- Home

- »

- Consumer F&B

- »

-

Private Label Packaged Food Market Size Report, 2030GVR Report cover

![Private Label Packaged Food Market Size, Share & Trends Report]()

Private Label Packaged Food Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Baked Goods, Savory Snacks, Meals & Soups, Dairy, Confectionery), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-400-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Private Label Packaged Food Market Summary

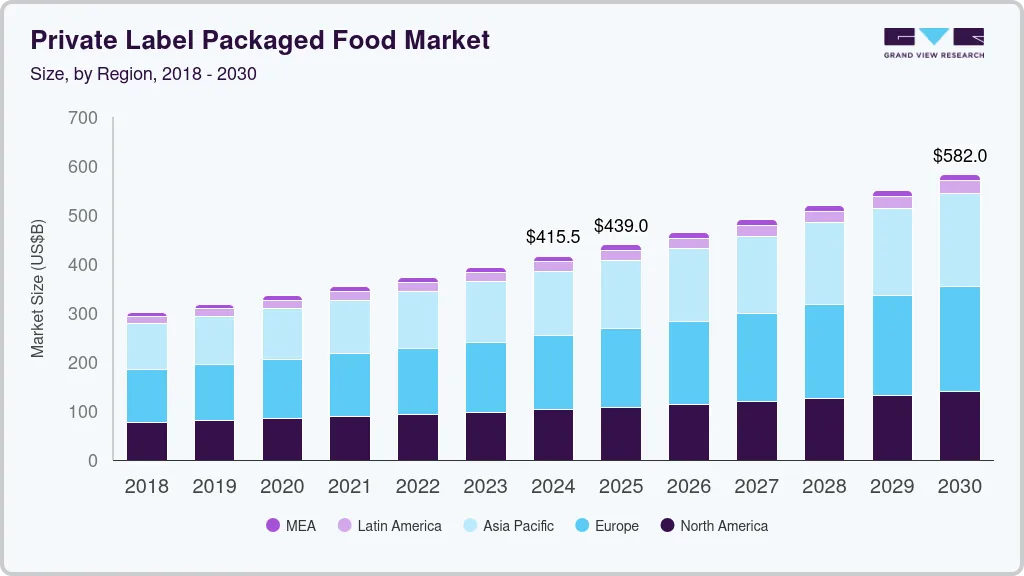

The global private label packaged food market size was estimated at USD 415.53 billion in 2024 and is projected to reach USD 581.97 billion by 2030, growing at a CAGR of 5.8% from 2025 to 2030. Increasing consumer demand for cost-effective yet high-quality food products.

Key Market Trends & Insights

- North America dominated the global private label packaged market with the largest revenue share of 24.9% in 2023.

- By product, the dairy segment led the market with the largest revenue share of 32.46% in 2023.

- By, distribution channel, the online segment is expected to grow at the fastest CAGR of 9.5% from 2024 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 415.53 Billion

- 2030 Projected Market Size: USD 581.97 Billion

- CAGR (2025-2030): 5.8%

- North America: Largest market in 2023

As consumers become more price-sensitive, especially in the face of economic uncertainties, private label products offer an appealing alternative to national brands. Retailers are responding by investing in their private label offerings, ensuring they meet high standards of quality and taste, which further drives consumer acceptance and loyalty.Consumers are increasingly seeking healthier food options, leading retailers to develop private label products that cater to this demand. This includes organic, gluten-free, vegan, and non-GMO product lines. In addition, sustainability has become a crucial trend, with consumers favoring products that have minimal environmental impact. This trend pushes retailers to adopt eco-friendly packaging and source ingredients responsibly for their private label brands.

One significant opportunity lies in expanding the product range to include premium and specialty items. As private labels shed their low-cost, low-quality image, there is potential for retailers to introduce gourmet and artisanal products under their own brands. Furthermore, the rise of e-commerce and online grocery shopping presents an opportunity for private label brands to reach a wider audience. Retailers can leverage their online platforms to promote and distribute private label products, enhancing visibility and accessibility.

Private label products, often known as store brands, typically offer similar quality to national brands but at a lower price point. This price advantage is particularly appealing in times of economic uncertainty or inflation, where consumers become more price-conscious and seek ways to stretch their budgets without compromising on quality. Retailers can sell these products at a lower price because they save on marketing and advertising expenses, passing the savings onto the consumer.

Product Insights

The dairy segment led the market with the largest revenue share of 32.46% in 2023. The perceived quality of private label dairy products has significantly improved over the years. Retailers have made substantial investments in ensuring their private label dairy products meet or exceed the quality of national brands. This effort has paid off as consumers have come to trust these products for their consistent quality and value. Dairy products are often sourced locally due to their perishable nature. Retailers can leverage local supply chains to offer fresher products compared to national brands that might have longer distribution channels. This local sourcing not only enhances the freshness and taste of the dairy products but also appeals to consumers who prefer supporting local agriculture. The shorter supply chain also allows retailers to have better control over the quality and pricing of their private label dairy products.

The private label plant-based dairy products market is expected to grow at the fastest CAGR of 11.8% from 2024 to 2030. The increasing demand for plant-based dairy is a major factor driving the growth of private label plant-based dairy products. Consumers are becoming more health-conscious and environmentally aware, seeking alternatives to traditional dairy products due to concerns about lactose intolerance, animal welfare, and the environmental impact of dairy farming. This shift is reflected in the growing popularity of plant-based milk (such as almond, soy, oat, and cashew milk), yogurt, and cheese. As these preferences become more mainstream, retailers are expanding their private label offerings to meet this demand.

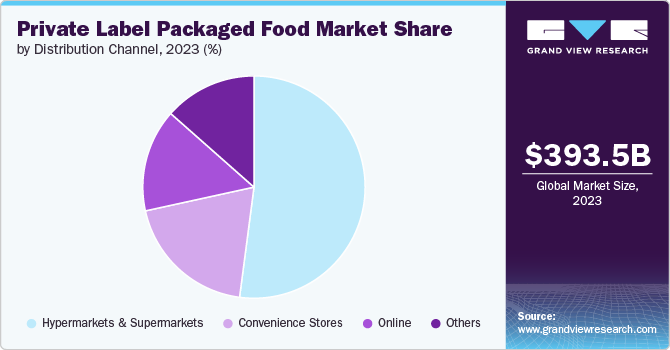

Distribution Channel Insights

Based on distribution channel, the hypermarkets & supermarkets led the market with the largest revenue share of 52.07% in 2023. Private label products allow retailers to exert greater control over their product ranges, quality, and supply chains. By sourcing and producing these products under their own brands, retailers can optimize margins and reduce dependence on national brand suppliers. This control not only helps in managing costs but also in maintaining consistent product quality and availability, which enhances customer satisfaction and loyalty.

The online segment is expected to grow at the fastest CAGR of 9.5% from 2024 to 2030. Online retail offers unparalleled convenience, allowing consumers to shop for private label packaged food from the comfort of their homes. The ability to browse, compare, and purchase products online without needing to visit physical stores appeals to busy lifestyles. This convenience is particularly beneficial for consumers seeking to avoid the hassle of in-store shopping or those who live in remote areas where access to physical stores might be limited.

Regional Insights

North America dominated the private label packaged food market with the largest revenue share of 24.9% in 2023. The demand for private label packaged food products in North America has been growing steadily, driven by several interrelated factors that reflect changing consumer preferences, economic conditions, and strategic retailer initiatives. Private label products in North America cover a broad spectrum of categories, from basic staples to gourmet and organic items. Retailers such as Walmart, Aldi, Tesco, Target, and others have been proactive in expanding their private label lines to include health-focused and specialty products, such as gluten-free, non-GMO, and plant-based foods. This wide range of options caters to diverse consumer preferences and dietary needs, making private labels appealing to a broader audience.

U.S. Private Label Packaged Food Market Trends

The private label packaged food market in the U.S. is expected to grow at the fastest CAGR of 5.5% from 2024 to 2030. Retailers in the U.S., such as Walmart, Costco, and Kroger, have built strong reputations and customer loyalty. When these trusted retailers offer private label packaged foods, consumers are more likely to purchase them, confident in the quality and value these products represent. Trust in these retail brands translates into trust in their private label offerings, boosting sales and market share.

Europe Private Label Packaged Food Market Trends

The private label packaged food market in Europe is expected to grow at the fastest CAGR of 6.0% from 2024 to 2030. European retailers are strategically promoting their private label brands through various marketing and in-store initiatives. These include special promotions, loyalty programs, and prominent shelf placements. By actively marketing their private label products and offering incentives, retailers drive consumer awareness and trial, which can lead to increased adoption and repeat purchases.

Asia Pacific Private Label Packaged Food Market Trends

The private label packaged food market in Asia Pacific is expected to grow at the fastest CAGR of 6.3% from 2024 to 2030. The COVID-19 pandemic has significantly influenced the shopping behaviors of consumers within Asian Countries, with many consumers shifting towards more cost-effective and reliable options. Private label products, with their balance of quality and affordability, have become a go-to choice for many households. The pandemic also accelerated the adoption of online grocery shopping, where private labels are often highlighted and recommended.

Key Private Label Packaged Food Company Insights

The global market is characterized by the presence of numerous well-established players such as Walmart, Costco, Kroger, Trader Joe’s, Target, Aldi, Amazon, Albertson Companies, Loblaw Companies Limited and H-E-B. Market players in the private label packaged food industry contend with fierce competition among themselves, particularly those ranked among the top manufacturers with varied form offerings. These companies boast extensive distribution networks that enable them to effectively cater to a broad customer base, spanning both regional and international markets.

Key Private Label Packaged Food Companies:

The following are the leading companies in the private label packaged food market. These companies collectively hold the largest market share and dictate industry trends.

- Walmart

- Costco

- Kroger

- Trader Joe’s

- Target

- Aldi

- Amazon

- Albertson Companies

- Loblaw Companies Limited

- H-E-B

Recent Developments

-

In May 2024, Walmart introduced its store-label food brand, Bettergoods, featuring a variety of products such as frozen foods, dairy items, snacks, beverages, pastas, soups, coffee, and chocolate

-

In May 2024, the discount supermarket chain Aldi unveiled a new recyclable wrap for two of its own-label butter products, marking a first for a UK supermarket

Private Label Packaged Food Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 439.01 billion

Revenue forecast in 2030

USD 581.97 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Walmart; Costco; Kroger; Trader Joe’s; Target; Aldi; Amazon; Albertson Companies; Loblaw Companies Limited; H-E-B.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Private Label Packaged Food Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global private label packaged food market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Baked Goods

-

Savory Snacks

-

Meals & Soups

-

Dairy

-

Confectionery

-

Processed Meat, Seafood & Meat Alternative

-

Sauces, Dips & Condiments

-

Sweet Biscuits, Snack Bars & Fruit Snacks

-

Ice Cream

-

Processed Fruit & Vegetables

-

Breakfast Cereals

-

Rice, Pasta & Noodles

-

Baby Food

-

Sweet Spreads

-

Edible Oils

-

Plant-based Dairy

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global private label packaged food market size was estimated at USD 393.5 million in 2023 and is expected to reach USD 415.53 billion in 2024.

b. The global private label packaged food market is expected to grow at a compounded growth rate of 5.8% from 2024 to 2030 to reach USD 581.97 billion by 2030.

b. Europe dominated the global private label packaged food market with a share of 36.3% in 2023 due to the retailers are strategically promoting their private label brands through various marketing and in-store initiatives

b. Some key players operating in the private label packaged food market include Walmart, Costco, Kroger, Trader Joe’s, Target, Aldi, Amazon, Albertson Companies, Loblaw Companies Limited and H-E-B.

b. Key factors driving market growth include the rising consumer demand for cost-effective yet high-quality food products. Additionally, as consumers increasingly seek healthier food options, retailers are developing private label products to meet this demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.