- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Protein Water Market Size, Share And Growth Report, 2030GVR Report cover

![Protein Water Market Size, Share & Trends Report]()

Protein Water Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Flavored, Unflavored), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-336-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Water Market Size & Trends

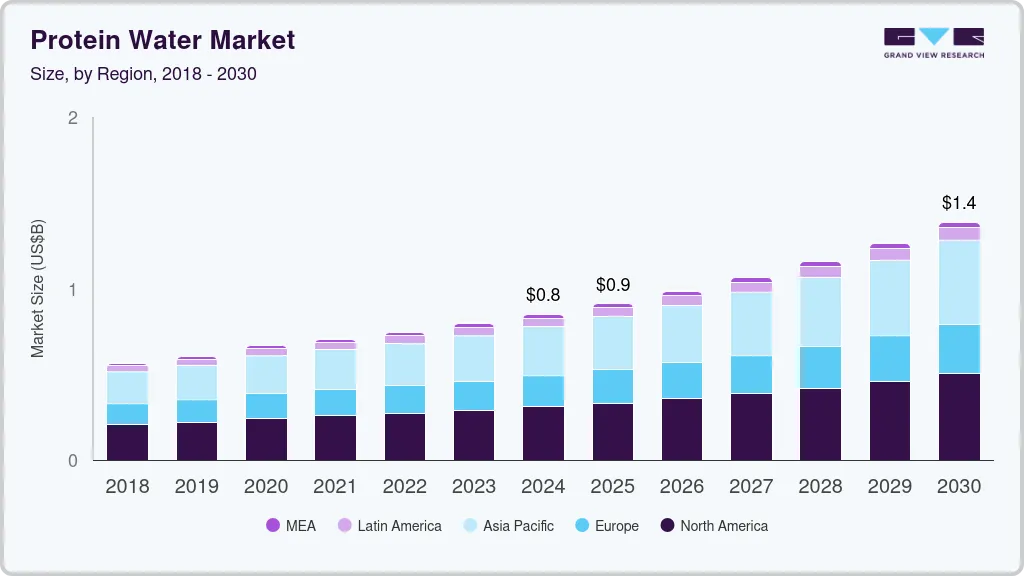

The global protein water market size was estimated at USD 848.6 million in 2024 and is expected to grow at a CAGR of 8.8% from 2025 to 2030. One of the significant drivers of the market is the increased participation in sports activities, driving the surge in demand for protein water due to the growing participation of athletes in health and fitness centers, and the advantages sports nutrition products offer to athletes such as improved energy levels, muscle healing, and recovery, and strengthening of the immune system.

Furthermore, the market has experienced significant growth fueled by convenience and ingenuity, as the refreshing nature and low-calorie content of protein water, coupled with ongoing product innovation, have established it as a favored option over conventional beverages. In March 2022, The Vita Coco Company unveiled its latest protein-infused water line, PWR LIFT, which has partnered with DEKA FIT to serve as the official protein water for all 2022 races. This collaboration ensures that participants in U.S. DEKA FIT events can anticipate being provided with a full range of PWR LIFT protein water at the conclusion of each race.

The rise in popularity of fitness trends such as high-intensity interval training (HIIT), CrossFit, and endurance sports like marathons and triathlons has heightened the need for sports nutrition drinks, particularly protein water. These activities often require immediate and convenient energy sources to sustain performance and aid in recovery, making energy drinks the preferred choice for participants.

According to ptpioneer.com, there has been a noticeable increase in physical activity among Americans, with a 1.6% rise in daily engagement in exercise and recreational activities between 2010 and 2022. This trend in fitness and active lifestyles contributes to the growing demand for protein water drinks. These beverages are sought after for their ability to provide rapid energy and enhance performance during workouts and sports.

Product Insights

Flavored protein water led the market and accounted for a revenue share of over 82% in 2023. The refreshing fruit flavors and natural ingredients found in these beverages cater to the evolving preferences of health-conscious consumers, further fueling the demand for these products. Flavors play a crucial role in enhancing the appeal of protein water as a tasty and refreshing choice while also providing essential nutrients for a balanced and healthy life. For instance, the availability of naturally infused fruity flavors such as mango, berry, citrus, and tropical varieties in protein water products aligns with the desire of health-conscious individuals to incorporate delicious yet nutritious options into their daily routines. These flavors not only make hydration more enjoyable but also contribute to the overall wellness goals of consumers seeking convenient and functional beverages that support their active lifestyles and fitness goals.

The unflavored segment is projected to grow at a CAGR of 7.9% from 2024 to 2030. Consumers opt for unflavored protein water due to the desire for customization, allowing them to control the taste by adding their preferred flavors while also enabling its use in various culinary applications. Concerns about sugar intake and artificial ingredients prompt individuals to choose unflavored protein water as a healthier alternative. This aligns with the increasing focus on clean-label products and a growing aversion to artificial additives.

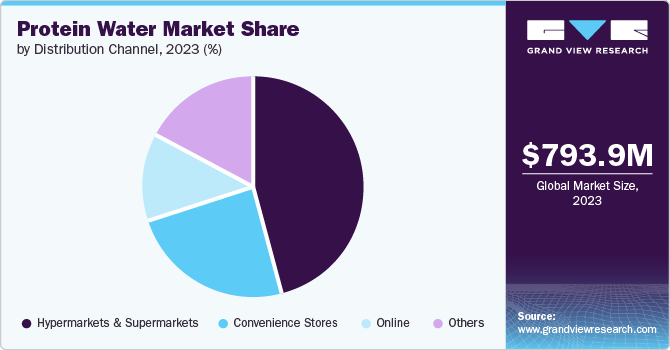

Distribution Channel Insights

Sales of protein water through hypermarkets and supermarkets accounted for a revenue share of 45.9% in 2023. Hypermarkets and supermarkets provide a convenient one-stop shopping experience for consumers, allowing them to easily access a wide range of products, including protein water, during their regular grocery visits. These retail environments offer high visibility for protein water products, allowing brands to showcase their offerings to a large and diverse customer base. This exposure can lead to increased product recognition and drive sales.

Sales through online channel is anticipated to grow at a CAGR of 9.9% from 2024 to 2030. The demand is mainly driven by the convenience of online shopping that allows consumers to access a wide variety of products from the comfort of their homes. This caters to busy lifestyles and the increasing preference for e-commerce. Major online retailers like Amazon and Walmart.com, along with specialty health and wellness websites and company-owned websites, have capitalized on this trend by offering extensive selections of functional drinks, often with competitive pricing and convenient delivery options.

Regional Insights

North America protein water market accounted for a share of 36.5% of the global revenue in 2023. The market is primarily driven by increasing health consciousness among consumers, who are seeking beverages that offer added health benefits beyond basic nutrition. In addition, the rise in busy, on-the-go lifestyles has fueled demand for convenient, ready-to-drink options that can provide quick and effective nutritional support. The trend toward clean-label products, emphasizing natural and fewer ingredients, also plays a significant role in shaping consumer preferences in this market.

U.S. Protein Water Market Trends

The protein water market in the U.S. is projected to grow at a CAGR of 8.4% from 2024 to 2030. Hydration and energy are major drivers behind the consumption of protein water. According to an article by Glanbia Nutritionals, in 2023, 44% of U.S. consumers have opted for beverages with hydration claims in the last three months, and 38% have selected those with energy-boosting claims.

Europe Protein Water Market Trends

The protein water market in Europe is expected to grow at a CAGR of 8.1% from 2024 to 2030. The protein water market in Europe is primarily driven by the growing consumer emphasis on health and wellness. As individuals increasingly prioritize their well-being, there is a rising demand for beverages that provide targeted health benefits extending beyond simple nourishment and hydration. This trend has sparked heightened interest in drinks infused with protein and other functional ingredients that claim to enhance physical performance, promote relaxation, strengthen immunity, and contribute to overall improved health.

Asia Pacific Protein Water Market Trends

The protein water market in Asia Pacific is expected to grow at a CAGR of 9.2% from 2024 to 2030. The surge in demand for functional protein beverages in the Asia Pacific region is linked to the upward trend in protein consumption. Countries such as China are witnessing a significant uptick in the introduction of food and drink items rich in protein, positioning proteins as the favored option for enrichment. Additionally, an increasing awareness of the importance of consistent physical activity for maintaining health is fueling the acceptance of protein water as a supportive element for exercise regimens.

Key Protein Water Company Insights

The market features established companies, emerging startups, and niche players vying for a competitive edge. Major players include sports nutrition brands, beverage companies, and wellness-focused manufacturers, along with new entrants introducing innovative protein water offerings.

Key Protein Water Companies:

The following are the leading companies in the protein water market. These companies collectively hold the largest market share and dictate industry trends.

- Aquatein

- Protein Water Co.

- NZ Muscle

- Nexus Sports Nutrition

- Muscle Nation

- Musashi Nutrition

- Protein2o Inc.

- Agropur Inc. (BiPro USA)

- BODIE*Z

- The Healthy Protein Co (Vieve)

- Glanbia PLC

Recent Developments

-

In January 2024, Warrior brand owned by KBF Enterprises launched Warrior Protein Water. Building on the success of its high-protein bars and supplements, Warrior introduced a new drink that combines hydration with a high protein content, enhanced by 10g of collagen peptides for added benefits to skin, hair, and nails.

-

In August 2023, +PW, a company known for its Protein Water products in Western markets, started focusing on its Collagen Booster drink in Asia, particularly China, where it sees high potential due to the country's large collagen market and the growing demand for beauty and wellness products.

Protein Water Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 911.0 million

Revenue forecast in 2030

USD 1.39 billion

Growth rate

CAGR of 8.8% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Aquatein; Protein Water Co.; NZ Muscle; Nexus Sports Nutrition; Muscle Nation; Musashi Nutrition Protein2o Inc.; Agropur Inc. (BiPro USA); BODIE*Z The Healthy Protein Co (Vieve); Glanbia PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Protein Water Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein water market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored

-

Unflavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global protein water market size was estimated at USD 793.9 million in 2023 and is expected to reach USD 848.6 million in 2024.

b. The global protein water market is expected to grow at a compounded growth rate of 8.5% from 2024 to 2030 to reach USD 1.38 billion by 2030.

b. Flavored protein water accounted for a market share of over 82% of the global revenues in 2023. The refreshing fruit flavors and natural ingredients found in these beverages cater to the evolving preferences of health-conscious consumers, further fueling the demand for these products.

b. Some key players operating in the protein water market include Aquatein, Protein Water Co., NZ Muscle, Nexus Sports Nutrition, Muscle Nation, Musashi Nutrition Protein2o Inc., Agropur Inc. (BiPro USA), BODIE*Z The Healthy Protein Co (Vieve), Glanbia PLC

b. Key factors that are driving the protein water market growth include the growing participation of athletes in health and fitness centers, and the advantages sports nutrition products offer to athletes such as improved energy levels, muscle healing, and recovery, and strengthening of the immune system.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.