- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyolefin Elastomers Market Size & Share Report, 2030GVR Report cover

![Polyolefin Elastomers Market Size, Share & Trends Report]()

Polyolefin Elastomers Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (PE, PP), By Manufacturing Method (Injection Molding, Extrusion Molding), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-157-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyolefin Elastomers Market Summary

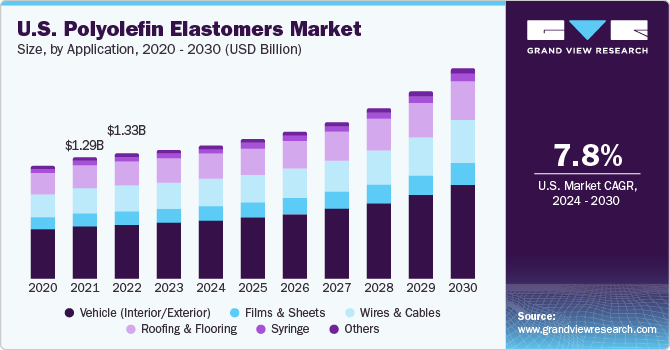

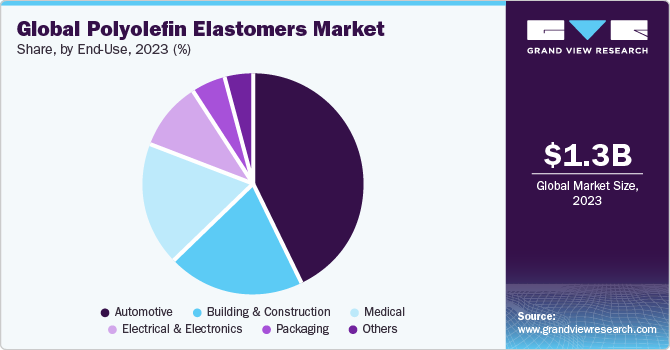

The global polyolefin elastomers market size was estimated at USD 1,364.8 million in 2023 and is projected to reach USD 2,225.0 million by 2030, growing at a CAGR of 7.8% from 2024 to 2030. This market is witnessing rising growth at a propulsive rate owing to increasing strategic initiatives such as production expansions, mergers & acquisitions, among others.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, South Africa is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, polyethylene (PE) accounted for a revenue of USD 726.8 million in 2023.

- Polyethylene (PE) is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1,364.8 Million

- 2030 Projected Market Size: USD 2,225.0 Million

- CAGR (2024-2030): 7.8%

- Asia Pacific: Largest market in 2023

For instance, in August 2023, Mitsui Chemicals, a Japanese polymer manufacturer inaugurated its new production unit for high-performance polyolefin elastomers in Singapore with a total production capacity of 345.0 kilotons per annum.

Attributes of polyolefin elastomers include high impact resistance, toughness, lower hardness, and low density. These resins are majorly used across compounding applications where they enhance impact performance and flexibility of polypropylene (PP) and polyethylene (PE)-based compounds. Additionally, these polymers are used to produce extruded and molded components with high flexibility and softness.

The demand for polyolefin elastomers including polyethylene (PE) and polypropylene (PP) is expected to grow across the U.S. from 2024 to 2030, owing to increasing demand for manufacturing of plastic films, containers, pipes, automotive components, medical devices such as surgical implants, and others.

Additionally, increasing healthcare investments in the U.S. are anticipated to bolster demand for polyolefin elastomers across the medical industry. For instance, as per the Organisation for Economic Co-operation and Development (OECD), in mid-year of 2023, approximately USD 14.0 billion of venture capital was raised by the government, which in turn is anticipated to propel market growth across the U.S. during the forecast period.

Furthermore, the U.S. boasts a strong network of manufacturers, suppliers, and distributors of polyolefin elastomers, such as Emco Industrial Plastics, LLC; Industrial Plastic Supply, Inc.; E & T Plastics Mfg. Co., Inc.; among others contributes to a competitive market. Moreover, several prominent U.S.-based companies such as Dow, Inc.; Mitsui Chemicals America, Inc.; are a few manufacturers engaged in the production of polyolefin elastomers and related manufacturing methods, leveraging advanced technologies and innovative manufacturing processes.

Market Dynamics

Industries including automotive and building & construction are preponderance for the polyolefin elastomers market. Automotive applications that require high impact strength, mechanical endurance, processibility, and enhanced dimensional stability majorly utilize polypropylene as a polyolefin. The constant striving for manufacturing of lightweight components for vehicles to reduce carbon emissions and enhance vehicular performance has propelled the demand for utilization of polyolefin elastomers for manufacturing of automotive components such as panoramic roofs, bumper facias, rocker panels & side moldings, and others.

Furthermore, across the building & construction industry, polyolefin elastomers are utilized for the manufacturing of window profile seals, dilatation seals, pipe seal applications, hose & tube applications, and other seal applications. Additionally, roofing membranes, waterproofing, bitumen modifications, among others require polyolefin elastomers.

Infrastructural development and investments is a major factor propelling demand for polyolefin elastomers across the building & construction industry across emerging economies such as China and India. For instance, according to the National Investment Promotion & Facilitation Agency, Invest India, the Indian government increased its infrastructural investment by 33% for the 2023-2024 fiscal year. Such initiatives are anticipated to propel the demand for polyolefin elastomers across the building & construction industry.

Type Insights

Polyethylene (PE) dominated the global market in 2023 across type segmentation, owing to a market share of over 53.0%, owing to the properties of PE such as low moisture absorption and impact resistance, it is highly utilized across automotive applications such as interior and exterior component manufacturing.

Followed by Polypropylene (PP), with a market revenue share of over 46.0%. Polypropylene is a highly versatile polyolefin elastomer widely utilized across multiple applications such as front and rear bumper manufacturing of vehicles. Furthermore owing to its properties such as higher resistance towards abrasion, chemical, and thermal changes, it is additionally utilized across the medical industry for the manufacturing of syringes, IV bags, tubing, and medical packaging.

Manufacturing Method Insights

Injection molding dominated the global market in 2023 across manufacturing method segmentation, owing to a market share above 52.0%, owing to growing demand from key end-use industries such as construction, automotive, and packaging. Furthermore, increasing packaging demand for food & beverages and the cosmetics & toiletries industry is expected to drive the injection molded segment over the forecast period.

Followed by extrusion molding owing to a market share of above 47.0% in 2023. Extrusion molding is majorly utilized for the manufacturing of pipe & tubes, deck railings, fencing, weatherstrippings, plastic films & sheets, window frames, wire insulations, and thermoplastic coatings.

Application Insights

Vehicles (Interior/Exterior) dominated the global polyolefin elastomers industry in 2023 across application segmentation, owing to a market share above 43.0%. Polyolefin elastomers are widely used across automotive applications including dashboards, centre consoles, interior door panels, truck bed liners, shaped tubs for trunks, and bumper facias.

Furthermore, rising demands for aesthetic interiors, as well as exteriors across vehicles, have increased demand for polyolefins for the manufacturing of vehicle components. The utilization of advanced seating systems, smart lighting systems, and increasing investments in the development of comfortable and convenient interiors are significantly boosting the growth of the global automotive interior market. Additionally, the adoption of lightweight materials to offer innovative looks and finishing for automotive interiors is a prominent driving factor.

End-use Insights

Automotive segment dominated the global polyolefin elastomers industry in 2023 across end-use segmentation, owing to a market share above 43.0%. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2022, global automotive production was 85 million which was 6% greater than the production of vehicles in 2021. This is anticipated to boost the demand for polyolefin elastomers for automotive component manufacturing.

Furthermore, rising disposable income across growing economies such as India & China; and increasing demand from the rising global population have increased demands for vehicles and is anticipated to propel market growth for the polyolefin market during the forecast period.

Followed by the medical segment at a market share above 18.0% owing to rising demand for polyolefin elastomers for manufacturing of medical films, medical tubing, IV bags, catheter bags, elastic nonwovens, plasters, and others. Rising healthcare investments are anticipated to fuel market growth during the forecast period.

Regional Insights

Asia Pacific region dominated the market and accounted for a revenue share of over 62.0% in 2023. Asia Pacific is a highly clustered region in regards to population across emerging economies such as India and China. Hence, rising disposable income, increasing adoption of e-vehicles, and demand for lightweight components have propelled demand for polyolefin elastomers across Asia Pacific.

Since electric vehicles require components to provide lightweight and fuel efficiency, polyolefin elastomers provide an advantage to automotive manufacturers. Exterior components such as carburettors, fenders, engine covers, and others utilize polyolefin elastomers for their manufacturing. Hence, the rising demand for e-vehicles is anticipated to propel market growth across Asia Pacific during the forecast period.

Key Companies & Market Share Insights

Research activities across the market is focused on new materials, that combine several properties and are projected to gain wide acceptance in this industry in coming years. Furthermore, strategic initiatives such as mergers & acquisitions, joint ventures, production, expansion, and others are carried out by key players across market space to maintain market competitiveness.

-

In May 2023, Borealis AG, introduced a new product portfolio of polyolefin plastomers and elastomers based on renewable feedstock, owing to increasing customer demands for high-performance and environmentally friendly packaging

-

In September 2022, SABIC, a Riyadh-based polymer manufacturer expanded their polyolefin materials plants in a joint venture with SK Geo Centric, South Korea-based manufacturer in South Korea. The companies have invested USD 140 million and is expected to initiate by the second quarter of 2024

Key Polyolefin Elastomers Companies:

- MITSUI CHEMICALS AMERICA, INC.

- LG Chem

- RTP Company

- Dow, Inc.

- Avient Corporation

- Sai Industries

- Dalmai Polymers LLP (DPL)

- Borealis AG

- ExxonMobil Corporation

- LyondellBasell Industries Holdings B.V.

- Arkema

- Hanwha Group

- Braskem

- INEOS AG

- Polmann India Ltd.

Polyolefin Elastomers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.41 billion

Revenue forecast in 2030

USD 2.23 billion

Growth Rate

CAGR of 7.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons; Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue and volume forecast, company profiles, competitive landscape, growth factors, and trends

Segments covered

Type, manufacturing method, application, end-use, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Netherlands; Spain; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

MITSUI CHEMICALS AMERICA, INC.; LG Chem; RTP Company; Dow, Inc.; Avient Corporation; Sai Industries; Dalmia Polymers LLP (DPL); Borealis AG; ExxonMobil Corporation; LyondellBasell Industries Holdings B.V.; Arkema; Hanwha Group; Braskem; INEOS AG; Polmann India Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyolefin Elastomers Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyolefin elastomers market report based on type, manufacturing methods, application, end-use, and regions:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

-

Manufacturing Methods Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Extrusion Molding

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Vehicle (Interior/Exterior)

-

Films & sheets

-

Wires & cables

-

Roofing & flooring

-

Syringe

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical & electronics

-

Building & construction

-

Medical

-

Packaging

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polyolefin elastomers market size was estimated at USD 1.36 billion in 2023 and is expected to reach USD 1.41 billion in 2024.

b. The global polyolefin elastomers market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 2.23 billion by 2030.

b. Polyethylene (PE) accounted to the largest share across the type segmentation of polyolefin elastomers market with a revenue share of 53.25% in 2023.

b. Major players present across the market include MITSUI CHEMICALS AMERICA, INC.; LG Chem; RTP Company; Dow, Inc.; Avient Corporation; Sai Industries; Dalmia Polymers LLP (DPL); Borealis AG; ExxonMobil Corporation; LyondellBasell Industries Holdings B.V.; Arkema; Hanwha Group; Braskem; INEOS AG; and Polmann India Ltd.

b. This market is witnessing rising growth at a propulsive rate owing to increasing strategic initiative such as production expansions, merger & acquisition, among others. For instance, in August 2023, Mitsui Chemicals, a Japanese polymer manufacturer inaugurated its new production unit for high-performance polyolefin elastomers at Singapore with a total production capacity of 345.0 kilotons per annum.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.