- Home

- »

- Pharmaceuticals

- »

-

Pruritus Therapeutics Market Size, Industry Report, 2030GVR Report cover

![Pruritus Therapeutics Market Size, Share & Trends Report]()

Pruritus Therapeutics Market (2025 - 2030) Size, Share & Trends Analysis Report By Disease (Atopic Dermatitis, Allergic Contact Dermatitis, Urticaria), By Product (Corticosteroids, Antihistamines), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-365-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pruritus Therapeutics Market Size & Trends

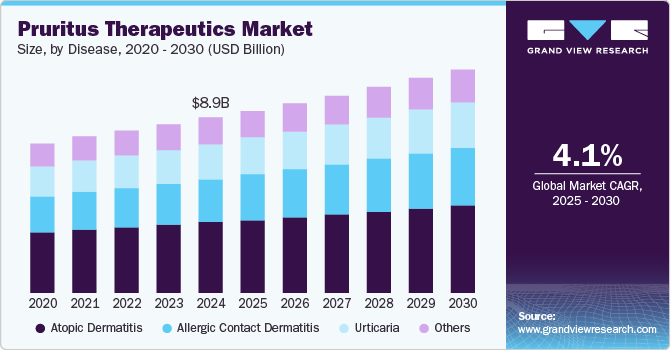

The global pruritus therapeutics market size was estimated at USD 8.93 billion in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2030. Skin conditions such as acne, eczema, psoriasis, and skin cancer often have pruritus as a primary symptom, increasing the demand for treatments. This trend is expected to continue, with approximately 200,340 new cases of melanoma estimated to be diagnosed in the U.S. in 2024, as reported by the AIM at Melanoma Foundation. As a result, market players are investing in research and development to create innovative therapies and launch new medications to cater to the growing demand.

A 2023 Oxford University Press analysis forecasts a 4% increase in UK chronic kidney disease prevalence by 2032, underscoring the necessity for innovative treatments to address this growing healthcare concern and mitigate its economic implications. The growing demand for pruritus therapeutics is also driven by the increasing awareness of the condition and the availability of new treatments. For instance, in October 2024, Alvotech and Teva announced FDA approval for a new intravenous presentation of SELARSDI (ustekinumab-aekn) in the U.S., expanding indications to include Crohn’s disease and ulcerative colitis.

Patients are increasingly turning to over-the-counter (OTC) topical medicines due to their low cost, similar effectiveness, and convenient availability. This trend is expected to continue, with market players investing in the development of OTC products to cater to the growing demand. Furthermore, the growing aging population and advancements in drug formulations also contribute to the market’s expansion. As the population ages, the incidence of pruritus is expected to increase, driving the demand for effective treatments.

Key market players, such as Pfizer Inc., are investing in R&D to create innovative therapies and launch new medications. For instance, in March 2024, Amgen presented significant findings on Otezla (apremilast) at the AAD Annual Meeting in the U.S., showcasing its efficacy in treating moderate to severe plaque psoriasis in pediatric populations. The launch of new products and the expansion of existing product portfolios are expected to drive industry growth in the coming years. As the market continues to evolve, market players are expected to focus on developing innovative and effective treatments to cater to the growing demand for pruritus therapeutics.

Disease Insights

Atopic dermatitis dominated the market and accounted for a share of 39.9% in 2024. Eczema or atopic dermatitis is one of the most common chronic skin diseases, often beginning in early childhood. Skin conditions may be associated with allergic rhinitis, asthma, and food allergies. Certain foods such as citrus fruits, eggs, tomatoes & milk can also cause eczema in young children. According to National Eczema Association, approximately 9.6 million U.S. children under the age of 18 have atopic dermatitis, and one-third have moderate to severe disease.

Allergic contact dermatitis is expected to grow at the fastest CAGR of 4.8% over the forecast period.The rising global prevalence of allergic contact dermatitis is a primary driver of market growth. Moreover, increasing allergies and skin sensitivities, exacerbated by environmental pollution, particularly in urban areas, contribute to the heightened demand for effective treatments. This segment is the fastest-growing within the Indian pruritus therapeutics market, reflecting strong market potential and an urgent need for targeted therapeutic interventions.

Product Insights

Corticosteroids dominated the market and accounted for a share of 28.1% in 2024. Corticosteroids are anti-inflammatory drugs and are used to provide comfort by reducing inflammation. A few corticosteroids include cortisone, dexamethasone, prednisolone, and hydrocortisone. Moreover, corticosteroids lessen allergic responses, itching, swelling, and redness. They are applied to numerous types of pruritus. Due to their wide range of uses, corticosteroids are common pruritus treatments, which accounts for their market domination.

Antihistamines are expected to register significant growth over the forecast period, driven by the increasing prevalence of allergies worldwide, leading to a high demand for relief from symptoms such as itching and hives. Antihistamines are widely used as a first-line treatment for pruritus, allergic contact dermatitis, and atopic dermatitis, offering an effective and convenient therapeutic option.

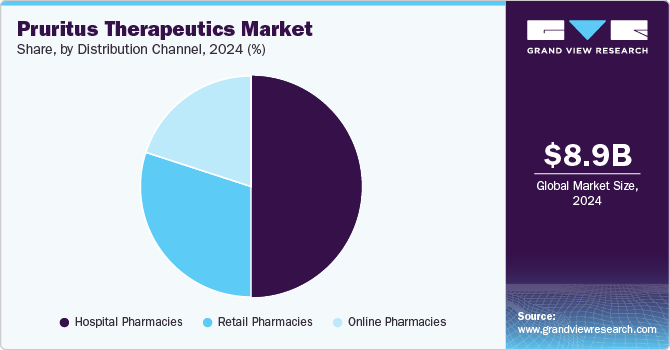

Distribution Channel Insights

Hospital pharmacies dominated the market and accounted for a share of 49.8% in 2024. Healthcare institutions are increasingly prioritizing comprehensive medication management to enhance patient care. Hospital pharmacies improve adherence to prescribed therapies by ensuring accessibility and convenience. The integration of pharmacy services allows for personalized medication counseling, while customized formulations address the needs of patients with severe pruritus. Collaborative efforts between healthcare providers and pharmacists further enhance treatment outcomes in managing pruritus.

Online pharmacies are projected to grow at the fastest CAGR of 5.9% over the forecast period, added by their convenience, offering home delivery services that appeal to tech-savvy individuals and those with mobility challenges. Furthermore, the COVID-19 pandemic has accelerated the adoption of online pharmacies, reflecting a growing consumer preference for digital healthcare solutions. The rise of digitalization and e-commerce trends enhances their growth, supported by competitive pricing compared to traditional pharmacies.

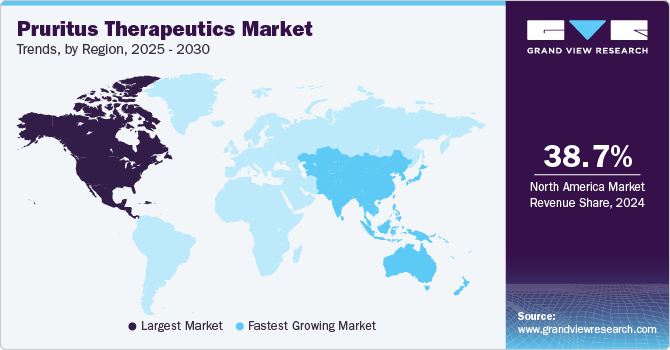

Regional Insights

North America pruritus therapeutics market dominated the global market with a revenue share of 38.7% in 2024. North America’s well-established healthcare infrastructure provides a robust platform for affordable and accessible treatments, driving demand for pruritus treatments. A high prevalence of dermatological conditions and substantial healthcare expenditure contribute to the region’s market growth. Key market players, led by AbbVie Inc., Amgen Inc., and Pfizer Inc., are developing innovative therapeutic options, including biologics and targeted treatments. Government initiatives, favorable policies, and R&D investments further propel market expansion.

U.S. Pruritus Therapeutics Market Trends

The pruritus therapeutics market in the U.S. dominated the North America pruritus therapeutics market with a revenue share of 90.1% in 2024. The introduction of new products and the presence of favorable government initiatives are some key factors attributing to its large share. Furthermore, the growing prevalence of target diseases and the presence of pruritus-inducing climatic conditions in the region are expected to drive market growth during the forecast period.

Europe Pruritus Therapeutics Market Trends

Europe pruritus therapeutics market held substantial market share in 2024. The growing prevalence of pruritus-related conditions, including atopic dermatitis and psoriasis, is fueling market growth. Key players are prioritizing investments in research and development to innovate pruritus therapies, alongside launching new medications and strengthening their product pipelines. Moreover, the robust healthcare infrastructure facilitates affordable and accessible treatment options, further contributing to market expansion.

The pruritus therapeutics market in Germany is expected to grow in the forecast period, driven by factors such as the rising incidence of skin disorders, such as eczema and psoriasis, which affect 5%-10% of the population, as reported by the British Association of Dermatologists. The nation’s robust healthcare system ensures access to necessary treatments. Moreover, significant investments in R&D by pharmaceutical companies foster the development of innovative therapies. A 2024 study Bertelsmann Foundation study showed that the country houses approximately 22% of those aged 65 and older. This aging demographic further amplifies the demand for pruritus management solutions, supported by government initiatives and awareness campaigns.

Asia Pacific Pruritus Therapeutics Market Trends

Asia Pacific pruritus therapeutics market is expected to register the fastest CAGR of 6.1% in the forecast period. A recent study at the 2023 Skin of Color Update Conference revealed distinct differences in the presentation, genetics, and treatment responses of inflammatory skin conditions among Asians, supported by the findings of a 2023 study by the NCBI. According to the Journal of the European Academy of Dermatology and Venereology, common skin disorders recorded in Singapore include eczema, hives, and acne, similar to other countries in the region. Favorable government initiatives in Japan and Australia are driving growth opportunities. For instance, in September 2024, Kyowa Kirin announced positive top-line results from the Phase 3 ROCKET HORIZON trial in Japan, demonstrating rocatinlimab’s efficacy for adults with moderate to severe atopic dermatitis.

India pruritus therapeutics market is expected to grow at the fastest rate over the forecast period in the Asia Pacific market. Increasing prevalence of dermatological disorders such as eczema and psoriasis fuels demand for therapeutics. India’s large population, coupled with growing awareness and government initiatives, significantly contributes to market growth, presenting opportunities for therapeutic development.

Key Pruritus Therapeutics Company Insights

Some key companies operating in the market include AbbVie Inc.; Amgen, Inc.; Astellas Pharma Inc.; and Bristol-Myers Squibb; among others. The market hosts numerous global and regional companies competing through collaborations, acquisitions, and strategic initiatives such as clinical trials and R&D investments.

-

AbbVie is a significant competitor in the pruritus therapeutics market, emphasizing immunology research and developing innovative treatments, including the approved RINVOQ (upadacitinib) for moderate to severe atopic dermatitis. The company is also conducting clinical trials for various immune-mediated disorders.

-

Bristol-Myers Squibb addresses pruritus treatment through cholestyramine for cholestatic pruritus, the development of BMS-981164 targeting IL-31, topical corticosteroids for mild to moderate rashes, and Sotyktu for moderate-to-severe psoriasis, alongside extensive immunology research.

Key Pruritus Therapeutics Companies:

The following are the leading companies in the pruritus therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie Inc.

- Amgen, Inc.

- Astellas Pharma Inc.

- Bristol-Myers Squibb

- Cara Therapeutics

- GSK plc

- Novartis AG

- Pfizer Inc.

- Sanofi

- Teva Pharmaceutical Industries Ltd

Recent Developments

-

In November 2024, the FDA accepted the sBLA for Dupixent (dupilumab) to treat chronic spontaneous urticaria in the U.S., with a decision expected by April 18, 2025, featuring pivotal data on efficacy.

-

In January 2024, Glenmark and Pfizer partnered to launch abrocitinib in India, marking it as the first oral advanced systemic treatment for moderate-to-severe atopic dermatitis, enhancing patient quality of life.

-

In March 2024, AbbVie and Allergan Aesthetics showcased 29 abstracts at the American Academy of Dermatology Annual Meeting in San Diego, highlighting advancements in dermatology and aesthetics portfolios.

Pruritus Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.29 billion

Revenue forecast in 2030

USD 11.34 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Disease, product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie Inc.; Amgen, Inc.; Astellas Pharma Inc.; Bristol-Myers Squibb; Cara Therapeutics; GSK plc; Novartis AG; Pfizer Inc.; Sanofi; Teva Pharmaceutical Industries Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pruritus Therapeutics Market Report Segmentation

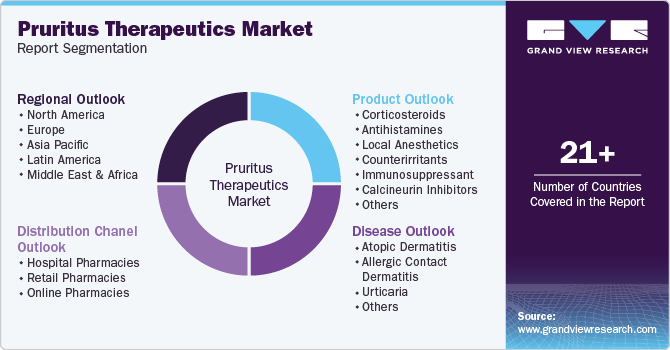

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pruritus therapeutics market report based on disease, product, distribution channel, and region:

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Atopic Dermatitis

-

Allergic Contact Dermatitis

-

Urticaria

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Corticosteroids

-

Antihistamines

-

Local Anesthetics

-

Counterirritants

-

Immunosuppressant

-

Calcineurin Inhibitors

-

Others

-

-

Distribution Chanel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.