- Home

- »

- Advanced Interior Materials

- »

-

Quartz Market Size And Share, Industry Report, 2033GVR Report cover

![Quartz Market Size, Share & Trend Report]()

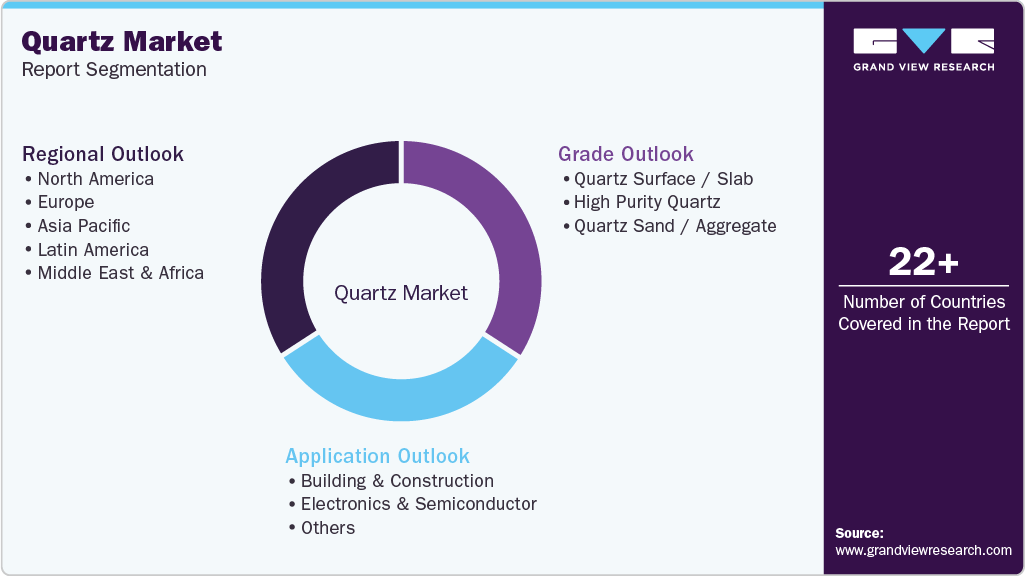

Quartz Market (2025 - 2033) Size, Share & Trend Analysis Report By Grade (Quartz Surface / Slab, High Purity Quartz), By Application (Building & Construction, Electronics & Semiconductor), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-827-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Quartz Market Summary

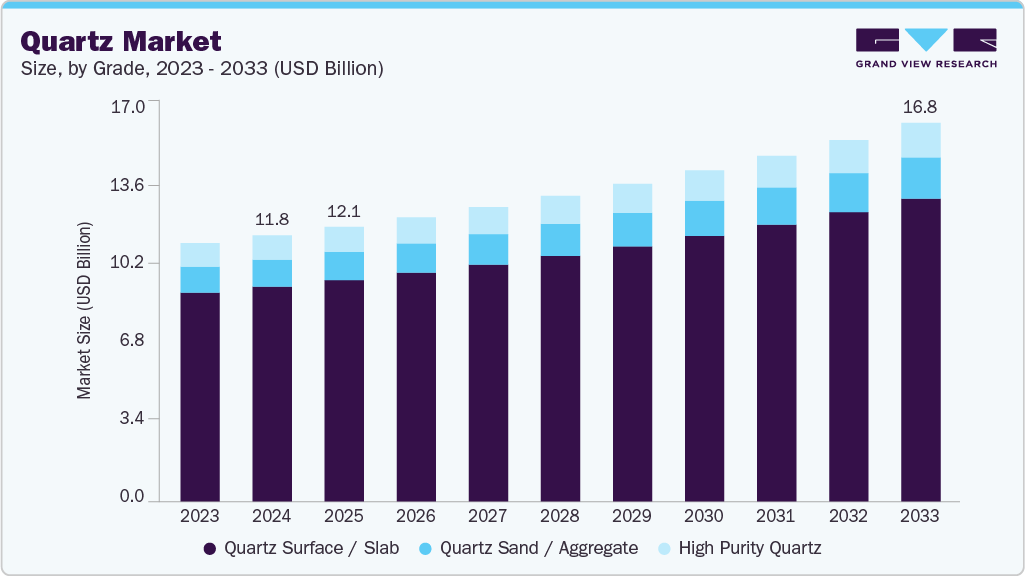

The global quartz market size was estimated at USD 11.78 billion in 2024 and is projected to reach USD 16.77 billion by 2033, growing at a CAGR of 4.1% from 2025 to 2033. The market is experiencing robust growth, primarily fueled by the relentless expansion of the building and construction industry worldwide.

Key Market Trends & Insights

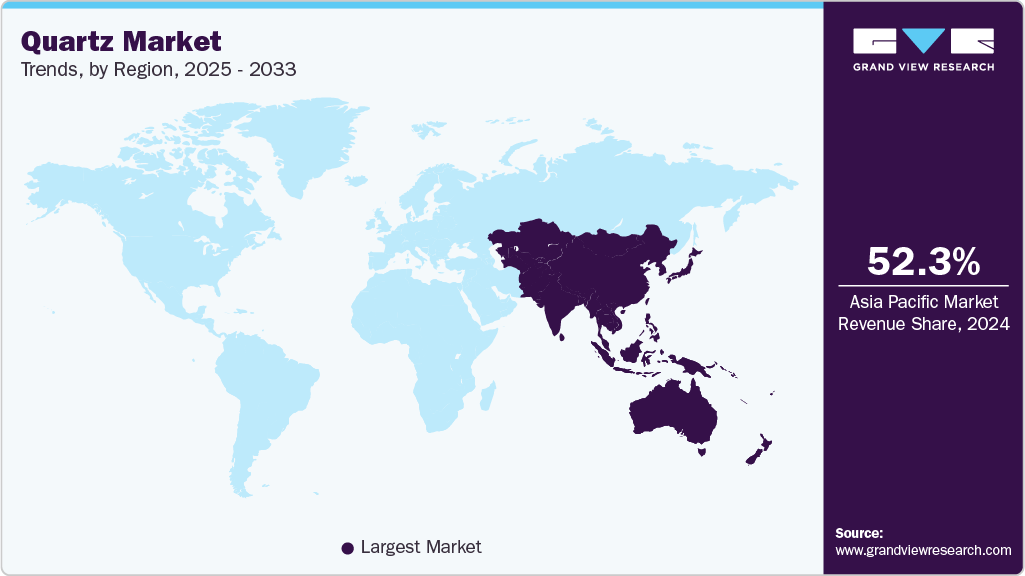

- Asia Pacific dominated the quartz market with the largest market revenue share of 52.3%.

- By grade, quartz surface/ slab segment accounted for the largest market revenue share of over 80.0% in 2024.

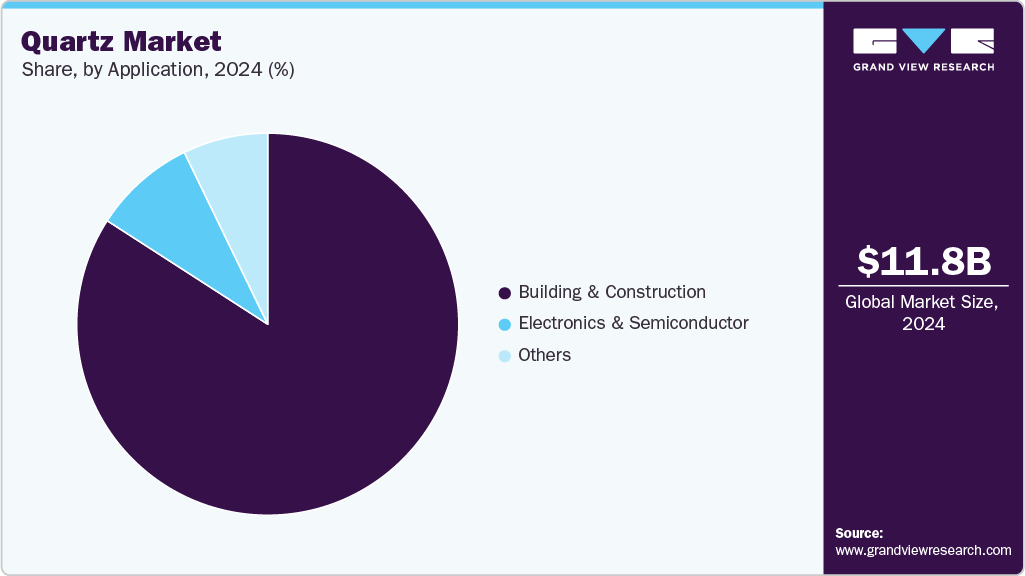

- By application, building & construction accounted for the largest market revenue share of over 84.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.78 Billion

- 2033 Projected Market Size: USD 16.77 Billion

- CAGR (2025-2033): 4.1%

- Asia Pacific: Largest market in 2024

Quartz, particularly in its engineered form, has become a material of choice for countertops, flooring, and wall cladding due to its superior performance characteristics. Its non-porous surface makes it highly resistant to staining and bacterial growth, a significant advantage over natural stone like marble. Furthermore, its exceptional durability and scratch resistance ensure longevity, making it a cost-effective investment for both residential and commercial projects. As urbanization continues, especially in emerging economies, and investment in new residential and infrastructure projects rises, the demand for high-quality, durable, and aesthetically versatile surfacing materials like quartz is projected to surge in tandem.The post-pandemic era has heightened awareness of cleanliness, and the non-porous nature of engineered quartz directly addresses this concern, making it a popular choice for kitchens and bathrooms. Aesthetically, advancements in manufacturing technology allow quartz slabs to mimic the look of high-end natural stones, such as marble and granite, but with greater consistency and a wider array of color and pattern options. This versatility allows designers and homeowners to achieve a luxury look without the associated maintenance hassles, such as the need for regular sealing. The combination of visual appeal and practical benefits positions quartz as a premium yet practical solution for modern interiors.

Continuous improvements in production techniques have led to higher efficiency, reduced waste, and the ability to create slabs with more complex and realistic veining patterns. Furthermore, research and development have led to the creation of new product variants, including ultra-compact quartz surfaces that offer even greater resistance to heat, impact, and UV radiation, expanding their application to outdoor kitchens and facades. The development of thinner, lighter slabs also opens up new possibilities for vertical applications and furniture, broadening the market scope beyond traditional countertops. These innovations not only enhance product performance but also help manufacturers differentiate their offerings in a competitive landscape.

Rising disposable incomes, particularly in the Asia-Pacific region, are enabling more consumers to invest in home renovation and premium building materials. The burgeoning middle class is increasingly willing to spend on products that offer a combination of quality, durability, and aesthetic value, a niche that quartz fills perfectly. Simultaneously, the global trend of urbanization leads to the construction of new housing units and commercial spaces, all of which require interior finishes. This sustained economic development and population shift create a fertile ground for the continued adoption of quartz surfaces across various applications.

Drivers, Opportunities & Restraints

The relentless growth of the global construction and renovation industry, particularly in residential kitchens and bathrooms, creates a massive demand for durable surfacing materials. Quartz excels in this area due to its engineered nature, offering exceptional scratch and stain resistance, low maintenance (requiring no sealing), and a non-porous surface that promotes hygiene by resisting bacteria and mold. Furthermore, advanced manufacturing techniques now allow quartz to replicate the aesthetic appeal of high-end natural stones like marble and granite, but with greater consistency and a wider variety of colors and patterns, making it a highly attractive option for designers and homeowners seeking both beauty and practicality.

The development of new product variants, such as ultra-compact quartz surfaces with enhanced resistance to heat, UV rays, and impact, opens new application areas for outdoor cladding, commercial flooring, and heavy-use commercial tops. There is also a substantial growth opportunity in emerging economies across Asia-Pacific and Latin America, where rising disposable incomes and rapid urbanization are increasing the adoption of premium building materials.

Despite its strong growth, the quartz industry faces notable restraints, with environmental and regulatory concerns being the most significant. The manufacturing process is energy-intensive and generates silica dust, which poses serious health risks (silicosis) to workers if not properly managed, leading to stringent and costly workplace safety regulations.

Grade Insights

Quartz surface/ slab held the revenue share of 80.7% in 2024. The quartz surface and slab segment is experiencing strong momentum due to rising demand from residential and commercial construction. Modern housing projects, premium apartments, and renovation activities are increasingly centered around durable, aesthetically consistent materials for kitchens, bathrooms, and interior spaces. Quartz slabs offer superior scratch resistance, long service life, and uniform patterns that appeal to both homeowners and architects.

The quartz sand and aggregate segment is gaining traction as construction, glass manufacturing, and foundry operations expand across major economies. Builders rely on high-quality quartz sand for concrete formulations, mortars, and specialty aggregates that enhance strength, thermal stability, and overall structural performance. Growing infrastructure investment in highways, commercial buildings, and industrial facilities is elevating the need for consistent silica-based aggregates that can support heavy-load applications.

Application Insights

Building & construction held the revenue share of 84.2% in 2024. The building and construction segment benefits from rapid urban expansion, large-scale infrastructure development, and sustained residential upgrades across both mature and emerging economies. Quartz materials are widely used in flooring, wall cladding, countertops, roofing granules, and decorative architectural elements because they offer reliable hardness, visual uniformity, and strong weather resistance. Developers choose engineered quartz slabs for kitchens and bathrooms due to their low maintenance requirements and long service life. For instance, in November 2025, Artelye introduced its latest quartz countertops, highlighting the growing preference for engineered stones due to their exceptional durability and longevity. Quartz countertops are praised for their high resistance to stains, scratches, and humidity, making them an ideal choice for high-traffic areas like kitchens and bathrooms.

The electronics and semiconductor segment is expanding steadily as high-purity quartz becomes indispensable for advanced manufacturing processes. Semiconductor fabrication requires ultra-low impurity quartz for crucibles, tubes, and components used in wafer production, diffusion, etching, and crystal growth. The rising complexity of integrated circuits and the push toward smaller node technologies demand materials that can withstand extreme temperatures while maintaining chemical stability, which strengthens the role of high-purity quartz.

Regional Insights

Asia Pacific accounted for the largest market revenue share of 52.3% in 2024. The market in the Asia Pacific is rapidly expanding due to recent discoveries of new quartz deposits in India, China, and parts of Southeast Asia. These discoveries have improved the availability of raw materials, reduced sourcing risks, and encouraged investments in advanced beneficiation technologies. For instance, in April 2025, China announced a significant discovery of high-purity quartz resources. This strategic move aims to reduce the country's dependency on foreign supplies of this essential material. According to Energy Connects, this discovery could rival the output of a major U.S. mine, emphasizing the geopolitical implications of quartz supply chains.

North America Quartz Market Trends

The quartz market in North America is primarily driven by a robust resurgence in residential and commercial construction and remodeling activity. As one of the most popular materials for countertops, quartz benefits directly from trends in kitchen and bathroom renovations, which represent significant portions of home improvement expenditure. The material's durability, non-porous nature, and low maintenance requirements make it a highly attractive alternative to natural stone like granite and marble.

The U.S. quartz market is advancing through strong momentum in high-tech industries. Expanding semiconductor fabrication capacity, higher adoption of advanced chip manufacturing nodes, and a rise in solar photovoltaic installations are pushing up consumption of high-purity quartz used in crucibles, wafers, and precision optical components. For instance, in September 2025, the U.S. government intensified pressure on Taiwan to relocate semiconductor production, demanding that 50% of the U.S. chip supply chain needs be met domestically to bolster national security amid over-reliance on TSMC.

Europe Quartz Market Trends

The quartz market in Europe is powerfully driven by the region's strong cultural emphasis on sustainability and circular economy principles. This has led manufacturers to innovate with eco-friendly production lines and products that directly appeal to environmentally conscious consumers and comply with strict EU regulations. For instance, Compac, a Spanish company, has developed quartz surfaces that incorporate up to 25% recycled materials, including post-industrial glass and mirror waste.

Latin America Quartz Market Trends

The quartz market in Latin America is rising due to expanding construction activity and a growing preference for durable interior materials. Rapid urban development in countries such as Brazil, Mexico, and Colombia is creating demand for engineered quartz surfaces used in residential and commercial projects. Developers and homeowners are choosing quartz for its long service life, visual consistency, and lower maintenance needs, which supports steady consumption across countertops, flooring, and decorative applications.

Key Quartz Company Insights

Some of the key players operating in the market include Australian Silica Quartz Group Ltd, Sibelco, and others.

-

Australian Silica Quartz Group Ltd is an Australian mineral exploration and development company that focuses on high-grade quartz and silica sand resources. The company operates multiple projects across Western Australia and Queensland, where it targets hard-rock quartz deposits as well as premium silica sand bodies. Its strategic shift from bauxite exploration toward silica has enabled it to concentrate capital and technical expertise on high-purity quartz potential. ASQ continues to work on upgrading its natural silica feedstock to achieve the high-purity levels needed for advanced industrial applications.

-

Sibelco is a global industrial minerals company with a long legacy of supplying high-quality mineral solutions. With operations across multiple continents, the company manages an extensive portfolio of minerals that serve construction, manufacturing, technology, and consumer industries. Among its mineral offerings, quartz stands out as one of its most important product families, supported by large-scale mining, processing expertise, and a global production network.

Key Quartz Companies:

The following are the leading companies in the quartz market. These companies collectively hold the largest market share and dictate industry trends.

- Australian Silica Quartz Group Ltd

- Creswick Quartz Pty Ltd

- HPQ Materials

- Imerys

- Jiangsu Pacific Quartz Co., Ltd

- Momentive Technologies

- Nordic Mining ASA

- Russian Quartz LLC

- Sibelco

- The Quartz Corporation

Recent Development

-

In August 2025, U.S.-based countertop giant Cambria announced a strategic consolidation, moving its Canadian production operations to a new, state-of-the-art factory in Minnesota. This "reshoring" initiative, as reported by the Star Tribune, highlights a pivotal trend in the market, driven by the need for greater supply chain control and operational efficiency amidst a challenging global industry landscape.

Quartz Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the total revenue generated globally from the sale of pure quartz products within a specific year.

Market size value in 2025

USD 12.15 billion

Revenue forecast in 2033

USD 16.77 billion

Growth rate

CAGR of 4.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, volume in tons, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, grade, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil; South Africa, Saudi Arabia

Key companies profiled

Australian Silica Quartz Group Ltd; Creswick Quartz Pty Ltd; HPQ Materials; Imerys; Jiangsu Pacific Quartz Co., Ltd; Momentive Technologies; Nordic Mining ASA; Russian Quartz LLC; Sibelco; The Quartz Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Quartz Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global quartz market report based on grade, application, and region:

-

Grade Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Quartz Surface / Slab

-

High Purity Quartz

-

Quartz Sand / Aggregate

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Electronics & Semiconductor

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global quartz market size was estimated at USD 11.78 billion in 2024 and is expected to reach USD 12.15 billion in 2025.

b. The global quartz market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2033 to reach USD 16.77 billion by 2033.

b. The quartz surface/ slab segment dominated the market with a revenue share of 80.7% in 2024.

b. Some of the key players of the global quartz market are Australian Silica Quartz Group Ltd, Creswick Quartz Pty Ltd, HPQ Materials, Imerys, Jiangsu Pacific Quartz Co., Ltd, Momentive Technologies, Nordic Mining ASA, Russian Quartz LLC, Sibelco, The Quartz Corporation, and others.

b. The key factor driving the growth of the global quartz market is the rising demand from electronics and semiconductor manufacturing, as quartz materials support precise wafer processing, improve thermal stability during chip fabrication, and enable high-purity components required for advanced device architectures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.