- Home

- »

- Animal Health

- »

-

Rabies Veterinary Vaccines Market, Industry Report, 2030GVR Report cover

![Rabies Veterinary Vaccines Market Size, Share & Trends Report]()

Rabies Veterinary Vaccines Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Companion Animals, Livestock Animals, Wildlife Animals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-011-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rabies Veterinary Vaccines Market Trends

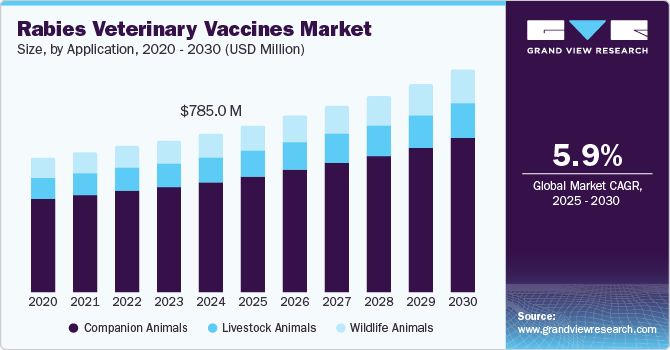

The global rabies veterinary vaccines market size was estimated at USD 785.0 million in 2024 and is anticipated to grow at a CAGR of 5.9% from 2025 to 2030. Increasing government initiatives to eradicate animal rabies, rising awareness of zoonotic diseases, increased coverage of animal vaccinations in developing countries, nationwide implementation of mass dog vaccination campaigns, increased wildlife rabies-eradication bait programs, and a notable increase in pet ownership rates are some of the factors driving the market growth.

The most common method of viral transmission is by the bite of an infected animal to other domestic animals or people. Although rabies is a serious but avoidable viral disease, the virus often attacks an animal's central nervous system, causing inflammation and eventually death if preventive or treatment steps are not taken in a timely manner. Approximately 10% of animal rabies episodes occur in domestic animals like dogs and cats, whereas over 90% of the over 5,000 rabies cases reported in the United States each year occur in wildlife, according to an article from the National Foundation for Infectious Diseases.

In addition, horses, pigs, and cattle have also been reported to contract rabies in countries such as Canada and U.S. However, dogs constitute the primary source of rabies transmission throughout a significant majority of the rest of the world, including Africa, Asia, and Latin America. In recent years, significant advancement has been made in the Latin American campaign to eradicate canine rabies. Latin America's rabies prevention initiatives have been successful due to the ongoing annual mass dog vaccination campaigns and rigorous surveillance of infected dogs. However, these eradication and prevention activities have been challenged as a result of critical COVID-19 control efforts in certain regions.

Rabies vaccinations for domesticated animals including dogs, cats, and ferrets are strictly regulated in the majority of countries. Although some areas allow veterinary technicians and individuals with specific training to vaccinate these animals, only licensed veterinarians are allowed to administer the vaccine. The frequency of vaccination regulations varies from state to state. Some jurisdictions follow the Compendium of Animal Rabies Prevention and Control or the product label of the used immunization, while others set a specific time frame. Furthermore, several countries have started to provide exceptions to vaccination restrictions when they are medically necessary by a veterinarian.

Rabies can be controlled and eradicated at the animal source, as the European Union has shown through its systematic approach to combating canine and wildlife-mediated rabies. A model for the elimination of this was the successful oral vaccine campaign for foxes and raccoon dogs, which was the product of ten years of development work and backing from the European Union. Many European countries, including nearly all EU member states, EFTA countries, the United Kingdom, Balkan countries, and some regions of Eastern European countries, have eradicated this in recent years or decades. The successful multiyear implementation of oral vaccination for wild animals, dog and cat vaccination, rigorous passive surveillance, and collaboration with stakeholders in a "One Health" approach contributed to this improvement.

Application Insights

The companion animals segment dominated the global market with a revenue share of over 70.0% in 2024. In certain parts of the world, the diseased dog population is responsible for nearly 98% of rabies transmission. Timely treatments are limited since the virus can incubate in any mammal for days to months without showing any clear clinical symptoms. This deadly virus infection causes the brain to become severely inflamed, which typically results in death. Regular vaccinations and booster shots are the only method to safeguard pet animals and their owners. Several countries have made vaccination for companion animals mandatory due to the significant impact of this zoonotic neuroinvasive virus, which supports the predicted revenue share.

The wild animals segment is anticipated to expand at the fastest CAGR of over 4% over the forecast period owing to the rising wildlife vaccination campaigns in developed regions. 90% of rabies cases reported in the United States in 2024 were caused by wild animals, according to the Centers for Disease Control & Prevention. Among the most often reported wild rabid species were feral cats (12.2%), skunks (8.9%), and raccoons (68%). Within the species to which they have been widely introduced, rabies virus variants continue to spread. In a similar vein, virus variants in raccoons, foxes, skunks, and mongooses are localized in particular geographic regions.

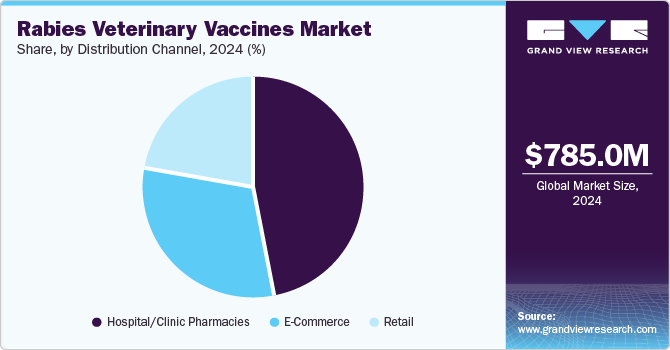

Distribution Channel Insights

Hospital/Clinic Pharmacies dominated the market with the largest share of 45% in 2024. Hospital pharmacies indeed play a dominant role in the global vaccine market, primarily due to their critical function in ensuring vaccine availability and administration in both emergency and preventive scenarios. Hospital pharmacies are often the primary point of vaccine distribution, particularly in regions where rabies poses a significant public health threat. Moreover, rabies cases, especially those requiring post-exposure prophylaxis, are typically treated in hospitals. Hospital pharmacies ensure a steady supply of vaccines for immediate use in emergencies.

E-commerce segment is the fastest-growing segment and is expected to grow at a CAGR of over 8% over the forecast period. E-commerce platforms offer a broader range of vaccines, including advanced formulations and multi-dose packs, increasing their availability across regions. Online retailers often provide competitive pricing, discounts, and subscription models, making it cost-effective for consumers to purchase vaccines. In addition, many e-commerce platforms include detailed product descriptions, user reviews, and expert advice, which help in educating buyers about vaccine usage and benefits, driving demand.

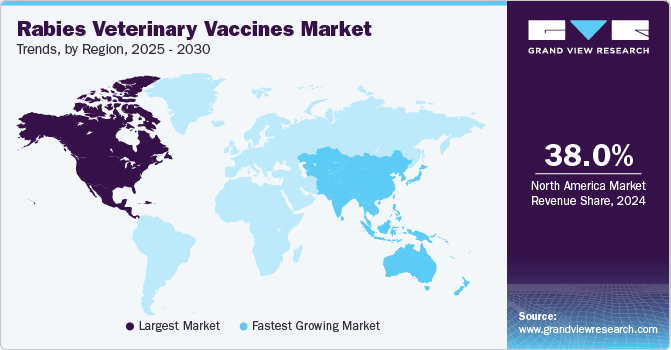

Regional Insights

The North America rabies veterinary vaccines market dominated the global market and accounted more than 38% of the total revenue share in 2024. This can be ascribed to the region's high veterinary healthcare costs and large pet population. Government agencies and reputable veterinary pharmaceutical companies are also collaborating to expand the use of oral wildlife rabies bait-vaccine campaigns and mass vaccination programs to supplement eradication efforts, and growing pet humanization trends and pet owners' awareness of the need to protect their beloved animals from deadly diseases like rabies are also contributing to the region's improved vaccination coverage.

U.S. Rabies Veterinary Vaccines Market Trends

The U.S. rabies veterinary vaccines market held a significant share of the North America market in 2024, owing to a stringent Government regulation against vaccinations. For instance, according to the Texas Department of State Health Services, Texas mandates that dogs and cats undergo a vaccination by the time they are four months old. A licensed veterinarian is required to administer the immunization. Rabies is a zoonotic disease with high fatality rates, posing significant public health risks. Governments often implement rigorous vaccination mandates and monitoring systems to curb the spread of rabies, thus drives the market growth.

Europe Rabies Veterinary Vaccines Market Trends

The Europe rabies veterinary vaccines market holds a second largest market share, due to increasing companion population, and pet care expenditure. With a larger companion animal population, there’s a greater risk of rabies transmission, increasing the demand for effective vaccination programs. Moreover, companion animals like dogs and cats are the primary targets for rabies vaccination campaigns, ensuring their protection and public safety. For instance, the number of pet owners is increasing, with 166 million out of Europe's 352 million pets being owned by 50% of European households.

The Germany rabies veterinary vaccines market is expected to grow significantly over the forecast period. Germany is among the European nations that have virtually eradicated rabies in both domestic and wild animals by meticulous management, especially oral immunization of foxes, the primary viral carriers. However, rabies in domestic and wild animals remains an issue in Eastern Europe and other parts of the world, according to an article published by Dr. Frühwein & Partner. Thus, a strict regulations and the importance of vaccination play a significant role in driving the market in Germany.

Asia Pacific Rabies Veterinary Vaccines MarketTrends

The Asia Pacific rabies veterinary vaccines market is expected to grow at the fastest CAGR over the forecast period. Rabies is a major public health concern in Southeast Asian nations. According to reports, canine rabies is prevalent in China, India, and the majority of ASEAN nations, with a markedly increased annual number of cases. One of the main causes of Asia's high illness burden is the vast number of stray dogs. In order to eradicate rabies by 2030, the region has recently started a number of initiatives, including mass dog vaccination campaigns carried out in cooperation with important stakeholders and governmental agencies.. For instance, In April 2022, Boehringer Ingelheim and the Global Alliance for Rabies Control (GARC) launched a mass vaccination operation to vaccinate 12,000 animals in the Philippines, Indonesia, Vietnam, and Malaysia as part of the rabies control drive. These elements have a major impact on the market growth.

The Thailand rabies veterinary vaccines market is growing at a significant rate and held a significant share in 2024. Thailand has seen a rise in rabies infections during the last ten years, particularly among dogs. Even though Thailand imports 2.5 million doses of vaccine annually, the Thai National Vaccine Institute (Ministry of Public Health, MOPH) made the decision to start vaccine research and development in order to protect against viral strains that are active in Thailand and its neighboring countries. Vaccine manufacturers aim to provide a locally made product at a reasonable cost with the potential for international licensure.

Latin America Rabies Veterinary Vaccines MarketTrends

The Latin American rabies veterinary vaccines market is anticipated to grow at a lucrative CAGR over the forecast period. Latin America includes countries like Argentina and Brazil. The market in this region is growing rapidly as a result of a shift in customer demographics and lifestyles that has led to greater demand for meat, eggs, and other animal products. Additionally, rising pet ownership have fueled market growth. In Argentina, for example, 86% of families own at least one pet, most often a dog or cat. Market participants continuously fund R&D initiatives to launch effective vaccines.

The Brazil rabies veterinary vaccines market exhibits high growth potential. This is mostly due to the large number of pet owners in this country. Among other countries in the world, Brazil is the only one with the greatest variety of animals. Because it is a global hub for meat production, the country consumes a lot of feed. A USDA research states that rising beef prices, rising global demand, and a general trend of sector expansion were the main drivers behind a 1% increase in cattle production in 2023. Hence, this trend is often linked to better nutritional management, which contributes to improved pet health and longevity, increasing the need for regular veterinary check-ups and preventive measures like vaccines.

Middle East and Africa (MEA) Rabies Veterinary Vaccines MarketTrends

The MEA rabies veterinary vaccines market growth is driven by various factors such as increasing awareness of zoonotic diseases. In countries like South Africa, these circumstances increased the need for efficient management of these diseases. Moreover, expansion of veterinary services in the region is another factor contributing to the market growth. With more veterinary services, pet owners and livestock farmers can conveniently seek vaccinations and treatments, leading to higher vaccination rates and reduced incidence. Expanding veterinary infrastructure allows for the storage and distribution of vaccines, ensuring their availability in both urban and rural areas.

The South Africa rabies veterinary vaccines market growth is anticipated to grow over the forecast period. This growth is attributed to the presence of large number of veterinarians practicing in the country. For instance, There are over 4,000 registered veterinarians in the entire country, and the number is rising, according to the South African Veterinary Association. The veterinary sector in South Africa supports both the cattle and pet industries, which are both growing rapidly as a result of the nation's rising pet ownership rates.

Key Rabies Veterinary Vaccines Company Insights:

There are various large and small participants in the market, making it fairly competitive. Major companies have diversified portfolios, strong R&D, distribution, and sales capabilities, and are publicly traded. Small and medium-sized businesses concentrate on particular solutions that meet market demands. Partnerships, mergers and acquisitions, research and development, regional expansion, and product launches are a few examples. For example, in January 2022, Boehringer Ingelheim collaborated with MabGenesis, a biopharmaceutical company, to discover novel monoclonal antibodies in canines.

Key Rabies Veterinary Vaccines Companies:

The following are the leading companies in the rabies veterinary vaccines market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc. (MSD Animal Health)

- Indian Immunologicals Ltd.

- Boehringer Ingelheim International GmbH (Animal Health)

- Zoetis

- Virbac

- BroadChem Philippines Biopharma Corporation

- Elanco

- Ceva

- BiogénesisBagó

Recent Developments

-

In June 2022, Artemis Technologies, Inc., a Canadian producer of oral rabies vaccines, was purchased by Ceva Sante Animale. With the addition of ONRAB, a recombinant oral vaccine that demonstrated promising trial outcomes for wild skunks and raccoons in the United States, the company's veterinary vaccine portfolio was broadened by this acquisition.

-

In March 2024, Zendal group introduced CSIC-developed vaccine against canine leishmaniasis, a recombinant vaccine to combat canine leishmaniasis, a parasite that causes skin ulcers to severe inflammation of the liver and spleen.

-

In June 2024, Merck & Co., Inc., introduced the NOBIVAC NXT Rabies portfolio in Canada, which includes NOBIVAC NXT Canine-3 Rabies and NOBIVAC NXT Feline-3 Rabies, as part of the company's continued commitment to rabies prevention.

Rabies Veterinary Vaccines Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 824.77 million

The revenue forecast in 2030

USD 1.10 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Boehringer Ingelheim International GmbH; Zoetis Services LLC; Merck & Co., Inc.; Elanco; BroadChem Philippines Biopharma Corporation; Virbac; Ceva; BiogénesisBagó; Indian Immunologicals Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Rabies Veterinary Vaccines Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global rabies veterinary vaccinesmarket on the basis of application, distribution channel, region.

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Companion Animals

-

Livestock Animals

-

Wildlife Animals

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/Clinic Pharmacies

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of Asia-Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global rabies veterinary vaccines market size was estimated at USD 785.0 million in 2024 and is expected to reach USD 824.7 million in 2025.

b. The global rabies veterinary vaccines market is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2025 to 2030 to reach USD 1.10 billion by 2030.

b. North America dominated the global rabies veterinary vaccines market with a share of over 38% in 2024. This is attributable to the large pet population coupled with mandatory rabies vaccine measures.

b. Some key players operating in the global rabies veterinary vaccines market include Merck & Co., Inc. (MSD Animal Health); Indian Immunologicals Ltd; Boehringer Ingelheim International GmbH (Animal Health); Zoetis; Virbac; BroadChem Philippines Biopharma Corporation; Elanco, Ceva, and Biogénesis Bagó.

b. Key factors that are driving the market growth include the increasing rabies vaccination coverage for dogs, rising zoonosis concerns, growing government initiatives to eradicate rabies, and increasing dog ownership rates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.