- Home

- »

- Advanced Interior Materials

- »

-

Pressure Sensitive Tapes Market Size & Share Report, 2030GVR Report cover

![Pressure Sensitive Tapes Market Size, Share & Trends Report]()

Pressure Sensitive Tapes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Specialty Tapes, Packaging Tapes, Consumer Tapes), By Technology (Hot Melt, Water-based, Solvent-based, Radiation Cured), By Region, And Segment Forecasts

- Report ID: 978-1-68038-743-8

- Number of Report Pages: 106

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pressure Sensitive Tapes Market Summary

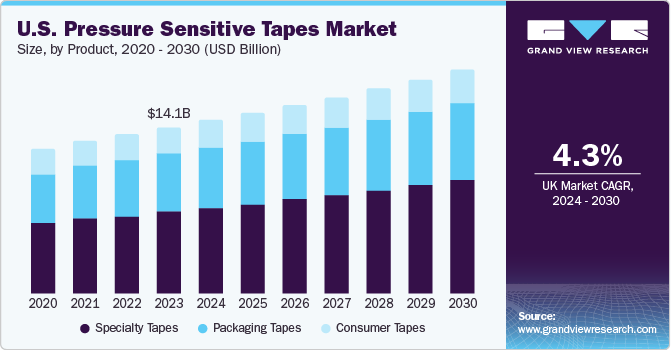

The global pressure sensitive tapes market size was estimated at USD 66.32 billion in 2023 and is projected to reach USD 92.45 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. The market is characterized by growing product penetration across end-use industries.

Key Market Trends & Insights

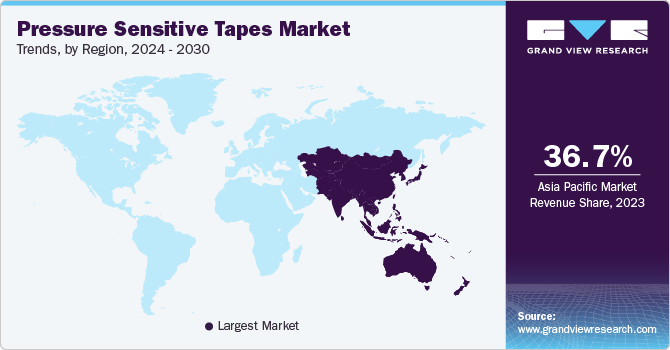

- The demand in the pressure sensitive tapes market in Asia Pacific accounted for a market share of 36.7% in 2023.

- The demand in the U.S. is on the rise due to the growth of packaging materials in the e-commerce sector.

- By product, the packaging tapes segment held the largest revenue share of more than 48.3% in 2023.

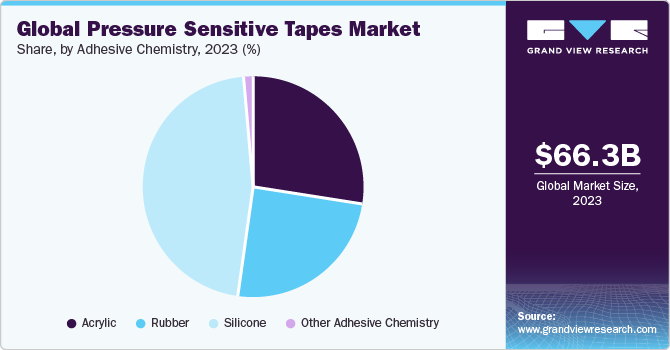

- By adhesive chemistry, acrylic segment contributing to over 46% revenue share in 2023.

- By technology, the hot melt segment accounted for over 41% share of the global revenue in 2023.

- By backing material, woven/non-woven accounted for 23.6% of the global market share in 2023.

- By application, the medical segment accounted for 23.4% of the revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 66.32 Billion

- 2030 Projected Market Size: USD 92.45 Billion

- CAGR (2024-2030): 4.9%

- Asia Pacific: Largest market in 2023

Ascending product demand in the medical and automotive industries is expected to emerge as the major factor driving the growth of the industry over the forecast period.The U.S. dominated the North America market on account of growing manufacturing sectors and the presence of manufacturers of semiconductors, automotive, and electronics. Moreover, increasing demand for tapes in fastening and bonding applications in the U.S. is further expected to drive the product demand.

The usage of pressure-sensitive adhesive tapes in automotive applications is on the rise worldwide with the surging adoption of electric vehicles. These tapes are used in automobile batteries for cell-to-cell bonding, along with providing thermal runaway protection against excessive heat. The low weight of pressure-sensitive tapes helps increase the fuel efficiency of vehicles, while their transparent surface helps maintain the aesthetic appeal of automobiles.

The product demand is expected to be restrained by the presence of a number of substitutes such as adhesives, sealants, and fasteners. Extensive utilization of these products for bonding across various end-use industries including automotive, building & construction, and aerospace is expected to drive product growth over the forecast period.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The industry is characterized by a high degree of innovation as technological trends are focused on producing advanced products with superior performance. The development of customized tapes designed for use in specialized applications is expected to boost the substitution of conventionally used adhesives and other bonding materials, thereby driving the industry over the forecast period.

The market is also characterized by a high level of merger and acquisition (M&A) activity. The new players require high capital to set up manufacturing plants and build a customer base, making it difficult for new players to enter the market. Hence, the industry giants opt for mergers and acquisitions with new players to maintain market dominance.

The use of adhesives and other materials in the production of pressure sensitive tapes is highly regulated. Regulations have been imposed regarding the use of types of adhesives and backing materials for various applications. In addition, the national governments in Europe and North America have mandated the listing of the materials used for the production of pressure sensitive tapes, thereby increasing the complexity of the regulatory framework.

Extensive utilization of a large number of products such as adhesives, sealants, and fasteners leads to a high threat of substitution. In addition, abundant availability of alternative products coupled with limited exposure in terms of potential use of tapes inhibits the adoption of the product for applications such as automotive, aerospace, and medical.

Pressure sensitive tapes are distributed to end-users such as construction companies, automobile manufacturers, hospitals & clinics, and individuals, which together form the last stage of the value chain. The tapes are employed on a large scale by the aforementioned end-users for various applications including decorative panels, partition walls, automotive interiors, and wound dressings.

Product Insights

The packaging tapes segment held the largest revenue share of more than 48.3% in 2023 and is expected to grow at the fastest CAGR during the forecast period. The demand for packaging tapes is likely to be driven by their increasing utilization in applications such as sealing, enclosing, bundling, and wrapping. The adhesives used for such tapes do not provide high adhesion as they are meant to be used for temporary applications.

Specialty tapes find high application in the medical, automotive, hygiene, and electrical industries. Wound care & plasters are one of the fastest-growing applications of the product across the globe. Ascending demand for sustainable and easy-to-use wound care solutions is expected to drive the consumption of specialty tapes in medical industry.

Consumer tapes are used in sports and entertainment applications, mainly for reinforcing bats, hockey sticks, and rackets. The product finds extensive application scope in sports such as hockey, cricket, and boxing for temporary fastening of shin pads and other protective equipment. In addition, the rising utilization of the product in indoor & outdoor temporary repair, securing, and protection applications is expected to drive the market over the forecast period.

Technology Insights

The hot melt segment accounted for over 41% share of the global revenue in 2023. The demand for hot melt technology is primarily driven by their high consumption volumes in North America. Increasing utilization of the product in the automotive and aerospace industries for bonding and mounting components is expected to boost the market growth over the forecast period.

The demand for solvent-based technology is limited on account of the concerns associated with the application process of the adhesive onto the backing materials. The use of solvent-based products in the medical and healthcare industry is highly regulated in terms of the type of adhesives and solvents to be used for the product.

Specialty tapes are generally manufactured using hot melt or solvent-based technology on account of the superior product performance achieved through the use of these technologies. Furthermore, hot melt technology ensures a longer product life for both indoor and outdoor applications. The technology can also be used to manufacture a variety of backing materials for varying applications.

Water-based adhesive tapes provide the advantage of low VOC content and are thus expected to register a high demand over the forecast period. However, the product is unlikely to make much headway into the European and North American markets due to the high existing penetration of hot melt and solvent-based adhesive technologies.

Backing Material Insights

Backing material of tapes is one of the major criteria for the choice of product across various applications. Woven/Non-woven was the largest backing material segment and accounted for 23.6% of the global market share in 2023. Woven and non-woven backing materials are used predominantly in the medical and hygiene industry. The growth in the aging population coupled with rising healthcare expenditure across the globe is anticipated to propel the demand for such tapes.

The polyvinyl chloride (PVC) backing materials segment is expected to grow at the fastest CAGR of 5.7% from 2024 to 2030. These types of tapes find extensive utilization in applications that require electrical insulation. PVC backing materials are available in multiple densities of the backing material depending on the application. Such tapes exhibit superior flame retardant properties, which is one of the major criteria for the choice of insulating products.

Polypropylene-backed material finds extensive application in sealing and packaging. These tapes do not stretch easily and conform to uneven and smooth surfaces, thereby registering a high demand across various packaging and sealing applications. The advantages offered by polypropylene backing include strong abrasion and water resistance, which further facilitate its use in carton packaging and sealing.

PET specialty tapes find extensive application in splicing raw films that are exposed to high-temperature processes. The use of advanced PET film for applications including assembly, bonding, and splicing across multiple industries is expected to propel their demand. These tapes are extensively utilized in critical applications in the aerospace and automotive industries, wherein protection from fluids and oils is a prerequisite.

Application Insights

In 2023, the medical applications segment accounted for 23.4% of the revenue share owing to their usage to attach dressings, bandages, and gauze to the skin and wounds. These tapes are used in almost all medical procedures, including wound care, post-operative care as well as IV set placements. Hence, the demand for surgical tapes is expected to grow owing to their use in many complicated as well as simple medical procedures.

The aerospace segment is projected to grow at the fastest CAGR of 6.8% over the forecast period owing to the growing use of pressure sensitive tapes for anti-slip solutions, cable management, vibration and noise dampening, mounting of honeycomb panels, protection for sensitive surfaces, and masking tapes for exterior panels.

Adhesive Chemistry Insights

Acrylic is one of the most widely utilized adhesive chemistries for manufacturing pressure sensitive tapes, thus contributing to over 46% revenue share in 2023. Acrylic adhesives are manufactured using acrylic polymers and offer high UV resistance. Furthermore, these adhesives provide better plasticizer and solvent resistance, which offers them a competitive advantage over rubber-based pressure sensitive tapes.

Rubber adhesives employed for the production of pressure sensitive tapes involve the use of both natural as well synthetic rubber, which are further modified with oil, antioxidants, and tacking resins. Although rubber adhesives impart the quickest sticking ability to the tapes, they do not achieve the same in high temperature applications. Furthermore, lower UV and solvent resistance associated with these adhesives is expected to hamper their demand over the projected period.

Ascending demand for silicone-based pressure sensitive tapes in electronics applications, on account of their excellent dielectric properties, is expected to have a positive impact on the growth. Excellent heat & cold resistance, good removability, and superior water & chemical resistance exhibited by these products are expected to emerge as the key factors propelling product growth over the forecast period.

Regional Insights

The presence of developed economies, such as the U.S. and Canada in North America contributes to the growth of the building & construction industry of the region, thereby driving the market for pressure-sensitive adhesive tapes.

Additionally, the ability of these tapes to handle wind loads in the changing climate of Canada, along with their better performance than mechanical fasteners, makes them ideal for bonding architectural panels.

U.S. Pressure Sensitive Tapes Market Trends

The demand in the pressure sensitive tapes market in the U.S. is on the rise due to the growth of packaging materials in the e-commerce sector. The tapes help secure the shipments and packages while transporting from one place to another. The U.S. government’s focus on infrastructure development and investment in construction projects is expected to further boost product demand.

The Mexico pressure sensitive tapes market is projected to grow at a lucrative CAGR from 2024 to 2030. National Infrastructure Program (PNI) was initiated by Mexican government under the National Development Plan to boost infrastructural growth in the country as a strategic move to increase productivity and improve competitive market of construction industry. PNI is anticipated to reduce regional differences across the country and increase overall standard of living in Mexico, resulting in an ascending product demand in the country.

Asia Pacific Pressure Sensitive Tapes Market Trends

The demand in the pressure sensitive tapes market in Asia Pacific accounted for a market share of 36.7% in 2023. Asia Pacific is one of the fastest-growing economies, spearheaded by China and India. The increasing production in the region due to rising investments by the major manufacturers is expected to positively impact the demand for tapes over the forecast period.

The pressure sensitive tapes market in Asia Pacific held a significant revenue share in 2023 owing to the booming e-commerce and consumer goods sectors in China and India. Pressure sensitive tapes are widely used in the packaging industry for sealing boxes or cartons. South Korea, China, Japan, and India are manufacturing hubs of white-labeled products, which is driving the regional demand.

The growth of the market for pressure sensitive tapes in India is expected to be driven by the rising product usage in bonding, noise reduction, and surface protection applications in the automotive industry. India’s steadily growing automotive industry, which includes an increase in commercial, vehicles, passenger vehicles, and two-wheelers. This is expected to positively influence the market growth.

Europe Pressure Sensitive Tapes Market Trends

The pressure sensitive tapes market in Europe held a significant revenue share in 2023. The automotive sector is a major contributor to Europe’s economic growth owing to the strong presence of German and Italian automobile companies. Pressure sensitive tapes such as foam tapes, black PSA tapes, and stripe tapes are extensively used to protect wheels from damage and corrosion. Furthermore, the growing packaging sector is expected to drive the market growth during the forecast period.

Ascending demand for tapes in the packaging industry is expected to drive the growth of the pressure sensitive tapes market in France in the forthcoming years. Although the demand for adhesives and sealants is high in France, increasing utilization of tapes for substituting adhesives in industrial applications is likely to propel the demand for tapes in the country.

The growth of the market for pressure sensitive tapes in Germany is driven by the high product demand in the packaging sector. The growth can also be attributed to the rising demand for skin and wound care products and tapes in Germany owing to its aging population. The growing functionalities of skin-friendly medical tapes and surgical tapes equipped with pressure sensitive tapes are expected to drive the market growth.

Central & South America Pressure Sensitive Tapes Market Trends

The growth of the pressure sensitive tapes market in Central & South Americais driven by the growing e-commerce & consumer goods and food & beverage packaging industries.The product has a diverse range of manufacturing applications including electronic, automotive, packaging, construction, and textiles. It is widely used for masking, bonding, and insulation in the automotive and electronic sectors, which is projected to drive the market growth.

The Brazil pressure sensitive tapes market is estimated to grow at a significant CAGR over the forecast period. Sustainability is a public concern in Brazil due to waste pollution and has fostered the inclination toward biomass pressure sensitive tapes.

Middle East & Africa Pressure Sensitive Tapes Market Trends

The pressure sensitive tapes market in Middle-East and Africa is expected to grow at a steady CAGR during the forecast period. The key driving factor includes the high demand for pressure sensitive adhesives in the building & construction industry. The rising adoption of biodegradable and reclycleable packaging material is an emerging trend in the market.

The growth of the Saudi Arabia pressure sensitive tapes market is driven by the ongoing infrastructural projects in Saudi Arabia and the massive influx of investments in real estate. For instance, the Government of Saudi Arabia disclosed its National Investment Strategy in October 2021 aims to assist the country in achieving its Vision 2030 goals. Renewable energy, manufacturing, logistics and transportation, healthcare, and infrastructure are among the major industries covered by the National Investment Strategy of Saudi Arabia.

Key Pressure Sensitive Tapes Company Insights

Some of the key market players include tesa SE, 3M, Intertape, Nitto Denko, LINTEC Corporation, and Henkel:

-

tesa SE is engaged in the manufacturing of self-adhesive products and system solutions for industrial as well as professional consumers. The company operates its business as a wholly-owned affiliate of Beiersdorf AG in over 100 countries, with production facilities located in Germany, Italy, the U.S., and China.

-

3M manages its business through five business verticals, namely consumer, health care, industrial, safety & graphics, and electronics & energy. The company specializes in reflective abrasives, tapes, sheets, and safety apparel and equipment.

L&L Products Inc.; Intertape Polymer; Lohmann GmbH & Co. KG; and Ashland are some of the emerging market participants.

-

L&L Products Inc. carries out its operations through four business segments, namely, aerospace, automotive, commercial vehicles, and industrial. The company ships its products to 37 countries and has manufacturing facilities spread across countries such as China, the U.S., India, France, the Czech Republic, Korea, Turkey, Australia, and Brazil.

-

Lohmann GmbH & Co. KG is engaged in the manufacturing, marketing, and distribution of double-sided adhesive tapes, transfer films, and adhesive systems. Its products are offered to numerous sectors, including transportation, building & construction, renewable energy, consumer goods & electronics, graphics, medical, and hygiene.

Key Pressure Sensitive Tapes Companies:

The following are the leading companies in the pressure sensitive tapes market. These companies collectively hold the largest market share and dictate industry trends.

- Tesa SE

- 3M

- Nitto Denko

- LINTEC Corporation

- L&L Products Inc.

- Henkel

- Lohmann GmbH & Co. KG

- Berry Plastics

- Intertape Polymer

- Avery Dennison

- Scapa

- HB Fuller

- Ashland

- The Dow Chemical Company

- Arkema Group

- Sika AG

Recent Developments

-

In September 2024, Henkel introduced a new mineral oil-free hot melt tape calledTechnomelt PS 3500, which allows the label industry to enhance food safety with mineral-oil hydrocarbons-free formulations; and enhance container recycling and waste disposal as these tapes can easily be washed off from plastic bottles; also it reduces waste & weight of liner-less label solutions.

-

In June 2023, Ahlstrom extended their range of Acti-V Industrial release liners with the introduction ofActi-V Industrial RF Brown andActi-V Industrial RF Natural.Both products offer high recycling properties by substituting a portion of virgin fibers for post-consumer recycled fibers. In addition, the new Acti-V Industrial RF Natural eliminates the need for any dye and uses a new raw materials mix that could result in an overall carbon footprint reduction of 17%-20% compared to standard Acti-W Industrial liners.

Pressure Sensitive Tapes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 69.39 billion

Revenue forecast in 2030

USD 92.45 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, backing material, adhesive chemistry, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil; Saudi Arabia; UAE

Key companies profiled

Tesa SE; 3M; Nitto Denko; LINTEC Corporation; L&L Products Inc.; Henkel; Lohmann GmbH & Co. KG; Berry Plastics; Intertape Polymer; Avery Dennison; Scapa; HB Fuller; Ashland; The Dow Chemical Company; Arkema Group; Sika AG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pressure Sensitive Tapes Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the pressure sensitive tapes market report based on product, technology, backing material, adhesive chemistry, application, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Specialty Tapes

-

By Technology

-

Hot Melt

-

Water-based

-

Solvent-based

-

Radiation-cured

-

-

By Backing Material

-

Woven/Nonwoven

-

Polyvinylchloride (PVC)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

Foam

-

Metal

-

Other Backing Materials

-

-

By Adhesive Chemistry

-

Acrylic

-

Rubber

-

Silicone

-

Other Adhesive Chemistry

-

-

By Application

-

Automotive

-

Aerospace

-

White goods

-

Electronics

-

Semiconductors

-

Electrical

-

Paper & printing

-

Construction

-

Medical

-

Hygiene

-

Retail & Graphics

-

Other Applications

-

-

-

Packaging Tapes

-

Consumer Tapes

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pressure sensitive tapes market size was estimated at USD 66.32 billion in 2023 and is expected to reach USD 69.39 billion in 2024.

b. The global pressure sensitive tapes market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 92.45 billion by 2030.

b. Packaging pressure sensitive tapes led the market and accounted for over 48.3% share of the revenue in 2023 owing to their increasing utilization in applications such as sealing, enclosing, bundling, and wrapping.

b. Some of the key players operating in the pressure sensitive tapes market include H.B. Fuller, tesa SE, Henkel AG & Co., KGaA, Bostik S.A., 3M, Sika AG, and Ashland, Inc.

b. The key factors that are driving the global pressure sensitive tapes market include growing product penetration across the end–use industries such as medical and automotive industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.