- Home

- »

- Advanced Interior Materials

- »

-

Precision Gearbox Market Size, Share & Growth Report 2030GVR Report cover

![Precision Gearbox Market Size, Share & Trends Report]()

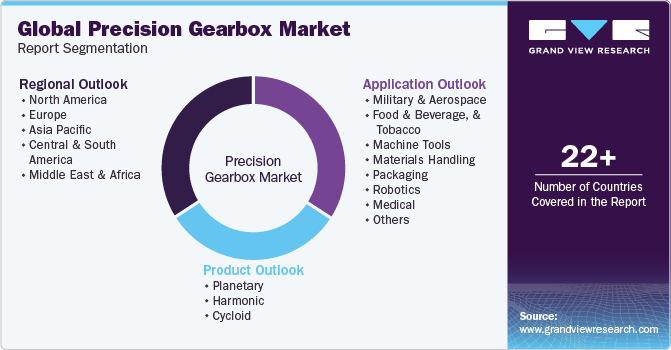

Precision Gearbox Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Planetary, Harmonic, Cycloid), By Application (Robotics, Military & Aerospace, Materials Handling, Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-007-1

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Precision Gearbox Market Summary

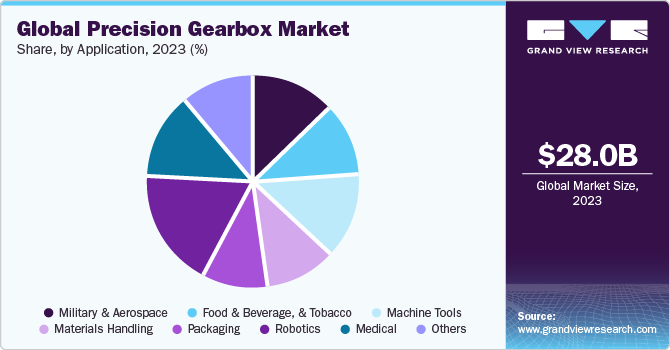

The global precision gearbox market size was estimated at USD 2.97 billion in 2023 and is projected to reach USD 5.72 billion by 2030, growing at a CAGR of 9.9% from 2024 to 2030. Rising awareness about the product benefits across various industries including, military & aerospace, machine tools, material handling, robotics, and medical, is expected to drive the industry growth.

Key Market Trends & Insights

- Asia Pacific led the market in 2023 and accounted for the largest revenue share of more than 65.5%.

- The North America precision gearbox market accounted for a significant revenue share of the global market in 2023.

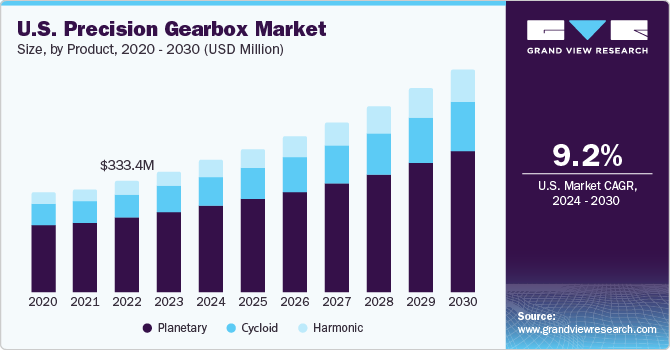

- In terms of product, the planetary gearbox segment dominated the industry in 2023 and accounted for the largest revenue share of 66.4%.

- Based on application, the robotics application segment dominated the industry with the largest revenue share of 18.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.97 Billion

- 2030 Projected Market Size: USD 5.72 Billion

- CAGR (2024-2030): 9.9%

- Asia Pacific: Largest market in 2023

This industry witnessed a steep decline in growth, owing to the lack of demand from the industrial sector. The government imposed restrictions caused a temporary closure across a wide range of industries, which resulted in a lack of new installations and maintenance and repair of existing automation systems, thereby limiting the product demand.The U.S. precision gearbox industry is expected to be driven by, increased military expenditure toward adoption of advanced munition, advanced technology systems, and advanced targeting systems. In addition, the increasing installation of automation systems in several industries such as automotive, food & consumer goods, metals, and semiconductors is expected to drive the industry growth.

In addition, a large number of manufacturers suffered huge financial losses due to the pandemic, leading to a number of manufacturers opting to postpone the installation of new automation systems. However, the industry witnessed a significant rise in product demand from the medical sector, which benefitted the growth of the industry during the forecast period.

The growth of the market in China is expected to be driven by an increase in the adoption of several advanced material handling equipment such as wagon tipplers, belt conveyor systems, and bucket elevators for easy movement and handling and materials, in the cement industry. In addition, the adoption of advanced robotic systems in warehousing as per the trend of zero-labor warehousing in China is expected to benefit the growth of the industry.

Direct-drive actuators are likely to pose a threat of substitution owing to their benefits such as low maintenance, minimized cost, and compact design. However, a lack of precision in movements is likely to restrict its demand across the application industries. This is projected to keep the threat of substitution low.

Product manufacturers are forward-integrated and engaged in the distribution and supply of manufactured goods. This allows the manufacturers to gain a higher revenue share and build a stronger industry position. In addition, the manufacturers prefer a consultative approach to provide optimum solutions and meet the exact consumer requirements.

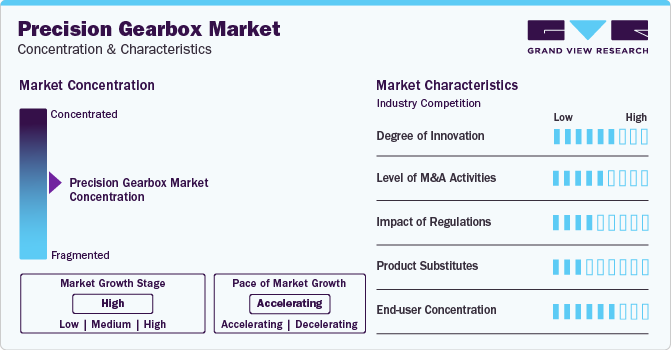

Market Concentration & Characteristics

The industry growth stage is high the pace of growth is accelerating. The market is moderately fragmented owing to the presence of several multinational players that are primarily consolidated in Europe and North America, with only a few big players from Asia Pacific. The prominent manufacturers of precision gearboxes compete based on product demand in various application industries, especially in robotics & automation and food packaging. Many companies design and manufacture their own precision gears and other related parts including bearings to be further used in gearboxes.

Continuous research & development (R&D) in the designing and manufacturing of precision gearboxes has led to the introduction of a compact and miniature-sized precise lineup of gearboxes used in robotics and motion control industrial applications. Moreover, these compact-sized gearboxes deliver high torque and accuracy in automation operations. As a result, robotics, food & packaging, and machine tools industries are the topmost areas of application where higher production is needed in a compact space.

Prominent manufacturers have been adopting various strategies including investments, agreements, partnerships, contracts, production capacity expansion, joint ventures, and collaborations to enhance their industry presence and to cater to the changing requirements of application industries. Key industry participants are focusing on the introduction of advanced, compact, and low backlash gearboxes in the market.

The industry is subject to scrutiny by regulations approved by several bodies concerning the application and services of precision gearbox in different sectors. Direct-drive actuators are likely to pose threat of substitution to precision gearboxes owing to its benefits such as low maintenance, minimized cost, and compact design. However, lack of precision in movements is likely to restrict its demand across the application industries.

The end-users operating in the precision gearbox market includes military & aerospace industries, food & beverage, packaging, material handling, robotics, and medical. For instance, precision gearbox are increasingly used in military applications for precise positioning, indexing and other applications.

Product Insights

The planetary gearbox segment dominated the industry in 2023 and accounted for the largest revenue share of 66.4%. Planetary precision gearbox is widely used in equipment including conveyers, servosystems, coil tubing injectors, and wheel drives. Properties such as high efficiency, high power density, and low backlash make them ideal for usage in several applications such as material handling equipment, machine tools, and food & beverage processing. Companies are coming up with zero-backlash rating (<=6 sec) planetary gearboxes primarily for usage in the robotics & automation (R&A) industry.

The harmonic gearbox segment is expected to grow at the fastest CAGR from 2024 to 2030. Harmonic precision gearboxes are used across several industries in applications such as machine tools, and electronic equipment. Harmonic gear reducers assembly consists of three components, wave generator, flex spline, and circular spline. High precision gearbox is used in robots and semiconductor devices that have compact designs and need high accuracy levels. Low precision gearbox is used for antenna systems, and standard precision systems are most widely used in food & beverages and machine tools applications.

Application Insights

The robotics application segment dominated the industry with the largest revenue share of 18.5% in 2023. The utilization of precision gearboxes in robotics is expected to rise, to enable precise movement in several end-use industries. In addition, companies are offering customization options for robotic system manufacturers for their usage in different application industries for various use cases. The usage of robotic devices helps to increase the levels of precision and waste minimization across industries.

The application of precision gearboxes in food & beverage industry is expected to rise over the forecast period, owing to their growing utilization in various food processing equipment for bakery, beverage, and tobacco items. In addition, several manufacturers offer customization services to large food processing companies as per specifications of the food processing equipment, which further drives the industry growth for precision gearbox manufacturers.

Precision gearbox systems are widely used in several applications in the food & beverage industry for drag conveyors, bucket elevators, crushers, flaking & milling machines, bakery processing systems, feeding & washing systems, crushers, squeezing systems, and kneaders. The adoption of ready-to-eat foods, packaged fruit juices, comfort foods, and bakery products is high in North American and European countries and it is rising gradually in the developing countries of Asia Pacific, Central & South America, and the Middle East & Africa, owing to several local players investing in the packaged foods industry coupled with investments by established players from North America and Europe for business expansion.

Regional Insights

The North America precision gearbox market accounted for a significant revenue share of the global market in 2023, owing to factors including the growing need for automation in industries like as automotive, aerospace, and robotics necessitating the use of high-precision gearboxes to ensure accurate motion control are contributing to the regional market expansion. Furthermore, technological improvements have resulted in the creation of more efficient and smaller gearboxes, which has increased their popularity. North America's robust industrial sector and emphasis on innovation foster the expansion of precision gearbox applications, resulting in regional market growth.

U.S. Precision Gearbox Market Trends

The growth of the precision gearbox market in the U.S. is expected to be driven by increased military expenditure toward the adoption of advanced munition, advanced technology systems, and advanced targeting systems. In addition, a rise in the installation of automation systems in several industries such as automotive, food & consumer goods, metals, and semiconductors is expected to drive the industry growth.

Asia Pacific Precision Gearbox Market Trends

Asia Pacific led the market in 2023 and accounted for the largest revenue share of more than 65.5%. The industry’s growth in Asia Pacific is expected to be driven by the wide adoption of precision gearbox in industries such as cement, and metallurgy in countries such as China, Japan, India, and South Korea for material handling applications. In addition, the growing consumption of packaged and processed foods in several countries in the region is expected to create new growth opportunities for the market.

The precision gearbox market in China is expected to be driven by an increased adoption of hi-tech material handling equipment such as bucket elevators, belt conveyor systems, and wagon tipplers for ease of material handling and movement, in the cement industry. Zero-labor warehousing is trending in China which is enhancing the adoption of advanced robotic systems which will benefit the market.

Japan precision gearbox industry growth is expected to be driven by the growing usage of precision gearboxes in several applications in the aerospace industry, such as landing systems, air turbine starters, propulsion drives, and other motion control systems. in addition, several precision gearbox manufacturers offer custom designing and manufacturing services to aircraft component manufacturers, thus creating new growth opportunities in the market.

Europe Precision Gearbox Market Trends

The precision gearbox market in Europe is expanding owing to the region's thriving automotive sector needs precision gearboxes for efficient power transfer and motion control in automobiles. Furthermore, the advent of automation in areas such as manufacturing, healthcare, and logistics has increased the need for high-precision gearboxes to ensure the smooth operation of machinery and robots. Europe's emphasis on sustainability and energy economy encourages the use of precision gears engineered for peak performance is driving the market growth.

Germany precision gearbox market growth is expected to be driven by an increased adoption of robotics & automation technologies is used in several industries such as automotive, electrical & electronics, construction, plastic, chemical, and food & beverage. Germany is the 4th largest robotics industry in the world, accounting for about 38% of the Europe robotics industry.

The precision gearbox market in UK held a significant market share in 2023.This growth isdue to factors such as the country's flourishing manufacturing industry, notably in the automotive, aerospace, and defense industries, which drives demand for high-precision gearboxes to ensure effective machinery performance. The UK's strong emphasis on innovation and technology breakthroughs encourages the creation of cutting-edge gearbox solutions. As automation spreads across industries, the demand for precise motion control grows, driving the market even more. Furthermore, favorable government programs and expenditures in research and development help to expand the market in the UK.

Central & South America Precision Gearbox Market Trends

The growth of the precision gearbox market in Central & South America is attributed to the changing industrial landscapes and increased usage of modern machinery. As the region's industries modernize and become more automated, there is an increased demand for precision gearboxes to improve efficiency and production. Furthermore, the growth of industries such as renewable energy, mining, and agriculture increases the demand for dependable gearboxes to support heavy-duty applications. Increased infrastructure investment in Central & South America creates potential for the deployment of precision gearboxes in construction equipment and transportation systems, which contributes to regional market growth.

Brazil precision gearbox market is projected to grow over the forecast period due to the increasing demand in the food & beverage industry. Gearboxes are known to maintain speed and torque resulting in improved safety, efficiency, and productivity. Moreover, gearboxes eliminate the use of components such as bearings and pulleys. The agricultural business has witnessed constant growth in Brazil resulting in the increasing demand for food processing technologies. The rising use of precision gearboxes in the food & beverage industry to maintain speed and torque results in improved safety, efficiency, and productivity. Moreover, gearboxes eliminate the use of components such as bearings and pulleys. Therefore, the increasing demand for gearboxes to make the conveying systems lighter, faster, and highly efficient is anticipated to propel the precision gearbox industry over the forecast period.

Middle East & Africa Precision Gearbox Market Trends

Factors such as rapid urbanization and industry are boosting the demand for machinery and equipment that requires accurate motion control contributing to the market expansion. The growth of the automotive and aerospace industries, as well as increased investment in renewable energy projects, open up new potential for precision gearbox applications. The expanding building and infrastructure development activities need dependable gearboxes for heavy-duty machinery. Furthermore, technical developments and collaborations with global manufacturers are increasing the availability and use of high-quality precision gearboxes in the Middle East and Africa, which is driving market expansion.

The precision gearbox industry in Saudi Arabia is anticipated to gain momentum over the forecast period, due to the expansion of the robotics industry in the country. Robotics play a major role in supporting the growth of small manufacturers. Factors such as affordability and accessibility are likely to propel its demand among small companies, manufacturers, and the agricultural industry. Precision gearboxes are used in robotic arms to enable highly precise movements. Thus, the expansion of the robotics industry is likely to benefit the precision gearbox industry growth over the forecast period

Key Precision Gearbox Company Insights

Some key market players operating in this market include Sumitomo Drive Technologies and NIDEC-SHIMPO CORPORATION

- Sumitomo Drive Technologies a subsidiary among Power Transmission & Controls Division (PTC) under Sumitomo Heavy Industries Group that manufactures variators and reducers.

- NIDEC-SHIMPO CORPORATION is engaged in the manufacturing of variable speed drives, speed reducers, ceramic art equipment, various measuring instruments, and other machinery tools. It serves various application industries including metal cutting & forming, assembly & test automation, packaging & filling, printing & converting, medical & healthcare, robotics, and semiconductor & circuit.

Grudel Group AG and Harmonic Drive LLC. are some of the emerging market participants.

- Grudel Group AG is a family-owned company that is engaged in the manufacturing of high-precision machine components and automation solutions. The company’s entire manufacturing process uses smart Güdel automation solutions for various application industries such as automotive, building materials, railways, energy, composite manufacturing, plastics, food, aerospace & aeronautics, pharmaceuticals, tire, and machine tools.

- Harmonic Drive LLC is engaged in the designing and manufacturing of precision servo actuators, gear components set, and gearheads. It offers standard and custom-engineered solutions to various application industries including robotics, medical, defense, aerospace, energy, and machine tooling.

Key Precision Gearbox Companies:

The following are the leading companies in the precision gearbox market. These companies collectively hold the largest market share and dictate industry trends.

- Harmonic Drive LLC

- NIDEC-SHIMPO CORPORATION

- Stöber Antriebstechnik GmbH and Co. KG

- WITTENSTEIN SE

- GAM ENTERPRISES, INC.

- DieQua Corporation

- Neugart GmbH

- Apex Dynamics, Inc.

- Sumitomo Drive Technologies

- Nabtesco Corporation

- Cone Drive

- Hiwin Corporation

- Wilhelm Vogel GmbH

- Sureservo

- SEW-EURODRIVE GmbH & Co KG

- Onvio LLC

- PARKER HANNIFIN CORP

- ATLANTA Drive Systems, Inc.

- Framo Morat

- Güdel Group AG

- SWG Solutions

- Bonfiglioli Riduttori S.p.A.

- EGT Eppinger Getriebe Technologie GmbH

- ABB Motors and Mechanical Inc.

- Ondrives Ltd.

- Designatronics Inc.

- Genesis Robotics

- Motus Labs

- Comp14

- GEORGII KOBOLD GmbH & Co. KG

Recent Developments

-

In October 2023, Schaeffler Expands Precision Bearings, Motors and Gearbox Ranges for Machine Tool Applications. Schaeffler is meeting the challenges of the machine tool industry with new automation solutions that are characterized by even greater dynamic characteristics, precision, energy efficiency, and longer machine runtimes.

-

In December 2022, Schaeffler continues to expand its portfolio of precision gearboxes and its development expertise by significant increase in production capacities since acquisition of Melior Motion GmbH.

Precision Gearbox Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.24 billion

Revenue forecast in 2030

USD 5.72 billion

Growth rate

CAGR of 9.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

March 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Harmonic Drive LLC; NIDEC-SHIMPO CORPORATION; Stöber Antriebstechnik GmbH and Co. KG; WITTENSTEIN SE; GAM ENTERPRISES, INC.; DieQua Corporation; Neugart GmbH; Apex Dynamics, Inc.; Sumitomo Drive Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precision Gearbox Market Report Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global precision gearbox market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Planetary

-

High Precision

-

Low Precision

-

Standard Precision

-

-

Harmonic

-

High Precision

-

Low Precision

-

Standard Precision

-

-

Cycloid

-

High Precision

-

Low Precision

-

Standard Precision

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Military & Aerospace

-

Food & Beverage, And Tobacco

-

Machine Tools

-

Materials Handling

-

Packaging

-

Robotics

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global precision gearbox market size was estimated at USD 2.97 billion in 2023 and is expected to reach USD 3.24 billion in 2024

b. Robotics applications led the market and accounted for about 18.50% share of the revenue in 2023, which can be attributed to the growing utilization of robotic devices, owing to the advantages they provide with respect to consistency & precision, high throughput rates, and minimization of waste & scrap

b. The global precision gearbox market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 5.72 billion by 2030.

b. Some of the key players operating in the precision gearbox market include Harmonic Drive LLC, NIDEC-SHIMPO CORPORATION, Stöber Antriebstechnik GmbH and Co. KG, WITTENSTEIN SE, GAM ENTERPRISES, INC., DieQua Corporation, Neugart GmbH, Apex Dynamics, Inc., Sumitomo Drive Technologies, Nabtesco Corporation, Cone Drive, Hiwin Corporation, Wilhelm Vogel GmbH, Sureservo, SEW-EURODRIVE GmbH & Co KG, Onvio LLC, and PARKER HANNIFIN CORP.

b. The key factors that are driving the precision gearbox market include raising awareness about the benefits of precision gearbox across various industries including, military & aerospace, machine tools, material handling, robotics, and medical, and increasing implementation of automation technology throughout the production process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.