- Home

- »

- Medical Devices

- »

-

Preclinical CRO Market Size & Share, Industry Report, 2033GVR Report cover

![Preclinical CRO Market Size, Share & Trends Report]()

Preclinical CRO Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Service (Toxicology Testing, Bioanalysis & DMPK Studies, Chemistry), By Model Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-035-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Preclinical CRO Market Summary

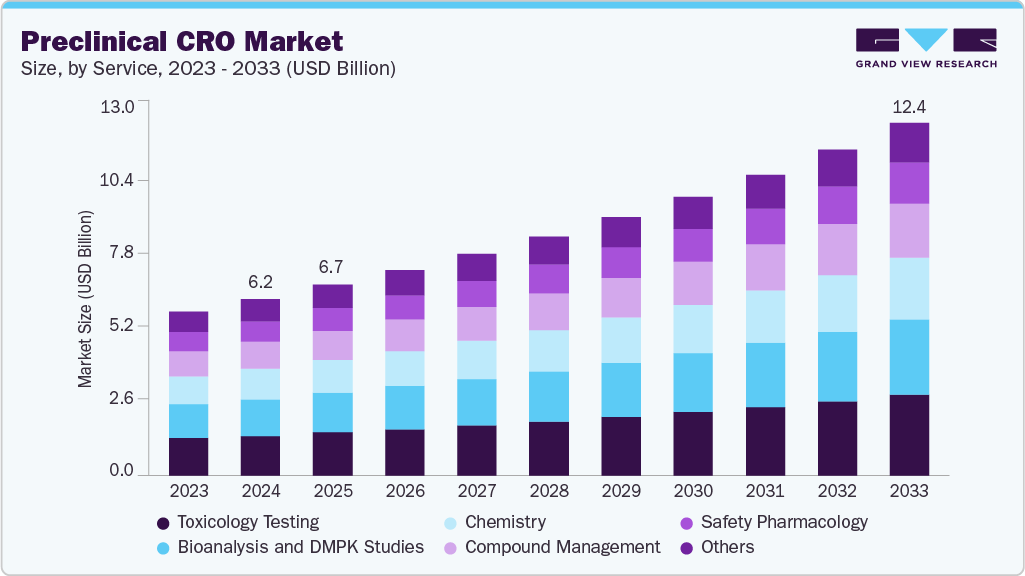

The global preclinical CRO market size was estimated at USD 6.19 billion in 2024 and is projected to reach USD 12.37 billion by 2033, growing at a CAGR of 8.03% from 2025 to 2033. The market is driven escalating R&D investments, the growing complexity of drug development, and the shifting demand toward specialized and advanced therapeutic modalities.

Key Market Trends & Insights

- North America preclinical CRO market held the largest share of 48.45% of the global market in 2024.

- The preclinical CRO industry in the U.S. is expected to grow significantly over the forecast period.

- By service, the toxicology testing segment led the market with the largest revenue share of 22.45% in 2024.

- Based on model type, the Patient Derived Organoid (PDOs) Models segment led the market with the largest revenue share in 2024.

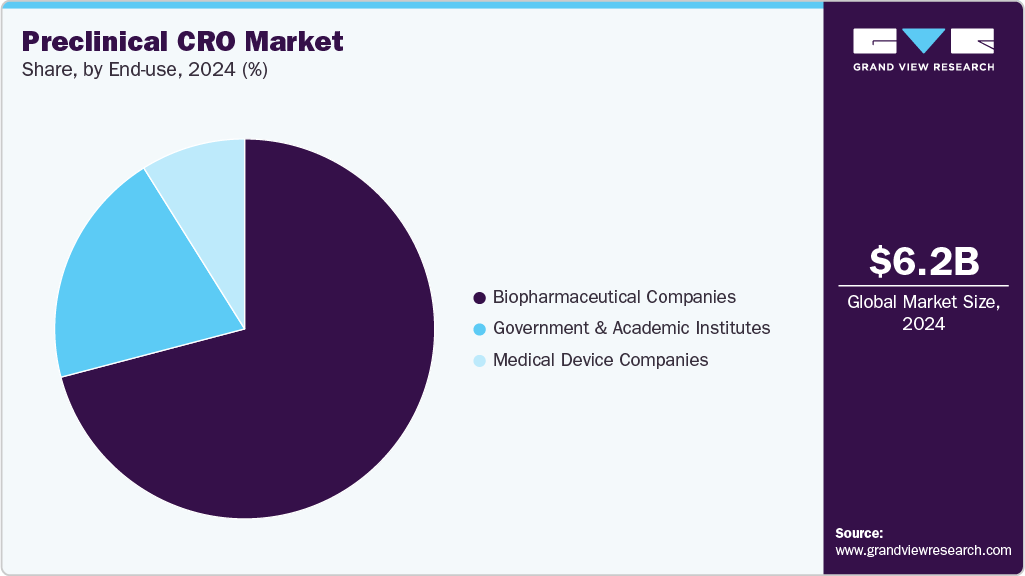

- By end use, the biopharmaceutical companies segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.19 Billion

- 2033 Projected Market Size: USD 12.37 Billion

- CAGR (2025-2033): 8.03%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market is primarily driven by the increasing complexity of drug discovery, along with the high costs of in-house research infrastructure, is driving greater adoption of preclinical CRO services. Drug developers are outsourcing studies such as toxicology, pharmacology, and bioanalysis to specialized service providers to reduce time-to-market and manage operational risks. This trend is further amplified by the growing prevalence of chronic and complex diseases, which require more extensive preclinical evaluations. Outsourcing also enables smaller biotech firms, which often have limited resources, to access advanced technologies and global expertise without the need for large-scale internal setups.

Furthermore, rapid technological advancements in artificial intelligence, machine learning, automation, and innovative preclinical models such as organ-on-chip systems are reshaping the capabilities of CROs. These innovations enable higher precision in results, faster study execution, and cost reductions, making outsourcing an even more attractive proposition. In addition, the rise of biologics, personalized medicine, and advanced therapies such as gene and cell-based treatments has increased demand for CROs with specialized expertise. Emerging markets, particularly in Asia Pacific, are becoming key hubs for preclinical outsourcing, offering cost advantages, expanding R&D infrastructure, and access to skilled scientific talent, thereby supporting global expansion strategies of major CROs.

Opportunity Analysis

Technological Advancements

Technological innovation is reshaping the operational model of preclinical CROs and redefining their competitive advantages. Artificial intelligence and machine learning are increasingly used to optimize study design, predict toxicological outcomes, and prioritize compound portfolios, enabling sponsors to reduce late-stage failures. Automation, including robotic liquid handling and high-throughput imaging platforms, is streamlining workflows, improving reproducibility, and expanding capacity without proportional increases in labour. Novel micro physiological systems, including organ-on-chip devices and human-derived 3D tissue constructs, are allowing researchers to capture more human-relevant data at earlier stages, particularly for complex organ systems such as the liver, lung, and brain. The rise of advanced imaging modalities, high-content screening, and digital pathology platforms is enhancing data quality while reducing turnaround times.

Pricing Analysis

Pricing strategies in the preclinical CRO market are evolving to balance client budget constraints with the growing complexity of studies. While traditional time-and-materials and fixed-fee contracts remain common, there is a notable shift toward milestone-based pricing, where payments are tied to the completion of defined project phases such as study initiation, data delivery, and regulatory submission readiness. This approach aligns incentives between CROs and sponsors while providing greater cost predictability for the client. Premium pricing is increasingly applied to specialized or capacity-limited services, such as GLP toxicology, bioanalytical assay validation, and rare disease model studies, where demand exceeds available resources. Bundled service pricing-offering integrated IND-enabling packages at a discounted rate compared to contracting each component separately-is gaining traction among sponsors seeking both efficiency and cost savings.

Service Insights

On the basis of service segment, the market is classified into bioanalysis and DMPK studies, toxicology testing, compound management, chemistry, safety pharmacology, and others. The toxicology testing segment accounted for the largest revenue share in the preclinical CRO industry of 22.45% in 2024. The growth of the segment is due to the increasing demand for comprehensive safety evaluations of drug candidates before entering clinical trials. Rising regulatory scrutiny from agencies such as the U.S. FDA, EMA, and PMDA has made toxicology studies a mandatory and resource-intensive step in the development pipeline, covering acute, sub-chronic, chronic, reproductive, developmental, and genotoxicity assessments.

Bioanalysis and DMPK Studies segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is driven due to the increasing complexity of drug candidates, which require detailed pharmacokinetic, pharmacodynamic, and bioanalytical profiling to meet stringent regulatory requirements. As therapeutic modalities expand into biologics, biosimilars, nucleic acid-based drugs, and antibody-drug conjugates, the need for highly sensitive and specific assays-such as LC-MS/MS, ligand-binding assays, and hybrid approaches has increased.These studies are critical for determining absorption, distribution, metabolism, and excretion characteristics, as well as understanding potential drug-drug interactions and bioavailability. Outsourcing to preclinical CROs provides access to specialized instrumentation, validated methods, and experienced scientific teams capable of handling complex matrices and low-concentration analytes.

Model type Insights

On the basis of model type segment, the market is segregated into Patient Derived Organoid (PDOs) Models and Patient Derived Xenograft (PDX) Models. The Patient Derived Organoid (PDOs) Models segment held the largest market share in 2024.due to their ability to closely replicate the three-dimensional structure, cellular diversity, and genetic profile of the original patient tumor or tissue. These models offer a higher level of physiological relevance compared to traditional cell lines, enabling more accurate predictions of drug efficacy, toxicity, and resistance mechanisms. Their use has expanded rapidly in oncology, rare disease research, and personalized medicine, where they facilitate high-throughput drug screening, biomarker identification, and individualized treatment planning.

Patient Derived Xenograft (PDX) Models segment is anticipated to grow at the considerable CAGR during the forecast period. The segment growth is driven due to their proven ability to maintain the histological architecture, genetic integrity, and tumor microenvironment of the original patient tumor when engrafted into immunodeficient mice. This high level of fidelity makes PDX models a valuable tool for evaluating drug efficacy, studying tumor progression, and identifying potential resistance pathways in a physiologically relevant in vivo setting.Pharmaceutical and biotechnology companies increasingly rely on PDX models for late-stage preclinical validation and biomarker-driven oncology programs, as they provide more predictive insights into clinical outcomes compared to conventional cell line-derived xenografts.

End-use Insights

On the basis of end use segment, the market is segregated into biopharmaceutical companies, government and academic institutes, and medical device companies. The biopharmaceutical companies segment held the largest market share in 2024,due to the increasing reliance of pharmaceutical and biotech firms on preclinical CROs to accelerate drug discovery and development processes. Rising R&D expenditures, coupled with the growing complexity of therapeutic modalities such as biologics, cell and gene therapies, and personalized medicines, have made in-house preclinical testing both costly and resource-intensive.

Government and Academic Institutes segment is anticipated to grow at the considerable CAGR during the forecast period. The segment growth is driven due to the increasing investment in basic and translational research aimed at understanding disease mechanisms, developing novel therapeutic approaches, and supporting public health initiatives. These institutions often collaborate with preclinical CROs to access specialized models, high-throughput screening platforms, and GLP-compliant toxicology and bioanalytical services that may not be available in-house.

Regional Insights

North America accounted for the largest revenue share of 48.45% in the preclinical CRO market in 2024. This is attributed to the substantial pharmaceutical and biotechnology R&D investments, a high concentration of global CRO headquarters, and stringent regulatory requirements enforced by the FDA and Health Canada. The region’s market growth is driven by increasing adoption of advanced therapeutic modalities such as biologics, cell and gene therapies, and precision medicine, which require specialized preclinical testing services.

U.S. Preclinical CRO Market Trends

The preclinical CRO market in the U.S. held the largest share in 2024. The country’s growth is due to high R&D spending, a robust biotech and pharmaceutical ecosystem, and stringent regulatory standards enforced by the FDA. Companies increasingly outsource preclinical studies to specialized CROs to accelerate IND-enabling programs, access advanced technologies, and optimize operational efficiency.

Europe Preclinical CRO Market Trends

The preclinical CRO market in Europe is expected to grow significantly due to the region’s extensive pharmaceutical research infrastructure and regulatory harmonization across the EU. Growing investments in biologics, precision medicine, and oncology pipelines are driving demand for outsourced toxicology, DMPK, and bioanalytical services. Collaborations between CROs and academic institutions also contribute to market expansion by integrating translational research with preclinical studies.

The preclinical CRO market in Germany held the significant share in 2024, owing to the country’s robust pharmaceutical and biotech industries, particularly in oncology and immunotherapy. CROs offering GLP-compliant toxicology and bioanalytical services, coupled with advanced in vivo and in vitro platforms, are in high demand. Strong government support for R&D and collaborations between universities and industry further enhance market expansion.

The preclinical CRO market in the UK held the largest share in 2024. The growth of the market is due to strong life sciences sector, world-class research institutions, and government initiatives supporting innovation in biotech and drug discovery. Outsourcing to local and global CROs helps pharmaceutical companies reduce timelines, access specialized disease models, and comply with stringent MHRA and EU regulatory standards, driving segment growth.

Asia Pacific Preclinical CRO Market Trends

Asia Pacific is expected to be the fastest growing preclinical CRO market due to the region’s cost advantages, expanding R&D infrastructure, and a growing pharmaceutical and biotechnology sector in countries such as China, India, Japan, and South Korea. Increasing adoption of biologics, cell and gene therapies, and personalized medicine has created demand for specialized preclinical services, including toxicology, DMPK, and disease-specific model studies. Government initiatives supporting innovation, growing direct foreign investment in life sciences, and the availability of skilled scientific talent further boost the region’s market potential.

The preclinical CRO market in China held the largest share in 2024. The growth is due to the country’s cost-effective service offerings, expanding R&D infrastructure, and increasing domestic biotech and pharmaceutical pipelines. The rise of biologics, biosimilars, and personalized medicine in China has created demand for specialized preclinical testing, including toxicology, DMPK, and disease-specific models. Government initiatives to support innovation further enhance market potential.

The preclinical CRO market in Japan is expected to grow over the forecast period. The country’s growth is due to the strong pharmaceutical sector, advanced technological capabilities, and regulatory focus on safety and efficacy. Outsourcing to CROs is common for IND-enabling studies, especially in oncology, CNS, and rare disease pipelines. Partnerships between CROs and domestic pharmaceutical companies accelerate drug development while ensuring compliance with PMDA regulations.

The preclinical CRO market in India is anticipated to grow at the lucrative CAGR over the forecast period. The country’s market growth is due to the lower operational costs, skilled scientific workforce, and growing R&D investments from both domestic and multinational companies. The availability of GLP-compliant facilities, advanced bioanalytical capabilities, and disease-specific models attract outsourcing for early-stage drug discovery and IND-enabling studies. Rapidly growing biotech startups and government support for innovation also contribute to market growth.

Key Preclinical CRO Company Insights

Several key players are acquiring various strategic initiatives to strengthen their market position offering diverse services to customers. The prominent strategies adopted by companies are service launches, mergers & acquisitions/joint ventures merger, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge drives the market growth.

Key Preclinical CRO Companies:

The following are the leading companies in the preclinical CRO market. These companies collectively hold the largest market share and dictate industry trends.

- Eurofins Scientific

- PRA Health Sciences, Inc. (ICON plc)

- Wuxi AppTec

- Medpace, Inc.

- Charles River Laboratories International, Inc.

- PPD (Thermo Fisher Scientific, Inc.)

- SGA SA

- Intertek Group Plc (IGP)

- LABCORP

- Crown Bioscience

Recent Developments

- In March 2023, Crown Bioscience & JSR Life Sciences Company announced starting a new site in Singapore, which will support the company in expanding its capacity for local and global biotech & pharma companies. The site will support companies that engage in preclinical & translational oncology drug discovery and development.

Preclinical CRO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.67 billion

Revenue forecast in 2033

USD 12.37 billion

Growth rate

CAGR of 8.03% from 2025 to 2033

Actual data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, model type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE ; Oman; Qatar

Key companies profiled

WuXi AppTec, Inc. (WAI); LABCORP; Eurofins scientific se; Medpace Inc.; Charles River Laboratories International, Inc.; Intertek group plc (igp); SGA SA; PPD (Thermo Fisher Scientific, Inc.); PRA Health Sciences, Inc. (ICON plc); CROWN bioscience

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Preclinical CRO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global preclinical CRO market report based on service, model type, end-use, and region:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Bioanalysis and DMPK studies

-

In vitro ADME

-

In-vivo PK

-

-

Toxicology Testing

-

GLP

-

Non-GLP

-

-

Compound Management

-

Process R&D

-

Custom Synthesis

-

Others

-

-

Chemistry

-

Medicinal Chemistry

-

Computation Chemistry

-

-

Safety Pharmacology

-

Others

-

-

Model Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Patient Derived Organoid (PDO) Model

-

Patient derived xenograft model

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical Companies

-

Government and Academic Institutes

-

Medical Device Companies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global preclinical CRO market size was estimated at USD 6.19 billion in 2024 and is expected to reach USD 6.67 billion in 2025.

b. The global preclinical CRO market is expected to grow at a compound annual growth rate of 8.03% from 2025 to 2033 to reach USD 12.37 billion by 2033.

b. North America dominated the preclinical CRO market with a share of 48.17% in 2024. This is attributable to increasing R&D and the adoption of new technology in medical devices along with increased availability of skilled human resources.

b. Some key players operating in the preclinical CRO market include SGS SA (SGS); Charles River Laboratories International, Inc.; Eurofins Scientific; PRA Health Sciences, Inc.; Wuxi AppTec; Medpace, Inc.; Pharmaceutical Product Development (PPD), LLC; Intertek Group Plc (IGP); Crown Bioscience and Laboratory Corporation of America, Inc.

b. Key factors that are driving the preclinical CRO market growth include an increasing number of drugs in preclinical phases, economies of production and scale, increasing R&D expenditure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.