- Home

- »

- Next Generation Technologies

- »

-

Production Printer Market Size, Share, Industry Report, 2033GVR Report cover

![Production Printer Market Size, Share & Trends Report]()

Production Printer Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Inkjet Production Printers, Toner-based Production Printers), By Color Output Type, By Production Method, By Print Speed, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-644-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Production Printer Market Summary

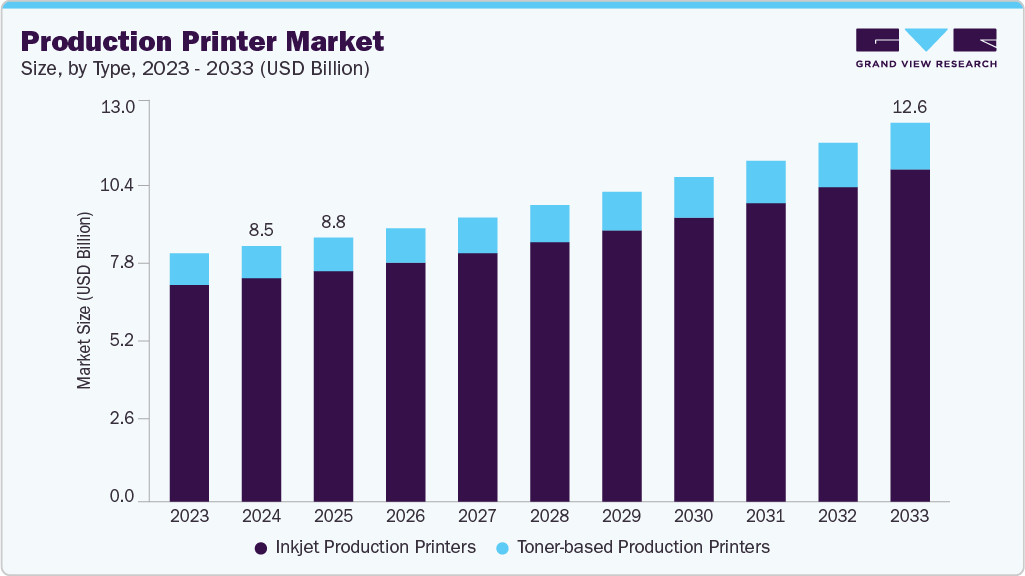

The global production printer market size was estimated at USD 8.49 billion in 2024 and is projected to reach USD 12.59 billion by 2033, growing at a CAGR of 4.6% from 2025 to 2033. The integration of high-speed inkjet technology and automation in print workflows has emerged as a significant trend in the global production printer market, driven by the growing demand for personalized print solutions,

Key Market Trends & Insights

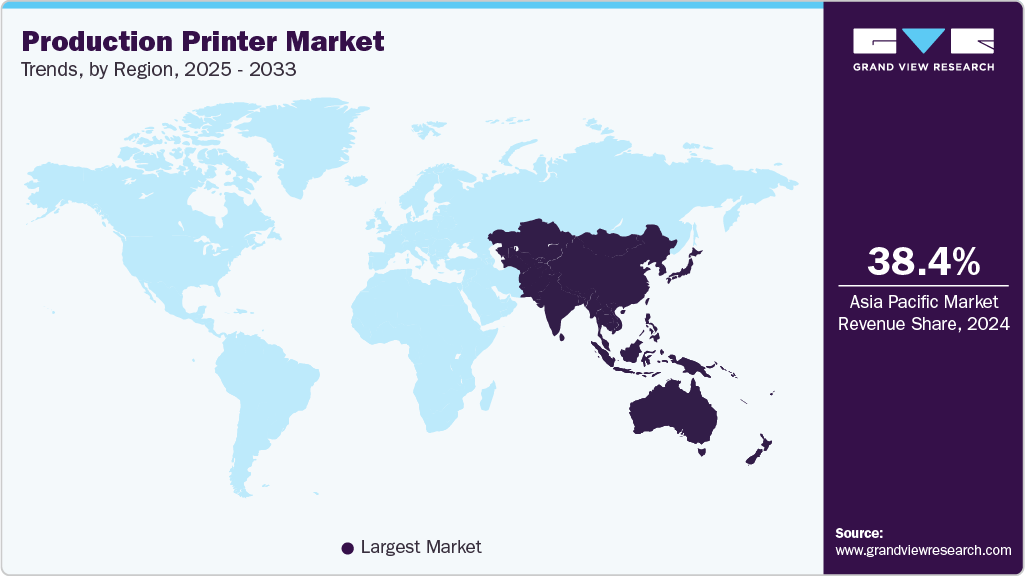

- The Asia Pacific Production Printer market accounted for a 38.4% share of the overall market in 2024.

- The production printer industry in China held a dominant position in 2024.

- By type, the inkjet production printers segment accounted for the largest share of 87.3% in 2024.

- By color output type, the color production printers segment held the largest market share in 2024.

- By production method, the cut fed (sheet-fed) segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.49 Billion

- 2033 Projected Market Size: USD 12.59 Billion

- CAGR (2025-2033): 4.6%

- Asia Pacific: Largest market in 2024

The rise of short-run printing in commercial sectors, and the increasing need for cost-effective and efficient high-volume printing in packaging and publishing applications. Stricter environmental compliance standards are propelling the market growth for sustainable production printers. In 2023, the U.S. Environmental Protection Agency (EPA) reinforced its enforcement of the Resource Conservation and Recovery Act (RCRA), mandating safer chemical alternatives and enhanced hazardous waste management across printing facilities. Regulations such as the National Emissions Standards for Hazardous Air Pollutants (NESHAP) have limited VOC emissions, directly boosting the market for water-based inks and energy-efficient UV curing systems, especially in the packaging and label segments. Furthermore, the EPA’s 2023 guidelines aimed at screen printing facilities advocated a 15-20% reduction in solvent use through advanced drying systems, influencing technology upgrades and sustainable workflow adoption.

The rise of e-commerce between 2020 and 2024 has accelerated demand for digitally printed packaging, significantly boosting the production printer market. According to U.S. Census Bureau data, the food and beverage manufacturing subsector saw a 12.3% increase in shipment values between 2020 and 2021, prompting a need for agile, short-run digital packaging solutions. During the same period, the wood products subsector grew by 31.3%, partly driven by innovations in digitally printed corrugated boxes. By 2023, over 68% of packaging converters had integrated inkjet systems to accommodate retailers’ needs for variable-data printing on shipping materials, directly propelling market growth.

Industrial sectors have increasingly adopted advanced inkjet systems since 2021, boosting the production printer market. For instance, the computer and electronics subsector saw a 13.5% growth in shipment values by the end of 2021, driven by applications in circuit printing and component labeling. Simultaneously, the transportation equipment sector grew by 12.1%, utilizing UV-curable inkjet printers for durable, high-resolution markings. These printers, which often exceed 1,200 dpi, meet rigorous safety standards and align with EPA reports from 2022-2023 that show a 30-40% reduction in VOC emissions compared to analog systems, reinforcing their value in regulatory-compliant production environments.

Between 2021 and 2023, the shift toward personalized, on-demand print jobs gained momentum, bolstering the demand for digital production printers. U.S. Census data shows the miscellaneous manufacturing subsector, home to many custom printing operations, expanded by 9.4% in 2021. Concurrently, the printing and related support activities subsector posted a 9.0% increase in shipment value, reflecting growth in quick-turn, low-volume print services. Government surveys conducted in 2022 revealed that 42% of commercial printers had already adopted on-demand capabilities for books, brochures, and promo items, significantly boosting market demand for flexible, high-efficiency digital presses.

Type Insights

The Inkjet Production Printers segment accounted for the largest share of 87.3% in 2024 and is expected to grow at the fastest CAGR during the forecast period. Inkjet Production Printers are driving a paradigm shift in the production print landscape, powered by their ability to handle high-speed, full-color jobs with precision and cost-efficiency. Their growing penetration into commercial, packaging, and publishing environments is due to advancements in pigment-based inks, improved media versatility, and superior print head durability. As demand for shorter runs and personalized print increases, inkjet systems are rapidly replacing traditional offset and even toner-based systems in many segments.

The Toner-based Production Printers segment is expected to grow at a significant CAGR during the forecast period. Toner-based Production Printers, while facing competitive pressure from inkjet, continue to play a vital role in high-resolution print requirements where consistency, durability, and sharpness are critical. Their dominance in sectors like legal, government, and education remains intact due to their proven reliability and lower maintenance needs for monochrome output, though their color capabilities are increasingly challenged.

Color Output Type Insights

The Color Production Printers segment held the largest market share in 2024. Color Production Printers are experiencing exponential growth, fueled by the surge in customized marketing collateral, branded packaging, and vibrant visual media. With businesses vying for consumer attention through high-impact printed communication, color printing has evolved from a luxury to a necessity. Advancements in digital color management, coupled with falling costs of consumables, are making high-quality color printing more accessible than ever.

The Monochrome Production Printers segment is expected to grow at a significant CAGR during the forecast period. Monochrome Production Printers retain relevance in volume-driven document processing. They are preferred in environments such as government records, banking, and logistics, where color is secondary to speed, clarity, and cost-per-page efficiency. However, their market share is gradually tapering off due to the broader shift toward visually dynamic content.

Production Method Insights

The Cut Fed (Sheet-Fed) segment dominated the market in 2024. Cut Fed (Sheet-Fed) Production Printers are gaining significant traction in the market due to their ability to support diverse media formats, quick setup, and job flexibility. Their dominance in commercial and photo printing is attributed to their agility in short-run and variable data tasks, where turnaround time and customization are key.

The Continuous Feed (Web-Fed) segment is projected to grow at a significant CAGR over the forecast period. Continuous Feed (Web-Fed) Production Printers excel in high-volume, uninterrupted printing scenarios. Their adoption in book printing, transactional mail, and utilities billing is driven by their efficiency in bulk output and evolving integration with color inkjet technology, which expands their usability beyond traditional monochrome jobs.

Print Speed Insights

The 100-300 ppm segment dominated the market in 2024 and is projected to grow at the fastest. 100-300 ppm production printers are emerging as the most widely adopted segment, balancing speed, efficiency, and affordability. They serve as ideal solutions for mid-volume commercial printers and enterprises needing agility without compromising output quality.

The Above 300 ppm segment is projected to grow at a significant CAGR over the forecast period. Above 300 ppm, printers are positioned at the top end of the performance spectrum, ideal for industrial-grade operations where massive print volumes and ultra-fast delivery times are standard. These systems are increasingly automated and integrated with advanced workflow solutions to minimize downtime and human intervention.

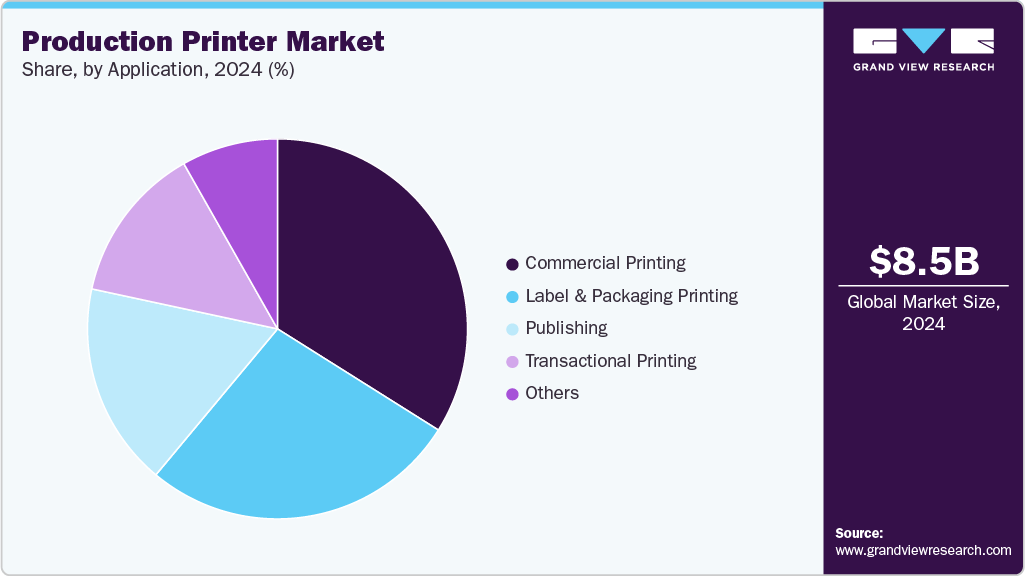

Application Insights

The Commercial Printing segment dominated the market in 2024 and is projected to grow at the fastest CAGR over the forecast period. Commercial Printing remains the bedrock of the production printer market. The rising demand for personalized marketing materials, brochures, and business communication tools is driving the need for faster, more flexible printers that support diverse media types and deliver vivid results in real time.

The Label & Packaging Printing segment is projected to grow at a significant CAGR over the forecast period. Label & Packaging Printing is the growing segment, propelled by the global boom in e-commerce, retail branding, and consumer goods. Production printers now enable brands to execute short-run, high-quality packaging with fast turnarounds, making them an essential asset for agile supply chains and localized marketing strategies.

Regional Insights

The North America Production Printer market accounted for 28.0% share of the overall market in 2024. In North America, the production printer market is witnessing a strong surge in demand for secure and compliance-ready printing solutions, driven by increasing regulatory scrutiny in sectors such as government, legal, and healthcare. As laws such as the U.S. Federal Information Security Modernization Act (FISMA), HIPAA, and Canada’s PIPEDA tighten requirements around data protection and confidentiality, institutions are investing in production printers equipped with advanced security features such as encrypted data transfer, user authentication, pull printing, and audit trails. This shift is prompting manufacturers to develop systems aligned with standards such as those from the National Institute of Standards and Technology (NIST), leading to a growing niche of printers tailored for secure, high-volume document workflows. The demand is especially notable in federal agencies and law firms, where secure document handling is critical, creating long-term procurement cycles and boosting the region’s market growth for specialized, compliance-driven production printing systems.

U.S. Production Printer Market Trends

The U.S. production printer market held a dominant position in 2024. In the U.S., regulations by the Environmental Protection Agency (EPA), such as the NESHAP for the printing industry, have tightened controls on VOC emissions. These rules are pushing printing facilities to invest in production printers that use low-VOC inks and efficient curing systems. Programs under the Clean Air Act and state-specific guidelines such as those in Texas are further accelerating this shift. As a result, the market is seeing a surge in demand for modern, compliant printers that help businesses meet regulatory benchmarks while lowering operational costs.

Europe Production Printer Market Trends

The Europe production printer market was identified as a lucrative region in 2024. Europe is at the forefront of sustainable packaging reforms. The upcoming Packaging and Packaging Waste Regulation (PPWR) is setting new targets for recyclability and circular packaging. These changes are driving companies to adopt digital printing systems that are more agile, produce less waste, and support sustainable practices. Production printers that allow short runs and customized packaging are gaining traction as firms adjust to meet EU-wide environmental goals.

Germany production printer market is expected to grow significantly during the forecast period owing to stringent recycling laws and extended producer responsibility (EPR) system, and is reshaping the way packaging and printing companies operate. As part of its commitment to EU sustainability targets, German businesses are adopting high-efficiency digital printers that are able to handle short-run jobs with minimal material waste. These machines are helping companies stay compliant while reducing production costs, especially in packaging and labeling applications.

The UK production printer market is evolving in response to both market pressures and environmental mandates. With a decline in traditional offset printing, more commercial printers are moving toward digital solutions. The push for sustainable packaging and waste reduction is leading to broader adoption of sheet-fed and inkjet printers that are efficient, versatile, and eco-conscious, offering a way to meet demand for customization and compliance at the same time.

Asia Pacific Production Printer Market Trends

The Asia Pacific production printer market accounted for a 38.4% share of the overall market in 2024. Asia Pacific is seeing massive growth in production printing, due to a blend of manufacturing expansion and digital innovation. The shift toward sustainable practices and tighter emission norms, especially in industrialized APAC nations, is making production printers that support low-VOC inks and real-time monitoring systems highly attractive. Countries such as Japan, China, and India are leading this trend, each with unique regulatory frameworks influencing adoption.

The China production printer market is expected to grow significantly during the forecast period. China’s “Blue Sky Action Plan” and other environmental campaigns are cracking down on industrial VOC emissions, including those from printing facilities. These measures are forcing companies to modernize their equipment, particularly in high-volume sectors like packaging. As a result, demand is rising for inkjet and UV-curable printers that meet emission targets and reduce solvent usage without compromising output.

The Japan production printer market is expected to grow significantly during the forecast period owing to the focus on industrial digitization under programs such as METI’s Digital Governance Code, which is pushing the print sector toward smart technologies. Modern production printers in Japan are increasingly equipped with automation features, AI-based calibration, and energy monitoring tools. These capabilities support the country’s broader transition to Industry 4.0, making them essential for manufacturers needing precision and compliance.

India production printer market and packaging industries are booming. With the Central Pollution Control Board (CPCB) tightening norms on VOCs and other pollutants, printers across sectors are upgrading to more sustainable machines. The rapid growth of e-commerce and consumer packaging, estimated at around 15% annually, is also driving interest in digital production printers that offer flexibility, speed, and compliance for short-run and variable-data printing needs.

Key Production Printer Company Insights

Some of the major players in the Production Printer market include Canon Pvt Ltd., FUJIFILM Holdings Corporation, HP Development Company, L.P., Konica Minolta, Inc., KYOCERA, Ricoh, among others, due to a combination of advanced R&D capabilities, broad product portfolios, strong global distribution networks, and consistent innovation in high-speed and high-volume printing technologies. These companies have strategically invested in next-generation inkjet and toner-based systems that cater to a wide range of applications—from commercial and transactional printing to packaging and publishing. Their ability to offer integrated solutions, including workflow automation, print management software, and eco-friendly consumables, enables them to meet evolving customer demands for efficiency, customization, and sustainability. In addition, their global presence and partnerships with enterprise clients across industries give them a competitive edge in market penetration and customer retention.

-

HP Development Company, L.P. has established itself as a key player in the production printer market through its strong emphasis on innovation in inkjet technology and high-volume digital printing solutions. Their PageWide and Indigo platforms are widely recognized for enabling high-speed, full-color printing with low operating costs, particularly in commercial and packaging segments. The company also focuses on sustainability, with water-based inks and energy-efficient devices that meet strict global environmental standards. Its integration of cloud-based print management and workflow automation tools has further strengthened its position among enterprise and industrial clients seeking scalable, end-to-end solutions.

-

Ricoh has carved a significant niche in the production printer market by offering a comprehensive range of toner and inkjet-based printing systems tailored for both office and industrial environments. Its strengths lie in the reliability, precision, and scalability of its solutions, which are adopted for transactional, publishing, and label applications. The company has heavily invested in digital transformation, integrating AI-driven maintenance, remote monitoring, and cloud connectivity into its hardware. Ricoh’s commitment to sustainable practices, such as recyclable materials and reduced emissions, also aligns well with regulatory trends, making it a preferred choice in markets demanding both performance and environmental responsibility.

Key Production Printer Companies:

The following are the leading companies in the production printer market. These companies collectively hold the largest market share and dictate industry trends.

- Canon Pvt Ltd..

- FUJIFILM Holdings Corporation

- HP Development Company, L.P.

- Konica Minolta, Inc.

- KYOCERA

- Ricoh

- RISO KAGAKU CORPORATION

- Seiko Epson Corporation

- Sharp Electronics Corporation

- Xerox Corporation

Recent Developments

-

On March 19, 2025, HP Development Company, L.P. introduced the HP PrintOS Production Hub, with global availability starting May 2025, offering cloud-based tools to streamline production workflows and improve operational efficiency for large-format printing.

-

On June 9, 2025, Ricoh launched the RICOH Pro C5400S, a series of color light-production sheet-fed digital printers, designed to enhance efficiency and versatility for small to medium-sized print shops.

Production Printer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.76 billion

Revenue forecast in 2033

USD 12.59 billion

Growth rate

CAGR of 4.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, color output type, production method, print speed, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Canon Pvt Ltd.; FUJIFILM Holdings Corporation; HP Development Company, L.P.; Konica Minolta, Inc.; KYOCERA; Ricoh; RISO KAGAKU CORPORATION; Seiko Epson Corporation; Sharp Electronics Corporation; Xerox Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Production Printer Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global production printer market report based on type, color output type, production method, print speed, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Inkjet Production Printers

-

Toner-based Production Printers

-

-

Color Output Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Color Production Printers

-

Monochrome Production Printers

-

-

Production Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Cut Fed (Sheet-Fed)

-

Continuous Feed (Web-Fed)

-

-

Print Speed Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 100 ppm

-

100-300 ppm

-

Above 300 ppm

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Printing

-

Label & Packaging Printing

-

Publishing

-

Transactional Printing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global production printer market size was estimated at USD 8.49 billion in 2024 and is expected to reach USD 8.76 billion in 2025.

b. The global production printer market size is expected to grow at a significant CAGR of 4.6% to reach USD 12.59 billion in 2033.

b. Asia-Pacific (APAC) held the largest market share of 38.4% in 2024. Asia-Pacific is seeing massive growth in production printing, due to a blend of manufacturing expansion and digital innovation. The shift toward sustainable practices and tighter emission norms, especially in industrialized APAC nations, is making production printers that support low-VOC inks and real-time monitoring systems highly attractive. Countries like Japan, China, and India are leading this trend, each with unique regulatory frameworks influencing adoption.

b. Some of the players in the production printer market are Canon Pvt Ltd., FUJIFILM Holdings Corporation, HP Development Company, L.P., Konica Minolta, Inc., KYOCERA, Ricoh, RISO KAGAKU CORPORATION, Seiko Epson Corporation, Sharp Electronics Corporation, and Xerox Corporation.

b. The key driving trend in the production printer market is the increasing demand for high-speed, variable data printing fueled by personalized marketing, short-run packaging, and on-demand publishing. This trend is amplified by the integration of advanced inkjet technologies, cloud-based workflow automation, and hybrid digital-offset solutions aimed at improving efficiency, scalability, and cost-effectiveness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.