- Home

- »

- Clothing, Footwear & Accessories

- »

-

Pre-owned Luxury Watches Market Size, Share Report, 2030GVR Report cover

![Pre-owned Luxury Watches Market Size, Share & Trends Report]()

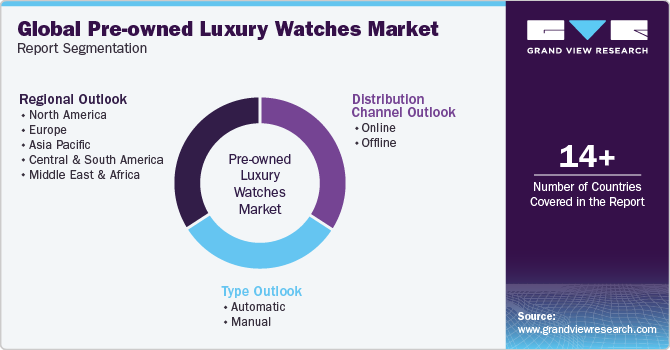

Pre-owned Luxury Watches Market Size, Share & Trends Analysis Report By Type (Automatic, Manual), By Distribution Channel (Online, Offline), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-161-5

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Pre-owned Luxury Watches Market Trends

The global pre-owned luxury watches market size was valued at USD 24.38 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030. The market for pre-owned luxury watches has experienced remarkable growth in recent years, driven by several key factors. The enduring appeal of luxury watches as status symbol and collectible item plays a crucial role. These timepieces often hold their value or even appreciate over time, making them attractive investments for buyers. The allure of owning a prestigious brand such as Rolex, Patek Philippe, or Audemars Piguet transcends generations, further bolstering demand in the market.

The secondhand market for luxury goods, including watches, has witnessed immense progress due to the cost-of-living crisis and the increasing demand for sustainability. While some buyers are attracted to the affordability of secondhand items, certain luxury watches, such as Rolex, can be more expensive than the original price due to high demand and limited supply. Secondhand markets offer immediate availability, and some customers are willing to pay more for exclusive and discontinued models. However, there is a risk of counterfeit products in the secondhand market, although some companies offer authentication programs. Overall, the luxury secondhand market continues to attract customers, driven by a desire for status-defining items and immediate access.

The rapid growth of e-commerce and online marketplaces has transformed the market. Digital platforms have made it easier for buyers and sellers to connect, expanding the reach of the market globally. Consumers can browse, compare, and purchase pre-owned luxury watches conveniently with the help of established authentication and verification processes.

The influence of social media and celebrity endorsements cannot be understated. Celebrities watch enthusiasts and influencers often showcase their pre-owned luxury timepieces, sparking interest and desirability among their followers. The stories and history behind vintage watches also add to their charm, making them attractive to those seeking a unique, one-of-a-kind piece.

In addition, the robust financial performance of second-hand luxury timepieces has drawn the attention of new purchasers, driving the expansion of the market. Affluent investors are progressively looking for non-traditional investment avenues to broaden their portfolios and safeguard against inflation. Luxury watches have emerged as an appealing category of alternative assets for these and other investors due to their consistently high demand and their history of delivering impressive price gains in the market over the years.

In October 2023, CHRONEXT announced the acquisition of the brand rights and domain of European retailer Watchmaster. The acquisition is a further milestone in CHRONEXT's growth strategy, and it strengthens the company's position in the European market.

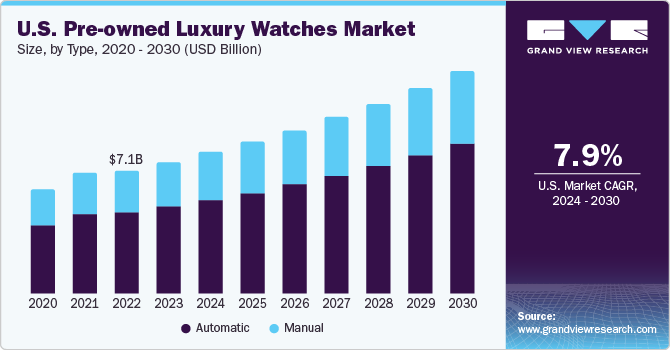

Type Insights

The automatic pre-owned luxury watches segment dominated the market in 2023 with a 66.2% revenue share. The craftsmanship and attention to detail involved in creating automatic luxury watches are a significant driving force. These timepieces are often handcrafted by skilled artisans who invest countless hours in perfecting every intricate detail. The meticulous craftsmanship and use of high-quality materials, such as precious metals and gemstones, give automatic luxury watches a distinct appeal, attracting connoisseurs who appreciate the artistry and fine engineering behind each piece.

The manual pre-owned luxury watches industry is estimated to expand at a CAGR of 8.8% during the forecast period. The mechanical luxury watch market puts a strong emphasis on tradition and heritage. Many luxury watch brands have a long and storied history that dates back centuries. Buyers are drawn to the idea of owning a timepiece that carries with it a sense of legacy and tradition. These watches often have iconic designs and distinct features that have remained relatively unchanged over the years, creating a sense of continuity and timelessness.

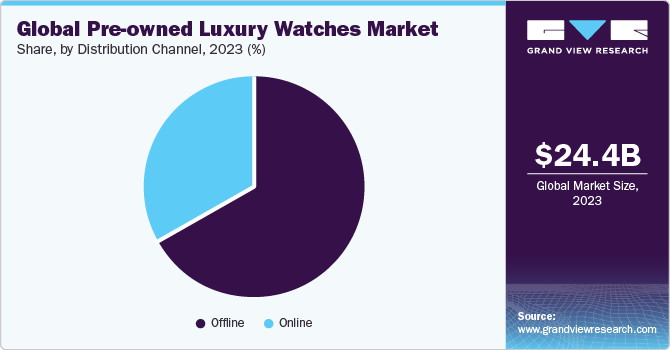

Distribution Channel Insights

Based on distribution channel, the offline distribution channel segment dominated the pre-owned luxury watches market in 2023 with a 65.8% revenue share. Ethnicity and trust are paramount in the luxury watch market and offline channels provide customers with a sense of security and assurance. When customers can physically inspect the timepieces, interact with knowledgeable sales staff, and even have the option to authenticate the watch in person, it significantly reduces the risk associated with purchasing high-value, pre-owned luxury watches.

The online segment is anticipated to exhibit the highest CAGR of 9.9% during the forecast period. The accessibility and convenience of online platforms have transformed the way consumers buy and sell luxury watches. With just a few clicks, buyers can explore a vast array of pre-owned timepieces, eliminating the need for physical visits to brick-and-mortar stores. This convenience is particularly appealing to a tech-savvy and time-conscious customer base, making online channels the preferred choice.

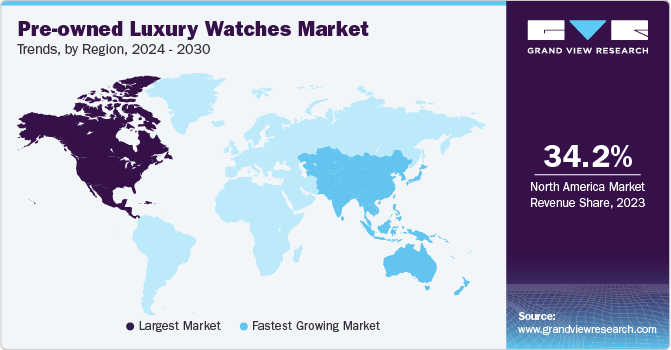

Regional Insights

North America dominated the global market in 2023 with a 34.2% share of the overall revenue. It is expected to register a CAGR of 8.0% during the forecast period. The rise of e-commerce and online marketplaces has made it easier for consumers to access and purchase pre-owned luxury watches. Online platforms provide a convenient and secure way to buy and sell these high-value items, increasing market accessibility. Moreover, the growth of online communities and forums dedicated to luxury watches has fostered trust among buyers, as they can connect with experienced collectors and sellers.

Asia Pacific is projected to grow at a CAGR of 10.9% during the forecast period. The growing affluence of the region's middle and upper-class consumers has led to an increasing demand for luxury items, including high-end timepieces. As disposable incomes increase, many individuals are looking to invest in luxury watches, and the market offers an attractive option to access these prestigious brands at a more affordable price point.

Europe is poised to witness substantial growth over the forecast period, registering a CAGR of 9.5% during the forecast period. The European market for pre-owned luxury watches benefits from a rich history and culture of watchmaking, with Switzerland being a global hub for high-end watch manufacturing. This legacy has fostered a strong collector's community and a market for vintage and rare timepieces. Enthusiasts are drawn to pre-owned watches for their unique designs, craftsmanship, and historical significance.

Key Companies & Market Share Insights

The global market is expected to witness moderate competition among the companies owing to the presence of numerous players across the industry. With changing consumer trends, numerous companies are expanding their product portfolio to gain a competitive edge in the market.

Manufacturers are resorting to strategies such as increasing production capabilities, launching new products in the market, and forming partnerships. For instance, in August 2023, Watches of Switzerland launched a pre-owned selection of luxury timepieces that can be shopped online. Pre-owned watches have been inspected and certified as authentic and come with a twelve-month warranty. The selection includes modern and vintage watches, rare & important timepieces, and mainstream models.

Key Pre-owned Luxury Watches Companies:

- Chrono24

- WatchBox

- eBay Inc.

- Bob's Watches

- Crown & Caliber

- Watchfinder & Co

- TrueFacet, LLC

- Govberg

- The Watch Club

- Watches of Switzerland

Pre-owned Luxury Watches Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.52 billion

Revenue Forecast in 2030

USD 45.01 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Switzerland; China; India; Japan; Australia; Singapore; Brazil; UAE; Saudi Arabia

Key companies profiled

Chrono24; WatchBox; eBay Inc.; Bob's Watches; Crown & Caliber; Watchfinder & Co; TrueFacet, LLC; Govberg; The Watch Club; Watches of Switzerland

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pre-owned Luxury Watches Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global pre-owned luxury watches market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automatic

-

Manual

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Switzerland

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

Singapore

-

India

-

-

Central And South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

U.A.E.

-

-

Frequently Asked Questions About This Report

b. The global pre-owned luxury watches market size was estimated at USD 24.38 billion in 2023 and is expected to reach USD 26.52 billion in 2023.

b. The global pre-owned luxury watches market is expected to grow at a compounded growth rate of 7.8% from 2024 to 2030 to reach USD 45.01 billion by 2030.

b. On the basis of type, the automatic type dominated the pre-owned luxury watches market in 2023 with 66.2% share in revenue. The craftsmanship and attention to detail involved in creating automatic luxury watches are a significant driving force. These timepieces are often handcrafted by skilled artisans who invest countless hours in perfecting every intricate detail. The meticulous craftsmanship and use of high-quality materials, such as precious metals and gemstones, give automatic luxury watches a distinct appeal, attracting connoisseurs who appreciate the artistry and fine engineering behind each piece.

b. Some key players operating in pre-owned luxury watches market are Chrono24, WatchBox, eBay Inc., Bob's Watches, Crown & Caliber, Watchfinder & Co, TrueFacet, LLC, Govberg, The Watch Club, and Watches of Switzerland

b. The enduring appeal of luxury watches as status symbols and collectible items plays a crucial role. These timepieces often hold their value or even appreciate over time, making them attractive investments for buyers. The allure of owning a prestigious brand like Rolex, Patek Philippe, or Audemars Piguet transcends generations, further bolstering demand in the pre-owned market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."