- Home

- »

- Next Generation Technologies

- »

-

Radar Simulator Market Size & Share, Industry Report, 2030GVR Report cover

![Radar Simulator Market Size, Share & Trends Report]()

Radar Simulator Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Product, By Type (Marine, Airborne, Ground), By Application (Military, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-167-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Radar Simulator Market Summary

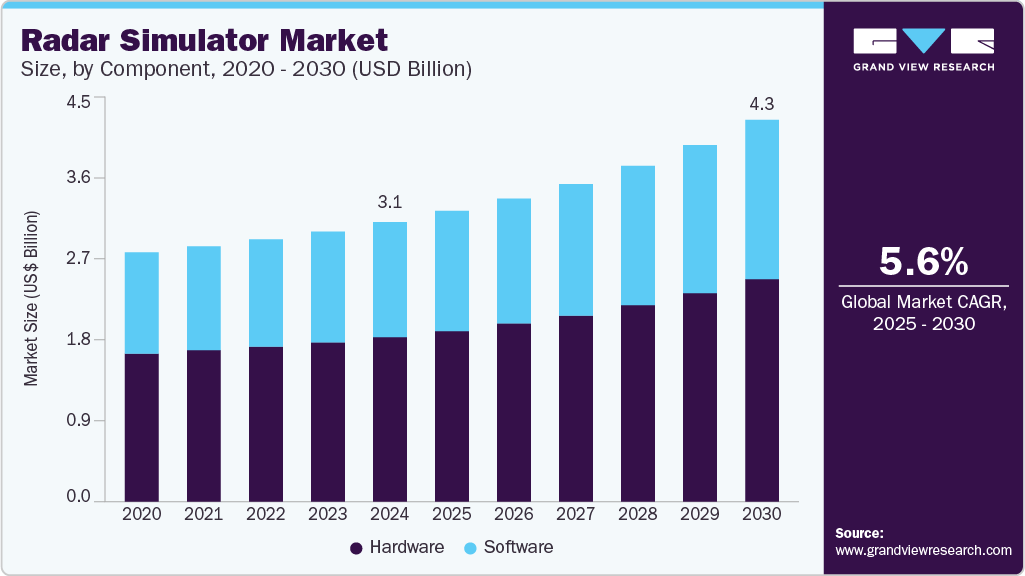

The global radar simulator market size was estimated at USD 3.13 billion in 2024 and is projected to reach USD 4.28 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. The growth is primarily driven by various factors such as the emergence of modern warfare systems, affordability of simulator training, increasing defense expenditure in emergency economies, demand for skilled and trained operators, and increasing R&D activities in the field of military simulation.

Key Market Trends & Insights

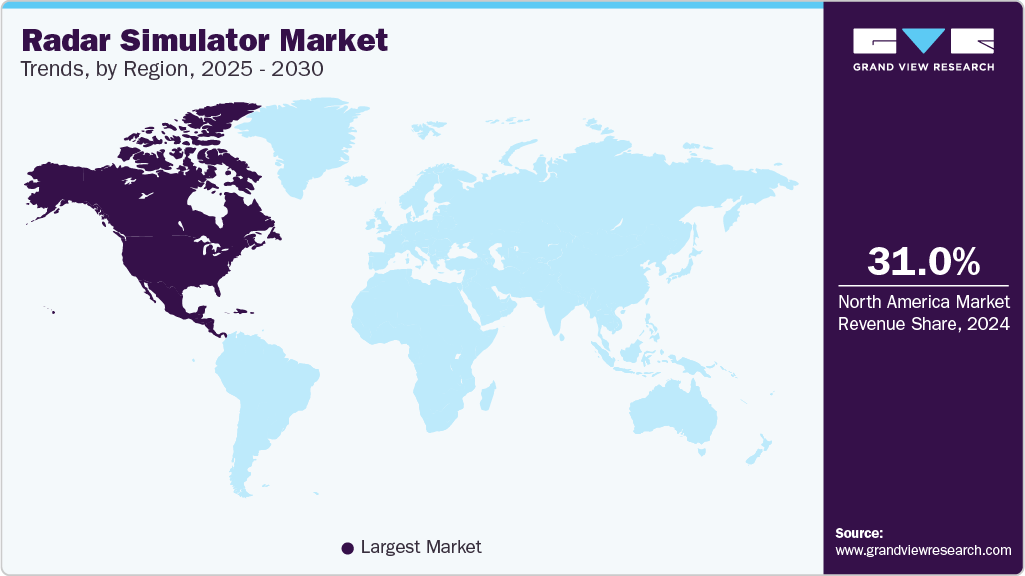

- North America radar simulator market accounted for the largest share of over 31% in 2024.

- The U.S. radar simulator industry is expected to grow at a CAGR of over 5% from 2025 to 2030.

- By component, the hardware segment dominated the radar simulator industry with a revenue share of over 59% in 2024.

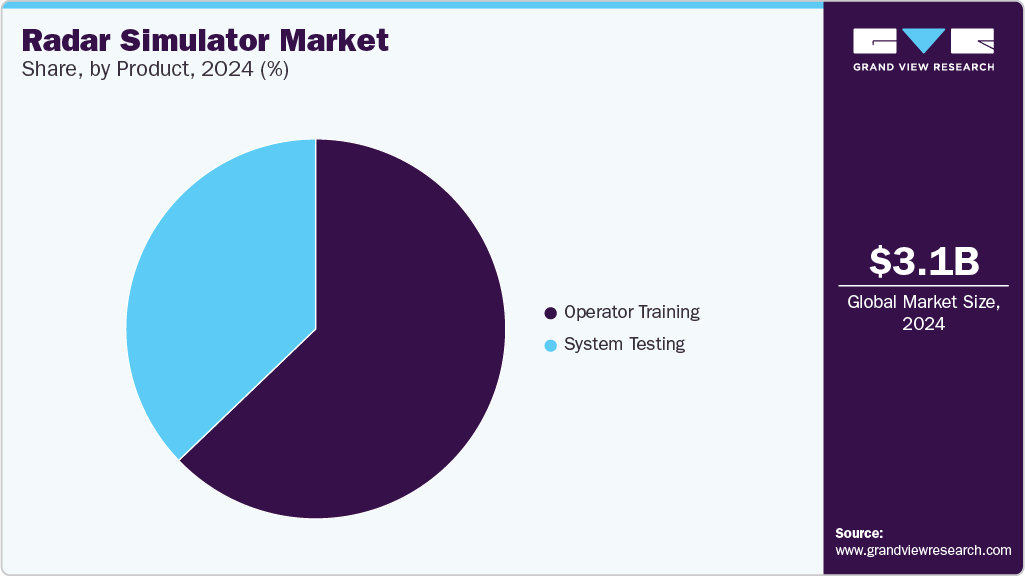

- By product, the system testing segment is expected to witness the fastest CAGR from 2025 to 2030.

- By type, the airborne segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.13 Billion

- 2030 Projected Market Size: USD 4.28 Billion

- CAGR (2025-2030): 5.6%

- North America: Largest market in 2024

Radar simulators provide an effective means to train operators on the intricacies of modern technologies, ensuring they are well-equipped to handle complex scenarios. These simulators enable aviation professionals to improve their skills in navigating through complex airspaces and responding to various scenarios, contributing to enhanced safety and efficiency, thereby significantly contributing to the market expansion.In the defense sector, radar simulators facilitate realistic training exercises, allowing personnel to practice surveillance, target tracking, and electronic warfare tactics in a simulated yet authentic setting, preparing them for diverse operational challenges. Additionally, radar simulators enable the testing and validation of new radar systems and tactics, ensuring optimal performance and readiness in real-world situations, thereby enhancing the overall radar simulator industry.

Additionally, the rising defense expenditure in emerging economies has a positive impact on the target market. Countries invest in strengthening their defense capabilities, and there is a parallel need to train military personnel effectively. Countries such as Russia and China are investing heavily in their defense sector. This trend highlights the importance of maintaining a well-trained and proficient defense workforce to address evolving security challenges.

The affordability of simulator training has become a key driver for the target market. Traditional live training exercises involving actual radio detection and ranging systems can be costly and logistically challenging. Radar simulators offer a cost-effective alternative by providing realistic training scenarios without the need for expensive equipment and resources. The cost-effectiveness of simulator training is becoming increasingly attractive, leading to a higher adoption rate and driving the market growth.

The demand for skilled and trained operators is a significant factor propelling the radar simulator industry. As systems become more sophisticated, the importance of having proficient operators capable of utilizing these technologies effectively grows. Simulators offer a controlled environment where operators can practice and refine their skills, ensuring optimal performance in real-world scenarios. The global demand for skilled radar operators, driven by geopolitical tensions and security concerns, creates a sustained need for advanced training solutions, thereby boosting the radar simulator market.

Component Insights

The hardware segment dominated the radar simulator industry with a revenue share of over 59% in 2024. This growth is driven by the rising demand for realistic, high-fidelity training simulations, prompting significant investments in robust hardware components. These include advanced signal processing units, antennas, and transmitters essential for immersive training environments. The complexity of modern radar systems further necessitates sophisticated hardware to accurately mirror real-world scenarios. Additionally, the durability and performance standards required in defense and aerospace applications continue to reinforce the segment's dominance.

The software segment is expected to witness a significant CAGR of over 5% from 2025 to 2030, driven by advancements in simulation technologies that offer high realism and adaptability. These software solutions enable organizations to replicate complex scenarios accurately, enhancing training effectiveness across sectors such as defense, aerospace, and automotive. The flexibility, cost-efficiency, and easy integration of simulation software with existing platforms make it a preferred choice for scalable virtual training environments. Continuous updates and AI integration are boosting functionality, keeping these tools at the cutting edge of innovation. As industries shift toward digitalization and virtual operations, demand for the software segment continues to rise.

Product Insights

The operator training segment accounted for the largest market share in 2024, driven by the critical need for skilled personnel to operate radio detection efficiently and ranging systems across industries. Radar simulators offer hands-on experiences, allowing users to practice complex scenarios such as missile tracking and air traffic control. The increasing demand for accurate, real-time decision-making is prompting organizations to invest in high-quality training programs. This focus on operational competence continues to fuel growth in the operator training segment.

The system testing segment is expected to witness the fastest CAGR from 2025 to 2030. Radar systems have become more advanced with technologies like phased array and AESA, and the demand for rigorous and realistic testing environments is surging. Radar simulators enable comprehensive system validation under various conditions, helping detect flaws before deployment. Strategic collaborations are further driving innovation in radar system validation. These advancements make system testing essential in R&D, propelling the segment’s rapid growth.

Type Insights

The airborne segment accounted for the largest market share in 2024, driven by the increasing complexity of airborne radio detection and ranging systems and the need for advanced training simulations. These simulators offer a cost-effective alternative to live training while allowing rapid adaptation to evolving technologies. As aviation continues to advance, the importance of radar simulation in ensuring safety and operational efficiency continues to grow.

The marine segment is expected to witness the fastest CAGR from 2025 to 2030, driven by the growing reliance on radar systems for navigation, collision avoidance, and maritime surveillance. Marine operations have become more complex, and the need for effective training through radar simulators has intensified. These simulators help mariners prepare for real-world challenges by replicating scenarios such as adverse weather and high vessel traffic. A cost-effective and safe method ensures continuous skill development, contributing significantly to segmental growth.

Application Insights

The commercial segment accounted for the largest market share in 2024, driven by the growing demand for advanced training solutions in the aviation and maritime industries. The surge in global air travel has increased the need for skilled air traffic controllers, boosting the adoption of radar simulators for safe and efficient airspace management. Similarly, the commercial maritime sector relies on radar simulators for navigation training and collision avoidance. These simulators help marine and aviation professionals stay updated with evolving radar technologies. The continuous need for operational safety and regulatory compliance is further fueling the growth of the commercial segment.

The military segment is expected to witness the fastest CAGR from 2025 to 2030, driven by the increasing need for advanced radar simulators to ensure combat readiness and operational proficiency. The growing emphasis on joint military operations and interoperability also boosts the adoption of radar simulators. This trend reflects the defense sector’s commitment to enhancing preparedness while optimizing training resources.

Regional Insights

North America radar simulator market accounted for the largest share of over 31% in 2024, primarily driven by the region’s robust defense spending and advanced military infrastructure. The increasing need for combat readiness and pilot training programs has led to the widespread adoption of radar simulators across the region. Government initiatives aimed at modernizing military equipment and enhancing training capabilities through simulation-based programs are significantly boosting demand. The region’s focus on maintaining air and naval superiority continues to drive investment in the market.

U.S. Radar Simulator Market Trends

The U.S. radar simulator industry is expected to grow at a CAGR of over 5% from 2025 to 2030, driven by the region’s robust defense infrastructure and continuous investments in military modernization. The growing emphasis on enhancing combat readiness and reducing live training costs is propelling demand for simulation-based training tools. The rise in joint military exercises and cross-border collaborations further amplifies the need for a realistic and interoperable radar simulation industry across the region.

Europe Radar Simulator Market Trends

The Europe radar simulator industry is expected to grow at a CAGR of over 5% from 2025 to 2030. Increased investments in aerospace technologies drive the growth. Countries such as Germany, France, and the UK are actively enhancing their air defense and surveillance capabilities, creating a surge in demand for advanced radar simulation solutions. The growing adoption of simulation-based training in both military and civil aviation sectors, along with strong regulatory standards for safety and operational efficiency, further accelerates market growth across the region.

The UK radar simulator market is expected to grow at a significant CAGR in the coming years. The country benefits from a robust defense sector and increasing investments in military modernization programs, which are driving demand for advanced radar training systems. The UK’s focus on strengthening aerospace and aviation capabilities supports the adoption of radar simulators for pilot training and mission preparedness. Ongoing initiatives to integrate cutting-edge technologies such as AI and machine learning into defense infrastructure further boost market growth.

The radar simulator market in Germany is fueled by the country’s strong defense and aerospace sectors, which demand advanced training technologies to maintain operational excellence. Germany’s focus on technological innovation and precision engineering further enhances the development of sophisticated simulation platforms, supporting the sustained market growth.

Asia Pacific Radar Simulator Market Trends

The Asia Pacific radar simulator industry is expected to grow at a CAGR of over 6% from 2025 to 2030, driven by rising defense spending and regional security concerns. The increasing demand for simulation-based training to reduce operational risks and costs is fueling the adoption of radar simulators across the military and aviation sectors. Additionally, government-led initiatives to strengthen domestic defense manufacturing and promote technological self-reliance are creating a favorable environment for market growth in the region.

The Japan radar simulator market is gaining traction, fueled by its advanced defense capabilities and continued investment in military modernization. Regional security concerns escalate, Japan is prioritizing the development of cutting-edge surveillance and defense systems, creating strong demand for radar simulators in training and operational readiness. The country's leadership in electronics and simulation technologies supports the development of high-precision radar training systems tailored for air, naval, and ground forces. These factors contribute to the growing radar simulator industry in Japan.

The radar simulator market in China is rapidly expanding. China’s strong emphasis on military modernization and aerospace development is a significant driver of the market growth. China’s growing defense budget and focus on enhancing indigenous capabilities have led to increased demand for advanced radar training solutions. The rise of joint military exercises and the need for cost-effective, realistic training environments are also encouraging the adoption of radar simulators across air, naval, and ground forces. These factors collectively contribute to the robust growth of the radar simulator industry.

Key Radar Simulator Company Insights

Some of the key players operating in the market include Micro Nav Limited and Mercury Systems, Inc.

-

Micro Nav Limited is a leading provider of radar simulation and air traffic control (ATC) training solutions. The company specializes in the development of advanced radar simulators that replicate realistic scenarios for training radar operators and air traffic controllers. Micro Nav Limited's simulators offer a high level of fidelity, allowing users to practice and enhance their skills in a simulated air traffic environment

-

Mercury Systems, Inc. is a company specializing in secure mission-critical technologies for aerospace and defense applications. The company provides radar testing and simulation system solutions, catering to the unique requirements of the military and aviation industries. Mercury Systems, Inc. provides radio detection and ranging environment solutions that enable validation and optimization in a secure and controlled environment

RTX Corporation Limited and Cambridge Pixel Ltd. are some of the emerging market participants in the radar simulator market.

-

RTX Corporation plays a crucial role in the testing and optimization of radar systems, particularly in defense applications, with a primary focus on radio detection and ranging simulation. The company addresses the intricate challenges associated with radio detection and ranging technology by delivering testing equipment and simulation solutions. RTX Corporation also provides radar interface units and advanced distributed solutions as part of its comprehensive offerings

-

Cambridge Pixel Ltd. offers comprehensive solutions for primary radar acquisition, target tracking, processing, and display through its SPx and HPx product families. These solutions find applications in various sectors, including air traffic control, military, naval command and control, ship bridge systems, vessel traffic management, and airborne applications. The company's innovative products contribute to the effectiveness and efficiency of radar systems in diverse operational scenarios

Key Radar Simulator Companies:

The following are the leading companies in the radar simulator market. These companies collectively hold the largest market share and dictate industry trends.

- Adacel Technologies Limited

- Rockwell Collins, Inc.

- Micro Nav Limited.

- Mercury Systems, Inc.

- Keysight Technologies

- Textron Systems.

- Presagis Canada Inc.

- L3Harris Technologies, Inc.

- RTX Corporation

- Cambridge Pixel Ltd.

- AceHawk Aerospace Ltd

- BAE Systems

Recent Developments

-

In May 2025, RTX Corporation launched an advanced radar simulator modeled on the AN/TPY-2 radar system for the U.S. Missile Defense Agency. This simulator, incorporating Gallium Nitride (GaN) technology, significantly enhances training and testing capabilities by providing realistic simulations that improve operator proficiency in detecting and responding to hypersonic missile threats, thereby strengthening national defense preparedness.

-

In May 2025, Collins Aerospace announced delivering the 13th AN/TPY-2 radar system. This advanced radar system, incorporating Gallium Nitride (GaN) technology, significantly enhances the nation's defense capabilities against hypersonic missiles by improving sensitivity, range, and surveillance capabilities.

-

In February 2025, L3Harris Technologies completed the first flight of its all-digital electronic warfare (EW) suite, Viper Shield, on a Block 70 F-16 operated by the U.S. Air Force. This advanced EW system enhances radar threat detection and jamming capabilities, providing critical simulation and training value in radar defense operations. The Viper Shield integrates seamlessly with multiple F-16 blocks, offering a cost-effective, low-risk solution to counter modern radar threats, with full production and delivery scheduled for late 2025.

Radar Simulator Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.25 billion

Revenue forecast in 2030

USD 4.28 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Components, product, type, application, and region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Adacel Technologies Limited; Rockwell Collins, Inc.; Micro Nav Limited; Mercury Systems, Inc.; Keysight Technologies; Textron Systems; Presagis Canada Inc.; L3Harris Technologies, Inc.; RTX Corporation, Cambridge Pixel Ltd.; AceHawk Aerospace Ltd; BAE Systems

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radar Simulator Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the radar simulator market report based on component, product, type, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

System Testing

-

Operator Training

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Marine

-

Airborne

-

Ground

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Military

-

Commercial

-

Aviation

-

Automobiles

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global radar simulator market was estimated at USD 3,127.6 million in 2024 and is expected to reach USD 3,249.2 million in 2025.

b. The global radar simulator market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 4,271.2 million by 2030.

b. The Asia Pacific radar simulator is expected to grow at a CAGR of over 6% from 2025 to 2030, driven by rising defense spending and regional security concerns. The increasing demand for simulation-based training to reduce operational risks and costs is fueling the adoption of radar simulators across the military and aviation sectors. Additionally, government-led initiatives to strengthen domestic defense manufacturing and promote technological self-reliance are creating a favorable environment for market growth in the region.

b. The key players in the radar simulator market are Adacel Technologies Limited, Rockwell Collins, Inc., Micro Nav Limited, Mercury Systems, Inc., Keysight Technologies, Textron Systems, Presagis Canada Inc., L3Harris Technologies, Inc., RTX Corporation, Cambridge Pixel Ltd., AceHawk Aerospace Ltd, and BAE Systems.

b. Key drivers of radar simulator market growth include the emergence of modern warfare systems, rising affordability of simulator-based training, increasing defense expenditure in emerging economies, growing demand for skilled operators, and expanding R&D activities in military simulation technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.