- Home

- »

- Pharmaceuticals

- »

-

Polycystic Ovary Syndrome Supplements Market Report, 2033GVR Report cover

![Polycystic Ovary Syndrome Supplements Market Size, Share & Trends Report]()

Polycystic Ovary Syndrome Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Ingredient (Myo-inositol-based supplements, Micronutrient & Omega-3), By Dosage Form (Capsules & tablets, Powders), By Indication, By Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-755-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polycystic Ovary Syndrome Supplements Market Summary

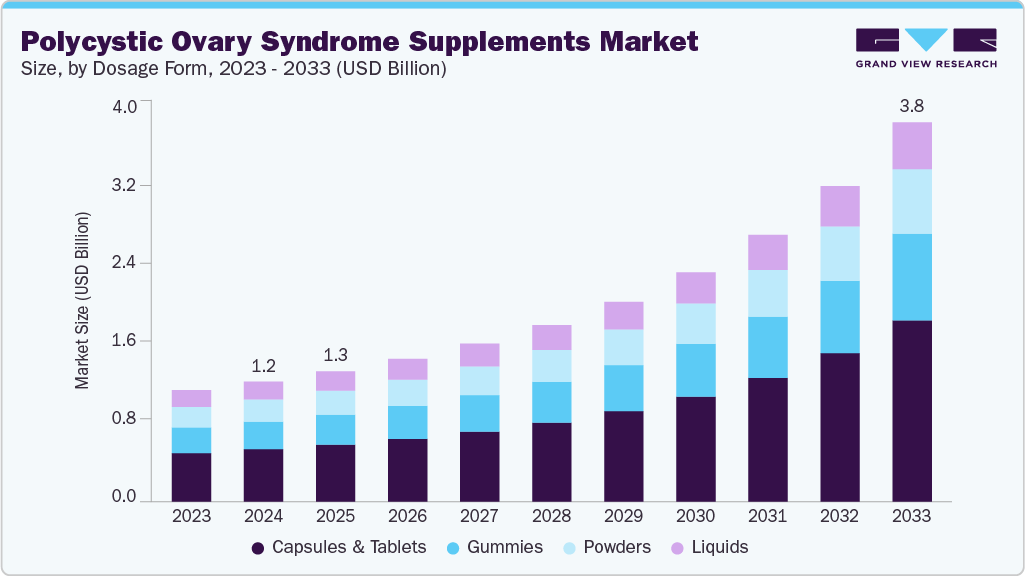

The global polycystic ovary syndrome supplements market size was valued at USD 1.20 billion in 2024 and is projected to reach USD 3.80 billion by 2033, growing at a CAGR of 14.29% from 2025 to 2033. The industry is gaining momentum due to the rising prevalence of polycystic ovary syndrome (PCOS) worldwide and growing awareness of its long-term health implications.

Key Market Trends & Insights

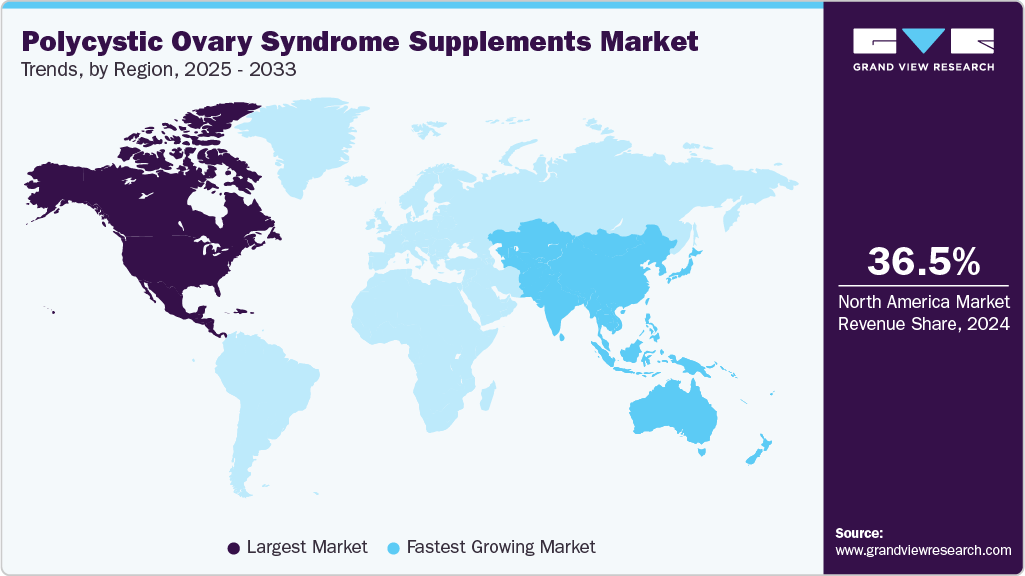

- The North America polycystic ovary syndrome supplements industry held the largest share of 36.54% in 2024.

- The polycystic ovary syndrome supplements industry in the U.S. is expected to grow significantly over the forecast period.

- By ingredient, the myo‑inositol-based supplements segment held the highest market share of 41.81% in 2024.

- By dosage form, the capsules & tablets segment held the highest market share in 2024.

- By indication, the hormonal regulation segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.20 Billion

- 2033 Projected Market Size: USD 3.80 Billion

- CAGR (2025-2033): 14.29%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

PCOS affects women of reproductive age, and with improving diagnostic capabilities and education campaigns, more women are being diagnosed earlier. This expanding patient pool is fueling demand for solutions that can help manage symptoms naturally, creating a strong growth base for supplement manufacturers.

Rising prevalence of PCOS across the globe

Polycystic Ovary Syndrome (PCOS) is one of the most common endocrine disorders affecting women of reproductive age, and its prevalence has been steadily increasing worldwide. Studies estimate that PCOS affects around 6-13% of women globally, with some regions such as South Asia reporting even higher rates, partly due to genetic predisposition and rising obesity levels. The growing incidence is closely linked to lifestyle factors such as poor diet, sedentary behavior, and increasing rates of insulin resistance and metabolic syndrome, which are strongly associated with PCOS development.

Another important factor contributing to the prevalence of PCOS is greater awareness and improved diagnostic capabilities. More women are now being screened for PCOS symptoms such as irregular periods, infertility, and hormonal imbalances, leading to earlier and more frequent diagnoses. Public health initiatives, social media awareness campaigns, and education by healthcare professionals are further shedding light on PCOS as a chronic condition that requires ongoing management, which has an expanding diagnosed population, directly boosting the demand for effective treatment and management options, including supplements.

Furthermore, there is an increasing shift toward natural and non-prescription management options. Many patients prefer lifestyle interventions and nutraceuticals such as inositol, omega-3 fatty acids, vitamin D, and herbal blends as alternatives or adjuncts to pharmacological treatments. This trend is supported by the rise of e-commerce and direct-to-consumer brands, which are making PCOS supplements widely accessible and offering subscription-based delivery models that encourage consistent usage.

The polycystic ovary syndrome supplements industry also benefits from growing healthcare professional support and clinical validation. Gynecologists, endocrinologists, and dietitians are increasingly recommending evidence-based supplements as part of holistic PCOS management plans. Clinical studies supporting the efficacy of specific nutraceuticals in improving ovulation, insulin sensitivity, and hormonal balance are helping legitimize this market segment and attract more consumers seeking credible, science-backed products.

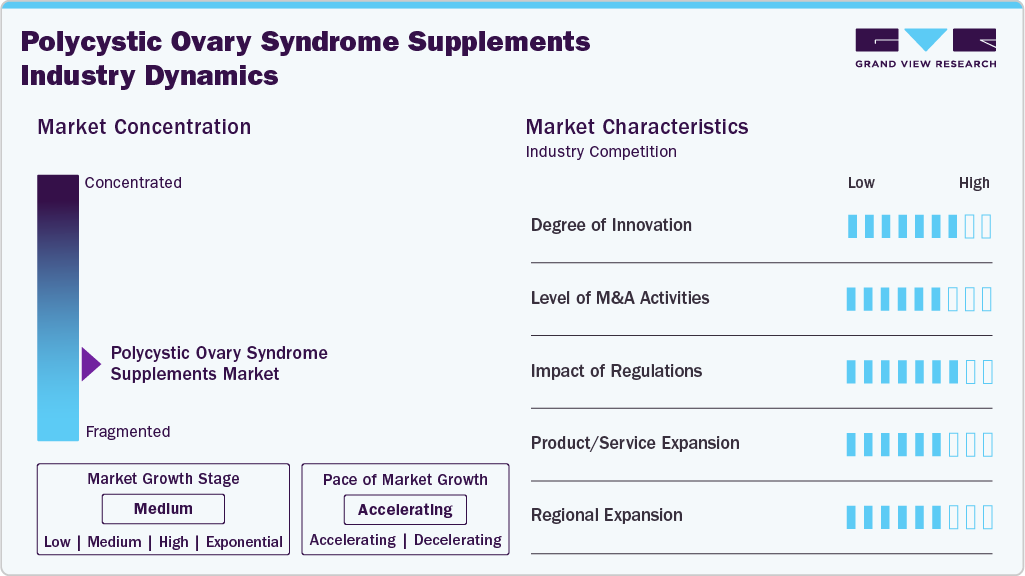

Market Concentration & Characteristics

Innovation is a major growth driver in this polycystic ovary syndrome supplements industry, with companies investing in clinically validated formulations that combine inositol isomers, antioxidants, omega-3s, and herbal extracts to address hormonal imbalance, insulin resistance, and reproductive health. Personalized supplements and subscription-based solutions are emerging trends, allowing for tailored regimens based on symptoms and diagnostic data.

M&A activity in this space remains moderate but is picking up as larger nutraceutical and pharma companies look to acquire niche women’s health brands to expand their product portfolios. Strategic acquisitions are often aimed at gaining access to proprietary formulations, customer bases, and strong digital distribution channels.

Regulatory frameworks vary significantly across regions. In the U.S., PCOS supplements are regulated as dietary supplements, allowing faster market entry but requiring strict adherence to FDA labeling and safety standards. In the EU and APAC, regulatory approval processes can be more stringent, especially for claims related to fertility and hormonal health, influencing product positioning and marketing strategies.

Players are rapidly expanding their portfolios to include complete PCOS management kits-covering not just supplements but also digital tracking tools, dietary guidance, and lifestyle programs. This ecosystem approach helps differentiate brands and improve consumer adherence, ultimately driving better outcomes and stronger brand loyalty.

Regional expansion is an active growth strategy, with North America, while Asia-Pacific is witnessing the fastest growth due to its large population base and increasing diagnosis rates. Companies are localizing product offerings and marketing campaigns to meet cultural preferences and regulatory requirements in emerging markets such as India, China, and Brazil.

Ingredients Insights

Myo‑inositol-based supplements dominated the market, with the largest revenue share of 41.81% in 2024, due to their well-documented clinical benefits in improving insulin sensitivity, restoring ovulatory cycles, and supporting hormonal balance. Growing evidence from randomized clinical trials has increased physician recommendations, making myo-inositol one of the most prescribed nutraceuticals for PCOS management. Additionally, rising consumer demand for natural, evidence-backed alternatives to pharmaceuticals has accelerated adoption, with many women preferring myo-inositol over synthetic hormonal therapies due to its favorable safety profile and minimal side effects.

Micronutrient & Omega-3 are expected to grow at a significant CAGR from 2025 to 2033. Deficiencies in key micronutrients such as vitamin D, magnesium, and zinc are common among women with PCOS and are linked to worsened insulin resistance and hormonal imbalance, which has fueled interest in targeted supplementation. Omega-3 fatty acids, known for their anti-inflammatory properties, are gaining traction for their role in improving lipid profiles, reducing inflammation, and supporting ovulatory function. Growing clinical research validating these benefits, along with wider availability of high-quality, affordable formulations through e-commerce and pharmacy channels, is encouraging both healthcare professional recommendations and consumer adoption worldwide.

Dosage Form Insights

The capsules & tablets segment led the PCOS supplements industry in 2024, accounting for the largest revenue share of 43.65%. Capsules and tablets remain a major growth driver in the PCOS supplements market due to their convenience, precise dosing, and longer shelf life compared to powders or liquids. These formats are widely preferred by consumers seeking an easy-to-use, discreet solution that can be integrated into daily routines. Manufacturers are leveraging this preference by offering combination formulations, such as myo-inositol, D-chiro-inositol, folic acid, and micronutrients, within a single capsule or tablet, improving adherence and perceived value.

The gummies segment is expected to grow at a significant CAGR over the forecast period. Gummies are emerging as a strong driver in the PCOS supplements market, appealing to younger consumers and those seeking a more enjoyable, convenient alternative to pills. Their palatable flavors and chewable format improve compliance, which is critical for PCOS management that often requires long-term supplementation. Brands are innovating by formulating gummies with key ingredients such as myo-inositol, vitamin D, and zinc, while maintaining low sugar content to suit insulin-resistant consumers.

Indication Insights

The hormonal regulation segment led the PCOS supplements industry in 2024, accounting for the largest revenue share of 33.83%. Managing hormonal imbalance is central to alleviating symptoms such as irregular cycles, acne, and hirsutism. Furthermore, growing awareness among women about the link between hormones, metabolic health, and fertility is driving demand, while brands emphasizing evidence-backed, natural solutions are gaining credibility and increasing adoption in both developed and emerging markets.

The fertility improvement segment is expected to grow at a significant CAGR over the forecast period. Supplements aimed at fertility improvement are a significant driver in the PCOS market, as many women with PCOS struggle with ovulatory dysfunction and infertility. Key ingredients such as myo-inositol, D-chiro-inositol, folic acid, and certain antioxidants have been clinically shown to improve ovulation rates, egg quality, and hormonal balance, making them highly recommended by gynecologists and fertility specialists. Thus, boosting the market growth.

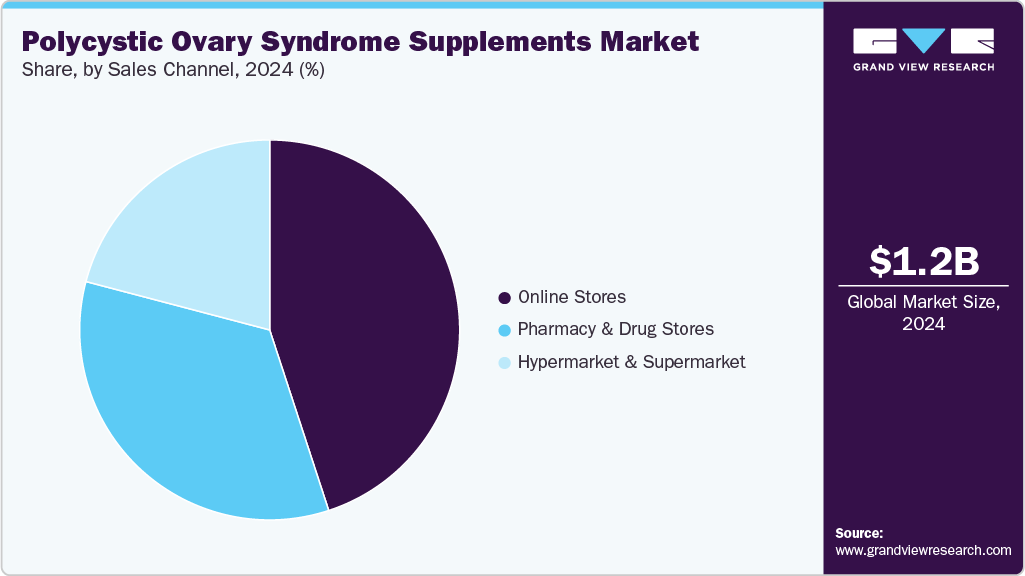

Sales Channel Insights

Based on sales channel, the online stores segment led the market with the largest revenue share of 44.97% in 2024, driven by consumers increasingly relying on online reviews, social media, and targeted digital marketing to discover supplements for symptom management, fertility support, and hormonal regulation. Subscription models, home delivery, and direct-to-consumer sales channels enhance convenience and adherence, especially for women managing PCOS long-term. Additionally, e-commerce enables brands to reach global markets efficiently, support personalized supplement recommendations, and launch new products quickly, further boosting market growth.

The pharmacy & drug stores segment is projected to grow at a significant CAGR during the forecast period, driven by providing trusted, easily accessible points of purchase for consumers seeking reliable and regulated products. Many women prefer buying supplements from these outlets due to perceived safety, professional guidance from pharmacists, and the ability to physically compare brands and formulations. Pharmacies also help enhance brand visibility and credibility, particularly for clinically backed supplements like myo-inositol, vitamin D, and micronutrient combinations. The presence of in-store promotions, health counseling, and bundling with other women’s health products further encourages adoption, supporting steady growth in this distribution channel.

Regional Insights

North America polycystic ovary syndrome (PCOS) supplements market dominated the global industry with the largest revenue share of 36.54% in 2024, owing to high PCOS awareness, strong healthcare infrastructure, and widespread adoption of nutraceuticals. Consumers increasingly prefer natural and evidence-backed supplements like myo-inositol and omega-3s, supported by recommendations from gynecologists and endocrinologists. E-commerce and pharmacy distribution further facilitate access, making North America a mature and rapidly growing market.

U.S. Polycystic Ovary Syndrome (PCOS) Supplements Market Trends

The polycystic ovary syndrome (PCOS) supplements market in the U.S. is driven by a combination of high disease awareness, strong consumer spending power, and robust digital marketing by supplement brands. Evidence-based formulations for fertility, hormonal balance, and metabolic health are widely recommended by healthcare professionals, supporting consistent market growth.

Europe Polycystic Ovary Syndrome (PCOS) Supplements Market Trends

The polycystic ovary syndrome (PCOS) supplements market in Europe is driven by growing awareness of women’s health, increasing prevalence of PCOS, and regulatory support for nutraceuticals. Combination formulations and personalized supplement offerings are gaining traction, particularly in urban markets where consumers prioritize natural and clinically validated options.

The U.K. polycystic ovary syndrome (PCOS) supplements marketis fueled by rising diagnoses of PCOS, widespread health literacy, and the growing popularity of over-the-counter and online supplements. Consumer preference for convenient dosage forms like capsules and gummies supports adoption across reproductive-aged women.

The Germany polycystic ovary syndrome (PCOS) supplements marketis shaped by high standards for product quality and safety, along with a strong inclination toward clinically validated supplements. Healthcare professional endorsements and evidence-based marketing drive consumer trust in PCOS-specific formulations.

Asia Pacific Polycystic Ovary Syndrome (PCOS) Supplements Market Trends

The polycystic ovary syndrome (PCOS) supplements market in Asia Pacific is anticipated to witness the fastest CAGR of 15.75% throughout the forecast period. The Asia Pacific market is expanding rapidly due to rising PCOS prevalence, growing awareness, and increasing disposable income. E-commerce platforms and digital health campaigns are key drivers, allowing brands to reach urban and semi-urban populations efficiently.

China polycystic ovary syndrome (PCOS) supplements market is propelled by increasing health awareness, rising female workforce participation, and expanding online retail channels. Consumers show a preference for scientifically backed nutraceuticals that target hormonal balance and fertility support.

The India polycystic ovary syndrome (PCOS) supplements market is driven by a high prevalence of PCOS, growing urban awareness, and rising adoption of dietary supplements. Affordable, clinically validated formulations distributed via pharmacies and online platforms are increasing accessibility and uptake.

The rising prevalence of the condition in India is the major driving factor for the region’s market growth. According to the Press Information Bureau (PIB) of the Indian government, a report published in January 2023, the PCOS cases in the nation range from 3.7 - 22.5% and are the major cause of female infertility, estimated at 64%. To address this issue, the Indian Council of Medical Research (ICMR), initiated a multicentric study nationwide in 2021. Some medical drugs available in the country to treat PCOS are Follical Forte Tablets, PCOS Care Capsules, Ferjoy-IN Tablets to treat hormonal imbalances, and Cureveda Women Elixir to provide relief from the symptoms. Such increasing incidences, initiatives, and companies innovating new drugs are driving the market growth.

Middle East & Africa Polycystic Ovary Syndrome (PCOS) Supplements Market Trends

The polycystic ovary syndrome (PCOS) supplements market in the Middle East is supported by increasing awareness of women’s health issues, higher disposable income, and urbanization. Social media campaigns and pharmacy availability play a significant role in shaping consumer adoption.

Kuwait polycystic ovary syndrome (PCOS) supplements market is primarily driven by awareness among urban women, strong purchasing power, and easy access to international nutraceutical brands through pharmacies and online platforms. Focus on fertility and hormonal regulation supplements is particularly prominent.

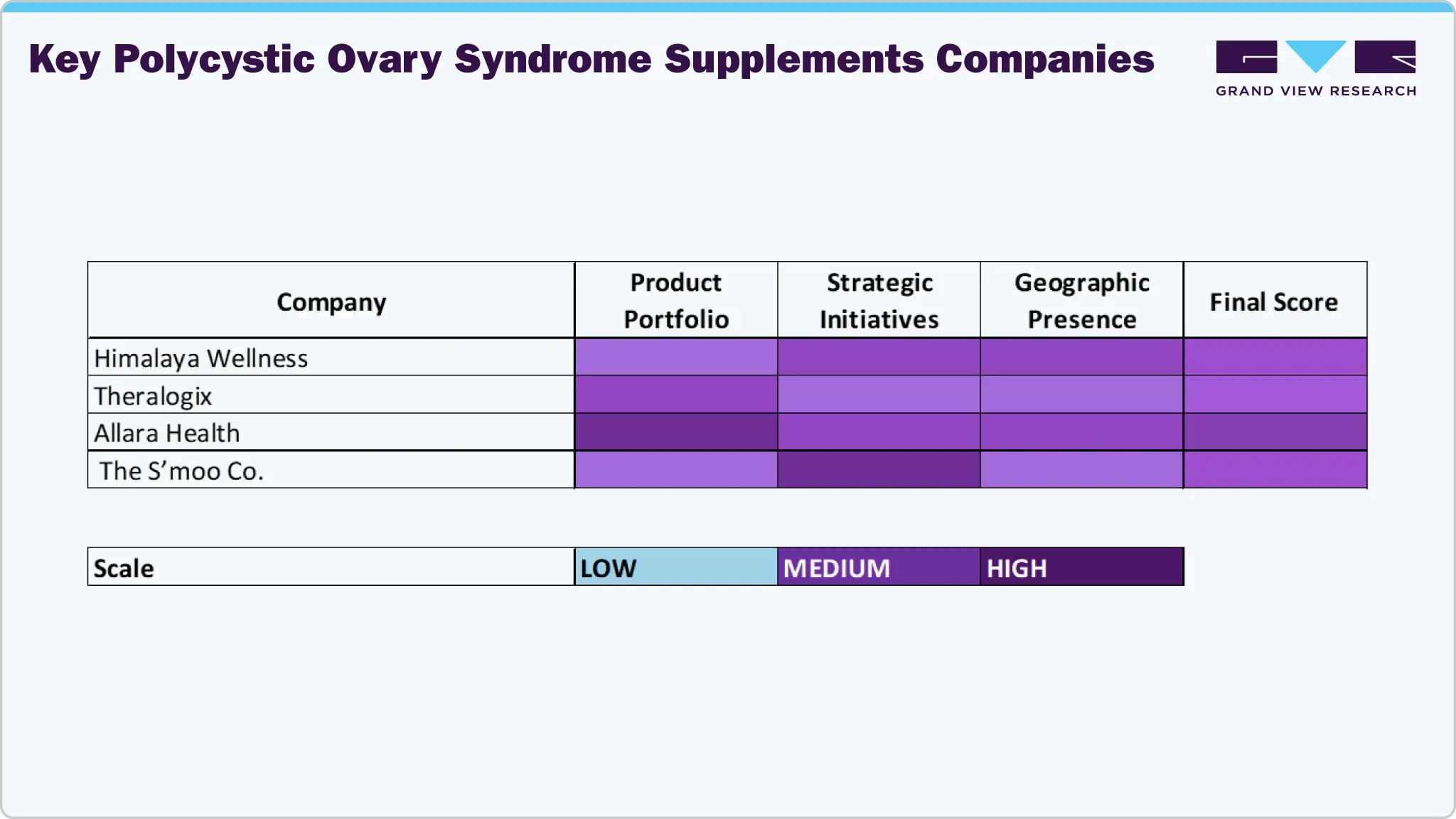

Key Polycystic Ovary Syndrome Supplements Companies Insights

Key players operating in the polycystic ovary syndrome (PCOS) supplements market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Polycystic Ovary Syndrome Supplements Companies:

The following are the leading companies in the polycystic ovary syndrome supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Himalaya Wellness

- Theralogix

- Allara Health

- The S’moo Co.

- Fertility Family

- SOVA

- MyOva

- Girl Vitamins

- New Leaf Products

- Zazzee Naturals

Recent Developments

-

In August 2023, BioSyent Inc. announced the Canadian launch of Inofolic, a natural health product designed for women living with PCOS. Inofolic combines myo-inositol and folic acid in a unique soft-gel capsule, aiming to support women with PCOS by addressing various symptoms associated with the condition. This product offers a new option for the approximately 1.4 million Canadian women affected by PCOS.

-

In January 2022, Evotec-partnered biotechnology company Celmatix Inc. announced its third milestone for the PCOS drug program in its five-year multi-target alliance.

Polycystic Ovary Syndrome Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.30 billion

Revenue forecast in 2033

USD 3.80 billion

Growth rate

CAGR of 14.29% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, dosage form, indication, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Himalaya; Theralogix; Allara Health; The S’moo Co.; Fertility Family; SOVA; MyOva; Black Girl Vitamins; New Leaf Products; Zazzee Naturals

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Polycystic Ovary Syndrome Supplements Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polycystic ovary syndrome (PCOS) supplements market report on the basis of ingredient, dosage form, indication, sales channel, and region.

-

Ingredient Outlook (Revenue, USD Million, 2021 - 2033)

-

Myo‑inositol-based supplements

-

Micronutrient & Omega-3

-

Herbal Supplements

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsules & tablets

-

Powders

-

Gummies

-

Liquids

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Menstrual Cycle Support

-

Hormonal Regulation

-

Fertility Improvement

-

Acne and Skin Health

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hypermarket & Supermarket

-

Pharmacy & Drug stores

-

Online Stores

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

- Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global polycystic ovary syndrome supplements market size was estimated at USD 1.20 billion in 2024 and is expected to reach USD 1.30 billion in 2025.

b. The global polycystic ovary syndrome supplements market is expected to grow at a compound annual growth rate of 14.29% from 2025 to 2033 to reach USD 3.80 billion by 2033.

b. North America dominated the PCOS supplements industry with the largest revenue share of 36.54% in 2024, owing to high PCOS awareness, strong healthcare infrastructure, and widespread adoption of nutraceuticals.

b. Some key players operating in the PCOS supplements market include Himalaya; Theralogix; Allara Health; The S’moo Co.; Fertility Family; SOVA; MyOva; Black Girl Vitamins; New Leaf Products; Zazzee Naturals.

b. The market is gaining momentum due to the rising prevalence of PCOS worldwide and growing awareness of its long-term health implications. PCOS affects women of reproductive age, and with improving diagnostic capabilities and education campaigns, more women are being diagnosed earlier.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.