- Home

- »

- Agrochemicals & Fertilizers

- »

-

Potassium Chloride Market Size, Industry Report, 2033GVR Report cover

![Potassium Chloride Market Size, Share & Trends Report]()

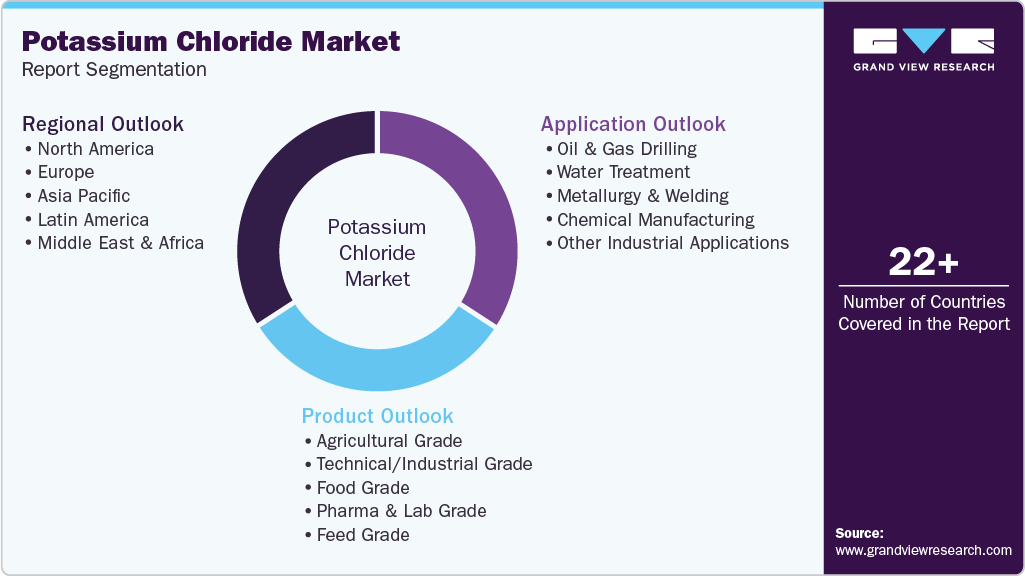

Potassium Chloride Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Agricultural Grade, Technical/Industrial Grade, Pharma & Lab Grade), By Application (Oil & Gas Drilling, Water Treatment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-699-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Potassium Chloride Market Summary

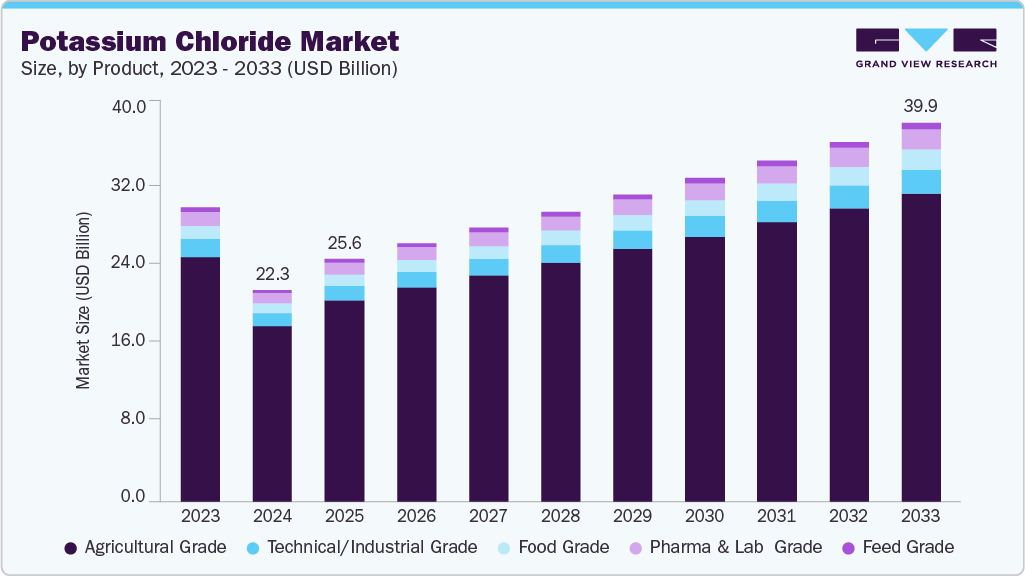

The global potassium chloride market size was estimated at USD 22,347.1 million in 2024 and is projected to reach USD 39,966.4 million by 2033, growing at a CAGR of 5.7% from 2025 to 2033. Potassium chloride is widely used as a primary input in fertilizer formulations due to its nutrient content, compatibility with various soil types, and efficiency in supporting high-yield crop cycles.

Key Market Trends & Insights

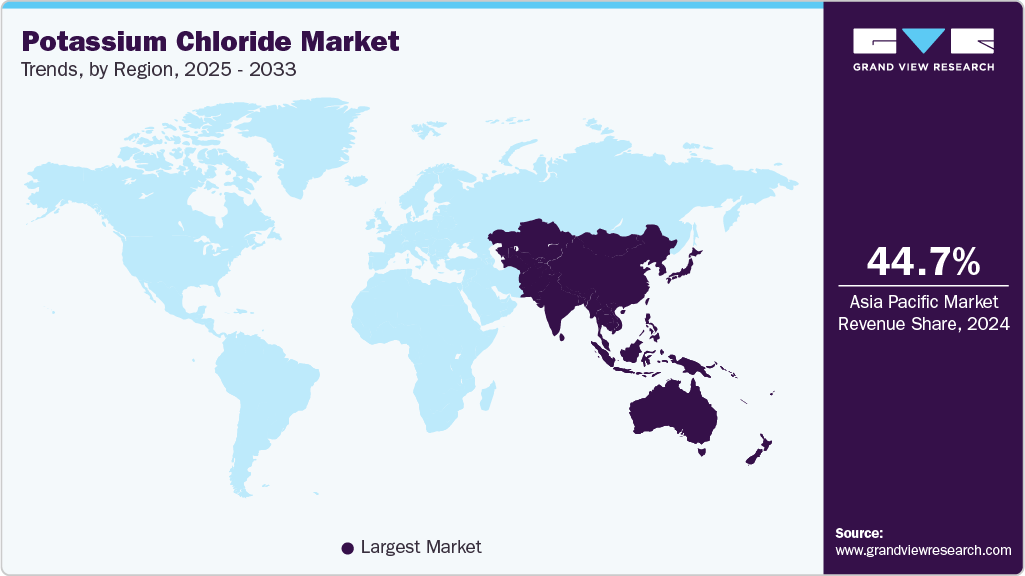

- Asia Pacific dominated the potassium chloride market with the largest revenue share of 44.7% in 2024.

- The global potassium chloride market is projected to grow at a CAGR of 5.7% from 2025 to 2033.

- The agricultural grade segment dominated the market and accounted for the largest revenue share of 83.1% in 2024.

- The food grade segment is expected to grow at the fastest CAGR of 7.7% from 2025 to 2033.

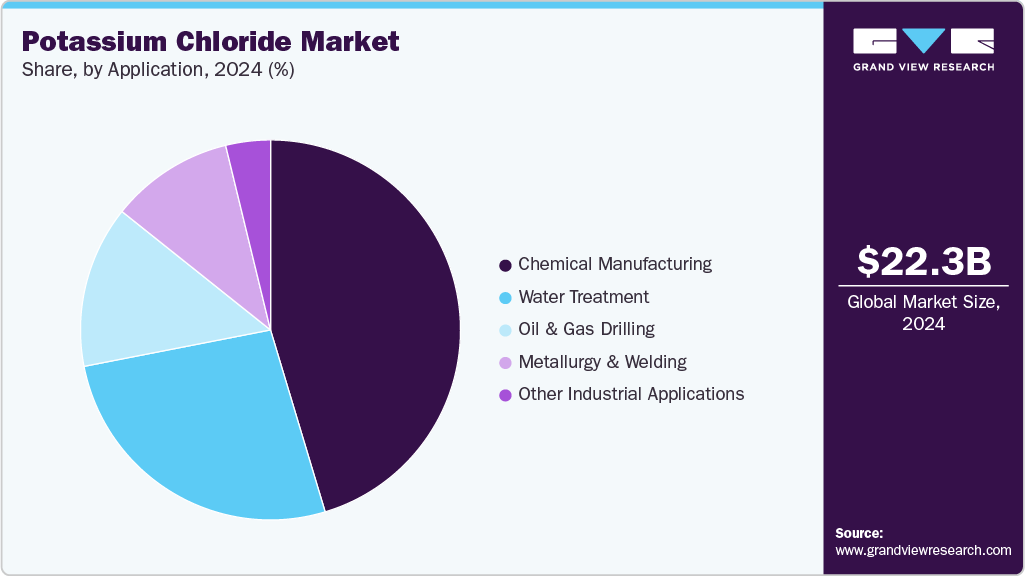

- The chemical manufacturing segment dominated the market and accounted for the largest revenue share of 45.4% in 2024.

- The water treatment segment is expected to grow at the fastest CAGR of 6.8% from 2025 to 2033.

Market Size & Forecasts

- 2024 Market Size: USD 22,347.1 Million

- 2033 Projected Market Size: USD 39,966.4 Million

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest market in 2024

As global agricultural systems transition toward input-intensive farming to meet growing food requirements, the consumption of potassium chloride is projected to follow a sustained upward trend. Global food production faces mounting pressure from population growth, limited arable land, and the need for climate-resilient agricultural practices. Potassium chloride plays a central role in enhancing crop quality, improving water use efficiency, and supporting plant metabolism under stress conditions. These agronomic benefits are essential for meeting yield targets in regions experiencing soil degradation and resource constraints. Fertilizer adoption programs, government subsidies, and agricultural development initiatives in regions such as Asia-Pacific, Africa, and Latin America are driving market expansion. Countries with limited domestic potash resources are increasing imports and entering into long-term supply agreements to ensure consistent fertilizer availability.Industrial applications are also contributing to market growth. Potassium chloride is used in the manufacturing of products across pharmaceuticals, food processing, and chemical sectors. It is incorporated in saline formulations, electrolyte replacements, and as a processing aid in packaged food products. In chemical production, potassium chloride serves as a precursor for potassium-based compounds used in detergents, batteries, and specialty glass manufacturing. These non-agricultural uses are supporting demand diversification and reducing market dependency on seasonal crop cycles. Increasing investment in downstream processing capacity is expected to widen the industrial consumption base in the forecast period.

Market structure is influenced by the geographic concentration of reserves, trade flows, and the vertical integration of mining operations. Canada, Russia, and Belarus account for a significant share of global production, shaping international pricing and supply strategies. Export policies, infrastructure investments, and resource management frameworks in these countries affect the stability of the global supply chain. Companies operating in the potassium chloride sector are expanding capacity, adopting cost-efficient extraction technologies, and developing distribution partnerships to address regional demand fluctuations. These strategies are enabling a more resilient and scalable supply environment aligned with long-term agricultural and industrial requirements.

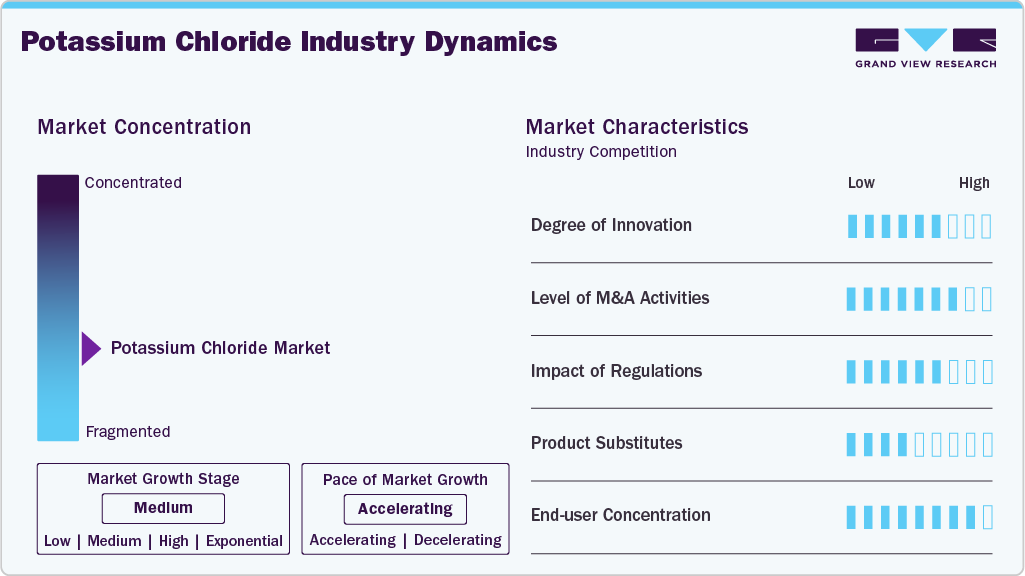

Market Concentration & Characteristics

The industry is fragmented, with a limited number of large-scale producers holding a significant portion of global supply while smaller participants operate at regional or niche levels. This structure reflects the high capital intensity and resource dependency of potassium chloride production, which is often concentrated in regions with substantial natural reserves. Despite fragmentation in terms of the number of participants, market control tends to be centralized due to the geographic concentration of large deposits and established mining infrastructure. This concentration influences global trade dynamics, pricing power, and the strategic importance of long-term supply agreements. Many importing regions depend heavily on external sources, which increases the importance of logistics coordination and geopolitical stability in ensuring uninterrupted supply chains.

The market is characterized by long production cycles, substantial entry barriers, and the need for consistent regulatory compliance related to environmental impact and land use. Demand is primarily driven by agricultural consumption, with seasonal and regional variations in application rates. Non-agricultural uses, including industrial and pharmaceutical applications, provide moderate diversification but do not yet account for a significant portion of overall consumption. Price fluctuations are influenced by factors such as crop demand, transportation costs, export policies, and currency volatility. Innovation in extraction technologies, sustainability practices, and tailored nutrient solutions is gradually shaping competitive differentiation. Overall, the market presents a complex interplay of natural resource dependency, trade-driven supply logistics, and cyclical demand patterns, making strategic alignment and supply chain resilience critical for sustained market participation.

Product Insights

The agricultural grade segment dominated the market and accounted for the largest revenue share of 83.1% in 2024. This dominance is attributed to the widespread use of potassium chloride as a core nutrient in crop fertilizers, especially for high-yield agriculture. The compound supports root development, enhances drought resistance, and improves overall crop quality. Extensive adoption in staple crops such as wheat, corn, and rice drives volume demand. Government-backed fertilizer subsidies, soil fertility programs, and increasing food production needs further reinforce market concentration in agriculture. Additionally, the low cost, ease of application, and compatibility with existing fertilizer blends make agricultural-grade KCl the preferred choice globally.

The food grade segment is expected to grow fastest, with a CAGR of 7.7% from 2025 to 2033. Growth in the food-grade segment is driven by rising consumer demand for low-sodium alternatives, where potassium chloride serves as a salt substitute. Health awareness campaigns and dietary regulations promoting reduced sodium intake are accelerating its adoption in processed foods. Its use in food preservation, flavor enhancement, and nutritional fortification further expands demand. Growing acceptance among food manufacturers and increased product approvals by regulatory bodies support the shift. Urbanization and processed food consumption trends, particularly in developing economies, also contribute to rapid market expansion in this segment over the forecast period.

Application Insights

The chemical manufacturing segment dominated the market and accounted for the largest revenue share of 45.4% in 2024. This dominance stems from potassium chloride's extensive use as a feedstock in the production of potassium hydroxide, potassium carbonate, and other derivatives. These downstream chemicals are essential in glass manufacturing, fertilizers, batteries, soaps, and detergents. The segment benefits from stable industrial demand and wide applicability across various manufacturing processes. High-volume consumption by chemical plants, especially in regions with integrated production facilities, drives significant revenue generation. Additionally, the consistent availability of potassium chloride and its cost-effectiveness support its preference over alternative raw materials in industrial chemical synthesis.

The water treatment segment is expected to grow at the fastest CAGR of 6.8% from 2025 to 2033. Growth in this segment is driven by increasing global focus on clean water access and wastewater management. Potassium chloride is used in water softening systems to regenerate ion-exchange resins as a safer alternative to sodium chloride. Rising adoption in residential and commercial water treatment units supports demand expansion. Regulatory pressure for sustainable water reuse and discharge control across industrial sectors further accelerates usage. Rapid urbanization, industrialization, and infrastructure development in emerging economies are increasing investment in water treatment solutions, enhancing the role of potassium chloride in environmental compliance and public health applications.

Regional Insights

The potassium chloride market in the Asia Pacific dominated with a 44.7% share in 2024. This dominance is attributed to the region’s large agricultural base, high population density, and rising demand for food production. Countries like China and India heavily depend on potassium-based fertilizers to sustain intensive farming systems. Limited domestic potash reserves in several Asia Pacific nations also drive substantial imports to meet fertilizer needs. Government-supported agricultural subsidy programs, technological advancements in farming, and increasing awareness of soil nutrient management contribute to higher consumption. Additionally, expanding industrial and food processing sectors in emerging economies further boost potassium chloride demand across both agricultural and non-agricultural applications in the region.

China Potassium Chloride Market Trends

China potassium chloride market is driven primarily by the country’s extensive agricultural activity and its high dependence on external sources for essential crop nutrients. With limited arable land and a large population to feed, China relies heavily on high-efficiency farming practices, which require consistent and balanced fertilizer application. Potassium chloride supports soil health, improves crop resilience, and boosts yields, making it an essential input in both staple and cash crop production.

In addition to agriculture, demand is supported by industrial applications such as chemical processing and food production, where potassium chloride is used for both functional and processing purposes. China's ongoing efforts to modernize its agricultural practices, enhance food security, and promote sustainable land use further strengthen domestic demand. Policy initiatives promoting nutrient-balanced fertilization and technological improvements in fertilizer application methods also contribute to the sustained growth of potassium chloride consumption across the country.

Europe Potassium Chloride Market Trends

The potassium chloride market in Europe held 12.5% of the global revenue share in 2024. The potassium chloride market in Europe is underpinned by region-specific drivers such as limited domestic potash reserves and widespread dependence on imports. Stringent environmental regulations and sustainability mandates heighten demand for carefully sourced fertilizer inputs, prompting users to prioritize nutrient efficiency and compliance. Agricultural users in the region emphasize balanced fertilization to support crop quality and soil health under diverse climatic conditions. In addition, industrial and food production requirements contribute to demand, as potassium chloride finds use in processing, preservation, and chemical synthesis. Stable consumption patterns tied to regulatory frameworks and efficient supply chains support a mature market characterized by consistent, regulated growth.

North America Potassium Chloride Market Trends

The potassium chloride market in North America is largely influenced by agricultural demand and supply chain dynamics. Farmers cultivating corn, soybeans, and wheat depend on KCl to optimize soil fertility and maximize yields, necessitating consistent fertilizer availability. Domestic production is limited, creating reliance on imports and exposing the region to international pricing and logistical shifts. Policy changes and trade regulations can impact supply costs, prompting users to negotiate long-term sourcing agreements. Industrial and food-processing usage provides steady secondary demand, particularly in processing aids and low-sodium formulations. These factors, agricultural dependency, import reliance, regulatory influence, and diverse end‑use demand, shape market stability and growth.

The potassium chloride market in the U.S. is shaped by heavy agricultural reliance on potash imports due to minimal domestic production capacity. This limited local supply forces dependence on external sources, creating vulnerability to trade policies and global price fluctuations. High import tariffs and supply disruptions translate into volatility in fertilizer costs, directly impacting farmer profitability. Agricultural demand remains strong, driven by large-scale cultivation of corn, soybeans, and wheat, all of which rely on KCl to enhance yields and support soil fertility. These dynamics, import reliance, trade sensitivity, and agricultural necessity, collaboratively define the structure and growth of the U.S. market.

Middle East & Africa Potassium Chloride Market Trends

The potassium chloride market in the Middle East & Africa is driven by increasing agricultural development, food security concerns, and a shift toward more efficient crop production methods. Many countries in the region face arid climates and poor soil fertility, which increases the need for potassium-based fertilizers to improve crop resilience, water retention, and overall yield. Government-led initiatives promoting modern farming practices and irrigation systems have further boosted the adoption of potassium chloride in agriculture.

Beyond agriculture, rising industrialization and infrastructure development contribute to steady demand in sectors such as chemical processing, water treatment, and food production. Efforts to diversify regional economies and reduce dependence on oil revenue have led to the expansion of manufacturing activities, which rely on potassium chloride as an input in various industrial processes. These combined factors, agricultural necessity, policy support, and industrial growth, sustain the market’s forward momentum in the region.

Latin America Potassium Chloride Market Trends

The potassium chloride market in Latin America is propelled largely by agricultural expansion and the need to enhance crop productivity. Predominant cultivation of nutrient-demanding crops encourages widespread use of potassium chloride to improve soil fertility, plant vigor, and stress tolerance. Farmers are increasingly adopting modern fertilization techniques to optimize yields and address soil nutrient depletion, which in turn drives steady regional demand for KCl.

Simultaneously, industrial development and growing processed food sectors contribute to additional consumption. Potassium chloride finds use as a food additive, processing aid, and ingredient in chemical manufacturing and water treatment. Trade openness and increasing fertilizer imports support availability in regions without large domestic reserves. Interactive factors, modern agricultural practices, improving infrastructure, and expanding non-agricultural applications-together sustain growth in the Latin American market.

Key Potassium Chloride Companies Insights

Key players operating in the potassium chloride market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Potassium Chloride Companies:

The following are the leading companies in the potassium chloride market. These companies collectively hold the largest market share and dictate industry trends.

- Nutrien Ltd.

- The Mosaic Company

- Uralkali PJSC

- Belaruskali

- EuroChem Group

- Qinghai Salt Lake Potash Company

- K+S Aktiengesellschaft

- Arab Potash Company

- SQM (Sociedad Química y Minera de Chile)

- Asia-Potash International Investment

Recent Developments

-

In January 2025, Qaz Boxs launched Potassium Chloride 60%, a high-purity, cost-effective fertilizer designed to enhance plant strength, root growth, and drought resistance. Now available in bulk for export, it suits a wide variety of crops worldwide.

-

In September 2024, QatarEnergy signed an MoU with Mesaieed Petrochemical, QIMC, and Türkiye’s Atlas Yatirim Planlama to establish Qatar Salt Products Company (QSalt). The new plant will produce industrial and table salt, including potassium chloride, enhancing Qatar’s self-sufficiency, export potential, and localization of its chemical and fertilizer industries.

Potassium Chloride Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25,641.4 million

Revenue forecast in 2033

USD 39,966.4 million

Growth rate

CAGR of 5.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Colombia; Germany; UK; Italy; Spain; Russia; China; Japan; South Korea; Australia; Saudi Arabia; Iran; Jordan; South Africa

Key companies profiled

Nutrien Ltd.; The Mosaic Company; Uralkali PJSC; Belaruskali; EuroChem Group; Qinghai Salt Lake Potash Company; K+S Aktiengesellschaft; Arab Potash Company; SQM (Sociedad Química y Minera de Chile); Asia-Potash International Investment

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Potassium Chloride Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global potassium chloride market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Agricultural Grade

-

Technical/Industrial Grade

-

Food Grade

-

Pharma & Lab Grade

-

Feed Grade

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Oil & Gas Drilling

-

Water Treatment

-

Metallurgy & Welding

-

Chemical Manufacturing

-

Other Industrial Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

-

Middle East & Africa

-

Saudi Arabia

-

Iran

-

Jordan

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global potassium chloride market size was estimated at USD 22,347.1 million in 2024 and is expected to reach USD 25,641.4 million in 2025.

b. The global potassium chloride market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033, reaching USD 39,966.4 million by 2033.

b. The agricultural grade segment held the largest revenue share in 2024 due to its extensive use in enhancing crop yield, soil fertility, and plant stress tolerance. High demand for potash-based fertilizers in large-scale farming also contributed significantly.

b. Some of the key players operating in the global potassium chloride market include Nutrien Ltd., The Mosaic Company, Uralkali PJSC, Belaruskali, EuroChem Group, Qinghai Salt Lake Potash Company, K+S Aktiengesellschaft, Arab Potash Company, Asia-Potash International Investment, and SQM (Sociedad Química y Minera de Chile)

b. The potassium chloride market is driven by rising global food demand, intensive farming practices, shrinking arable land, and the need for improved crop yields. Expanding industrial applications in chemicals, water treatment, and food processing further boost market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.