- Home

- »

- Semiconductors

- »

-

Radiation Hardened Electronics Market Size Report, 2030GVR Report cover

![Radiation Hardened Electronics Market Size, Share & Trends Report]()

Radiation Hardened Electronics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Manufacturing Technique, By Product Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-272-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Radiation Hardened Electronics Market Summary

The global radiation hardened electronics market size was estimated at USD 1.7 billion in 2023 and is projected to reach USD 2.42 billion by 2030, growing at a CAGR of 5.7% from 2024 to 2030. The increasing global demand for electronic products, driven by rising consumer disposable income, is a crucial factor propelling the radiation-hardened (rad-hard) electronics market.

Key Market Trends & Insights

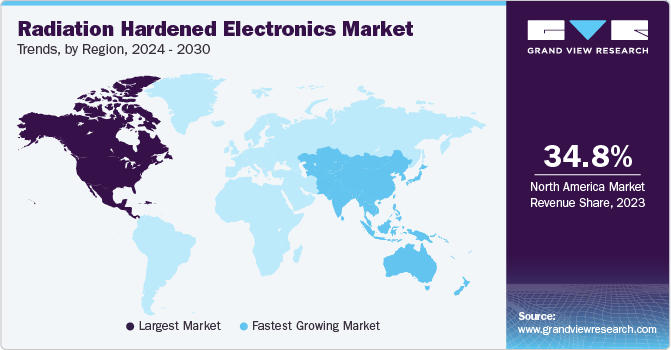

- The North America radiation-hardened electronics market accounted for the largest revenue share of 34.8% in 2023.

- The U.S. accounted for over 25% of the global revenue share in 2023 and is expected to grow significantly from 2024 to 2030.

- Based on component, the power management segment accounted for the largest market revenue share of 29.2% in 2023.

- Based on application, the space segment accounted for the largest revenue share in 2023.

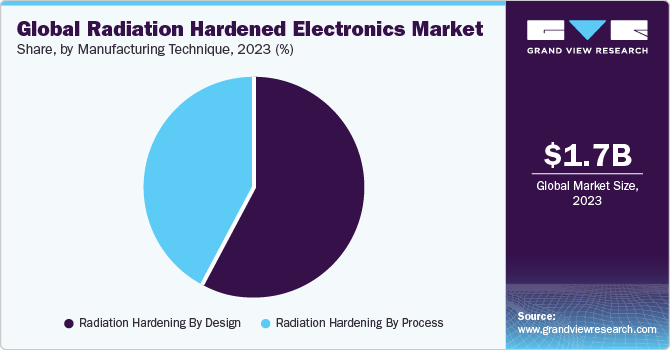

- Based on manufacturing technique, the radiation hardening by design (RHBD) segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.7 Billion

- 2030 Projected Market USD 2.42 Billion

- CAGR (2024-2030): 5.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The growing interest of consumers for electronic gadgets, and dependable and safe electronics, such as radiation-hardened components are likely to expand growth opportunities in the market.

Continuous research and development efforts in the electronic field contribute to market growth. The focus on enhancing the performance, reliability, and affordability of these specialized components is opening new opportunities in various sectors, including aerospace, defense, nuclear power plants, and healthcare. Ongoing advancements in materials science, design techniques, and testing methodologies are improving the performance and reliability of radiation-hardened electronics. These technological developments make these components more affordable and suitable for various applications.

The increased focus on environmental factors is boosting the use of radiation-hardened electronics. There is a growing need to monitor and minimize radiation exposure in different settings, particularly in North America, where environmental issues are gaining more attention. This increased consciousness drives a higher requirement for electronics that can function efficiently in challenging environments.

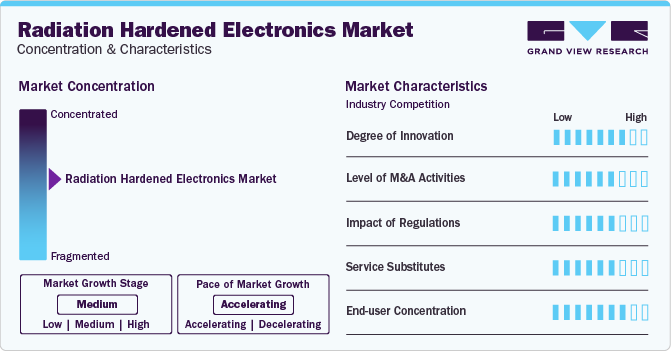

Market Concentration & Characteristics

The radiation-hardened electronics industry's growth stage is medium, and the pace of growth is accelerating. The degree of innovation is high due to the advancements focusing on physical and logical approaches to make chips resistant to ionizing radiation. These innovations are crucial for applications in space and nuclear energy, where radiation poses a significant threat to electronic components, especially in space environments where radiation exposure is high. New generations of radiation-hardened electronics are expected to enhance onboard computing capabilities, autonomy, and artificial intelligence, leading to substantial benefits in space missions.

Mergers & Acquisition (M&A) activities in the industry are high. As the industry continues to grow and evolve, companies seek strategic partnerships, mergers, and acquisitions to enhance their capabilities, expand their product offerings, and strengthen their market position. These activities are driven by various factors, such as the need for technological advancements, access to new markets, consolidation of resources, and gaining a competitive edge in the market. For instance, in February 2024, BEA Systems completed the acquisition of Ball Aerospace, integrating cutting-edge space, science, and defense capabilities into its offerings under a new division named Space & Mission Systems.

The end-user concentration is high in the space, aerospace and defense, and nuclear power plants industries. These sectors heavily rely on radiation-hardened electronics due to the extreme radiation exposures they face. In the space industry, radiation-hardened electronics are crucial for satellites exposed to high levels of radiation in orbit, impacting electronic materials.

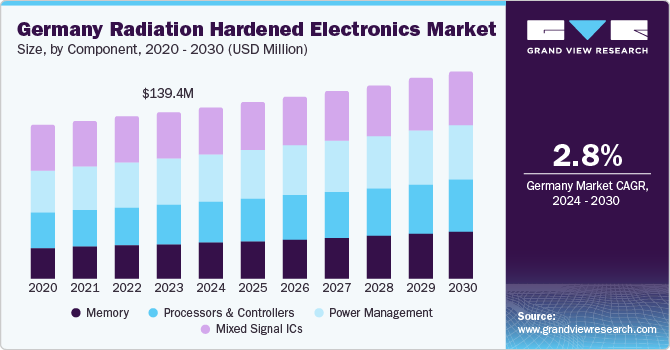

Component Insights

The power management segment accounted for the largest market revenue share of 29.2% in 2023, as it plays a crucial role in ensuring the reliability and functionality of electronic systems operating in high-radiation environments. In nuclear power plants, where safety systems rely on electronics, having radiation-hardened power management systems is essential to prevent hazards or shutdowns.

The memory components segment is anticipated to register the fastest CAGR from 2024 to 2030. The demand for radiation-hardened memory solutions is increasing due to the growing need to manage substantial amounts of data obtained from various sensors and processors in multiple applications. They are essential for storing and retrieving data accurately, especially in aerospace, defense, and space applications, where radiation exposure can cause data corruption or loss if not adequately protected.

Product Type Insights

The Commercial Off-The-Shelf (COTS) segment accounted for the largest revenue share in 2023. This product type is gaining popularity in commercial small and military satellites due to its reliability and cost-effectiveness. The need for highly reliable microelectronics at lower costs in the space sector, fuelled by projects like NASA's deep space missions and the deployment of large constellations of small satellites, is driving the adoption of COTS devices.

The custom-made segment is anticipated to register the fastest CAGR from 2024 to 2030. The demand for custom-made radiation-hardened electronics is driven by high reliability, precision, and durability in critical applications, where standard off-the-shelf components may not provide adequate protection against radiation-induced failures. Customization allows for optimizing electronic systems to withstand the specific radiation profiles encountered in various operational scenarios, ensuring optimal performance and longevity.

Application Insights

The space application segment accounted for the largest revenue share in 2023. The increasing demand for advanced electronic components that can withstand the harsh radiation and temperature conditions of space environments is fuelling the growth of this segment. NASA's SpaceCube comprises a series of Field Programmable Gate Arrays (FPGA) based onboard systems tailored for radiation-hardened electronics in space settings. These systems elevate onboard computing capacity, autonomy, and the integration of artificial intelligence and machine learning applications within space missions.

The application of nuclear power plants is anticipated to grow at the fastest CAGR over the forecast period. In nuclear power plants, specialized radiation-hardened electronics play a crucial role in applications such as control systems, monitoring devices, and emergency sensing capabilities. These electronics are essential for withstanding the high levels of ionizing radiation present in nuclear reactor environments.

Manufacturing Technique Insights

The Radiation Hardening by Design (RHBD) segment accounted for the largest revenue share in 2023. RHBD involves designing and developing electronic components and systems to withstand the damaging effects of radiation, particularly in environments such as outer space, high-altitude flights, and nuclear reactors and it plays a significant role in ensuring the dependability, and performance of components in challenging radiation environments.

Radiation Hardening by Process (RHBP) is anticipated to grow significantly from 2024 to 2030. The adoption of RHBP is driven by the need for robust and reliable electronic systems in critical applications where radiation exposure is a constant threat. By leveraging RHBP techniques, manufacturers can enhance the radiation tolerance of their components, making them suitable for use in space missions, military applications, and other scenarios where resilience to radiation is essential.

Regional Insights

The North America radiation-hardened electronics market accounted for the largest revenue share of 34.8% in 2023. The region has been at the forefront of the development and adoption of radiation-hardened electronics, particularly in the aerospace and defense sectors. This is due to several prominent companies involved in producing and innovating radiation-hardened components, contributing to the market’s expansion.

U.S. Radiation Hardened Electronics Market Trends

The radiation-hardened electronics market in the U.S. accounted for over 25% of the global revenue share in 2023 and is expected to grow significantly from 2024 to 2030.. The country has a robust presence in the market, with companies like Data Device Corporation, Honeywell International Inc., and Texas Instruments Incorporated playing vital roles in advancing technology and meeting the demands of various applications requiring radiation-resistant components.

Asia Pacific Radiation Hardened Electronics Market Trends

The radiation hardened electronics market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. Countries like China, India, and Japan are investing heavily in space exploration and satellite technology, and an increase in their military capabilities such as deploying advanced missile systems, unmanned aerial vehicles (UAVs), and other critical defense electronics further fuels the market expansion.

The China radiation hardened electronics market accounted for the largest share of the market of the region in 2023. China’s growing presence in the space industry and its focus on enhancing its satellite capabilities contribute to the increasing demand for radiation-hardened electronics. The country’s initiatives include remote sensing satellites, satellite navigation systems, communication satellites, human spaceflight programs, and lunar exploration efforts.

The radiation hardened electronics market in South Korea is anticipated to register the fastest CAGR over the forecast period due to its advanced semiconductor industry and the integration of these electronics in space and nuclear energy. The country’s push towards nuclear energy as a clean energy source has underscored the need for radiation-hardened electronics in controlling and monitoring nuclear reactors safely.

Latin America Radiation Hardened Electronics Market Trends

The Latin American radiation-hardened electronics market is anticipated to grow significantly over the forecast period. Space agencies such as the Brazilian Space Agency (AEB) and Argentina National Space Activities Commission (CONEA) initiate various space programs that require radiation-hardened electronics for satellites and other spacecraft to withstand the harsh conditions of space.

Key Radiation Hardened Electronics Company Insights

Some of the key players operating in the market include Honeywell International Inc.; Renesas Electronics Corporation; and BAE Systems.

-

Honeywell International Inc. offers a range of microelectronics solutions, including Application-Specific Integrated Circuits (ASICs) and memories like Static Random Access Memory (SRAM) and Non-Volatile Magneto-Resistive Random Access Memory (MRAM). These products are designed to withstand intense radiation environments, making them ideal for use in space missions and other radiation-prone settings.

-

Renesas Electronics Corporation offers a wide range of radiation-hardened products that adhere to stringent standards such as MIL-PRF-38535/QML compliance. These products include SMD, MIL-STD-883, and Class-V/Q components designed to withstand the challenges of space and defense environments. Renesas’ products are known for their efficiency, thermal optimization, and reliability, making them suitable for applications requiring high performance under extreme conditions.

Key Radiation Hardened Electronics Companies:

The following are the leading companies in the radiation hardened electronics market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc.

- BAE Systems.

- Honeywell International Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- Renesas Electronics Corporation.

- STMicroelectronics

- Teledyne Technologies Incorporated.

- Texas Instruments Incorporated

- TTM Technologies Inc.

Recent Developments

-

In November 2023, Infineon Technologies AG announced the expansion of its radiation-hardened asynchronous static RAMs range with built-in Error Correction Code (ECC) memory for space and other challenging environments.

-

In April 2021, Microchip Technology Inc. announced an extended range of radiation-hardened Arm-based microcontrollers tailored for space systems, elevating spacecraft technology for planetary exploration and space research. The SAMRH71 Arm-based microprocessor, endorsed for radiation hardening, and the SAMRH707, both integrating Arm Cortex-M7 SoC technology, mark a significant advancement in enhancing spacecraft system capabilities for missions beyond Earth.

-

In August 2021, STMicroelectronics and Xilinx collaborated to power radiation-hardened FPGAs with ST's space-qualified regulators. This partnership is geared towards establishing a dependable power solution for the Xilinx Kintex UltraScale XQRKU060 FPGA, leveraging ST's space-qualified voltage regulators.

Radiation Hardened Electronics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.73 billion

Revenue forecast in 2030

USD 2.42 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, manufacturing technique, product type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

Advanced Micro Devices, Inc.; BAE Systems; Honeywell International Inc.; Infineon Technologies AG; Microchip Technology Inc.; Renesas Electronics Corporation; STMicroelectronics; Teledyne Technologies Incorporated.; Texas Instruments Incorporated; TTM Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radiation Hardened Electronics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global radiation hardened electronics market report based on component, manufacturing technique, product type, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Mixed Signal ICs

-

Processors & Controllers

-

Memory

-

Power Management

-

-

Manufacturing Technique Outlook (Revenue, USD Million, 2017 - 2030)

-

Radiation Hardening By Design (RHBD)

-

Radiation Hardening By Process (RHBP)

-

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial off-the-Shelf

-

Custom Made

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Aerospace & Defense

-

Medical

-

Nuclear Power Plants

-

Space

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global radiation hardened electronics market size was estimated at USD 1.7 billion in 2023 and is expected to reach USD 1.73 billion in 2024

b. The global radiation hardened electronics market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 2.42 billion by 2030

b. North America dominated the radiation-hardened electronics market with a share of 34.8% in 2023. Factors such as the increasing need for operational efficiency and real-time data access across various industries, including telecommunication, aerospace & defence, and others drive the demand for radiation-hardened electronics in the region.

b. Some key players operating in the radiation hardened electronics market include Advanced Micro Devices, Inc.; BAE Systems.; Honeywell International Inc.; Infineon Technologies AG; Microchip Technology Inc.; Renesas Electronics Corporation.; STMicroelectronics; Teledyne Technologies Incorporated.; Texas Instruments Incorporated; TTM Technologies Inc.

b. Factors such as an increase in the development of space and nuclear projects drive the demand for the radiation-hardened electronics market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.