- Home

- »

- Specialty Polymers

- »

-

Polyvinylpyrrolidone Market Size, Industry Report, 2033GVR Report cover

![Polyvinylpyrrolidone Market Size, Share & Trends Report]()

Polyvinylpyrrolidone Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Adhesives, Pharmaceuticals, Cosmetics, Food & Beverage), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: 978-1-68038-839-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyvinylpyrrolidone Market Summary

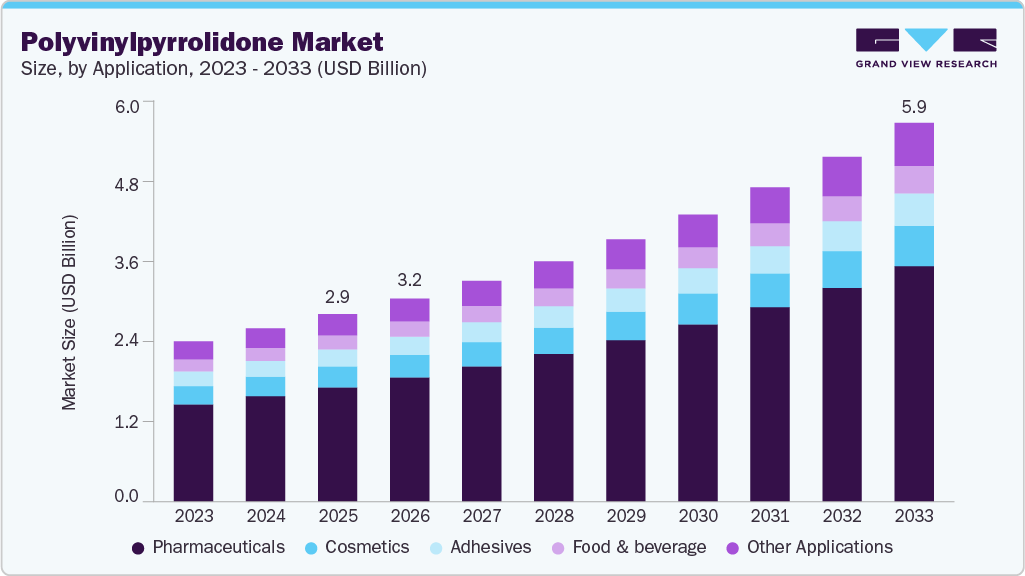

The global polyvinylpyrrolidone market size was estimated at USD 2,925.5 million in 2025 and is projected to reach USD 5,915.3 million by 2033, growing at a CAGR of 9.3% from 2026 to 2033. The demand for polyvinylpyrrolidone (PVP) is on the rise due to its expanding use in cosmetics, food and beverages, adhesives, and pharmaceuticals.

Key Market Trends & Insights

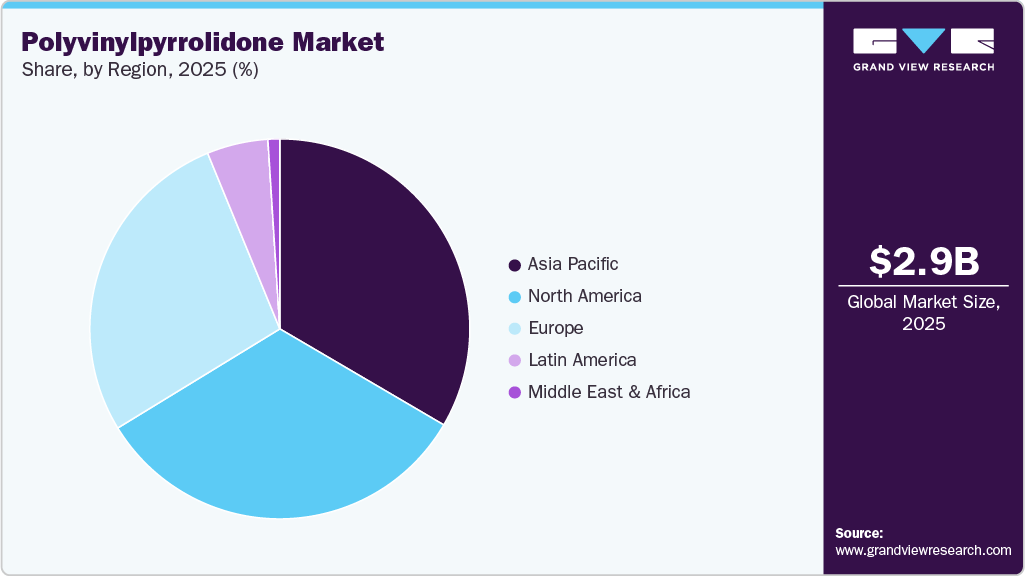

- Asia Pacific dominated the polyvinylpyrrolidone market with the largest revenue share of 33.4% in 2025.

- The China polyvinylpyrrolidone market held a substantial share of Asia Pacific in 2025.

- By application, the pharmaceuticals segment dominated the market with a revenue share of 61.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2,925.5 Million

- 2033 Projected Market Size: USD 5,915.3 Million

- CAGR (2026-2033): 9.3%

- Asia Pacific: Largest market in 2025

A prominent factor contributing to this growth is the increasing popularity of hair care products within the cosmetics sector. The increased use of PVP in the production of shampoos, conditioners, hair sprays, mousses, and hair dyes is expected to drive industry growth.The product's superior properties, including excellent film-forming, anti-microbial, moisture-holding, and non-allergic properties offered by the polymer, are anticipated to be the key factors driving the industry's growth. Furthermore, the rising use of the product in manufacturing nail enamels, lipsticks, skin creams, sunscreen, and mascara is likely to propel PVP demand over the forecast period.

Increasing demand for polyvinylpyrrolidone in brew beverages as a stabilizer is expected to propel demand over the forecast period. Furthermore, rising application scope of PVP in various non-alcoholic drinks such as vinegar, tea drinks, and fruit juices is anticipated to drive the growth of the polyvinylpyrrolidone industry.

Polyvinylpyrrolidone (PVP) is a versatile synthetic polymer widely used across nanotechnology, pharmaceuticals, and polymer chemistry due to its amphiphilic nature and excellent solubility. In nanoparticle synthesis, it stabilizes by adsorbing onto metal surfaces, such as silver or gold, preventing aggregation through steric repulsion. It also serves as a capping agent during the formation of rod-like hydroxyapatite (HAp) nanoparticles, regulating crystal growth for biomedical applications. In the pharmaceutical industry, PVP serves as a drug carrier, enhancing the solubility and bioavailability of poorly water-soluble drugs through solid dispersion systems, as exemplified by formulations such as ibuprofen or ritonavir. Additionally, it is employed as an emulsifier in solution polymerization, such as in the production of vinyl acetate polymers, and as a disintegrant in tablet formulations to enhance drug release. These diverse applications underscore PVP’s critical role in enabling advanced material synthesis and enhancing drug performance.

The increasing demand for polyvinylpyrrolidone in the manufacturing of adhesives is expected to be a major driver of market growth. The product exhibits a unique cohesive property, making it an excellent binder for various surfaces, including metal, plastic, glass, fabric, and paper. The good dispersion stability, low toxicity, excellent bonding strength, and thixotropy offered by PVP are anticipated to have a positive impact on the growth in adhesive applications. The rising demand for manufacturing inks, polishing agents, sintered glaze materials, and paints is expected to propel growth over the forecast period.

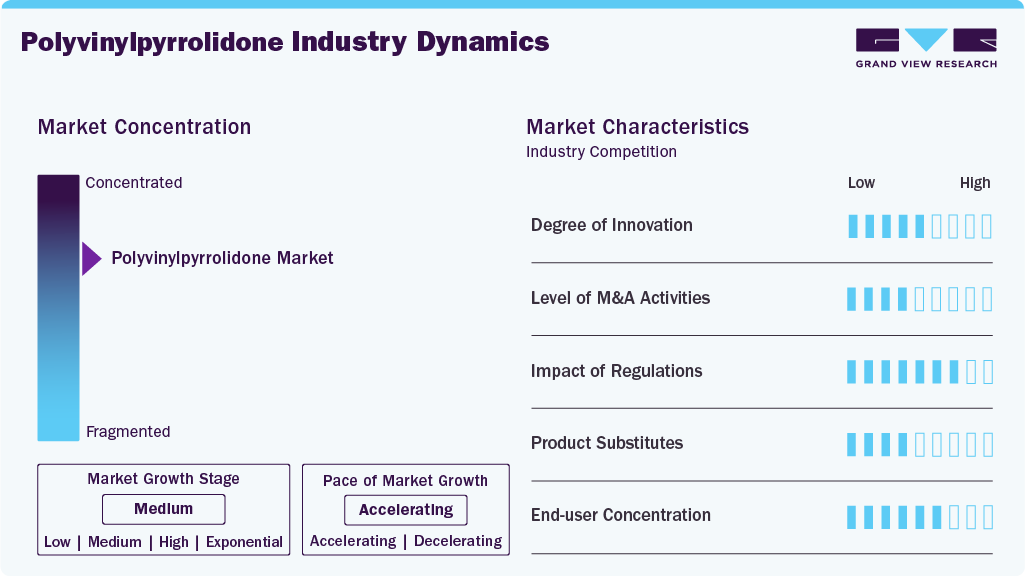

Market Concentration & Characteristics

The polyvinylpyrrolidone market is moderately concentrated, with a few dominant players holding substantial global shares. Major chemical companies lead the market through vertical integration, leveraging in-house production of vinylpyrrolidone monomers, advanced polymerization technologies, and extensive international distribution networks. Their control across the value chain, from raw material synthesis to final PVP grades, ensures high product consistency, cost efficiency, and reliable supply to high-value industries such as pharmaceuticals, personal care, and food processing.

At the same time, regional manufacturers in Asia Pacific, especially those in China and India, are expanding their presence by capitalizing on low production costs, government-backed infrastructure, and rapidly growing domestic demand. These players primarily focus on industrial-grade and low-to-medium purity PVP, targeting high-volume applications such as adhesives, detergents, textiles, and agriculture. Backed by rising investments in polymer production and R&D, these companies are also gradually improving their quality standards to compete in export markets.

However, the polyvinylpyrrolidone industry faces critical challenges. One key restraint is the increasing scrutiny of synthetic polymers in consumer and pharmaceutical products. Regulatory authorities in regions such as North America and the EU are tightening guidelines for the use of certain synthetic excipients, driven by concerns over biodegradability, microplastic pollution, and residual solvent content. As sustainability gains importance in formulation strategies, manufacturers are pressured to innovate with greener, bio-based alternatives and more transparent supply chains to maintain market access and regulatory compliance.

Application Insights

The pharmaceutical polyvinylpyrrolidone segment dominated the polyvinylpyrrolidone market with a share of 61.0% in 2025, due to the growing demand for polyvinylpyrrolidone in the pharmaceutical application as a drug solubilizer, cosolvent, sterilization disinfectant, and dispersion stabilizer is expected to boost market growth. The product manufactures various drugs, including paracetamol, aspirin, dimethyl tetracycline, benzene sulfonamide, and dipyridamole. Polyvinylpyrrolidone plays a crucial role in ophthalmic medications and injections. The use of polymers in eye drops reduces patient discomfort and prolongs drug contact time, making them a preferred choice for advanced pharmaceutical applications.

The food & beverage segment is expected to grow at a healthy CAGR of 8.9% from 2026 to 2033, due to growing use of PVP in beverage manufacturing, particularly in wine production. Light wines produced from grapes, corn, and barley contain colloidal particles and polyphenols that affect clarity and stability. Cross-linked PVP effectively adsorbs these polyphenols, enabling easy removal through filtration. As a result, rising demand for PVP as an alcoholic beverage stabilizer is anticipated to support market expansion over the forecast period.

Regional Insights

The Asia Pacific polyvinylpyrrolidone market dominated with a 33.4% share in 2025, owing to the rising pharmaceutical production in countries such as India and China. The demand for pharmaceutical-grade PVP has surged due to its emerging applications in various end-use industries, including pharmaceuticals, agrochemicals, and cosmetics. The growing adhesives industry in the region is expected to be a key factor driving the demand over the projected period. Rapid industrialization in countries such as China, Korea, Japan, Thailand, and India is expected to boost demand for adhesives in construction and automotive applications, which in turn are anticipated to propel polyvinylpyrrolidone consumption over the forecast period. The changing consumer lifestyle, coupled with increasing disposable income in the region, is likely to spur demand for alcoholic beverages such as wine and functional beverages, including sports drinks and juices, which will likely open new avenues for polyvinylpyrrolidone.

China Polyvinylpyrrolidone Market Trends

The China polyvinylpyrrolidone marketheld a substantial share of Asia Pacific in 2025, driven by its widespread use as a binder, solubilizer, and film-forming agent in drug formulations. Owing to its excellent water solubility and biocompatibility, PVP is a key excipient in tablets, capsules, and oral suspensions. It enhances drug stability and bioavailability, making it essential for both generic and branded medications. China's robust generic drug manufacturing ecosystem, supported by a large domestic patient base and government incentives, has fueled high-volume consumption of pharmaceutical-grade PVP. In line with global trends, Chinese manufacturers are also expanding production of low-residue, pharmaceutical-compliant grades, aligning with international quality standards such as GMP and USP to boost exports to North America and Europe.

Europe Polyvinylpyrrolidone Market Trends

The Europe polyvinylpyrrolidone industry held 27.6% of the global revenue share in 2025. This demand is driven by the region’s strict regulatory framework, clean beauty trends, and consumer preference for safe, multifunctional ingredients. Countries such as France, Germany, and Italy are leading hubs for premium cosmetic manufacturing, with established brands formulating products in line with EU Cosmetic Regulation (EC) No 1223/2009, which emphasizes safety, traceability, and ingredient transparency. Polyvinylpyrrolidone is especially valued for its film-forming, binding, and suspending properties in personal care formulations, making it a common ingredient in hair sprays, gels, skin creams, and makeup products. Its water solubility and compatibility with a wide pH range enhance formulation stability while delivering the desired sensory characteristics. Moreover, the growing demand for vegan, non-toxic, and biodegradable polymers has encouraged formulators to favor synthetic yet safe ingredients, such as PVP, particularly when compared to traditional animal-derived binding agents. As a result, European manufacturers are incorporating higher-grade PVP in product lines that target sensitive skin and environmentally conscious consumers, reinforcing the region's role in driving innovation and premiumization within the global cosmetics segment.

North America Polyvinylpyrrolidone Market Trends

The North America polyvinylpyrrolidone industry secured 32.8% of the global share in 2025, owing to the demand from the pharmaceutical sector. PVP serves as a critical excipient in drug formulations, functioning as a binder, stabilizer, and solubilizer in tablets, capsules, and oral liquids. The region’s mature pharmaceutical industry, supported by strong R&D infrastructure and regulatory compliance standards (e.g., FDA), continues to rely on high-purity grades of PVP for consistent drug performance. Furthermore, the increasing production of generic drugs and over-the-counter (OTC) medications has heightened the demand for cost-effective, multifunctional excipients, such as PVP. Additionally, innovations in controlled-release drug delivery systems and increasing investments in biopharmaceuticals are further expanding the scope of PVP in North America’s pharmaceutical manufacturing landscape.

The U.S. polyvinylpyrrolidone industry is experiencing steady growth driven by rising demand across the pharmaceutical, cosmetic, and food industries. In pharmaceuticals, PVP is widely used as a binder, disintegrant, and solubilizing agent in tablet formulations, making it a crucial component in drug manufacturing. With increasing health awareness and an aging population, the demand for effective and easily consumable medications is boosting PVP consumption. Additionally, PVP's role in povidone-iodine antiseptics remains significant in medical and personal hygiene products.

In the cosmetics and personal care sector, PVP is valued for its film-forming and thickening properties, commonly found in hair sprays, gels, and skin creams. The food industry also contributes to market expansion, using PVP as a stabilizer and clarifying agent in beverages. Technological advancements and clean-label product trends are expected to further enhance PVP applications. Regulatory support for safe additives and increasing R&D investments continue to shape a promising outlook for the U.S. market.

Latin America Polyvinylpyrrolidone Market Trends

The Latin America polyvinylpyrrolidone industry is witnessing steady growth, largely driven by the increasing application of polyvinylpyrrolidone as a binder, dispersant, and solubilizer in agrochemical formulations. In crop protection products such as wettable powders, suspension concentrates, and seed treatments, PVP plays a critical role in enhancing the stability, dispersion, and bioavailability of active ingredients. Its water solubility and film-forming ability make it ideal for ensuring uniform application of herbicides and fungicides across diverse climatic conditions. The biocompatibility and non-toxic nature of PVP also align with the region’s shift toward eco-conscious agricultural practices. A notable example is the use of PVP in micronutrient delivery systems in Brazil, where it improves the adhesion of trace elements to seeds, boosting germination and crop yield. As agrochemical manufacturers in Latin America increasingly demand multifunctional, inert, and environmentally safe excipients, PVP is becoming a crucial component, driving its sustained market growth in the region.

Middle East & Africa Polyvinylpyrrolidone Market Trends

The Middle East & Africa polyvinylpyrrolidone industry is experiencing strong growth, driven by its rising application in the food and beverage industry, where demand for high-performance processing aids and stabilizers is increasing. PVP, especially food-grade variants, plays a crucial role as a clarifying agent in beverage production, most notably in beer and wine filtration, due to its strong protein-binding capabilities. It effectively removes haze-forming proteins, ensuring improved shelf life, clarity, and taste stability of the final product. The region's expanding beverage manufacturing sector, fueled by urbanization, tourism, and rising consumer preferences for premium and imported products, is creating new demand for such processing aids. For instance, South Africa’s growing craft beer industry has adopted PVP in modern filtration systems to meet both export quality standards and local consumer expectations. Additionally, its non-toxic and odorless nature, as well as its compliance with international food safety regulations, make PVP a favored choice among regional producers aiming to modernize their processes while ensuring product safety and consistency.

Key Polyvinylpyrrolidone Company Insights

Some of the key players operating in the polyvinylpyrrolidone market include Ashland and NIPPON SHOKUBAI CO., LTD.

-

NIPPON SHOKUBAI CO., LTD., headquartered in Osaka, Japan, is a prominent and steadily advancing player in the global polyvinylpyrrolidone market, known for its precision chemical engineering and strong materials science capabilities. With a strategic focus on high-performance polymers and specialty chemicals, Nippon Shokubai manufactures pharmaceutical-grade and industrial-grade PVP and its derivatives, delivering key functionalities such as excellent solubility, film-forming ability, binding efficiency, emulsification, and dispersibility. These properties make its PVP products widely applicable across pharmaceuticals (as binders and disintegrants in tablets), personal care (as styling agents and film formers), and agrochemicals (as dispersants and carriers). The company’s vertically integrated production capabilities and stringent quality control systems ensure high product consistency and compliance with international pharmacopeias (JP, USP, EP). Its Kitakyushu production base and other strategic facilities support robust supply chain resilience and regional responsiveness, especially within the Asia-Pacific market. Nippon Shokubai is expanding its portfolio into emerging sectors like energy storage, biomedical materials, and advanced coatings.

Boai NKY Pharmaceuticals Ltd. and Glide Chem Private Limited are the emerging participants in the polyvinylpyrrolidone Market.

-

Glide Chem Private Limited, headquartered in India, is an emerging and agile player in the global polyvinylpyrrolidone market, steadily strengthening its presence across growing pharmaceutical, cosmetic, and industrial sectors. Traditionally known for its expertise in fine chemicals and excipients, Glide Chem is expanding its capabilities in PVP manufacturing with a strong focus on quality consistency, cost-effectiveness, and regulatory compliance. The company’s PVP products are extensively used in pharmaceutical formulations, personal care products, adhesives, agrochemicals, and food-grade applications, meeting diverse performance and solubility requirements. In addition, Glide Chem offers technical support, formulation guidance, and a reliable supply chain network, positioning itself as a dependable and flexible partner in the evolving PVP landscape, particularly across the Asia Pacific, Middle East, and Western markets.

Key Polyvinylpyrrolidone Companies:

The following are the leading companies in the polyvinylpyrrolidone market. These companies collectively hold the largest market share and dictate industry trends.

- Ashland

- BASF

- Boai NKY Pharmaceuticals Ltd.

- Glide Chem Private Limited

- Hangzhou Motto Science & Technology Co., Ltd.

- JH Nanhang Life Sciences Co., Ltd.

- NIPPON SHOKUBAI CO., LTD.

- Shanghai Qifuqing Material Technology Co., Ltd.

- Shanghai Yuking Water Soluble Material Tech Co., Ltd.

- Sichuan Lutianhua Co., Ltd

- Thermo Fisher Scientific Inc.

- Sigma-Aldrich Co. LLC (Merck)

Recent Developments

-

In January 2025, Ashland completed a $10 million expansion of its pharmaceutical manufacturing facility in Cabreúva, Brazil, significantly boosting its production capacity for Aquarius tablet coatings, which include PVP/VA (copovidone) as a key component. This move supports the growing demand for coated tablets in Brazil and Latin America, where tablet consumption has been increasing steadily, and aligns with Ashland’s global strategy to innovate and invest in advanced pharmaceutical solutions.

-

In April 2025, Nippon Shokubai’s recent decision to establish a new IONEL (LiFSI) plant in Kitakyushu City underscores the growing demand for advanced battery materials amid the rapid electrification of automobiles. While the announcement directly concerns lithium-ion battery electrolytes, it indirectly signals potential growth opportunities for complementary materials, such as polyvinylpyrrolidone. PVP is being increasingly explored in battery technologies as a binder, dispersant, or separator coating additive, thereby enhancing electrode stability and ionic conductivity. As the battery supply chain expands and local production is prioritized, especially in Japan’s robust automotive sector, the supportive infrastructure and increased investment in battery-related materials like IONEL will likely drive parallel growth in high-performance polymers such as PVP, expanding its market potential in energy storage applications.

Polyvinylpyrrolidone Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3,171.9 million

Revenue forecast in 2033

USD 5,915.3 million

Growth rate

CAGR of 9.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Thailand; Indonesia; Malaysia; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Ashland; BASF; Boai NKY Pharmaceuticals Ltd.; Glide Chem Private Limited; Hangzhou Motto Science & Technology Co., Ltd.;JH Nanhang Life Sciences Co., Ltd.; NIPPON SHOKUBAI CO., LTD.; Shanghai Qifuqing Material Technology Co., Ltd.; Shanghai Yuking Water Soluble Material Tech Co., Ltd.; Sichuan Lutianhua Co., Ltd; Thermo Fisher Scientific Inc.; Sigma-Aldrich Co. LLC (Merck)

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyvinylpyrrolidone Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global polyvinylpyrrolidone market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Adhesives

-

Pharmaceutical

-

Cosmetics

-

Food &beverage

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Pharmaceutical polyvinylpyrrolidone by application dominated the polyvinylpyrrolidone market with a market share of 61.0% in 2025 due to their growing demand for polyvinylpyrrolidone in the pharmaceutical application as a drug solubilizer, cosolvent, sterilization disinfectant, and dispersion stabilizer is expected to boost market growth. The product manufactures various drugs, including paracetamol, aspirin, dimethyl tetracycline, benzene sulfonamide, and dipyridamole. Polyvinylpyrrolidone plays an important role in ophthalmic medicines and injections.

b. Some of the key players operating in the polyvinylpyrrolidone Market include Ashland, BASF Corporation, Boai NKY Pharmaceuticals Ltd., Glide Chem Private Limited, Hangzhou Motto Science & Technology Co., Ltd., JH Nanhang Life Sciences Co.,Ltd., NIPPON SHOKUBAI CO.,LTD., Shanghai Qifuqing Material Technology Co. Ltd., Shanghai Yuking Water Soluble Material Tech Co. Ltd., Sichuan Lutianhua Co., Ltd, Thermo Fisher Scientific Inc., Sigma-Aldrich Co. LLC (Merck)

b. The demand for polyvinylpyrrolidone (PVP) is on the rise due to its expanding use in cosmetics, food and beverages, adhesives, and pharmaceuticals. A prominent factor contributing to this growth is the increasing popularity of hair care products within the cosmetics sector. The heightened utilization of PVP in the production of shampoos, conditioners, hair sprays, mousses, and hair dyes is anticipated to propel industry expansion throughout the forecast period.

b. The global polyvinylpyrrolidone market size was estimated at USD 2,925.5 million in 2025 and is expected to reach USD 3,171.9 million in 2026.

b. The global polyvinylpyrrolidone market is expected to grow at a compound annual growth rate of 9.3% from 2026 to 2033 to reach USD 5,915.3 million by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.