- Home

- »

- Electronic & Electrical

- »

-

Portable Bluetooth Speaker Market Size, Share Report, 2030GVR Report cover

![Portable Bluetooth Speaker Market Size, Share & Trends Report]()

Portable Bluetooth Speaker Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Commercial, Residential), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-837-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Portable Bluetooth Speaker Market Summary

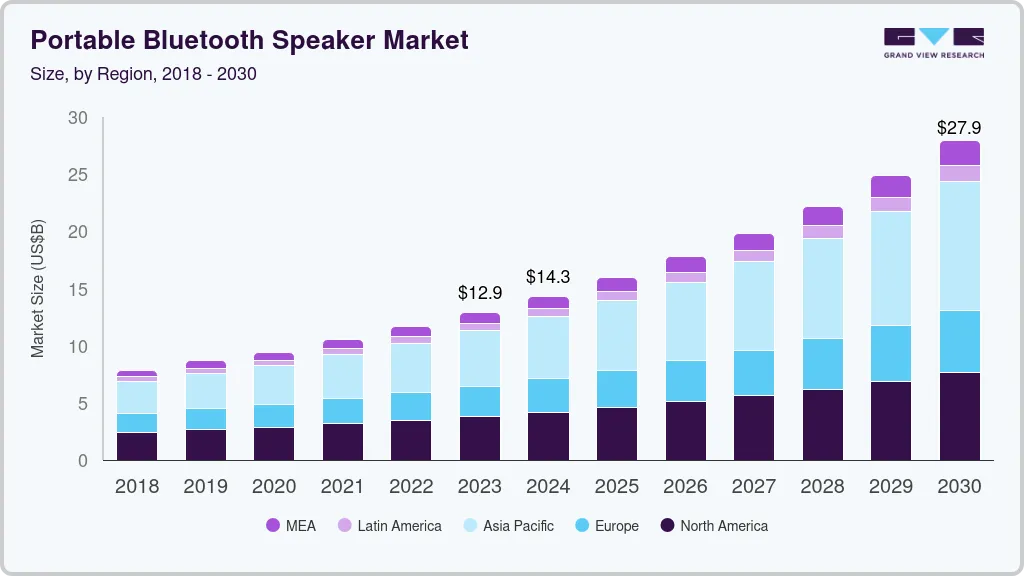

The global portable bluetooth speaker market size was estimated at USD 12.90 billion in 2023 and is projected to reach USD 27.91 billion by 2030, growing at a CAGR of 11.7% from 2024 to 2030. The widespread availability of online streaming services and ready access to ample data storage on smartphones, tablets, and laptops has made it increasingly convenient for consumers to utilize bluetooth speakers.

Key Market Trends & Insights

- The portable bluetooth speaker market in Asia pacific held the largest revenue share of around 37.54% in 2023.

- The U.S. portable bluetooth speaker market is expected to grow at a CAGR of 10.1% from 2024 to 2030.

- Based on application, the residential segment accounted for a revenue share of around 70.86% in 2023.

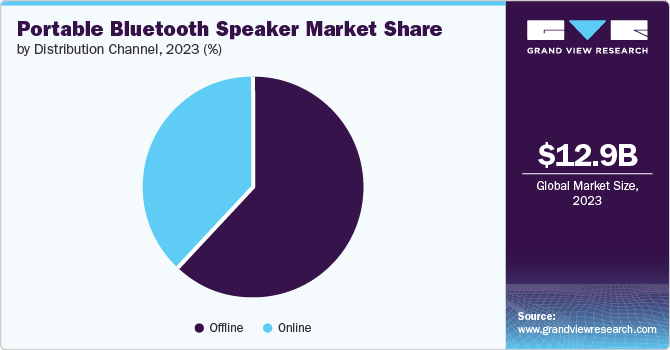

- Based on distribution channel, the offline distribution channel segment accounted for a revenue share of around 62.10% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 12.90 Billion

- 2030 Projected Market Size: USD 27.91 Billion

- CAGR (2024-2030): 11.7%

- Asia Pacific: Largest market in 2023

Smaller- and medium-sized speakers can be effortlessly transported and used in various locations, whereas larger models are ideal for stationary use at home. The rise in outdoor and recreational activities, such as picnics, camping, and beach outings, has spurred the demand for these speakers. Wi-Fi-based networks are becoming more widespread, and the number of connected devices is expanding, which has increased the demand for wireless access in urban households. In addition, speakers' capacity for wireless communication is currently a significant market-driving force. This pattern has helped the creation of smart speakers. For instance, the Yamaha ats-2090 offers a wireless smart sound bar, which can be connected to Bluetooth and Wi-Fi.

Improved wireless networking features have recently been implemented into various speakers, including sound bars, portable docking speakers, and wall units. The improved audio quality hence promotes a rise in demand for sophisticated speakers. High-End home theatre systems are also becoming more popular due to changing consumer lifestyles and their increased need for entertainment. Subwoofer systems, in-wall speakers, and sound bars could all benefit, creating a new market.

The portable bluetooth speaker market is poised for significant growth, driven by market opportunities that align with evolving consumer preferences and technological advancements. One notable trend shaping the market is the introduction of ipx8 water resistance, marking a departure from the commonly seen ipx7 or ip67 ratings. This enhanced protection against water pressure opens possibilities for flagship speakers designed for outdoor use, presenting a unique selling proposition and catering to the demand for more durable and versatile devices.

Prominent companies have been focusing on quality and technology to increase sales. For instance, Skullcandy unveiled a broad selection of portable speakers in different sizes in June 2023, including the most recent Bluetooth technology. Common features amongst the ounce, kilo, terrain mini, terrain XL, and terrain models include ipx7 water resistance and USB type-c charging. The price of these speakers varies based on their size, but they are available in the same color variations. The kilo is distinguished as a solid, durable construction that accompanies its anticipated 24-hour battery life. On the other hand, the terrain and ounce series are intended to provide a battery life of 14 to 18 hours per charge.

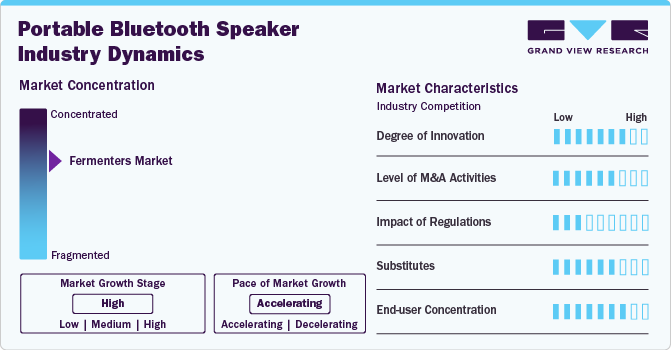

Industry Dynamics

The market has seen significant innovations, particularly in enhancing audio quality through advanced codecs and noise-canceling technologies. Integration with smart assistants like Alexa and google assistant has become more common, offering hands-free operation. Battery life improvements and faster charging options are also notable, along with rugged, waterproof designs for outdoor use. Additionally, customization through mobile apps and the inclusion of multipoint pairing features enhance user experience and functionality.

Regulations in the market, such as spectrum allocation and safety standards, ensure product reliability and user safety. Compliance with international standards like bluetooth sig protocols fosters interoperability and quality assurance. Environmental regulations drive the adoption of eco-friendly materials and energy-efficient technologies, while privacy laws necessitate robust data protection measures in bluetooth-enabled devices.

Substitutes for portable bluetooth devices include wired headphones and speakers, often offering superior audio quality and reliability. Wi-Fi-Enabled audio devices provide higher data transfer rates and greater range, supporting advanced features like multi-room audio. Additionally, near-field communication (NFC) devices and infrared (IR) technology can serve specific use cases where bluetooth might not be ideal, such as secure short-range communication.

End-user concentration in the portable bluetooth market is broad, encompassing many demographics, including tech-savvy young adults, fitness enthusiasts, and professionals needing hands-free communication. The market also spans various usage scenarios, from casual listening and gaming to business and travel, reflecting bluetooth technology's versatility and widespread appeal. This diverse user base drives continuous innovation and demand across different product categories and price points.

Application Insights

The residential segment accounted for a revenue share of around 70.86% in 2023. The demand for enhanced audio output for an immersive home entertainment experience has boosted segment growth. Most modern TVS have bluetooth connectivity, enabling seamless pairing with compatible bluetooth speakers. Bluetooth speakers are versatile and are used in various scenarios within a residential environment. They serve as background music sources for social gatherings, parties, or while performing household chores. They help create a personalized audio experience while relaxing, working out, or even enjoying leisure time outdoors.

Features of portable bluetooth speakers, such as wireless connectivity, convenience, portability, and enhanced sound quality, coupled with the affordability and availability of a wide range of speakers, from compact entry-level models to premium options, have increased product adoption for household applications. The commercial segment is projected to grow at a CAGR of 12.4% over the forecast period of 2024-2030, driven by their increased use in retail stores, restaurants, health clubs, theme parks, educational facilities, hospitality venues, music cafes, and leisure spaces.

The increased popularity of outdoor recreational activities and adventure tourism has driven the demand for durable and portable audio solutions. Some of the speakers in the market, such as Furrion LIT speaker, cater to this trend, ensuring the speaker can withstand the rigors of outdoor environments. Outdoor enthusiasts, adventurers, and businesses seeking durable and versatile audio solutions are increasingly looking for features such as wireless connectivity, rugged design, waterproof features, long battery life, multi-functionality, and mounting options.

Distribution Channel Insights

The offline distribution channel segment accounted for a revenue share of around 62.10% in 2023. Offline stores are favored due to the visual aspects of shopping, which influence buying decisions. The experience of physically trying out different speakers and assessing their features along with a wide product range is unique to offline shopping. Consumers can physically engage with speakers, evaluate sound quality, and assess features before purchasing to avoid the hassles of returns or replacements. This is projected to push consumers toward stores to purchase portable bluetooth speakers, further driving sales through offline channels.

The online distribution channel is estimated to grow at a CAGR of 12.9% over the forecast period, supported by the availability of a wide variety of portable bluetooth speakers from different brands and easy brand comparison. Furthermore, online channels offer discounts on premium and mid-range products, making them accessible to a broad demographic. Consumers can choose from basic budget models to premium offerings with advanced features. The rapid expansion of the global e-commerce industry has empowered consumers to compare products from different companies, thus boosting online sales. Leading e-commerce platforms, such as amazon, ALIBABA, EBAY, and Flipkart, offer up-to-date products at discounted rates, accompanied by additional conveniences like hassle-free returns and cash-on-delivery (COD) services.

Regional Insights

The portable bluetooth speaker market in North America held a share of 29.55% of the global revenue in 2023. The increasing adoption of bluetooth-enabled devices in the region can be attributed to their versatile adaptability and convenient portability features. This trend leads market players. In the region to increasingly choose bluetooth-enabled devices as their preferred offerings for the local consumer base. The growing enthusiasm for music among consumers drives the demand for portable bluetooth speakers. This surge is accompanied by increased subscriptions for music apps in North America. For Instance, In 2023, Spotify had 551 million annual users, with North America accounting for 111 million of them.

U.S. Portable Bluetooth Speaker Market Trends

The U.S. portable bluetooth speaker market is expected to grow at a CAGR of 10.1% from 2024 to 2030. Music apps and streaming services are growing in popularity in the U.S. for instance, as reported by Forbes homes, the music streaming scene in the U.S. has undergone a remarkable evolution in the past decade. As of January 2024, the country boasted an impressive 90 million paid music-streaming subscribers. This figure sharply contrasts with the situation in the first half of 2014, where there were merely 7.9 million users of music streaming services.

Asia Pacific Portable Bluetooth Speaker Market Trends

The portable bluetooth speaker market in Asia pacific held the largest revenue share of around 37.54% in 2023 and is expected to retain its dominance over the forecast period. The Increasing adoption of bluetooth-enabled devices can be attributed to their versatile adaptability and convenient portability features. The demand is also fueled by tech-savvy consumers who prefer wireless speakers that allow them to listen to music on the go.

The China portable bluetooth speakers market emerged dominant in the Asia pacific region with a revenue share of 32.37% in 2023. China is the world's largest e-commerce market, accounting for nearly half of global transactions, which is expected to drive the e-commerce sales of portable bluetooth speakers in the country.

Europe Portable Bluetooth Speaker Market Trends

The portable bluetooth speaker market in Europe is expected to witness a steady CAGR of 11.0% over the forecast period. The increasing demand for wireless convenience and connectivity with smartphones and other devices has spurred the adoption of these speakers.

The UK portable bluetooth speakers market is expected to grow at a CAGR of 10.0% from 2024 to 2030. The growth can be attributed to the rising demand for portable bluetooth speakers among different age groups.

Key Portable Bluetooth Speaker Company Insights

The industry has both international and domestic participants. brand market share analysis indicates that key players are focusing on strategies, such as new product launches, partnerships, mergers & acquisitions, and global expansion.

Key Portable Bluetooth Speaker Companies:

The following are the leading companies in the portable bluetooth speaker market. These companies collectively hold the largest market share and dictate industry trends.

- Harman International

- Bose Corporation

- Sony Group Corporation

- Marshall Group Ab

- Apple Inc.

- Bang & Olufsen

- Logitech

- Plantronics Inc.

- Voxx International Corporation

- Fugoo

Recent Developments

-

In July 2023, Sony India launched its srs-xv80 speakers. The product offers clear and robust sound, accentuated by powerful bass. Being a portable speaker, it provides the convenience of easy transportation. This open-directional party speaker incorporates four tweeters, ensuring impactful bass and crystal-clear audio. with a battery life of up to 25 hours, the SONY srs-xv80 ensures prolonged performance

-

In April 2023, Bose Corporation divested the bose professional division to transom capital group, a private equity firm. Transom Capital Group will take over bose professional's commercial installation and conference activities. during this transition, Bose professional will receive focused attention to assist its professional audio clientele and continue developing unique products and developments for the market

-

In February 2023, Harman International’s Jbl Brand Launched its pulse 5 portable speakers in The U.S. the product offers immersive 360° lighting synchronized with music, customizable through the app. Its Audio Features Include A 30 W Woofer And 10 W Tweeter, Covering 58 Hz To 20 KHZ. Its 27 WH Battery Provides 12-Hour Playback, Fast Recharge, Bluetooth 5.3 For dual device pairing, and Partyboost For stereo or linked sound. The Ip67 rating ensures dust and water resistance, making it ideal for Outdoor Use

-

In August 2022, Logitech’s Brand Ultimate Ears announced the expansion of its product line with the launch of Wonderboom 3. Crafted from entirely recycled polyester fabric, including a substantial 31% post-consumer recycled plastic, This speaker presents a circular sound experience, delivering deep bass and sustaining 14 hours of full-stereo boom. With its Ip67 rating, it is both waterproof and dustproof; it can even float in a pool

Portable Bluetooth Speaker Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.34 billion

Revenue forecast in 2030

USD 27.91 billion

Growth rate

CAGR Of 11.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue In USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Uk; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa; Uae

Key companies profiled

Harman International; Bose Corporation; Sony Group Corp.; Marshall Group Ab; Apple Inc.; Bang & Olufsen; Logitech; Plantronics Inc.; Voxx International Corporation; Fugoo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore Purchase Options

Global Portable Bluetooth Speaker Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the portable bluetooth speaker market report based on application, category, type, application, end-use, distribution channel, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (Mea)

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global portable Bluetooth speaker market was estimated at USD 12.58 billion in 2023 and is expected to reach USD 14.34 billion in 2024.

b. The global portable Bluetooth speaker market is expected to grow at a compound annual growth rate of 11.7% from 2024 to 2030, reaching USD 27.91 billion by 2030.

b. Asia Pacific dominated the portable Bluetooth speaker market with a share of over 37.54% in 2023. The growth of the regional market is mainly driven by the increasing adoption of Bluetooth-enabled devices by consumers in the Asia Pacific can be attributed to their versatile adaptability and convenient portability features. Moreover, demand for portable Bluetooth speakers in the region is fueled by tech-savvy consumers who prefer wireless speakers that allow them to listen to music on the go.

b. Some of the key players operating in the portable Bluetooth speaker market include HARMAN International, Bose Corporation, Sony Group Corporation, Marshall Group AB, Apple Inc., Bang & Olufsen, Logitech, Plantronics Inc., VOXX International Corporation, and Fugoo.

b. Key factors that are driving the portable Bluetooth speaker market growth include the widespread availability of online streaming services, coupled with ready access to ample data storage on smartphones, tablets, and laptops, which has made it increasingly convenient for consumers to utilize Bluetooth speakers. Smaller and medium-sized speakers can be effortlessly transported and used in various locations, whereas larger models are ideal for stationary use at home. Furthermore, the rise in outdoor and recreational activities, such as picnics, camping, and beach outings, has spurred the demand for these speakers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.