- Home

- »

- Medical Devices

- »

-

Portugal Accident Insurance Market, Industry Report, 2030GVR Report cover

![Portugal Accident Insurance Market Size (Gross Written Premium, New Business Premium), Share, And Trend Report]()

Portugal Accident Insurance Market (2025 - 2033 ) Size (Gross Written Premium, New Business Premium), Share, And Trend Analysis Report, By Insurance Type (Public, Private), By Policy Type (Corporate, Retail Policy), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-636-3

- Number of Report Pages: 194

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Portugal Accident Insurance Market Trends

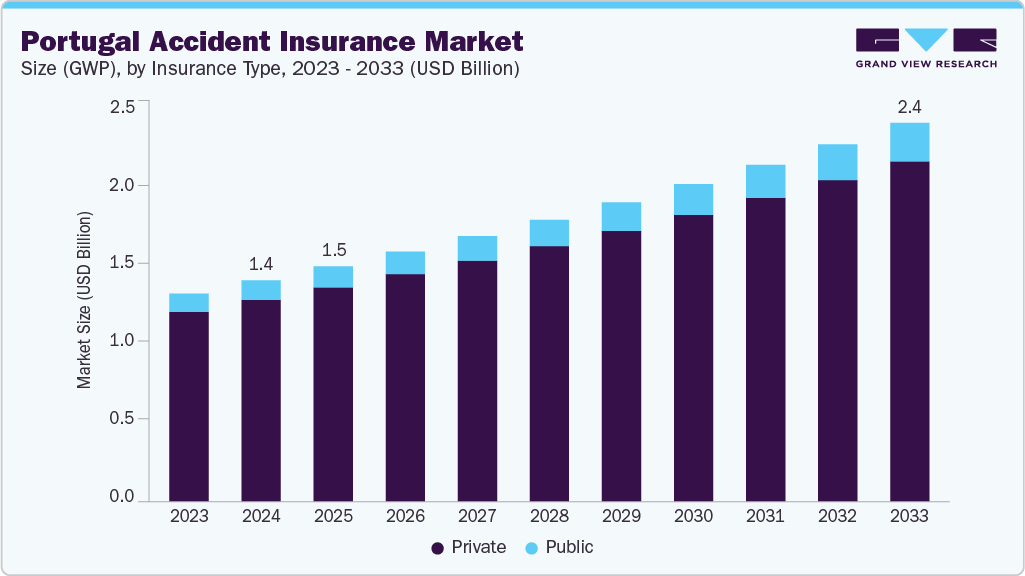

The Portugal accident insurance market size in terms of gross written premium (GWP), was estimated at USD 1.42 billion in 2024 and is expected to expand at a CAGR of 6.14% from 2025 to 2033.

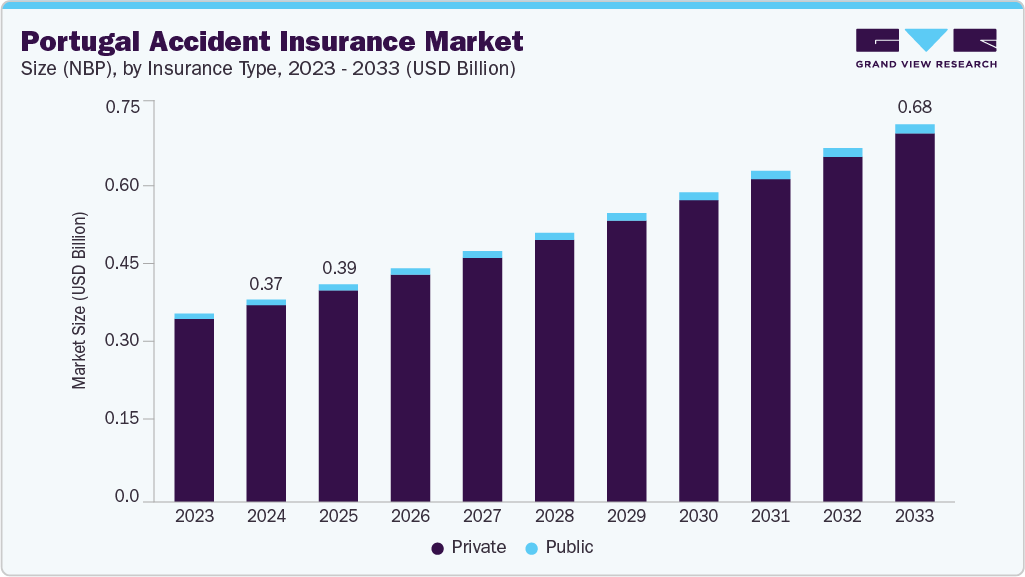

The Portugal accident insurance market size in terms of new business premium (NBP), was estimated at USD 0.37 billion in 2024 and is expected to expand at a CAGR of 7.14% from 2025 to 2033.

The growth of industry is driven by the increasing number of road casualties, rising medical costs, and a growing awareness of the importance of accident insurance. According to the Portugal News published in December 2024, nearly 135,000 road accidents have been documented, resulting in 453 fatalities and 2,550 serious injuries. This reflects an increase in accidents but a decrease in fatalities compared to 2023. These figures are part of the traffic casualties report issued by the National Road Safety Authority (ANSR) during the launch of the “Safe Parties” campaign for the Christmas and New Year 2024 & 2025 period.

Private accident insurance is gaining popularity as more people look for additional protection beyond what public systems offer. This shift is primarily fueled by increasing disposable incomes, enabling consumers to invest in more comprehensive insurance options. In addition, the rise in road casualties and mental health issues has prompted employers to enhance their employee benefits, including insurance coverage. Technological advancements in claims processing and customer service have further improved accessibility and efficiency, simplifying the process for consumers to obtain and manage their policies. These elements contribute to a robust growth trend for both public and private insurance in Portugal.

Furthermore, as per the grand view research analysis and estimates there is a steady growth in the profitability of the insurance market indicating further expansion.

Private Accident Insurance Profitability Estimates

Metric

Overall Market Estimate

Riders (Add-On Policies) Estimate

Stand-Alone Policies Estimate

Accident Loss Ratio

(Claims /Premiums)

49% - 55%

40% - 50%

50% - 60%

Accident Combined Ratio (CoR)

(Claims + Expenses / Premiums)

78% - 84%

42% - 52%

48% - 58%

Source: Grand View Research Estimates

Portugal insurers are embracing digitalization to enhance customer experience and operational efficiency. Investments in online platforms, mobile apps, and telemedicine services are becoming commonplace. The Insurance and Pension Funds Supervisory Authority (ASF) is actively participating in insurtech initiatives and has issued regulations to address ICT-related risks.

Environmental, Social, and Governance (ESG) considerations are increasingly influencing the Portuguese insurance landscape. Initiatives such as the "Right to be Forgotten" law, which allows individuals who have overcome serious illnesses to obtain insurance without discrimination, exemplify this trend. In addition, insurers are offering eco-friendly products and promoting sustainability. Moreover, the Portugal Insurance and Pension Funds Supervisory Authority (ASF) continues to strengthen regulatory frameworks to ensure market stability and consumer protection. As of the third quarter of 2024, the top three insurers in Portugal held approximately 59.2% of the market share in premiums, indicating a trend towards market consolidation

The Portugal government has implemented various policies aimed at promoting private sector participation in accident & casualty recovery delivery.

Key Portuguese government policies promoting private sector participation in accident & casualty recovery delivery:

Policy Area

Description

Impact on Private Sector

Public-Private Partnerships (PPPs)

Partnerships with private entities to manage and operate healthcare facilities and services

Increases opportunities for private firms to operate A&C-related services

Contracted Service Provision

Government contracts private clinics and rehab centers for post-casualty care

Expands patient base and revenue for private providers

Legal & Insurance Reforms

Mandatory insurance coverage for casualty-related healthcare costs; legal support for private billing

Facilitate faster access to private recovery services and payment mechanisms

Market Liberalization

Encouragement of private sector participation through deregulation and market entry support

Attracts domestic and foreign investment in recovery infrastructure

Accreditation & Incentives

Simplified licensing, quality standards, and incentives for private rehab and trauma centers

Promotes quality assurance and lowers barriers to entry for providers

Mandatory occupational accident coverage in Portugal requires employers to insure their employees against workplace casualties. This insurance, known as workmen’s compensation, covers medical expenses, disability benefits, and survivor benefits for injuries or fatalities that occur at work. All employers are mandated to buy this insurance from licensed providers, ensuring quick compensation for injured workers without lengthy legal processes. In 2023, this insurance accounted for about 17.7% of total general insurance premiums, highlighting its importance in the Portuguese insurance market and providing stability for insurers.

Government Funding for Accident Victims in Portugal

Source of Funding

Purpose

Compulsory private insurance premiums (by employers / self-employed)

Medical care and rehabilitation - Cover full treatment costs (hospital, medication, physiotherapy, travel, accommodation, even family support when needed) for occupational accidents; managed by private insurers under law‑mandated policies.

Cash benefits for temporary or permanent disability - Temporary disability pays 70-75% of reference earnings; permanent disability ranges from 50% to 80%, increasing with dependents; may include lump sums where appropriate.

Survivor and death benefits - Entitles dependents (spouse, children, parents) to pension percentages (e.g., 20-50% for orphans, 30-40% for spouses), plus funeral grants (30 days of wage).

Workers’ Compensation Fund contributions (1% payroll by employers)

Guarantee of payments - Ensures continuation of pension or compensation if employers’ default or go insolvent; protects victims’ rights even in corporate failure.

National Health Service (SNS) budget

Supplementary care in public facilities - Victims may use SNS services (especially for occupational diseases or when allowed by insurance frameworks); funded via general taxation.

General State Budget / Social Security transfers

Preventive & emergency programmes - Funds national accident prevention, trauma systems, child safety education, emergency readiness (e.g., National Trauma Commission) via SNS & Ministry of Health.

Source: Grand View Research Analysis

Moreover, advancements like telematics and digital platforms have revolutionized the marketing and management of insurance. Insurers can now provide tailored policies grounded in individual behaviors and risk assessments, which boosts customer engagement and satisfaction. In addition, technology streamlines claim processing and improves fraud detection methods. For instance, Allianz in Portugal offers Insurance Copilot, an AI-powered tool designed to revolutionize claims management. Debuting in 2024 for automotive claims, this solution enhances workflows and automates essential tasks, thereby boosting efficiency and accuracy throughout the claims process.

A notable instance of technological advancements influencing the Portugal accident insurance market is the adoption of digital services by leading insurers. For instance,in May 2022, Real Vida Seguros, in collaboration with Munich Re, introduced a practical and innovative digital underwriting solution tailored for the Portuguese life insurance market. This solution utilizes technology created by Munich Re Automation Solutions, which is recognized as the leading provider of advanced digital business, underwriting, and data analytics tools for the life insurance sector. With this new system, intermediaries at Real Vida Seguros can provide their clients with more efficient and modern underwriting experience.

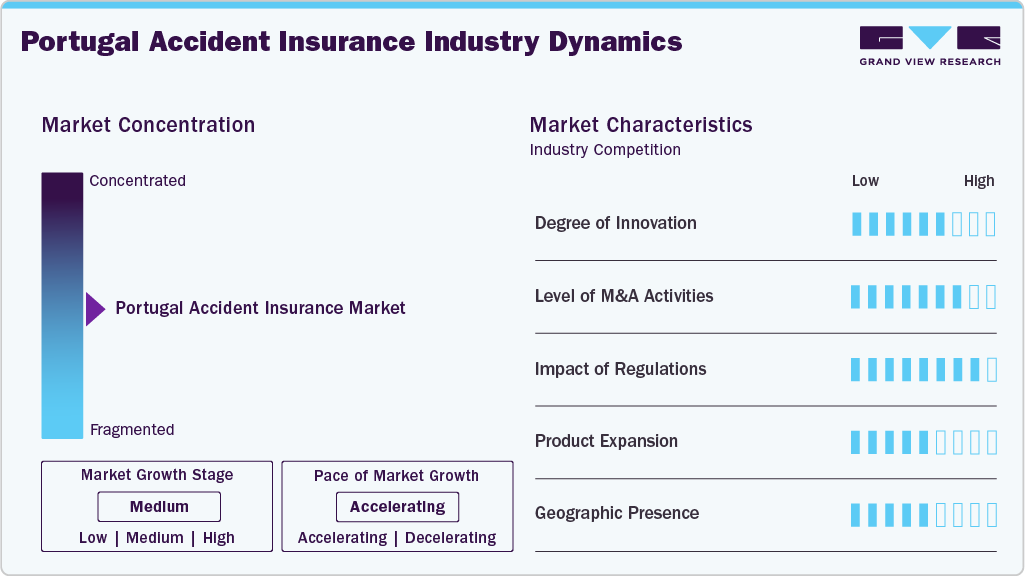

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, impact of regulations, level of partnership & collaboration activities, and geographic expansion. The market operate under a highly competitive and fragmented structure.The degree of innovation is moderate, and the impact of regulations on industry is high. The level of partnership & acquisition activities is moderate, and geographic expansion of the industry is high.

The degree of innovation in the industry is significantly moderate, driven by digitalization, regulatory reforms, and personalized solutions. For instance, Fidelidade launched the Fidelidade mobile application, enabling users to manage their insurance policies, submit claims, and access resources conveniently. As of mid-2024, the app boasts over 1.6 million registered users, accounting for more than 15% of Portugal's population.

Several key market players are devising business growth strategies in the form of mergers and acquisitions. Through M&A activity, these companies can expand their business geographies. In January 2025, PIB Group, a specialist insurance intermediary, has expanded its European presence by entering the Portuguese market through the acquisition of Vitorinos Group via PIB Group Iberia. This acquisition is a significant strategic step for PIB Group Iberia and is the most important deal for the company in the Iberian territory to date.

The regulatory landscape has a significant impact on the industry. The Portugal Insurance and Pension Funds Supervisory Authority (ASF) is the primary regulatory body overseeing the insurance sector in Portugal. ASF ensures that insurance companies, including those offering accident insurance, comply with legal and prudential requirements to maintain market integrity and protect policyholders. Portugal's insurance industry operates under a comprehensive legal framework that incorporates EU directives and national laws:

-

Insurance and Reinsurance Law (Law No. 147/2015): This law transposes the Solvency II Directive into Portuguese legislation, establishing conditions for conducting insurance and reinsurance business, including capital requirements and risk management standards.

-

Insurance Contract Law (Decree-Law No. 72/2008): It outlines the general principles governing insurance contracts, ensuring clarity and fairness in contractual relationships between insurers and policyholders.

Insurance providers are increasingly diversifying their offerings to cater to different customer segments, including expatriates, freelancers, self-employed individuals, and corporate employees. Moreover, insurers are also leveraging data analytics and artificial intelligence to refine their offerings, allowing for more personalized insurance solutions that cater to the unique circumstances of policyholders.

Insurance Type Insights

The insurance type segment comprises of public and private. Public insurance is further cross segmented into corporate policy and retail policy.

The private sector segment dominated the market and accounted for the largest revenue share of 91.15% in 2024. The growth of private accident insurance in Portugal is primarily driven by the increasing awareness of the importance of financial protection against casualties. Many individuals are now recognizing the need to safeguard their income and savings against unforeseen events, such as accidents, which can result in disability or death. In addition, insurance companies are now offering more comprehensive and affordable personal accident insurance products, which is attracting more customers. For instance, insurers such as Allianz, Assicurazioni Generali S.p.A and Zurich are providing a range of benefits, including accidental death, permanent disablement, medical expenses, and hospitalization benefits.

For instance, below is the product offered by Lonpac, a private insurer:

Product/Service

Coverage Details

Average Premium (USD)

Target Client

Accident Care

- Death

- Permanent Total Disablement (PTD)

- Permanent Partial Disablement (PPD)

- Temporary Total Disablement (TTD) (Weekly benefit)

- Accidental Hospitalization Expenses Reimbursement

- Convalescence Benefit

- Ambulance Charges

- Funeral Expenses Extension

USD 20.58/month

People falling in the 5 to 65 years of age group

The public segment is expected to register the fastest growth over the forecast period. This growth is driven by the need to protect vulnerable groups and ensure access to recovery services after accidents. The government aims to cover those lacking private or employer-based insurance, including students, military personnel, and certain public servants. Social welfare commitments make basic coverage accessible, especially for low-income or unemployed individuals. In addition, public insurance supports emergency services, particularly in rural areas with few private providers. EU directives on workplace safety have also led Portugal to enhance its public accident insurance programs, emphasizing prevention and support for public healthcare systems.

Policy Type Insights

The corporate policy segment dominated the market in 2024 and accounted for the largest revenue share of 76.52%. The growth of corporate policies within the industry is influenced by several important factors, such as growing regulatory standards, an increased emphasis on workplace safety, and the climbing expenses related to employee benefits. Furthermore, the heightened focus on employee well-being has motivated organizations to make accident insurance a key component of their benefits offerings. Companies understand that ensuring proper coverage not only safeguards employees but also boosts job satisfaction and improves retention rates. Moreover, the rise in costs associated with compensation claims has driven businesses to implement more effective risk management strategies through corporate insurance policies.

Retail policy segment policy segment is anticipated to register significant growth over the forecast period driven by the growing regulatory changes shaping the accident insurance landscape. The government has implemented stricter regulations mandating certain types of coverage, increasing compliance rates, and expanding the retail policies' customer base. Introducing innovative insurance products tailored to meet consumer needs, such as customizable plans and usage-based pricing models, has also contributed to market expansion. Furthermore, demographic shifts, including an aging population and urbanization trends, influence the demand for insurance. Urbanization leads to higher accidents due to increased city traffic and activity levels, prompting residents to secure adequate coverage.

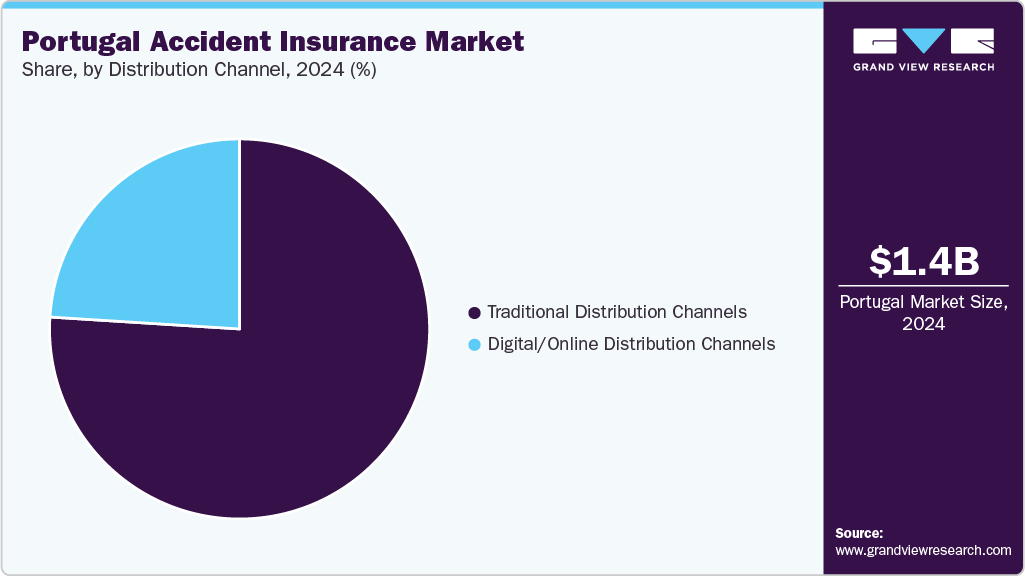

Portugal Health Insurance Market (GWP), by Distribution Channel Insights

The traditional distribution channels such as insurance agents, brokers, and bancassurance, dominated the market in 2024. This dominance is attributed to a blend of cultural, regulatory, and market-specific influences. A major factor is the high level of trust consumers place in face-to-face advisory services, especially when it comes to purchasing personal or occupational accident insurance, which often involves complex terms and long-term commitments. In addition, bancassurance partnerships remain robust, with banks utilizing their extensive customer bases and physical networks to offer accident insurance alongside personal loans and mortgages. The regulatory mandate for mandatory occupational accident insurance for employees has also maintained demand through employer-centric broker channels. Moreover, many small and medium-sized enterprises (SMEs) prefer the personalized assistance of brokers or agents who are knowledgeable about local labor regulations and can customize insurance packages accordingly.

Digital/online distribution channels are expected to register the fastest growth over the forecast period primarily. The growth of the segment is driven by the increasing internet and smartphone penetration across the country, which has significantly expanded the consumer base that can access and purchase insurance products online. Portuguese consumers, particularly younger demographics, now demand convenience, transparency, and speed in financial transactions, leading insurers to shift towards digital platforms for policy comparison, purchase, and claims management. Regulatory support from the Insurance and Pension Funds Supervisory Authority (ASF) has further encouraged innovation, allowing digital brokers and insurtech startups to operate with more agility. Moreover, rising competition in the insurance market has led to the use of digital channels as a cost-effective way to reach and retain customers, especially in the personal accident segment, where fast underwriting and simplified policy terms lend themselves well to online sales.

Key Portugal Accident Insurance Company Insights

The private accident insurance sector is considerably fragmented. Notable insurers in this segment include Allianz, Assicurazioni Generali S.p.A and Zurich, are few of the largest insurance groups, offering diverse and comprehensive accident insurance products tailored to various customer segments. Lonpac leading player holds a substantial market share primarily among civil servants and high-income individuals.

Key Portugal Accident Insurance Companies:

- Tranquilidade (Grupo Generali)

- Mapfre Seguros Portugal

- Allianz

- Zurich

- Ageas

- Fidelidade

- Banco ActivoBank

- Famasegur

- Ibex Insurance Services Ltd.

- Mutualista Montepio

Recent Developments

-

In May 2024, Allianz Partners and Cosmo Connected formed a partnership to provide insurance solutions for micromobility users. This collaboration integrates insurance directly into the user's helmet, offering a unique and convenient protection package. This partnership leverages Cosmo Connected's expertise in connected safety devices and Allianz Partners' insurance capabilities.

Portugal Accident Insurance In Terms of GWP Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.51 billion

Revenue forecast in 2033

USD 2.43 billion

Growth rate

CAGR of 6.14% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Insurance type, policy type, distribution channel

Country scope

Portugal

Key companies profiled

Tranquilidade (Grupo Generali); Mapfre Seguros Portugal; Allianz; Zurich; Ageas; Fidelidade; Banco ActivoBank; Famasegur; Ibex Insurance Services Ltd.; Mutualista Montepio

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Portugal Accident Insurance In Terms of NBP Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 0.39 billion

Revenue forecast in 2033

USD 0.68 billion

Growth Rate

CAGR of 7.14% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Insurance type

Country scope

Portugal

Key companies profiled

Tranquilidade (Grupo Generali); Mapfre Seguros Portugal; Allianz; Zurich; Ageas; Fidelidade; Banco ActivoBank; Famasegur; Ibex Insurance Services Ltd.; Mutualista Montepio

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Portugal Accident Insurance Market Segmentation

This report forecasts revenue and volume growth at country level and provides an analysis on industry trends in each of the sub segments from 2021 to 2033. For the purpose of this study, Grand View Research, Inc. has segmented the Portugal accident insurance market report on the basis of insurance type, policy type, and distribution channel:

-

Insurance Type Outlook (Revenue USD Billion, 2021 - 2033)

-

Portugal Accident Insurance Market {Gross Written Premiums (GWP)}

-

Public

-

By Policy Type

-

Corporate Policy

-

Retail Policy

-

-

-

Private

-

By Policy Type

-

Corporate Policy

-

Retail Policy

-

-

By Type

-

General Health Insurers

-

General Takaful Insurers

-

-

-

-

-

Portugal Accident Insurance Market {New Business Premiums (NBP)}

-

Public

-

Private

-

-

(GWP) Policy Type Outlook (Revenue USD Billion, 2021 - 2033)

-

Corporate Policy

-

Retail Policy

-

-

(GWP) Distribution Channel Outlook (Revenue USD Billion, 2021 - 2033)

-

Traditional Distribution Channels

-

Digital/Online Distribution Channels

-

Frequently Asked Questions About This Report

b. The private sector segment dominated the market and accounted for the largest revenue share of 91.15% in 2024. The growth of private accident insurance in Portugal is primarily driven by the increasing awareness of the importance of financial protection against casualties.

b. Some key players operating in the Portugal accident insurance market include Tranquilidade (Grupo Generali), Mapfre Seguros Portugal, Allianz, Zurich, Ageas, Fidelidade, Banco ActivoBank, Famasegur, Ibex Insurance Services Ltd., Mutualista Montepio.

b. Key factors driving the market growth include the increasing number of road casualties, rising medical costs, and a growing awareness of the importance of accident insurance.

b. The Portugal accident insurance market size was valued at USD 1.42 billion in 2024 and is expected to reach USD 1.51 billion in 2025.

b. The Portugal accident insurance market is expected to grow at a compound annual growth rate of 6.14% from 2025 to 2033, reaching USD 2.43 billion in 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.