- Home

- »

- Homecare & Decor

- »

-

Professional Beauty Services Market Size Report, 2030GVR Report cover

![Professional Beauty Services Market Size, Share & Trends Report]()

Professional Beauty Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Skin Care, Hair Care, Nail Care, Massage & Spa Services), By End-use (Men, Women), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-349-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Professional Beauty Services Market Summary

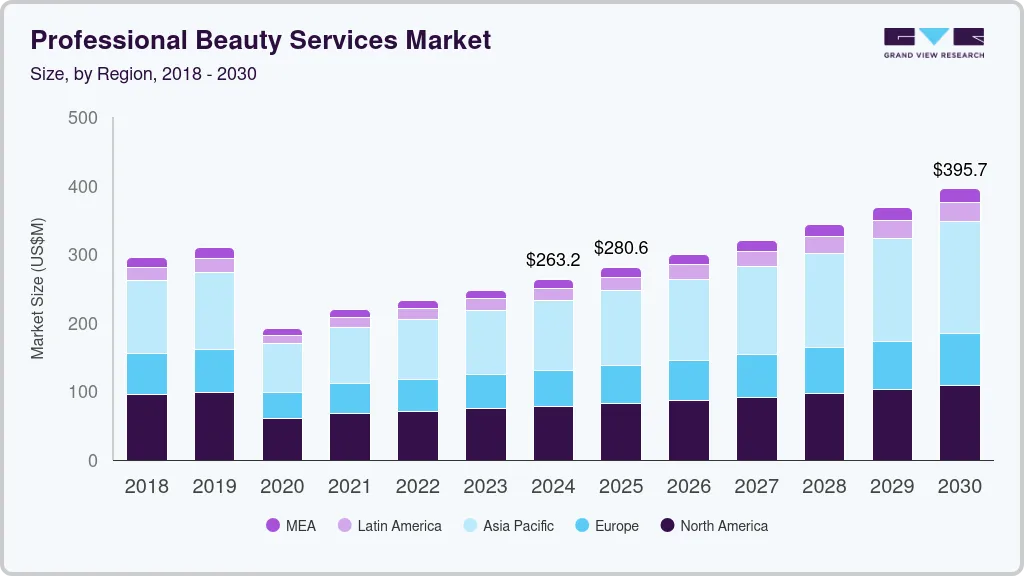

The global professional beauty services market size was estimated at USD 247.24 billion in 2023 and is projected to reach USD 395.69 billion by 2030, growing at a CAGR of 7.0% from 2024 to 2030. The market has experienced robust growth in recent years, driven by evolving consumer preferences, increasing disposable incomes, and technological advancements.

Key Market Trends & Insights

- The professional beauty services market of North America held a market share of 30.24% of the global revenue in 2023.

- The U.S. professional beauty services market is expected to grow at a CAGR of 6.9% from 2024 to 2030.

- By service, the hair care services accounted for the market share of 53.53% in 2023.

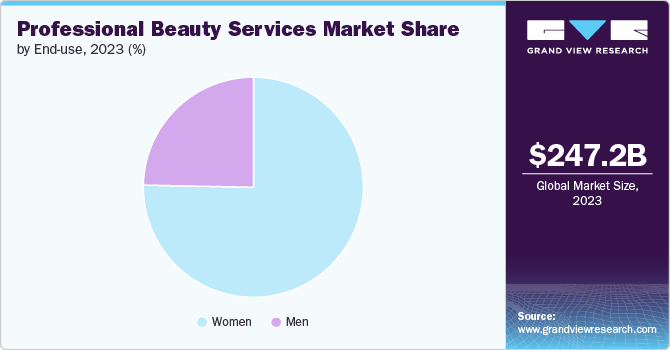

- By end-use, the women’s professional beauty services held a market share of 75.31% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 247.24 Billion

- 2030 Projected Market Size: USD 395.69 Billion

- CAGR (2024-2030): 7.0%

- Asia Pacific: Largest market in 2023

Consumers, particularly women, are increasingly prioritizing self-care and grooming, leading to higher demand for skincare treatments, hair, and makeup services. This trend is further amplified by the growing influence of social media and digital platforms, where beauty trends and innovations quickly gain popularity, influencing consumer behavior and driving market expansion.

According to statistics published by the Global Wellness Institute, the number of spa establishments worldwide increased from 169,369 in 2019 to 181,175 in 2022. The rising number of spa establishments is a significant driver of growth in the professional beauty services industry. This expansion not only enhances accessibility to spa services for a broader customer base but also elevates the overall industry standards by fostering competition and innovation. As more spas enter the market, they introduce diverse and specialized treatments, catering to varying consumer preferences and needs.

This variety stimulates consumer interest and increases spending on beauty and wellness services. Additionally, the proliferation of spas creates numerous employment opportunities and stimulates economic activity, further solidifying the sector's contribution to the global economy. As a result, the burgeoning number of spa establishments plays a crucial role in propelling the growth and development of the professional beauty services industry.

Technological innovations have significantly reshaped the landscape of professional beauty services, enhancing service delivery and customer engagement. Advanced skincare technologies, such as laser treatments and non-invasive cosmetic procedures, have become more accessible and popular among consumers seeking effective and convenient solutions for skincare concerns. Similarly, digital tools and online booking systems have streamlined operations for beauty salons and spas, improving efficiency and enhancing customer experiences, thereby fostering growth and scalability within the industry.

The rise of wellness and holistic health trends has also contributed to the growth of the professional beauty services market. Consumers are increasingly seeking integrated approaches to beauty and wellness, driving demand for services that promote both aesthetic enhancement and overall well-being. This shift has prompted beauty service providers to expand their offerings to include wellness-focused treatments such as aromatherapy, massage therapies, and personalized nutrition consultations, catering to a more health-conscious clientele.

Demographic trends, such as an aging population and a growing middle class in emerging markets, are further fueling market growth. Aging populations are driving demand for anti-aging treatments and specialized skincare services while rising incomes in emerging markets are expanding the consumer base for luxury beauty services and premium products. Additionally, cultural shifts towards gender inclusivity and male grooming habits are opening new opportunities for beauty service providers to diversify their offerings and capture a broader market segment.

The opening of new salon chains and branches significantly contributes to the growth of the professional beauty services market. In March 2024, Moxie Salon and Beauty Bar LLC, an independent salon franchisor, announced the inauguration of its newest salon in East Brunswick, New Jersey. This strategic expansion into Middlesex County marks a significant step in Moxie Salon's aggressive growth within the hair salon industry. This increased market penetration not only captures new customer segments but also enhances brand visibility and recognition, driving higher foot traffic and sales.

In the coming years, sustainability and ethical considerations are expected to play an increasingly pivotal role in shaping the future of the professional beauty services market. Consumers are becoming more mindful of the environmental impact of beauty products and services, driving demand for sustainable practices, eco-friendly ingredients, and cruelty-free certifications. Beauty service providers that prioritize sustainability and transparency in their operations are likely to gain a competitive edge and appeal to environmentally-conscious consumers, driving innovation and sustainable growth in the industry.

Service Insights

The hair care services accounted for the market share of 53.53% in 2023. The growing influence of social media and digital platforms has significantly impacted consumer behavior. Beauty trends, hairstyling techniques, and product recommendations quickly gain traction online, driving consumers to seek out professional services to achieve the latest looks. The desire to emulate celebrities and social media influencers has heightened the demand for expert hair care and styling.

In June 2024, Chatters Hair Salon opened its 118th salon at RioCan Colossus Centre in Vaughan, Ontario. This new salon, featuring 14 styling stations with over 70 brands, including Drybar, Curlsmith, Redken, and Moroccanoil, marks a significant expansion in the Ontario region. This move aligns with Chatters' strategic growth plan to meet increasing consumer demand. Embracing its "Beauty Has No Boundaries" philosophy, the salon offers an inclusive service menu with genderless haircuts and services for all customers. This expansion is poised to boost consumer adoption of advanced hair care services by providing greater accessibility to high-quality treatments and products. The new location's extensive service offerings and inclusive approach will attract a diverse customer base, further driving market growth and enhancing the brand's presence in the region.

The demand for nail care services is projected to grow at a CAGR of 8.6% over the forecast period of 2024 to 2030. Advancements in nail care technology and product innovation have expanded the range of services available at salons. This includes long-lasting manicures, gel nails, intricate nail art, and specialized treatments for nail health and maintenance. These advancements not only attract existing customers seeking higher-quality services but also appeal to new demographics looking for innovative beauty solutions.

The rise of social media and digital platforms has amplified trends in nail art and design, driving consumer demand for professional services that can replicate popular styles and techniques. Nail technicians skilled in creating unique designs and using advanced techniques are in high demand among fashion-conscious consumers seeking to showcase their individuality.

End-use Insights

The women’s professional beauty services held a market share of 75.31% in 2023. According to statistics published by the Washington State Department of Corrections, women spend slightly more than men on beauty services and products, with annual expenditures amounting to $3,756 compared to $2,928 for men. This data underscores the significant role that female consumers play in driving demand within the beauty industry.

The higher expenditure by women is a crucial factor contributing to the growth of the professional beauty services industry. This spending behavior not only highlights the substantial market size but also indicates a consistent and growing demand for a wide range of beauty services, from skincare and haircare to cosmetics and wellness treatments. As women continue to prioritize personal grooming and self-care, their spending habits fuel the expansion of salon chains, stimulate innovation in service offerings, and drive overall industry revenue.

The demand for beauty services among men is projected to grow at a CAGR of 7.9% over the forecast period of 2024-2030. Increasing awareness of personal care, coupled with a growing acceptance of male grooming products and services, is driving this trend. Men are becoming more conscious of their appearance and are investing in skincare, haircare, and grooming products. The expansion of male-targeted services, such as specialized barber shops, men's spas, and dedicated product lines, is also contributing to this growth. As the stigma around male grooming diminishes and societal norms evolve, the men's grooming segment is poised to become a significant contributor to the overall growth of the professional beauty services industry.

Regional Insights

The professional beauty services market of North America held a market share of 30.24% of the global revenue in 2023. The demand is mainly driven on account of increasing disposable incomes, heightened consumer awareness of personal grooming, and a cultural shift towards wellness and self-care. Over the forecast period, sustained economic growth, evolving beauty standards, and demographic trends toward aging populations are expected to fuel continued robust growth in the region.

U.S. Professional Beauty Services Market Trends

The U.S. professional beauty services market is expected to grow at a CAGR of 6.9% from 2024 to 2030. In the U.S., advancements in hair care technology and products have significantly broadened the scope of services available at professional salons. Innovations like keratin treatments, advanced coloring techniques, and specialized scalp treatments cater to consumers seeking highly effective and durable solutions that are challenging to replicate at home. These technological strides elevate the appeal of professional services by offering superior results and enhancing the overall value proposition, thereby fostering increased patronage and frequent visits to salons.

Asia Pacific Professional Beauty Services Market Trends

The professional beauty services market of Asia Pacific accounted for a revenue share of 38.06% in the year 2023. The influence of social media and celebrity endorsements has heightened beauty consciousness, driving demand for advanced skin care treatments, hair care solutions, and cosmetic procedures offered by service providers. This evolving consumer behavior and expanding market dynamics position Asia Pacific as a significant growth engine within the global market.

Europe Professional Beauty Services Market Trends

Europe professional beauty services market is projected to grow at a CAGR of 6.4% from 2024 to 2030. According to a survey conducted by MINDBODY, Inc., men in the UK spend an average of £184.46 on hair styling services, while women spend approximately £258.50. This rising expenditure on hair styling and related personal grooming services is anticipated to contribute to market growth across Europe significantly.

Key Professional Beauty Services Company Insights

The competitive matrix of the market is characterized by a dynamic interplay of key players, each striving to differentiate themselves through innovation, quality, and customer engagement. Major competitors in this market include established salon chains, independent beauty service providers, and emerging boutique salons, all vying for market share in an increasingly fragmented industry.

Market leaders leverage their extensive brand recognition, wide service offerings, and significant capital investments to maintain a competitive edge. They often invest heavily in state-of-the-art facilities, advanced technology, and training programs to ensure a consistent and high-quality customer experience.

Key Professional Beauty Services Companies:

The following are the leading companies in the professional beauty services market. These companies collectively hold the largest market share and dictate industry trends.

- Regis Corporation

- TONI&GUY

- Franck Provost

- Revive Nails & Massage Therapy

- Alluring Nails & Tanning

- Sally Beauty Holdings

- Coty Inc.

- L'Oréal Professionnel (L'Oréal Group)

- Ulta Beauty, Inc.

- Fantastic Sams

Recent Developments

-

In April 2024, the one of the leading luxury Italian salon chain, Luca Piattelli, recently opened its first flagship store in India. Located in the Sardarjung neighborhood of New Delhi, the salon provides an extensive range of services for both men and women. The newly opened salon will offer luxury nail, hair, skin, and spa services.

-

In September 2023, Regis Corporation, one of the leading service providers in the haircare industry, announced its entry into a Master Franchise Agreement with Ravissant Style Private Limited. Under the agreement, Ravissant Style committed to opening a minimum of 100 salons within the initial five years, with plans for further growth through sub-franchising in Northern and Western India. This strategic partnership aimed to redefine the Indian salon market by enhancing customer experiences and setting new industry standards.

Professional Beauty Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 263.21 billion

Revenue forecast in 2030

USD 395.69 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Regis Corporation; TONI&GUY; Franck Provost; Revive Nails & Massage Therapy; Alluring Nails & Tanning; Sally Beauty Holdings; Coty Inc.; L'Oréal Professionnel (L'Oréal Group); Ulta Beauty, Inc.; Fantastic Sams

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Professional Beauty Services Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global professional beauty services market report on the basis of service, end-use, and region.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Skin Care

-

Facial & Clean-ups

-

Make-up

-

Waxing/ Hair-removal

-

Others

-

-

Hair Care

-

Hair Cut and Styling

-

Hair Coloring and Highlights

-

Hair Spa

-

Others

-

-

Nail Care

-

Manicure

-

Pedicure

-

Fiberglass & Silk Wraps

-

UV Gel Overlays & Extensions

-

Acrylic Overlays & Extensions

-

-

Massage and Spa Services

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global professional beauty services market was estimated at USD 247.24 billion in 2023 and is expected to reach USD 263.21 billion in 2024.

b. The global professional beauty services market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 395.69 billion by 2030.

b. Asia Pacific dominated the professional beauty services market, with a share of over 38.06% in 2023. Social media and celebrity endorsements have heightened beauty consciousness, driving demand for advanced skin and hair care treatments in the region.

b. Some of the key players operating in the professional beauty services market include Regis Corporation; TONI&GUY; Franck Provost; Revive Nails & Massage Therapy; Alluring Nails & Tanning; Sally Beauty Holdings; Coty Inc.; L'Oréal Professionnel (L'Oréal Group); Ulta Beauty, Inc.; and Fantastic Sams.

b. Key factors driving the growth of the professional beauty services market are evolving consumer preferences, increasing disposable incomes, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.