- Home

- »

- Advanced Interior Materials

- »

-

Pump Jack Market Size, Share And Trends Report, 2030GVR Report cover

![Pump Jack Market Size, Share & Trends Report]()

Pump Jack Market (2025 - 2030) Size, Share & Trends Analysis Report By Well (Vertical Well, Horizontal Well), By Weight (Less Than 100,000 LBS, 100,000 LBS to 300,000 LBS, More Than 300,000 LBS), By Application (Onshore, Offshore), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-364-0

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pump Jack Market Summary

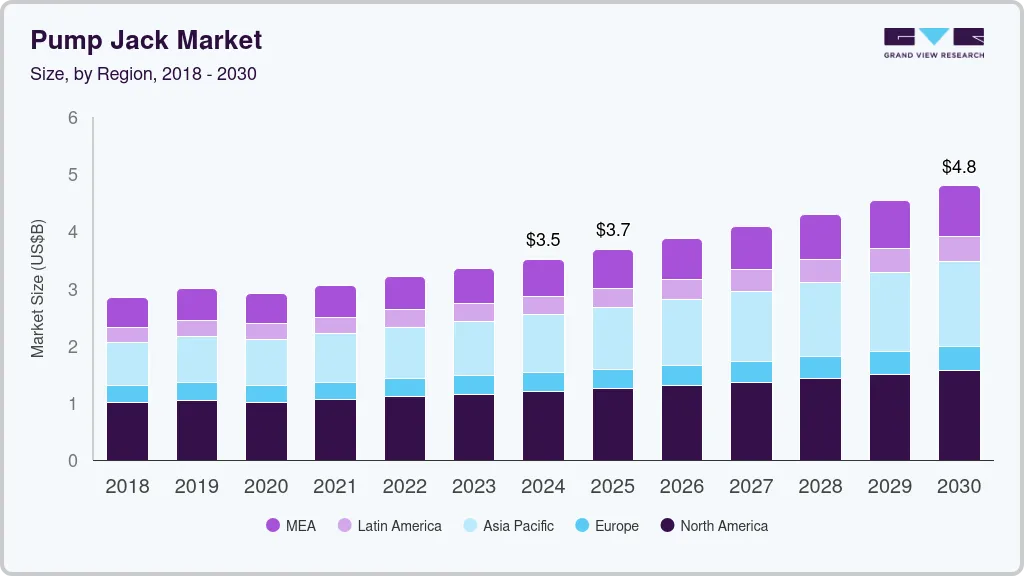

The global pump jack market size was estimated at USD 3,513.4 million in 2024 and is projected to reach USD 4,801.7 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. The increasing global demand for oil has led to a surge in the need for pump jacks.

Key Market Trends & Insights

- The pump jack market of North America is experiencing substantial growth as the region has a significant demand.

- The U.S. pump jack market is estimated to grow at a significant CAGR of 6.4% over the forecast period.

- Based on well, the vertical well segment held a notable market share in 2023.

- Based on weight, the less than 100,000 lbs segment held a considerable market share in 2023.

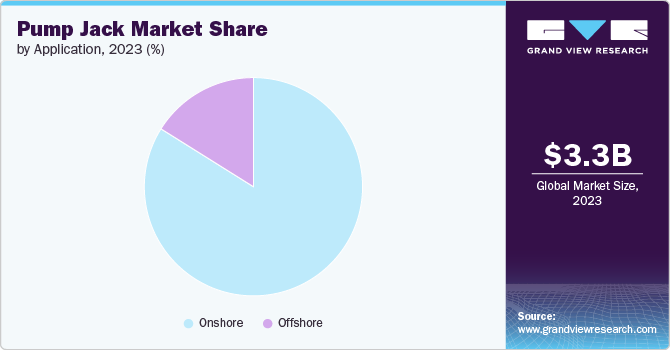

- Based on application, the offshore drilling segment held a 16.1% market share in 2023 and is projected to expand at a CAGR of 4.5% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,513.4 Million

- 2030 Projected Market Size: USD 4,801.7 Million

- CAGR (2025-2030): 5.4%

- North America: Largest market in 2023

Moreover, pumps jacks offer high value in onshore drilling which is less expensive than offshore drilling, making it a preferred method for extracting oil from mature fields. The increasing demand for onshore drilling is creating a conducive environment for market growth.

Despite the growing focus on renewable energy sources, the demand for pump jacks remains high due to the continued reliance on fossil fuels. This reliance is expected to continue, driving the demand for pump jacks. Additionally, the integration of automation in oil extraction processes has significantly boosted the demand for pump jacks. Automation enhances efficiency and reduces labor costs, making it a crucial aspect of modern oil extraction methods. Furthermore, the rise in new exploration fields and the advancement of shale oil in North America have increased the demand for pump jacks. These new fields require efficient and cost-effective extraction methods, which pump jacks provide.

Drivers, Opportunities & Restraints

The global demand for crude oil from various sectors is a primary consideration driving the pump jack market. As the demand for petroleum products, driven by factors such as rapid development and increasing living standards in developing countries, continues to grow, the demand for pump jacks also increases.

However, the rapid development of the electric vehicle industry is a factor restraining the growth of the pump jack market. As the demand for electric vehicles increases, a shift is expected from traditional petroleum-based fuels, which can impact the demand for crude oil and subsequently affect the need for pump jacks.

Despite these restraints, technological progress in pump jack units presents opportunities for market growth. Advancements in automation and control systems have improved the efficiency and performance of pump jacks, making them more effective in oil extraction and creative lucrative opportunities for market growth.

Well Insights

“The demand for the vertical well segment is expected to grow at a significant CAGR of 5.7% from 2024 to 2030 in terms of revenue”

The vertical well segment held a notable market share in 2023. One of the primary benefits of vertical wells is their simplicity, which can result in cost savings in terms of equipment, labor, and time required for extraction. Vertical wells are generally less expensive to drill compared to horizontal wells. Moreover, vertical wells are often considered to have a lower environmental impact compared to horizontal wells. They typically have a smaller surface footprint and infrastructure requirements, which can be advantageous for companies in terms of the current global outlook on environmental considerations.

The horizontal well segment accounted for 37.8% of the global revenue share in 2023 and is projected to expand at a significant CAGR over the forecast period. Horizontal wells are generally more productive compared to vertical wells, especially in thin or naturally fractured reservoirs. The horizontal orientation allows for greater contact with the reservoir, increasing the flow of oil or gas and improving overall productivity, a significant factor driving segment growth.

Weight Insights

“The demand for the less than 100,000 lbs segment is expected to grow at a significant CAGR of 6.0% from 2024 to 2030 in terms of revenue”

The less than 100,000 lbs segment held a considerable marker share in 2023. Pump jacks weighing less than 100,000 lbs are commonly used in vertical wells due to their efficiency and low-cost installation methods. They are well-suited for vertical well applications, where they can efficiently extract oil or gas from the reservoirs.

The 100,000 lbs to 300,000 lbs segment accounted for 48.1% of the global revenue share in 2023 and is expected to expand at a considerable CAGR over the forecast period. Pump jacks in the 100,000 lbs to 300,000 lbs weight range have the capability to serve different types of wells. Their versatility allows them to be used in a variety of well configurations, making them a preferred choice for operators.

Application Insights

“The demand for the onshore segment is projected to grow at a notable CAGR of 5.5% from 2024 to 2030 in terms of revenue”

The onshore drilling segmented held a substantial market share in 2023. Onshore drilling is generally less expensive than offshore drilling. Pump jacks are commonly used in onshore wells to enhance operational efficiency and tap into the remaining oil reserves and the cost-effectiveness of onshore drilling drives the demand for pump jacks in onshore applications.

The offshore drilling segment held a 16.1% market share in 2023 and is projected to expand at a CAGR of 4.5% over the forecast period. Technological advancements in pump jack design and performance have made them more efficient and reliable for offshore oil production. Innovations in pump jack technology, such as improved corrosion resistance and remote monitoring capabilities, have contributed to their effectiveness in offshore applications. These advancements drive the demand for pump jacks in offshore operations.

Regional Insights

The pump jack market of North America is experiencing substantial growth as the region has a significant demand for crude oil, which drives the demand for pump jacks. North America has a large number of mature onshore oil fields. Pump jacks are used in these fields to achieve operational efficiency and tap into the remaining oil reserves. The presence of mature onshore oil fields in North America drives the demand for pump jacks in the region.

U.S. Pump Jack Market Trends

The U.S. pump jack market is estimated to grow at a significant CAGR of 6.4% over the forecast period. The adoption of automation technologies in oil extraction operations is a major driver for the demand of pump jacks in the country. Automation improves operational efficiency, reduces labor costs, and enhances safety in oil production. Pump jacks play a crucial role in automated oil extraction processes, driving their demand in the US market.

Asia Pacific Pump Jack Market Trends

The pump jack market of Asia Pacific is witnessing substantial growth. The Asia Pacific region is witnessing rapid industrialization and urbanization, leading to an increased demand for energy, including oil and gas. Pump jacks play a crucial role in enhancing oil production, meeting the energy needs of growing industries and urban centers. Moreover, an expanding population, rising living standards, and economic growth are factors driving the demand for oil and subsequently the need for pump jacks to extract crude oil.

Middle East and Africa Pump Jack Market Trends

Middle East and Africa pump jack marketheld a considerable market share in 2023. The region is home to some of the world's largest oil reserves, with countries such as Saudi Arabia, Iran, Iraq, and the UAE being top oil producers. Pump jacks are essential in extracting oil from wells, and the presence of oil-rich countries in the region drives the demand for pump jacks. Moreover, the Middle East and Africa is witnessing experiencing rapid industrialization and infrastructure development which is setting up a conducive environment for market growth.

Key Pump Jack Company Insights

-

SLB is a manufacturer and provider of technology for reservoir characterization, drilling, production, and processing. The company has a global footprint in more than 100 countries and focuses on offering products and services revolving around the oil and gas industry, decarbonization applications, and the scaling of new energy systems.

-

Halliburton is a global company that manufactures and provides engineering solutions and energy services to customers in the oil and gas industry. The company’s artificial lift portfolio includes electric submersible pumping systems, horizontal pumping systems, mining pumping systems, and others. Headquartered in Houston, Texas, Halliburton has production facilities in the US, Malaysia, Singapore, and the UK.

-

Weatherford is engaged in the production and provision of energy-related products and services to customers in the oil and gas industry. The company offers a wide range of products and services utilized in the drilling, evaluation, completion, production, and intervention of oil and natural gas wells. The company has a global presence spanning approximately 75 countries and 345 operating locations.

Key Pump Jack Companies:

The following are the leading companies in the pump jack market. These companies collectively hold the largest market share and dictate industry trends.

- SLB.

- Halliburton

- Weatherford

- NOV.

- Hess Corporation (Chevron Corporation.)

- Penguin Petroleum Services (P) Limited

- Bharat Heavy Electricals Limited

- SHANDONG SAIGAO GROUP CORPORATION

- Sivam SpA

- Tenaris.

Recent Developments

-

In April 2024, SLB. and ChampionX. announced an agreement for SLB to acquire ChampionX. in an all-stock transaction. The acquisition of ChampionX. will strengthen SLB's position in the production space, with a focus on production chemicals and artificial lift or technologies or pump jacks. The combined portfolios of SLB and ChampionX is expected to drive customer value through industry expertise, digital integration, enhanced equipment life, and production optimization.

-

In January 2024, NOV. announced its acquisition of Extract, a manufacturer of Extract of artificial lift technologies. The company made this acquisition to capitalize on Extract’s goodwill in the market and its capabilities in maximizing the run-time of electric submersible pumps.

Pump Jack Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3687.6 million

Revenue forecast in 2030

USD 4,801.7 million

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Well, weight, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

SLB.; Halliburton ; Weatherford; NOV.; Hess Corporation (Chevron Corporation.); Penguin Petroleum Services (P) Limited; Bharat Heavy Electricals Limited; SHANDONG SAIGAO GROUP CORPORATION.; Sivam SpA; Tenaris.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pump Jack Market Report Segmentation

This report forecasts revenue growth at global; regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study; Grand View Research has segmented the global pump jack market based on the well, weight, application, and region:

-

Well Outlook (Revenue; USD Million; 2018 - 2030)

-

Vertical Well

-

Horizontal Well

-

-

Weight Outlook (Revenue; USD Million; 2018 - 2030)

-

Less Than 100;000 lbs

-

100;000 lbs to 300;000 lbs

-

More Than 300;000 lbs

-

-

Application Outlook (Revenue; USD Million; 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue; USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pump jack market size was estimated at USD 3,351.8 million in 2023 and is expected to reach USD 3.51 billion in 2024

b. The global pump jack market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 4.80 billion by 2030

b. North America dominated the pump jack market with a revenue share of 33.7% in 2023. The Pump Jack market in North America is experiencing substantial growth due to increasing industrialization and urbanization in the region

b. Some of the key players operating in the pump jack market include SLB., Halliburton , Weatherford, NOV., Hess Corporation (Chevron Corporation.), Penguin Petroleum Services (P) Limited, Bharat Heavy Electricals Limited, SHANDONG SAIGAO GROUP CORPORATION., Sivam SpA, and Tenaris

b. The demand for Pump Jack market is attributed to the increased demand for oil from various sectors, such as transportation and manufacturing, increasing automation in oil extraction and other advancements in artificial lift technology, and the expansion of emerging economies driving demand for electricity

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.