- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Radiation Cured Coatings Market Size & Share Report, 2030GVR Report cover

![Radiation Cured Coatings Market Size, Share & Trends Report]()

Radiation Cured Coatings Market (2023 - 2030) Size, Share & Trends Analysis Report By Raw Material (Oligomers, Monomers), By Formulation (Electro Beam Curing), By Application (Wood, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-118-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

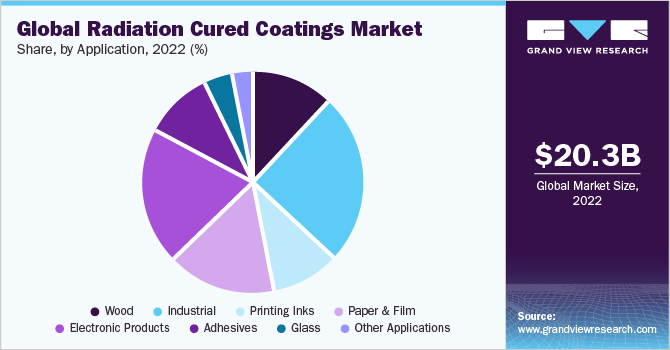

The global radiation cured coatings market size was valued at USD 20.30 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. The growth of the market is attributed to the advantages offered by these coatings, such as rapid curing times, reduced environmental impact, and improved performance characteristics. Various industries such as printing, packaging, wood coatings, and electronics are increasingly adopting these products due to their ability to provide high-quality finishes, improved scratch & chemical resistance, and reduced volatile organic compound (VOC) emissions. The growth is driven by the increasing adoption of more sustainable and efficient coating solutions in various applications.

Radiation-cured coatings are used on vehicle components, such as interior trims, exterior parts, and aircraft interiors, to provide aesthetic appeal and durability. Also, they are applied to wood surfaces for furniture, cabinets, flooring, and decorative items to provide protection against moisture, scratches, and UV radiation. These coatings enhance the clarity, scratch resistance, and UV protection of optical films used in displays, touchscreens, and eyeglasses.

The manufacturing process begins with formulating the radiation-cured coating. This involves selecting oligomers, monomers, photo-initiators, additives, and other ingredients to achieve desired properties such as adhesion, hardness, flexibility, and color. The selected ingredients are mixed and dispersed thoroughly to create a homogeneous coating formulation. This step ensures that all components are evenly distributed. The formulated coating is applied onto the substrate using methods such as spraying, dipping, roller coating, or curtain coating. The thickness of the coating layer is controlled based on the application requirements.

Setting up the equipment for UV or electron beam curing can involve higher upfront costs, including the purchase and installation of specialized curing systems. Also, some radiation-cured coatings may be sensitive to certain chemicals, which can affect their performance in certain environments. Developing a product with specific properties may require a careful balance of ingredients and additives, which can be more complex than traditional coating formulations. This is likely to challenge market growth during the projected years.

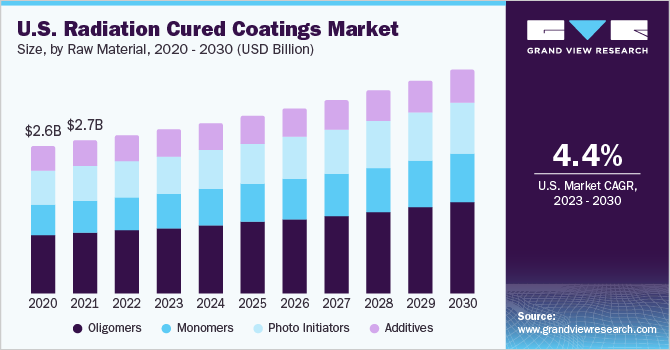

Raw Material Insights

The oligomers segment dominated the market with a revenue share of 41.3% in 2022. This is attributed to their ability to be rapidly cured using UV light or electron beams, resulting in shortened production cycles and increased efficiency. Oligomers lead to the formation of a highly crosslinked polymer network, resulting in coatings with excellent mechanical, chemical, and scratch resistance properties. Additionally, this product often exhibits strong adhesion to a wide range of substrates, promoting long-lasting and reliable bonding.

The monomers segment is expected to expand at the highest CAGR of 4.7% over the forecast period in the radiation cured coatings market. This is attributed to the fact that they generally exhibit strong adhesion to various substrates, offering long-lasting and reliable bonding. These coatings form a highly crosslinked polymer network, leading to coatings with excellent mechanical, chemical, and scratch resistance properties.

Photo-initiator-based products utilize photo-initiators, which are compounds that generate free radicals or reactive species when exposed to UV or visible light. These free radicals initiate the polymerization and crosslinking reactions that transform liquid coatings into solid films. Formulators select appropriate photo-initiators based on the specific requirements of the coating application.

Formulation Insights

The electro-beam curing segment dominated the market with a revenue share of 55.4% in 2022. This growth is attributed to its significantly shorter production cycle and increased throughput as it is extremely fast and can cure coatings within milliseconds. E-beam technology provides uniform and consistent curing throughout the entire thickness of the coating, ensuring that even complex shapes and three-dimensional surfaces are fully cured.

The ultraviolet curing segment is predicted to expand at the highest CAGR of 4.3% over the forecast period. This strong growth is attributed to the instantaneous polymerization of coatings when exposed to UV light. This results in significantly reduced curing times compared to traditional methods, leading to faster production cycles and increased efficiency. Coated products cured using UV can be handled and packaged immediately after curing, eliminating the need for extended curing times or cooling periods.

Application Insights

The industrial application segment dominated the market with a revenue share of 25.6% in 2022. This is attributed to the faster production cycles and increased throughput achieved in industrial processes owing to the rapid curing times offered by the product. As industries focus on reducing their environmental impact, these products are favored due to their low emission of volatile organic compounds (VOCs) and reduced energy consumption during curing.

The electronic products segment accounted for the second-largest revenue share in 2022 and is expected to expand at the fastest CAGR of 4.4% over the forecast period. This demand is attributed to the ability of radiation-cured coatings to protect PCBs from environmental factors, such as moisture, chemicals, and abrasion, while also improving their electrical insulation properties. In the field of flexible and printed electronics, these products offer protection and environmental resistance to printed circuitry, sensors, and conductive inks.

Radiation-cured coatings are applied to wooden furniture products to enhance their appearance, provide a smooth and durable finish, and protect against scratches, moisture, and UV radiation. Wood cabinetry, including kitchen cabinets and bathroom vanities, benefits from these coatings, as they offer protection against wear and tear, as well as resistance to moisture and household chemicals.

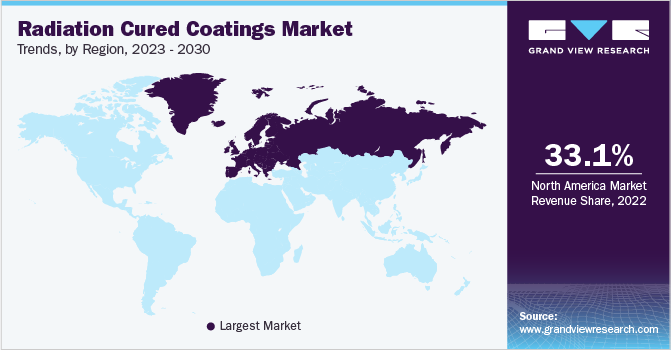

Regional Insights

Europe emerged as the dominating region with a revenue share of 33.1% in 2022. The growth is attributed to the stringent environmental regulations that encourage the use of coatings with lower volatile organic compound (VOC) emissions. European industries are known for their adoption of advanced technologies. Radiation-cured coatings, with their efficient curing processes and improved performance, are in line with Europe's technology-driven approach.

The German automotive sector is a significant consumer of the product for vehicle interiors, exteriors, and components. These coatings provide protective and decorative finishes. The country is known for its robust industrial sectors, including automotive, electronics, packaging, and furniture. These industries often use radiation-cured coatings to enhance product performance, aesthetics, and durability.

Asia Pacific is predicted to expand with the highest CAGR of 4.6% over the forecast period. This growth is attributed to the flourishing construction and infrastructure sectors in the region, leading to higher demand for coatings for various surfaces, including floors, walls, and metal structures. Radiation-cured coatings provide efficient and durable solutions for these applications.

Key Companies & Market Share Insights

The key market players are focused on developing innovative radiation-cured coatings with improved performance properties, such as scratch resistance, adhesion, and chemical resistance. Research and development efforts are also directed towards creating more sustainable and eco-friendly formulations. Several market participants differentiate themselves by offering customized radiation-cured coating solutions tailored to specific industry needs and applications.

For instance, in June 2023, Evonik added to its product lineup the ‘TEGO Rad 2550’ slip and defoamer additive, designed for radiation-curing inks and coatings. TEGO Rad 2550, available as a clear, low-viscosity liquid, offers an effective reduction of both static and dynamic surface tension in both traditional UV- and LED-cured formulations. Some of the prominent players in the global radiation cured coatings market include:

-

Dow

-

Sherwin-Williams Company

-

PPG Industries Inc

-

Axalta Coating Systems Ltd

-

Akzo Nobel NV

-

ICA SpA

-

Covestro AG

Radiation Cured Coatings Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 21.03 billion

Revenue forecast in 2030

USD 28.36 billion

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, formulation, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Netherlands; Russia; Switzerland; China; India; Japan; South Korea; Malaysia; Indonesia; Vietnam; Australia; New Zealand; Brazil; Argentina; Chile; Colombia; Saudi Arabia; South Africa; Iran; Oman; UAE; Qatar; Kuwait; Angola; Nigeria

Key companies profiled

Dow; Sherwin-Williams Company; PPG Industries Inc.; Axalta Coating Systems Ltd.; Akzo Nobel NV; ICA SpA; Covestro AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radiation Cured Coatings Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global radiation cured coatings market report on the basis of raw material, formulation, application, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oligomers

-

Monomers

-

Photo initiators

-

Additives

-

-

Formulation Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ultraviolet Curing

-

Electro Beam Curing

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wood

-

Industrial

-

Printing Inks

-

Paper & Film

-

Electronic Products

-

Adhesives

-

Glass

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

The Netherlands

-

Russia

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Indonesia

-

Vietnam

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Iran

-

Oman

-

UAE

-

Qatar

-

Kuwait

-

Angola

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global radiation cured coatings market size was estimated at USD 20.30 billion in 2022 and is expected to reach USD 21.03 billion in 2023.

b. The global radiation cured coatings market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 28.36 billion by 2030.

b. Europe dominated the radiation cured coatings market with a share of 33.1% in 2022. This is attributable to the stringent environmental regulations that encourage the use of coatings with lower volatile organic compound (VOC) emissions in the region.

b. Some key players operating in the radiation cured coatings market include Dow, Sherwin-Williams Company, PPG Industries Inc, Axalta Coating Systems Ltd , Akzo Nobel NV, ICA SpA, Covestro AG, and others.

b. Key factors that are driving the market growth include their advantages such as rapid curing times, reduced environmental impact, and improved performance characteristics and their wide usage of UV-cured materials in the graphics and industrial wood industries owing to their high efficiency and speed.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.