- Home

- »

- Advanced Interior Materials

- »

-

Insulation Market Share And Share, Industry Report, 2033GVR Report cover

![Insulation Market Size Share & Trends Report]()

Insulation Market (2025 - 2033) Size Share & Trends Analysis Report By Product (Glass Wool, Mineral Wool), By End Use (Infrastructure, Industrial, HVAC & OEM), By Region (North America, Asia Pacific, Europe, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: 978-1-68038-196-2

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Insulation Market Summary

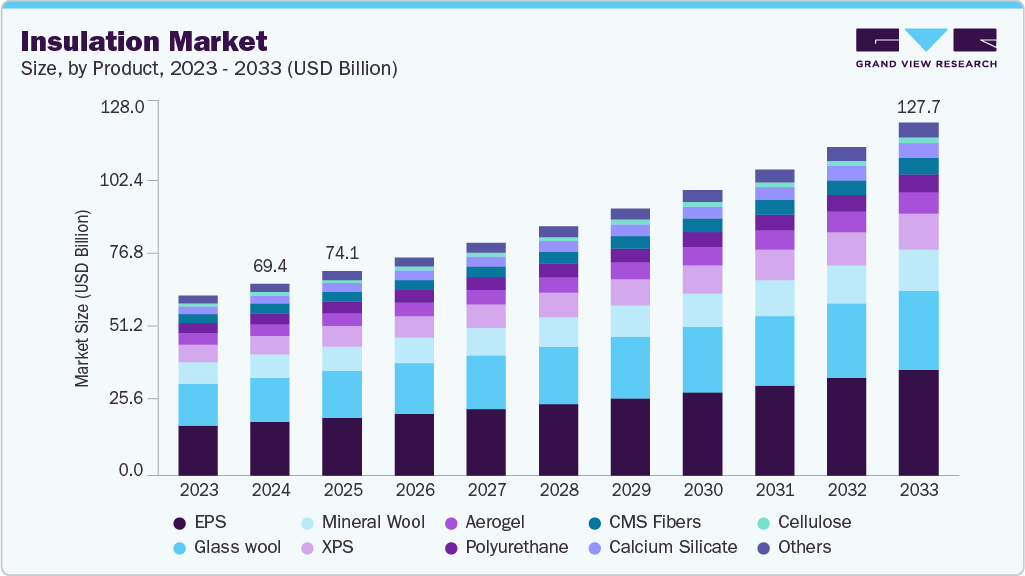

The global insulation market size was estimated at USD 69.43 billion in 2024 and is projected to reach USD 127.70 billion by 2033, growing at a CAGR of 7.0% from 2025 to 2033. Rising consumer awareness pertaining to energy conservation is likely to remain a crucial driving factor for the global insulation industry.

Key Market Trends & Insights

- Asia Pacific dominated the insulation market with the largest revenue share of 42.4% in 2024.

- By product, the EPS segment is expected to grow at the fastest CAGR of 7.9% over the forecast period.

- By application, the infrastructure segment is expected to grow at fastest CAGR of 7.3% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 69.43 Billion

- 2033 Projected Market Size: USD 127.70 Billion

- CAGR (2025-2033): 7.0%

- Asia Pacific: Largest and Fastest market in 2024

Favorable regulations in a majority of regions are also expected to have a positive impact on market growth. In addition, increased infrastructure spending in the emerging markets of the Asia Pacific & Latin America is expected to propel the insulation industry growth. On the other hand, fluctuating prices of the fundamental raw materials are expected to continue to pose a challenge for market participants.Rapid urbanization and increasing construction activities across developing economies are major demand drivers. Regulatory mandates related to thermal performance and energy savings have prompted builders to use advanced insulation solutions. The rise in HVAC installations, especially in commercial and retail sectors, creates indirect demand. Innovations in material science, such as vacuum insulation panels, aerogels, and spray foam, are enabling better thermal performance at lower thicknesses. Sustainability-driven consumers and corporations are also influencing the selection of eco-friendly, recyclable insulation products. Moreover, the rising prominence of temperature-sensitive logistics, like pharmaceuticals and food, has expanded insulation needs beyond construction.

The market is witnessing a shift toward environmentally sustainable insulation materials, including sheep wool, cellulose, mycelium, and recycled denim. High-performance aerogels, vacuum insulation panels (VIPs), and phase-change materials (PCMs) are gaining ground in high-end applications. Smart insulation integrated with IoT sensors for thermal performance tracking is emerging. Modular and prefabricated construction methods are increasing the use of factory-fitted insulation panels. Companies are investing in low-emission and fire-resistant insulation materials. Digital tools are also being used to simulate energy savings pre-construction. Overall, sustainability, circularity, and performance optimization are shaping R&D in the insulation industry.

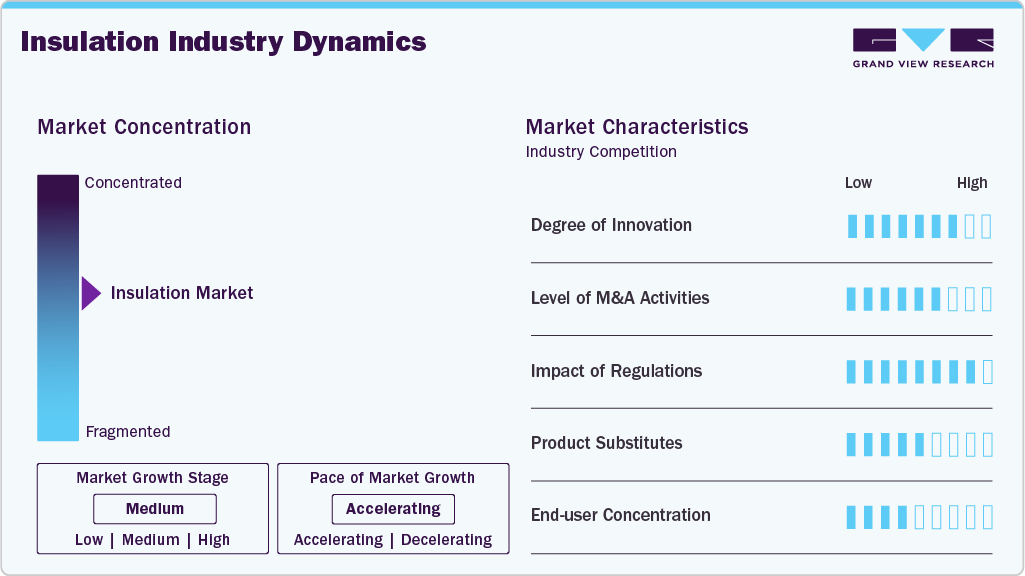

Market Concentration & Characteristics

The global insulation industry is moderately consolidated, with a few major players occupying significant shares across multiple geographies. However, several regional and niche manufacturers thrive in domestic and specialty segments, especially in eco-friendly and custom insulation. Vertical integration of raw material production and distribution is seen among key players. Intense competition in commodity insulation types (glass wool, EPS, XPS) keeps pricing pressure high. Consolidation through mergers and acquisitions is ongoing, with companies seeking portfolio diversification and regional reach, particularly in Asia Pacific and Latin America.

While insulation is essential for thermal and acoustic performance, substitution risk is relatively low in regulated environments due to compliance needs. However, competition exists among different insulation types (e.g., mineral wool vs. spray foam vs. cellulose) based on cost, performance, and fire resistance. Reflective barriers and smart glass windows can reduce the need for traditional insulation in some cases. In unregulated construction, thinner and cheaper alternatives may be chosen. Overall, the threat of substitutes is moderate and primarily driven by cost-performance trade-offs, environmental impact, and ease of installation.

Product Insights

The expanded polystyrene (EPS) insulation segment led the market with the largest revenue share of 27.8% in 2024, owing to its lightweight nature, cost-effectiveness, and excellent thermal resistance. Its wide applicability across residential and commercial buildings, coupled with moisture resistance and compressive strength, makes it a preferred choice for walls, roofs, and floors. EPS is particularly popular in developing economies due to its affordability and availability. Furthermore, its easy installation and compatibility with green building standards have contributed to its strong uptake in insulation retrofits and new construction projects.

The glass wool segment is expected to grow at the fastest CAGR of 6.7% over the forecast period, driven by its superior acoustic and thermal insulation properties, fire resistance, and sustainability credentials. Increasing demand from residential and commercial sectors, especially in regions with stringent fire safety norms like Europe, is pushing its adoption. Glass wool is also recyclable and increasingly used in green-certified buildings. As awareness of energy efficiency and noise insulation grows in urban settings, this segment is expected to gain traction in both retrofit and new-build applications globally.

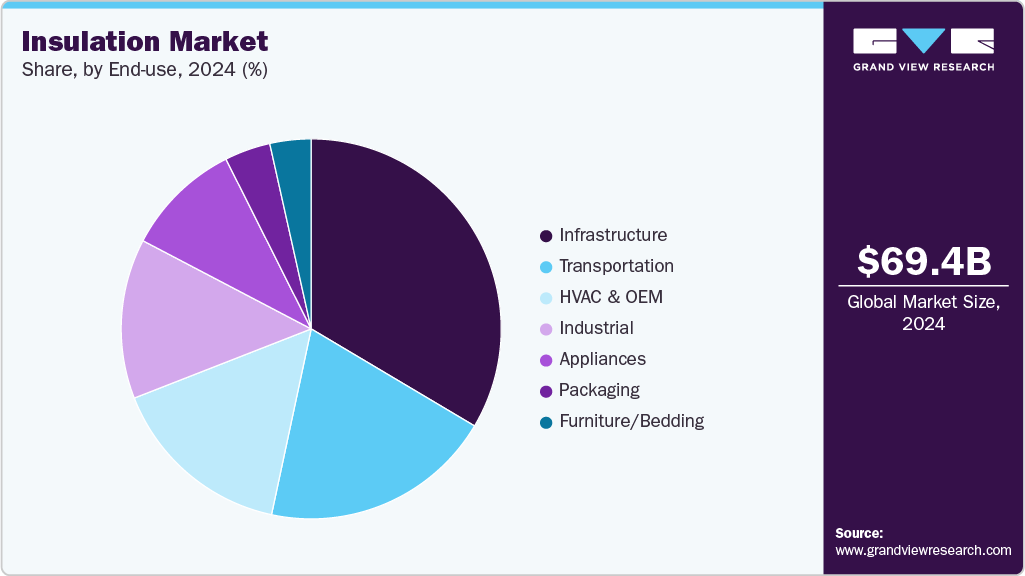

End Use Insights

The infrastructure segment led the market with the largest revenue share of 33.5% in 2024, due to the extensive use of thermal and acoustic insulation in residential, commercial, and industrial buildings. Insulation materials are crucial for improving energy efficiency, reducing HVAC loads, and ensuring indoor comfort. Rising adoption of green building codes and building energy performance regulations across regions like North America, Europe, and the Asia Pacific has further driven demand. Both new construction and retrofitting of aging infrastructure have contributed to the dominance of this segment, supported by increasing urbanization and government initiatives promoting sustainable housing.

The transportation segment is expected to grow at the fastest CAGR of 7.3% over the forecast period, particularly across the automotive, aerospace, and marine industries. The growing focus on fuel efficiency, noise reduction, and thermal comfort in vehicles has spurred the use of lightweight and high-performance insulation materials. Electric vehicles (EVs) especially require effective thermal management systems, boosting demand for advanced insulation solutions. In addition, the increasing production of aircraft and the expansion of refrigerated transport fleets for pharmaceuticals and food have further contributed to insulation demand in the transportation sector.

Regional Insights

The insulation market in North America is being driven by strict energy efficiency codes and increased awareness of building performance. Residential retrofitting under weatherization programs and demand from commercial structures like malls and data centers is high. The adoption of spray foam insulation and eco-friendly materials is increasing. Canada is witnessing a rise in green building certifications, further boosting insulation usage. The region also sees demand from cold storage facilities and pharmaceutical manufacturing, especially post-pandemic.

U.S. Insulation Market Trends

The insulation market in the U.S. is driven by residential energy retrofits and compliance with DOE and EPA programs. Strong demand exists for fiberglass and spray foam in both new and existing buildings. Tax credits for energy-efficient renovations and LEED-certified projects incentivize insulation. Innovations in green materials and smart insulation systems are also being adopted. Industrial demand remains high from sectors like oil & gas, food processing, and logistics. A rising trend in prefab construction and modular housing is increasing the use of pre-insulated components.

Asia Pacific Insulation Market Trends

Asia Pacific dominated the insulation market with the largest revenue share of 42.4% in 2024, due to robust residential and infrastructure development across China, India, and Southeast Asia. Urbanization and industrial expansion, combined with government mandates for energy-efficient buildings, have fueled uptake. Retrofitting programs in older commercial buildings, along with growth in cold storage and electronics manufacturing, also contributed. Material affordability and local production capabilities support cost-effective adoption, especially in China and India. Export potential and regional investments in green housing and smart cities further strengthen Asia Pacific’s dominance.

The insulation market in China remains a powerhouse in insulation production and consumption, driven by rapid infrastructure development, cold chain expansion, and large-scale residential housing. The government’s push for energy-efficient and green buildings under its Five-Year Plans has directly impacted insulation demand. Domestic firms dominate the market, offering mineral wool, EPS, and newer sustainable materials. Insulation in prefabricated housing and industrial refrigeration is an emerging focus area. Environmental compliance pressures are prompting the industry to innovate and switch to low-emission manufacturing processes.

Europe Insulation Market Trends

The insulation market in Europe benefits from stringent environmental laws and incentives under the EU Green Deal. Retrofitting aging infrastructure in Germany, France, and the UK plays a key role. Mineral wool, glass wool, and rigid foams dominate, while organic and recycled materials are growing in share. Acoustic insulation demand is high due to urban noise concerns. Passive house construction norms in countries like Austria and Sweden encourage High-R insulation. Fire safety regulations post-Grenfell have accelerated the use of non-combustible insulation.

The Germany insulation market accounted for the largest market revenue share in Europe in 2024, due to strong building codes, retrofitting programs, and widespread passive house adoption. Government incentives for energy upgrades and decarbonization goals are major drivers. Mineral wool and wood fiber insulation are preferred due to sustainability and fire safety. The country also emphasizes locally sourced, low-emission materials. Industrial insulation demand comes from automotive and manufacturing facilities. Circular economy principles influence insulation material choices, promoting recyclability.

Central & South America Insulation Market Trends

The insulation market in Central & South America is witnessing gradual market growth, led by Brazil and Mexico. Urbanization, infrastructure upgrades, and rising awareness of energy savings contribute to demand. The market is still developing, with cost-effective materials like EPS and fiberglass being widely used. Government policies are not as strict as in developed regions, but sustainability initiatives and foreign investment in green construction are encouraging growth. Climatic variations across the continent drive varying insulation needs in different countries.

Middle East & Africa Insulation Market Trends

The insulation market in the Middle East & Africa region is adopting insulation mainly for thermal protection in extreme climates and energy efficiency in buildings. GCC countries like the UAE and Saudi Arabia are mandating green building codes, boosting insulation demand. Fiberglass and polyurethane foams are commonly used in commercial and industrial projects. Africa’s market is smaller but growing, with infrastructure development in South Africa, Kenya, and Nigeria pushing basic insulation uptake. Demand from oil & gas and refrigerated storage adds industrial value.

Key Insulation Company Insights

The insulation industry is characterized by the presence of various small- and large-scale vendors, resulting in a moderate level of concentration in the market. The surging requirement for insulation solutions is fueling the growth of the market. The market players are concentrating on new joint ventures, collaborations, agreements, and strategies to advance their production facilities and gain a larger market share.

Biesanz Stone Co. and Michigan Limestone & Chemical Company are the major limestone suppliers, while Alfa Aesar and American Borate Company supply borates. Companies such as BASF, Bayer, and Dow Chemical Company dominate the raw material supply for foamed plastic insulation products.

Key Insulation Companies:

The following are the leading companies in the insulation market. These companies collectively hold the largest market share and dictate industry trends.

- GAF Materials Corporation

- Huntsman International LLC

- Johns Manville

- Cellofoam North America, Inc.

- Rockwool International A/S

- DuPont

- Owens Corning

- Atlas Roofing Corporation

- Saint-Gobain S.A.

- Kingspan Group

- BASF

- Knauf Insulation

- Armacell International Holding GmbH

- URSA

- Covestro AG

- Recticel NV/SA

- Carlisle Companies, Inc.

- Bridgestone Corporation

- Fletcher Building

- 3M Company

Recent Developments

-

In August 2022, Owens Corning acquired Natural Polymers, LLC, which is a Cortland, Illinois-based manufacturer of spray polyurethane foam insulation for building and construction applications.

-

In January 2022, Knauf Insulation acquired glass mineral wool plant in Romania. This acquisition will provide Knauf Insulation a better reach to its customers in Europe.

Insulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 74.05 billion

Revenue forecast in 2033

USD 127.70 billion

Growth rate

CAGR of 7.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2021 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Asia Pacific; Europe; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea

Key companies profiled

GAF Materials Corp.; Huntsman International LLC; Johns Manville; Cellofoam North America, Inc.; Rockwool International A/S; DuPont; Owens Corning; Atlas Roofing Corporation; Saint-Gobain S.A.; Kingspan Group; BASF; Knauf Insulation; Armacell International Holding GmbH; URSA; Covestro AG; Recticel NV/SA; Carlisle Companies, Inc.; Bridgestone Corporation; Fletcher Building; 3M Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insulation Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the insulation market report based on the product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Glass Wool

-

Mineral Wool

-

EPS

-

XPS

-

CMS Fibers

-

Calcium Silicate

-

Aerogel

-

Cellulose

-

PIR

-

Phenolic Foam

-

Polyurethane

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Infrastructure

-

Industrial

-

HVAC & OEM

-

Transportation

-

Appliances

-

Furniture

-

Packaging

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.