- Home

- »

- Biotechnology

- »

-

Protein Sequencing Market Size, Share, Growth Report 2030GVR Report cover

![Protein Sequencing Market Size, Share & Trends Report]()

Protein Sequencing Market (2024 - 2030) Size, Share & Trends Analysis Report By Product & Service (Protein Sequencing Products, Protein Sequencing Services), By Application, By End-use, By Region And Segment Forecasts

- Report ID: GVR-4-68039-983-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Sequencing Market Size & Trends

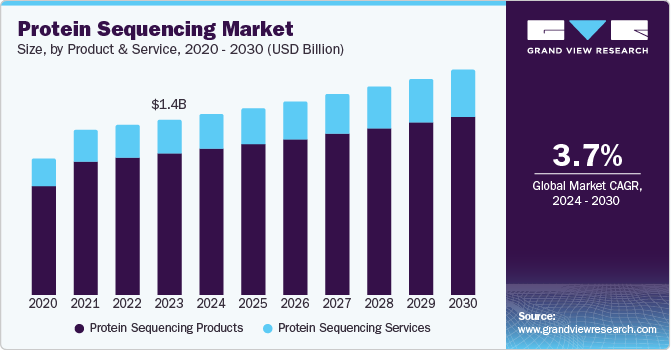

The global protein sequencing market size was valued at USD 1.39 billion in 2023 and is expected to grow at a CAGR of 3.7% from 2024 to 2030. This growth is attributed to advancements in proteomics research and increasing funding for R&D activities. In addition, the rising adoption of mass spectrometry for protein sequencing and key players' development of integrated, automated sequencing systems are fueling market expansion. Furthermore, pharmaceutical and biotechnology firms' increasing emphasis on target-based drug development, especially in developed and emerging countries, is another significant factor driving the market.

Protein sequencing is identifying the exact order of amino acids that make up a protein or peptide. This technique allows researchers to determine the identity of a protein and identify any modifications it has undergone after translation. In many cases, only a small portion of the protein's sequence (known as sequence tags) is needed to match it to a database of protein sequences derived from gene sequences. The two main direct methods for protein sequencing are Edman degradation and mass spectrometry using an automated sequencing instrument.

In addition, increased funding for proteomics research from the public and private sectors is enhancing research capabilities, especially in emerging economies. Furthermore, pharmaceutical companies' growing focus on target-based drug development is increasing the application of protein sequencing in biotherapeutics and genetic engineering. Technological advancements in mass spectrometry and integrated sequencing systems lead to more effective and precise sequencing approaches.

Moreover, the growing demand for personalized medicine and the identification of disease biomarkers further boost the market growth. Partnerships among academic institutions and biotech firms to develop innovative sequencing techniques are expected to foster new revenue streams. Overall, sustained investment in R&D and the expansion of applications across various sectors will significantly drive the growth of the protein sequencing market in the coming years.

Product & Services Insights

Protein sequencing products led the market and accounted for the largest revenue share of 80.9% in 2023 attributed to the rising adoption of techniques, such as mass spectrometry and Edman degradation technologies, by academic institutions, pharmaceutical companies, and biotechnology firms for applications such as biotherapeutics characterization, proteomics research, and drug discovery, which is fueling demand for sequencing instruments, reagents, and consumables. In addition, growing investment in proteomics R&D, especially in developed regions such as North America and Europe, provides funding for sequencing product purchases.

Protein sequencing products are categorized into various segments, such as reagents and consumables, instruments, and software. Reagents and consumables dominated the market and accounted for the largest revenue share in 2023, owing to advancements in proteomics research and increased demand for accurate protein analysis. Furthermore, the growing complexity of protein sequencing techniques also necessitates a wider range of specialized reagents, further propelling market growth in this segment.

Protein sequencing services segment is expected to grow significantly over the forecast period driven by the increasing complexity of protein analysis and the high costs associated with sequencing infrastructure. In addition, technological advancements, such as mass spectrometry and next-generation sequencing, have enhanced service offerings. Furthermore, the rising demand for personalized medicine and biomarker discovery further fuels this growth as pharmaceutical and biotechnology companies seek efficient drug development and proteomic research solutions.

Applications Insights

Biotherapeutics applications dominated the market and accounted for the largest revenue share in 2023 attributed to the increasing focus of pharmaceutical companies on developing innovative biotherapeutics, particularly monoclonal antibodies. These therapeutic proteins are important for treating numerous diseases, including cancer and autoimmune disorders. Furthermore, developments in protein sequencing technologies enhance biopharmaceuticals' characterization and quality control. The growing demand for personalized medicine further propels this segment, as precise protein sequencing is crucial for recognizing biomarkers and modifying treatments to individual patient needs, thereby supporting the market growth.

Genetic engineering is expected to grow at a CAGR of 3.4% over the forecast period owing to increasing investments in biotechnology and pharmaceutical research, enhancing the need for precise protein characterization. In addition, the demand for genetically engineered proteins in therapeutic applications, such as monoclonal antibodies and vaccines, further drives this growth. Furthermore, the rise of personalized medicine demands accurate protein sequencing to tailor treatments based on individual genetic needs.

End-use Insights

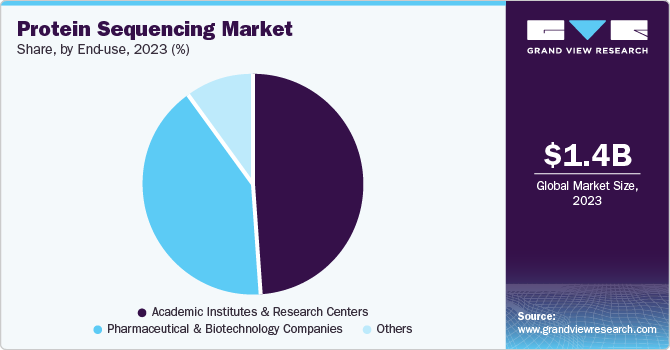

Academic institutes & research centers dominated the market and accounted for the largest revenue share of 49.0% in 2023 driven by increasing funding for proteomics research from public and private entities. These institutions are engaged in wide biological and biomedical studies that need advanced protein sequencing technologies for identifying and characterizing proteins. The growing demand for protein analysis in various disciplines, such as molecular biology and pharmacology, further drives this segment.

Pharmaceutical & biotechnology companies are expected to grow at a CAGR of 4.2% over the forecast period attributed to the increasing focus of major pharmaceutical and biotechnology businesses on target-based drug development, specifically in developed and evolving economies. The growing demand for protein sequencing in numerous applications such as biotherapeutics characterization, drug discovery, and disease biomarker identification further drives this segment. Furthermore, the increasing investment by pharmaceutical and biotech companies in proteomics R&D and the need for protein sequencing in biopharmaceutical quality control support the segment's expansion.

Regional Insights

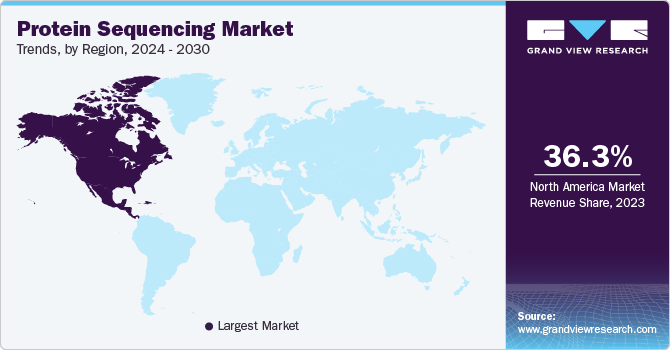

North America protein sequencing market dominated the global market and accounted for the largest revenue share of 36.3% in 2023. The region benefits from advanced technological innovations and a robust healthcare infrastructure, which facilitate extensive research and development in proteomics. In addition, substantial funding from government and private organizations supports ongoing research initiatives. Furthermore, the presence of key industry players, such as Quantum-Si, who are launching cutting-edge protein sequencing systems, further enhances market dynamics, positioning North America as a leader in this field over the forecast period.

U.S. Protein Sequencing Market Trends

The protein sequencing market in the U.S.is expected to grow significantly over the forecast period, owing to a strong emphasis on target-based drug development and increasing investments in biotechnology research. The U.S. is home to numerous leading academic institutions and research centers contributing to protein sequencing technology advancements. Moreover, federal funding for biomedical research significantly bolsters the market, enabling innovative studies and applications in drug discovery and personalized medicine. This combination of factors positions the U.S. as a pivotal market for protein sequencing growth.

Asia Pacific Protein Sequencing Market Trends

The Asia Pacific protein sequencing market is expected to grow at a CAGR of 5.5% over the forecast period. This growth is attributed to increasing investments in biotechnology and pharmaceutical research. Countries such as India and China are emerging as significant hubs for proteomics, driven by rising demand for personalized medicine and biomarker discovery. Furthermore, the growing number of academic initiatives focused on developing protein-based therapeutics enhances research capabilities and fosters collaborations, collectively contributing to the region's expanding market opportunities.

The protein sequencing market in China is expected to witness substantial growth over the forecast period, fueled by government support for scientific research and innovation. The country is witnessing a surge in biotechnology firms focusing on drug discovery and development, which heavily rely on protein sequencing technologies. Furthermore, advancements in mass spectrometry and other sequencing methods are improving the accuracy and efficiency of protein analysis. The increased emphasis on developing novel therapeutics and diagnostics further propels the demand for protein sequencing services and products in the Chinese market.

Europe Protein Sequencing Market Trends

The Europe protein sequencing marketaccounted for a significant revenue share in 2023 driven by increased funding for life sciences research and a strong emphasis on personalized medicine. European countries are investing heavily in proteomics and biotechnology, which enhances the demand for accurate protein sequencing technologies. Numerous academic institutions and research centers conducting extensive studies in drug development and biomarker discovery further drive this growth. Additionally, the rising adoption of advanced sequencing methods, such as mass spectrometry, supports the market's expansion across the region.

Key Protein Sequencing Company Insights

Some key companies in the protein sequencing market include Thermo Fisher Scientific, Inc., Shimadzu Corporation, Agilent Technologies, and others. These companies are adopting various strategies, such as investing in research and development to innovate advanced sequencing technologies and enhance accuracy and throughput to gain a competitive edge. In addition, strategic collaborations and partnerships with academic institutions and biotechnology firms are also common, facilitating knowledge exchange and resource sharing. Furthermore, companies focus on expanding their product portfolios through new product launches and acquisitions, addressing diverse customer needs, and strengthening their market presence.

-

Thermo Fisher Scientific, Inc. manufactures advanced mass spectrometry instruments, including the Q Exactive and Orbitrap series, which are pivotal for accurate protein analysis. The company offers reagents, consumables, and software solutions to enhance proteomics research, enabling scientists to identify and quantify proteins effectively in various applications, including drug discovery and biotherapeutics.

-

Agilent Technologies, Inc. manufactures high-performance liquid chromatography (HPLC) systems and mass spectrometry instruments that facilitate precise protein analysis. Agilent also provides a comprehensive range of reagents, consumables, and software tools for proteomics applications.

Key Protein Sequencing Companies:

The following are the leading companies in the protein sequencing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Shimadzu Corporation

- Agilent Technologies, Inc.

- Rapid Novor, Inc.

- Charles River Laboratories

- Proteome Factory AG

- Selvita

- Bioinformatics Solutions Inc.

- Creative Proteomics

- Alphalyse

Recent Developments

-

In October 2023, Thermo Fisher Scientific, Inc. acquired Olink, a company offering next-generation proteomics. This acquisition aimed enhance Thermo Fisher's protein sequencing and biomarker discovery capabilities through Olink's innovative Proximity Extension Assay technology. With a library of over 5,300 validated protein biomarkers, this integration is expected to accelerate advancements in life sciences research and precision medicine.

-

In June 2023,Agilent Technologies Inc. unveiled two new liquid chromatography-mass spectrometry systems to enhance protein sequencing capabilities. The Agilent 6495D LC/TQ system is designed for high-sensitivity targeted analysis, improving efficiency in handling large sample volumes. Meanwhile, the Agilent Revident LC/Q-TOF system features advanced architecture and intelligence, facilitating untargeted analyses for protein sequencing and other applications. Both systems are supported by new software tools, MassHunter Explorer and ChemVista, which streamline data exploration and enhance overall productivity in proteomics research.

Protein Sequencing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.43 billion

Revenue forecast in 2030

USD 1.77 billion

Growth Rate

CAGR of 3.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, China, Japan, India, South Korea, Brazil, Saudi Arabia

Key companies profiled

Thermo Fisher Scientific, Inc.; Shimadzu Corporation; Agilent Technologies, Inc.; Rapid Novor, Inc.; Charles River Laboratories; Proteome Factory AG; Selvita; Bioinformatics Solutions Inc.; Creative Proteomics; Alphalyse

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Sequencing Market Report Segmentation

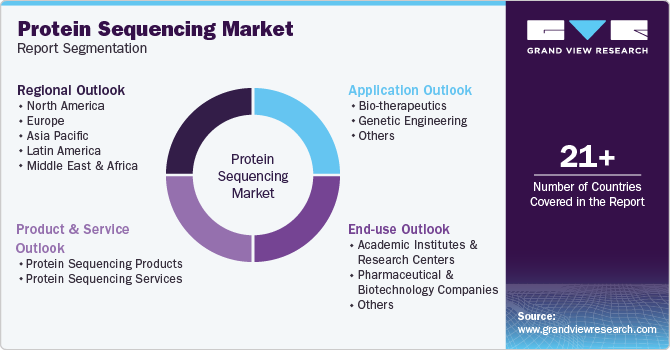

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein sequencing market report based on product & service, application, end use, and region.

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein Sequencing Products

-

Reagents & Consumables

-

Instruments

-

Software

-

-

Protein Sequencing Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bio-therapeutics

-

Genetic Engineering

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Institutes & Research Centers

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.