- Home

- »

- Advanced Interior Materials

- »

-

Prefabricated Panels Market Size, Industry Report, 2030GVR Report cover

![Prefabricated Panels Market Size, Share & Trends Report]()

Prefabricated Panels Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Modular, Panelized), By End Use (Residential, Non-residential), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-605-0

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Prefabricated Panels Market Summary

The global prefabricated panels market size was estimated at USD 60.73 billion in 2024, and is projected to reach USD 87.13 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030, driven by increasing demand for efficient and cost-effective construction solutions. As urbanization accelerates and real estate prices surge, both residential and commercial builders are turning to prefabricated panels to reduce construction time and labor costs.

Key Market Trends & Insights

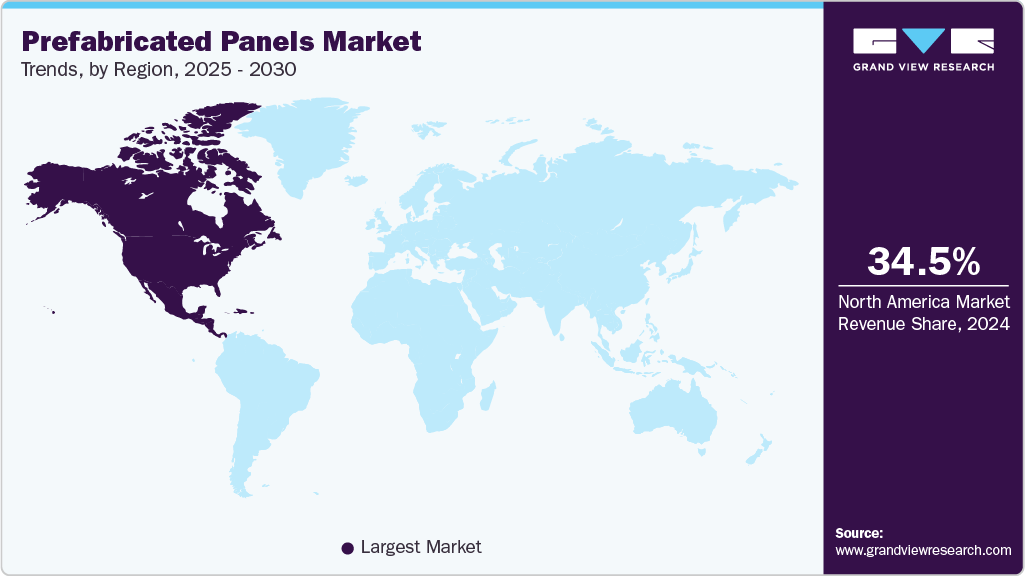

- The prefabricated panels market in North America dominated the market and accounted for the largest revenue share of 34.5% in 2024.

- The U.S. prefabricated panels market is the leading market in North America.

- By product, the modular segment led the market and accounted for the largest revenue share of 50.7% in 2024.

- By end use, the residential segment dominated the market and accounted for the largest revenue share of 57.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 60.73 Billion

- 2030 Projected Market Size: USD 87.13 Billion

- CAGR (2025-2030): 6.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The ability to assemble buildings off-site and transport them for rapid installation is particularly appealing in densely populated urban areas and regions facing labor shortages. This shift is further accelerated by government initiatives promoting affordable housing and infrastructure development. Technological innovation is a major catalyst fueling market expansion. Companies are investing heavily in automation, 3D printing, and advanced robotics to improve the precision and quality of panel production. In addition, integrating smart materials and modular designs allows for greater flexibility and customization, meeting the evolving demands of architects and developers. Innovations in insulation, fire resistance, and acoustic performance also make prefabricated panels more competitive with traditional construction materials.Sustainability is another key driver shaping the prefabricated panels industry. With growing awareness of environmental issues and tightening regulations on carbon emissions, builders are seeking eco-friendly materials that reduce waste and energy consumption. Prefabricated panels, especially those made from recycled or low-impact materials, align well with green building standards like LEED and BREEAM. Their efficient production process not only minimizes waste but also reduces on-site disturbances, making them attractive for environmentally sensitive projects.

Looking ahead, the prefabricated panels industry is poised for robust expansion across both developed and emerging economies. In addition to residential construction, the panels are gaining traction in sectors such as healthcare, education, and commercial real estate due to their scalability and efficiency. As digital technologies like BIM (Building Information Modeling) become more widely adopted, coordination and planning for prefabricated projects will become even more streamlined. The combination of rising demand, continuous innovation, and a strong push for sustainability will likely position prefabricated panels as a cornerstone of modern construction in the coming decade.

Market Concentration & Characteristics

The market exhibits a moderate to high level of market concentration, with a few key players dominating the global landscape. Major companies like Lindab, Kingspan Group, Atco, and Tata Steel hold significant market shares due to their established supply chains, advanced manufacturing capabilities, and wide-ranging product portfolios. These players often benefit from long-term contracts with construction firms and governments, creating entry barriers for new participants. However, smaller and mid-sized manufacturers are emerging in regional markets, especially in Asia Pacific and Latin America, often focusing on cost-effective or niche applications to carve out a competitive space.

Product substitutes pose a considerable challenge to the market, especially in traditional construction environments. Alternatives like brick-and-mortar structures, poured-in-place concrete, and structural insulated panels (SIPs) remain preferred in regions with lower labor costs or where prefabrication infrastructure is lacking. Furthermore, 3D concrete printing and modular wood construction advancements offer innovative substitutes that compete on sustainability, customization, and cost. As such, for prefabricated panel manufacturers to remain competitive, continuous innovation, improved durability, and enhanced insulation features are essential to distinguish their offerings in a market with increasing substitute options.

Product Insights

The modular segment led the market and accounted for the largest revenue share of 50.7% in 2024, as it reduces on-site labor, construction time, and overall costs, making it a popular choice for large-scale residential, commercial, and institutional projects. Modular prefabrication also supports better quality control and minimizes weather-related delays, which are common in traditional construction methods. The growing need for rapid urban housing and infrastructure development, especially in regions like North America, Europe, and parts of Asia, continues to drive the dominance of modular systems in the market.

Panelized segment is experiencing the fastest market growth, because unlike modular systems, panelized construction involves manufacturing individual components, such as wall panels, roof panels, and floor panels, which are then assembled on-site. This offers more flexibility in design and easier transportation compared to complete modules. Technological advancements, particularly in insulated panels, fire-resistant materials, and energy-efficient designs, are boosting the adoption of panelized systems across both residential and commercial sectors. As sustainability and customization become top priorities in the building industry, the panelized segment is expected to grow robustly in the coming years.

End Use Insights

The residential segment dominated the market and accounted for the largest revenue share of 57.1% in 2024, driven by the rising demand for affordable, quick-to-build housing solutions. Urbanization, housing shortages, and rising land and labor costs, especially in developing economies, have prompted governments and private developers to adopt prefabricated panels for residential buildings. The ability to construct homes rapidly with consistent quality and reduced environmental impact makes prefabrication especially attractive for mass housing projects, low-income housing schemes, and suburban developments. Furthermore, increased consumer awareness of energy-efficient homes has further supported the adoption of prefabricated panels in residential construction.

The non-residential segment is the fastest-growing within the market, fueled by rapid commercial, industrial, and institutional infrastructure developments. Hospitals, offices, warehouses, and educational institutions are increasingly becoming prefabricated due to their scalability, faster completion times, and cost efficiency. Post-pandemic recovery has led to a surge in healthcare and logistics-related infrastructure projects, many of which prefer modular and panelized systems for quicker deployment. Moreover, growing emphasis on sustainable and flexible construction methods in corporate and public sector projects is expected to accelerate the demand for prefabricated panels in the non-residential domain.

Regional Insights

Asia Pacific prefabricated panels market is driven primarily by rapid urbanization, population growth, and expanding infrastructure projects. Countries like China, India, and Southeast Asia are witnessing a construction boom, particularly in the residential and affordable housing sectors. Government initiatives promoting sustainable and time-efficient building practices have accelerated the adoption of prefabrication. In addition, the availability of cost-effective labor and raw materials makes the region highly competitive in manufacturing and exporting prefabricated solutions.

China Prefabricated Panels Market Trends

The prefabricated panels market in China stands out as the largest contributor within Asia Pacific, owing to its massive real estate and infrastructure development initiatives. The Chinese government’s focus on smart cities, green buildings, and mass housing projects has made prefabricated panels a strategic choice for developers. Moreover, strong manufacturing capabilities, technological innovation, and large-scale urban planning give China a significant edge in both domestic consumption and export of prefabricated construction materials.

North America Prefabricated Panels Market Trends

The prefabricated panels market in North America dominated the market and accounted for the largest revenue share of 34.5% in 2024, driven by rising demand for sustainable and fast-track construction methods. The region’s advanced construction technology, coupled with growing labor shortages and high building costs, has led to increased interest in prefabricated solutions. Moreover, the growing emphasis on energy-efficient buildings, especially in urban areas, fuels the demand for insulated and fire-resistant panels across residential and commercial sectors.

The U.S. prefabricated panels market is the leading market in North America, benefiting from high demand for modular construction in sectors such as healthcare, education, and hospitality. With an increasing focus on reducing construction timelines and improving energy efficiency, prefabricated panels are being widely adopted across both urban and suburban projects. Government regulations promoting green construction and using advanced building materials have further accelerated market growth in the U.S.

Europe Prefabricated Panels Market Trends

The prefabricated panels market in Europe represents a mature yet steadily growing market, supported by strict environmental regulations and a strong push toward sustainable building practices. Countries across the EU are investing in modernizing infrastructure and improving building efficiency, which has led to broader adoption of panelized and modular construction methods. Furthermore, technological advancements and digitalization of construction (e.g., BIM adoption) are helping streamline prefabrication processes across the continent.

Germany prefabricated panels market plays a pivotal role in the European market, thanks to its engineering expertise and stringent building standards. German manufacturers are at the forefront of innovation in high-performance panels, focusing on thermal insulation, energy efficiency, and fire safety. The country’s commitment to green construction and industrial modernization has fostered an environment where prefabrication is accepted and encouraged in residential and commercial development.

Central & South America Prefabricated Panels Market Trends

The prefabricated panels market in Central & South America is an emerging market, with growth driven by the need for cost-effective and rapid housing solutions in urban and disaster-prone areas. Countries like Brazil, Chile, and Colombia are exploring prefabrication as a viable option to address housing deficits and improve construction efficiency. While the market is still developing, increasing investment in infrastructure and favorable government housing policies are expected to boost adoption in the coming years.

Middle East & Africa Prefabricated Panels Market Trends

The prefabricated panels market in the Middle East & Africa region is gradually adopting prefabricated panels, mainly in response to growing construction demand in urban centers and remote locations. Large-scale infrastructure and hospitality projects in the Middle East-especially in the UAE and Saudi Arabia-are leveraging prefabrication for its speed and quality benefits. In Africa, the market is gaining momentum in low-cost housing and humanitarian projects where prefabricated panels offer a fast and economical building solution amid logistical and resource challenges.

Key Prefabricated Panels Company Insights

Some of the key players operating in the market include Lindab Group and Kingspan Group

-

Lindab Group is a Sweden-based company renowned for its high-quality prefabricated steel building solutions and ventilation systems. In the market, Lindab stands out for its energy-efficient, lightweight construction systems that cater to industrial, commercial, and residential applications across Europe. Their focus on sustainability, quick installation, and aesthetic design has positioned them as a leading player in modular and panelized building systems.

-

Kingspan Group, headquartered in Ireland, is a global leader in high-performance insulation and building envelope solutions. The company dominates the market with its advanced insulated sandwich panels, which are used extensively in commercial, industrial, and cold storage facilities. Kingspan's emphasis on energy efficiency, fire safety, and innovation in construction materials has made it a top choice for sustainable and high-performance building projects worldwide.

Tata Steel and NCI Building Systems are some of the emerging market participants in the market.

-

Tata Steel, one of India’s largest steel producers, has made significant strides in the prefabricated construction space through its Nest-In brand. The company offers a range of prefabricated housing and infrastructure solutions using steel-based panels and modular components. Focusing on affordable, scalable, and quick-to-deploy construction systems, Tata Steel addresses housing, sanitation, and institutional infrastructure needs in emerging markets, particularly across India and Asia.

-

NCI Building Systems, now part of Cornerstone Building Brands (U.S.), is a major manufacturer of metal building components and prefabricated construction solutions. The company serves a broad market across North America with its wide portfolio of insulated metal panels, roofing systems, and wall systems. NCI leverages automation, design flexibility, and energy efficiency to cater to commercial, industrial, and agricultural building needs, making it a key player in the region’s prefab sector.

Key Prefabricated Panels Companies:

The following are the leading companies in the prefabricated panels market. These companies collectively hold the largest market share and dictate industry trends.

- Kingspan Group

- Tata Steel

- Atco Ltd.

- Butler Manufacturing

- Metecno Group

- NCI Building Systems

- Algeco

- Ritz-Craft Corporation

- EPACK Prefab

- Lindab Group

Recent Developments

-

In 2024, Kingspan Group announced the launch of PowerPanel, an integrated insulated panel with solar PV that enables single-fix installation for high-performance building envelopes.

Prefabricated Panels Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 64.50 billion

Revenue forecast in 2030

USD 87.13 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Kingspan Group; Tata Steel; Atco Ltd.; Butler Manufacturing; Metecno Group; NCI Building Systems; Algeco; Ritz-Craft Corporation; EPACK Prefab; Lindab Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prefabricated Panels Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global prefabricated panels market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Modular

-

Panelized

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global prefabricated panels market size was estimated at USD 60.73 billion in 2024 and is expected to reach USD 64.50 billion in 2025

b. The global prefabricated panels market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 87.13 billion by 2030.

b. The modular segment led the market and accounted for the largest revenue share of 50.7% in 2024, due to its ability to deliver fully integrated, ready-to-install structures with reduced construction time and labor costs.

b. Some of the key players operating in the prefabricated panels market include Kingspan Group, Tata Steel, Atco Ltd., Butler Manufacturing, Metecno Group, NCI Building Systems, Algeco, Ritz-Craft Corporation, EPACK Prefab, and Lindab Group

b. Key factors driving the prefabricated panels market include rising demand for fast and cost-efficient construction, growing urbanization, sustainability initiatives, and advancements in building technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.