- Home

- »

- Backup Power Solutions

- »

-

Power Rental Systems Market Size & Share Report, 2030GVR Report cover

![Power Rental Systems Market Size, Share & Trends Report]()

Power Rental Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Peak Shaving, Continuous Power, Standby Power), By End-use (Government and Utilities), By Region, And Segment Forecasts

- Report ID: 978-1-68038-016-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Rental Systems Market Size & Trends

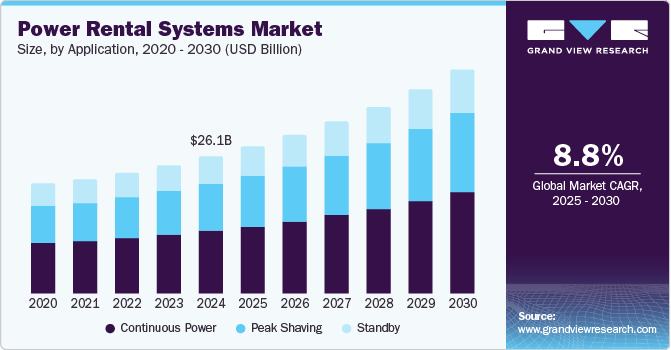

The global power rental systems market size was estimated at USD 26.11 billion in 2024 and is expected to grow at a CAGR of 8.8% from 2025 to 2030. This growth is attributed to increasing industrialization and urbanization, creating a higher demand for reliable electricity, particularly in regions with inadequate grid infrastructure. In addition, frequent power outages and the need for backup power during emergencies further boost the adoption of rental solutions. Furthermore, the expansion of construction and infrastructure projects necessitates temporary power sources. The integration of renewable energy technologies also enhances the appeal of power rental systems, making them a flexible and sustainable option for various industries.

Power rental offers significant benefits compared to purchasing power equipment. Rental generators provide essential flexibility in power ratings, incur minimal maintenance and installation costs, and are available on short notice, making them cost-effective. Industries typically opt for rental solutions when maintaining existing power systems, facing limited grid infrastructure, or requiring temporary power. This model is particularly popular for events worldwide.

The mining sector is a major user of rental power because its operations are often situated far from urban centers where grid access is lacking. Since mining projects are temporary, companies in this field favor rental generators to meet their energy needs without long-term commitments. Furthermore, manufacturing industries utilize rental generators to maintain existing systems or manage peak load demands during outages.

In addition, technological advancements are driving growth in the power rental market. Manufacturers focus on creating generators that boast improved fuel efficiency and reduced emissions while enhancing power output. These innovations lower operational costs and minimize environmental impacts, making rental solutions more appealing. Integrating renewable energy sources into rental offerings has led to the development of hybrid systems that deliver greater efficiency and lower fuel consumption than traditional diesel generators.

Moreover, the mining sector's demand for continuous power supply further propels market growth. Rental generator sets are essential for operations in areas with poor grid connectivity, especially in mining, where high-capacity generators are necessary for heavy-duty tasks. This trend indicates a robust market potential for larger generator sets in the mining industry, reflecting the increasing reliance on rental power solutions across various sectors.

Application Insights

Continuous power applications dominated the market and accounted for the largest revenue share of 45.7% in 2024. This growth is attributed to the increasing need for reliable electricity in the oil and gas, construction, and mining industries. In addition, these sectors often operate in remote locations with limited grid access, necessitating a dependable power source for prolonged periods. Furthermore, continuous power rental solutions ensure uninterrupted operations, support critical infrastructure, and enable businesses to maintain productivity without the risk of outages, thereby enhancing operational efficiency and reliability.

The peak shaving applications are expected to grow at a CAGR of 9.3% over the forecast period, owing to the need to manage energy consumption during high-demand periods. In addition, businesses often face increased electricity costs during peak hours, prompting them to seek temporary power solutions to reduce their reliance on the grid. By utilizing rental generators, companies can effectively lower their energy expenses while ensuring adequate power supply during peak load times. This approach optimizes operational costs and enhances overall energy management strategies within various industries.

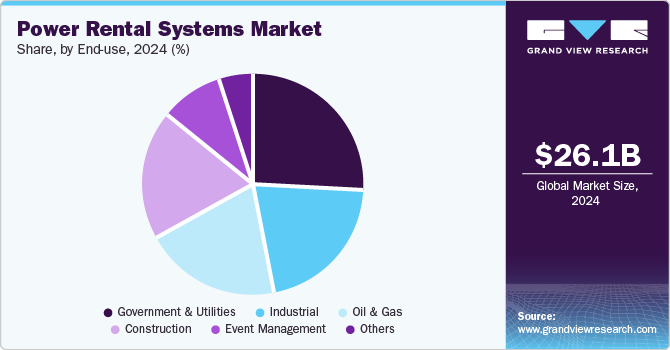

End-use Insights

The government and utilities segment led the market and accounted for the largest revenue share of 25.9% in 2024 attributed to the increasing demand for reliable, uninterrupted power supply. In addition, many regions, particularly developing areas, face challenges with inadequate grid infrastructure, leading to frequent outages. Power rental solutions provide a flexible and immediate response to these issues, ensuring that essential services remain operational. Furthermore, government initiatives aimed at infrastructure development and urbanization further propel the need for temporary power solutions to support various public projects.

The event management segment is expected to grow at a CAGR of 9.1% from 2025 to 2030, owing to the need for reliable electricity during large-scale events and festivals. Organizers often require temporary power solutions to ensure seamless operations without interruptions. In addition, rental power's flexibility allows event planners to tailor their energy needs according to specific requirements, accommodating everything from lighting to sound systems. Moreover, as the popularity of outdoor events increases, so does the reliance on power rentals, making it a vital component for successful event execution.

Regional Insights

The North America power rental systems market is expected to grow substantially over the forecast period, driven by power infrastructure and frequent outages. Industries such as construction, oil and gas, and event management increasingly rely on rental generators as a reliable backup during emergencies or planned maintenance. In addition, the growing awareness of the need for uninterrupted operations further propels this market segment. Moreover, natural disasters prompt businesses to seek temporary power solutions quickly, reinforcing the importance of rental services in maintaining operational continuity.

U.S. Power Rental Systems Market Trends

The growth of the power rental market in the U.S. is fueled by a rising demand for innovative solutions that enhance operational efficiency and reduce environmental impact. Furthermore, technological advancements in generator design lead to improved fuel efficiency and lower emissions, making rental options more appealing to businesses aiming for sustainability. Moreover, the increasing frequency of natural disasters necessitates a robust rental infrastructure capable of providing immediate support during crises, solidifying the role of power rentals as a critical component of energy management strategies across various sectors.

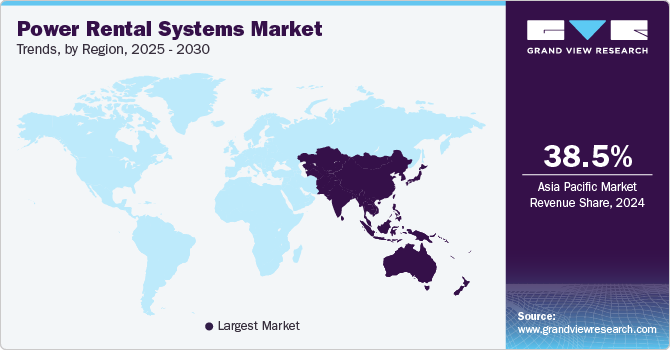

Asia Pacific Power Rental Systems Market Trends

The Asia Pacific power rental systems market dominated the global market and accounted for 38.5% in 2024 attributed to rapid industrialization and urbanization across the region. Countries like India and China are witnessing significant infrastructure development, which requires reliable temporary power solutions. In addition, frequent power outages and limited grid access in many areas further drive the demand for rental generators. Furthermore, the increasing adoption of renewable energy sources encourages businesses to utilize power rental systems as a flexible solution to meet their energy needs during peak times and emergencies.

China power rental systems market led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by significant technological advancements in generator efficiency and emissions reduction. In addition, the government’s focus on sustainable energy solutions has led to increased investments in hybrid systems combining traditional fuels and renewable sources. These innovations enhance the appeal of rental services, providing reliable and environmentally friendly options for industries facing high energy demands. Furthermore, China's rapid economic growth necessitates flexible power solutions to support its expanding manufacturing and construction sectors.

Latin America Power Rental Systems Market Trends

The power rental systems market in Latin America is expected to grow at a CAGR of 9.9% over the forecast period, owing to the ongoing infrastructure development projects. Many countries in the region are investing heavily in construction activities that require temporary power solutions, particularly in remote areas where grid connectivity is insufficient. In addition, the need for reliable on-site electricity to support these projects drives the demand for rental services. Furthermore, economic fluctuations often lead businesses to prefer renting over purchasing equipment, further boosting market growth.

Europe Power Rental Systems Market Trends

Europe power rental systems market is expected to grow significantly over the forecast period, driven by the rising demand for reliable and uninterrupted power supply across various industries such as construction, events, and utilities. In addition, the issue of power outages and the need for backup solutions during emergencies have amplified the reliance on rental services. Moreover, the increasing focus on sustainability has shifted towards greener rental options, with companies investing in hybrid systems that integrate renewable energy sources. Regulatory pressures to reduce carbon emissions further enhance the market's evolution, presenting opportunities for innovative power rental solutions.

The power rental systems market in Germany dominated the European market and accounted for the largest revenue share in 2024. This growth is attributed to a strong emphasis on renewable energy integration and energy efficiency. In addition, the country's commitment to transitioning towards sustainable energy sources encourages industries to adopt rental solutions that align with environmental goals. Furthermore, as companies seek to minimize operational costs while ensuring compliance with stringent regulations, the flexibility offered by power rentals becomes increasingly attractive.

Key Power Rental Systems Company Insights

Some of the key players in the market include Aggreko, Herc Rentals Inc., APR Energy, and others. These companies are adopting various strategies to enhance their competitive edge. These include launching innovative products that cater to evolving customer needs, forming strategic partnerships to expand service offerings, and entering agreements that enhance market reach. Furthermore, companies focus on sustainability by integrating renewable energy solutions into their rental services. These strategies aim to improve operational efficiency, meet regulatory requirements, and address the growing demand for reliable and environmentally friendly power solutions across diverse industries.

-

Herc Rentals Inc. specializes in renting heavy equipment, tools, generators, and pumps, enabling clients to manage their power needs efficiently without the burden of ownership. The company delivers reliable temporary power solutions, including emergency and standby power systems, to support critical operations across numerous sectors while ensuring safety and compliance with industry standards.

-

APR Energy designs and deploys modular power plants that provide flexible and scalable electricity generation to meet specific customer requirements. The company emphasizes rapid deployment capabilities, effectively allowing clients to address urgent power needs. APR Energy aims to deliver sustainable and efficient power rental solutions supporting global economic growth and infrastructure development by integrating advanced technologies and renewable energy sources into its offerings.

Key Power Rental Systems Companies:

The following are the leading companies in the power rental systems market. These companies collectively hold the largest market share and dictate industry trends.

- Aggreko

- Herc Rentals Inc.

- APR Energy

- Caterpillar

- United Rentals, Inc.

- Cummins Inc.

- Ashtead Group plc

- Atlas Copco AB

- Al Faris

- Shenton Group

- Hertz System, Inc.

- Kohler Co.

- Bredenoord

- HIMOINSA

Recent Developments

-

In January 2024, Aggreko completed the acquisition of RenEnergy Group's UK and South African operations, enhancing its presence in the power rental systems market. RenEnergy specializes in solar energy and energy storage solutions for commercial and industrial clients, offering services such as installing solar panels and charging systems. Following the acquisition, RenEnergy will maintain its brand, aiming to leverage Aggreko's resources for growth in the renewable energy sector, as both companies seek to expand their capabilities and client solutions.

-

In October 2023, Shenton Group announced the expansion of its rental fleet to include 500kVA generators, enhancing its offerings in the power rental systems market. These high-capacity generators are designed to provide reliable power supply for critical applications across various sectors, including manufacturing and healthcare. The generators are versatile, allowing for diverse configurations and seamless synchronization. Shenton Group emphasizes customer satisfaction with 24/7 support and efficient fuel management, ensuring uninterrupted power for essential operations.

Power Rental Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.04 billion

Revenue forecast in 2030

USD 42.74 billion

Growth Rate

CAGR of 8.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; Brazil; Argentina; UAE; Qatar

Key companies profiled

Aggreko; Herc Rentals Inc.; APR Energy; Caterpillar; United Rentals, Inc.; Cummins Inc.; Ashtead Group plc; Atlas Copco AB; Al Faris; Shenton Group; Hertz System, Inc.; Kohler Co.’ Bredenoord; HIMOINSA.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Power Rental Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global power rental systems market report based on end-use, application, and region:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government and Utilities

-

Oil & Gas

-

Construction

-

Industrial

-

Event Management

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Peak Shaving

-

Continuous Power

-

Standby

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Qatar

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.