- Home

- »

- Plastics, Polymers & Resins

- »

-

Polybenzimidazole (PBI) Market Size, Industry Report, 2033GVR Report cover

![Polybenzimidazole Market Size, Share & Trends Report]()

Polybenzimidazole Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Neat PBI Resin, PBI Fibers), By End-use (Aerospace Components, Semiconductor/ Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-763-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polybenzimidazole (PBI) Market Summary

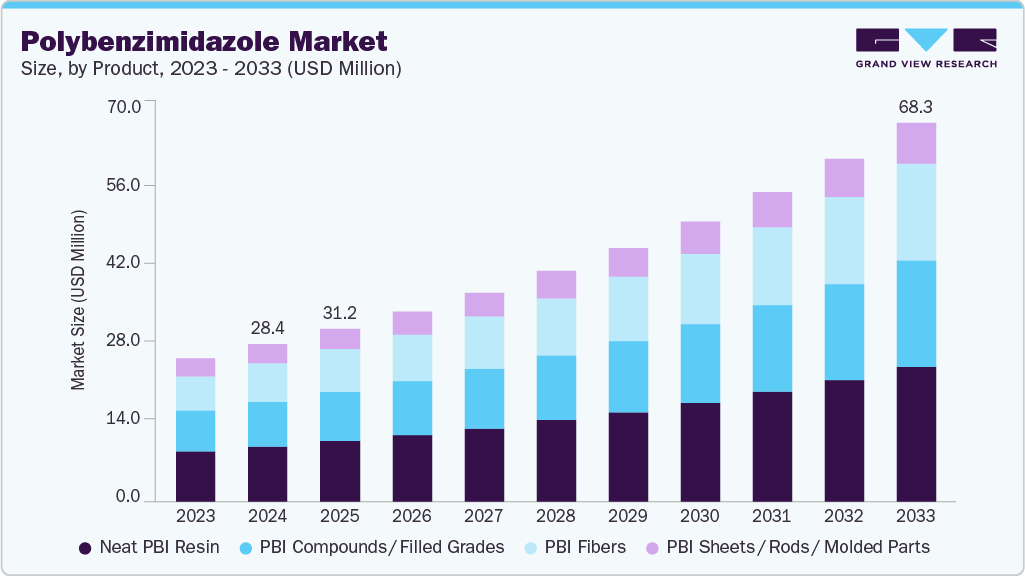

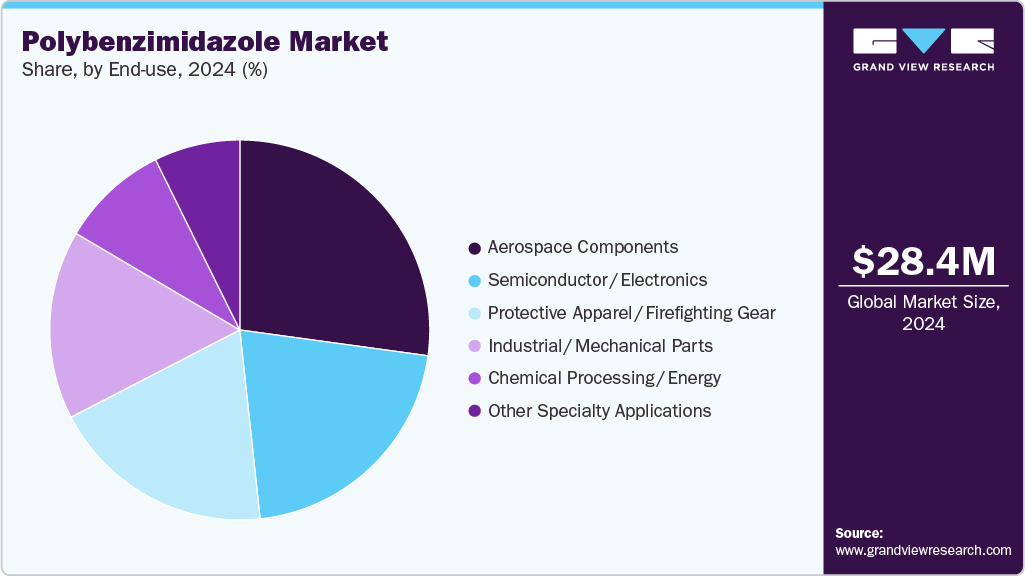

The global polybenzimidazole market size was estimated at USD 28.4 million in 2024 and is projected to reach USD 68.3 million by 2033, growing at a CAGR of 10.3% from 2025 to 2033. The market is driven by its exceptional thermal stability, chemical resistance, and mechanical strength, making it indispensable in aerospace, defense, and automotive applications.

Key Market Trends & Insights

- Asia Pacific dominated the global polybenzimidazole (PBI) market with the largest revenue share of over 46.27% in 2024.

- The Polybenzimidazole (PBI) market in China is expected to grow at a substantial CAGR of 11.1% from 2025 to 2033.

- By product, the PBI fibers segment is expected to grow at a fastest CAGR of 10.8% from 2025 to 2033 in terms of revenue.

- By end use, the protective apparel/ firefighting gear segment is expected to grow at a fastest CAGR of 11.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 28.4 Million

- 2033 Projected Market Size: USD 68.3 Million

- CAGR (2025-2033): 10.3%

- Asia Pacific: Largest market in 2024

In addition, rising demand for high-performance materials in protective clothing, membranes, and electrical components is fueling market growth. PBI offers exceptional thermal stability (withstanding temperatures above 400°C), flame resistance, and superior mechanical strength, making it an attractive material for aircraft insulation, space suits, and defense equipment. For instance, NASA has historically used PBI in astronaut suits due to its resistance to fire and thermal degradation. With the global aerospace industry expected to expand due to increasing air travel and space exploration projects, the demand for PBI as a critical material is set to grow significantly.

The push for lightweight and durable materials in automotive manufacturing is another key growth driver. Automakers are increasingly adopting high-performance polymers such as PBI to enhance fuel efficiency and meet stringent emission norms. PBI is used in automotive gaskets, sealing systems, and brake components because of its resistance to wear, creep, and harsh chemicals. For example, PBI-based materials are used in braking systems to withstand high frictional heat without degradation, which is vital for safety and performance. As electric vehicles (EVs) become more prominent, PBI’s application in high-temperature electrical insulation and thermal management systems is anticipated to further accelerate market growth.

The rapid expansion of the electronics and semiconductor industries is creating new opportunities for the PBI market. With devices becoming smaller, more powerful, and exposed to high thermal loads, manufacturers are increasingly looking for materials that can ensure reliability and longevity. PBI films and fibers are utilized in circuit boards, connectors, and semiconductor manufacturing equipment due to their exceptional dielectric properties, low outgassing, and resistance to chemicals. For instance, PBI-based films are used in photolithography processes in semiconductor fabs. The rising demand for advanced consumer electronics and 5G infrastructure is expected to further support the adoption of PBI in this sector.

Market Concentration & Characteristics

The PBI market is characterized as a high-performance polymer industry with niche applications. Unlike commodity plastics, PBI is produced in relatively low volumes but offers very high value due to its exceptional properties, such as flame resistance, high mechanical strength, and chemical inertness. Its applications are concentrated in industries that demand reliability under extreme conditions, including aerospace, defense, electronics, and protective clothing. This specialization makes the market relatively smaller but highly profitable compared to mass-market polymers.

The production of PBI is highly complex, involving expensive raw materials and advanced polymerization techniques. This makes the industry capital-intensive and technology-driven, with only a limited number of manufacturers globally. Barriers to entry are significant because new players require strong R&D capabilities and specialized manufacturing facilities to compete. Companies in this industry typically compete based on innovation, product customization, and reliability rather than on cost.

Product Insights

The neat PBI resin segment recorded the largest market revenue share of over 35.0% in 2024. Neat PBI resin is the pure, unfilled form of polybenzimidazole, typically supplied as a solid powder or solution. It is known for its exceptional thermal stability, chemical resistance, and mechanical strength, maintaining integrity at temperatures above 400°C. Neat PBI resin is widely used in high-performance coatings, adhesives, and film applications where extreme heat resistance is critical, such as in aerospace and electronics. In addition, rising adoption in additive manufacturing for producing high-temperature resistant 3D printed parts is opening new growth avenues.

The PBI fibers segment is expected to grow at the fastest CAGR of 10.8% during the forecast period. PBI fibers are spun from neat or modified PBI resins and are renowned for their flame resistance, thermal stability, and durability. They are widely used in protective apparel, including firefighter suits, military uniforms, and industrial safety clothing. PBI fibers are also incorporated into heat-resistant fabrics for aerospace and industrial applications, such as insulating materials in high-temperature furnaces or protective covers for electrical components. The key drivers for PBI fibers are the growing emphasis on occupational safety, stringent fire safety regulations, and demand for high-performance protective textiles.

End-use Insights

The aerospace components segment recorded the largest market share of over 27.0% in 2024.PBI is widely used in aerospace due to its exceptional thermal stability, chemical resistance, and flame-retardant properties. Components such as insulation for aircraft engines, seals, gaskets, and structural parts in high-temperature zones rely on PBI to maintain performance under extreme conditions. For instance, in jet engines or spacecraft, PBI fibers can withstand temperatures exceeding 500°C, which is critical for safety and efficiency. In addition, PBI-based composites are used in aircraft interiors to meet stringent fire safety regulations without compromising weight.

The protective apparel/firefighting gear segment is projected to grow at the fastest CAGR of 11.1% during the forecast period. PBI fibers are a key material in protective clothing for firefighters, industrial workers, and military personnel. They provide excellent flame resistance, thermal stability, and chemical resistance, ensuring safety in high-risk environments. PBI-based fabrics are used in turnout gear, gloves, and hoods, often blended with other fibers like Kevlar or Nomex for enhanced durability and comfort. Military modernization programs and the growing market for high-performance safety apparel support the segment’s growth.

Regional Insights

North America polybenzimidazole (PBI) market accounted for a revenue share of 21.42% in 2024. This positive outlook is due to the presence of advanced aerospace, defense, and semiconductor industries. The U.S. has a high demand for PBI in applications requiring extreme thermal stability, such as aerospace components, fire-resistant protective apparel, and industrial machinery parts. The region’s strong focus on R&D and innovation, combined with well-established chemical and polymer manufacturing infrastructure, supports the continuous development of high-performance materials like PBI.

U.S. Polybenzimidazole Market Trends

The polybenzimidazole (PBI) industry in the U.S. dominated the North American region due to its robust defense sector, advanced semiconductor manufacturing, and stringent safety standards for protective gear. U.S. government initiatives for high-temperature-resistant materials in space exploration, military applications, and industrial processes further fuel demand. In addition, the presence of leading PBI manufacturers and suppliers in North America facilitates rapid commercialization and application of new PBI technologies, making the U.S. a key market influencer.

Europe Polybenzimidazole Market Trends

Europe polybenzimidazole (PBI) industrygrowth is driven by aerospace, automotive, and chemical processing sectors that demand high-performance polymers. Countries such as Germany, France, and the UK are investing heavily in lightweight, heat-resistant materials for industrial applications, including aircraft engines, protective clothing, and electronic components. Europe also has a strong regulatory framework that emphasizes safety and environmental compliance, which indirectly promotes the adoption of advanced polymers such as PBI in applications requiring high thermal and chemical resistance.

Asia Pacific Polybenzimidazole Market Trends

Asia Pacific polybenzimidazole (PBI) industry is projected to be the fastest-growing market globally in the PBI market due to the rapid expansion of end-use industries such as aerospace, electronics, and chemical processing. Countries such as China, Japan, and South Korea are heavily investing in advanced materials to enhance high-performance applications, including thermal and chemical-resistant components. The increasing adoption of electric vehicles (EVs) and semiconductor manufacturing in the region is also driving demand for PBI-based materials in components like insulation and protective gear.

China Polybenzimidazole (PBI) industryis a key market within Asia Pacific, and is a major contributor due to its strong manufacturing base and growing high-tech sectors. The country's investment in aerospace programs, EV battery systems, and high-performance electronics has created substantial demand for heat- and chemical-resistant materials such as PBI. Furthermore, the increasing collaborations between domestic and international chemical and polymer manufacturers are accelerating technology transfer and local production, making China a crucial driver in the region.

Key Polybenzimidazole Company Insights

The global PBI industry is moderately consolidated, with a few key players holding significant market share due to high barriers to entry stemming from complex manufacturing processes, high raw material costs, and stringent quality standards. Major companies such as PBI Performance Products, Inc., Mitsubishi Chemical and Advanced Materials, among others dominate the landscape, supplying PBI across aerospace, electronics, protective apparel, and chemical processing sectors.

Key players leverage advanced R&D capabilities, strategic partnerships, and integrated production facilities to maintain competitive advantages, while smaller regional players focus on niche applications or local markets. Market share is largely influenced by technological innovation, regulatory compliance, and the ability to deliver high-performance specialty applications, making the competitive landscape highly dependent on product differentiation and end-use expertise.

- In June 2025, 1-Material announced the launch of its in-house production of PBI. This launch addresses industry shortages for PBI, which is widely used in demanding environments such as aerospace, electronics, and chemical processing. The new production capability enables 1-Material to deliver reliable, high-quality PBI products that can sustain high-temperature applications and harsh chemical conditions, supporting industries that require durable, high-performance engineered polymers.

Key Polybenzimidazole Companies:

The following are the leading companies in the polybenzimidazole (PBI) market. These companies collectively hold the largest market share and dictate industry trends.

- PBI Performance Products, Inc.

- Mitsubishi Chemical Advanced Materials

- HOS Technik

- Gharda Chemicals Ltd.

- Polymics, Ltd.

- Symmtek Polymers LLC

- 1-Material

- Singoo

- Cope Plastics

Polybenzimidazole Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 31.2 million

Revenue forecast in 2033

USD 68.3 million

Growth rate

CAGR of 10.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; China; Japan; India; Australia; South Korea; UK; Germany; France; Spain; Italy; Argentina; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

PBI Performance Products, Inc.; Mitsubishi Chemical Advanced Materials; HOS Technik; Gharda Chemicals Ltd.; Polymics, Ltd.; Symmtek Polymers LLC; 1-Material; Singoo; Cope Plastics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polybenzimidazole Market Report Segmentation

This report forecasts revenue & volume growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polybenzimidazole (PBI) market report based on product, end-use, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Neat PBI Resin

-

PBI Compounds / Filled Grades

-

PBI Fibers

-

PBI Sheets / Rods / Molded Parts

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Aerospace Components

-

Semiconductor / Electronics

-

Protective Apparel / Firefighting Gear

-

Industrial / Mechanical Parts

-

Chemical Processing / Energy

-

Other Specialty Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.