- Home

- »

- Sensors & Controls

- »

-

Pressure Sensor Market Size & Share, Industry Report, 2030GVR Report cover

![Pressure Sensor Market Size, Share & Trends Report]()

Pressure Sensor Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Type (Wired, Wireless), By Technology (Piezoresistive, Electromagnetic), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-246-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pressure Sensor Market Summary

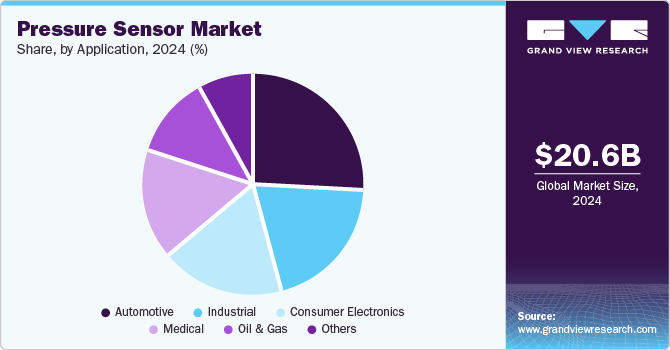

The global pressure sensor market size was estimated at USD 20.60 billion in 2024 and is projected to reach USD 26.32 billion by 2030, growing at a CAGR of 4.1% from 2025 to 2030. The market growth is driven by increasing demand across various industries, including automotive and healthcare.

Key Market Trends & Insights

- The Asia Pacific pressure sensor market dominated with the revenue share of 39.08% in 2024.

- India’s pressure sensor industry is expected to grow at the fastest CAGR during the forecast period.

- By product, the absolute pressure sensor segment held the largest market share of 42.6% in 2024.

- By type, the wired segment held the largest market share in 2024.

- By technology, the piezoresistive segment held the largest market share in 2024.

- By application, the automotive segment dominated the market in 2024 in terms of revenue share.

Market Size & Forecast

- 2024 Market Size: USD 20.60 Billion

- 2030 Projected Market Size: USD 26.32 billion

- CAGR (2025-2030): 4.1%

- Asia Pacific: Largest market in 2024

Applications range from consumer electronics and portable healthcare wearables to alarm systems, medical breathing devices, water purifiers, refrigeration systems, and off-road construction equipment. In addition, advancements in technology have enabled the development of compact, cost-effective, and smart pressure sensors that integrate with smart devices for precise measurements, further fueling market demand.The growing use of pressure sensors in home appliances, such as refrigerators and washing machines, is driving the demand for pressure sensors. Numerous pressure sensor providers are also focusing on developing innovative products to cater to the increasing demand from the automotive sector. For instance, in October 2024, Future Electronics, a prominent company in electronic component distribution, announced the availability of Melexis' Triphibian family of MEMS pressure sensors. This innovative, patented technology is a breakthrough for the automotive industry and related markets, as it can withstand pressures exceeding 5 bar while maintaining direct contact with liquid media. Such product launches are harnessing innovation and growth in the pressure sensor industry.

Several OEMs have started using Microelectromechanical Systems (MEMS) pressure sensors in smartphones, tablets, and wearables. For instance, Samsung has integrated pressure sensors in its flagship phone Galaxy S4. Other handset makers, such as Sony Mobile Communications AB, Apple Inc., and Xiaomi Inc., have also started using MEMS pressure sensors in their respective smartphones. Consumers’ preference for compact consumer electronics and the advances in MEMS technology have also enabled the development of sensors that are smaller in size. As a result, the adoption of MEMS pressure sensors in consumer electronics is growing, thereby contributing to the overall pressure sensor industry growth.

In recent years, the automotive industry has undergone a technology transition with an increasing focus on comfort and safety, which provides ample opportunities for the development of pressure sensors. At the same time, increasing sensor-rich applications in drones, autonomous vehicles, and AR/VR equipment are further accelerating the demand for MEMS pressure sensors. Moreover, the increasing military spending across regions is also paving the way for technologies like drones and Unmanned Aerial Vehicles (UAVs). Such factors bode well for the growth of the market over the forecast period.

Various companies across the globe are focusing on providing pressure sensors with built-in IoT systems. Pressure sensors are used in IoT systems to monitor devices and systems driven by pressure signals. For instance, in April 2024, TE Connectivity (TE), a prominent company in connectivity and sensor technology, expanded its portfolio with the addition of two IoT wireless pressure sensors, the 65xxN, designed for short-range applications, and the 69xxN, optimized for long-range coverage. Such initiatives are anticipated to drive the market’s growth over the forecast period.

Product Insights

The absolute pressure sensor segment held the largest market share of 42.6% in 2024. An absolute pressure sensor is a closed system that references a perfect vacuum and creates pressure readings unaffected by atmospheric pressure. Absolute pressure sensors are used in applications requiring industrial, high-performance vacuum pump monitoring. The growing demand for error-free engine functionality to manufacture safe and secure vehicles is a significant factor driving the segment's growth. Moreover, the increasing demand for these absolute pressure sensors for vacuum packaging medical products in a clean environment further boosts the segment’s growth.

The differential pressure sensor segment is expected to grow at the fastest CAGR during the forecast period. Differential pressure sensors are used in industrial environments where a pressure difference is utilized to determine the flow of liquids and gases. Numerous differential pressure sensor providers are undergoing strategic initiatives such as new product launches for various industrial applications. For instance, in September 2024, Eaton introduced its VS6 electronic differential pressure sensor, an advanced clogging indicator that continuously monitors the differential pressure in lubrication and hydraulic oil filters, allowing users to easily assess the condition of the filter elements.

Type Insights

The wired segment held the largest market share in 2024. A wired pressure sensor is available in different technologies, such as photoelectric, capacitive, and inductive. The rising demand for wired pressure sensors in the industrial, automotive, and other sectors, owing to their lower radio frequency interference, smaller size, compatibility between manufacturers, and lower cost installation properties, is expected to drive the growth of the segment over the forecast period. Lower power consumption by a wired pressure sensor is further contributing to segment growth.

The wireless segment is expected to register the fastest CAGR of 5.8% during the forecast period. The benefits offered by wireless pressure sensors, such as ease of portability, enhanced safety, and cost-effectiveness, are expected to drive the growth of the segment. The increasing use of wireless pressure sensors in applications, such as consumer products, industrial automation & manufacturing, air compressor monitoring, and pool pump systems, is expected to drive the segment growth over the forecast period. Self-contained, wellhead pressure, battery-powered monitoring, and casing pressure monitoring solutions are propelling the growth of the wireless-type segment.

Technology Insights

The piezoresistive segment held the largest market share in 2024. The rising adoption of piezoresistive pressure sensors in cars and passenger vehicles for better emission and safety is a major factor driving the segment's growth. Piezoresistive pressure sensors are used in a wide range of aerospace and industrial applications owing to their robustness, rapid response time, and high frequency. Several manufacturers are focusing on developing waterproof sensors that are resistant to external disturbances, thereby driving the segment’s growth.

The optical segment is expected to register the fastest CAGR from 2025 to 2030. Optical pressure sensors detect a change in pressure through an effect on light. Because of their freedom from electromagnetic interference, optical sensors are very useful in harsh environments. Their small size, flexibility, the absence of any potentially hazardous voltages, and the fact that the sensors are made of non-toxic materials make them very well suited to various applications, such as in the medical sector.

Application Insights

The automotive segment dominated the market in 2024 in terms of revenue share. Pressure sensors are used in electric cars to stop the doors from catching fingers. Moreover, numerous pressure sensor companies worldwide are developing and launching new pressure sensors and systems to measure the dynamic pressure system in moving vehicles. In addition, pressure sensors are also used in engine management systems to monitor intake manifold pressure and optimize fuel delivery. This can help improve fuel efficiency and reduce emissions. These benefits are boosting the product demand in the automotive segment.

The consumer electronics segment is expected to grow rapidly during the forecast period. The segment growth is driven by the widespread adoption of wearable devices, smartphones, and smart home technologies. The demand for compact, low-power, and highly accurate sensors has surged as manufacturers seek to enhance device functionality and user experience. Innovations in MEMS technology have enabled the development of miniature pressure sensors that provide precise measurements for applications such as altitude tracking, indoor navigation, and environmental monitoring.

Regional Insights

The North America pressure sensor industry was identified as a lucrative region in 2024, owing to the high demand for pressure sensors in TPMS and EGR system applications in the automotive segment. The presence of key players in the region is also one of the major factors driving market growth. At the same time, the increasing demand for pressure sensors in industries, such as oil & gas, petrochemical, and medical, is also accelerating the market growth in this region.

U.S. Pressure Sensor Market Trends

The U.S. pressure sensor industry held a dominant position in 2024 in the North American region. The market is witnessing robust growth, largely driven by the country’s advanced industrial landscape and technological innovation. The presence of key sectors such as aerospace, automotive, and healthcare fuels continuous demand for high-precision pressure sensors. Moreover, the growing trend of smart manufacturing and automation is increasing the adoption of sensor-integrated systems.

Europe Pressure Sensor Market Trends

Europe pressure sensor industry is expected to register a moderate CAGR from 2025 to 2030. The Europe pressure sensors industry is supported by a strong foundation in industrial engineering and sustainability initiatives. The region’s commitment to environmental monitoring and regulatory compliance is a key growth driver, especially in sectors such as energy, automotive, and manufacturing.

The UK pressure sensor industry is expected to grow at a notable CAGR from 2025 to 2030. In the UK, the pressure sensor industry is growing steadily, supported by increased investments in the healthcare sector and rising adoption of smart technologies. Pressure sensors play a critical role in medical devices, HVAC systems, and water treatment applications, areas where the country has been actively investing.

The pressure sensor industry in Germany held a substantial market share in 2024. The increasing automotive sector across the country and rising focus on industrial automation can be attributed to the growth of the market. The country’s strong manufacturing base relies heavily on sensors for process control, machine monitoring, and vehicle systems, especially in electric and autonomous vehicles. With deep integration of Industry 4.0 practices, Germany continues to drive demand for intelligent and rugged pressure sensing technologies.

Asia Pacific Pressure Sensor Market Trends

The Asia Pacific pressure sensor market dominated with the revenue share of 39.08% in 2024 and is anticipated to grow at a CAGR of 5.2% during the forecast period. The growth of the region can be attributed to the large-scale production of electronic components as well as the rising investment in R&D. The increasing demand for consumer electronics, such as tablets, wearable devices, and smartphones, is driving the demand for pressure sensors in this region. India and China are contributing a large share of the regional market. China is a mature marketplace and features strong business opportunities.

India’s pressure sensor industry is expected to grow at the fastest CAGR during the forecast period. India’s market is growing at a promising pace, fueled by expanding demand in healthcare, automotive, and consumer electronics. With increasing investments in affordable medical technologies and the Make in India initiative boosting local manufacturing, pressure sensors are finding broader applications in ventilators, smartphones, and industrial equipment.

The China pressure sensor industry held a substantial market share in 2024. China is experiencing growth in the pressure sensor industry, propelled by large-scale industrialization and strong government support for technological advancement. The expansion of EV manufacturing and urban development initiatives, such as smart cities, are major contributors to this trend.

Key Pressure Sensor Company Insights

Some of the key companies in the pressure sensor industry include ABB Ltd., Siemens AG, and Robert Bosch GmbH, among others. Key players focus on partnerships, research & development, and geographic expansion to enhance their market positions.

-

Siemens AG’s comprehensive range of pressure and flow sensors leverages proven technology and rigorous testing to deliver accurate, reliable, and maintenance-free performance. The company provides sensors for both pressure and differential pressure measurement, tailored to meet the demands of HVAC systems on both the air and water sides.

-

Bosch Sensortec GmbH (Bosch Sensortec’s) barometric pressure sensors support a wide range of applications in smartphones, wearables, and smart home devices. These ultra-compact, low-power sensors enhance drone altitude stabilization, enable accurate indoor navigation, and contribute to precise calorie tracking in wearables. They operate based on either the piezoresistive or capacitive sensing principle.

Key Pressure Sensor Companies:

The following are the leading companies in the pressure sensor market. These companies collectively hold the largest market share and dictate industry trends.

- AlphaSense

- Process Sensing Technologies (PST) group.

- Figaro Engineering Inc.

- Membrapor

- Nemoto Kyorindo co., Ltd.

- Robert Bosch GmbH

- ABB Ltd.

- Siemens AG

- GfG Europe Ltd.

- Baker Hughes

Recent Developments

-

In May 2024, Parker Hannifin, a prominent company in motion and control technologies, launched the SCP09 pressure sensor, a reliable and versatile solution tailored for hydraulic applications. Engineered for accuracy and precision, the SCP09 delivers reliable pressure measurements across diverse conditions, making it ideal for both mobile machinery and industrial hydraulic systems.

-

In February 2024, Tekscan introduced a pressure mapping sensor specifically designed to address the challenges of measuring interface pressure in battery manufacturing and R&D. This innovative system provides valuable insights by pinpointing potential issues in battery design, ultimately contributing to safer, more reliable, and improved energy storage solutions.

Pressure Sensor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.54 billion

Revenue forecast in 2030

USD 26.32 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, technology, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Russia, Nordic Region, China, Japan, India, South Korea, Australia, Brazil, Argentina, KSA, UAE, and South Africa

Key companies profiled

AlphaSense; Process Sensing Technologies (PST) group; Figaro Engineering Inc.; Membrapor; Nemoto Kyorindo co., Ltd.; Robert Bosch GmbH; ABB Ltd.; Siemens AG; GfG Europe Ltd.; Baker Hughes

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pressure Sensor Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest application trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pressure sensor market report based on product, type, technology, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Absolute Pressure Sensors

-

Differential Pressure Sensors

-

Gauge Pressure Sensors

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Piezoresistive

-

Electromagnetic

-

Capacitive

-

Resonant Solid-State

-

Optical

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Oil & Gas

-

Consumer Electronics

-

Medical

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Nordic Region

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pressure sensor market size was estimated at USD 20.60 billion in 2024 and is expected to reach USD 21.54 billion in 2025.

b. The global pressure sensor market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030 to reach USD 26.32 billion by 2030.

b. The Asia Pacific region dominated the market in 2024. The growth of the region can be attributed to the large-scale production of electronic components as well as the rising investments in R&D. The increasing demand for consumer electronics such as tablets, wearable devices, and smartphones is driving the demand for pressure sensors in this region. India and China are contributing to a large share of the regional pressure sensor market. China is a mature marketplace and features strong business opportunities.

b. Some key players operating in the pressure sensor market include AlphaSense, Process Sensing Technologies (PST) group., Figaro Engineering Inc., Membrapor, Nemoto Kyorindo co., Ltd., Robert Bosch GmbH, ABB Ltd., Siemens AG, GfG Europe Ltd., and Baker Hughes.

b. The market’s growth can be attributed to the rising demand for pressure sensors from various industry verticals, such as automotive and healthcare, and in various applications, such as consumer electronics, portable healthcare wearables, alarm systems, medical breathing appliances, water purifiers, refrigeration systems, and off-road constructions among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.