- Home

- »

- Next Generation Technologies

- »

-

Poland Fiber Laser Cutting Machines Market, Industry Report, 2030GVR Report cover

![Poland Fiber Laser Cutting Machines Market Size, Share & Trends Report]()

Poland Fiber Laser Cutting Machines Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (2D, 3D), By End-use (Automotive, Medical Devices, Aerospace & Defense), And Segment Forecasts

- Report ID: GVR-4-68040-253-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

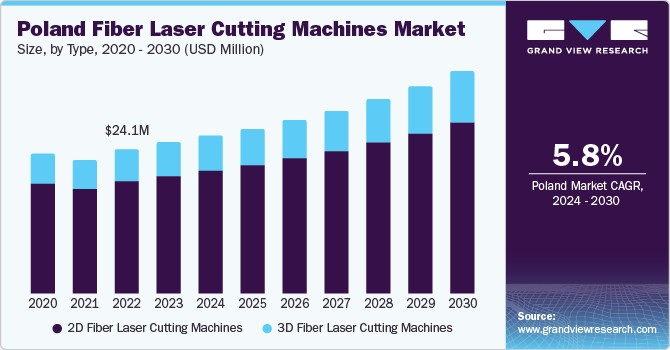

The Poland fiber laser cutting machines market size was valued at USD 25.1 million in 2023 and is anticipated to grow at a CAGR of 5.8% from 2024 to 2030. The increasing automation in major sectors in Poland such as aerospace & defense, automotive, and electrical & electronics, along with the rising adoption of advanced manufacturing techniques, are driving the demand for fiber laser cutting machines. Polish companies across various industries are currently focusing on improving efficiency and precision in their production processes, thus shifting toward advanced cutting technologies such as fiber lasers. In addition, the growing trend of customization and personalization in manufacturing is boosting the demand for these machines in Poland. The increasing importance of customization in industries has further driven market expansion, as these machines enable precise and intricate cutting, allowing manufacturers to create unique products tailored to customer requirements

Poland accounted for a revenue share of 2.04% in the global fiber laser cutting machines market in 2023. The country has witnessed significant advancements in the manufacturing sector, becoming a leading industrial hub in Europe. The proliferation of automation and AI in manufacturing has led to an increased demand for innovative manufacturing technologies, with the government actively pushing for modernization of this segment. Furthermore, increasing investments from international organizations have also encouraged companies in Poland to purchase and adopt advanced equipment in their processes, leading to healthy growth of the fiber laser cutting machines market.

Additionally, there has been a concentrated push by the Polish government to adopt sustainable and environment-friendly practices, as well as energy-efficient machineries that cause minimal environmental impact. This has created several growth avenues for manufacturers of fiber laser cutting machines. Moreover, a continued shift toward automation and an increasing focus on Industry 4.0 initiatives present significant opportunities for market expansion. Currently, the demand for cutting-edge solutions that can integrate seamlessly into automated workflows is growing as manufacturing entities are emphasizing streamlining operations and improving productivity. Fiber laser cutting machines are well-positioned to meet these evolving needs owing to their high precision, speed, and versatility, leading to industry growth.

Companies in the market are promoting their products through both online and offline practices, with a view to reach a larger audience. Owing to the increasing Internet proliferation in Poland, digital marketing has become an effective avenue to reach audiences interested in fiber laser cutting machines. For instance, companies are actively engaging in Search Engine Optimization (SEO) strategies, targeting specific keywords related to fiber laser technology. By optimizing website content and incorporating relevant keywords, businesses are striving to improve their visibility in online search results. On the offline side, increasing participation in trade shows such as STOM-LASER and STOM-BLECH & CUTTING Expo have enabled companies such as Seron and EAGLE Group to directly interact with potential clients and showcase technological innovations & industry expertise. These factors are also responsible for driving positive market developments.

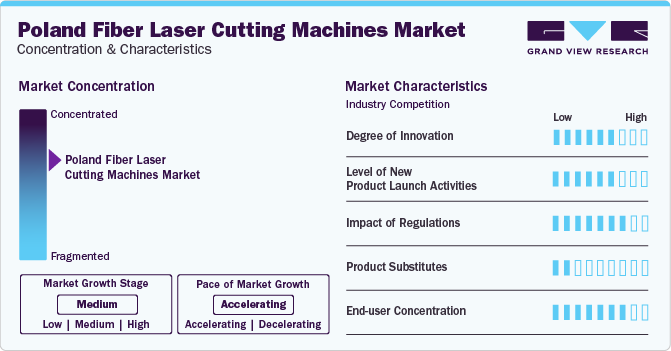

Market Concentration & Characteristics

The market growth stage is moderate, and pace of market growth is accelerating. Over the past few years, the industrial sector has received significant investments from both national and global bodies to improve the country’s positioning in Europe. Subsidies, grants, and tax incentives provided by the government have encouraged companies to invest in advanced manufacturing technologies such as 2D fiber laser cutting machines, driving market demand. Consequently, various innovative products that feature increased power and cutting speed are being launched in the market for fiber laser cutting machines in Poland. For instance, in October 2022, EAGLE announced that in partnership with Pivatic, the company had developed and delivered an advanced coil-fed cutting solution. This technology is considered to speed up the sheet metal cutting process, while also minimizing manual handling and wastage. Such developments fuel market expansion.

There has been a steady rate of new product launches in the country, mainly through well-known expos and trade fairs such as the STOM-BLECH & CUTTING Expo and the STOM-LASER trade show. For instance, KIMLA has been a notable participant at the latter event, held in Kielce, for many years, displaying products such as waterjet water cutters, tool milling machines, fiber laser cutters, and industrial plotters, while also demonstrating their operations. Such developments have helped boost the adoption of these machineries in the country.

To enter and operate optimally in the fiber laser cutting machines market in Poland, companies are required to strictly adhere to compliance procedures and permits. The Polish law emphasizes the responsibility of both machine manufacturers and employers to minimize hazards associated with machinery operation and ensure comprehensive safety for employees. This aligns with the need to limit hazards and provide a safe working environment. Understanding and implementing the technical and organizational solutions is instrumental for companies in addressing safety concerns.

Although fiber laser cutting machines are used extensively in Poland, there are other alternatives also, such as plasma cutting, waterjet cutting, and CNC machining that have emerged in recent years. However, there are advantages and drawbacks to each of these solutions that call for better understanding of the requirements by companies to adopt a particular technology and achieve optimum results. Thus, the threat of substitute products is low in the market.

The steady development of major industries such as automotive, medical, aerospace, and electronics in Poland has enhanced the application scope of fiber laser cutting machines. For instance, they are used in developing surgical instruments and custom medical devices for important operating procedures in the medical field. The growing demand for precision engineering in the aerospace & defense segment is driving product adoption in this area. Furthermore, the fast-growing electrical and electronics segment also presents growth opportunities for fiber laser cutting machine manufacturers. Thus, there is a very significant end-user base for these products in the country.

Type Insights

Based on type, the 2D fiber laser cutting machines segment accounted for a dominant revenue share of 78.09% in 2023 in the Poland fiber laser cutting machines market. Technological advancements have played a crucial role in driving the growth of this segment. Continuous innovations have made these machines more efficient and cost-effective over time. Manufacturers have been able to enhance the performance of 2D fiber laser cutting machines, making them more accessible for small- and large-scale businesses. This has encouraged companies in Poland to invest in these machines to modernize and improve their production processes. Additionally, the emphasis on sustainability in manufacturing has increased the demand for these types of equipment.

The 3D fiber laser cutting machines segment, on the other hand, is expected to advance at the fastest CAGR through 2030. These machines offer significant advantages over traditional cutting methods, including reduced material waste, lower energy consumption, and faster processing times. As Polish companies such as AJAN POLSKA seek to optimize their operations and remain competitive, they are making significant investments in 3D fiber laser cutting technology to improve their overall efficiency. Another factor driving growth in this segment is the rising focus of manufacturers in the country on cost reduction and waste minimization.

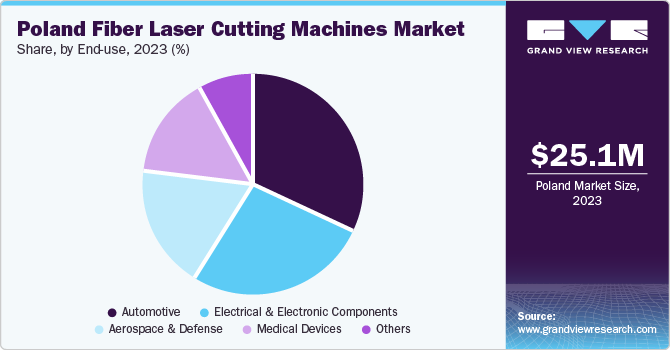

End-use Insights

In terms of end-use, the automotive segment held the largest revenue share in the Poland market for fiber laser cutting machines in 2023. The automotive industry in the country is one of the largest in Europe, with major exports being electric buses, vehicle bodies, trailers, and batteries. As a result, demand for fiber laser cutting machines has grown steadily, since they are extensively used to cut different types of materials, including plastics, sheet metal, and composites. These machines are known for their accuracy and dependability, which are essential to meet quality standards in this industry. In addition, their efficiency and cost-effectiveness heighten their appeal for automotive manufacturers seeking to streamline production and reduce expenses.

The medical devices segment is expected to advance at the fastest growth rate during the forecast period. Growing investments in the healthcare sector by Poland’s government in recent years, along with increasing rate of patient admissions for surgeries, have created a healthy demand for fiber laser cutting machines. Fiber lasers are widely used in surgical procedures to achieve precision and efficiency in cutting, ablation, and manipulation of tissues. This is particularly crucial in minimally invasive surgeries, where accuracy and minimal tissue damage are paramount. In addition, they are used in medical imaging systems to develop high-resolution imaging modalities for diagnostic purposes. Their ability to deliver intense, focused light enables clear visualization of anatomical structures, contributing to improved patient outcomes.

Key Poland Fiber Laser Cutting Machines Company Insights

Major companies involved in the fiber laser cutting machines market in Poland have been involved in development of new products, acquisitions, and site expansions to boost their production and drive revenue. Companies are increasingly investing in the development of 3D fiber laser cutting technology to expand their offerings for different end-use sectors such as automotive, aerospace, and medical devices, among others. Additionally, organizations are participating in events such as the STOM-LASER trade show in Kielce to introduce advanced products and promote their range.

Key Poland Fiber Laser Cutting Machines Companies:

- KIMLA

- CORMAK

- AJAN Polska

- Seron

- Amada Sp. z o.o.

- EAGLE Group

- Weni Solution

Recent Developments

-

In March 2023, Eagle Lasers unveiled its 30kW iNspire fiber laser cutting machine in Poland, at the STOM-LASER trade event held in Kielce. Besides having a 30kW fiber laser source, the product also features a fast 9-second pallet exchange, 6G acceleration, and a proprietary eVa cutting head to deliver high-quality and precise cutting capabilities

-

In March 2022, Weni Solution announced the opening of the WENI STORE, the company’s specialized online store that houses components, accessories, and parts for laser devices situated in Poland. Through this store, buyers can purchase products from well-known brands such as OMRON, RECI, and Ruida, along with consumables and accessories. The platform offers solutions at competitive prices with a short delivery period, ensuring customer satisfaction

-

In February 2022, SERON, a notable CNC machine manufacturer in Poland, showcased its products at the STOM-BLECH & CUTTING Expo. The company specializes in manufacturing machines that promote automation of production plants. The company presented customized products such as plasma cutters and fiber optic cutters at this event

-

In May 2021, Seron announced the construction of a new production plant in the city of Stalowa Wola in Poland. This strategic expansion has helped in improving the quality of the manufactured fiber laser cutting machines

Poland Fiber Laser Cutting Machines Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 36.9 million

Growth rate

CAGR of 5.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use

Key companies profiled

KIMLA; CORMAK; AJAN Polska; Seron; Amada Sp. z o.o.; EAGLE Group; Weni Solution

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Poland Fiber Laser Cutting Machines Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Poland fiber laser cutting machines market report based on type and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

2D Fiber Laser Cutting Machines

-

3D Fiber Laser Cutting Machines

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Devices

-

Automotive

-

Aerospace & Defense

-

Electrical & Electronic Components

-

Others

-

Frequently Asked Questions About This Report

b. The Poland fiber laser cutting machines market market size was estimated at 25.1 million in 2023 and is expected to reach 26.3 million in 2024.

b. The Poland fiber laser cutting machines market market is expected to grow at an annual compound rate of 5.8% from 2024 to 2030 to reach 36.9 million by 2030.

b. The 2D fiber laser cutting machines segment accounted for a dominant revenue share of 78.09% in 2023 in the Poland fiber laser cutting machines market. Technological advancements have played a crucial role in driving the growth of this segment. Continuous innovations have made these machines more efficient and cost-effective over time.

b. Some of the companies operating in the Poland fiber laser cutting machines market include KIMLA; CORMAK; AJAN Polska; Seron; Amada Sp. z o.o.; EAGLE Group; Weni Solution

b. The increasing automation in major sectors in Poland such as aerospace & defense, automotive, and electrical & electronics, along with the rising adoption of advanced manufacturing techniques, are driving the demand for fiber laser cutting machines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.