- Home

- »

- Organic Chemicals

- »

-

Potassium Hydroxide Market Size, Industry Report, 2033GVR Report cover

![Potassium Hydroxide Market Size, Share & Trends Report]()

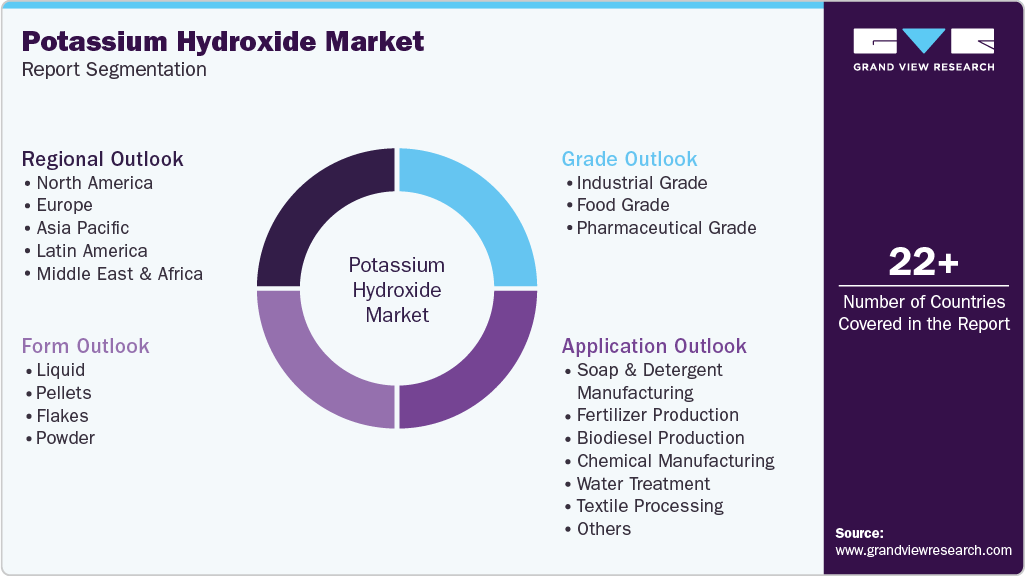

Potassium Hydroxide Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Liquid, Pellets, Flakes, Powder), By Grade (Industrial, Food, Pharmaceutical), By Application (Food Processing, Water Treatment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-655-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Potassium Hydroxide Market Summary

The global potassium hydroxide market size was estimated at USD 3,438.7 million in 2024 and is projected to reach USD 4,844.9 million by 2033, growing at a CAGR of 3.7% from 2025 to 2033. Market growth is mainly fueled by rising demand in agriculture, pharmaceuticals, and specialty chemicals.

Key Market Trends & Insights

- Asia Pacific dominated the global potassium hydroxide market with the largest revenue share of 39.8% in 2024.

- The potassium hydroxide market in the U.S. is expected to grow at a substantial CAGR of 3.6% from 2025 to 2033.

- By form, the pellets segment is expected to grow at a considerable CAGR of 4.3% from 2025 to 2033 in terms of revenue.

- By grade, the food grade segment is expected to grow at a considerable CAGR of 4.1% from 2025 to 2033 in terms of revenue.

- By application, the biodiesel production segment is expected to grow at a considerable CAGR of 5.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3,438.7 Million

- 2033 Projected Market Size: USD 4,844.9 Million

- CAGR (2025-2033): 3.7%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Its essential role in producing potassium-based compounds and liquid soaps drives consistent consumption. Regulatory shifts toward sustainable chemical processes are prompting manufacturers to adopt cleaner technologies.The global market is primarily driven by its wide-ranging industrial applications. As a strong alkaline compound, potassium hydroxide is essential in producing potassium-based fertilizers in high demand due to intensive agricultural practices and the need for high-yield crops. The chemical also plays a critical role in manufacturing liquid soaps, detergents, and alkaline batteries. Its use as a pH regulator, catalyst, and intermediate in numerous chemical syntheses underpins demand across pharmaceuticals, textiles, and petroleum refining sectors. The transition toward bio-based and eco-friendly products further boosts demand, particularly in biodiesel production. Consistent expansion of food processing and water treatment sectors also contributes to the strong consumption of potassium hydroxide globally.

Despite its versatile industrial utility, the market faces several challenges. One major restraint is the hazardous nature of the compound potassium hydroxide, which is highly caustic and poses significant health, environmental, and handling risks. Stringent regulatory requirements from agencies such as the United States Environmental Protection Agency and the European Chemicals Agency for safe manufacturing, storage, and transport increase operational complexity and compliance costs. In addition, fluctuations in raw material availability, especially chlorine and potassium salts, impact production economics. Market saturation in developed regions and limited awareness in emerging markets further restrict growth. Price volatility and competition from sodium hydroxide, a functional substitute in many applications, also hinder wider market penetration.

The market holds significant growth potential amid the global push toward sustainability and green chemistry. Increasing the adoption of potassium hydroxide in the production of biofuels, particularly biodiesel, is a notable opportunity as governments and industries target carbon neutrality and energy diversification. Demand for potassium hydroxide in electrochemical applications, especially in alkaline batteries and next-generation energy storage systems, is expected to rise with the electric vehicle and renewable energy transitions. The compound’s use in carbon capture technologies and water purification systems aligns with expanding environmental remediation initiatives. The rising demand for high-purity potassium hydroxide in pharmaceutical and food-grade formulations also opens pathways for specialized, high-margin product segments in the global market.

Market Concentration & Characteristics

The global potassium hydroxide industry exhibits moderate to high concentration, with a few major players securing a significant share of production capacity and influencing pricing dynamics. Key multinational chemical giants, including Olin Corporation, Occidental Petroleum (OxyChem), Evonik Industries, UNID Co., Tessenderlo Chemie, and Asahi Glass, benefit from vertically integrated chlor-alkali facilities and expansive distribution systems. Industry reports suggest that the top five producers control approximately forty to forty-five percent of global output. In contrast, the top three alone hold nearly thirty percent of the market share. This concentration gives them pricing power and economies of scale, making competition difficult for regional or niche suppliers. Emerging partnerships and strategic acquisitions among these leaders further solidify a competitive landscape marked by high entry barriers and robust supply chain integration.

Potassium hydroxide’s market dynamics are defined by a diversified product ecosystem featuring both solid and liquid forms, with solid potassium hydroxide (KOH) favored in regions with less developed infrastructure and liquid grades commanding greater demand in industrial settings. Product differentiation is highly pursued, with manufacturers offering tailored grades ranging from industrial-grade to ultra‑high‑purity variants for specialized applications in electronics, pharmaceuticals, biodiesel, and battery technologies. Key market characteristics include a strong emphasis on purity, stringent regulatory compliance, and technological innovation, such as membrane-cell production and low-impurity purification processes. Distribution is supported by chemical logistics leaders like Brenntag and Univar, emphasizing storage and handling infrastructure vital for maintaining quality and safety in high-value segments.

Form Insights

The liquid segment dominated the market and accounted for the largest revenue share of 56.3% in 2024. Its suitability for large-scale industrial processes drives this growth, enabling seamless integration into alkaline battery electrolyte systems and biodiesel transesterification reactions. Liquid potassium hydroxide offers rapid solubility, consistent quality, and ease of handling, which appeals to major chemical manufacturers. Its prominence in soap, detergent, and water treatment formulations further cements its market dominance. Regions with advanced chlor-alkali production capacities, such as Asia Pacific and North America, heavily favor liquid grades for operational efficiency, reinforcing their leading share across global revenue streams.

Pellets is expected to grow fastest with a CAGR of 4.3% from 2025 to 2033 during the forecast period. This segment is propelled due to increasing demand in emerging markets where solid forms simplify transportation, storage, and dosing in fertilizer blending and food processing. Pellets provide superior shelf stability and are favored in remote or off-grid blending units. The solid format supports precise laboratory, pharmaceutical, and high-purity industrial dosing. Technological advancements in production, such as pelletizing with low moisture content, also contribute to uptake in regions with less optimized logistics infrastructure.

Grade Insights

The industrial grade segment led the market and accounted for the largest revenue share of 67.4% in 2024. This growth is driven by its widespread applicability across sectors like soap and detergent manufacturing, neutralizing agents in paper and textile processing, and pH control in water treatment. Industrial-grade KOH offers an ideal balance of purity and cost, satisfying bulk demand requirements in chemical and agricultural industries. Its dominance stems from established supply chains conforming to industrial specifications and reliable quality derived from membrane and diaphragm chlor-alkali processes.

Food grade is predicted to grow fastest with a CAGR of 4.1% from 2025 to 2033 during the forecast period. This segment is increasing due to heightened demand for food-grade acids and alkalis in processing operations such as chocolate and cocoa treatment, fruit and vegetable peeling, and pH correction in beverage manufacturing. Rising regulatory standards for food safety, particularly in North America and Europe, are driving adoption. Moreover, the shift toward clean-label and additive-free products is increasing the need for high-purity reagents, favoring food-grade KOH for compliance with stringent purity thresholds.

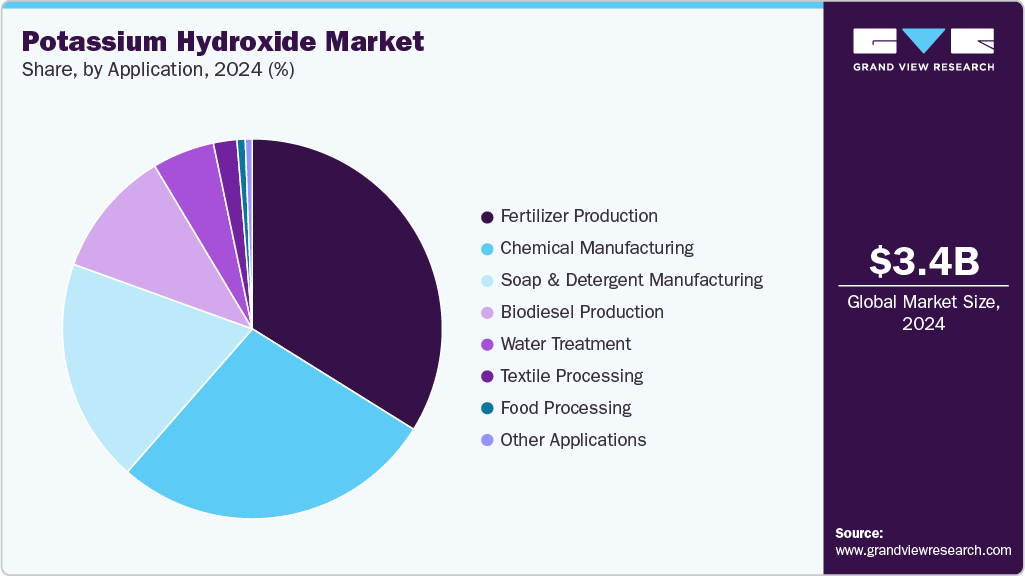

Application Insights

The fertilizer production segment led the market and accounted for the largest revenue share of 33.9% in 2024. This growth is driven by the escalating adoption of potassium-based fertilizers to maintain soil fertility and enhance crop yield amid global food security challenges. Agriculture remains the largest consumer of potassium hydroxide, which is used to manufacture potassium carbonate and potentiometric fertilizers. The expansion of high-yield farming and modern agronomy techniques, particularly across Asia-Pacific, has further reinforced this segment’s leading share of the KOH market.

The biodiesel production segment is expected to grow fastest, with a CAGR of 5.5% from 2025 to 2033 during the forecast period. This growth is propelled by the rising demand for sustainable biofuels driven by carbon reduction targets in Europe and North America. KOH is a preferred transesterification catalyst due to its high activity and selectivity. As biodiesel plant capacities expand and mandates tighten, KOH usage is projected to surge. Its role in producing renewable diesel and lubricants is amplified through government incentives and investment toward greener fuel infrastructure.

Regional Insights

Asia Pacific market led the global landscape with a revenue share of 39.8% in 2024. It is predominantly attributed to the region's rapid growth driven by extensive industrial expansion, particularly in chemical, fertilizer, and detergent production across China, India, and South Korea. Asia Pacific remains the largest production hub, accounting for over fifty percent of global output, with China alone contributing nearly half of the regional tonnage. Local demand for liquid and solid KOH in biofuel, electronics, and water treatment has surged, supported by integrated chlor-alkali infrastructure, affordable feedstock, and government support for manufacturing and sustainability initiatives.

The potassium hydroxide market in China is the epicenter of Asia Pacific’s dominance, driven by its large-scale chlor-alkali plants and strong integration with downstream industries. Domestic demand spans fertilizer manufacture, soaps, electronics, and biodiesel, while export affordability attracts neighboring Southeast Asian importers. Rapid industrialization, expanding agricultural land requiring potassium compounds, and consistent policy incentives for green chemicals ensure China sustains a central role in the global KOH value chain.

Europe Potassium Hydroxide Market Trends

The potassium hydroxide market in Europe is expected to grow fastest, with a CAGR of 4.1% from 2025 to 2033 during the forecast period. The market is increasing steadily due to the region’s emphasis on renewable energy, sustainable agriculture, and stringent environmental regulations. Europe accounts for around twenty-five percent of the global market share. Germany, France, and the UK are investing in biodiesel and battery technologies that rely on high-purity KOH. Demand for water treatment and food processing is also contributing. The regulatory landscape favors green chemistry, driving manufacturers to expand capacity and innovate high-grade KOH formulations for specialized applications.

Germany potassium hydroxide marketis experiencing consistent growth, driven by its advanced chemical industry, strong renewable energy focus, and dynamic automotive battery production. German producers benefit from mature chlor-alkali infrastructure and a robust specialty chemicals ecosystem. High-purity KOH is increasingly required in battery electrolytes, pharmaceuticals, and food processing. Government-led decarbonization and circular economy goals encourage local production of green chemicals, with Germany leveraging its technical competitiveness and supply chain integration to meet growing domestic and European demand.

North American Potassium Hydroxide Market Trends

The potassium hydroxide market in North America accounted for a revenue share of 29.9% in 2024. It is attributed to extensive soap, detergent, battery manufacturing, and water treatment applications. The region benefits from robust chlor-alkali plants in the US and Canada, supported by integrated production and distribution capabilities. Demand for KOH in biodiesel synthesis, food-grade formulations, and wastewater remediation continues to expand, bolstered by favorable policies for biofuel and stringent environmental standards. Regional investment in specialty chemical manufacturing supports stability and moderate growth.

The U.S. potassium hydroxide marketgrowth is driven by expansion in biofuel production, alkaline battery demand, and chemical manufacturing. The U.S. leads North American consumption, supported by domestic transesterification plants and EV battery development. The rising use of KOH as a catalyst in biodiesel plants and electrolytes in lead-acid and alkaline batteries reflects national energy policies promoting cleaner fuels and electrification. Strong regulatory focus on wastewater treatment and industrial chemical standards ensures steady industrial-grade KOH demand, with domestic chlor-alkali facilities and logistics networks sustaining supply-chain resilience.

Latin America Potassium Hydroxide Market Trends

The potassium hydroxide market in Latin America is emerging, driven by rising agricultural demand for potassium fertilizers, expanding biofuel production, and growing chemical industry infrastructure. Brazil and Argentina lead regional growth plans for biodiesel and sustainable farming, increasing local KOH consumption. Investments in pulp and paper mills and water treatment plants also boost demand. While infrastructure remains developing, pellet and solid KOH grades are favored for easier transport and storage in remote areas. Government initiatives to increase rural productivity and energy diversification further support this emerging market trend.

Middle East and Africa Potassium Hydroxide Market Trends

The potassium hydroxide market in the Middle East and Africa is driven by the region’s expanding water desalination, fertilizer blending, and petrochemical sectors. Gulf countries invest in wastewater treatment plants, agriculture in arid zones, and downstream petrochemical integration, all requiring KOH. The region accounts for about ten percent of the global market. Industrialization, population growth, and food security programs in North Africa elevate demand for KOH. Although infrastructure and regulatory maturity vary, the overall outlook is firm, supported by strategic investments in green chemistry and improved hazardous handling and distribution logistics.

Key Potassium Hydroxide Company Insights

Some key players operating in the market include Solvay, BASF, and American Elements.

-

OxyChem (Occidental Chemical Corporation) is a chemical manufacturer developing and producing essential chemistry products that purify water, build communities and vehicles, enable climate‑friendly refrigerants, and supply pharmaceuticals. Emphasizing safety, sustainability, and innovation, the division operates integrated chemical and energy assets across the United States, the Middle East, and North Africa. Its chemicals, including chlorine, caustic soda, PVC resins, and calcium chloride, support downstream industries. The business pursues low‑carbon goals through CO₂‑enhanced oil recovery and emissions‑reduction strategies. Its potassium hydroxide offerings support applications in chemical manufacturing, personal care, soaps, detergents, and food processing, emphasizing purity, consistent supply, and compatibility with high-quality regulatory standards.

-

INEOS KOH Inc. is a specialist chlor-alkali producer within INEOS Enterprises, operating from a membrane-based facility in Ashtabula, Ohio. Utilizing BICHLOR membrane cell technology, the company produces potassium hydroxide, potassium carbonate, hydrochloric acid, and chlorine. These products serve diverse sectors such as agriculture, food, pharmaceutical, and water treatment. The site maintains ISO quality and NSF/ANSI certification for potable water applications. The company produces high-purity potassium hydroxide using mercury-free membrane cell technology, delivering consistent product quality and tailored grades for water treatment, pharmaceutical, food processing, and agricultural industry requirements.

Gujarat Alkalies and Chemicals Limited, UNID, Airedale Chemical Company Limited, and others are some of the emerging market participants.

-

Airedale Chemical Company Limited is a family‑owned British chemical specialist headquartered in Keighley, West Yorkshire, serving diverse industries through its multiple divisions. Its product portfolio encompasses commodity and specialty chemicals for life sciences, food and beverage, metal surface treatments, functional applications, and innovation. The company provides toll and small-pack manufacturing, supported by its logistics fleet. Certified to ISO quality and environmental standards, Airedale serves customers across the UK, Europe, and global markets, combining extensive distribution with specialist technical services. Its potassium hydroxide solutions are formulated in multiple concentrations and tailored for industrial cleaning, chemical synthesis, and regulatory-sensitive applications, including food and pharmaceutical environments.

Key Potassium Hydroxide Companies:

The following are the leading companies in the potassium hydroxide market. These companies collectively hold the largest market share and dictate industry trends.

- Solvay

- BASF

- Dow

- Occidental Petroleum Corporation (OxyChem)

- Olin Corporation

- UNID

- Merck KGaA

- American Elements

- Airedale Chemical Company Limited

- Altair Chemical S.r.l.

- Gujarat Alkalies and Chemicals Limited

- INEOS KOH Inc.

- ERCO Worldwide

- HAINAN HUARONG CHEMICAL CO., LTD.

Recent Development

- In February 2024, INEOS Inovyn launched an Ultra-Low-Carbon chlor-alkali range, including caustic potash, to significantly reduce product carbon footprints. The initiative uses renewable energy at key sites and is certified under the ISCC PLUS scheme. The aim is to help downstream users meet sustainability targets. This move strengthens low-carbon positioning in the global market.

Potassium Hydroxide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,547.0 million

Revenue forecast in 2033

USD 4,844.9 million

Growth rate

CAGR of 3.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Form, grade, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Solvay; BASF; Dow; Occidental Petroleum Corporation (OxyChem); Olin Corporation; UNID; Merck KGaA; American Elements; Airedale Chemical Company Limited; Altair Chemical S.r.l.; Gujarat Alkalies and Chemicals Limited; INEOS KOH Inc.; ERCO Worldwide; HAINAN HUARONG CHEMICAL CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Potassium Hydroxide Market Report Segmentation

This report forecasts volume & revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global potassium hydroxide market report based on form, grade, application, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Liquid

-

Pellets

-

Flakes

-

Powder

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Industrial Grade

-

Food Grade

-

Pharmaceutical Grade

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Soap & Detergent Manufacturing

-

Fertilizer Production

-

Biodiesel Production

-

Chemical Manufacturing

-

Water Treatment

-

Textile Processing

-

Food Processing

-

Other Applications

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global potassium hydroxide market size was estimated at USD 3,438.7 million in 2024 and is expected to reach USD 3,547.0 million in 2025.

b. The global potassium hydroxide market is expected to grow at a compound annual growth rate of 3.7% from 2025 to 2033 to reach USD 4,844.9 million in 2033.

b. Asia Pacific market dominated the global landscape with a revenue share of 39.8% in 2024. It is primarily attributed to the region's robust growth driven by extensive industrial expansion, especially in chemicals, fertilizers, and detergents across China, India, and South Korea.

b. Some key players operating in the potassium hydroxide market include Solvay, BASF, Dow, Occidental Petroleum Corporation (OxyChem), Olin Corporation, UNID, Merck KGaA, American Elements, Airedale Chemical Company Limited, Altair Chemical S.r.l., Gujarat Alkalies and Chemicals Limited, INEOS KOH Inc., ERCO Worldwide, HAINAN HUARONG CHEMICAL CO.,LTD.

b. The global potassium hydroxide market is driven by its essential role in diverse industries, including fertilizers, soaps, detergents, batteries, and chemical manufacturing. Its strong alkaline properties support applications in pH regulation, catalysis, and synthesis across sectors like pharmaceuticals, textiles, and refining.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.