- Home

- »

- Next Generation Technologies

- »

-

Print On Demand Market Size, Share, Industry Report, 2033GVR Report cover

![Print On Demand Market Size, Share & Trends Report]()

Print On Demand Market (2026 - 2033) Size, Share & Trends Analysis Report By Platform (Software, Services), By Product (Apparel, Home Décor, Drinkware, Accessories, Others), By Region (North America, Europe, Asia-Pacific, Latin America), And Segment Forecasts

- Report ID: GVR-4-68039-932-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Print On Demand Market Summary

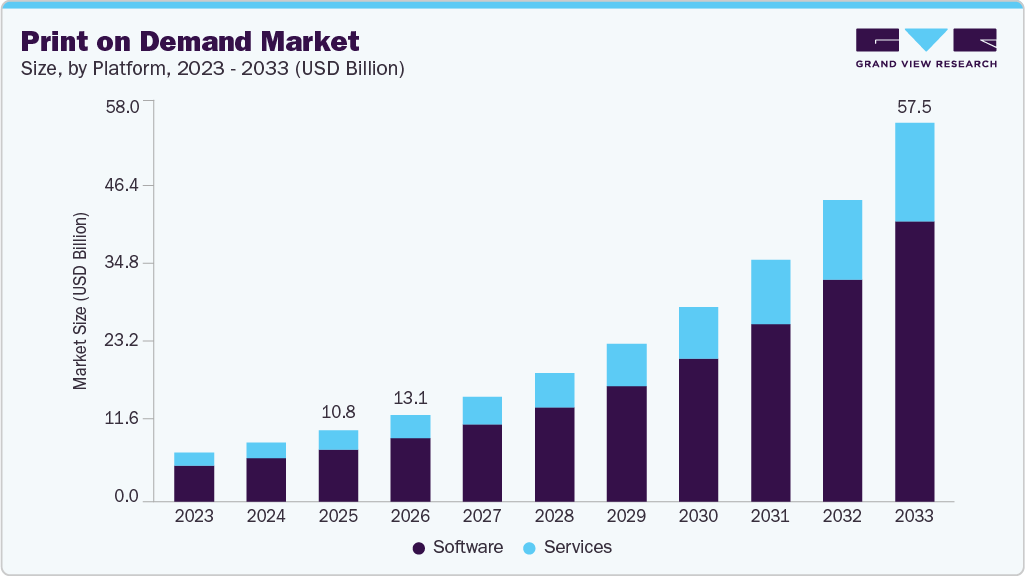

The global print on demand market size was estimated at USD 10.78 billion in 2025 and is projected to reach USD 57.49 billion by 2033, growing at a CAGR of 23.6% from 2026 to 2033. The rising demand for customized and personalized apparel, home décor, accessories, and drinkware, among others, due to changing consumer preferences and increasing interest in gifting custom-made products for special occasions, has bolstered the growth of the market.

Key Market Trends & Insights

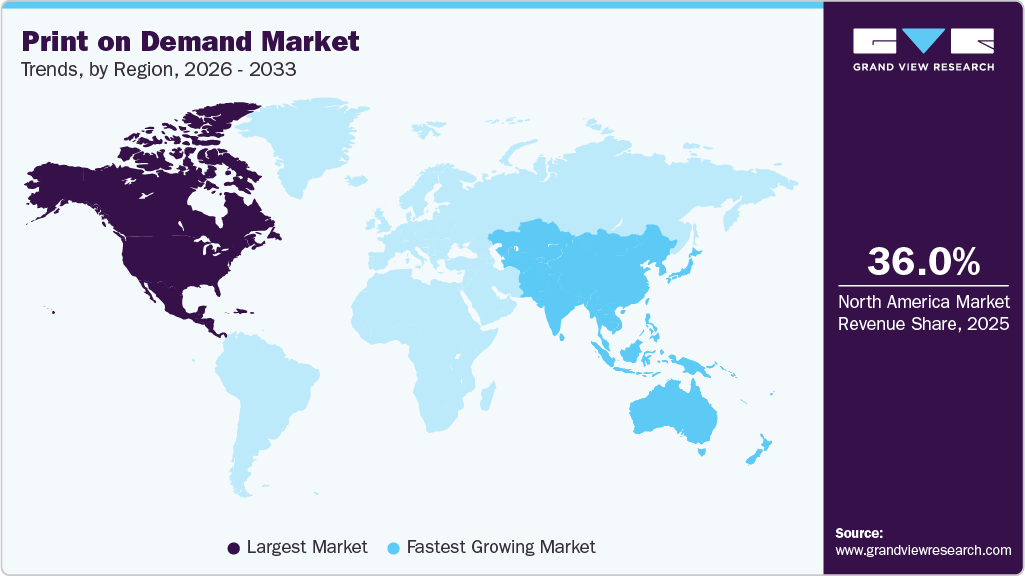

- North America dominated the print on demand industry with the largest revenue share of 36.0% in 2025.

- Asia Pacific is expected to register the fastest CAGR of 24.8% over the forecast period.

- By platform, the software segment held the largest revenue share of 69.6% in 2025.

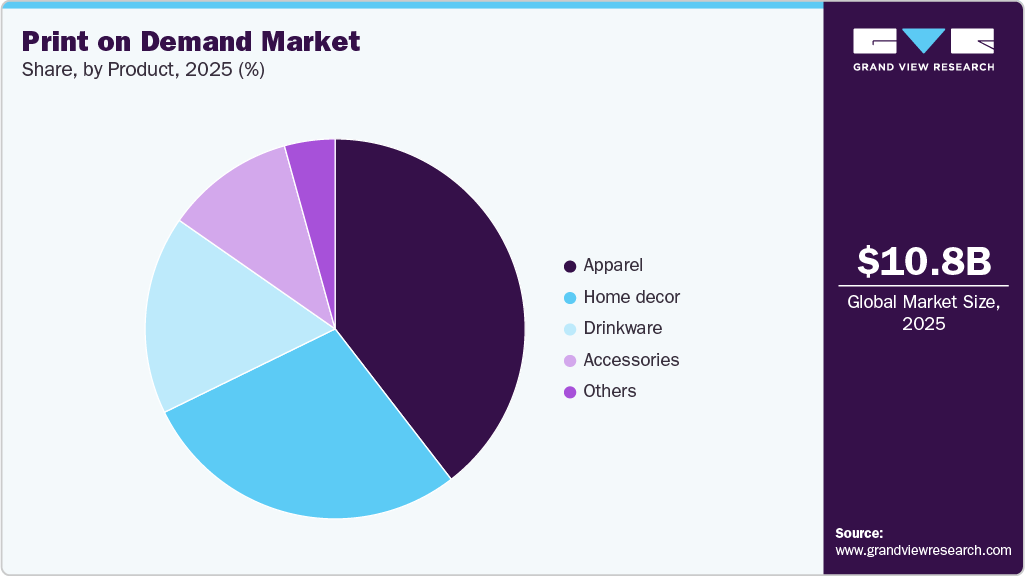

- By product, the apparel held the largest revenue share of 39.5% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 10.78 Billion

- 2033 Projected Market Size: USD 57.49 Billion

- CAGR (2026-2033): 23.6%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The rapid rise in digital retail transactions is propelling the market growth of print-on-demand, as more consumers shift toward online purchasing environments where customized, small-batch goods dominate. Government e-commerce statistics show that online retail spending remains structurally higher than in previous years, reinforcing the demand for flexible, on-demand production rather than bulk manufacturing.As shoppers increasingly seek personalized apparel, décor, books, and accessories, print-on-demand suppliers gain a strategic advantage by fulfilling micro-orders that traditional printers cannot cost-effectively serve.

Continuous improvements in digital print engines, textile inkjet systems, and additive manufacturing are boosting the market, as these technologies now support faster production, higher color accuracy, and a wider range of print materials. Government-backed research on modular manufacturing highlights how agile, compact, and digitally connected production tools are enabling fully customizable, low-inventory workflows that are directly aligned with print-on-demand operations. These technical strides reduce the minimum economic print run, encouraging adoption among brands and institutions that require rapid, short-run, or highly individualized product output.

Government environmental assessments and resource-use data reveal growing global attention to textile waste and overproduction, propelling the market growth of print-on-demand as a more sustainable alternative. Made-to-order print models eliminate the chronic issue of unsold inventory and help brands reduce waste, returns, and excess materials. As public-sector environmental agencies emphasize waste reduction and responsible material use, companies are responding by adopting print-on-demand production to align with their sustainability commitments and regulatory expectations.

Government agencies and public institutions have increasingly adopted print-on-demand solutions, such as on-demand nautical charts, official print packs, and standardized procurement workflows, thereby boosting the market by validating the reliability, data standards, and delivery accuracy of print-on-demand. These official deployments demonstrate that print-on-demand systems can comply with strict quality and traceability requirements, helping commercial buyers view print-on-demand not as a novelty but as a proven, institutionally trusted production model suitable for large-scale and regulated environments.

Recent disruptions in logistics networks and paper/material availability have heightened the need for flexible production strategies, driving the global growth of print-on-demand. Since print-on-demand relies on localized, short-run production and minimal inventory, it is less vulnerable to long-haul shipping constraints and bulk material shortages. Governments monitoring supply-chain stability have repeatedly highlighted vulnerabilities in traditional manufacturing and import-dependent models, further encouraging businesses to adopt print-on-demand as a resilient, market-ready alternative.

Platform Insights

Based on the platform, the print-on-demand market is segmented into software and service. The service segment is anticipated to register the fastest CAGR of 24.9% over the forecast period. This can be attributed to a larger number of service providers offering drop shipping and end-to-end fulfillment services. The service providers also offer services like marketing & branding services, custom packaging, and creative services like photography and graphic design. These services offer convenience and options to print-on-demand merchants and artists.

The software segment accounted for the largest revenue share in 2025 and is expected to retain its dominance throughout the forecast period. The growth of the software segment can be attributed to the increase in technology investments by service providers in the print-on-demand industry. Service providers offer software solutions such as Application Programming Interface (API) and design-making tools. The API makes it convenient for print-on-demand merchants to integrate their online store with a print-on-demand platform. The software segment is further bifurcated into stand-alone and integrated.

Product Insights

Based on product, the market is classified into apparel, home decor, drinkware, accessories, and others. The apparel segment accounted for the largest revenue share of 39.5% in 2025 and is projected to retain its position over the forecast period. This can be attributed to the increase in the shift toward fashion clothing, fast penetration of online retail in the fashion space, and the younger generation looking for custom and unique products. According to Printify, Inc., a U.S.-based company, apparel was the highest-selling product group on its platform in September 2021, accounting for 62.38% of the total items sold.

The home décor segment is expected to register the fastest CAGR of 24.5%. The growth is largely driven by the global shift toward remote work following the pandemic, as more individuals spend time at home and seek to enhance their living spaces. Additionally, the expanding availability of a diverse range of home and living products such as mats, cushions, posters, and more is providing customers with abundant choices, thereby boosting sales.

Regional Insights

North America dominated the market in 2025 with a revenue share of 36.0% and is anticipated to maintain its dominance over the forecast period. Factors such as technology infrastructure, stable economies, and the presence of manufacturing facilities for print-on-demand products are the reasons for the market's growth. For instance, some of the largest print-on-demand companies like Printful, Inc., Printify, Inc., and Zazzle Inc. are headquartered in the U.S. Companies based outside North America, like Norway-based Gelato and Australia-based Redbubble Ltd., also have fulfillment centers in the region.

U.S. Print on Demand Market Trends

The print on demand market in the U.S. is primarily driven by the rise of the creator economy and the seamless integration of print on demand services with major e-commerce platforms such as Shopify, Etsy, and Amazon. Content creators, small businesses, and independent artists are increasingly launching customized merchandise without upfront inventory costs. The convenience of on-demand fulfillment and consumers’ preference for personalized products are key contributors to market growth.

Asia Pacific Print on Demand Market Trends

Asia Pacific is expected to register the fastest CAGR of 24.8% over the forecast period. The growth can be attributed to the existence of major market players. Growing internet penetration, smartphone adoption, and a large number of online shoppers are the key growth drivers for the regional market. Technological advancements and the presence of several large textile units are expected to contribute to the regional market's growth.

The China print on demand market is expanding rapidly due to the proliferation of mobile-first social commerce platforms like WeChat, Douyin, and Xiaohongshu. Consumers, especially Gen Z and millennials, are increasingly drawn to individualized fashion and lifestyle products. Local supply chain efficiency and the ability to fulfill orders quickly and affordably also position China as a high-growth market for print on demand services.

Europe Print on Demand Market Trends

In Europe, the demand for sustainable and environmentally responsible products is a major driver for the print on demand market. Consumers are becoming more conscious of waste reduction and overproduction, making made-to-order models highly appealing. Additionally, local manufacturing options and compliance with strict EU sustainability regulations are encouraging businesses to shift toward print on demand models.

The print on demand market in the UK is being driven by the increasing number of independent online sellers and startups seeking to offer niche or personalized products. The growth of online retail and digital entrepreneurship has accelerated by changing consumer habits, which has led many to adopt print on demand services to test product designs without financial risk. Consumers in the UK show strong demand for bespoke, limited-edition items, especially in apparel, gifts, and accessories.

Key Print on Demand Company Insights

Some of the leading print on demand providers globally included in the study are VistaPrint (Cimpress), Printify, Inc., Canva, Printful Inc., among others. The market has a fragmented competitive landscape featuring various global and regional players. Leading industry players are adopting strategies such as partnerships, collaborations, mergers and acquisitions, and agreements to survive the highly competitive environment and enhance their business footprints. Moreover, service providers are spending substantial funds on research and development activities to develop advanced products and integrate new technologies in their offerings to achieve a competitive lead over other market players.

-

Printify, Inc. is a global print on demand company, founded in 2015 and headquartered in Riga, Latvia, with additional offices in the U.S. (San Francisco, California). The platform offers a wide range of print on demand products, including custom apparel (t-shirts, hoodies, leggings, and socks), accessories (phone cases, tote bags, mugs), home décor items (canvas prints, pillows, blankets), and stationery (notebooks, stickers, calendars). These products are fulfilled through a global network of more than 75 print providers across 100+ locations worldwide, allowing merchants to choose partners based on price, shipping time, and product availability.

-

VistaPrint is a global e-commerce and print on demand company, founded in 1995. It operates as a subsidiary of Cimpress plc, a mass-customization conglomerate headquartered in Ireland. VistaPrint’s core offerings include a comprehensive range of marketing materials and print on demand products such as business cards, brochures, signs and posters, invitations and stationery, clothing and bags, promotional merchandise, as well as digital marketing tools. The company serves individuals and small businesses with customizable, professionally printed solutions tailored to branding and promotional needs.

Key Print On Demand Companies:

The following are the leading companies in the print on demand market. These companies collectively hold the largest Market share and dictate industry trends.

- Printify, Inc.

- Printful Inc.

- Canva

- VistaPrint (Cimpress)

- CustomCat

- Gelato

- Gooten

- Printed Mint

- Teelaunch

- Zazzle, Inc.

- RedBubble Group

Recent Developments

-

In May 2025, Gelato released 149 new features to its production management platform, GelatoConnect, aimed at accelerating efficiency, automation, and scalability for print service providers. Among the key updates were web-to-print storefront integrations with platforms such as Shopify, Etsy, Infigo, and Pressero, enabling plug-and-play setups without requiring code or engineering resources.

-

In April 2022, VistaPrint announced the acquisition of Depositphotos, Inc., a microstock agency, and Crello, an online graphic editing provider. With these acquisitions, VistaPrint rebranded as Vista, encompassing Vista x Wix, VistaPrint, Crello, and 99designs. In addition, the company rebranded Crello as VistaCreate.

-

In November 2021, Printful Inc. announced a strategic partnership with Vexels, a Uruguay-based design platform specializing in merchandise and commercial-use graphics. This collaboration will integrate Vexels’ design capabilities into Printful’s design tool, enhancing the user experience by enabling customers to create and access high-quality designs more efficiently.

Print on Demand Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 13.06 Billion

Revenue forecast in 2033

USD 57.49 Billion

Growth Rate

CAGR of 23.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, product, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Printify, Inc.; Printful Inc.; Canva; VistaPrint (Cimpress); CustomCat; Gelato; Gooten; Printed Mint; Teelaunch; Zazzle, Inc.; RedBubble Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Print on Demand Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global print on demand market based on platform, product, and region.

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Stand-alone

-

Integrated

-

-

Services

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Apparel

-

Home Decor

-

Drinkware

-

Accessories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global print on demand market size was estimated at USD 10.78 billion in 2025 and is expected to reach USD 13.06 billion in 2026.

b. The global print on demand market is expected to grow at a compound annual growth rate of 23.6% from 2026 to 2033 to reach USD 57.49 billion by 2033.

b. The apparel segment dominated the global print on demand market with a share of 39.5% in 2025. This is attributable to the companies lowering printing costs by allowing them to track, manage, and operate their entire printer fleet from a single application interface.

b. Some key players operating in the global print on demand market include Printify, Inc.; Printful Inc.; Canva; VistaPrint (Cimpress); CustomCat; Gelato; Gooten; Printed Mint; Teelaunch; Zazzle, Inc.; RedBubble Group.

b. The rising demand for customized and personalized apparel, home décor, accessories, and drinkware, among others, due to changing consumer preferences and increasing interest in gifting custom-made products for special occasions, have bolstered the growth of the market. In addition, factors such as rising disposable income, increasing internet penetration and smartphone adoption, and inclination toward fashion apparel and unique products are fueling the demand for print-on-demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.