- Home

- »

- Advanced Interior Materials

- »

-

Pottery Ceramics Market Size, Share, Industry Report, 2033GVR Report cover

![Pottery Ceramics Market Size, Share & Trends Report]()

Pottery Ceramics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Tableware, Art Ware), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68039-982-3

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pottery Ceramics Market Summary

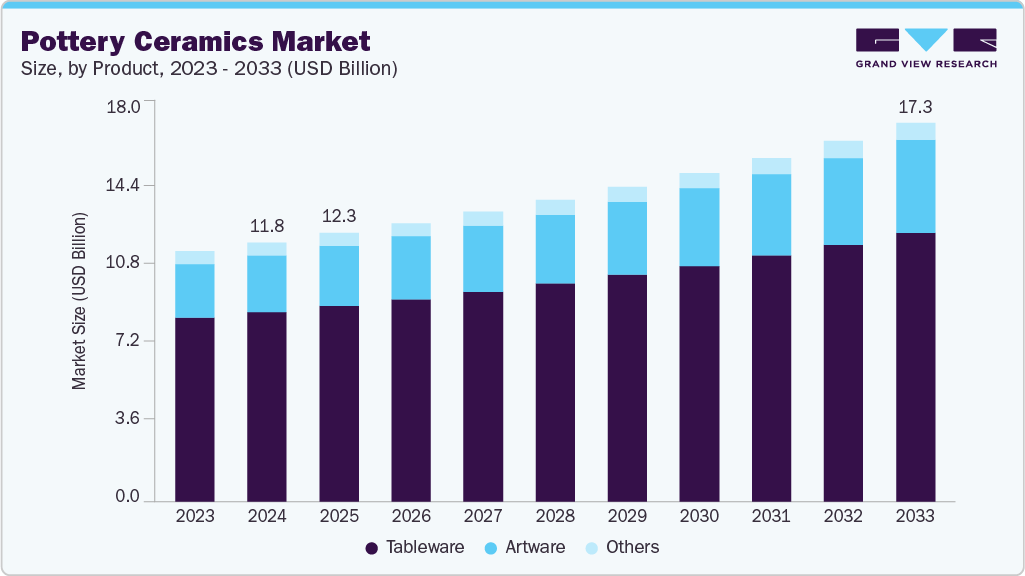

The global pottery ceramics market size was estimated at USD 11.83 billion in 2024 and is projected to reach USD 17.27 billion by 2033, growing at a CAGR of 4.4% from 2025 to 2033. The growth is primarily driven by increasing investments in the construction and renovation of hotels and restaurants, which are fueling demand for aesthetically appealing and functional ceramic products.

Key Market Trends & Insights

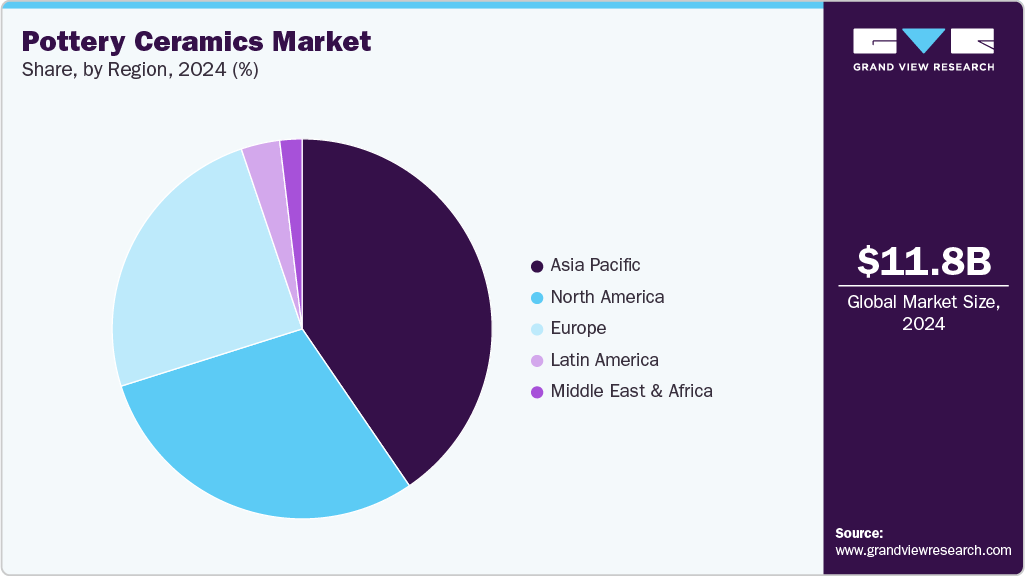

- Asia Pacific dominated the global pottery ceramics market with a revenue share of 40.5% in 2024.

- The pottery ceramics market in Latin America is expected to grow at a substantial CAGR of 5.7% from 2025 to 2033.

- By product, tableware dominated the market with a revenue share of over 73.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.83 billion

- 2033 Projected Market Size: USD 17.27 billion

- CAGR (2025-2033): 4.4%

- Asia Pacific: Largest market in 2024

- Latin America: Fastest growing market

Additionally, rising consumer preference for handcrafted and artisanal pottery, especially in premium hospitality and dining settings, along with growing emphasis on sustainability and eco-friendly materials, further supports market expansion. Factors such as customer satisfaction and brand loyalty have encouraged hotel and restaurant owners to enhance their interiors and create aesthetically pleasing environments. This has led to a rise in the consumption of pottery ceramics such as tableware and artware, which add an elegant and sophisticated touch to their spaces. Additionally, growing investment in new residential construction is prompting consumers to spend more on decorative items like vases, pots, and crockery to enhance the aesthetic appeal of their homes, further driving demand for pottery ceramics.

Furthermore, while the industry is witnessing steady growth driven by rising demand in the hospitality and residential sectors, it faces significant challenges from the availability of substitute materials. Alternatives such as metals, plastics, and glass are widely used due to their higher durability, lower cost, and resistance to breakage, particularly in environments where practicality and long-term performance are essential. These materials are especially favored in high-traffic settings like commercial kitchens, cafeterias, and mass housing projects.

As a result, consumer preferences may shift away from pottery ceramics, especially when budget constraints or functionality take precedence over aesthetics. Although pottery ceramics offer a unique artisanal and decorative appeal, substitute products' competitive pricing and functional advantages continue to limit their broader adoption. The availability of cost-effective alternatives is a key restraint that could impact the long-term growth potential of the global pottery ceramics market.

Drivers, Opportunities & Restraints

Several key factors drive the pottery ceramics industry. One of the primary growth drivers is the expanding hospitality and tourism industry, where hotels, restaurants, and resorts increasingly seek aesthetically appealing ceramic tableware and décor to enhance guest experiences. Growing consumer awareness around home aesthetics has also increased spending on decorative pottery items such as vases, pots, and crockery. The rising demand for handcrafted and artisanal products also supports market growth, especially in premium and luxury segments. Pottery holds traditional and symbolic value in many cultures, ensuring a consistent demand for such products across regions.

There are also notable opportunities in the market. The increasing emphasis on eco-friendly and sustainable living has created space for innovation in biodegradable and environmentally responsible ceramic materials. E-commerce provides a global platform for local and artisanal producers to expand their reach, while customization trends allow brands to offer personalized pottery items that cater to individual tastes. Furthermore, luxury and boutique hospitality segments embrace exclusive, artistically designed ceramics to differentiate their offerings, opening up new premium markets.

However, the market faces certain restraints. The availability of substitutes such as metals, plastics, and glass presents a significant challenge, as these materials often offer higher durability and lower costs. The fragile nature of ceramic products and their limited lifespan in high-use environments also deters some consumers. Additionally, the high cost of production, especially for handmade items using quality raw materials, can limit their appeal in price-sensitive markets. Environmental concerns associated with traditional kiln firing processes, which consume significant energy and generate emissions, further add to the challenges faced by manufacturers in the pottery ceramics industry.

Product Insights & Trends

Tableware’s non-porous nature and resistance to odor, grease, and bacteria make it ideal for fine dining establishments, where hygiene and presentation are critical. Chefs strongly prefer white ceramic bowls and plates over glass alternatives, as they enhance the visual appeal of food. The growing demand for premium ceramic tableware in hotels and restaurants prompts manufacturers to increase production. For instance, in 2024, Churchill China (UK) Ltd. advanced its expansion plans at the Stoke-on-Trent factory to cater to rising orders from luxury hospitality clients across Europe and Asia.

The artware segment is projected to grow fastest during the forecast period. Artware includes vases, sculptures, and pots, which are widely used by the global hospitality industry to enhance the aesthetic value of their interiors. In 2024, the growing trend of thematic decor in boutique hotels and resorts and luxury property staging by real estate developers significantly contributed to increased demand for handcrafted ceramic artware. Developers of high-end apartments and villas increasingly incorporate bespoke ceramic art pieces to attract premium buyers who value artistic and cultural touches in their living spaces.

The other product segment, including ceramic roof tiles and holders, also retained its importance in 2024. Ceramic roof tiles are being increasingly adopted in construction due to their durability, thermal efficiency, and resistance to harsh weather. Their heavy thermal mass helps regulate room temperature, making them an energy-efficient solution in residential and commercial buildings. The construction industry's shift toward sustainable and long-lasting materials has further propelled the use of ceramic-based building components, especially in regions experiencing rising temperatures and stricter building codes.

Regional Insights

North America pottery ceramics market continues to grow steadily, supported by rising demand in hospitality, interior décor, and real estate development sectors. With consumers emphasizing home aesthetics and personalized décor, the region's demand for tableware and artware has increased. Hotels, restaurants, and boutique accommodations are investing in ceramic products to enhance their ambiance and dining experiences. Moreover, the growing appreciation for handcrafted and locally produced ceramics and sustainability trends encourages traditional pottery and modern ceramic brands to expand their product lines. E-commerce growth and home improvement trends contribute to wider market accessibility and consumer interest.

U.S. Pottery Ceramics Market Trends

The pottery ceramics market in the U.S. is primarily driven by premium hospitality chains, home décor retailers, and affluent consumers seeking unique, artisanal products. The country has witnessed strong adoption of ceramic tableware in fine dining and specialty restaurants, where chefs prefer white, minimalistic ceramic plates and bowls to enhance food presentation. In addition, the rise in home renovations and luxury real estate projects is fueling demand for decorative ceramics such as vases, sculptures, and planters. Domestic manufacturers are expanding to meet this demand with a focus on sustainable production methods and eco-friendly materials to align with shifting consumer values. The U.S. market also benefits from design trends influenced by European and Japanese aesthetics, favoring clean lines, natural finishes, and artisanal quality.

Asia Pacific Pottery Ceramics Market Trends

The pottery ceramics market in Asia Pacific is driven by urbanization, rising disposable incomes, and expanding tourism infrastructure. Countries like China, India, Japan, and Thailand are seeing increased demand for ceramic tableware and décor in luxury hotels, high-end restaurants, and new residential developments. The traditional and cultural relevance of pottery in countries like India and China also continues to support market growth. Moreover, a large manufacturing base enables cost-effective production, making Asia Pacific a major exporter of pottery ceramics globally. The rise in modern retail formats and e-commerce contributes to the widespread availability of decorative and functional ceramics among middle- and high-income consumers.

Europe Pottery Ceramics Market Trends

The pottery ceramics market in Europe remains a mature and design-conscious market, with a strong emphasis on craftsmanship, sustainability, and aesthetic value. Countries such as Germany, Italy, France, and the UK have well-established pottery traditions and are home to premium ceramic brands catering to local and international markets. The demand for sustainable and eco-friendly home décor products and growing minimalist and Nordic interior design trends drive ceramic tableware and artware use in residential and hospitality sectors. European consumers value artisanal and ethically produced ceramics, while governments and institutions support small and medium pottery enterprises through cultural and innovation grants. This alignment of tradition with modern consumer values keeps Europe at the forefront of design-led pottery ceramic trends.

Key Pottery Ceramics Companies Insights

Key players operating in the pottery ceramics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Pottery Ceramics Companies:

The following are the leading companies in the pottery ceramics market. These companies collectively hold the largest market share and dictate industry trends.

- American Art Clay Co., Inc. (AMACO)

- Bhoomi Pottery

- Bluematchbox Potters Supplies Ltd

- CCGNZ Group Limited

- Clay-King

- Dick Blick Holdings Inc.

- Laguna Clay Company

- Sajo Ceramics

- Sheffield Pottery Inc.

- Sounding Stone

Recent Developments

-

In March 2024, American Art Clay Co. (AMACO) launched its new “Supernova” crystalline glaze. This food-safe product quickly gained popularity among studio potters and educators for its vibrant surface effects and ease of use. The release strengthened AMACO’s position in the decorative ceramics segment and reinforced its commitment to glaze innovation.

-

In April 2024, Laguna Clay Company was recognized in multiple global ceramics industry reports as a leading supplier of clay bodies and glaze materials, driven by consistent demand from art schools and studio potters across North America. The company maintained its market leadership by expanding its distribution partnerships and increasing the supply of specialty clays for artisan pottery production.

-

In January 2024, Dick Blick Holdings Inc. (Blick Art Materials) expanded its ceramic product portfolio by launching new pottery starter kits and introducing exclusive clay and glaze bundles targeted at educational institutions and beginner potters. This initiative aligned with its broader strategy to support hands-on art education and enhance accessibility to ceramic materials.

-

In February 2024, Bhoomi Pottery partnered with IGA Galleria to co-host the Pune Potters’ Market 2024, showcasing handcrafted ceramic artware by over 40 Indian studio potters. The event highlighted Bhoomi’s leadership in sustainable pottery and its dedication to promoting artisanal craftsmanship in domestic and international markets.

Pottery Ceramics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.26 billion

Revenue forecast in 2033

USD 17.27 billion

Growth rate

CAGR of 4.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Turkey; China; Japan; India; Brazil; GCC

Key companies profiled

American Art Clay Co. (AMACO); Bhoomi Pottery; Bluematchbox Potters Supplies Ltd; CCGNZ Group Limited; Clay-King; Dick Blick Holdings Inc. (Blick Art Materials); Laguna Clay Company; Sajo Ceramics; Sheffield Pottery Inc.; Sounding Stone

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pottery Ceramics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global pottery ceramics market report based on product and region.

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Tableware

-

Artware

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global pottery ceramics market size was estimated at USD 11.83 billion in 2024 and is expected to reach USD 12.26 billion in 2025.

b. The global pottery ceramics market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2033, reaching USD 17.27 billion by 2033.

b. Tableware dominated the market by product, with a revenue share of over 73.0% in 2024.

b. Some of the key vendors in the global pottery ceramics market are American Art Clay Co. (AMACO), Bhoomi Pottery, Bluematchbox Potters Supplies Ltd, CCGNZ Group Limited, Clay-King, Dick Blick Holdings Inc. (Blick Art Materials), Laguna Clay Company, Sajo Ceramics, Sheffield Pottery Inc., and Sounding Stone.

b. The expanding hospitality and tourism industry drives the pottery ceramics market, where hotels, restaurants, and resorts increasingly seek aesthetically appealing ceramic tableware and décor to enhance guest experiences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.