- Home

- »

- Homecare & Decor

- »

-

Plumbing Fixtures Market Size, Share & Trends Report, 2030GVR Report cover

![Plumbing Fixtures Market Size, Share & Trends Report]()

Plumbing Fixtures Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Deployment (Residential, Commercial), By Location (Bathroom, Kitchen), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-345-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plumbing Fixtures Market Summary

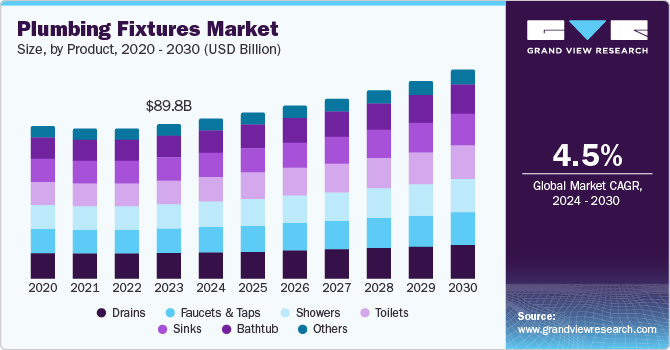

The global plumbing fixtures market size was estimated at USD 89.8 billion in 2023 and is projected to reach USD 120.9 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030. Urbanization, particularly in emerging economies, is a key driver of demand for new housing and infrastructure projects, resulting in increased installation of plumbing fixtures such as sinks, toilets, and showers.

Key Market Trends & Insights

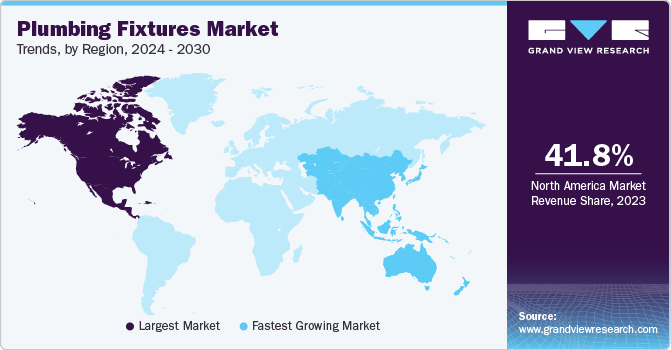

- North America plumbing fixtures market dominated the global market with a revenue share of 41.8% in 2023.

- Asia Pacific plumbing fixtures market is expected to register the fastest CAGR of 6.1% in the forecast period.

- Based on deployment, the Commercial segment dominated the market and accounted for a share of 51.4% in 2023.

- Based on application, the repair & remodel segment led the market with a revenue share of 70.3% in 2023.

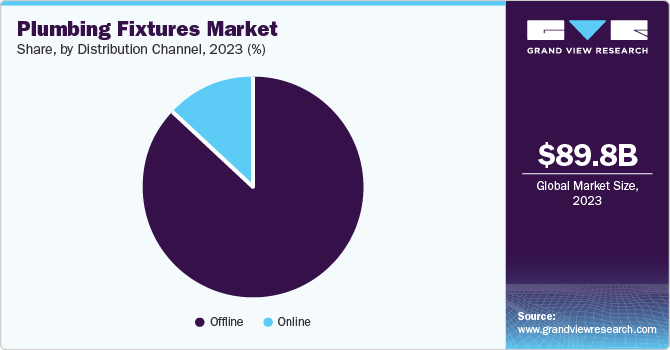

- Based on distribution channel, the offline segment dominated the market with a share of 86.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 89.8 Billion

- 2030 Projected Market Size: USD 120.9 Billion

- CAGR (2024-2030): 4.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

This trend is expected to continue as populations rise and urbanization accelerates. As consumer incomes increase, they are more likely to invest in modern and aesthetically pleasing plumbing fixtures, contributing to market growth as homeowners prioritize renovations and upgrades. Furthermore, technological advancements in plumbing fixtures, such as touchless faucets and smart toilets, are becoming increasingly popular, enhancing user experience while promoting sustainability.

A growing interest in home remodeling and renovation projects leads homeowners to replace older fixtures with modern, efficient alternatives, driving demand in the residential segment. Moreover, the growing emphasis on water conservation and eco-friendly products prompts consumers to choose water-efficient fixtures that align with environmental goals. This trend is expected to persist as consumers become more aware of the importance of sustainability and environment-friendly practices.

Due to their exceptional heat tolerance characteristics, the rising popularity of ceramic materials in sanitary ware is also driving market growth worldwide. This trend is expected to continue, owing to the increasing consumer demand for aesthetically pleasing washrooms and kitchens. The development of innovative products and enhancements of existing ones, prioritizing both comfort and luxury, will further enhance the utility of fixtures in residential and commercial settings.

Product Insights

Drains led the market and accounted for a share of 16.4% in 2023. Rapid urbanization, construction activities, and growing awareness of water conservation and sustainability drive the need for high-quality drain fixtures. Innovative design and materials enhance functionality and durability, appealing to consumers seeking reliable products. Regulatory standards and building codes emphasize effective drainage systems, boosting demand for advanced drain fixtures.

The toilets segment is expected to grow at the fastest CAGR of 5.0% over the forecast period. Due to consumer concerns about water conservation and sustainability, water-saving technologies, dual-flush systems, and touchless flushing mechanisms are in high demand. The COVID-19 pandemic has accelerated the need for hygiene-centric features such as touchless flush options and antimicrobial surfaces. Growing construction activity in emerging economies also fuels demand for modern and efficient toilet fixtures.

Deployment Insights

Commercial usage of fixtures dominated the market and accounted for a share of 51.4% in 2023. The ongoing new construction projects in hotels, restaurants, and office buildings require efficient plumbing systems. The focus on hygiene and sanitation in public spaces fuels the demand for advanced fixtures, while smart building technologies promote the integration of modern plumbing solutions.

The residential segment is projected to register the fastest CAGR of 5.2% over the forecast period. Homeowners are investing in renovations and upgrades, prioritizing aesthetic appeal and functionality. Environmental concerns are driving the increasing demand for water-efficient fixtures. New housing developments and heightened awareness of sanitation further boost demand, contributing to robust growth in the segment.

Location Insights

Bathroom fixtures held the largest revenue share, 53.0%, in 2023. Urbanization and rising disposable incomes drive the demand for modern bathrooms, with consumers seeking high-end, technologically advanced fixtures prioritizing comfort and luxury. Moreover, the focus on hygiene and water conservation is driving demand for innovative plumbing solutions, making bathrooms a key investment area in both residential and commercial sectors.

Kitchen fixtures are expected to register the fastest growth of 4.6% over the forecast period, driven by changing consumer lifestyles and prioritizing multifunctionality and aesthetics. Modern kitchens are viewed as social spaces, driving demand for stylish sinks, faucets, and fixtures. Renovation activities are increasing, with homeowners seeking to enhance their kitchen environments. Smart technologies and eco-friendly products are also driving growth in the segment.

Application Insights

The repair & remodel segment led the market with a revenue share of 70.3% in 2023. Homeowners are investing in modernizing their spaces to enhance aesthetics and functionality, driving demand for replacing outdated fixtures. Rising disposable incomes, urbanization, and emphasis on water efficiency and sustainability support this trend, as consumers seek to create comfortable, stylish living environments that increase home value.

The new construction segment is expected to experience the fastest CAGR of 5.1% over the forecast period, aided by robust construction activities and urban development. Growing populations and expanding urban areas necessitate new residential and commercial buildings, requiring comprehensive plumbing systems. Smart home technologies and government initiatives promoting sustainable building practices drive demand for modern, efficient, and water-efficient plumbing solutions.

Distribution Channel Insights

Offline distribution channels dominated the market with a share of 86.6% in 2023. The segment growth is fueled by its established presence and customer preference for in-person shopping. Physical examination of products before purchase is crucial, especially for high-value items such as ceramic and glass. Offline channels offer immediate availability, expert installation advice, and professional installation services, solidifying their market position.

Online distribution of plumbing fixtures is projected to grow at the fastest CAGR of 6.4% over the forecast period. The rise of e-commerce in the plumbing fixtures market is driven by consumer demand for convenience, accessibility, and wider product selection. Online platforms offer 24/7 shopping, competitive pricing, and fast shipping, appealing to busy professionals and homeowners. This shift towards digital shopping mirrors broader consumer trends, emphasizing the importance of online presence in the industry.

Regional Insights

North America plumbing fixtures market dominated the global market with a revenue share of 41.8% in 2023. Factors driving market growth in the region include rising urbanization, consumer demand for modern fixtures, and advancements in smart plumbing technologies. Residential and commercial projects and the hospitality sector’s growth fuel demand for stylish and efficient solutions, solidifying the region’s position as a global key player.

U.S. Plumbing Fixtures Market Trends

The plumbing fixtures market in the U.S. dominated the North America plumbing fixtures market with a revenue share of 81.4% in 2023. The country is experiencing strong demand for residential and commercial fixtures, focusing on premium and innovative products. Stringent water and energy standards accelerate the adoption of eco-friendly and advanced fixtures.

Europe Plumbing Fixtures Market Trends

The European plumbing fixtures market held a substantial market share in 2023, owing to renovation activities, sustainable living trends, and consumer demand for energy-efficient and water-saving technologies. Stricter environmental regulations and urbanization also fuel demand for eco-friendly products. Consumers seek high-quality fixtures that balance functionality with aesthetics, driving market expansion.

The plumbing fixtures market in Germany is expected to grow in the forecast period, fueled by its strong economy, high household spending, and mature infrastructure sectors. Germany leads the European luxury plumbing market, driven by increasing consumer spending on homes, luxury housing, and smart homes, as well as rapid urbanization.

Asia Pacific Plumbing Fixtures Market Trends

Asia Pacific plumbing fixtures market is expected to register the fastest CAGR of 6.1% in the forecast period, owing to the significant construction activities in this region's residential and commercial sectors. The region’s focus on modern living standards and improved infrastructure contributes to market expansion. Consumers demand durable and affordable plumbing solutions, fueling demand for innovative products that meet contemporary needs and enhance living standards.

The plumbing fixtures market in China dominated the Asia Pacific plumbing fixtures market with a revenue share of 21.5% in 2023 due to extensive residential and commercial construction projects. The market growth is expected to be further driven by new building and infrastructure projects and increasing awareness of hygiene and sanitation, particularly in touchless and antimicrobial fixtures.

Key Plumbing Fixtures Company Insights

Some key companies operating in the market include American Bath Group, Colston Bath, Delta Faucet Company, and Gerber Plumbing Fixtures LLC, among others. Companies prioritize product innovation, smart and water-efficient fixtures, and expanding online presence through strategic partnerships to enhance market reach and cater to evolving consumer demands.

-

American Bath Group offers a comprehensive product portfolio, including bathtubs, shower bases, vanities, and kitchen sinks, through e-commerce and retail channels.

-

Delta Faucet Company offers a broad range of products, such as kitchen & bathroom faucets, showerheads, and accessories. Through its WaterSense-labeled products, the company focuses on water conservation.

Key Plumbing Fixtures Companies:

The following are the leading companies in the plumbing fixtures market. These companies collectively hold the largest market share and dictate industry trends.

- American Bath Group

- Colston Bath

- Delta Faucet Company

- Gerber Plumbing Fixtures LLC

- GROHE

- Kohler Co.

- Moen Incorporated

- Ferguson Enterprises, LLC.

- TOTO LTD.

Recent Developments

-

In September 2024, Hindware's Italian Collection launched the Automate Imperial Smart Toilet, a modern and sleek toilet featuring advanced technology, including a presence-sensing lid and seat, oscillating water spray, and foot-touch flush.

-

In February 2024, TOTO unveiled new luxury products at the KBIS 2024, including the NEOREST WX Smart Bidet Toilet, SOIRÉE WASHLET+ S7A, and matte black finish, showcasing its commitment to quality and customer satisfaction.

Plumbing Fixtures Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 92.9 billion

Revenue forecast in 2030

USD 120.9 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, deployment, location, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, UK, France, Germany, Italy, Spain, India, China, Japan, Brazil, Argentina, South Africa, UAE

Key companies profiled

American Bath Group; Colston Bath; Delta Faucet Company; Gerber Plumbing Fixtures LLC; GROHE; Kohler Co.; Moen Incorporated; Ferguson Enterprises, LLC.; TOTO LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plumbing Fixtures Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plumbing fixtures market report based on product, deployment, location, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bathtub

-

Sinks

-

Toilets

-

Showers

-

Faucets & Taps

-

Drains

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Bathroom

-

Kitchen

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

New Construction

-

Repair & Remodel

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.