- Home

- »

- Next Generation Technologies

- »

-

Cloud Access Security Broker Market, Industry Report, 2030GVR Report cover

![Cloud Access Security Broker Market Size, Share, & Trends Report]()

Cloud Access Security Broker Market (2025 - 2030) Size, Share, & Trends Analysis Report By Solution (Data Security, Threat Protection), By Deployment Mode (IaaS, PaaS, SaaS), By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-980-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Access Security Broker Market Summary

The global cloud access security broker market size was estimated at USD 9.44 billion in 2024 and is projected to reach USD 25.56 billion by 2030, growing at a CAGR of 18.3% from 2025 to 2030. The cloud access security broker (CASB) market is primarily driven by the increasing adoption of cloud computing across enterprises, rising cybersecurity threats, and stringent regulatory compliance requirements.

Key Market Trends & Insights

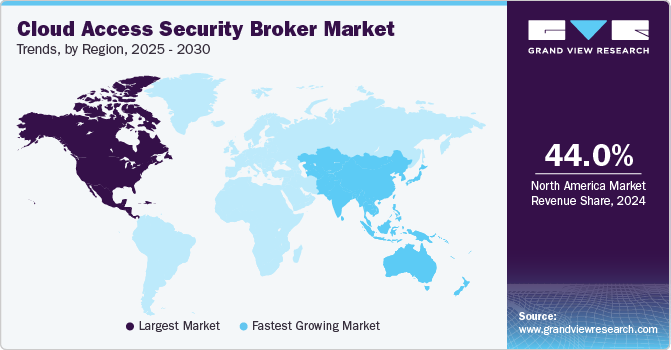

- North America cloud access security broker market held the major share of over 44% of the cloud access security broker industry in 2024.

- The Asia Pacific's cloud access security broker industry is growing significantly at a CAGR of over 21% from 2025 to 2030.

- Based on solution, the data security segment accounted for the largest market share of over 41% in 2024.

- Based on deployment mode, the SaaS segment accounted for the largest market share of over 52% in 2024 due to the widespread adoption of cloud-based applications across enterprises.

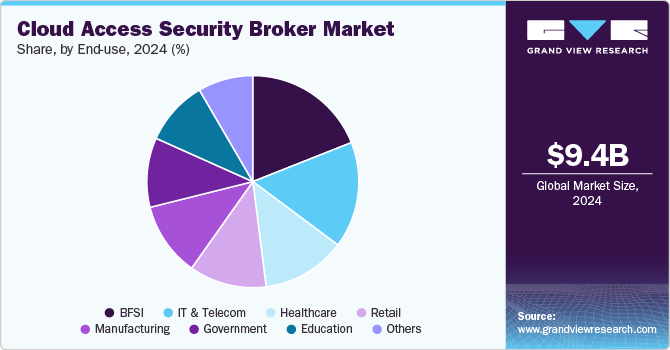

- Based on end-use, the BFSI segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.44 Billion

- 2030 Projected Market Size: USD 25.56 Billion

- CAGR (2025-2030): 18.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As organizations shift to cloud-based applications and services, the need for robust security solutions to monitor and protect sensitive data becomes critical. CASBs provide visibility, data security, threat protection, and compliance enforcement across cloud environments, making them essential to modern cybersecurity strategies.

The growing prevalence of sophisticated cyberattacks, such as ransomware and insider threats, has further accelerated the demand for cloud access security broker solutions. Enterprises seek advanced security measures, including data loss prevention (DLP), encryption, and user behavior analytics, to safeguard confidential information in cloud applications. Additionally, regulatory frameworks such as GDPR, CCPA, and HIPAA mandate strict data protection policies, prompting organizations to deploy CASBs to ensure compliance.

The rapid shift towards cloud-based infrastructure and applications is a primary driver of the cloud access security broker market. Organizations across industries are increasingly leveraging Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS) solutions to enhance operational efficiency, scalability, and cost-effectiveness. However, this transition introduces security challenges, such as lack of visibility into cloud activities and potential data breaches. cloud access security broker solutions address these concerns by providing comprehensive monitoring, access control, and risk assessment, ensuring secure cloud adoption without compromising productivity.

The escalating frequency and sophistication of cyber threats, including ransomware, phishing attacks, insider threats, and cloud misconfigurations, are significantly driving the demand for CASB solutions. Cybercriminals increasingly target cloud environments due to their vast data repositories and often insufficient security controls. CASBs provide real-time threat intelligence, user behavior analytics, and anomaly detection to identify and mitigate security risks. Additionally, CASB solutions integrate with Security Information and Event Management (SIEM) systems to enhance incident response and forensic analysis, further strengthening an organization's cybersecurity posture.

The integration of artificial intelligence (AI), machine learning (ML), and zero-trust security models into CASB solutions is further propelling market growth. AI-driven CASB platforms enhance threat detection by analyzing user behavior, identifying anomalies, and predicting potential security breaches before they occur. Zero-Trust frameworks, which operate on the principle of "never trust, always verify," enable organizations to implement strict access controls, micro-segmentation, and continuous authentication for cloud resources. These advancements make CASBs more effective in proactively securing cloud environments against emerging cyber threats.

Solution Insights

The data security solution segment accounted for the largest market share of over 41% in 2024. Data security remains the dominant solution segment in the cloud access security broker market due to the increasing volume of sensitive information stored and processed in cloud environments. Enterprises across industries rely on cloud-based applications for critical operations, making data protection a top priority. CASB solutions offer advanced data security features, including DLP, encryption, tokenization, and access controls, ensuring that confidential data remains protected against unauthorized access and leaks. Additionally, regulatory requirements such as GDPR, CCPA, and HIPAA mandate strict data security measures, driving organizations to implement CASB solutions that provide compliance support and audit capabilities. The growing emphasis on zero-trust security models and secure collaboration in cloud-based workflows further reinforces the dominance of data security in the CASB market.

The threat protection segment is expected to grow at a significant rate during the forecast period due to the rising complexity and frequency of cyber threats targeting cloud environments. Cybercriminals increasingly exploit cloud misconfigurations, insider threats, and advanced malware to infiltrate enterprise systems. As a result, organizations are prioritizing proactive threat detection and response mechanisms to safeguard their cloud applications and infrastructure. CASB solutions equipped with AI-driven anomaly detection, behavioral analytics, and real-time threat intelligence help organizations identify suspicious activities and mitigate security risks before they escalate. The increasing adoption of zero-trust architecture and cloud-native security frameworks is further fueling demand for threat protection solutions, positioning them as a rapidly growing segment within the CASB market.

Deployment Mode Insights

The SaaS accounted for the largest market share of over 52% in 2024 due to the widespread adoption of cloud-based applications across enterprises. Businesses increasingly rely on SaaS solutions such as Microsoft 365, Google Workspace, Salesforce, and Dropbox to enhance productivity and collaboration. However, these cloud applications introduce security challenges, including data exposure, unauthorized access, and compliance risks. CASB solutions deployed in SaaS mode provide seamless integration, centralized policy enforcement, and real-time visibility into cloud activity, making them the preferred choice for organizations seeking scalable and efficient cloud security. Additionally, the low maintenance requirements and ease of deployment associated with SaaS-based CASBs contribute to their market dominance, as enterprises prioritize security solutions that do not require extensive on-premise infrastructure.

The PaaS segment is expected to grow at a significant rate during the forecast period. PaaS environments introduce unique security risks, such as container vulnerabilities, API security gaps, and misconfigured cloud services, necessitating advanced CASB capabilities tailored for application-layer protection. The growing focus on cloud workload security, microservices architecture, and secure DevOps (DevSecOps) drives demand for CASB solutions optimized for PaaS environments. As organizations accelerate digital transformation initiatives, the need for real-time monitoring, access controls, and compliance enforcement in PaaS deployments is fueling rapid growth in this segment.

End-use Insights

The BFSI end use segment accounted for the largest market share in 2024 due to its heavy reliance on cloud-based platforms for financial transactions, customer data management, and regulatory compliance. Given the highly sensitive nature of financial data, the BFSI industry faces stringent regulatory requirements, such as GDPR, PCI-DSS, SOX, and GLBA, which necessitate implementing advanced cloud security solutions. CASB solutions enable BFSI organizations to enforce DLP, encryption, identity access management (IAM), and threat detection to protect against cyber threats, unauthorized access, and compliance violations. Additionally, the rise of digital banking, fintech services, and remote financial operations has further increased the need for robust CASB solutions to secure cloud-based workflows, making BFSI the leading end-use segment in the market.

The manufacturing segment is expected to grow at a significant rate during the forecast period due to the increasing integration of the Industrial Internet of Things (IIoT), smart factories, and cloud-based supply chain management. As manufacturers transition to Industry 4.0 technologies, they rely on cloud platforms for real-time data analytics, predictive maintenance, and remote monitoring of industrial operations. However, this digital transformation introduces cybersecurity risks, such as intellectual property (IP) theft, industrial espionage, and operational disruptions from cyberattacks. CASB solutions help manufacturing enterprises secure cloud-based applications, prevent data breaches, and ensure compliance with industry regulations, such as ISO 27001 and NIST cybersecurity frameworks. Additionally, the growing adoption of multi-cloud strategies and hybrid cloud environments in manufacturing is driving the need for comprehensive cloud security solutions, contributing to the rapid expansion of CASB in this sector.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share in 2024 due to their extensive reliance on cloud-based applications and the high volume of sensitive data they manage. These organizations operate across multiple locations, use diverse cloud services, and face complex regulatory compliance requirements such as GDPR, HIPAA, and CCPA, making robust cloud security solutions necessary. CASB solutions enable large enterprises to enforce granular access controls, DLP, encryption, and threat intelligence, ensuring comprehensive security across their cloud ecosystems. Large enterprises often have dedicated IT security teams and higher budgets, allowing them to invest in AI-driven CASB solutions, Zero Trust security frameworks, and multi-cloud security strategies. As cloud adoption expands, large enterprises remain the primary contributors to the CASB market due to their need for advanced security, compliance management, and real-time threat detection.

The small & medium enterprise (SME) segment is expected to grow at the fastest rate during the forecast period due to the increasing shift towards cloud-based business operations, remote work, and digital transformation initiatives. SMEs are becoming prime targets for cyber threats, including phishing, ransomware, and cloud misconfigurations, driving the demand for cost-effective, easy-to-deploy CASB solutions. Additionally, the rise of Software-as-a-Service (SaaS) adoption among SMEs and growing awareness of cloud security risks has accelerated the adoption of CASB solutions tailored to their needs. Cloud security providers increasingly offer scalable, subscription-based CASB solutions that provide automated security controls, compliance management, and threat protection without requiring extensive IT resources. As cybersecurity regulations become more stringent across industries, SMEs are expected to continue adopting CASB solutions at a rapid pace to secure their cloud environments and mitigate security risks.

Regional Insights

North America cloud access security broker market held the major share of over 44% of the cloud access security broker industry in 2024. North America remains the largest driven by the widespread adoption of cloud computing across enterprises and the growing emphasis on zero-trust security frameworks. The presence of leading cybersecurity vendors and cloud service providers, such as Microsoft, Cisco, and Palo Alto Networks, has also contributed to the region's strong market growth.

U.S. Cloud Access Security Broker Market Trends

The cloud access security broker industry in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. dominates the North American cloud access security broker industry, owing to its high cloud adoption rate, strict regulatory environment, and rising cybersecurity threats. Enterprises across industries, including BFSI, healthcare, IT & telecom, and government, increasingly invest in AI-powered CASB solutions to protect sensitive data in cloud environments. Compliance requirements such as HIPAA, CCPA, and SOX have fueled demand for CASB solutions offering audit trails, encryption, and access controls.

Europe Cloud Access Security Broker Market Trends

Europe's cloud access security broker industry is growing significantly, at a CAGR of over 17% from 2025 to 2030. This growth is driven by GDPR compliance requirements, which mandate stringent data protection policies for cloud-based applications. Organizations are increasingly deploying CASB solutions to ensure secure cloud access, data privacy, and regulatory adherence. The region is also witnessing a rise in hybrid cloud deployments and multi-cloud strategies, increasing the demand for CASB solutions with advanced visibility and security analytics.

The UK cloud access security broker market is expected to grow rapidly in the coming years. The U.K. cloud access security broker industry is expanding rapidly due to rising cyber threats, data sovereignty concerns, and increasing cloud adoption across enterprises. Post-Brexit regulatory shifts have led organizations to seek enhanced cloud security measures to comply with GDPR-equivalent laws and other data protection regulations. The financial services sector, in particular, is driving demand for CASB solutions with real-time monitoring, anomaly detection, and IAM to secure sensitive transactions and client data.

Cloud access security broker market in Germany held a substantial market share in 2024. Germany is a key market for cloud access security broker adoption in Europe, propelled by strict data privacy laws, rising industrial digitalization, and growing cloud migration among enterprises. The country's strong emphasis on cyber resilience, regulatory compliance, and data localization requirements has increased the demand for CASB solutions that ensure end-to-end encryption and secure cloud access.

Asia Pacific Cloud Access Security Broker Industry Trends

The Asia Pacific's cloud access security broker industry is growing significantly at a CAGR of over 21% from 2025 to 2030. The Asia Pacific region is witnessing rapid growth in the cloud access security broker industry, driven by digital transformation initiatives, increasing cloud adoption, and growing cybersecurity awareness. Governments across the region are implementing strict data, encouraging enterprises to adopt CASB solutions for regulatory compliance and data security.

The China cloud access security broker market held a substantial share in 2024. China's CASB cloud access security broker industry is expanding significantly due to strict government regulations on data security and cloud computing, particularly with implementing the Cybersecurity Law and PIPL. Enterprises focus on data localization, access control, and cloud visibility to meet compliance requirements.

Cloud access security broker market in Japan held a substantial share in 2024. Japan is witnessing steady growth in the cloud access security broker industry market, driven by the increasing use of cloud services, rising cybersecurity concerns, and stringent regulatory frameworks such as the Protection of Personal Information (APPI) Act. Banking, manufacturing, and healthcare enterprises are deploying CASB solutions to prevent data leaks, mitigate insider threats, and ensure secure third-party cloud collaborations.

India cloud access security broker market is expanding rapidly. The rise of fintech, IT services, e-commerce platforms, and the growing adoption of hybrid cloud environments drive demand for AI-powered CASB solutions that offer real-time security monitoring, access management, and multi-cloud security controls.

Key Cloud Access Security Broker Company Insights

Key players operating in the cloud access security broker market include Broadcom Corporation, Censornet, Forcepoint, iboss, Lookout, Inc., McAfee, LLC, Microsoft, Netskope, Proofpoint, Inc., and Zscaler, Inc. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2024, SCC announced a strategic partnership with iboss, a recognized leader in cloud security, to strengthen cybersecurity measures for businesses operating in cloud-first environments. This collaboration aims to introduce an advanced Zero Trust security service designed to protect data, systems, applications, and users from evolving cyber threats. By integrating iboss's cutting-edge security technologies, SCC will offer a comprehensive suite of cloud security solutions, including Secure Web Gateway (SWG), browser isolation, malware defense, Cloud Access Security Broker (CASB), and data loss prevention. This holistic approach ensures real-time, scalable protection, enabling businesses to safeguard their digital assets against emerging cyber risks. The partnership underscores SCC's commitment to delivering robust security solutions, reinforcing its position as a trusted technology partner for enterprises navigating the complexities of modern cloud environments.

-

In October 2023, Lookout, Inc., a provider of data-centric cloud security solutions, announced new enhancements to the Lookout Cloud Security Platform to strengthen organizations' ability to assess, discover, and protect data as it moves across networks, from endpoints to the cloud. These advancements offer a unified security solution that enhances visibility and safeguards access across all applications, ensuring comprehensive data protection in an increasingly complex digital landscape.

Key Cloud Access Security Broker Companies:

The following are the leading companies in the cloud access security broker market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom Corporation

- Censornet

- Forcepoint

- iboss

- Lookout, Inc.

- McAfee, LLC

- Microsoft

- Netskope

- Proofpoint, Inc.

- Zscaler, Inc.

Cloud Access Security Broker Market Report Scope

Report Attribute

Details

Market size in 2025

USD 11.02 billion

Revenue forecast in 2030

USD 25.56 billion

Growth rate

CAGR of 18.3% from 2025 to 2030

Actual data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment mode, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

Broadcom Corporation; Censornet; Forcepoint; iboss; Lookout, Inc.; McAfee, LLC; Microsoft; Netskope; Proofpoint, Inc.; and Zscaler, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Access Security Broker Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cloud access security broker market report based on solution, deployment mode, enterprise size, end use, and region.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Control and Monitoring Cloud Services

-

Risk and Compliance Management

-

Data Security

-

Threat Protection

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

IaaS

-

PaaS

-

SaaS

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Retail

-

IT & Telecom

-

Education

-

Manufacturing

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud access security broker market size was estimated at USD 9.44 billion in 2024 and is expected to reach USD 11.02 billion in 2025.

b. The global cloud access security broker market is expected to witness a compound annual growth rate of 18.3% from 2025 to 2030 to reach USD 25.56 billion by 2030.

b. North America held the largest share of over 44% in 2024. Growing concern about data security from fraud and data breaches is propelling the sales of cloud access security broker solutions in this region.

b. Key industry players operating in the cloud access security broker market include Broadcom Corporation, Censornet, Forcepoint, iboss, Lookout, Inc., McAfee, LLC, Microsoft, Netskope, Proofpoint, Inc., and Zscaler, Inc.

b. The cloud access security broker (CASB) market is primarily driven by the increasing adoption of cloud computing across enterprises, rising cybersecurity threats, and stringent regulatory compliance requirements. As organizations shift to cloud-based applications and services, the need for robust security solutions to monitor and protect sensitive data becomes critical. CASBs provide visibility, data security, threat protection, and compliance enforcement across cloud environments, making them an essential component of modern cybersecurity strategies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.