- Home

- »

- Pharmaceuticals

- »

-

Prediabetes Market Size & Share, Industry Report, 2030GVR Report cover

![Prediabetes Market Size, Share & Trends Report]()

Prediabetes Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (Diguanide, Thiazolidinediones, Glucagon-like Peptide-1 Agonists (GLP-1), DPP-4 Inhibitors), By Age Group (Children, Adult, Elderly), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-221-4

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Prediabetes Market Size & Trends

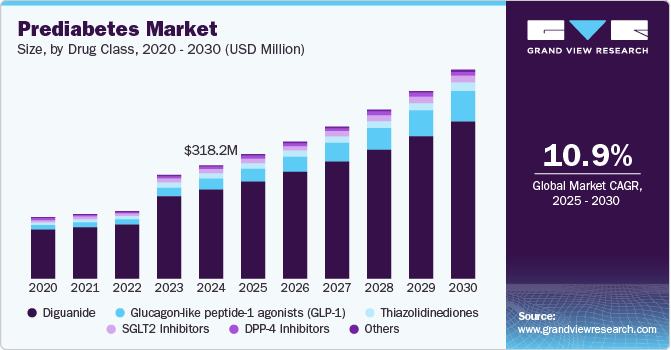

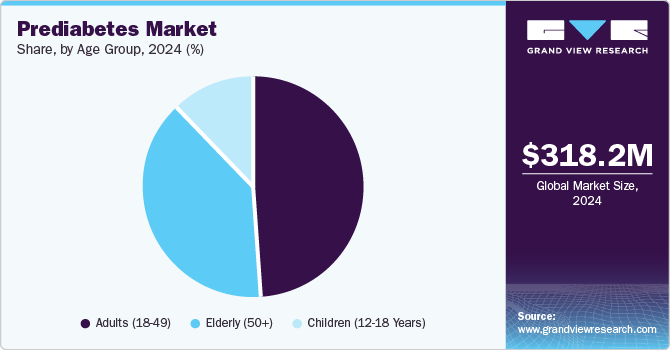

The global prediabetes market size was valued at USD 318.2 million in 2024 and is expected to grow at a CAGR of 10.9% from 2025 to 2030. The increasing incidence of conditions leading to insulin resistance and impaired glucose metabolism, stemming from mutations in specific genes, serves as the primary driver of the prediabetes industry. Prediabetes is a condition characterized by elevated blood sugar levels not high enough to be classified as type 2 diabetes. The normal blood glucose level ranges from 70 to 99 milligrams per deciliter (mg/dL).

In individuals with prediabetes, blood glucose levels are typically between 100 and 125 mg/dL. According to an article published in the BMC Public Health journal in May 2023, the global prevalence of prediabetes was estimated to be 319 million in 2021 and is projected to increase to 441 by 2045. In addition, the rising prevalence of various associated risk factors, such as sedentary lifestyles, obesity, and unhealthy dietary patterns, contributes significantly to market expansion.

The growing use of antidiabetic medications, especially Metformin, which reduces sugar production and absorption in the body to prevent disease progression, positively impacts market growth. Metformin gained approval from the U.S. FDA in 1994 as a treatment for type 2 diabetes. Available in immediate and extended-release forms, it is frequently combined with other antidiabetic drugs.

Moreover, the rising adoption of continuous glucose monitoring devices, which provide real-time feedback on glucose levels and facilitate disease management, further strengthens market growth. These gadgets prove beneficial in overseeing diabetes among groups like toddlers, pregnant women, the elderly, and those with concurrent health conditions. Furthermore, individuals with prediabetes find value in using continuous glucose monitoring (CGM) technology. For instance, according to the National Center for Biotechnology Information (NCBI), in March 2023, individuals with prediabetes experienced heightened postprandial glucose levels, and the utilization of CGM could trigger behavioral modifications, potentially postponing the onset of diabetes. The increasing adoption of technology for diagnosing prediabetes, in turn, boosts the demand for its treatment.

Drug Class Insights

Biguanide segment dominated the market with the largest revenue share of 78.8% in 2024 due to its proven efficacy in managing blood glucose levels and improving insulin sensitivity. Metformin is widely recommended as a first-line treatment for prediabetes, as it helps prevent the progression to type 2 diabetes. Its affordability, long track record of safety, and favorable side effect profile have made it a preferred choice among healthcare providers. The increasing awareness of prediabetes and its complications has further fueled the demand for diguanide-based therapies.

The Glucagon-like Peptide-1 Agonists (GLP-1) segment is anticipated to be the fastest-growing segment, with a CAGR of 19.1% from 2025 to 2030, owing to their proven efficacy in improving glycemic control and reducing the risk of progression to type 2 diabetes. These therapies help lower blood sugar levels and promote weight loss, making them highly attractive for prediabetic patients seeking to manage their condition. The increasing global prevalence of prediabetes is expected to drive a surge in demand for GLP-1 agonists, making them a crucial treatment option for early diabetes intervention.

Age Group Insights

The adults (18-49) segment held the largest market share in 2024, attributed to increasing awareness of the condition and rising risk factors such as sedentary lifestyles, poor dietary habits, and obesity. This demographic is highly engaged in health monitoring, often seeking preventive care, which makes them more likely to adopt lifestyle changes or medication to manage prediabetes. The digital health platforms and wellness programs tailored to this age group have further fueled growth, as they provide convenient solutions for managing and reversing the condition early, driving prediabetes industry expansion.

The elderly (50+) segment is projected to grow at a significant CAGR from 2025 to 2030 due to increasing life expectancy and rising health concerns among the aging population. The risk of developing prediabetes increases with age, influenced by factors such as sedentary lifestyles, poor diet, and genetic predispositions. This demographic is becoming more proactive about their health, actively seeking early interventions and preventive treatments. Growing awareness of prediabetes and its complications is expected to drive the demand for diagnostic tools, medications, and lifestyle management solutions among the elderly.

Regional Insights

North America prediabetes market accounted for the largest market share of 41.3% in 2024, propelled by the adoption of GLP-1 agonists and the growing interest in personalized treatments. GLP-1 agonists, known for their ability to improve glycemic control and promote weight loss, are increasingly being used to manage prediabetes, offering effective intervention. In addition, personalized medicine, tailored to individual genetic profiles and lifestyle factors, is gaining traction, allowing for more precise and effective treatment plans. These advancements are helping manage prediabetes more efficiently, fueling market growth across the region.

U.S. Prediabetes Market Trends

The U.S. prediabetes market held the largest share of the regional market in 2024. The increasing availability of digital health solutions and the rising obesity rates are accelerating the expansion of the prediabetes industry across the U.S. Digital tools such as mobile apps, wearables, and telehealth platforms are making it easier for individuals to monitor their health, track blood sugar levels, and manage lifestyle changes. The rising obesity rate, a major risk factor for prediabetes, prompts more people to seek preventive care. This synergy of increased health technology adoption and the obesity epidemic is anticipated to drive demand for solutions in prediabetes detection, management, and treatment. In November 2023, VALBIOTIS SA announced the success of its product TOTUM•63 in a clinical study evaluating its mode of action for prediabetes treatment. This positive outcome adds to the growing pipeline of pharmacological therapies to improve glucose metabolism, offering a promising new intervention for managing prediabetes in the U.S. market.

Europe Prediabetes Market Trends

Europe prediabetes market is projected to expand at a significant rate over the forecast period. The rising prevalence of prediabetes in Europe, fueled by factors such as the aging population and increasing obesity rates, is expected to fuel the market. The growing diagnosis of prediabetes drives the demand for effective prevention and treatment options. Pharmaceutical advancements, including the development of GLP-1 agonists and other innovative therapies, offer improved blood sugar levels and weight management, enhancing patient outcomes. These advancements, coupled with a focus on early intervention, are set to expand the Europe prediabetes industry in the coming years. In September 2023, Valbiotis and Nestlé Health Science decided to introduce a dietary supplement in 2024 tailored for individuals with prediabetes and type-2 diabetes, following promising outcomes from a study demonstrating the product's effectiveness in improving critical indicators of glucose metabolism.

Asia Pacific Prediabetes Market Trends

Asia Pacific prediabetes market is set to be the fastest-growing region with a CAGR of 11.6% from 2025 to 2030. Rising urbanization and the widespread adoption of a sedentary lifestyle in the region contribute to an increase in prediabetes cases. The shift to desk jobs and increased reliance on processed, high-calorie foods are contributing to the rising prevalence of conditions such as prediabetes. Moreover, genetic predisposition and poor dietary habits, such as high sugar and fat consumption, further exacerbate the situation. The increasing focus on early intervention, along with advancements in treatment options and improved healthcare accessibility, is set to drive significant growth in the Asia Pacific region, with more individuals seeking effective solutions to manage and prevent the condition.

India prediabetes market is anticipated to experience the fastest growth over the forecast period, owing to innovations in diagnostic tools and treatments, coupled with increased health awareness. Advanced technologies, such as more accurate and accessible screening methods, along with improved medications and management strategies, are making early detection and treatment more effective. Furthermore, increasing public awareness about the risks of prediabetes and its potential complications encourages proactive health management. This growing focus on prevention and expanding healthcare access is projected to impel the demand for prediabetes-related solutions in the country.

Key Prediabetes Company Insights

Some of the key companies in the prediabetes industry include Novo Nordisk A/S; Boston Pharmaceuticals; AstraZeneca; Bristol-Myers Squibb Company and Pfizer Inc.

-

AstraZeneca provides a broad range of innovative pharmaceutical products, focusing on treatments in oncology, cardiology, nephrology, metabolic diseases, and respiratory conditions. It develops both prescription medications and biologics aimed at improving patient outcomes globally.

-

Bristol-Myers Squibb Company offers innovative biopharmaceutical products, focusing on various areas, particularly oncology, immunology, cardiology, and fibrosis. It specializes in developing treatments for serious diseases, including cancer, cardiovascular conditions, and autoimmune disorders.

Key Prediabetes Companies:

The following are the leading companies in the prediabetes market. These companies collectively hold the largest market share and dictate industry trends.

- Novo Nordisk A/S

- Valbiotis

- RESVERLOGIX

- Caelus Health

- Scimar

- Boston Pharmaceuticals

- APHAIA PHARMA AG

- AstraZeneca

- Bristol-Myers Squibb Company

- Pfizer Inc.

Recent Developments

-

In June 2024, Aphaia Pharma announced positive results from its Phase 2 trial of APHD-012, an oral glucose formulation for prediabetes. The trial met its primary endpoint, showing significant improvement in glucose tolerance and a positive safety profile after 6 weeks of treatment.

-

In September 2023, Novo Nordisk introduced its “Wegovy” weight loss injection in the UK, providing an innovative treatment option for individuals struggling with obesity. This launch expanded access to effective weight management solutions.

Prediabetes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 349.0 million

Revenue forecast in 2030

USD 585.7 million

Growth Rate

CAGR of 10.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, age group, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Novo Nordisk A/S; Valbiotis; RESVERLOGIX; Caelus Health; Scimar; Boston Pharmaceuticals; APHAIA PHARMA AG; AstraZeneca; Bristol-Myers Squibb Company; Pfizer Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prediabetes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global prediabetes market report on the basis of drug class, age group, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Diguanide

-

Thiazolidinediones

-

Glucagon-like peptide-1 agonists (GLP-1)

-

SGLT2 inhibitors

-

DPP-4 inhibitors

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Children (12-18 years)

-

Adults (18-49)

-

Elderly (50+)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.