- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Probiotic Ingredients Market Size, Industry Report, 2033GVR Report cover

![Probiotic Ingredients Market Size, Share & Trends Report]()

Probiotic Ingredients Market (2026 - 2033) Size, Share & Trends Analysis Report By Form (Dry/Powder, Liquid), By Ingredient (Bacteria, Yeast, Spore Formers), By Application (Food & Beverages, Dietary Supplement), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-395-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Probiotic Ingredients Market Summary

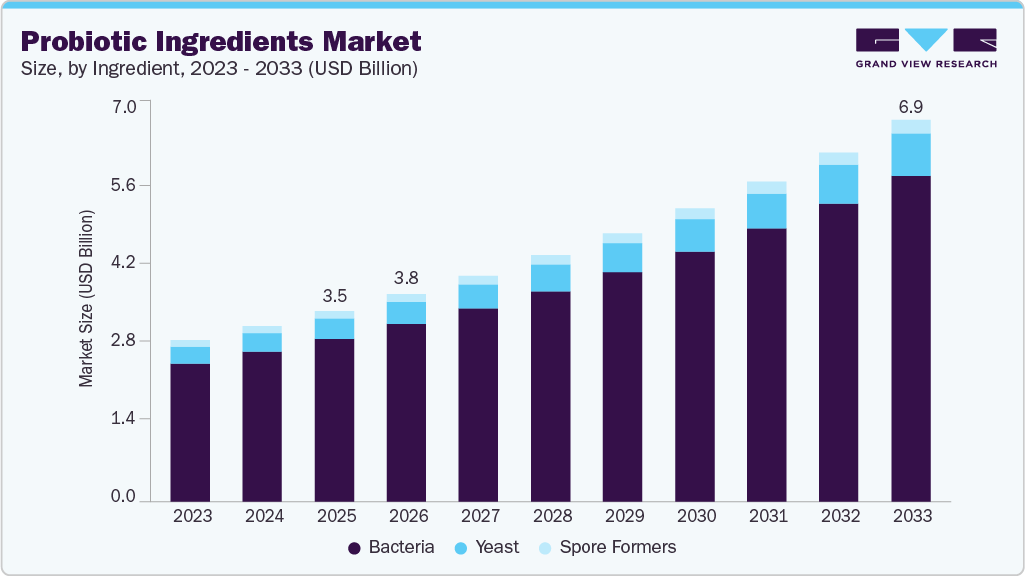

The global probiotic ingredients market size was estimated at USD 3.49 billion in 2025, and is projected to reach USD 6.98 billion by 2033, growing at a CAGR of 9.1% from 2026 to 2033. The market is witnessing strong and sustained growth, fueled by an increase in awareness among the masses worldwide related to the consumption of healthy products.

Key Market Trends & Insights

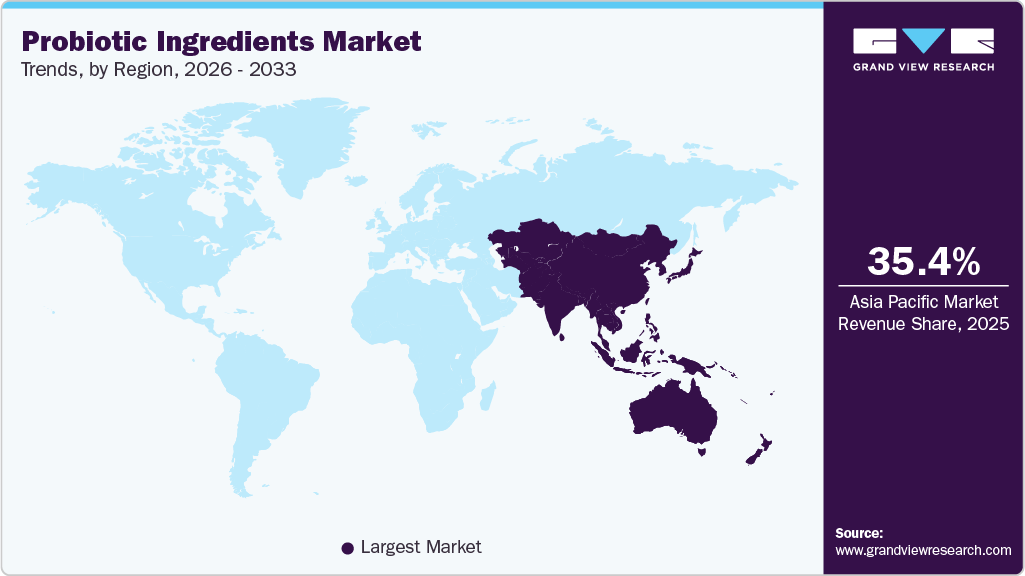

- Asia Pacific dominated the global probiotic ingredients industry in 2025 with a share of 35.42%.

- The probiotic ingredients in dry/powdered form accounted for a share of 84.10% in 2025.

- Based on ingredient, the yeast-based probiotic ingredients industry is expected to witness a CAGR of 9.5% from 2026 to 2033.

- By application, the food & beverages segment accounted for a share of 73.43% in 2025.

- The animal feed application is expected to witness a CAGR of 9.3% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 3.49 Billion

- 2033 Projected Market Size: USD 6.98 Billion

- CAGR (2026-2033): 9.1%

- Asia Pacific: Largest market in 2025

Consumers are highly aware of the benefits of improved gut health. Moreover, the information on gut health and the ways and mechanisms to improve it is easily available globally. During the COVID-19 crisis, different marketing techniques were adopted by the probiotic food manufacturers to promote their products in the market, including its immunity enhancing features. Increasing research activities in the market and ongoing advancements in the field of science have shifted the preference of consumers from conventional food products and beverages to functional food products and beverages. The incorporation of probiotics in functional food products and beverages has increased in recent years as probiotics are known to promote cognitive responses, improve immunity, and promote the general wellbeing of consumers.The incorporation of probiotics in functional food products and beverages has increased in recent years as probiotics help to promote cognitive responses, improve immunity, and promote the general well-being of consumers. The dry/powder form of probiotic ingredients can also be used in a variety of end-use applications such as diary-based & cereal-based food and beverages as well as in non-dairy probiotic food and beverages, owing to its high compatibility with other ingredients. This factor is expected to propel the market growth.

Several well-characterized strains of lactobacilli and bifidobacteria are available for human consumption to reduce the risk of gastrointestinal infections or treat similar infections. The consumption of probiotics can repopulate the digestive tract with beneficial bacteria, resulting in improved digestive management in humans. Thus, probiotics can help to maintain a healthy immune system by increasing lymphocytes.

Probiotics utilized in animal nutrition have received positive responses from farmers, pet owners, and cattle feeders. Animals have very complicated digestive systems owing to their unorganized eating habits, the inclusion of probiotics in feed helps to improve their gut health, boost immunity, and enhance overall performance. Livestock-based food products not only provide high-value proteins but are also important sources of a wide range of essential micronutrients to consumers. Traditionally, antibiotics have been utilized as remedial measures to enable animals to fight against microbial infections, resulting in improved productivity and profitability for livestock owners.

Form Insights

Probiotic ingredients in dry/powdered form accounted for the largest share of 84.10% of the global revenues in 2025. owing to the ease of storage, transport, and use provided by the dry/powder form of probiotic ingredients. Various freeze-drying and freezing techniques are used to produce the dry form. Even though these methods of production are regarded as effective in the field, manufacturing probiotic ingredients involves significant energy and transportation costs. In the large-scale industrial production of powdered probiotic ingredients, spray drying is the most popular, effective, and economical process used across the globe. The spray drying process offers the fastest and safest way to manufacture encapsulated powdered probiotics.

The demand for liquid probiotic ingredients is expected to grow at a CAGR of 9.5% from 2026 to 2033. The liquid probiotic ingredients are cost-effective compared to their counterparts. The commercially available liquid probiotic ingredients for animal feed are cheaper than the powder form by a significant margin. It allows farmers to maintain the gut health of livestock economically. Thus, the cheap price matrix of liquid probiotic ingredients is estimated to boost the growth of the liquid probiotic ingredient segment over the forecast period. The liquid probiotic ingredients have been effective for the livestock as it improves feed intake, feed digestibility, and average daily gain of the livestock. Thus, increasing utilization and benefits provided by liquid probiotic ingredients are expected to boost the segment growth across the globe.

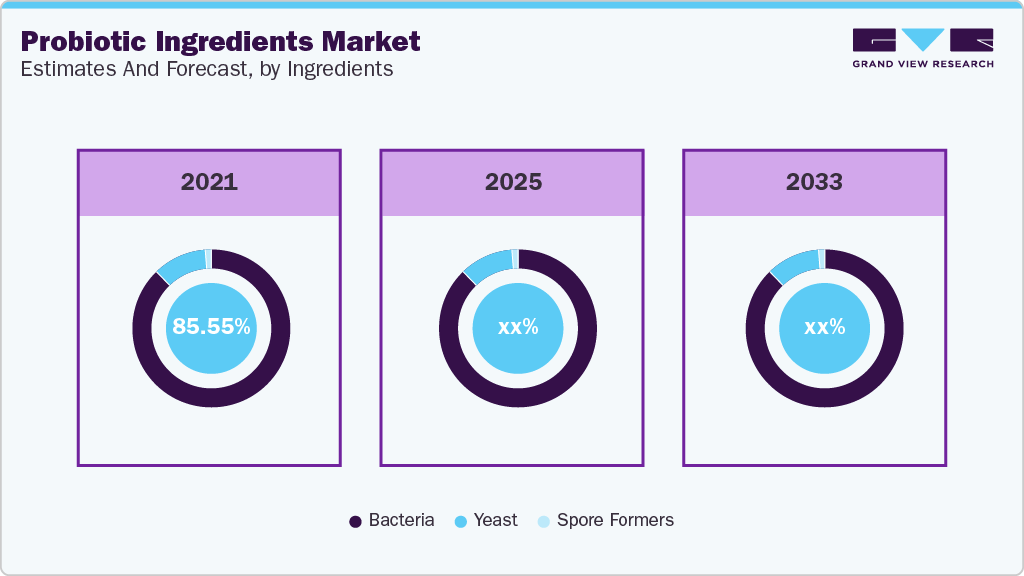

Ingredient Insights

The bacteria-based probiotic ingredients dominated with a revenue share of 85.48% in 2025. Extensive research on bacteria such as Bifidobacterium and Lactobacillus has been conducted in recent years; owing to this, the bacteria segment has witnessed significant growth. The strains of Lactobacillus, Lactococcus, Streptococcus, and Bifidobacterium are important components of bacteria-based probiotic ingredients. Among these, Lactobacillus is the most used bacterial strain in various end-use industries, which is expected to boost its growth.

Yeast-based probiotic ingredients are expected to grow at a CAGR of 9.5% from 2026 to 2033 in the protein ingredient industry. Yeast-based probiotic strains have various applications in the food industry, such as the production of specific enzymes and new bioactive peptides. Furthermore, they have been mainly used for the commercial production of yogurt and in the fermentation of vegetable products such as cabbage, beetroot, radish, and carrots. Thus, increasing potential applications of yeast-based probiotic strains in various industries are expected to boost the growth of the yeast segment during the forecast period. Spore production (sporulation) is induced by a wide range of environmental factors that inhibit cell growth, making sporulation a survival strategy.

Application Insights

Probiotic ingredients for food & beverage applications accounted for the largest share of 73.43% of the globalprobiotic ingredients industry in 2025. Consumers across the globe are shifting towards probiotic ingredients owing to their role in preventing or treating digestive disorders, obesity, and other immunity-related issues. Consumers prefer the intake of probiotic ingredients in various types of food and beverages, as taste is a primary concern for them. Increasing disposable income, coupled with rising awareness about a healthy lifestyle, is likely to promote the adoption of probiotic ingredients in various food and beverage items.

Probiotic ingredients for dietary supplement applications are projected to grow at a CAGR of 9.8% from 2026 to 2033. The demand for preventive health care has been increasing over the past few years owing to the increased cost of healthcare services across the globe. Gut health is directly related to immunity and people are increasingly adopting dietary supplements to increase or maintain their immunity. Chronic diseases such as gastrointestinal diseases, cardiovascular diseases, and obesity are increasing among consumers due to lifestyle traits such as improper eating habits and sedentary routines. These factors are expected to increase the demand for probiotic ingredients in dietary supplements.

Regional Insights

The probiotic ingredients industry in North America accounted for a share of 25.82% of the global revenue in 2025, driven by strong consumer awareness of gut health, a well-established dietary supplements industry, and high penetration of functional foods and beverages. The region benefits from a mature healthcare ecosystem, where probiotics are increasingly recommended for digestive health, immunity support, and women’s wellness, particularly in preventive care. Rising prevalence of lifestyle-related disorders such as obesity, diabetes, and gastrointestinal issues has further accelerated demand for probiotic-enriched products across supplements, functional dairy, and non-dairy applications. The manufacturers of probiotic ingredients have been heavily investing in research & development activities. For instance, ADM has identified a fat-reducing probiotic molecule in its Bifidobacterium proprietary strain. Such investments are responsible for increasing applications from the end use industries, which, in turn, are augmenting the demand for probiotic ingredients in North America.

U.S. Probiotic Ingredients Market Trends

The probiotic ingredients industry in the U.S. is projected to grow at a CAGR of 9.0% from 2026 to 2033.Consumers in the U.S. are concerned about diet, nutrition, and food safety due to modernization and the trend toward a healthier society. Moreover, gut health is directly related to diet and nutrition which impacts the overall health of the human body. The trend of healthy eating has witnessed increased popularity over the last decade in the U.S. as gut health is directly related to the eating habits and diets of consumers. Thus, increasing trend of healthy eating to maintain gut health is expected to boost the growth of the U.S. market in the foreseeable future.

Europe Probiotic Ingredients Market Trends

The Europe probiotic ingredients industry is projected to grow at a CAGR of 8.6% from 2026 to 2033. European consumers are more inclined toward probiotic foods and probiotic beverages, as awareness about the health benefits of these probiotic food products is increasing in the region. Furthermore, probiotic yogurt is one of the emerging probiotic food products in Europe, which, in turn, is boosting the growth of the food & beverages segment in the European probiotic ingredients. Increasing use of probiotics to maintain gut health is the key factor for the growth of the dietary supplements segment in the market. Gut health is directly related to immune health, thus, since the outbreak of the COVID-19 pandemic globally, European consumers are actively considering gut health as one of the important health issues. Thus, the use of probiotic ingredients in dietary supplements is expected to increase substantially in Europe over the forecast period.

The probiotic ingredients industry in the UK is projected to grow at a CAGR of 8.8% from 2026 to 2033, supported by increasing consumer focus on preventive healthcare, digestive wellness, and immunity support. Rising adoption of probiotics in dietary supplements and functional foods, particularly yogurts, fermented beverages, and plant-based alternatives, is a key growth driver. UK consumers are highly responsive to science-backed health claims, encouraging manufacturers to invest in clinically validated probiotic strains and improved delivery formats such as capsules, gummies, and sachets.

Beyond human nutrition, expanding applications of probiotic ingredients in the animal feed market are also contributing to demand growth. The UK’s livestock and poultry sectors are increasingly adopting probiotics as natural alternatives to antibiotic growth promoters, in line with stricter regulations on antibiotic usage and rising emphasis on sustainable animal husbandry. Probiotics are being used to improve gut health, feed efficiency, and overall immunity in animals, supporting productivity and animal welfare.

Asia Pacific Probiotic Ingredients Market Trends

The Asia Pacific probiotic ingredients industry is projected to grow at a CAGR of 9.7% from 2026 to 2033. Consumer buying behavior towards probiotics in the Asia Pacific, coupled with the high awareness about the benefits of consuming probiotic ingredients, is the major factor driving the probiotic ingredients industry in the Asia Pacific. The research study conducted by Kerry in 2019, one of the leading probiotic ingredient suppliers, found that the majority of the consumers in Asia Pacific are proactive about their digestive health. These consumers are seeking probiotic food & beverage products that address their concerns. On the back of these factors, the demand for probiotic ingredients is expected to witness substantial growth in the near future.

Central & South America Probiotic Ingredients Market Trends

The probiotic ingredients industry in Central & South America is projected to grow at a CAGR of 8.1% from 2026 to 2033. The market is growing due to rising income levels, expanding food and beverage sectors, and a shift toward healthier diets. Brazil and Argentina lead in both production and consumption of animal products and bacteria. Increased investment in food processing infrastructure aids market development. The growing fitness industry also plays a role.

Middle East & Africa Probiotic Ingredients Market Trends

The Middle East & Africa probiotic ingredients industry is projected to grow at a CAGR of 7.6% from 2026 to 2033. The Middle East and Africa are experiencing gradual growth in the probiotic ingredients industry, driven by urbanization, changing food preferences, and rising demand for fortified foods. Population growth and increasing awareness of nutrition-related health issues are key drivers. Import reliance is slowly shifting as local production capabilities improve. Halal-certified and culturally adapted protein products also support market adoption.

Key Probiotic Ingredients Company Insights

Established companies and emerging players in the probiotic ingredients industry are fostering a highly competitive landscape by focusing on product innovation, quality enhancement, and strategic pricing strategies. This competition is fueled by continuous investments in advanced processing technologies, automation, and a skilled workforce to maintain operational efficiency and comply with stringent regulatory standards. In addition, increasing consumer demand for clean-label, sustainable, and functional protein sources is reshaping market dynamics. These factors collectively drive market share shifts and encourage the development of diverse, value-added protein ingredients.

Key Probiotic Ingredients Companies:

The following are the leading companies in the probiotic ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- Kerry Inc

- Chr. Hansen Holding AS

- DSM

- DuPont de Nemours Inc

- Associated British Foods plc

- Lallemand Inc

- Archer Daniels Midland

- Advanced Enzyme Technologies

- Probi AB

- Adisseo

Recent Developments

-

In November 2025, Probi broadened its offerings with two new probiotic lines: Sports & Active Nutrition focused on physical performance, and Pet Health probiotics targeting digestive and oral health in companion animals highlighting diversification beyond traditional human supplements.

-

In November 2025, Evonik announced at Poultry India 2025 an updated Ecobiol probiotic with improved activity for poultry gut health, and an expansion in the probiotic ingredients in the animal feed market that supports sustainable livestock nutrition

-

In July 2025, ClostraBio, Inc. announced that its next-generation probiotic strain CLB101 received self-affirmed GRAS status, positioning it for commercial launch in the U.S. market.

Probiotic Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.79 billion

Revenue forecast in 2033

USD 6.98 billion

Growth rate

CAGR of 9.1% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, ingredients, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Kerry Inc.; Chr. Hansen Holding AS; DSM (BioCare Copenhagen); DuPont de Nemours Inc. (IFF Nutrition & Bio-Science); Associated British Foods plc; Lallemand Inc.; Archer Daniels Midland (ADM) (Deerland Probiotics & Enzymes Inc); Advanced Enzyme Technologies; Probi AB; Adisseo

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Probiotic Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the probiotic ingredients market report based on form, ingredients, application, and region.

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Dry/Powder

-

Liquid

-

-

Ingredients Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Bacteria

-

Lactobacilli

-

Bifidobacterium

-

Streptococcus

-

Other Genus

-

-

Yeast

-

Spore Formers

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Dairy

-

Cereals

-

Baked Food

-

Others

-

-

Dietary Supplements

-

Chewable & Gummies

-

Capsules

-

Powders

-

Tablets

-

Soft Gels

-

Others

-

-

Animal Feed

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global probiotic ingredients market size was estimated at USD 2.50 billion in 2021 and is expected to reach USD 2.72 billion in 2022.

b. The global probiotic ingredients market is expected to grow at a compound annual growth rate of 8.8% from 2022 to 2030 to reach USD 5.33 billion by 2030.

b. The Asia Pacific dominated the probiotic ingredients market with a share of 34.6% in 2021. This is attributable to the presence of major market participants in the region, high awareness regarding probiotic usage, and easy availability of products has benefited the regional demand in the recent past.

b. Some key players operating in the probiotic ingredients market include Probiotical S.p.A.; Ganeden, Inc.; Sabinsa Corporation; Biocodex, Inc.; BioGaia AB; Chr. Hansen Holding A/S; Danisco A/S; Danone, Inc.; and Lallemand, Inc.

b. Key factors that are driving the market growth include increasing consumer awareness regarding preventive healthcare coupled with increasing expenditure on probiotics, most notably in countries such as Japan, Germany, and U.K.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.