- Home

- »

- Advanced Interior Materials

- »

-

Printed Tape Market Size & Share, Industry Report, 2030GVR Report cover

![Printed Tape Market Size, Share & Trends Report]()

Printed Tape Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Polypropylene, PVC), By End Use (Food & Beverage, Consumer Durables, Transportation & Logistics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-832-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Printed Tape Market Size & Trends

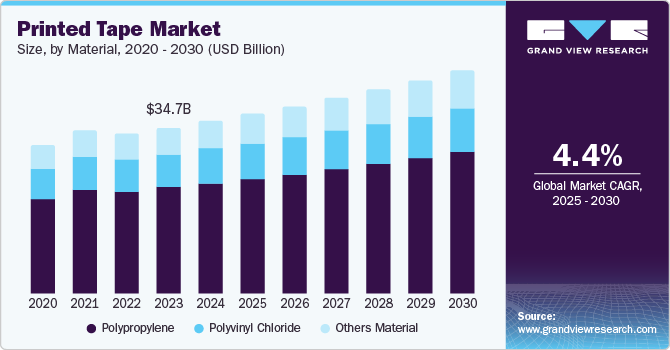

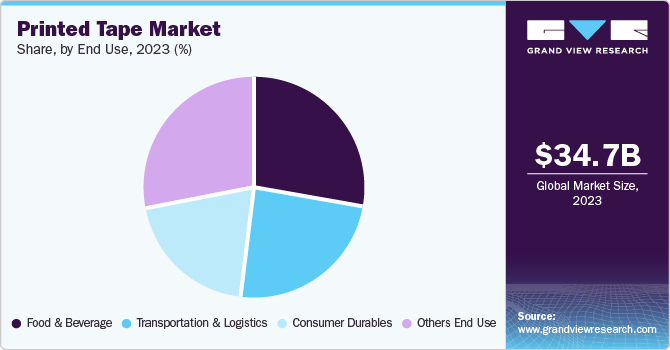

The global printed tape market size was valued at USD 34.7 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030 owing to the rising demand for packaging and shipping. With global trade and consumerism rising, industries ranging from food and electronics to pharmaceuticals have increasingly opted for customizable, premium printed tapes to enhance their packaging standards. This trend aligns with functionality and is a strategic move to leverage branding opportunities. Moreover, the growing emphasis on reliable packaging solutions to cater to complex supply chains has further accelerated the growth of the printed tape market

In addition, the surge in e-commerce and online retail has further stimulated the market forward. As more consumers turn to online shopping, the demand for secure and efficient packaging solutions has skyrocketed. A survey by Speed Commerce indicates that 60-70% of consumers are willing to pay a premium for sustainable packaging, and over 50% would increase their purchases of products featuring such packaging. Printed tape plays a crucial role in this ecosystem by ensuring package security, enhancing brand visibility, and providing tamper resistance. E-commerce companies have increasingly adopted durable and visually appealing printed tapes to protect their products, and a strong tool for promoting brand identity, communicating their message directly to customers to elevate the overall experience. For instance, 3M and IPG have introduced innovative printed tapes designed for e-commerce packaging.

Furthermore, the expansion of the industrial and logistics sectors has led to the growing need for efficient and reliable packaging solutions. Printed tapes are increasingly being used to ensure the safe and secure transportation of goods. The ability to print important information, such as handling instructions and branding, directly onto the tape adds an extra layer of convenience and security, making it an attractive option for businesses.

Moreover, technological advancements in printing techniques have made it possible to produce high-quality, aesthetically appealing printed tapes that meet the evolving demands of consumers. These advancements have enabled manufacturers to offer a wide range of customization options, allowing businesses to differentiate their products and strengthen their brand image. The growing focus on branding and customization is a direct response to the competitive market landscape, where companies are constantly seeking ways to stand out.

Material Insights

Polypropylene (PP) dominated the market with a 63.9% share in 2023. The market was primarily driven by its cost-effectiveness. Polypropylene is relatively inexpensive compared to other materials such as polyvinyl chloride (PVC), which makes it a preferred choice for manufacturers looking to optimize production costs without compromising quality. This affordability allows businesses to produce printed tapes in large volumes, catering to the increasing demand from various industries such as e-commerce, logistics, and packaging. Additionally, this material offers high tensile strength and resistance to wear and tear, ensuring that printed tapes made from PP can withstand the rigors of shipping and handling. Its robustness makes it ideal for securing packages, providing both functionality and reliability for maintaining product integrity.

Polyvinyl chloride (PVC) is expected to grow during the forecast period due to its exceptional durability and flexibility. The material’s smooth surface allows for high-quality printing, enabling manufacturers to produce vibrant and detailed designs. Polyvinyl chloride tapes are compatible with various printing techniques, including flexography, offset, and digital printing. This is particularly important for branding and marketing purposes, as companies seek to enhance their brand visibility and appeal through customized printed tapes. The ability to print clear and attractive graphics on PVC tapes makes them a preferred choice for businesses looking to stand out in a competitive market. These tapes are suitable for a diverse range of applications, including packaging, labeling, electrical insulation, and industrial use.

End Use Insights

Food & beverage secured the largest market revenue share in 2023 with the increasing demand for secure and attractive packaging. As consumers become more health-conscious and environmentally aware, the need for packaging that ensures product safety and maintains freshness has considerably grown. Printed tapes play a crucial role in this by providing tamper-evident seals and clear labeling, which are essential for maintaining product integrity and consumer trust. Moreover, consumers have increasingly opted for the convenience of online shopping and home delivery, leading to a surge in reliable and visually appealing packaging solutions. Printed tapes help brands stand out in a crowded market by enhancing brand visibility and providing a professional appearance to packages.

Consumer durables are projected to grow at the fastest CAGR of 5.1% over the forecast period owing to the growing demand for secure and attractive packaging. Consumer durables, such as electronics, appliances, and home goods, often involve high-value items. Printed tapes provide an added layer of security and tamper evidence, which is essential for maintaining product integrity and consumer trust. These tapes are crucial for adding barcodes and QR codes to items, allowing for effective inventory control, tracking, and access to consumer information.

Regional Insights

The Asia Pacific printed tape market dominated the global revenue share with 40.1% in 2023 driven by the rapid expansion of the e-commerce sector. The increasing popularity of online shopping across countries including China, India, and Japan, resulted in a heightened demand for secure and efficient packaging solutions. Printed tapes play a crucial role in this ecosystem by providing tamper-evident seals and enhancing brand visibility, which is essential for ensuring product safety and customer satisfaction. The market dominance was supported by its proactive stance on adopting technology and the abundance of printing technology manufacturers. Additionally, supportive government measures, efforts to increase production within the country, and a strong logistics and supply chain network in the Asia Pacific region have driven the growth of the printed tape market.

China Printed Tape Market Tapes Trends

The China printed tape market dominated Asia Pacific in 2023. The country’s extensive industrial base, particularly in sectors including electronics, automotive, and consumer goods, has generated substantial demand for printed tapes. Moreover, China has become a major global player in the manufacturing and exporting of printed tapes owing to its advanced industrial infrastructure and technological capability. These tapes, including polypropylene and UV curable types, meet the needs of a growing local market and a thriving online retail environment.

North America Printed Tape Market Tapes Trends

The printed tape market in North America was identified as a lucrative region in 2023. A significant trend in the regional printed tapes market is the increasing need for personalized products. Businesses have progressively used printed tapes to promote their brand with cost-efficiency. Customized prints such as company logos, product information, and unique designs allow businesses to stand out in a competitive market. This pattern is especially prominent in the e-commerce industry, where printed tapes improve the unboxing experience and help with brand identification.

U.S. Printed Tape Market Trends

The U.S. printed tape market is expected to be driven by printing technology over the forecast period. Innovations in digital printing and materials have enabled the production of high-quality, customizable printed tapes that meet the diverse needs of various industries including packaging, branding, and logistics. Brands including NADCO Tapes & Labels Inc. and Printed Tape have extensively offered customizable printed tape. These advancements allow for better print clarity, durability, and the incorporation of intricate designs, which are crucial for branding and marketing purposes.

Europe Printed Tape Market Tapes Trends

The Europe printed tape market secured a significant share in 2023 owing to rising consumer awareness and preference for sustainable packaging. European consumers have increasingly prioritized eco-friendly products, prompting companies to adopt sustainable practices. Printed tapes made from recyclable or biodegradable materials have gained considerable popularity as businesses strive to reduce their environmental footprint and align with consumer values.

Key Printed Tape Company Insights

Some of the key companies in the global printed tape market are Tesa Tapes (India) Private Limited, Berry Global Inc., Atlas Tapes S.A., and others. These market participants have increasingly attempted to acquire new potential markets to gain regional share and profits. This provides the companies with diversified business portfolios, which aids in increasing the overall revenue.

-

Tesa Tapes (India) Private Limited specializes in designing and manufacturing adhesive tapes and self-adhesive solutions for various industries, businesses, and customers. Their product range includes solutions for furniture, surface protection, security labeling, interior mounting, and mirror assembly. These products are utilized in sectors such as automotive, building, medical, printing, and appliances.

-

Shurtape Technologies, LLC, is a manufacturer and marketer of adhesive tapes and consumer home and office products. The company serves a wide range of markets, including DIY, MRO, building and construction, packaging, HVAC, automotive, marine, aerospace, medical, and retail. They are known for their innovative products under brands such as Duck, FrogTape, Duck, Shurtape, Painter’s Mate, Kip, T-Rex, and Pro Tapes.

Key Printed Tape Companies:

The following are the leading companies in the printed tape market. These companies collectively hold the largest market share and dictate industry trends.

- tesa Tapes (India) Private Limited

- Berry Global Inc.

- Atlas Tapes S.A.

- BOLEX

- ADH Tape

- 3M

- Nitto Denko Corporation

- Shurtape Technologies, LLC

- Vibac Group S.p.a

- Windmill Tapes

Recent Developments

-

In September 2024, Shurtape Technologies, LLC acquired Preferred Finishing Technologies, LLC, a textile manufacturing company that specializes in inkjet dye sublimation printing and fabric finishing. This strategic merger strengthens the nearly 15-year partnership between both companies.

-

In August 2024, Shurtape Technologies, LLC, updated the premium HVAC tape design based on feedback from the field stating that inspectors seek "red-letter tape" during HVAC inspections. The company’s DC 181 is expected to feature red lettering on metallic film tape.

Printed Tape Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.1 billion

Revenue forecast in 2030

USD 46.7 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Brazil, Argentina, and Saudi Arabia

Key companies profiled

tesa Tapes (India) Private Limited; Berry Global Inc.; Atlas Tapes S.A.; BOLEX; ADH Tape; 3M; Nitto Denko Corporation; Shurtape Technologies, LLC; Vibac Group S.p.a; Windmill Tapes

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Printed Tape Market Report Segmentation

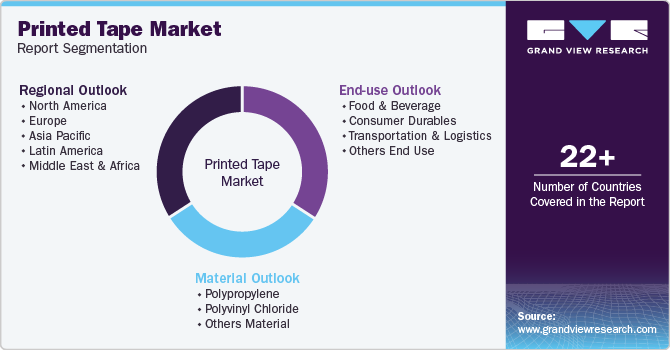

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global printed tape market report based on material, end use, and region:

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Polypropylene

-

Polyvinyl Chloride

-

Others Material

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverage

-

Consumer Durables

-

Transportation & Logistics

-

Others End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.