- Home

- »

- Next Generation Technologies

- »

-

Public Key Infrastructure Market Size, Industry Report, 2030GVR Report cover

![Public Key Infrastructure Market Size, Share & Trends Report]()

Public Key Infrastructure Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise Size, By Application, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-164-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Public Key Infrastructure Market Summary

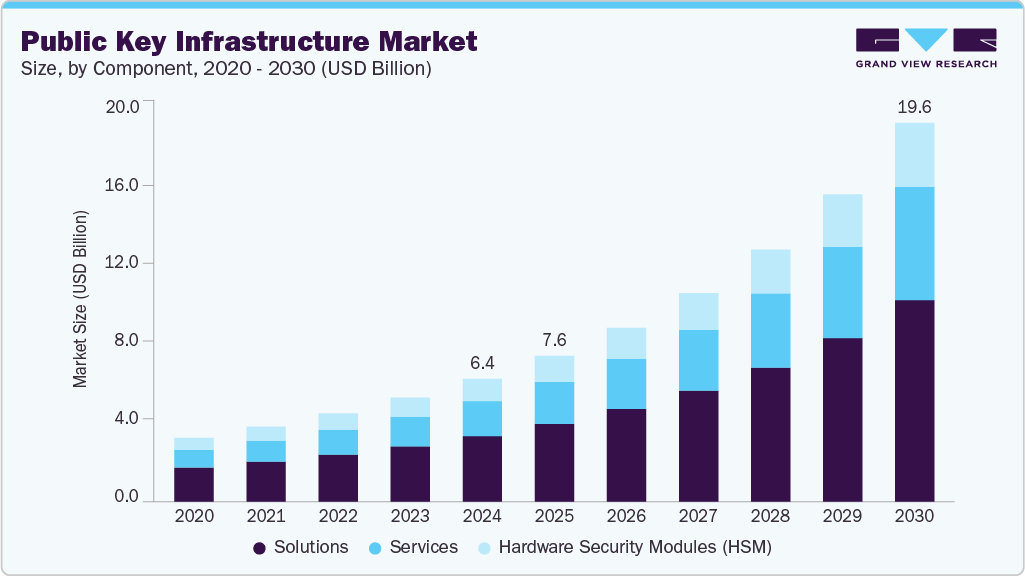

The global public key infrastructure market size was estimated at USD 6.37 billion in 2024 and is projected to reach USD 19.65 billion by 2030, growing at a CAGR of 21.1% from 2025 to 2030, the rising need for secure digital communication and identity authentication across banking, healthcare, government, and e-commerce sectors drives growth. The expansion of cloud services, IoT, and remote work is fueling demand for robust encryption and certificate management.

Key Market Trends & Insights

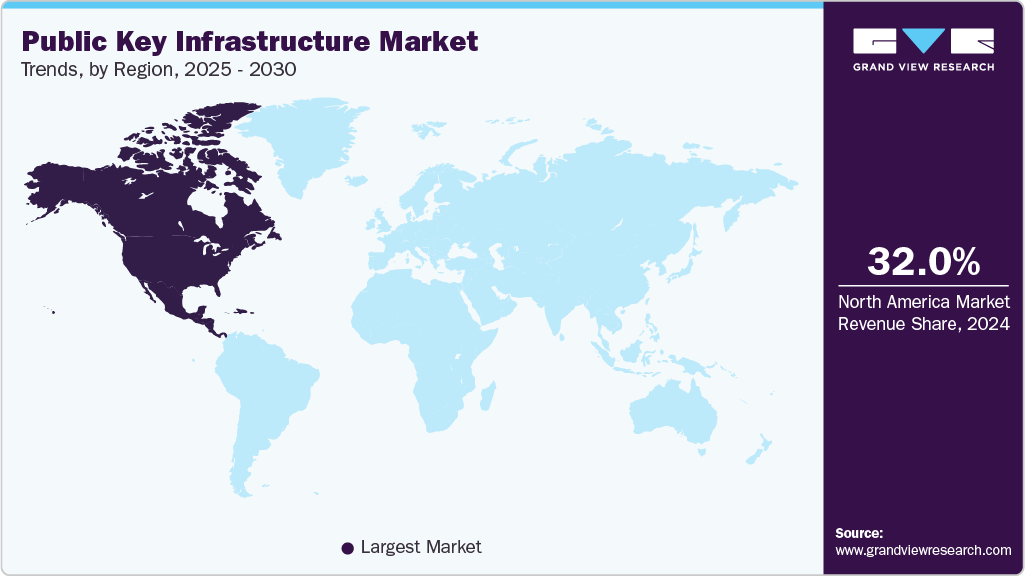

- North America public key infrastructure market accounted for the highest share of over 32% in 2024.

- The public key infrastructure market in the U.S. dominated the market with a share of over 88% in 2024.

- By component, the solutions segment accounted for the largest market share of over 53% in 2024.

- By deployment, the on-premises segment accounted for the largest market share in 2024.

- By enterprise size, the large enterprises segment accounted for the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.37 Billion

- 2030 Projected Market Size: USD 19.65 Billion

- CAGR (2025-2030): 21.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing cyber threats, regulatory compliance, and integrating PKI with technologies like blockchain and zero-trust architectures further accelerate market adoption. The public key infrastructure industry is witnessing strong momentum due to organizations' accelerated digital transformation initiatives worldwide. As companies migrate operations to cloud platforms and adopt remote work models, securing identity verification and data encryption is becoming paramount. The PKI offers a scalable and reliable framework to protect sensitive digital communications. This shift is expected to fuel substantial growth in the adoption of PKI solutions over the coming years.The growing adoption of cloud computing is a major catalyst driving innovation in the public key infrastructure industry. Organizations leverage cloud-based PKI services to manage digital certificates and encryption keys with greater agility and scalability. This model supports hybrid and multi-cloud environments, making it easier to ensure consistent security policies across distributed systems. As cloud usage continues to rise, demand for cloud-integrated public key infrastructure solutions is expected to follow suit.

The expansion of digital public services is contributing to the robust performance of the public key infrastructure industry. Governments worldwide are adopting digital IDs, e-signatures, and secure document workflows, all relying on public key infrastructure frameworks. This transition supports greater efficiency, transparency, and citizen engagement in government processes. With national digitalization agendas accelerating, public key infrastructure will play a central role in ensuring secure and trusted interactions.

The digital transformation of healthcare is creating new growth opportunities for the public key infrastructure industry. Securing data exchange, patient privacy, and compliance with health data regulations necessitate strong encryption and identity verification. PKI enables healthcare providers to securely share medical records, authenticate users, and facilitate telehealth services. The sector’s increasing reliance on digital infrastructure is expected to sustain strong demand for Public Key Infrastructure.

Smart infrastructure development is driving the adoption of cybersecurity technologies, benefiting the public key infrastructure industry. These environments require secure communications and trusted device identities, from connected utilities and traffic systems to smart buildings. Public key infrastructure provides the cryptographic framework to authenticate devices and safeguard data transmission in smart ecosystems. The global push for urban innovation is set to be a long-term growth engine for the public key infrastructure industry.

Component Insights

The solutions segment accounted for the largest market share of over 53% in 2024, driven by heightened concerns over data privacy and regulatory mandates. Encryption solutions in public key infrastructure are gaining traction to protect data at rest, in transit, and use. Organizations are adopting PKI-enabled encryption frameworks to safeguard sensitive information across cloud, IoT, and enterprise environments. The integration of encryption with key management services enables seamless and scalable data protection. This increasing reliance on encryption solutions reinforces the security foundation necessary for digital transformation initiatives.

Services is expected to witness the highest CAGR of over 21% from 2025 to 2030, primarily driven by the critical need for uninterrupted security operations, support, and maintenance services, which are becoming indispensable components of PKI strategies. These services provide rapid incident resolution, real-time system monitoring, and proactive certificate health checks. Vendors are enhancing post-deployment support offerings to reduce certificate-related outages and compliance lapses. Consequently, robust support frameworks are crucial in maintaining trust across digital communication channels.

Deployment Insights

The on-premises segment accounted for the largest market share in 2024. The rising demand for public key infrastructure in highly regulated industries such as banking, energy, and healthcare reinforces the adoption of on-premises solutions. These sectors require low-latency cryptographic operations, minimal exposure to external threats, and consistent compliance with sector-specific mandates. On-premises deployments offer the control and customization needed to meet these rigorous operational and regulatory standards. As digital transformation accelerates in these verticals, organizations leverage on-site PKI frameworks to maintain performance and trust.

Cloud is expected to witness the highest CAGR from 2025 to 2030. The rising demand for secure remote access and zero-trust architecture is accelerating the use of cloud-based public key infrastructure. As organizations embrace hybrid work environments, cloud PKI supports real-time authentication and encryption across globally distributed endpoints. It facilitates continuous certificate lifecycle management while maintaining visibility and control across remote devices. This trend transforms cloud PKI into a strategic enabler of secure digital operations in a post-pandemic business landscape.

Enterprise Size Insights

The large enterprises segment accounted for the highest market share in 2024. The rising demand for seamless integration across hybrid and multi-cloud environments drives large enterprises toward advanced public key infrastructure solutions. These organizations often operate with diverse platforms, legacy systems, and third-party applications that must interoperate securely. PKI enables unified trust management and secure API communication, ensuring data integrity and interoperability at scale. This capability is essential for enterprises seeking to maintain operational continuity while expanding digital services.

The small & medium enterprises (SMEs) segment is expected to witness the highest CAGR from 2025 to 2030. The rising demand for digital trust in customer interactions encourages SMEs to adopt Public Key Infrastructure for website security and secure digital communications. With more online businesses, ensuring trusted authentication and encrypted transactions is critical for reputation and customer confidence. PKI enables SSL/TLS certificates, code signing, and secure user access, enhancing credibility in the digital marketplace. This growing emphasis on secure user experiences reinforces PKI adoption across customer-centric SMEs.

Industry Vertical Insights

The BFSI segment accounted for the highest market share in 2024. The rising demand for accurate identity verification in digital onboarding and financial transactions is fueling PKI adoption across the BFSI segment. Financial institutions leverage digital certificates and secure authentication mechanisms to prevent impersonation, account takeover, and fraud. PKI enables seamless integration with eKYC and digital ID platforms, creating a trusted environment for customers and institutions. This enhanced identity assurance is essential for secure financial ecosystems in an increasingly digitized world.

The healthcare segment is expected to witness the highest CAGR from 2025 to 2030. The rising demand for secure storage and access to electronic health records is accelerating the use of PKI in healthcare. As healthcare providers shift from paper to digital systems, PKI enables encryption and access control to protect sensitive patient data from unauthorized access or breaches. Digital certificates issued via PKI ensure only verified personnel and systems can view or modify records. This approach is vital for maintaining data confidentiality, integrity, and trust in digital health systems.

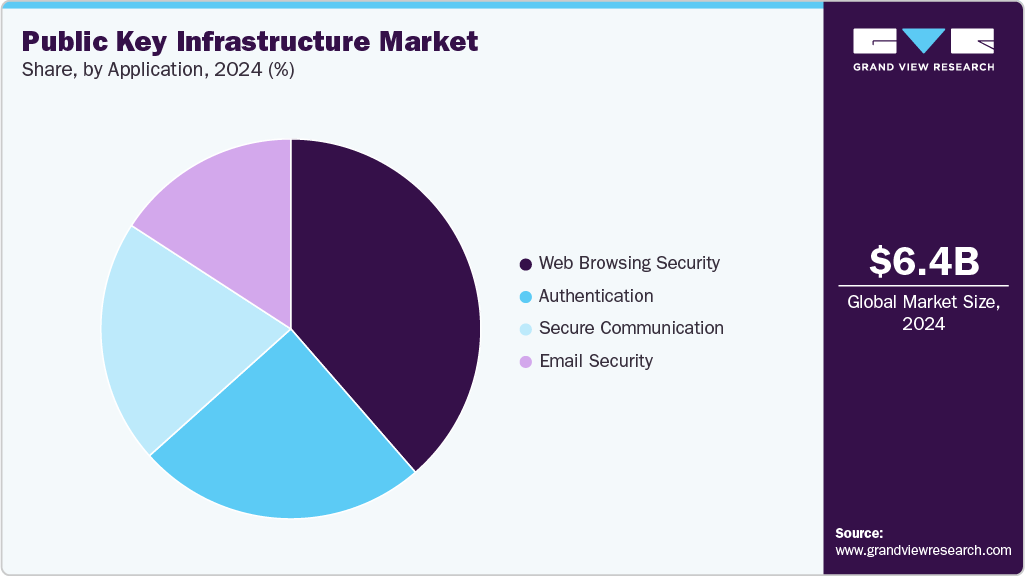

Application Insights

The web browsing security segment accounted for the highest market share in 2024. The rising demand for identity assurance during web browsing drives the integration of public key infrastructure with digital certificate-based user authentication. Enterprises and platforms increasingly leverage PKI to verify user identities in-browser, especially for accessing sensitive portals or online banking interfaces. This enhances security and user trust, as browser interactions become more transparent and verifiable. PKI-enabled identity validation helps eliminate password fatigue and reduce the risk of credential-based breaches.

The secure communication segment is expected to witness the highest CAGR from 2025 to 2030. The rising demand for end-to-end encrypted messaging and communication tools drives enterprises to adopt public key infrastructure as a core security framework. As remote and hybrid work environments expand, businesses require secure channels for internal collaboration and confidential exchanges. PKI ensures the authentication of users and devices, enabling encrypted emails, chats, and file transfers that cannot be intercepted or altered. This growing reliance on secure digital communication positions PKI as essential for enterprise data protection.

Regional Insights

North America public key infrastructure market accounted for the highest share of over 32% in 2024, driven by the surge in IoT device deployments across manufacturing sectors and smart city projects. It has become essential for device authentication and securing communication within vast IoT ecosystems. Enterprises increasingly adopt certificate-based security measures to ensure data integrity and build trust across interconnected devices. This growing emphasis on IoT security opens substantial growth opportunities for PKI providers in the region.

U.S. Public Key Infrastructure Market Trends

The public key infrastructure market in the U.S. dominated the market with a share of over 88% in 2024, fueled by the financial sector’s intensified focus on fraud prevention and secure digital transactions. It supports strong encryption and enhanced digital signatures, which are critical for regulatory compliance and customer confidence in online banking and payment systems. Financial institutions are integrating PKI frameworks to safeguard vast volumes of digital financial interactions. This strong emphasis on secure financial operations continues to drive sustained growth in public key infrastructure utilization.

Europe Public Key Infrastructure Market Trends

The public key infrastructure market in Europe is expected to grow at a CAGR of over 20% from 2025 to 2030, largely propelled by the increasing utilization of cloud services among enterprises. Organizations are turning to scalable PKI solutions to manage certificates securely across multi-cloud environments, ensuring seamless data protection and trusted communications. This transition towards cloud-native security frameworks reflects businesses’ growing need to protect complex IT infrastructures. Consequently, public key infrastructure innovations are evolving to meet the demand for agile, cloud-focused certificate management.

The UK public key infrastructure market accounted for the highest market share in 2024, driven by rising cyber threats targeting enterprises. There is heightened adoption of public key infrastructure for securing corporate communications and cloud access. Organizations are implementing zero-trust principles enabled by certificate-based identity verification. This trend is accelerating the replacement of legacy security systems with public key infrastructure-driven models.

The public key infrastructure market in Germany is largely driven by stringent data privacy regulations that compel enterprises to invest heavily in encryption and digital identity management. PKI solutions are central to compliance strategies across key automotive, healthcare, and finance sectors. Organizations leverage PKI to secure data handling and protect sensitive information against breaches. This regulatory environment is fostering innovation in cryptographic services and security frameworks.

Asia Pacific Public Key Infrastructure Market Trends

The public key infrastructure market in Asia Pacific is expected to grow at the highest CAGR of over 22% from 2025 to 2030, primarily driven by the rising demand for secure digital payment systems and mobile banking. Public Key Infrastructure is becoming a critical enabler for secure financial ecosystems. Enhanced digital certificate issuance and validation processes reduce transaction risks and improve user trust. Financial institutions are thus investing significantly in PKI technologies to support their growing digital channels.

Japan public key infrastructure market is gaining traction. Japan’s aging population and the growth of telemedicine drive the need for public key infrastructure to secure patient data and remote healthcare services. PKI provides secure authentication for medical devices and protects confidentiality in telehealth. Additionally, the automotive industry’s shift toward autonomous vehicles is increasing demand for PKI to secure vehicle-to-vehicle and vehicle-to-infrastructure communications. These trends are accelerating the adoption of advanced cryptographic solutions to enhance security in the healthcare and automotive sectors.

The public key infrastructure market in China accounted for the highest market share in 2024, driven by rapid advancements in artificial intelligence and big data analytics. These technologies are increasing the need for PKI to secure data exchanges and ensure the integrity of AI models, safeguarding sensitive information. The rollout of 5G networks further boosts PKI adoption by enabling secure device authentication and communication. These trends support China's smart city projects and industrial automation initiatives.

Key Public Key Infrastructure Company Insights

Some key players operating in the market are Amazon Web Services, Inc., and DigiCert, Inc.

-

Amazon Web Services, Inc. offers comprehensive cloud-based Public Key Infrastructure services that enable organizations to manage digital certificates on a scale. Their integrated approach supports seamless deployment of secure communication in hybrid and multi-cloud environments. AWS’s PKI solutions are widely adopted for their scalability, automation, and robust security features.

-

DigiCert, Inc., is a leading certificate authority specializing in SSL/TLS certificates and Public Key Infrastructure solutions. The company is known for its advanced encryption technologies and certificate lifecycle management tools, which are critical for securing enterprise digital identities and ensuring compliance with global standards.

AppViewX and Keyfactor are some of the emerging market participants.

-

AppViewX specializes in certificates of lifecycle automation and Public Key Infrastructure management solutions designed to reduce operational risks. Their platform emphasizes ease of integration and workflow automation for complex enterprise environments. AppViewX is gaining traction due to its innovative approach to certificate management scalability.

-

Keyfactor offers cloud-first Public Key Infrastructure solutions focusing on key and certificate lifecycle automation and IoT security. The company’s platform enhances visibility and control over cryptographic assets, driving security modernization efforts. By addressing evolving needs in digital identity protection, Keyfactor is emerging as a strong player.

Key Public Key Infrastructure Companies:

The following are the leading companies in the public key infrastructure market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- AppViewX

- DigiCert, Inc..

- eMudhra Limited

- ENIGMA Information Protection Systems

- Entrust Corporation

- FutureX

- GlobalSign

- Google LLC

- HID Global Corporation

- Keyfactor

- Microsoft Corporation

- Sectigo

- SSL.com

- STORMSHEILD

- WISeKey International Holding Ltd

Recent Developments

-

In March 2025, Keyfactor strengthened its partnership with Utimaco by integrating its EJBCA Hardware Appliance with Utimaco’s FIPS 140-2 Level 3 validated Hardware Security Modules, enhancing secure digital certificate issuance and management at scale. This collaboration offers organizations robust end-to-end private key protection through tamper-proof HSMs. Designed for crypto-agility, the solution supports in-field upgrades with NIST-approved post-quantum algorithms, preparing enterprises for future quantum computing challenges.

-

In February 2025, iValue Group partnered with eMudhra Limited to expand digital trust and Public Key Infrastructure solutions across India, the SAARC region, and Southeast Asia. This collaboration aims to enhance cybersecurity and streamline secure digital transactions through advanced PKI and digital identity management technologies. Leveraging iValue’s broad distribution network, the partnership seeks to accelerate adoption and help organizations meet evolving digital security and compliance demands.

-

In January 2025, SEALSQ Corp, WISeKey, and the Juffali Group expanded their joint venture, WISeKey Arabia, to advance Saudi Arabia’s digital transformation objectives. The initiative focuses on deploying quantum-resistant technologies, including Public Key Infrastructure, digital identity, and IoT security solutions. A key innovation is WISeSat.Space, a secure satellite platform enabling real-time IoT data processing in remote regions, boosts security and operational efficiency across smart cities and supply chains.

Public Key Infrastructure Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.56 billion

Revenue forecast in 2030

USD 19.65 billion

Growth rate

CAGR of 21.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

Amazon Web Services, Inc.; AppViewX; DigiCert, Inc.; eMudhra Limited; ENIGMA Information Protection Systems; Entrust Corporation; FutureX; GlobalSign; Google LLC; HID Global Corporation; Keyfactor; Microsoft Corporation; Sectigo; SSL.com; STORMSHEILD; WISeKey International Holding Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Public Key Infrastructure Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global public key infrastructure market report based on component, deployment, enterprise size, application, industry vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware Security Modules (HSM)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Web Browsing Security

-

Email Security

-

Secure Communication

-

Authentication

-

-

Industrial Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Government & Defense

-

Media and Entertainment

-

Retail

-

Healthcare

-

Manufacturing

-

Education

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global public key infrastructure Market size was estimated at USD 6.37 billion in 2024 and is expected to reach USD 7.56 billion in 2025.

b. The global public key infrastructure market is expected to grow at a compound annual growth rate of 21.1% from 2025 to 2030 to reach USD 19.65 billion by 2030.

b. Based on component, the solutions segment dominated the market in 2024 with a share of over 32% owing to the increasing concerns about data protection and the widespread technological transition which significantly boosts demand for security solutions.

b. Some key players operating in the public key infrastructure market include Amazon Web Services, Inc., AppViewX, DigiCert, Inc., eMudhra Limited, ENIGMA Information Protection Systems, Entrust Corporation, FutureX, GlobalSign, Google LLC, HID Global Corporation, Keyfactor, Microsoft Corporation, Sectigo, SSL.com, STORMSHEILD, and WISeKey International Holding Ltd.

b. Key factors that are driving the public key infrastructure market growth include the increasing adoption of enterprise key management among IT and security professionals, growing adoption of smart technologies and distributed applications, and the advent of 5G.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.