- Home

- »

- Next Generation Technologies

- »

-

Private 5G Network Market Size, Industry Report, 2033GVR Report cover

![Private 5G Network Market Size, Share & Trends Report]()

Private 5G Network Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Frequency (Sub-6 GHz, mmWave), By Spectrum (Licensed, Unlicensed/Shared), By Enterprise Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-656-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Private 5G Network Market Summary

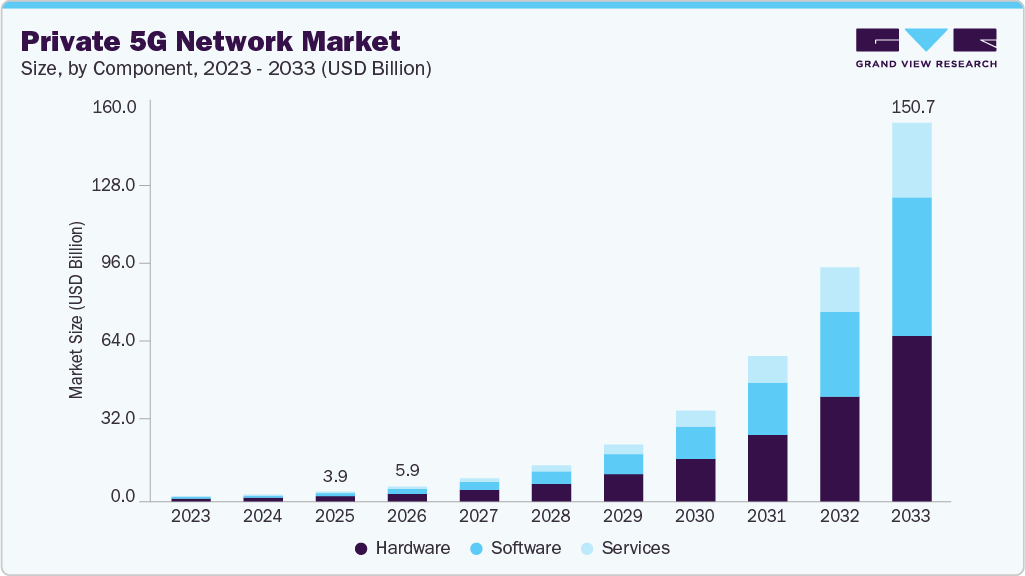

The global private 5G network market size was estimated at USD 3.89 billion in 2025, and is projected to reach USD 150.66 billion by 2033, growing at a CAGR of 58.9% from 2026 to 2033. Private 5G networks offer businesses and governments dedicated, secure, and high-performance connectivity.

Key Market Trends & Insights

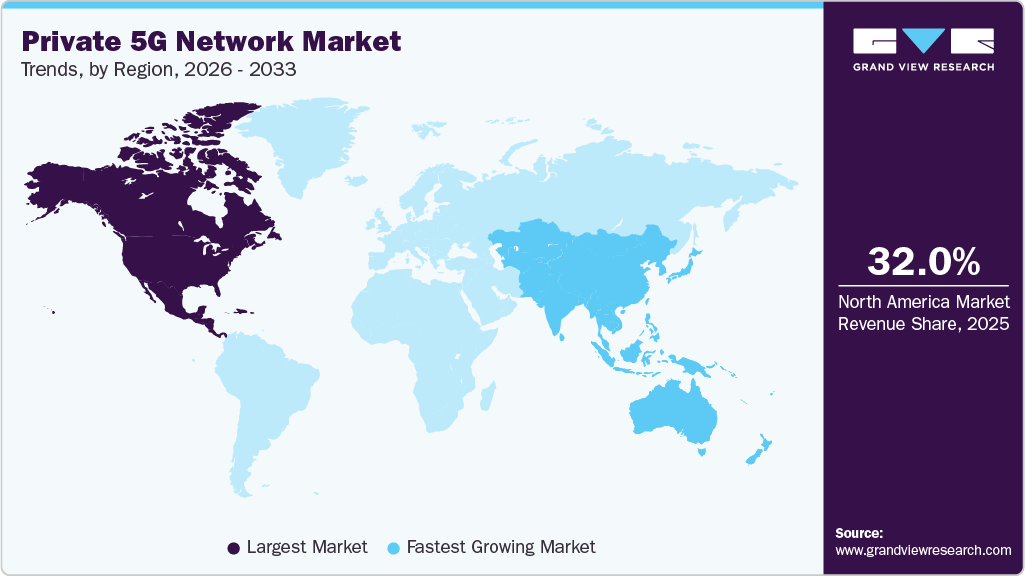

- The North America private 5G network market accounted for a 32.0% share of the overall market in 2025.

- The private 5G network industry in the U.S. held a dominant position in 2025.

- By component, the hardware segment accounted for the largest share of 51.8% in 2025.

- By frequency, the sub-6 GHz segment held the largest market share in 2025.

- By spectrum, the unlicensed/shared segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.89 Billion

- 2033 Projected Market Size: USD 150.66 Billion

- CAGR (2026-2033): 58.9%

- North America: Largest Market in 2025

- Asia Pacific: Fastest-growing market in 2025

This enables them to connect to more devices, enhance automation, and deliver improved customer experiences. These benefits are driving the adoption of private 5G networks in various industries, including smart cities that rely on private 5G for applications such as traffic management and security, among others.Cellular technology, in the form of private 5G networks, is being used by businesses, organizations, and local governments across various industries. These industries include manufacturing, utilities, transportation, logistics, retail, agriculture, and those involved in smart city initiatives. The benefits of private 5G networks, including ultra-fast speeds, enhanced security, cost efficiency, reliability, prioritized network access, and extended range, compared to Wi-Fi, are driving their adoption across various industries. Thus, various benefits provided by private 5G networks are contributing to the overall market’s growth.

As an increasing number of devices and enterprises connect to the internet, enterprises may face issues with low coverage and security due to network bottlenecks. Private 5G networks address these issues by providing dedicated network connectivity, enhanced security, improved connectivity, and enhanced automation with lower latency. These benefits can help enterprises deliver an enhanced customer experience. Furthermore, private 5G networks support technologically advanced applications, including machine control systems, wireless UHD cameras, collaborative/cloud robots, and remote asset monitoring, which is driving the adoption of private 5G networks.

The rapidly growing smart cities in developed countries such as the U.S., Canada, Singapore, the UK, Germany, Italy, and France have spurred the deployment of IoT devices for several applications. These applications mainly include transportation, public safety & security, and energy management, among others. To provide unified and secured connectivity for these mission-critical applications, several telecom providers are launching innovative private 5G network solutions. The continuous innovation in the private 5G network market is creating significant growth opportunities for the market.

Despite the high growth potential, the deployment and implementation of a private 5G network is a tedious and highly expensive process. As the number of 5G users and network traffic increases in the near future, the need for standalone 5G infrastructure will become necessary. Building and maintaining a private 5G network can be expensive, requiring significant investment in infrastructure and equipment, which acts as a hindrance to market growth. However, key telecom operators are taking strategic initiatives and are investing in infrastructure and research & development, which is expected to diminish this market challenge.

Component Insights

The hardware segment dominated the market in 2025 and accounted for a 51.8% share of the global revenue. The dominance of this segment can be attributed to the increased deployment of core networks and backhaul, and transport equipment across the globe. The hardware segment is further divided into Radio Access Network (RAN), core network, backhaul, and transport. Key network providers, such as Nokia Corporation, Qualcomm Technologies, Inc., and Ericsson, are deploying feasible equipment to support back operations in delivering high-speed bandwidth, supporting the segment growth.

The services segment is projected to witness the fastest growth from 2026 to 2033. The services segment is further segregated into installation & integration, data services, and support & maintenance. With an increasing focus on installing private 5G core networks for dedicated users to manage their information securely, the services segment is expected to experience significant growth in the installation and integration services.

Frequency Insights

The Sub-6 GHz segment dominated the market in 2025. It offers a lower frequency range of around 1 GHz to 6 GHz and is limited in terms of speed. However, sub-6 GHz provides larger coverage, which makes it more suitable for real-world implementation, especially in private 5G networks where enterprises are looking for coverage over a large area. Moreover, the sub-6 GHz spectrum has already been utilized for previous generation networks, making it a more accessible and cost-effective option for 5G, thereby contributing to the overall segment’s growth.

The mmWave segment is projected to witness the fastest growth from 2026 to 2033. A few federal governments across leading countries have released mmWave frequency bands to provide private 5G services. For instance, the Federal Communications Commission (FCC) has released several mmWave frequencies, including 24.25-24.45 GHz, 47.2-48.2 GHz, 24.75-25.25 GHz, and 38.6-40 GHz, among others. In addition, countries such as Japan, South Korea, and Italy have released mmWave frequencies for enhanced data services. Thus, the high focus on releasing mmWave frequencies by key federal governments is expected to augment the mmWave segment growth over the next seven years.

Spectrum Insights

The unlicensed/shared segment dominated the private 5G network industry in 2025. An unlicensed spectrum does not require enterprises to acquire the license for the entire spectrum; it is cost-effective and time-efficient. Unlicensed spectrum bandwidth is easily accessible and highly preferred during massive machine-type communications (mMTC), such as IoT device connectivity in smart cities, stadiums, and machine-to-machine connectivity. The rising demand for high-speed, cost-effective, and time-efficient private 5G networks is contributing to the growth of the unlicensed/shared spectrum segment.

The licensed segment is expected to register a significant CAGR over the forecast period. A licensed spectrum is more expensive than an unlicensed/shared spectrum, as a company must purchase an entire license for a specific spectrum bandwidth to achieve enhanced and secure internet connectivity. Access to a licensed spectrum can be achieved from Communication Service Providers (CSPs). Despite the higher costs, many countries, such as the U.S. and Germany, are utilizing licensed spectrum for industrial and mission-critical applications. Thus, the rising demand for highly secure connectivity in mission-critical applications, such as Automated Guided Vehicles (AGVs), is expected to drive the licensed spectrum segment’s growth over the forecast period.

Enterprise Size Insights

The large enterprises segment dominated the market in 2025. Private 5G networks are revolutionizing the operations of large enterprises across the globe by enhancing security, increasing efficiency, and fostering scalable innovation. Private 5G provides superior network service and an enhanced customer experience, supporting a large number of complex use cases that Wi-Fi cannot accommodate. Large enterprises with data-intensive processes for use cases such as industrial automation, smart energy/utilities, and remote healthcare, among others, are adopting private 5G networks, thereby driving the segment’s growth.

The small & medium enterprises segment is expected to grow significantly from 2026 to 2033. Due to the higher costs and deployment complexities of private 5G networks, its adoption has been slower among small & medium enterprises. However, with the latest versions of the Open Radio Access Network (ORAN) technology specifications and the launch of ORAN-compliant silicon chipsets, these barriers of cost and complexity are starting to diminish for small & medium enterprises (SMEs). As technology evolves and the market matures, the adoption of private 5G networks is expected to rise among small & medium enterprises.

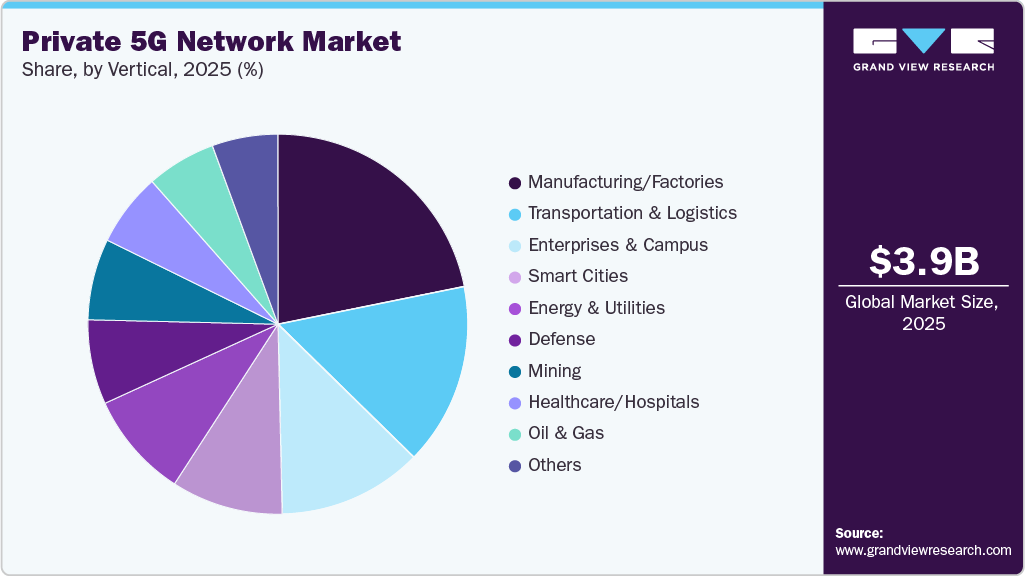

Vertical Insights

The manufacturing/factories segment dominated the market in 2025. The growth is attributed to the high demand for private 5G services to provide seamless connectivity to various devices, such as Ultra-HD cameras, extended reality headsets, and Automated Guided Vehicle Systems (AGVs). Besides, the growing need to establish uninterrupted communication among machines is expected to boost the segment growth.

The transportation & logistics segment is expected to grow at a notable CAGR from 2026 to 2033. Private 5G networks are expected to help trucking companies, warehouse operators, courier companies, railway companies, port authorities, and other transportation & logistics companies to track the location and condition of their assets. Ultra-high speed, higher bandwidth, real-time data collection, and cloud-native architecture are some of the key features of a private 5G network, which are driving its adoption by transportation and logistics companies.

Regional Insights

The North America private 5G network industry dominated the market and accounted for a 32.0% share in 2025. The regional market’s dominance can be attributed to the presence of various private 5G solution providers in North America, including Qualcomm Technologies, Inc., AT&T Inc., and Verizon Communications, among other players. These players are investing heavily in deploying private 5G network infrastructure, fueling the industry growth in the region.

U.S. Private 5G Network Market Trends

The private 5G network industry in the U.S. is expected to grow at a significant CAGR of 61.1% from 2026 to 2033. In January 2023, Verizon Business commissioned its wireless private 5G network at The Smart Factory of Deloitte @ Wichita in the U.S., a new Industry 4.0 immersive experience center. Such initiatives, driven by an inclination towards smart manufacturing and Industry 4.0, are contributing to the U.S. market’s growth.

The Canada private 5G network industry is expected to grow at a significant CAGR from 2026 to 2033. The benefits provided by private 5G networks, such as accessibility, reliability, quality of service, and security, are driving consumers in Canada to adopt private 5G networks, which is boosting the growth outlook.

Europe Private 5G Network Market Trends

The private 5G network industry in Europe is expected to grow at a significant CAGR from 2026 to 2033. The regional market is experiencing rapid growth driven by demand for secure, high-speed connectivity for applications such as industrial applications, smart cities, and IoT solutions.

The UK private 5G network industry is expected to grow at a significant CAGR from 2026 to 2033. In December 2022, the UK government announced an investment worth GBP 110 million in R&D initiatives focusing on telecom security, 5G, and 6G. Such favorable government initiatives are propelling the industry growth in the UK.

The private 5G network industry in Germany is expected to grow at the fastest CAGR from 2026 to 2033. The growth outlook can be attributed to favorable government initiatives that are driving innovation, investment, and integration of private 5G networks among various industry verticals.

Asia Pacific Private 5G Network Market Trends

The private 5G network industry in the Asia Pacific region is expected to register the fastest CAGR from 2026 to 2033. The growth is attributed to the presence of several manufacturers, along with their significant investments in building automated factories in the region. In addition, huge investments to acquire a 5G spectrum for providing private 5G networks in India, China, Japan, South Korea, and Australia are projected to contribute to the regional market growth.

The China private 5G network industry is expected to grow at the fastest CAGR over the forecast period. For instance, GSMA’s ‘Mobile Economy China 2024’ report predicted that more than half of the Chinese mobiles would be 5G by the end of 2024. This growing demand for 5G networks is creating significant growth opportunities in the region.

The private 5G network industry in India is anticipated to grow at a significant CAGR over the forecast period. The adoption of private 5G networks in the Indian market has been comparatively slower; however, it is expected to gain traction over the coming years owing to its higher coverage, lower latency, and reliability.

The Japan private 5G network industry is expected to grow at a considerable CAGR from 2026 to 2033. Key telecom operators in Japan are entering into strategic initiatives to provide private 5G networks to enterprise customers nationwide, thereby fueling the market’s growth.

Middle East and Africa Private 5G Network Market Trends

The private 5G network industry in the Middle East and Africa is anticipated to grow at a considerable CAGR from 2026 to 2033. The growing investment in 5G networks in the Middle Eastern region is creating significant growth opportunities for the regional landscape.

Key Private 5G Network Company Insights

Some of the established players operating in the market include Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Deutsche Telekom, Nokia Corporation, Samsung Electronics Co., Ltd., and Cisco Systems, Inc., among others. These companies focus on their extensive telecommunications infrastructure portfolios, sustained investments in next-generation network technologies, and long-standing collaborations with global operators and enterprise customers.

They have consistently demonstrated leadership in deploying and commercializing advanced connectivity solutions such as 5G, cloud-native networks, IoT platforms, and software-defined architectures. Their strong capabilities across radio access networks, core networks, network security, and edge computing enable them to support high-performance, low-latency, and scalable communication ecosystems. Furthermore, their global presence, continual R&D initiatives, and integration of sustainable and energy-efficient network practices reinforce their strategic importance and competitiveness in an industry that is rapidly transitioning toward intelligent, automated, and converged digital infrastructure.

-

Telefonaktiebolaget LM Ericsson provides information and communication technology (ICT) services, including 5G and IoT-powered networks, managed services, digital services, and others to service providers across the globe. These services comprise the operating segments of the company, which are tailored to meet the company’s customer needs. The company is taking strategic initiatives regarding new product deployments and the geographical expansion of its facilities worldwide.

-

Nokia Corporation is a mobile and fixed network infrastructure combining software, hardware, and services provider. The company is also engaged in the deployment of 5G networks. The company operates through three reportable segments, namely networks, Nokia software, and Nokia technologies. Through the Nokia Software segment, the company focuses on 5G, digital, automation, and portfolio integration platforms. Nokia Corporation is among the leading players with a vast product portfolio and strong global presence.

Key Private 5G Network Companies:

The following are the leading companies in the private 5G network market. These companies collectively hold the largest market share and dictate industry trends.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Samsung

- ZTE Corp.

- Deutsche Telekom

- Juniper Networks

- AT&T Inc.

- Verizon Communications

- Altiostar

- Huawei Technologies Co., Ltd.

- Mavenir

- BT Group

- T-Systems International GmbH

- Cisco Systems, Inc.

- Vodafone Ltd.

Recent Developments

-

In April 2025, Ericsson announced the successful deployment of a private 5G network for Newmont Corporation at the Cadia gold-copper mine in Australia, the world’s largest underground mine. This deployment enabled the industry’s first use of private 5G for remote-control (teleremote) dozers in surface operations, delivering long-range, low-latency, and highly reliable connectivity that significantly improves operational safety and productivity in mining environments.

-

In March 2024, SoftBank Corp. announced the service launch of its Private 5G (dedicated type). This service allows local governments, organizations, and other enterprises to build 5G customized networks on their premises with a dedicated base station. The service is optimal for customers who require low latency and advanced network solutions, making it suitable for smart factory applications.

-

In December 2023, Telefonaktiebolaget LM Ericsson announced its partnership with Orange. The collaboration aims to offer B2B customers the opportunity to deploy their own private 5G network.

-

In September 2023, Deutsche Telekom announced the launch of its new private 5G network solution, the ‘Campus Network Smart.’ The solution is launched in partnership with Microsoft Corporation and is part of Deutsche Telekom’s strong 5G private network portfolio. The Campus Network Smart solution is cloud-based, scalable, and incorporates a pay-as-you-grow model.

Private 5G Network Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.88 billion

Revenue forecast in 2033

USD 150.66 billion

Growth rate

CAGR of 58.9% from 2026 to 2033

Base year for estimation

2025

Actual Data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, frequency, spectrum, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Telefonaktiebolaget LM Ericsson; Nokia Corp.; Huawei Technologies Co., Ltd.; Samsung; ZTE Corp.; Deutsche Telekom; Juniper Networks; AT&T Inc.; Verizon Communications; Altiostar; Mavenir; BT Group; T-Systems International GmbH; Cisco Systems, Inc.; Vodafone Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Private 5G Network Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the private 5G network market report based on component, frequency, spectrum, enterprise size, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Radio Access Network

-

Core Network

-

Backhaul & Transport

-

Software

-

Services

-

Installation & Integration

-

Data Services

-

Support & Maintenance

-

-

Frequency Outlook (Revenue, USD Million, 2021 - 2033)

-

Sub-6 GHz

-

mmWave

-

-

Spectrum Outlook (Revenue, USD Million, 2021 - 2033)

-

Licensed

-

Unlicensed/Shared

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing/Factories

-

Automotive

-

Electrical & Electronics

-

Food & Beverages

-

Pharmaceuticals

-

Heavy Machinery

-

Clothing & Accessories

-

Others

-

Energy & Utilities

-

Transportation & Logistics

-

Defense

-

Enterprises & Campus

-

Mining

-

Healthcare/Hospitals

-

Oil & Gas

-

Retail

-

Agriculture

-

Smart Cities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global private 5G network market size was valued at USD 3.89 billion in 2025 and is expected to reach USD 5.88 billion in 2026.

b. The global private 5G network market is expected to grow at a compound annual growth rate of 58.9% from 2026 to 2033 to reach USD 150.66 billion by 2033.

b. The hardware segment accounted for the largest revenue share of over 51.8% in 2025 in the private 5G network market due to the increased deployment of core networks and backhaul and transport equipment across the globe.

b. In 2025, the sub-6 GHz frequency segment held the largest revenue share of 76.6% in the private 5G network market and is expected to exhibit a CAGR of nearly 55.1% from 2026 to 2033.

b. The unlicensed/shared spectrum accounted for the highest revenue share of over 71.1% in the private 5G network market in 2025 and is projected to expand further at the fastest CAGR from 2026 to 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.