- Home

- »

- Advanced Interior Materials

- »

-

Pre-Insulated Pipes Market Size, Share, Industry Report 2030GVR Report cover

![Pre-Insulated Pipes Market Size, Share & Trends Report]()

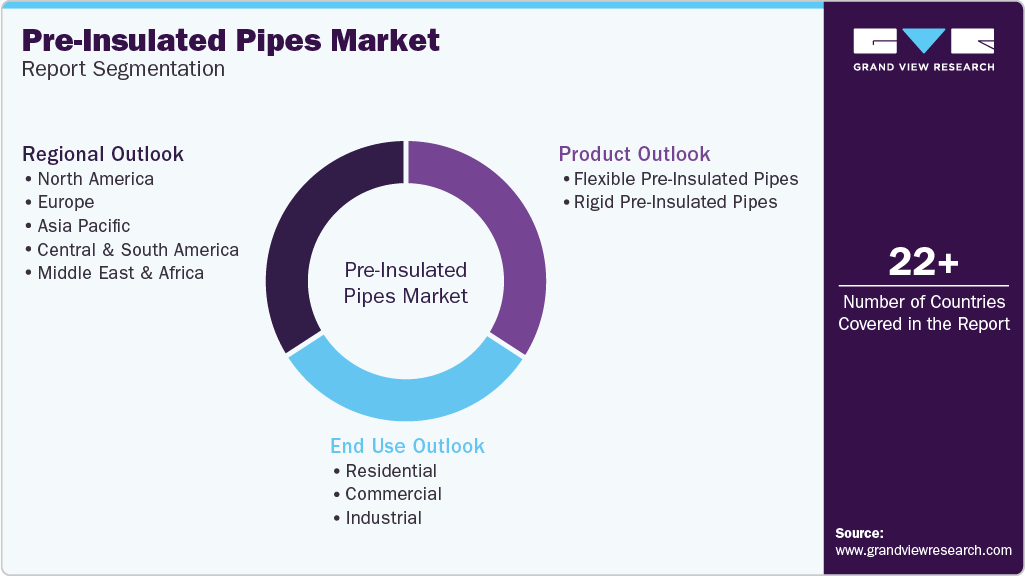

Pre-Insulated Pipes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Flexible Pre-Insulated Pipes, Rigid Pre-Insulated Pipes), By End Use (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-595-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pre-Insulated Pipes Market Size & Trends

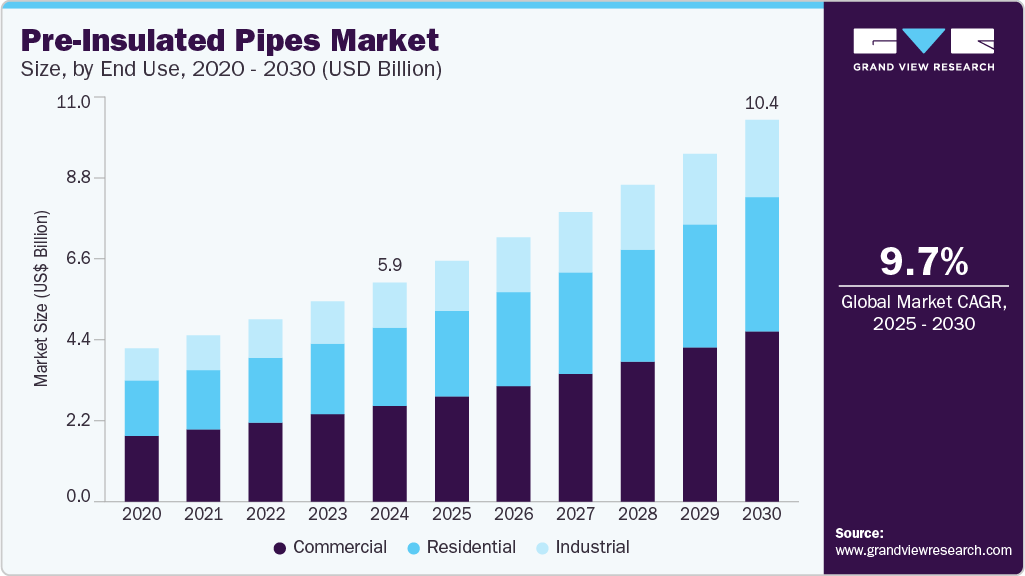

The global pre-insulated pipes market size was estimated at USD 5.97 billion in 2024 and is projected to grow at a CAGR of 9.7% from 2025 to 2030, driven by the rising demand for efficient and sustainable thermal insulation solutions in district heating and cooling systems.

Key Highlights:

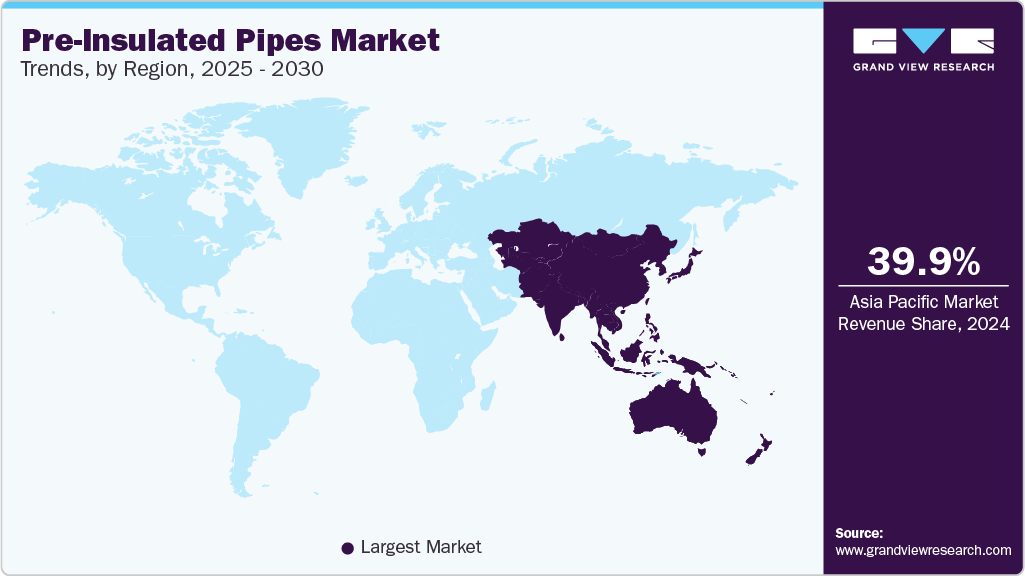

- Asia Pacific pre-insulated pipes industry dominated globally with the largest revenue share of about 39.96% in 2024.

- China's pre-insulated pipes industry is primarily driven by large-scale urban infrastructure development and the aggressive rollout of district heating systems, particularly in colder regions.

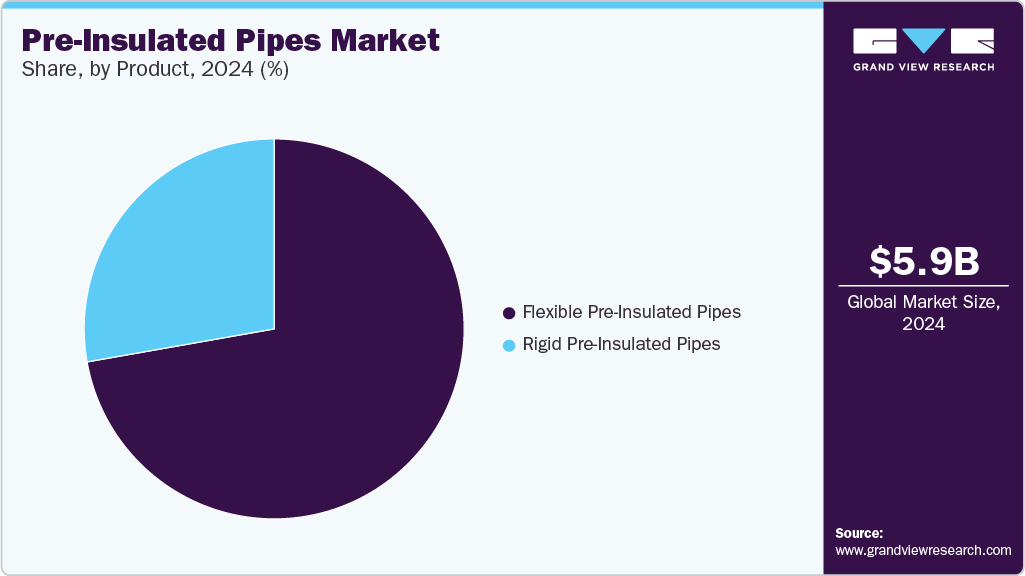

- Based on product, the flexible pre-insulated pipes segment led the market with the largest revenue share of 72.2% in 2024.

- Based on end use, the commercial segment dominated the market with the largest revenue share of 43.8% in 2024.

As urbanization accelerates and governments prioritize energy efficiency, district energy networks have become critical infrastructure in reducing heat losses and optimizing energy use.

Pre-insulated pipes, known for their superior thermal performance and reduced operational costs, have emerged as an ideal solution for transporting hot and cold fluids over long distances while minimizing energy loss. This has especially been evident in European and North American regions, where energy conservation mandates and carbon neutrality goals are actively promoted.

Infrastructure modernization in emerging economies is also a crucial factor driving market growth. Governments across Asia Pacific, Latin America, and the Middle East are investing heavily in smart cities, industrial zones, and urban utility upgrades. These development initiatives are encouraging the use of durable and energy-efficient piping systems like pre-insulated pipes, particularly in water supply, sewage treatment, and HVAC applications. Moreover, rising awareness of lifecycle cost savings and reduced maintenance needs associated with pre-insulated pipes has made them increasingly attractive for large-scale infrastructure projects.

The rapid expansion of the oil & gas and chemical processing sectors contributes significantly to market growth. These industries rely on pre-insulated piping systems for the safe and efficient transport of temperature-sensitive fluids across pipelines in harsh environments. Pre-insulated pipes help maintain process temperatures and protect against external temperature variations, which is critical for maintaining product integrity and operational efficiency. The increasing number of onshore and offshore pipeline installations, coupled with advancements in polyurethane foam insulation technology, has further boosted adoption across these sectors.

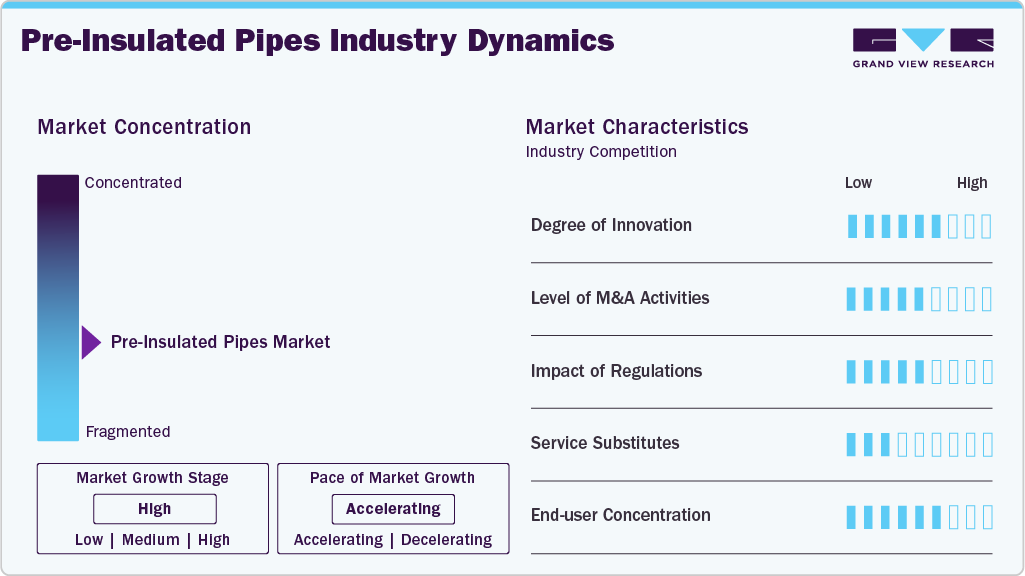

Market Concentration & Characteristics

The global pre-insulated pipes industry exhibits moderate-to-high market concentration, with a few key players accounting for a significant share due to their technological expertise, global distribution networks, and long-standing customer relationships. The degree of innovation in the market is notably high, particularly in insulation materials and pipe coatings aimed at improving thermal efficiency, corrosion resistance, and service life. Players continually invest in R&D to develop sustainable and energy-efficient solutions to meet the growing demand from district heating, oil and gas, and industrial applications. In addition, the market has witnessed a rising level of mergers, acquisitions, and strategic collaborations aimed at expanding product portfolios, enhancing regional presence, and meeting evolving customer requirements.

Regulatory frameworks play a critical role in shaping the dynamics of the pre-insulated pipes industry. Environmental and energy-efficiency regulations across Europe, North America, and other developed economies strongly influence product development, especially concerning low-emission materials and insulation performance. The availability of service substitutes remains limited, given the unique thermal and mechanical performance characteristics of pre-insulated pipe systems. However, end user concentration varies across segments, with district heating and cooling systems representing a significant portion of demand in Europe and urban areas worldwide, while the oil and gas sector drives demand in the Middle East, Asia Pacific, and North America. This concentration underscores the importance of aligning product offerings with specific industry needs and regional compliance standards.

Product Insights

The flexible pre-insulated pipes segment led the market with the largest revenue share of 72.2% in 2024, driven by the increasing demand for efficient and easy-to-install piping solutions in residential and commercial district heating and cooling systems. These pipes offer superior flexibility, allowing for simplified routing in complex and constrained installations, which significantly reduces installation time and labor costs. Their lightweight construction also facilitates faster deployment, particularly in urban infrastructure projects where space constraints and installation speed are critical considerations. This efficiency makes them an ideal choice for retrofitting older buildings and for applications in remote or difficult-to-access locations.

The rigid pre-insulated pipes segment is expected to grow at the fastest CAGR of 9.9% over the forecast period, driven by its superior thermal insulation capabilities and structural integrity. These pipes are widely preferred in district heating and cooling networks due to their ability to minimize thermal losses over long distances, ensuring energy efficiency and cost-effectiveness. The rigidity of the pipes allows for straightforward installation in trenchless systems and underground networks, reducing labor costs and construction time. Moreover, the rising demand for sustainable energy infrastructure in urban areas has propelled the adoption of rigid pre-insulated pipes, especially in regions focused on enhancing green building certifications and energy conservation measures.

End Use Insights

The commercial segment dominated the market with the largest revenue share of 43.8% in 2024, driven by rising demand for energy-efficient and cost-effective thermal insulation systems in commercial infrastructure. Increasing construction of commercial buildings such as shopping centers, office complexes, hotels, hospitals, and educational institutions has escalated the need for efficient district heating and cooling networks. Pre-insulated pipes offer a reliable solution for maintaining the thermal integrity of fluids being transported over long distances, thereby ensuring optimal energy usage and reduced utility costs in commercial applications.

The residential segment is expected to grow significantly at a CAGR of 9.5% over the forecast period, driven by the rising adoption of district heating and cooling systems in urban residential developments. Increasing urbanization and the demand for energy-efficient solutions in heating infrastructure are compelling developers and municipalities to adopt pre-insulated piping systems. These systems offer minimal heat loss, long service life, and low maintenance, making them ideal for residential applications where consistent thermal performance and cost-effectiveness are critical.

Regional Insights

The pre-insulated pipes industry in North America is witnessing growth underpinned by the stringent energy efficiency regulations and strong investments in modernizing existing district heating and cooling systems. The U.S. and Canada are increasingly focusing on sustainable construction practices and carbon footprint reduction in the built environment. In addition, aging infrastructure replacement and the expansion of urban areas are fueling demand for pre-insulated piping, especially in large-scale residential and institutional projects.

U.S. Pre-Insulated Pipes Market Trends

The U.S. pre-insulated pipes industry is propelled by federal and state-level incentives promoting energy-efficient infrastructure, especially within commercial and residential heating networks. The emphasis on green building certifications and environmentally responsible construction is encouraging adoption across new developments. Furthermore, the need to refurbish aging heating and cooling systems in cities is generating consistent demand for high-performance insulated piping.

Asia Pacific Pre-Insulated Pipes Market Trends

Asia Pacific pre-insulated pipes industry dominated globally with the largest revenue share of about 39.96% in 2024. The Asia Pacific market is witnessing robust growth due to rapid urbanization, infrastructure expansion, and government-led initiatives supporting district heating and cooling networks. Countries such as India, Japan, and South Korea are investing significantly in smart city projects and energy-efficient building systems. In addition, the rising focus on reducing carbon emissions and energy consumption across the public and private sectors is leading to increased adoption of pre-insulated piping systems in both residential and industrial applications.

China's pre-insulated pipes industry is primarily driven by large-scale urban infrastructure development and the aggressive rollout of district heating systems, particularly in colder regions. Government regulations mandating energy-efficient construction practices and the country’s commitment to carbon neutrality are fostering demand for thermally insulated piping. The ongoing modernization of utility networks and replacement of aging pipelines further support market growth, alongside extensive investments in smart city developments.

Europe Pre-Insulated Pipes Market Trends

Europe pre-insulated pipes industry remains a key market due to its mature district energy sector and strong regulatory framework promoting thermal efficiency and emissions reduction. Countries across the region are aggressively upgrading heating infrastructure as part of their climate commitments, particularly under the European Green Deal. High awareness of energy conservation, coupled with advanced engineering standards, is fostering widespread use of pre-insulated pipes in both public and private sector projects.

Germany’s pre-insulated pipes industry is being driven by the country's transition to renewable energy and a strong push toward sustainable urban heating solutions. The expansion of district heating networks, supported by federal energy efficiency subsidies, is a major contributor to demand. Furthermore, the country's focus on reducing dependence on fossil fuels and achieving its long-term climate goals is encouraging investment in durable, high-insulation pipe systems.

Latin America Pre-Insulated Pipes Market Trends

The pre-insulated pipes industry in Latin America is emerging gradually, with demand spurred by increasing industrial activity and infrastructure development in countries such as Brazil and Mexico. While district heating is less common, the growing adoption of energy-efficient technologies in urban development projects is creating opportunities. In addition, government-backed infrastructure modernization and the need for efficient utility distribution systems are beginning to support market expansion.

Middle East & Africa Pre-Insulated Pipes Market Trends

The pre-insulated pipes industry in the Middle East & Africa is primarily driven by the demand for efficient cooling solutions due to the region’s arid climate. District cooling systems are gaining traction in Gulf countries like the UAE and Saudi Arabia, where urban development and commercial construction are booming. In addition, the need to reduce water and energy consumption in infrastructure, combined with government sustainability initiatives, is contributing to market growth across the region.

Key Pre-Insulated Pipes Company Insights

Some of the key players operating in the market include Aquatherm and Brugg Group.

-

Aquatherm is a Germany-based company recognized globally for its plastic piping systems, particularly used in heating, cooling, and potable water applications. The company emphasizes sustainable production and has a strong reputation for durable and corrosion-resistant systems. Aquatherm’s pre-insulated pipe product line includes the Aquatherm TI and Aquatherm Blue pipe, designed for chilled and hot water networks.

-

Brugg Group, headquartered in Switzerland, operates through multiple divisions, with Brugg Pipesystems being the specialized unit for piping solutions. The group has a global footprint and offers robust engineering and thermal insulation expertise. Brugg Group provides pre-insulated pipes under brands like CALPEX and ECOFLEX, used in district heating, cooling, and industrial piping networks.

CPV Ltd. and Durotan are some of the emerging market participants in the pre-insulated pipes industry.

-

CPV Ltd., based in the UK, is a leader in specialist pipe systems with a strong heritage in manufacturing pre-insulated pipe systems for energy and chemical industries. The company's Hiline range of pre-insulated pipe systems includes Hiline Standard, Hiline Aqua, and Hiline Solar, used extensively in district heating, cooling, and renewable energy installations.

-

Durotan is a UK-based provider of district heating solutions and is one of the longest-standing companies in the market for pre-insulated pipe systems. It supplies the Logstor brand of pre-insulated pipe systems, offering steel and polymer-based options that serve municipal heating grids, commercial facilities, and energy recovery systems.

Key Pre-Insulated Pipes Companies:

The following are the leading companies in the pre-insulated pipes market. These companies collectively hold the largest market share and dictate industry trends.

- Aquatherm

- Brugg Group

- Brugg Pipesystems

- CPV Ltd.

- Durotan

- Flexalen

- Georg Fischer

- Insulcon

- Isoplus

Recent Developments

-

In February 2024, Nexans, a prominent player in the energy transition sector, introduced a new line of pre-insulated aluminum composite cables (ACCS) specifically designed for offshore wind farms. This innovative launch is intended to meet the rising need for renewable energy infrastructure while enhancing overall energy efficiency.

Pre-Insulated Pipes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.55 billion

Revenue forecast in 2030

USD 10.38 billion

Growth Rate

CAGR of 9.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Aquatherm; Brugg Group; Brugg Pipesystems; CPV Ltd.; Durotan; Flexalen; Georg Fischer; Insulcon; Isoplus

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pre-Insulated Pipes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pre-insulated pipes market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flexible Pre-Insulated Pipes

-

Rigid Pre-Insulated Pipes

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global pre-insulated pipes market size was estimated at USD 5.97 billion in 2024 and is expected to reach USD 6.55 billion in 2025.

b. The global pre-insulated pipes market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2030 to reach USD 10.38 billion by 2030.

b. The flexible pre-insulated pipes segment led the market and accounted for the largest revenue share of 72.2% in 2024, driven by the increasing demand for efficient and easy-to-install piping solutions in residential and commercial district heating and cooling systems.

b. Some of the prominent companies in the pre-insulated pipes market include Aquatherm, Brugg Group, Brugg Pipesystems, CPV Ltd., Durotan, Flexalen, Georg Fischer, Insulcon, and Isoplus.

b. Key factors driving the pre-insulated pipes market include increasing demand for energy-efficient solutions, rising investments in district heating and cooling systems, and growing urban infrastructure development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.