- Home

- »

- IT Services & Applications

- »

-

Productivity Management Software Market Size Report, 2030GVR Report cover

![Productivity Management Software Market Size, Share & Trends Report]()

Productivity Management Software Market Size, Share & Trends Analysis Report By Solution, By Deployment (Cloud, On-premise), By Enterprise Size (Small & Medium Enterprise, Large Enterprise), By Industry, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-962-3

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

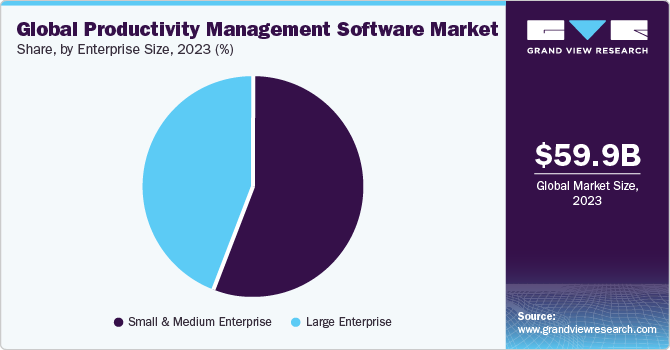

The global productivity management software market size was estimated at USD 59.88 billion in 2023 and is anticipated to grow at a CAGR of 14.1% from 2024 to 2030. The growing preference for a centralized digital workplace is creating huge opportunities for various software solutions, which further fuels the market. As organizations increasingly prioritize digital workplace management to enhance employee productivity, streamline operations, and optimize resource utilization, the demand for productivity management software is expected to rise. According to databy FORBES advisor, sixty percent of workers feel increased burnout due to digital communication, which can be tackled by using productivity management software.

Furthermore, the increasing adoption of cloud-based solutions within the market plays a significant role. Cloud-based software offers several advantages, including cost-effectiveness due to eliminating upfront hardware and software investments, scalability to accommodate evolving needs and accessibility from any device, and empowering a mobile and flexible workforce. The integration capabilities of these solutions are also crucial, allowing them to seamlessly connect with existing it infrastructure, such as CRM, ERP, and communication platforms, for a more streamlined workflow and reduced data silos, ultimately boosting overall business efficiency.

Businesses constantly seek ways to streamline processes, eliminate redundancies, and optimize resource allocation. Productivity management software provides valuable tools for task management, workflow automation, and project planning. It allows for better resource utilization, reduced bottlenecks, and faster completion times. Effective decision-making requires clear visibility into business operations. Productivity management software offers robust reporting and analytics features. These features empower businesses to gather, analyze, and interpret data on employee performance, project progress, and resource utilization. This data-driven approach allows for informed decision-making, enabling companies to identify areas for improvement and optimize their overall operations. Improved collaboration and communication are crucial for efficient teamwork.

Productivity management software often integrates features like communication channels, shared workspaces, and document collaboration tools. It fosters real-time communication, facilitates knowledge sharing, and ensures everyone is on the same page, leading to smoother project execution and improved team performance. Transparency in business operations builds trust and fosters a culture of accountability. Productivity management software can promote transparency by providing a centralized platform for task tracking, project updates, and communication. It allows team members and stakeholders to easily access information, track progress, and hold each other accountable for deliverables. Increased operational efficiency translates into faster turnaround times, fewer errors, and better resource allocation. It ultimately leads to improved customer satisfaction. Additionally, transparency in communication and project management fosters trust with clients, allowing them to stay informed and confident in the delivery process. By enhancing operational efficiency and transparency, productivity management software empowers businesses to deliver a superior customer experience.

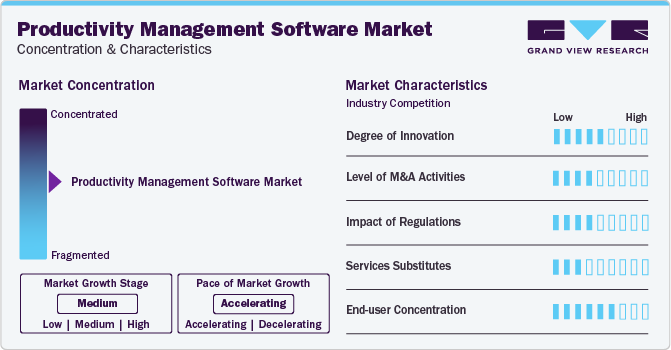

Market Concentration & Characteristics

The technology environment in the market is rapidly evolving. Companies are introducing artificial intelligence capabilities to increase efficiency. For instance, in June 2023, oracle introduced generative AI-powered capabilities into oracle fusion cloud human capital management (HCM). These capabilities, supported by the oracle cloud infrastructure (OCI) generative AI service, can expedite business value, improve productivity, enrich the experiences of candidates and employees, and streamline HR processes.

There has been a significant increase in the integration of artificial intelligence in productivity management software, resulting in a minimal need for new training programs. Many companies are launching productivity management software with artificial intelligence capabilities to enhance their product offering. For Instance, in June 2023, Asana, Inc. announced its latest product capabilities centered on generative artificial intelligence. The newly launched asana intelligence incorporates enterprise-size AI capabilities at the core of ASANA'S work management platform, empowering organizations to expedite decision-making and enhance productivity.

The regulatory landscape surrounding productivity management software is evolving to address growing data privacy and security concerns. Regulations like the general data protection regulation (GDPR) and the CALIFORNIA consumer privacy act (CCPA) are setting stricter standards for data handling practices. Software vendors must prioritize robust data encryption, transparent data usage policies, and user control over personal information. Additionally, regulations around accessibility are gaining traction, requiring software solutions to be inclusive for users with disabilities.

In productivity management software, the threat of substitutes can be termed moderate, as it includes manual processes such as spreadsheets, paper-based systems, or email communications to monitor the tasks. While these methods are cost-effective, they lack efficiency, accuracy, and scalability compared to productivity management software.

Productivity management software is crucial, as it helps organizations enhance efficiency, streamline workflows, and optimize performance. Productivity management software covers various end-use industries, including BFSI, it & telecom, healthcare, manufacturing, transportation, and others.

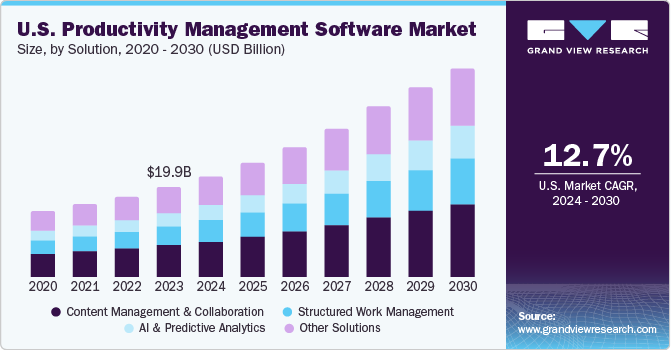

Solution Insights

The content management & collaboration segment accounted for the largest revenue share of over 35% in 2023. Content management and collaboration solutions offer capabilities for productivity management. They provide a centralized repository for all documents, files, and content, making it easier for employees to access and share information. It helps reduce the time spent searching for information, increasing productivity. Collaboration tools allow real-time communication and collaboration among team members, regardless of location. It helps enhance teamwork and reduces the time spent on back-and-forth emails and phone calls.

The AI & predictive analytics segment is anticipated to grow at a CAGR of 15.5% from 2024 to 2030. AI and predictive analytics solutions are revolutionizing productivity management software by offering advanced capabilities that empower organizations to optimize their operations and enhance efficiency. These technologies enable the analysis of vast amounts of data to uncover valuable insights, predict future trends, and automate decision-making processes.

Deployment Insights

The cloud segment accounted for the largest revenue share of over 63.3% in 2023. an increasing number of businesses are adopting cloud technology, which drives the segment's growth. These solutions offer capabilities similar to those of On-premise solutions, including time tracking, task management, and collaboration tools. Cloud-based solutions are typically more cost-effective and easier to implement and scale, as they do not require the same hardware and infrastructure investment as On-premise solutions.

The On-premise segment is anticipated to expand at a CAGR of 7.4% from 2024 to 2030. The control and customization options offered by On-premise deployment are driving the segment's growth. On-premise productivity management software is installed and run on a company's own servers and infrastructure. Moreover, businesses that prefer security and compliance often prefer On-premise deployment as it gives them more control to the data shared.

Industry Insights

The BFSI segment accounted for a significant revenue share in 2023. productivity management software plays a significant role in the BFSI industry by streamlining operations, enhancing efficiency, and ensuring regulatory compliance. It also assists customer relationship management by providing tools for managing client information, analyzing their needs, and offering personalized services.

The manufacturing segment is anticipated to grow significantly from 2024 to 2030. It assists manufacturing companies by optimizing resource utilization, streamlining processes, and enhancing overall efficiency. It enables manufacturers to align production with demand, minimize downtime, and reduce lead times by leveraging advanced technologies, data analytics, and automation solutions to improve operational performance and meet market demands efficiently.

Enterprise Size Insights

The large enterprise segment accounted for a significant revenue share in 2023. As large enterprise operates on a massive scale with extensive workforces and complex operations, there is a heightened need for efficient resource allocation and optimization. Moreover, with the increasing competition and volatility in the market, large enterprise sizes are increasingly focusing on operational efficiency and performance improvement to maintain their competitive edge, thus driving the growth of the market.

The small and medium size enterprise segment is anticipated to grow at a significant CAGR from 2024 to 2030 as it offers businesses ways to streamline operations and improve efficiency. These solutions provide a centralized location for all documents, files, and content, making it easier for employees to access and share information.

Regional Insights

The North America productivity management software market held the major share of over 39% in 2023. The increasing need to manage routine tasks and the highly evolving infrastructure organizations are driving the market's growth in the region. Moreover, the increased adoption of AI and machine learning technologies would leverage market growth. In the upcoming years. In addition, the widespread adoption of remote work has driven the demand for productivity management software that supports collaboration, task management, and communication in virtual work environments.

U.S. Productivity Management Software Market Trends

The productivity management software market in the U.S. is growing significantly at a CAGR of 12.9% from 2024 to 2030. The rise of remote work in the U.S. led to an increased emphasis on productivity management tools. According to the U.S. bureau of labor statistics, in august 2023, approximately 19.5 percent of the workforce engaged in telework or performed work from home. Companies in the U.S. are adopting software that facilitates collaboration, task management, and communication to support distributed teams.

Europe Productivity Management Software Market Trends

The Europe productivity management software market is growing significantly at a CAGR of 13.7% From 2024 To 2030. Businesses in Europe are increasingly adopting digital transformation initiatives to enhance efficiency and competitiveness in the workplace. Businesses are also focused on employee skill development and training. According to EUROSTAT, 22% of companies in the EUROPEAN union engaged in training initiatives to cultivate or improve their staff's information and communication technology (ICT) skills.

The productivity management software market in the UK is growing significantly at a CAGR of 10.1% from 2024 to 2030. The growing emphasis on regulatory and compliance requirements, particularly in data security and privacy areas, is driving the adoption of productivity management tools that align with regulatory standards, ensuring secure and compliant work processes.

The Germany productivity management software market is growing significantly at a CAGR of 12.2% from 2024 to 2030. The growing trend of cloud-based productivity management software continues to grow in Germany. Integration with collaboration tools, such as messaging platforms and project management software, is a key trend in the country. This integration streamlines workflow and enhances overall team communication and collaboration.

The productivity management software market in France is expected to grow at notable CAGR from 2024 to 2030. The need for effective collaboration and communication tools is a key driving factor for the market in France. Productivity management tools often include messaging, file sharing, and project collaboration to support modern work environments. solutions seamlessly integrating with existing enterprise size systems and applications are preferred in the contemporary workplace.

Asia Pacific Productivity Management Software Market Trends

The Asia Pacific productivity management software market is growing significantly at a CAGR of 15.8% from 2024 to 2030. The growing trend of working from home is driving the market growth in the region. The rise of remote and flexible work arrangements accelerated the need for tools that facilitate remote collaboration, task management, and communication. Productivity management software addresses these requirements, making it an essential tool for businesses.

The productivity management software market in China is anticipated to witness a significant growth at a CAGR from 2024 to 2030. One of the primary driving forces for market growth is the rapid digital transformation across industries in the country. Companies increasingly adopt advanced technologies such as AI, 5G, and Industry 4.0 to streamline operations and enhance productivity, leading to a growing demand for advanced productivity management solutions.

Japan productivity management software market is growing significantly at a CAGR of 15.1% from 2024 to 2030. The increasing integration of cloud-based productivity management software is the significant factor driving the market's growth. Cloud solutions offer businesses the flexibility to access and manage data from anywhere, advancing collaboration and remote work capabilities. The integration of AI into productivity management software emerged as a significant driving factor for the market.

The productivity management software market in India is growing significantly at a CAGR of 18.4% from 2024 to 2030. The growing integration of AI into productivity management software drives the market's growth. In addition, due to the adaption of flexible work arrangements, the need for robust software that enables seamless communication, project tracking, and collaboration regardless of physical location has increased.

Middle East & Africa Productivity Management Software Market Trends

The Middle East And Africa productivity management software market is growing significantly at a CAGR of 14.1% from 2024 to 2030. Digital transformations, technological advancements and a heightened focus on data security and compliance, propel the market.

The productivity management software market in Saudi Arabia is growing significantly at a CAGR of 14.7% from 2024 to 2030. The advancements in technological processes in areas such as cloud computing, artificial intelligence, and data analytics in the country are fueling the growth of the market.

Key Productivity Management Software Company Insights

Some Key Companies Operating In The Market Include Google Llc, Adobe, And Microsoft, Among Others Are Some Of The Leading Participants In The Market.

-

Google LLC, a global technology solution and service provider, plays a significant role in the market. The company offers a comprehensive suite of productivity management software within its google workspace. google workspace is a cloud-based digital office suite encompassing a range of work, collaboration, and project management tools. this collection includes Gmail, google drive, calendar, docs, sheets, slides, forms, chat, and meet, providing users a versatile platform to enhance productivity, communication, and collaboration.

-

Microsoft is a provider of productivity management software, offering a comprehensive suite of tools designed to enhance efficiency, collaboration, and overall productivity in modern enterprise sizes. The company’s productivity offering is MICROSOFT 365, a versatile platform that integrates various applications to streamline operations and empower businesses to achieve their goals effectively. MICROSOFT 365 encompasses essential tools like word, excel, POWERPOINT, teams, ONEDRIVE, and SHAREPOINT, each playing a vital role in document creation, data analysis, project management, collaboration, and secure file storage.

Zoho Corporation Pvt. Ltd., Hyperoffice, and Asana, Inc. are some market participants in the market.

-

Zoho Corporation Pvt. Ltd. is a software company that offers a comprehensive suite of productivity management software solutions designed to streamline business operations and enhance efficiency. the company's flagship product, zoho one, encompasses all business management software that caters to various aspects of office management, including data management, documentation, finance management, work scheduling, people management, and many others.

-

Hyperoffice is a company specializing in web collaboration, online meetings, web conferencing, online databases, and email marketing applications tailored for small and mid-sized businesses. The company's flagship product, the HYPEROFFICE collaboration suite, offers integrated tools designed to enhance productivity and streamline organizational work processes.

Key Productivity Management Software Companies:

The following are the leading companies in the productivity management software market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Asana, Inc.

- Broadcom

- Epicor Software Corporation

- Google (Alphabet Inc.)

- Hyperoffice

- International Business Machines Corporation

- Microsoft

- Monday.Com

- Oracle

- Rockwell Automation

- Sage Group Plc

- Salesforce, Inc.

- Sap Se

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In February 2024, Schneider Electric launched ECOSTRUXURE plant lean management, a solution aimed at increasing productivity and digitalization in manufacturing. The solution aggregates and collects information across industrial processes to develop key performance indicators (KPIS) for short-interval management meetings.

-

In October 2023, Oracle Netsuite, a subsidiary of oracle, introduced netsuite enterprise size performance management (EPM) to assist organizations to automate and unify their financial operations. Netsuite EPM incorporates budgeting, planning, account reconciliation, forecasting, reporting, and financial close processes across the organization to elevate and enhance decision-making and business visibility and foster growth.

-

In June 2023, Asana, Inc. announced its latest product capabilities centered around generative artificial intelligence. the newly launched asana intelligence incorporates enterprise size ai capabilities at the core of ASANA'S work management platform, empowering organizations to expedite decision-making and enhance productivity.

-

In September 2023, Salesforce, Inc. and google expanded their strategic partnership to connect salesforce crm and google workspace to enhance productivity through ai. google workspace is a widely used productivity tool. This collaboration is expected to introduce new bidirectional integrations, enabling customers to combine context from salesforce and google workspace.

Productivity Management Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 67.94 billion

Revenue forecast in 2030

USD 149.74 billion

Growth rate

CAGR Of 14.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue In USD billion, And CAGR From 2024 To 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, enterprise size, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Uk; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Uae; Saudi Arabia; South Africa

Key companies profiled

Adobe; Asana, Inc.; Broadcom; Epicor Software Corporation; Google (Alphabet Inc.); Hyperoffice; International Business Machines Corporation; Microsoft; Monday.Com; Oracle; Rockwell Automation; Sage Group Plc; Salesforce, Inc.; Sap Se; Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. explore purchase options

Global Productivity Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global productivity management software market report based on solution, deployment, enterprise size, industry, and region.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Content Management & Collaboration

-

AI & Predictive Analytics

-

Structured Work Management

-

Other Solutions

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprise Size

-

Small & Medium Enterprise Size

-

-

Industry Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Healthcare

-

Manufacturing

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Uk

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global productivity management software market size was estimated at USD 59.88 billion in 2023 and is expected to reach USD 67.94 billion in 2024.

b. The global productivity management software market is expected to grow at a compound annual growth rate of 14.1% from 2024 to 2030 to reach USD 149.74 billion by 2030.

b. North America dominated the productivity management software market with a share of 39.06% in 2023. The growth is mainly attributed to the increased adoption of PMS solutions to manage mundane tasks and highly evolving infrastructure in organizations. Increased adoption of AI and ML technologies would further fuel market growth.

b. The growing requirement to manage tasks and workflow among businesses to amplify the growth and swiftly growing advancements in Machine Learning (ML) and Artificial Intelligence (AI) are the key factors driving the market.

b. Some key players operating in the productivity management software market include Adobe, Asana Inc, Oracle, Microsoft, monday.com, Zoho Corporation Pvt. Ltd, and Salesforce, Inc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."