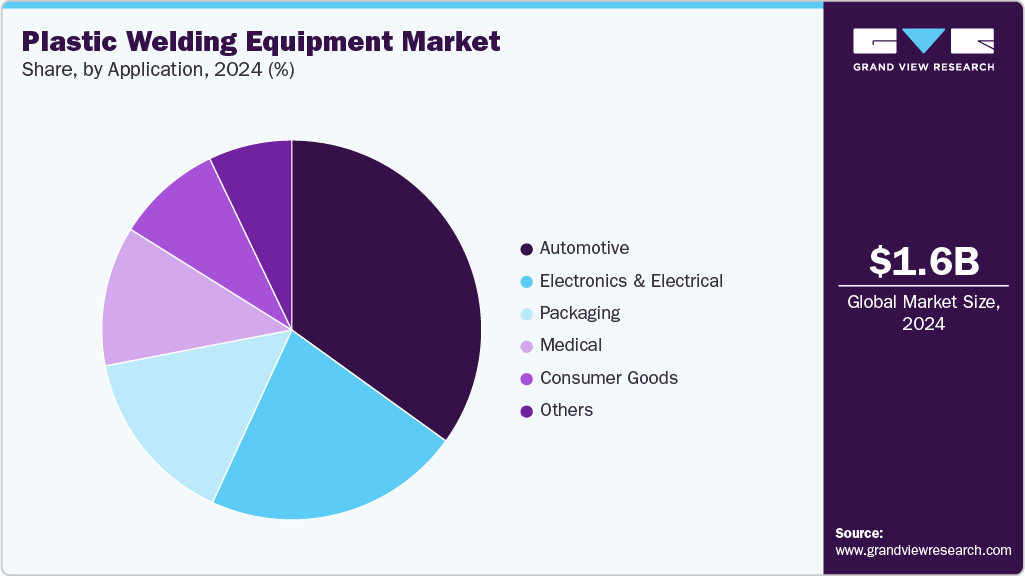

Application Insights

The automotive segment accounted for a share of 34.9% in 2024, owing to high demand for lightweight, durable plastic components that improve fuel efficiency. Welding technologies like ultrasonic and hot plate are widely used for assembling bumpers, dashboards, and fuel tanks. Strict emission norms have pushed automakers to adopt advanced plastic welding to replace metal parts. The industry's focus on cost reduction and performance supports sustained equipment adoption.

Electronics and electrical applications are the fastest-growing segment, driven by increasing miniaturization and demand for high-precision assemblies. Plastic welding ensures reliable sealing and insulation of electronic housings, connectors, and sensors. The surge in wearable devices, smartphones, and EV electronics fuels this growth. Rising investment in semiconductor and consumer electronics manufacturing further accelerates demand.

Regional Insights

North America plastic welding equipment market is expected to grow at a significant CAGR of 4.6% due to strong industrial infrastructure and high adoption of advanced manufacturing technologies. The presence of key automotive and medical device manufacturers drives consistent demand. Technological innovation and automation are heavily integrated across sectors. The government's focus on clean energy and sustainability also boosts equipment upgrades.

U.S. Plastic Welding Equipment Market Trends

The plastic welding equipment market in the U.S. is expected to grow at a CAGR of 4.5% from 2025 to 2033. The U.S. dominates the North America plastic welding equipment market due to its advanced manufacturing base and high demand from automotive, aerospace, and medical device industries.

Mexico plastic welding equipment market is the fastest-growing market in North America, fueled by rising foreign investments in automotive and electronics manufacturing. Its proximity to the U.S. and cost-effective labor attract global OEMs and suppliers.

Europe Plastic Welding Equipment Market Trends

The plastic welding equipment market in Europe is experiencing steady growth, driven by stringent regulations on vehicle emissions and plastic recycling. Countries like Germany and Italy lead in automation and machinery innovation. Demand for precision welding in automotive and medical sectors supports market expansion. Sustainability goals are pushing industries toward efficient and eco-friendly welding solutions.

Germany plastic welding equipment market is experiencing steady growth, driven by its leadership in automotive engineering and industrial automation. High demand for precision welding in electric vehicles and medical devices drives equipment adoption. The country’s focus on sustainable manufacturing practices supports investment in energy-efficient technologies. Strong R&D capabilities and presence of key players further boost market development.

The UK plastic welding equipment market is witnessing notable growth, fueled by rising demand in the medical, electronics, and packaging industries. Efforts to strengthen local manufacturing post-Brexit are encouraging equipment modernization. Increasing focus on recyclable plastics and circular economy practices promotes advanced welding technologies. Government support for innovation and automation is enhancing industrial competitiveness.

Asia Pacific Plastic Welding Equipment Market Trends

The plastic welding equipment market in Asia Pacific is a dominant market and accounted for the 36.7% share, owing to rapid industrialization and expanding automotive, electronics, and consumer goods sectors in China, India, and Southeast Asia. The region benefits from low-cost manufacturing and increasing investments in infrastructure. Growing urbanization and demand for packaged goods further support plastic welding adoption. Favorable government policies encourage local production and technological upgrades.

China leads the Asia Pacific plastic welding equipment market, driven by its massive manufacturing base and rapid industrialization. High demand from automotive, electronics, and consumer goods sectors fuels equipment adoption. Government policies supporting smart manufacturing and automation further drive growth. China's strong export orientation also boosts the need for reliable and high-speed welding solutions.

The plastic welding equipment market in India is growing rapidly, supported by expanding infrastructure, automotive, and electronics industries. Government initiatives like “Make in India” are encouraging local production and industrial modernization. Rising demand for cost-effective, lightweight plastic components increases the use of welding equipment. Growing awareness of automation and quality standards is further boosting adoption across sectors.

Middle East & Africa Plastic Welding Equipment Market Trends

The plastic welding equipment market in the Middle East & Africa region is witnessing rising adoption due to growing construction, packaging, and automotive activities. GCC countries are investing in industrial automation and manufacturing diversification. Demand for durable plastic components in water and energy infrastructure is boosting equipment use. However, market penetration is still emerging due to limited local production capacity.

Saudi Arabia plastic welding equipment market is experiencing growth in the plastic welding equipment market due to expanding infrastructure and industrial projects under Vision 2030. The rise in automotive, packaging, and construction activities is driving demand for high-performance plastic joining solutions. Investments in manufacturing and local production capabilities are boosting market potential. Growing interest in automation and quality control supports equipment modernization.

Latin America Plastic Welding Equipment Market Trends

The plastic welding equipment market in Latin America shows gradual growth, supported by industrial expansion and infrastructure projects in countries like Brazil and Mexico. The automotive aftermarket and consumer goods industries contribute to increasing equipment demand. Economic development and trade agreements promote manufacturing investments. However, adoption remains limited by budget constraints in smaller enterprises.

Brazil plastic welding equipment market is driven by the expansion of its automotive, packaging, and consumer electronics sectors. Rising demand for lightweight and durable plastic components is increasing adoption across industries. Government efforts to boost domestic manufacturing and reduce dependency on imports are supporting the market. Additionally, industrial automation and quality control trends are encouraging investment in advanced welding technologies.

Key Plastic Welding Equipment Companies Insights

Key players operating in the plastic welding equipment market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Plastic Welding Equipment Companies:

The following are the leading companies in the plastic welding equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Leister AG

- Dukane Corp.

- Emerson Electric Co.

- WEGENER Welding, LLC

- Miller Weldmaster

- BAK Technology AG

- Herrmann Ultraschall

- LPKF Laser & Electronics

- Seelye Acquisitions, Inc.

- MUNSCH Kunststoff-Schweißtechnik GmbH

- Johnson Plastosonic (P) Ltd

- Bortte

- KING ULTRASONIC CO., LTD

- Sibas Ultrasonics Pvt Ltd

- Knmtech Ultrasonics

Recent Developments

-

In May 2024, Emerson launched the new Branson GLX-1 laser welder, designed for precision welding of small, intricate plastic components. The compact system is cleanroom-compatible and ideal for medical devices, electronics, and automotive sensors. It features modular architecture and integrates easily with production automation systems. The GLX-1 also supports non-destructive “un-welding,” promoting recyclable and sustainable manufacturing practices.

-

In May 2024, BAK Technology AG joined the ROTHENBERGER Group, becoming part of its portfolio of nine specialized brands. The acquisition enhances BAK’s position in mobile hot-air plastic welding and extrusion technologies. Both companies see the merger as a strategic move to strengthen Swiss operations and share technical expertise. BAK will continue operating independently while benefiting from ROTHENBERGER’s global support and resources.

Plastic Welding Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,728.4 million

Revenue forecast in 2033

USD 2,675.4 million

Growth rate

CAGR of 5.6% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, type, application, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Leister AG; Dukane Corp.; Emerson Electric Co.; WEGENER Welding, LLC; Miller Weldmaster; BAK Technology AG; Herrmann Ultraschall; LPKF Laser & Electronics; Seelye Acquisitions, Inc.; MUNSCH Kunststoff-Schweißtechnik GmbH; Johnson Plastosonic (P) Ltd; Bortte; KING ULTRASONIC CO., LTD; Sibas Ultrasonics Pvt Ltd; Knmtech Ultrasonics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Welding Equipment Market Report Segmentation

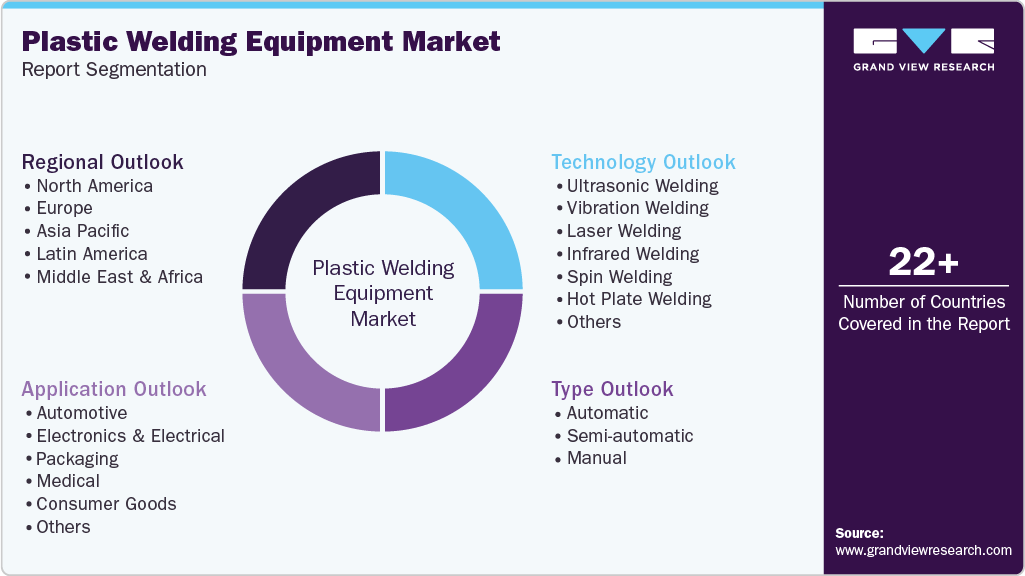

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global plastic welding equipment market report based on technology, type, application, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Ultrasonic Welding

-

Vibration Welding

-

Laser Welding

-

Infrared Welding

-

Spin Welding

-

Hot Plate Welding

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Automatic

-

Semi-automatic

-

Manual

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Electronics & Electrical

-

Packaging

-

Medical

-

Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastic welding equipment market size was estimated at USD 1,652.5 million in 2024 and is expected to be USD 1,728.4 million in 2025.

b. The global plastic welding equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2033 to reach USD 2,675.4 million by 2033.

b. Automatic plastic welding equipment segment accounted for a share of 47.8% in 2024. his dominance is driven by the segment’s ability to deliver high efficiency, precision, and scalability, which are critical for mass production environments.

b. Some of the key players operating in the global plastic welding equipment market include Leister AG; Dukane Corp.; Emerson Electric Co.; WEGENER Welding, LLC; Miller Weldmaster; BAK Technology AG; Herrmann Ultraschall; LPKF Laser & Electronics; Seelye Acquisitions, Inc.; MUNSCH Kunststoff-Schweißtechnik GmbH; Johnson Plastosonic (P) Ltd; Bortte; KING ULTRASONIC CO., LTD; Sibas Ultrasonics Pvt Ltd; Knmtech Ultrasonics.

b. The global plastic welding equipment market is driven by rising demand for lightweight, durable plastic components across automotive, electronics, and packaging industries. Growth in automation and precision manufacturing further boosts adoption of advanced welding systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.